What are Perpetual Bonds?

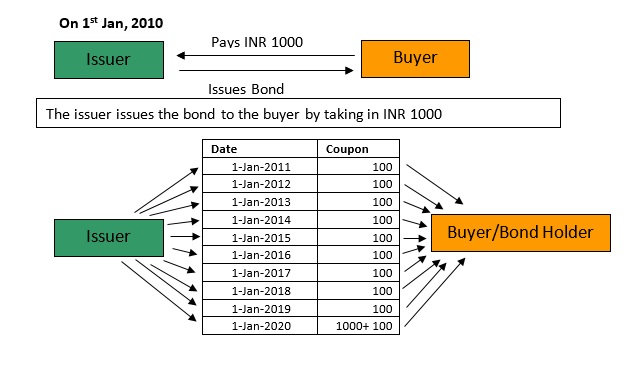

Perpetual Bonds refer to the idea that the coupon payments on these bonds will potentially always be made in perpetuity. This kind of bond is often regarded as equity. Bonds with a perpetual maturity have no expiration date. They are often known as consol bonds or simply perps. Like the majority of bonds, they issue coupons to investors as a means of paying interest. However, the bond's principal does not have a defined redemption or repayment date.

One of the earliest perpetual bond examples is the Dutch water board of Lekdijk Bovendams, issued on May 15, 1648.

Callable Perpetual Bond

Bonds that are redeemable by the issuer within a specific time frame are known as callable perpetual bonds.

Where to Buy Perpetual Bonds?

These bonds are typically issued by banks or government organisations to raise money at set interest or coupon rates. Bonds are bought by investors so that they can earn guaranteed income forever unless the issuer decides to redeem the bonds. The issuer is also exempt from paying back the principal sum.

Perpetual Bond Formula

Let's learn how to calculate the present value of a perpetual bond:

Present value = d/r

where,

- d represents periodic bond coupon payment

- r represents the bond's discount rate

Note: A perpetual bond's present value is quite sensitive to the given discount rate.

For example, if a perpetual bond pays INR 15,000 a year for all time and a discount rate of 5% is used, the present value would be:

INR 15,000 / 0.05 = INR 3,000,000

Talk to our investment specialist

Pros and Cons of Perpetual Bond

Perpetual Bond investments can give you a stable income. Since these bonds don't have a maturity date, the income will be received for a long period of time. Compared to a few other Investing instruments on the market, the return on investment is better with these bonds. However, if you are still confused, let's find out some pros and cons of investing in perpetual bonds.

Pros

- India is recognised for offering significantly greater returns on investment in the form of interest through perpetual bonds. For the owner of a perpetual bond, the coupon payment may continue indefinitely

- For investors who invest in fixed income, perpetual bonds are a source of income. The investment has no set maturity date; hence the perpetual bonds' interest is repeating in nature

- Even though perpetual bonds are vulnerable to interest rate and credit risk, overall investment risk is often lower than the risk associated with equities. In the case of bankruptcy, the interests of perpetual bondholders take precedence over those of shareholders

Cons

- There is an Opportunity Cost associated with perpetual bond investments since you could be giving up other, perhaps more lucrative, opportunities

- A call provision, which enables the issuer to redeem the bond after a specific period of time, is typically present in perpetual bonds

- Inflation risk, or the possibility that your investment won't generate enough income to keep up with inflation, is a risk associated with investing in perpetual bonds. Your money loses buying power when this happens

Duration of Perpetual Bond

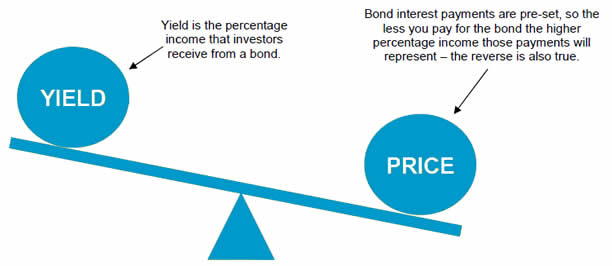

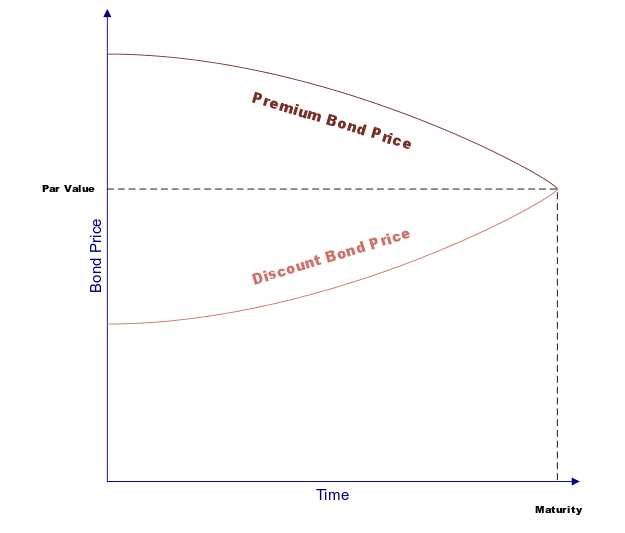

The tenure of a bond determines how sensitive a bond's price or value is to variations in market interest rates. (1+Yield)/Yield is the formula used to determine a perpetual bond's tenure. It's stated in years.

Taxation of Perpetual Bonds

The yearly coupon from perpetual bonds will be added to the investor's total income and taxed in accordance with the income tax bracket the person falls under. However, if the bond is sold on the secondary market and the investor experiences a long-term capital gain (after a one-year holding period), the long-term Capital Gains tax, which is not indexed, will be applied at a rate of 10%.

Why Invest in Perpetual Bonds in India?

You can receive a fixed income by investing in perpetual bonds in India. Because these bonds don't have a maturity date, the money collected will last long. Compared to a few other investing instruments on the market, the return on investment is better.

The Bottom Line

Banks, corporations, Mutual Funds, and individual investors invest in perpetual bonds. It can assist you in achieving certain financial objectives in your life and generating money in the form of interest. Before choosing the investment amount, you must consider your capacity for risk and profit. While some economists are adamant proponents of perpetual bonds because they can assist financially strapped governments create cash, others are opposed to the concept of creating debt that isn't meant to be repaid. They also disagree that it is a smart fiscal strategy for a government to be obligated to pay someone forever.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.