What are Alternative Investment Funds?

AIF is an acronym for Alternative Investment Fund, a form of managed fund in India. It's a collective fund that invests in assets outside Bonds, equities, and cash. For the benefit of investors, it collects funds from investors and invests them in different categories of assets as defined by the Securities and Exchange Board of India (SEBI).

It makes investments in venture capital, private equity, hedge funds, managed futures, and other financial instruments. Generally, high-net-worth people and organizations engage in AIF since they need a large initial investment.

Definition of Alternative Investment Funds By SEBI

An AIF is defined as a fund formed or registered in India, under regulation 2(1)(b) of SEBI Regulations 2012, as a Limited Liability Partnership (LLP), corporation, trust, or body corporate that:

- It is a privately pooled investment entity that collects assets from investors, both domestic and international, and invests them according to a stated investment policy to benefit its stakeholders

- It excludes funds subject to the SEBI (Collective Investment Schemes) Laws, 1999, SEBI (Mutual Funds) Regulations, 1996, or any other SEBI regulations governing fund management

Types of Alternative Investment Funds

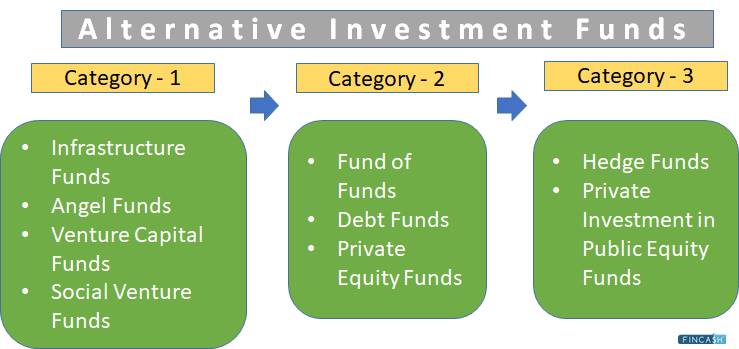

AIFS is classified into three categories by the SEBI, such as:

Category 1

This category includes funds that invest in Startups, Small and Medium-sized Enterprises (SMEs), and new businesses with strong growth potential that are regarded as socially and economically viable.

Since these initiatives have a multiplier effect on the economy in terms of growth and job generation, the government encourages and incentivizes investment in them. This category includes.

Infrastructure Funds

This fund makes investments in public assets, like road and rail infrastructure, airports, and communication infrastructures, among other things. Since the infrastructure industry has high Barriers to Entry and relatively limited competition, investors who are positive about its expansion in the future can invest in the fund. The government may provide tax incentives to Infrastructure Funds that invest in socially desirable or viable projects.

Angel Funds

This is a type of Venture Capital fund where fund managers pool money from several "angel" investors to invest in early-stage companies. When new businesses turn profitable, investors earn dividends. An "angel investor" is a person who wants to participate in an angel fund and contributes business management expertise, therefore supporting the company's growth.

Venture Capital Funds

Venture capital funds invest in high-growth startups that are cash-strapped and need financing to develop or expand their operations. As it's difficult for new businesses and entrepreneurs to obtain cash through traditional banking, Venture Capital Funds have emerged as the most preferred source of capital.

Social Venture Funds

The Social Venture Fund (SVF), which invests in companies with a strong social conscience and a desire to have a good influence on society, is one example of socially responsible Investing. These companies aim to make money while also solving environmental and social issues. Despite the fact that it is a philanthropic investment, it is possible to expect a profit because the businesses will continue to generate revenue

Talk to our investment specialist

Category 2

Funds that are invested in both equities and debt instruments are included in this category. Moreover, those funds that aren't currently classified as Category 1 or 3 are also included in this one. The government does not offer any tax benefits for investments in Category 2 AIFS. This category includes:

Fund of Funds

This fund is a mix of numerous AIFs. Rather than creating its own Portfolio or determining which specific industry to invest in, the fund's investment strategy is to invest in a portfolio of other AIFs. However, unlike fund of funds under Mutual Funds, Fund of Funds under AIFs are unable to issue publicly traded units of the fund.

Debt Funds

This fund primarily invests in debt instruments issued by both publicly traded and privately owned firms. Companies with a poor credit rating are more likely to issue high-yield debt securities that come with a high risk. As a result, enterprises with great expansion potential and strong corporate standards but capital restrictions may be a good investment alternative for debt fund investors. Since an Alternative Investment Fund is a privately pooled investment entity, the money deposited in it cannot be used to give loans, according to SEBI regulations.

Private Equity Funds

They invest in private companies that aren't publicly listed and have a limited number of shareholders as unregistered and illegal private businesses are unable to raise funding from PE funds. Furthermore, these companies provide their clients with a wide portfolio of stocks, minimizing the risk of the investment. A PE fund typically has a predetermined investment horizon of 4-7 years. After seven years, the company aims to be able to exit the investment with a reasonable return.

Category 3

AIFs in category 3 are those that provide returns in a short period of time. To achieve their objectives, these funds employ a variety of complicated and diversified trading methods. There is no concession or incentive provided by the government for these funds. This category includes:

Hedge Funds

To achieve high returns, a hedge fund combines funds from institutional and accredited investors and invests in both domestic and foreign markets. They have a high level of leverage and handle their investment portfolio aggressively. When opposed to its rivals, such as mutual funds and other investment vehicles, hedge funds are less regulated. These funds typically charge a 2% asset management fee and retain 20% of earnings gained as a fee.

Private Investment in Public Equity Funds

Buying shares of publicly traded stock at a reduced price is referred to as private investment in public equity. This allows the investor to acquire an interest in the firm, while the company selling the stake benefits from the money inflow.

Pros and Cons of AIF

Alternative Investment Funds, like any financial instruments, have their own advantages and drawbacks. The following is the list of pros and cons:

Pros

- With the help of AIF, diversification of market strategies and investing types is made easier.

- It comes with a strong potential to improve the performance of an investment

- Since their success is not based on the ups and downs of the stock market, alternative investments can help to reduce the Volatility often associated with traditional investments

Cons

- Alternative investment funds are complex, and doing your research before investing in them is essential

- A large initial investment is required, which is out of reach for small-scale investors

Eligibility Criteria for AIF Registration

For AIFs to be registered, the following requirements must be met:

- AIF investors must be Indian or non-Indian residents

- The ability to invite the public to subscribe to an entity's shares is limited by its Memorandum of Association (MOA) and Articles of Association (AOA)

- Any AIF must have a minimum corpus of Rs. 20 crores to be considered

- If the applicant is an LLP, a partnership deed must be provided and registered under the LLP Act 2008

- The total number of investors shall never exceed 1000

- A trust deed lawfully registered under the Registration Act 1908 must also be given if an AIF registration application is a registered trust

Documents Required for Registration

Along with the registration application, the following documents must be produced:

- The applicant entity's Certificate of Incorporation or Registration

- In case the AIF registration is done by a Limited Liability Partnership Act 2008, a partnership deed is required

- The applicant's registered office address and contact information

- Details of directors and shareholders with respect to the AIF

- In the case of the AIF registration, the original Deed of Trust is executed by a society or trust that has been registered under the Trusts Act of 1882

- The applicant entity's Memorandum and Articles of Association

- A copy of the applicant's Placement Memorandum

- The application entity's contact information and additional information

- Any additional business information relevant to the company's or LLP's expansion goals

Procedure of AIF Registration

In order to get your entity registered for AIF, the applicant must follow the above-mentioned steps:

- For Categories I, II, and III AIF, an application for an AIF Registration Certificate can be submitted to the SEBI in Form A, as specified in the First Schedule of the Regulations, together with the required documentation

- The registration application must be accompanied by a non-refundable application fee, which must be paid in the manner specified in Part B of the Second Schedule as prescribed by Part(A), Schedule (II)

- Before contemplating granting the applicant a Registration Certificate, the SEBI will review the conditions outlined in the Regulations

- The applicant typically receives a response from the SEBI within 21 working days after submitting their registration application. The time it takes to register, on the other hand, is determined by how quickly the applicant meets the prerequisites

- In the application's covering letter, the candidate must specify whether-

- If it is a Venture Capital Fund that is registered with the SEBI, then you must provide further information

- In case the applicant has been undertaking AIF activities, then you must provide further information before lodging the registration application

- The applicant is requesting for registration of a new fund

- In addition, the applicant shall periodically make an online application in accordance with SEBI standards

Registration Fees of AIF

After acquiring SEBI clearance, an applicant must submit the following registration fee for the issuance of a Certificate of Registration:

| Category | Registration Fees |

|---|---|

| Category I | INR 5,00,000 |

| Category II | INR 1,00,000 |

| Category III | INR 15,00,000 |

This certificate registration has validity till the AIF's existence is terminated.

Alternative Investment Fund Registration Compliances

After receiving the AIF Registration Certificate, the applicant must comply with the following requirements:

- Following registration, Alternative Investment Funds must adhere to the reporting criteria set out by SEBI on a regular basis

- An AIF must monitor the SEBI website on a regular basis for any updates, circulars, or recommendations published by SEBI relating to the Alternative Investment Fund activities

- In case there are significant changes in the information already provided to SEBI, AIF shall notify SEBI within a reasonable time frame

The Bottom Line

AIFs are the most versatile investment vehicles since they allow for unlisted stock investments, as well as leverage and shorting. As a result, AIFs can provide strategies with significantly higher levels of complexity. In this way, investors have the widest variety of risk-reward possibilities accessible.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.