16 New Debt Mutual Fund Categories Introduced by SEBI

Securities and Exchange Board of India (SEBI) introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before Investing in a scheme.

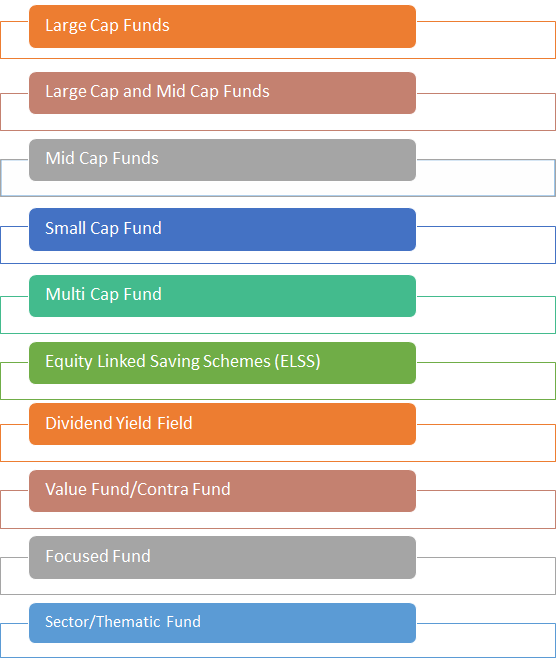

SEBI intends to make Mutual Fund investment easier for the investors. Investors could invest according to their needs, Financial goals and risk ability. SEBI has circulated new Mutual Fund categorisation on 6th October 2017. This mandates Mutual Fund Houses to categories all their debt schemes (existing & future scheme) into 16 distinct categories. SEBI has also introduced 10 new categories in Equity Mutual Funds.

New Categorisation in Debt Schemes

As per SEBI’s new categorisation, Debt fund schemes will have 16 categories. Here’s the list:

1. Overnight Fund

This debt scheme will invest in overnight securities having a maturity of one day.

2. Liquid Fund

These schemes will invest in debt and money market securities with a maturity of up to 91 days.

3. Ultra Short Duration Fund

This scheme will invest in debt and money market securities with a Macaulay duration between three to six months. Macaulay duration measures how long it will take the scheme to recoup the investment.

4. Low Duration Fund

The scheme will invest in debt and money market securities with a Macaulay duration between six to 12 months.

5. Money Market Fund

This scheme will invest in money market instruments having a maturity up to one year.

6. Short Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of one to three years.

7. Medium Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of three to four years.

8. Medium to Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of four to seven years.

9. Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration greater than seven years.

10. Dynamic Bond Fund

This is a debt scheme that invests across all the duration.

Talk to our investment specialist

11. Corporate Bond Fund

This debt scheme mainly invests in the highest rated corporate Bonds. The fund can invest a minimum 80 percent of its total assets in the highest-rated corporate bonds

12. Credit Risk Fund

This scheme will invest in below the high-rated corporate bonds. The Credit Risk Fund should invest at least 65 percent of its assets below the highest-rated instruments.

13. Banking and PSU Fund

This scheme predominantly invests in debt instruments of Banks, Public Financial Institutional, Public Sector Undertakings.

14. Gilt Fund

This scheme invests in government securities across maturity. Gilt Funds will invest a minimum 80 percent of its total assets in government securities.

15. Gilt Fund with 10-year Constant Duration

This scheme will invest in government securities with a maturity of 10 years. 15. Gilt Fund with 10-year Constant Duration will invest a minimum 80 percent in government securities.

16. Floater Fund

This debt scheme mainly invests in floating rate instruments. Floater Fund will invest a minimum of 65 percent of its total assets in floating rate instruments.

Fund Selection Methodology used to find 10 funds

Best Debt Mutual Funds to Invest 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Credit Risk Fund Growth ₹22.5247

↑ 0.01 ₹363 1.6 4 8.9 8 8.7 8.64% 2Y 3M 14D 2Y 8M 1D PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 5.01% 6M 14D 7M 2D UTI Banking & PSU Debt Fund Growth ₹22.7796

↑ 0.00 ₹1,078 1 2.8 7.4 7.5 7.8 7.04% 1Y 1M 10D 1Y 2M 19D Aditya Birla Sun Life Savings Fund Growth ₹571.125

↑ 0.10 ₹22,857 1.3 3 7.1 7.4 7.4 6.81% 5M 19D 6M 11D HDFC Banking and PSU Debt Fund Growth ₹23.8057

↑ 0.01 ₹5,620 0.7 2.8 7.1 7.3 7.5 7.26% 3Y 1M 17D 4Y 5M 1D Aditya Birla Sun Life Money Manager Fund Growth ₹385.357

↑ 0.06 ₹28,816 1.4 2.9 7.1 7.5 7.4 6.62% 6M 11D 6M 11D ICICI Prudential Long Term Plan Growth ₹38.1879

↑ 0.04 ₹14,826 1.2 3.2 7 7.7 7.2 7.82% 5Y 8M 26D 13Y 6M 14D HDFC Corporate Bond Fund Growth ₹33.6286

↑ 0.01 ₹33,207 0.6 2.8 6.9 7.7 7.3 7.36% 4Y 5M 19D 7Y 8M 16D Aditya Birla Sun Life Corporate Bond Fund Growth ₹116.779

↑ 0.07 ₹28,253 0.7 3.1 6.9 7.7 7.4 7.12% 4Y 10M 24D 7Y 6M 14D Indiabulls Liquid Fund Growth ₹2,623.14

↑ 0.46 ₹169 1.5 2.9 6.4 6.9 6.6 6.62% 1M 1M Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary Axis Credit Risk Fund PGIM India Credit Risk Fund UTI Banking & PSU Debt Fund Aditya Birla Sun Life Savings Fund HDFC Banking and PSU Debt Fund Aditya Birla Sun Life Money Manager Fund ICICI Prudential Long Term Plan HDFC Corporate Bond Fund Aditya Birla Sun Life Corporate Bond Fund Indiabulls Liquid Fund Point 1 Bottom quartile AUM (₹363 Cr). Bottom quartile AUM (₹39 Cr). Lower mid AUM (₹1,078 Cr). Upper mid AUM (₹22,857 Cr). Lower mid AUM (₹5,620 Cr). Top quartile AUM (₹28,816 Cr). Upper mid AUM (₹14,826 Cr). Highest AUM (₹33,207 Cr). Upper mid AUM (₹28,253 Cr). Bottom quartile AUM (₹169 Cr). Point 2 Established history (11+ yrs). Established history (11+ yrs). Established history (12+ yrs). Established history (22+ yrs). Established history (11+ yrs). Established history (20+ yrs). Established history (16+ yrs). Established history (15+ yrs). Oldest track record among peers (29 yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Low. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Low. Point 5 1Y return: 8.90% (top quartile). 1Y return: 8.43% (top quartile). 1Y return: 7.44% (upper mid). 1Y return: 7.15% (upper mid). 1Y return: 7.13% (upper mid). 1Y return: 7.07% (lower mid). 1Y return: 6.99% (lower mid). 1Y return: 6.94% (bottom quartile). 1Y return: 6.92% (bottom quartile). 1Y return: 6.36% (bottom quartile). Point 6 1M return: 1.14% (top quartile). 1M return: 0.27% (bottom quartile). 1M return: 0.68% (lower mid). 1M return: 0.62% (lower mid). 1M return: 0.84% (upper mid). 1M return: 0.62% (bottom quartile). 1M return: 0.90% (upper mid). 1M return: 0.92% (upper mid). 1M return: 0.99% (top quartile). 1M return: 0.56% (bottom quartile). Point 7 Sharpe: 2.08 (upper mid). Sharpe: 1.73 (upper mid). Sharpe: 1.05 (lower mid). Sharpe: 2.17 (top quartile). Sharpe: 0.36 (bottom quartile). Sharpe: 1.91 (upper mid). Sharpe: 0.37 (lower mid). Sharpe: 0.24 (bottom quartile). Sharpe: 0.22 (bottom quartile). Sharpe: 2.72 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: -0.70 (bottom quartile). Point 9 Yield to maturity (debt): 8.64% (top quartile). Yield to maturity (debt): 5.01% (bottom quartile). Yield to maturity (debt): 7.04% (lower mid). Yield to maturity (debt): 6.81% (lower mid). Yield to maturity (debt): 7.26% (upper mid). Yield to maturity (debt): 6.62% (bottom quartile). Yield to maturity (debt): 7.82% (top quartile). Yield to maturity (debt): 7.36% (upper mid). Yield to maturity (debt): 7.12% (upper mid). Yield to maturity (debt): 6.62% (bottom quartile). Point 10 Modified duration: 2.29 yrs (lower mid). Modified duration: 0.54 yrs (upper mid). Modified duration: 1.11 yrs (upper mid). Modified duration: 0.47 yrs (top quartile). Modified duration: 3.13 yrs (lower mid). Modified duration: 0.53 yrs (upper mid). Modified duration: 5.74 yrs (bottom quartile). Modified duration: 4.47 yrs (bottom quartile). Modified duration: 4.90 yrs (bottom quartile). Modified duration: 0.08 yrs (top quartile). Axis Credit Risk Fund

PGIM India Credit Risk Fund

UTI Banking & PSU Debt Fund

Aditya Birla Sun Life Savings Fund

HDFC Banking and PSU Debt Fund

Aditya Birla Sun Life Money Manager Fund

ICICI Prudential Long Term Plan

HDFC Corporate Bond Fund

Aditya Birla Sun Life Corporate Bond Fund

Indiabulls Liquid Fund

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.