6 Best Monthly Income Plan (MIP) 2026

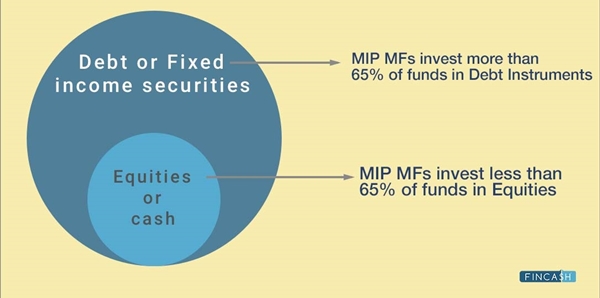

The Monthly Income Plan is an open-ended mutual fund that predominantly invests its assets in fixed income instruments.

Typically, monthly income plan is a combination of debt and equity assets, in which more 65% of the assets are invested in fixed income yielding instruments. However, the remaining assets of the monthly income scheme are invested in equity-linked instruments, like shares and stocks, that provide market-linked returns.

The basic objective of the monthly income plan is to provide regular income to people. Also, a MIP Mutual fund offers an option of monthly as well as quarterly income, that people can choose according to their convenience.

Investing in MIPs is easy and hassle-free. Investors can buy and sell MIP units like any other mutual fund scheme. You can invest either through a lump sum or through a systematic Investment plan (SIP), where a fixed amount is invested at regular intervals. If you want to invest in monthly income plan, it is advised to consider a list of best monthly income plan offered by various mutual fund companies.

MIP Returns

The returns from MIPs are primarily in the form of dividends, which are declared by the mutual fund company at regular intervals, typically on a monthly or quarterly basis. The dividends received from MIPs are tax-free in the hands of the investors. In addition to providing regular income, MIPs also offer the benefit of capital appreciation. The equity portion of the fund allows investors to participate in the growth potential of the stock market, while the debt component ensures that the downside risk is limited.

MIPs are managed by professional fund managers who make investment decisions on behalf of the investors. The fund managers have a wealth of experience and expertise in managing investments and are responsible for allocating the assets of the fund in a manner that generates the best possible returns.

MIPs come in different variants, such as conservative, moderate, and aggressive. Conservative MIPs invest a larger portion of their assets in debt instruments, while aggressive MIPs have a higher allocation to equities. The investment objective of each variant is different, and investors can choose the one that best suits their risk appetite.

Who Should Invest in Monthly Income Plan (MIP)?

Any moderate risk-averse investor who is looking for some exposure to equity markets along with a fixed income can invest in a monthly income plan. Apart from providing fixed income, monthly income scheme offers market linked returns. Moreover, a monthly income plan is suitable for senior citizens as well, those who are nearing retirement.

Fund Selection Methodology used to find 6 funds

6 Best Performing Monthly Income Mutual Funds in India FY 26 - 27

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Since launch (%) ICICI Prudential MIP 25 Growth ₹77.5988

↓ -0.25 ₹3,334 -0.4 1.9 8.4 10.3 8.8 7.9 9.8 DSP Regular Savings Fund Growth ₹59.9397

↓ -0.11 ₹183 0 2.4 7.5 10 8.1 7.2 8.6 Aditya Birla Sun Life Regular Savings Fund Growth ₹69.0314

↓ -0.15 ₹1,533 0.4 3.1 9.3 9.5 8.6 7.1 9.3 Baroda Pioneer Conservative Hybrid Fund Growth ₹30.2092

↑ 0.02 ₹33 -1.7 -1.2 3.3 9.1 7.8 6.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MIP 25 DSP Regular Savings Fund Aditya Birla Sun Life Regular Savings Fund Baroda Pioneer Conservative Hybrid Fund Point 1 Highest AUM (₹3,334 Cr). Lower mid AUM (₹183 Cr). Upper mid AUM (₹1,533 Cr). Bottom quartile AUM (₹33 Cr). Point 2 Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (21+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 3★ (lower mid). Rating: 5★ (upper mid). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 8.82% (top quartile). 5Y return: 8.09% (lower mid). 5Y return: 8.58% (upper mid). 5Y return: 7.83% (bottom quartile). Point 6 3Y return: 10.26% (top quartile). 3Y return: 9.99% (upper mid). 3Y return: 9.53% (lower mid). 3Y return: 9.05% (bottom quartile). Point 7 1Y return: 8.44% (upper mid). 1Y return: 7.48% (lower mid). 1Y return: 9.26% (top quartile). 1Y return: 3.31% (bottom quartile). Point 8 1M return: 0.40% (lower mid). 1M return: 0.50% (upper mid). 1M return: 1.19% (top quartile). 1M return: -1.08% (bottom quartile). Point 9 Alpha: 0.00 (bottom quartile). Alpha: 0.55 (upper mid). Alpha: 1.62 (top quartile). Alpha: 0.25 (lower mid). Point 10 Sharpe: 0.50 (lower mid). Sharpe: 0.29 (bottom quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.85 (top quartile). ICICI Prudential MIP 25

DSP Regular Savings Fund

Aditya Birla Sun Life Regular Savings Fund

Baroda Pioneer Conservative Hybrid Fund

*Above is the list of best performing monthy income providing Mutual Funds managing assets over 3 years.

The Scheme seeks to generate regular income through investments primarily in debt and money market instruments. As a secondary objective, the Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the Scheme. However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for ICICI Prudential MIP 25 Below is the key information for ICICI Prudential MIP 25 Returns up to 1 year are on (Erstwhile DSP BlackRock MIP Fund) The scheme is seeking to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities. The scheme will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of the 100 largest corporates by market capitalisation, listed in India. Research Highlights for DSP Regular Savings Fund Below is the key information for DSP Regular Savings Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life MIP II - Wealth 25 Plan) An Open-ended income scheme with the objective to generate regular income so as to make monthly payment or distribution to unit holders with the secondary objective being growth of capital. Monthly Income is not assured and is subject to availability of distributable surplus. Research Highlights for Aditya Birla Sun Life Regular Savings Fund Below is the key information for Aditya Birla Sun Life Regular Savings Fund Returns up to 1 year are on (Erstwhile Baroda Pioneer MIP Fund) To generate regular income through investment in debt and money market instruments and also to generate long term capital appreciation by investing a portion in equity and equity related instruments. Research Highlights for Baroda Pioneer Conservative Hybrid Fund Below is the key information for Baroda Pioneer Conservative Hybrid Fund Returns up to 1 year are on 1. ICICI Prudential MIP 25

ICICI Prudential MIP 25

Growth Launch Date 30 Mar 04 NAV (27 Feb 26) ₹77.5988 ↓ -0.25 (-0.32 %) Net Assets (Cr) ₹3,334 on 31 Jan 26 Category Hybrid - Hybrid Debt AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio 0.5 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,857 28 Feb 23 ₹11,380 29 Feb 24 ₹13,002 28 Feb 25 ₹14,010 28 Feb 26 ₹15,261 Returns for ICICI Prudential MIP 25

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.4% 3 Month -0.4% 6 Month 1.9% 1 Year 8.4% 3 Year 10.3% 5 Year 8.8% 10 Year 15 Year Since launch 9.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 11.4% 2022 11.4% 2021 5.1% 2020 9.9% 2019 10.9% 2018 9.6% 2017 5.1% 2016 12.9% 2015 10.9% Fund Manager information for ICICI Prudential MIP 25

Name Since Tenure Manish Banthia 19 Sep 13 12.38 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Roshan Chutkey 2 May 22 3.76 Yr. Sharmila D’mello 31 Jul 22 3.51 Yr. Data below for ICICI Prudential MIP 25 as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 12.24% Equity 23.73% Debt 63.74% Other 0.29% Equity Sector Allocation

Sector Value Financial Services 6.57% Consumer Cyclical 3.18% Technology 2.28% Health Care 2.12% Consumer Defensive 1.93% Communication Services 1.89% Real Estate 1.47% Energy 1.23% Industrials 1.2% Utility 1.19% Basic Materials 0.66% Debt Sector Allocation

Sector Value Corporate 45.25% Government 22.08% Cash Equivalent 8.64% Credit Quality

Rating Value A 7.37% AA 42.78% AAA 49.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.68% Gs 2040

Sovereign Bonds | -5% ₹159 Cr 16,464,700 6.90% Gs 2065

Sovereign Bonds | -4% ₹140 Cr 15,000,000 National Bank For Agriculture And Rural Development

Debentures | -3% ₹100 Cr 10,000 Manappuram Finance Limited

Debentures | -3% ₹100 Cr 10,000 Adani Enterprises Limited

Debentures | -3% ₹99 Cr 10,000 L&T Metro Rail (Hyderabad) Limited

Debentures | -2% ₹80 Cr 800 Goi Frb 2034

Sovereign Bonds | -2% ₹75 Cr 7,409,560 360 One Prime Limited

Debentures | -2% ₹75 Cr 7,500 Yes Bank Limited

Debentures | -2% ₹64 Cr 650 Godrej Properties Limited

Debentures | -2% ₹51 Cr 5,000 2. DSP Regular Savings Fund

DSP Regular Savings Fund

Growth Launch Date 11 Jun 04 NAV (27 Feb 26) ₹59.9397 ↓ -0.11 (-0.19 %) Net Assets (Cr) ₹183 on 31 Jan 26 Category Hybrid - Hybrid Debt AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.12 Sharpe Ratio 0.29 Information Ratio 0.66 Alpha Ratio 0.55 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,766 28 Feb 23 ₹11,081 29 Feb 24 ₹12,612 28 Feb 25 ₹13,672 28 Feb 26 ₹14,756 Returns for DSP Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.5% 3 Month 0% 6 Month 2.4% 1 Year 7.5% 3 Year 10% 5 Year 8.1% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.2% 2023 11% 2022 12% 2021 3.5% 2020 7.8% 2019 9.3% 2018 6.9% 2017 -5.3% 2016 11% 2015 10.7% Fund Manager information for DSP Regular Savings Fund

Name Since Tenure Abhishek Singh 31 May 21 4.67 Yr. Shantanu Godambe 1 Aug 24 1.5 Yr. Data below for DSP Regular Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 16.17% Equity 19.11% Debt 63.59% Other 1.13% Equity Sector Allocation

Sector Value Financial Services 9.52% Health Care 2.36% Consumer Cyclical 1.54% Technology 1.25% Utility 1.16% Consumer Defensive 0.93% Energy 0.78% Basic Materials 0.68% Industrials 0.51% Communication Services 0.37% Debt Sector Allocation

Sector Value Government 59.45% Cash Equivalent 11.06% Corporate 9.25% Credit Quality

Rating Value AA 5.89% AAA 94.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity Goi Floating Rate Bond 2033

Sovereign Bonds | -12% ₹21 Cr 2,000,000 7.32% Gs 2030

Sovereign Bonds | -12% ₹21 Cr 2,000,000 7.03% Maharashtra Sgs 2038

Sovereign Bonds | -8% ₹15 Cr 1,500,000

↑ 1,500,000 7.06% Gs 2028

Sovereign Bonds | -6% ₹10 Cr 1,000,000 6.33% Gs 2035

Sovereign Bonds | -5% ₹10 Cr 1,000,000 Muthoot Finance Limited

Debentures | -4% ₹8 Cr 750 7.37% Gs 2028

Sovereign Bonds | -3% ₹5 Cr 500,000 7.10% Gs 2029

Sovereign Bonds | -3% ₹5 Cr 500,000 7.10% Gs 2034

Sovereign Bonds | -3% ₹5 Cr 500,000 Goi Floating Rate Bond 2031

Sovereign Bonds | -3% ₹5 Cr 500,000 3. Aditya Birla Sun Life Regular Savings Fund

Aditya Birla Sun Life Regular Savings Fund

Growth Launch Date 22 May 04 NAV (27 Feb 26) ₹69.0314 ↓ -0.15 (-0.22 %) Net Assets (Cr) ₹1,533 on 31 Jan 26 Category Hybrid - Hybrid Debt AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.91 Sharpe Ratio 0.63 Information Ratio 0.18 Alpha Ratio 1.62 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,143 28 Feb 23 ₹11,487 29 Feb 24 ₹12,752 28 Feb 25 ₹13,756 28 Feb 26 ₹15,093 Returns for Aditya Birla Sun Life Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 1.2% 3 Month 0.4% 6 Month 3.1% 1 Year 9.3% 3 Year 9.5% 5 Year 8.6% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.1% 2023 10.5% 2022 9.6% 2021 5.3% 2020 13.4% 2019 9.2% 2018 5.8% 2017 -2.2% 2016 15.5% 2015 13.1% Fund Manager information for Aditya Birla Sun Life Regular Savings Fund

Name Since Tenure Mohit Sharma 31 Oct 24 1.25 Yr. Harshil Suvarnkar 22 Mar 21 4.87 Yr. Data below for Aditya Birla Sun Life Regular Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.48% Equity 21.33% Debt 70.88% Other 0.32% Equity Sector Allocation

Sector Value Financial Services 7.82% Health Care 2.46% Consumer Cyclical 2.1% Basic Materials 2.01% Technology 1.67% Industrials 1.46% Communication Services 1.16% Consumer Defensive 0.9% Real Estate 0.86% Energy 0.68% Utility 0.2% Debt Sector Allocation

Sector Value Corporate 45.91% Government 26.49% Cash Equivalent 5.95% Credit Quality

Rating Value A 2.22% AA 19.91% AAA 77.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cholamandalam Investment And Finance Company Limited

Debentures | -4% ₹56 Cr 5,500 Bharti Telecom Limited

Debentures | -3% ₹50 Cr 5,000 Housing And Urban Development Corporation Limited

Debentures | -3% ₹50 Cr 5,000

↑ 5,000 Jtpm Metal TRaders Limited

Debentures | -3% ₹45 Cr 4,316 Adani Power Ltd

Debentures | -2% ₹35 Cr 3,500

↑ 3,500 7.10% Gs 2034

Sovereign Bonds | -2% ₹31 Cr 3,000,000 Bajaj Housing Finance Limited

Debentures | -2% ₹30 Cr 300 Nuvama Wealth Finance Limited

Debentures | -2% ₹30 Cr 3,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK2% ₹28 Cr 206,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 17 | HDFCBANK2% ₹28 Cr 300,000 4. Baroda Pioneer Conservative Hybrid Fund

Baroda Pioneer Conservative Hybrid Fund

Growth Launch Date 8 Sep 04 NAV (11 Mar 22) ₹30.2092 ↑ 0.02 (0.06 %) Net Assets (Cr) ₹33 on 31 Jan 22 Category Hybrid - Hybrid Debt AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆☆ Risk Moderate Expense Ratio 2.08 Sharpe Ratio 0.85 Information Ratio -0.38 Alpha Ratio 0.25 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,434 Returns for Baroda Pioneer Conservative Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month -1.1% 3 Month -1.7% 6 Month -1.2% 1 Year 3.3% 3 Year 9.1% 5 Year 7.8% 10 Year 15 Year Since launch 6.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Baroda Pioneer Conservative Hybrid Fund

Name Since Tenure Data below for Baroda Pioneer Conservative Hybrid Fund as on 31 Jan 22

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

Risks in MIP Mutual Fund Scheme

Before investing in any of the above mentioned best monthly income plans, you must know the risks of a monthly income scheme.

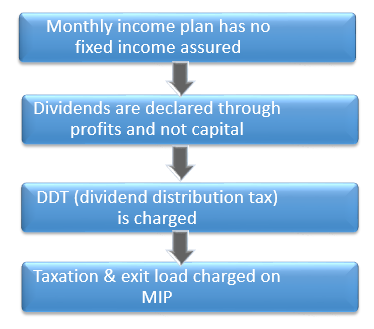

No fixed assurance

It is a common belief that monthly income plan provides fixed income monthly. But, there is no guarantee of assured returns in such Mutual Funds. As this scheme also invests in equities, the returns depend on the fund performance and the market status.

Talk to our investment specialist

Dividends are declared through profits and not capital

Dividends for Monthly Income Scheme can be paid only from the additional income and not from the capital investment. For instance, if the Net Asset Value (NAV) of the fund increases from INR 10 to INR 13, the scheme can declare only out of INR 3 it has earned in capital appreciation. Therefore, if the scheme's NAV rises slowly or falls due to market moves, it may not declare dividends at all.

DDT is charged

If you opt for MIP with dividend option, the income that you earn periodically in the form of dividends is charged a Dividend Distribution Tax (DDT). So, the returns are not totally tax-free.

Taxation & Exit Load on MIP

The lock-in period of certain Monthly Income Schemes are as high as three years, so if the scheme is sold before the maturity period a certain exit load is applicable. Also, the MIPs invest most of their assets in debt instruments, so the taxation on them as per debt investment.

How to Invest in Monthly Income Plans Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You clarified nicely that MIP is not about regular monthly income as its returns works like regular mutual fund schemes. But is this MIP having risk with the capital too. Do we lose capital in case market performance is poor ie same as MFs

Best information is given for investment

Please advise for investment regards

Excellent understand ing