10 New Equity Mutual Fund Categories Introduced by SEBI

Securities and Exchange Board of India (SEBI) introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before Investing in a scheme.

SEBI intends to make Mutual Fund investment easier for the investors so that investors could invest according to their needs, Financial goals and risk ability. SEBI has circulated new Mutual Fund categorisation on 6th October 2017. This mandates Mutual Fund Houses to categories all their equity schemes (existing & future scheme) into 10 distinct categories. SEBI has also introduced 16 new categories in debt mutual funds.

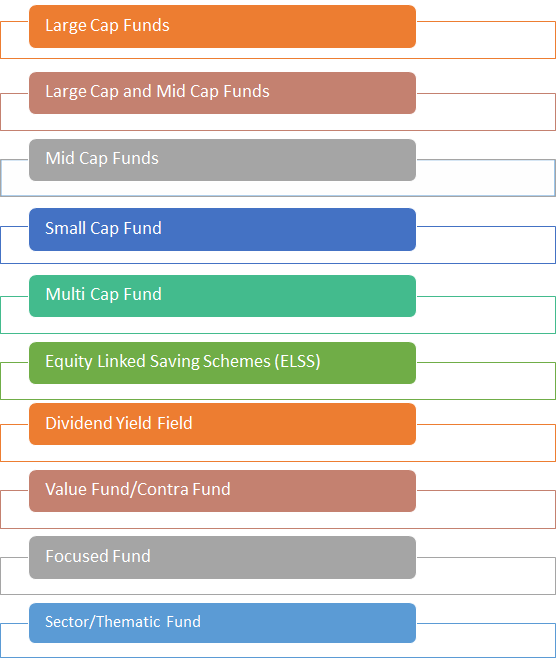

New Categorisation in Equity Schemes

SEBI has set a clear classification as to what is a large cap, mid cap and small cap:

| **Market Capitalization | Description** |

|---|---|

| Large cap company | 1st to 100th company in terms of full market capitalization |

| Mid cap company | 101st to 250th company in terms of full market capitalization |

| Small cap company | 251st company onwards in terms of full market capitalization |

Talk to our investment specialist

Here’s the list of new Equity Fund categories with their Asset Allocation plan:

1. Large Cap Fund

These are the funds that predominantly invest in the large-cap stocks. The exposure in large-cap stocks has to be a minimum 80 percent of the scheme’s total assets.

2. Large and Mid Cap Fund

These are the schemes that invest in both large & mid cap stocks. These funds will invest a minimum of 35 percent each in mid and large cap stocks.

3. Mid Cap Fund

This is a scheme that mainly invests in mid-cap stocks. The scheme will invest 65 percent of its total assets in mid-cap stocks.

4. Small Cap Fund

The Portfolio should have at least 65 percent of its total assets in small-cap stocks.

5. Multi Cap Fund

This equity scheme invests across market cap, i.e., large cap, mid cap and small cap. A minimum of 65 percent of its total assets should be allocated to equities.

6. ELSS

Equity Linked Savings Schemes (ELSS) is a tax saving fund that comes with a lock-in period of three years. A minimum of 80 percent of its total assets has to be invested in equities.

7. Dividend Yield Fund

This fund will predominantly invest in dividend yielding stocks. This scheme will invest a minimum 65 percent of its total assets in equities, but in dividend yielding stocks.

8. Value Fund

This is an equity fund that will follow the value investment strategy.

9. Contra Fund

This equity scheme will follow the contrarian investment strategy. Value/Contra will invest at least 65 percent of its total assets in equities, but a Mutual Fund house can either offer a value fund or a contra fund, but not both.

10. Focused Fund

This fund will focus on large, mid, small or multi-cap stocks, but can have a maximum of 30 stocks. focused fund can invest at least 65 percent of its total assets in equities.

11. Sector/Thematic Fund

These are the funds that invest in a particular sector or a theme. At least 80 percent of the total assets of these schemes will be invested in a particular sector or theme.

Fund Selection Methodology used to find 10 funds

Best Equity Mutual Funds to Invest 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 16.5 26.1 41.2 16.8 4.1 23.7 DSP Natural Resources and New Energy Fund Growth ₹110.438

↑ 0.34 ₹1,765 15.2 25.4 38.8 25.1 21.5 17.5 DSP US Flexible Equity Fund Growth ₹78.698

↓ -0.52 ₹1,119 5.4 16.9 34.3 23.6 17.2 33.8 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 2.1 6.6 24.2 28.6 24 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.89

↓ -1.06 ₹3,641 -1.2 8 22.1 18.2 13.4 17.5 Kotak Equity Opportunities Fund Growth ₹355.699

↓ -4.19 ₹29,991 0.3 5.8 20.6 20.5 17.4 5.6 Kotak Standard Multicap Fund Growth ₹87.09

↓ -1.07 ₹56,479 -0.8 4.2 19.3 18.2 14.4 9.5 Invesco India Growth Opportunities Fund Growth ₹98.19

↓ -1.00 ₹8,959 -5.6 -3.3 18.9 24.8 17.5 4.7 Aditya Birla Sun Life Small Cap Fund Growth ₹84.0292

↓ -1.02 ₹4,778 -2.8 0.5 18.9 18.8 15 -3.7 Tata India Tax Savings Fund Growth ₹45.8014

↓ -0.43 ₹4,566 -1.3 5.6 17.6 17.1 14.5 4.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund Kotak Equity Opportunities Fund Kotak Standard Multicap Fund Invesco India Growth Opportunities Fund Aditya Birla Sun Life Small Cap Fund Tata India Tax Savings Fund Point 1 Bottom quartile AUM (₹372 Cr). Bottom quartile AUM (₹1,765 Cr). Bottom quartile AUM (₹1,119 Cr). Lower mid AUM (₹3,003 Cr). Lower mid AUM (₹3,641 Cr). Top quartile AUM (₹29,991 Cr). Highest AUM (₹56,479 Cr). Upper mid AUM (₹8,959 Cr). Upper mid AUM (₹4,778 Cr). Upper mid AUM (₹4,566 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (16+ yrs). Established history (12+ yrs). Oldest track record among peers (21 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (18+ yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 4.12% (bottom quartile). 5Y return: 21.46% (top quartile). 5Y return: 17.18% (upper mid). 5Y return: 24.04% (top quartile). 5Y return: 13.43% (bottom quartile). 5Y return: 17.37% (upper mid). 5Y return: 14.36% (bottom quartile). 5Y return: 17.54% (upper mid). 5Y return: 14.99% (lower mid). 5Y return: 14.45% (lower mid). Point 6 3Y return: 16.78% (bottom quartile). 3Y return: 25.07% (top quartile). 3Y return: 23.63% (upper mid). 3Y return: 28.56% (top quartile). 3Y return: 18.25% (lower mid). 3Y return: 20.48% (upper mid). 3Y return: 18.18% (bottom quartile). 3Y return: 24.82% (upper mid). 3Y return: 18.80% (lower mid). 3Y return: 17.14% (bottom quartile). Point 7 1Y return: 41.22% (top quartile). 1Y return: 38.81% (top quartile). 1Y return: 34.28% (upper mid). 1Y return: 24.24% (upper mid). 1Y return: 22.11% (upper mid). 1Y return: 20.63% (lower mid). 1Y return: 19.26% (lower mid). 1Y return: 18.90% (bottom quartile). 1Y return: 18.90% (bottom quartile). 1Y return: 17.64% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 2.18 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.61 (upper mid). Alpha: 2.61 (top quartile). Alpha: 3.74 (top quartile). Alpha: -0.94 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: -0.76 (bottom quartile). Point 9 Sharpe: 2.24 (top quartile). Sharpe: 1.32 (top quartile). Sharpe: 1.15 (upper mid). Sharpe: 0.21 (lower mid). Sharpe: 1.03 (upper mid). Sharpe: 0.44 (lower mid). Sharpe: 0.46 (upper mid). Sharpe: 0.19 (bottom quartile). Sharpe: 0.01 (bottom quartile). Sharpe: 0.14 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.25 (top quartile). Information ratio: 0.08 (upper mid). Information ratio: 0.19 (upper mid). Information ratio: 0.56 (top quartile). Information ratio: 0.00 (bottom quartile). Information ratio: -0.35 (bottom quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Kotak Equity Opportunities Fund

Kotak Standard Multicap Fund

Invesco India Growth Opportunities Fund

Aditya Birla Sun Life Small Cap Fund

Tata India Tax Savings Fund

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.