সেরা ব্যালেন্সড মিউচুয়াল ফান্ড ইন্ডিয়া 2022

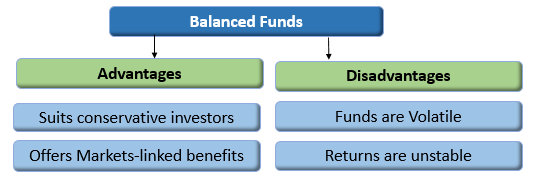

শীর্ষব্যালেন্সড ফান্ড হয়যৌথ পুঁজি যারা তাদের সম্পদের 65% এর বেশি বিনিয়োগ করেইক্যুইটি এবং ভাল সামগ্রিক রিটার্ন প্রদানের জন্য ঋণ উপকরণে অবশিষ্ট সম্পদ। ব্যালেন্সড মিউচুয়াল ফান্ডগুলি বিনিয়োগকারীদের জন্য উপকারী যারা একটি নিতে ইচ্ছুকবাজার পাশাপাশি কিছু নির্দিষ্ট রিটার্ন খুঁজতে গিয়ে ঝুঁকি। ইক্যুইটি এবং স্টকগুলিতে বিনিয়োগ করা সম্পদগুলি বাজার-সংযুক্ত রিটার্ন অফার করে যখন ঋণের উপকরণগুলিতে বিনিয়োগ করা সম্পদগুলি নির্দিষ্ট রিটার্ন অফার করে। ইক্যুইটি এবং ঋণ উভয়ের সংমিশ্রণ হওয়ায়, বিনিয়োগকারীদের যখন খুব সতর্ক হওয়া উচিতবিনিয়োগ এই তহবিল মধ্যে. ব্যালেন্সড মিউচুয়াল ফান্ডে বিনিয়োগ করার আগে বিনিয়োগকারীদের শীর্ষ ব্যালেন্সড ফান্ড খোঁজার পরামর্শ দেওয়া হয়। আমরা নীচে শীর্ষ ব্যালেন্সড মিউচুয়াল ফান্ড তালিকাভুক্ত করেছি।

Talk to our investment specialist

2022 - 2023 ভারতে বিনিয়োগের জন্য শীর্ষ 7টি ব্যালেন্সড মিউচুয়াল ফান্ড

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 0.5 10.5 27.1 16 14.2 SBI Dynamic Asset Allocation Fund Growth ₹15.9463

↑ 0.03 ₹655 3.9 6.2 25.1 6.9 8.3 Axis Triple Advantage Fund Growth ₹45.8066

↓ -0.05 ₹1,875 6.1 15.6 23.7 16.4 11.9 15.3 SBI Multi Asset Allocation Fund Growth ₹66.6779

↓ -0.60 ₹13,033 4.6 12.9 21.9 19.8 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹828.397

↓ -3.72 ₹78,179 2.7 10.5 18 20 20.3 18.6 Bandhan Hybrid Equity Fund Growth ₹26.915

↓ -0.31 ₹1,576 -0.1 4.6 15.9 16.3 13.5 7.7 HDFC Multi-Asset Fund Growth ₹76.398

↓ -0.69 ₹5,460 1.7 7.2 15.2 15.3 12.9 13.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21 Research Highlights & Commentary of 7 Funds showcased

Commentary Sundaram Equity Hybrid Fund SBI Dynamic Asset Allocation Fund Axis Triple Advantage Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund Bandhan Hybrid Equity Fund HDFC Multi-Asset Fund Point 1 Lower mid AUM (₹1,954 Cr). Bottom quartile AUM (₹655 Cr). Lower mid AUM (₹1,875 Cr). Upper mid AUM (₹13,033 Cr). Highest AUM (₹78,179 Cr). Bottom quartile AUM (₹1,576 Cr). Upper mid AUM (₹5,460 Cr). Point 2 Oldest track record among peers (25 yrs). Established history (10+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (23+ yrs). Established history (9+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (upper mid). Not Rated. Rating: 2★ (lower mid). Top rated. Rating: 2★ (lower mid). Not Rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 14.20% (upper mid). 5Y return: 8.31% (bottom quartile). 5Y return: 11.86% (bottom quartile). 5Y return: 14.85% (upper mid). 5Y return: 20.31% (top quartile). 5Y return: 13.52% (lower mid). 5Y return: 12.90% (lower mid). Point 6 3Y return: 16.03% (lower mid). 3Y return: 6.92% (bottom quartile). 3Y return: 16.41% (upper mid). 3Y return: 19.82% (upper mid). 3Y return: 19.96% (top quartile). 3Y return: 16.28% (lower mid). 3Y return: 15.31% (bottom quartile). Point 7 1Y return: 27.10% (top quartile). 1Y return: 25.12% (upper mid). 1Y return: 23.73% (upper mid). 1Y return: 21.93% (lower mid). 1Y return: 18.04% (lower mid). 1Y return: 15.87% (bottom quartile). 1Y return: 15.22% (bottom quartile). Point 8 1M return: 1.80% (upper mid). 1M return: 1.04% (lower mid). 1M return: 2.85% (top quartile). 1M return: 1.80% (upper mid). 1M return: 1.38% (lower mid). 1M return: 0.81% (bottom quartile). 1M return: 0.96% (bottom quartile). Point 9 Alpha: 5.81 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: -1.32 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 2.64 (top quartile). Sharpe: 2.59 (upper mid). Sharpe: 1.01 (bottom quartile). Sharpe: 1.60 (lower mid). Sharpe: 1.86 (upper mid). Sharpe: 0.17 (bottom quartile). Sharpe: 1.10 (lower mid). Sundaram Equity Hybrid Fund

SBI Dynamic Asset Allocation Fund

Axis Triple Advantage Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

Bandhan Hybrid Equity Fund

HDFC Multi-Asset Fund

শীর্ষ 7 ব্যালেন্সড ফান্ড

(Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on The objective of the fund will be to provide investors with an opportunity to invest in a portfolio of a mix of equity and equity related securities and fixed income instruments. The allocation between fixed income and equity instruments will be managed dynamically so as to provide investors with long term capital appreciation However, there can be no assurance that the investment objective of the Scheme will be achieved. Research Highlights for SBI Dynamic Asset Allocation Fund Below is the key information for SBI Dynamic Asset Allocation Fund Returns up to 1 year are on To generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold exchange traded funds. Research Highlights for Axis Triple Advantage Fund Below is the key information for Axis Triple Advantage Fund Returns up to 1 year are on (Erstwhile SBI Magnum Monthly Income Plan Floater) To provide regular income, liquidity and attractive returns to investors in addition

to mitigating the impact of interest rate risk through an actively managed

portfolio of floating rate and fixed rate debt instruments, equity, money market

instruments and derivatives. Research Highlights for SBI Multi Asset Allocation Fund Below is the key information for SBI Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile IDFC Balanced Fund) The Fund seeks to generate long term capital appreciation along with current income by investing in a mix of equity and equity related securities, debt securities and money market instruments. There is no assurance or guarantee that the objectives of the scheme will be realised. Research Highlights for Bandhan Hybrid Equity Fund Below is the key information for Bandhan Hybrid Equity Fund Returns up to 1 year are on (Erstwhile HDFC Multiple Yield Fund - Plan 2005) To generate positive returns over medium time frame

with low risk of capital loss over medium time frame.

However, there can be no assurance that the

investment objective of the Scheme will be achieved Research Highlights for HDFC Multi-Asset Fund Below is the key information for HDFC Multi-Asset Fund Returns up to 1 year are on 1. Sundaram Equity Hybrid Fund

Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. SBI Dynamic Asset Allocation Fund

SBI Dynamic Asset Allocation Fund

Growth Launch Date 26 Mar 15 NAV (02 Jul 21) ₹15.9463 ↑ 0.03 (0.18 %) Net Assets (Cr) ₹655 on 31 May 21 Category Hybrid - Dynamic Allocation AMC SBI Funds Management Private Limited Rating Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 2.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 Returns for SBI Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1% 3 Month 3.9% 6 Month 6.2% 1 Year 25.1% 3 Year 6.9% 5 Year 8.3% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for SBI Dynamic Asset Allocation Fund

Name Since Tenure Data below for SBI Dynamic Asset Allocation Fund as on 31 May 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Axis Triple Advantage Fund

Axis Triple Advantage Fund

Growth Launch Date 23 Aug 10 NAV (12 Feb 26) ₹45.8066 ↓ -0.05 (-0.12 %) Net Assets (Cr) ₹1,875 on 31 Dec 25 Category Hybrid - Multi Asset AMC Axis Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 1.01 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,316 31 Jan 23 ₹11,603 31 Jan 24 ₹13,362 31 Jan 25 ₹15,261 31 Jan 26 ₹18,429 Returns for Axis Triple Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.8% 3 Month 6.1% 6 Month 15.6% 1 Year 23.7% 3 Year 16.4% 5 Year 11.9% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.3% 2023 15.4% 2022 12.9% 2021 -5.8% 2020 22.8% 2019 18% 2018 15.3% 2017 1.9% 2016 15.9% 2015 7.1% Fund Manager information for Axis Triple Advantage Fund

Name Since Tenure Devang Shah 5 Apr 24 1.74 Yr. Aditya Pagaria 1 Jun 24 1.59 Yr. Ashish Naik 22 Jun 16 9.53 Yr. Hardik Shah 5 Apr 24 1.74 Yr. Pratik Tibrewal 1 Feb 25 0.91 Yr. Krishnaa N 16 Dec 24 1.04 Yr. Data below for Axis Triple Advantage Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 6.46% Equity 66.13% Debt 9.52% Other 17.88% Equity Sector Allocation

Sector Value Financial Services 20.39% Consumer Cyclical 9.68% Industrials 8.6% Technology 7.12% Basic Materials 7.01% Health Care 6.61% Consumer Defensive 3.67% Communication Services 2.76% Energy 1.3% Real Estate 1.03% Utility 0.08% Debt Sector Allocation

Sector Value Cash Equivalent 6.62% Corporate 6.11% Government 3.26% Credit Quality

Rating Value A 11.2% AA 33.72% AAA 55.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -14% ₹268 Cr 24,248,251

↑ 11,700,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK5% ₹100 Cr 1,009,018

↑ 139,786 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | 5321745% ₹94 Cr 701,518

↑ 330,620 Axis Silver ETF

- | -4% ₹73 Cr 3,250,000

↓ -5,017,048 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN3% ₹62 Cr 629,497

↑ 274,687 Infosys Ltd (Technology)

Equity, Since 31 May 18 | INFY2% ₹45 Cr 276,762

↓ -6,829 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹43 Cr 202,647 Future on BANK Index

- | -2% -₹40 Cr 402,600

↑ 402,600 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 13 | LT2% ₹38 Cr 92,027 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Mar 18 | TCS2% ₹33 Cr 104,319

↑ 84,305 4. SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund

Growth Launch Date 21 Dec 05 NAV (13 Feb 26) ₹66.6779 ↓ -0.60 (-0.89 %) Net Assets (Cr) ₹13,033 on 31 Dec 25 Category Hybrid - Multi Asset AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 1.6 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,431 31 Jan 23 ₹11,977 31 Jan 24 ₹15,246 31 Jan 25 ₹16,963 31 Jan 26 ₹20,613 Returns for SBI Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.8% 3 Month 4.6% 6 Month 12.9% 1 Year 21.9% 3 Year 19.8% 5 Year 14.8% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 12.8% 2022 24.4% 2021 6% 2020 13% 2019 14.2% 2018 10.6% 2017 0.4% 2016 10.9% 2015 8.7% Fund Manager information for SBI Multi Asset Allocation Fund

Name Since Tenure Dinesh Balachandran 31 Oct 21 4.17 Yr. Mansi Sajeja 1 Dec 23 2.09 Yr. Vandna Soni 1 Jan 24 2 Yr. Data below for SBI Multi Asset Allocation Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 12.13% Equity 45.25% Debt 32.2% Other 10.42% Equity Sector Allocation

Sector Value Financial Services 13.68% Real Estate 6.21% Consumer Cyclical 5.57% Energy 3.81% Basic Materials 3.79% Technology 3.61% Consumer Defensive 3.18% Industrials 2.21% Utility 1.61% Health Care 1.08% Communication Services 0.32% Debt Sector Allocation

Sector Value Corporate 24.92% Cash Equivalent 10.61% Government 8.8% Credit Quality

Rating Value A 2.11% AA 50.36% AAA 47.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Silver ETF

- | -7% ₹961 Cr 43,430,907

↓ -865,271 Brookfield India Real Estate Trust (Real Estate)

-, Since 30 Apr 25 | BIRET4% ₹503 Cr 15,164,234 SBI Gold ETF

- | -3% ₹423 Cr 37,241,000 6.68% Govt Stock 2040

Sovereign Bonds | -3% ₹340 Cr 35,000,000 Reliance Industries Ltd (Energy)

Equity, Since 15 Sep 24 | RELIANCE2% ₹270 Cr 1,720,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | HDFCBANK2% ₹264 Cr 2,662,000 Jtpm Metal TRaders Limited

Debentures | -2% ₹258 Cr 25,000 6.28% Govt Stock 2032

Sovereign Bonds | -2% ₹246 Cr 25,000,000

↑ 25,000,000 6.01% Govt Stock 2030

Sovereign Bonds | -2% ₹227 Cr 23,000,000

↑ 5,500,000 PB Fintech Ltd (Financial Services)

Equity, Since 31 Jul 25 | 5433902% ₹223 Cr 1,222,500 5. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (12 Feb 26) ₹828.397 ↓ -3.72 (-0.45 %) Net Assets (Cr) ₹78,179 on 31 Dec 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.86 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,181 31 Jan 23 ₹15,831 31 Jan 24 ₹20,109 31 Jan 25 ₹23,330 31 Jan 26 ₹27,072 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.4% 3 Month 2.7% 6 Month 10.5% 1 Year 18% 3 Year 20% 5 Year 20.3% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.9% 2018 7.7% 2017 -2.2% 2016 28.2% 2015 12.5% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 13.93 Yr. Manish Banthia 22 Jan 24 1.94 Yr. Ihab Dalwai 3 Jun 17 8.59 Yr. Akhil Kakkar 22 Jan 24 1.94 Yr. Sri Sharma 30 Apr 21 4.68 Yr. Gaurav Chikane 2 Aug 21 4.42 Yr. Sharmila D'Silva 31 Jul 22 3.42 Yr. Masoomi Jhurmarvala 4 Nov 24 1.16 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 18.84% Equity 64.99% Debt 6.49% Other 9.67% Equity Sector Allocation

Sector Value Financial Services 21.15% Consumer Cyclical 11.33% Consumer Defensive 6.77% Basic Materials 6.33% Industrials 5.88% Technology 5.88% Energy 4.96% Health Care 4.01% Utility 2.25% Communication Services 2.17% Real Estate 1.58% Debt Sector Allocation

Sector Value Cash Equivalent 15.41% Corporate 5.02% Government 4.91% Credit Quality

Rating Value A 1.28% AA 17.26% AAA 81.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -7% ₹5,594 Cr 489,470,882

↑ 177,210,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | 5321744% ₹3,125 Cr 23,271,875 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,411 Cr 15,349,805 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹2,299 Cr 23,194,083 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | 5322153% ₹2,244 Cr 17,676,017 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹1,983 Cr 49,218,026

↑ 19,913,362 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,844 Cr 11,413,639

↓ -861,234 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,534 Cr 918,654

↓ -99,000 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | 5430662% ₹1,510 Cr 17,529,181

↓ -54,400 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 19 | LT2% ₹1,409 Cr 3,450,617 6. Bandhan Hybrid Equity Fund

Bandhan Hybrid Equity Fund

Growth Launch Date 30 Dec 16 NAV (13 Feb 26) ₹26.915 ↓ -0.31 (-1.12 %) Net Assets (Cr) ₹1,576 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC IDFC Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.35 Sharpe Ratio 0.17 Information Ratio 0.62 Alpha Ratio -1.32 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,888 31 Jan 23 ₹12,821 31 Jan 24 ₹15,921 31 Jan 25 ₹17,745 31 Jan 26 ₹19,939 Returns for Bandhan Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.8% 3 Month -0.1% 6 Month 4.6% 1 Year 15.9% 3 Year 16.3% 5 Year 13.5% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.7% 2023 21% 2022 20.4% 2021 -1.1% 2020 30.8% 2019 13.9% 2018 4.7% 2017 -3.8% 2016 16.2% 2015 Fund Manager information for Bandhan Hybrid Equity Fund

Name Since Tenure Harshal Joshi 28 Jul 21 4.43 Yr. Brijesh Shah 10 Jun 24 1.56 Yr. Prateek Poddar 7 Jun 24 1.57 Yr. Ritika Behera 7 Oct 23 2.24 Yr. Gaurav Satra 7 Jun 24 1.57 Yr. Data below for Bandhan Hybrid Equity Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 5% Equity 78.22% Debt 16.78% Equity Sector Allocation

Sector Value Financial Services 22.3% Consumer Cyclical 11.51% Technology 8.41% Health Care 6.53% Industrials 5.49% Consumer Defensive 5.1% Basic Materials 5.04% Energy 4.86% Utility 3.37% Communication Services 3.09% Real Estate 1.93% Debt Sector Allocation

Sector Value Corporate 8.81% Government 7.97% Cash Equivalent 5% Credit Quality

Rating Value AA 4.52% AAA 95.48% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK6% ₹99 Cr 994,069

↑ 89,544 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 20 | RELIANCE5% ₹77 Cr 487,991

↑ 37,145 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | 5321744% ₹62 Cr 465,128

↑ 59,731 Bajaj Housing Finance Limited

Debentures | -4% ₹60 Cr 6,000,000 Tata Capital Limited

Debentures | -3% ₹51 Cr 5,000,000 7.3% Govt Stock 2053

Sovereign Bonds | -3% ₹50 Cr 5,000,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 17 | 5322153% ₹45 Cr 351,277

↑ 79,847 Infosys Ltd (Technology)

Equity, Since 31 Jan 17 | INFY3% ₹41 Cr 250,966

↑ 30,117 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN2% ₹39 Cr 400,530

↑ 11,108 NTPC Ltd (Utilities)

Equity, Since 28 Feb 23 | 5325552% ₹35 Cr 1,051,423

↑ 38,208 7. HDFC Multi-Asset Fund

HDFC Multi-Asset Fund

Growth Launch Date 17 Aug 05 NAV (13 Feb 26) ₹76.398 ↓ -0.69 (-0.89 %) Net Assets (Cr) ₹5,460 on 31 Dec 25 Category Hybrid - Multi Asset AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 1.85 Sharpe Ratio 1.1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-15 Months (1%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,956 31 Jan 23 ₹12,562 31 Jan 24 ₹15,094 31 Jan 25 ₹16,850 31 Jan 26 ₹19,343 Returns for HDFC Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1% 3 Month 1.7% 6 Month 7.2% 1 Year 15.2% 3 Year 15.3% 5 Year 12.9% 10 Year 15 Year Since launch 10.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.2% 2023 13.5% 2022 18% 2021 4.3% 2020 17.9% 2019 20.9% 2018 9.3% 2017 -1.9% 2016 11.8% 2015 8.9% Fund Manager information for HDFC Multi-Asset Fund

Name Since Tenure Anil Bamboli 17 Aug 05 20.39 Yr. Arun Agarwal 24 Aug 20 5.36 Yr. Srinivasan Ramamurthy 13 Jan 22 3.97 Yr. Bhagyesh Kagalkar 2 Feb 22 3.91 Yr. Dhruv Muchhal 22 Jun 23 2.53 Yr. Nandita Menezes 29 Mar 25 0.76 Yr. Data below for HDFC Multi-Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 26.15% Equity 51.35% Debt 10.6% Other 11.9% Equity Sector Allocation

Sector Value Financial Services 22.65% Consumer Cyclical 9.13% Energy 6.75% Health Care 5.88% Technology 5.78% Industrials 4.67% Communication Services 3.21% Consumer Defensive 3.19% Basic Materials 3.08% Utility 2.12% Real Estate 1.94% Debt Sector Allocation

Sector Value Cash Equivalent 25.25% Government 6.02% Corporate 5.49% Credit Quality

Rating Value AA 15.3% AAA 84.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Gold ETF

- | -12% ₹659 Cr 57,946,747 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 18 | RELIANCE6% ₹317 Cr 2,016,500 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | 5321745% ₹299 Cr 2,225,700 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 18 | HDFCBANK5% ₹262 Cr 2,641,200 Reliance Industries Ltd.

Derivatives | SHORT4% -₹200 Cr 1,266,500

↑ 1,266,500 State Bank of India (Financial Services)

Equity, Since 31 Aug 21 | SBIN3% ₹155 Cr 1,575,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Jun 18 | BHARTIARTL3% ₹154 Cr 731,925 Icici Bank Ltd.

Derivatives | SHORT3% -₹149 Cr 1,099,700

↑ 1,099,700 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 20 | MARUTI2% ₹107 Cr 63,800

↑ 14,539 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 21 | 5322152% ₹102 Cr 800,000

↑ 50,000

কীভাবে অনলাইনে ব্যালেন্সড ফান্ডে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন।

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।

You Might Also Like

3 Best Balanced Funds By Franklin Templeton Mutual Fund 2026

Top 3 Best Balanced Funds By Nippon/reliance Mutual Fund 2026

Top 4 Best Balanced Funds By ICICI Prudential Mutual Fund 2026

Best Debt Mutual Funds In India For 2026 | Top Funds By Tenure & Tax Benefits

6 Best Balanced Funds By Aditya Birla Sun Life Mutual Fund 2026

Research Highlights for Sundaram Equity Hybrid Fund