সেরা ব্যালেন্সড মিউচুয়াল ফান্ড 2022

শীর্ষব্যালেন্সড ফান্ড হয়যৌথ পুঁজি যে ভাল সামগ্রিক রিটার্ন ফলন উভয় ইক্যুইটি এবং ঋণ উপকরণ উভয় তাদের সম্পদ বিনিয়োগ. ব্যালেন্সড মিউচুয়াল ফান্ডগুলি বিনিয়োগকারীদের জন্য উপকারী যারা একটি নিতে ইচ্ছুকবাজার পাশাপাশি কিছু নির্দিষ্ট রিটার্ন খুঁজতে গিয়ে ঝুঁকি।

ইক্যুইটি এবং স্টকগুলিতে বিনিয়োগ করা সম্পদগুলি বাজার-সংযুক্ত রিটার্ন অফার করে যখন ঋণের উপকরণগুলিতে বিনিয়োগ করা সম্পদগুলি নির্দিষ্ট রিটার্ন অফার করে। ইক্যুইটি এবং ঋণ উভয়ের সংমিশ্রণ হওয়ায়, বিনিয়োগকারীদের যখন খুব সতর্ক হওয়া উচিতবিনিয়োগ এই তহবিল মধ্যে. ব্যালেন্সড মিউচুয়াল ফান্ডে বিনিয়োগ করার আগে বিনিয়োগকারীদের শীর্ষ ব্যালেন্সড ফান্ড খোঁজার পরামর্শ দেওয়া হয়। আমরা নীচে শীর্ষ ব্যালেন্সড মিউচুয়াল ফান্ড তালিকাভুক্ত করেছি।

ব্যালেন্সড মিউচুয়াল ফান্ডে কেন বিনিয়োগ করবেন?

সাধারণত, বিনিয়োগকারীরা কম ঝুঁকি সহ অল্প সময়ের মধ্যে তাদের বিনিয়োগকে বৈচিত্র্যময় করার উপায় খোঁজেন। ইক্যুইটি এবং ঋণ উভয় উপকরণের সংমিশ্রণ হওয়ায়, সুষম মিউচুয়াল ফান্ড এই উভয় জগতের সেরা অফার করে। সুতরাং, এই তহবিলগুলি ক্রমাগত পরিবর্তিত বাজারের অবস্থার কারণে পতনের ঝুঁকি হ্রাস করে যখন ঋণের এক্সপোজারের কারণে কিছু মৌলিক রিটার্ন পরিচালনা করে। এটি সুষম তহবিলকে 100% বিনিয়োগের চেয়ে সামান্য কম ঝুঁকি সহ রিটার্ন পাওয়ার মধ্যপথের সন্ধানকারী বিনিয়োগকারীদের জন্য একটি অত্যন্ত উপযুক্ত বিনিয়োগ বিকল্প করে তোলেইক্যুইটি ফান্ড.

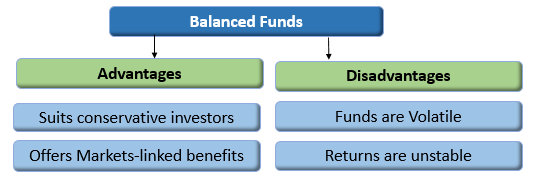

শীর্ষ ব্যালেন্সড ফান্ডের সুবিধা ও অসুবিধা

সুবিধাদি

- স্থায়ী সম্পদের 35-40% বিনিয়োগ করে স্থিতিশীল আয় প্রদান করেআয় বিকল্প

- ইক্যুইটিতে সম্পদের 60-65% বিনিয়োগ করে বাজার-সংযুক্ত রিটার্নের প্রস্তাব দেয়

- মাঝারি ঝুঁকি নিতে ইচ্ছুক রক্ষণশীল বিনিয়োগকারীদের জন্য উপযুক্ত

অসুবিধা

- ইক্যুইটিতে বিনিয়োগ করা তহবিলগুলি অস্থির এবং উচ্চ ঝুঁকিপূর্ণফ্যাক্টর

- সম্মিলিত আয় (ঋণ এবং ইক্যুইটি মিউচুয়াল ফান্ড উভয়েরই রিটার্ন) দীর্ঘমেয়াদে খুব ভালো রিটার্ন নাও দিতে পারে

Talk to our investment specialist

FY 22 - 23 বিনিয়োগ করার জন্য সেরা পারফর্মিং ব্যালেন্সড ফান্ড বা হাইব্রিড ফান্ড

টপ পারফর্মিং অ্যাগ্রেসিভ হাইব্রিড ফান্ড

এই তহবিল তার মোট সম্পদের প্রায় 65 থেকে 85 শতাংশ ইক্যুইটি-সম্পর্কিত উপকরণগুলিতে এবং তাদের সম্পদের প্রায় 20 থেকে 35 শতাংশ ঋণের উপকরণগুলিতে বিনিয়োগ করবে।মিউচুয়াল ফান্ড হাউস একটি সুষম হাইব্রিড বা আক্রমণাত্মক হাইব্রিড তহবিল অফার করতে পারে, উভয়ই নয়।

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.57

↑ 0.11 ₹1,329 0.8 2.6 16.1 19.8 18.6 ICICI Prudential Equity and Debt Fund Growth ₹410.64

↑ 0.44 ₹49,257 -0.4 4.1 16.4 19.6 19.1 JM Equity Hybrid Fund Growth ₹117.534

↑ 0.12 ₹753 -4.1 -1.3 5.6 17.8 15.1 UTI Hybrid Equity Fund Growth ₹413.996

↑ 0.43 ₹6,654 -1 3.8 11.9 16.9 15.1 Bandhan Hybrid Equity Fund Growth ₹27.014

↑ 0.03 ₹1,632 -0.3 4.3 18.6 16.9 14.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary BOI AXA Mid and Small Cap Equity and Debt Fund ICICI Prudential Equity and Debt Fund JM Equity Hybrid Fund UTI Hybrid Equity Fund Bandhan Hybrid Equity Fund Point 1 Bottom quartile AUM (₹1,329 Cr). Highest AUM (₹49,257 Cr). Bottom quartile AUM (₹753 Cr). Upper mid AUM (₹6,654 Cr). Lower mid AUM (₹1,632 Cr). Point 2 Established history (9+ yrs). Established history (26+ yrs). Established history (30+ yrs). Oldest track record among peers (31 yrs). Established history (9+ yrs). Point 3 Not Rated. Top rated. Rating: 1★ (lower mid). Rating: 3★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.60% (upper mid). 5Y return: 19.10% (top quartile). 5Y return: 15.13% (lower mid). 5Y return: 15.08% (bottom quartile). 5Y return: 14.10% (bottom quartile). Point 6 3Y return: 19.75% (top quartile). 3Y return: 19.57% (upper mid). 3Y return: 17.77% (lower mid). 3Y return: 16.94% (bottom quartile). 3Y return: 16.90% (bottom quartile). Point 7 1Y return: 16.07% (lower mid). 1Y return: 16.41% (upper mid). 1Y return: 5.62% (bottom quartile). 1Y return: 11.87% (bottom quartile). 1Y return: 18.62% (top quartile). Point 8 1M return: 5.58% (top quartile). 1M return: 3.20% (lower mid). 1M return: 2.02% (bottom quartile). 1M return: 1.74% (bottom quartile). 1M return: 3.98% (upper mid). Point 9 Alpha: 0.00 (lower mid). Alpha: 3.54 (upper mid). Alpha: -6.31 (bottom quartile). Alpha: -0.75 (bottom quartile). Alpha: 4.01 (top quartile). Point 10 Sharpe: 0.08 (bottom quartile). Sharpe: 0.62 (top quartile). Sharpe: -0.36 (bottom quartile). Sharpe: 0.15 (lower mid). Sharpe: 0.57 (upper mid). BOI AXA Mid and Small Cap Equity and Debt Fund

ICICI Prudential Equity and Debt Fund

JM Equity Hybrid Fund

UTI Hybrid Equity Fund

Bandhan Hybrid Equity Fund

টপ পারফর্মিং কনজারভেটিভ হাইব্রিড ফান্ড

এই স্কিমটি প্রধানত ঋণের উপকরণগুলিতে বিনিয়োগ করবে। তাদের মোট সম্পদের প্রায় 75 থেকে 90 শতাংশ ঋণের উপকরণে এবং প্রায় 10 থেকে 25 শতাংশ ইক্যুইটি-সম্পর্কিত উপকরণগুলিতে বিনিয়োগ করা হবে। এই স্কিমটিকে রক্ষণশীল হিসাবে নামকরণ করা হয়েছে কারণ এটি এমন লোকেদের জন্য যারা ঝুঁকি-প্রতিরোধী। যে বিনিয়োগকারীরা তাদের বিনিয়োগে বেশি ঝুঁকি নিতে চান না তারা এই স্কিমে বিনিয়োগ করতে পছন্দ করতে পারেন।

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MIP 25 Growth ₹77.8491

↓ -0.01 ₹3,334 -0.1 2.2 8.7 10.4 8.9 Kotak Debt Hybrid Fund Growth ₹59.6419

↑ 0.07 ₹3,044 0 3.4 7.3 10.3 9.3 SBI Debt Hybrid Fund Growth ₹74.8674

↓ -0.03 ₹9,761 0.2 3.2 9.4 10.2 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary ICICI Prudential MIP 25 Kotak Debt Hybrid Fund SBI Debt Hybrid Fund Point 1 Lower mid AUM (₹3,334 Cr). Bottom quartile AUM (₹3,044 Cr). Highest AUM (₹9,761 Cr). Point 2 Established history (21+ yrs). Established history (22+ yrs). Oldest track record among peers (24 yrs). Point 3 Top rated. Rating: 4★ (bottom quartile). Rating: 5★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderate. Point 5 5Y return: 8.89% (bottom quartile). 5Y return: 9.27% (lower mid). 5Y return: 9.43% (upper mid). Point 6 3Y return: 10.36% (upper mid). 3Y return: 10.33% (lower mid). 3Y return: 10.24% (bottom quartile). Point 7 1Y return: 8.65% (lower mid). 1Y return: 7.27% (bottom quartile). 1Y return: 9.36% (upper mid). Point 8 1M return: 0.87% (bottom quartile). 1M return: 1.44% (lower mid). 1M return: 1.91% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: -1.88 (bottom quartile). Alpha: 0.00 (lower mid). Point 10 Sharpe: 0.50 (upper mid). Sharpe: -0.21 (bottom quartile). Sharpe: 0.16 (lower mid). ICICI Prudential MIP 25

Kotak Debt Hybrid Fund

SBI Debt Hybrid Fund

শীর্ষ পারফর্মিং আরবিট্রেজ ফান্ড

এই তহবিল সালিসি কৌশল অনুসরণ করবে এবং তার সম্পদের অন্তত 65 শতাংশ ইক্যুইটি-সম্পর্কিত উপকরণগুলিতে বিনিয়োগ করবে। আরবিট্রেজ ফান্ড হল মিউচুয়াল ফান্ড যা মিউচুয়াল ফান্ডের রিটার্ন জেনারেট করতে নগদ বাজার এবং ডেরিভেটিভ মার্কেটের মধ্যে ডিফারেনশিয়াল প্রাইস লিভারেজ করে। আরবিট্রেজ তহবিল দ্বারা উত্পন্ন রিটার্ন স্টক মার্কেটের অস্থিরতার উপর নির্ভরশীল। আরবিট্রেজ মিউচুয়াল ফান্ডগুলি হাইব্রিড প্রকৃতির এবং উচ্চ বা ক্রমাগত অস্থিরতার সময়ে, এই তহবিলগুলি বিনিয়োগকারীদের তুলনামূলকভাবে ঝুঁকিমুক্ত রিটার্ন প্রদান করে।

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Arbitrage Fund Growth ₹36.4202

↓ 0.00 ₹10,957 1.6 3 6.5 7.1 6 ICICI Prudential Equity Arbitrage Fund Growth ₹35.6565

↑ 0.00 ₹32,976 1.6 3 6.4 7 6 SBI Arbitrage Opportunities Fund Growth ₹35.1267

↑ 0.00 ₹43,574 1.5 2.9 6.4 7.1 6.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary UTI Arbitrage Fund ICICI Prudential Equity Arbitrage Fund SBI Arbitrage Opportunities Fund Point 1 Bottom quartile AUM (₹10,957 Cr). Lower mid AUM (₹32,976 Cr). Highest AUM (₹43,574 Cr). Point 2 Oldest track record among peers (19 yrs). Established history (19+ yrs). Established history (19+ yrs). Point 3 Rating: 3★ (lower mid). Top rated. Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderately Low. Point 5 5Y return: 5.97% (lower mid). 5Y return: 5.96% (bottom quartile). 5Y return: 6.13% (upper mid). Point 6 3Y return: 7.11% (upper mid). 3Y return: 7.05% (bottom quartile). 3Y return: 7.10% (lower mid). Point 7 1Y return: 6.46% (upper mid). 1Y return: 6.44% (lower mid). 1Y return: 6.44% (bottom quartile). Point 8 1M return: 0.53% (lower mid). 1M return: 0.58% (upper mid). 1M return: 0.50% (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 1.31 (lower mid). Sharpe: 1.17 (bottom quartile). Sharpe: 1.37 (upper mid). UTI Arbitrage Fund

ICICI Prudential Equity Arbitrage Fund

SBI Arbitrage Opportunities Fund

টপ পারফর্মিং ডাইনামিক অ্যাসেট অ্যালোকেশন ফান্ড

এই স্কিমটি গতিশীলভাবে তাদের ইক্যুইটি এবং ঋণ উপকরণে বিনিয়োগ পরিচালনা করবে। এই তহবিলগুলি ঋণের বরাদ্দ বাড়ায় এবং যখন বাজার ব্যয়বহুল হয়ে যায় তখন ইক্যুইটিগুলিতে ওজন হ্রাস করে। এছাড়াও, এই তহবিলগুলি কম-ঝুঁকিতে স্থিতিশীলতা প্রদানের উপর ফোকাস করে।Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Dynamic Equity Fund Growth ₹21.52

↑ 0.02 ₹3,773 -0.8 3.5 10 14.9 11.4 Franklin India Multi - Asset Solution Fund Growth ₹21.7681

↑ 0.02 ₹114 1.3 3.2 12.8 13.9 12.7 ICICI Prudential Balanced Advantage Fund Growth ₹77.42

↑ 0.06 ₹70,343 0.1 4 14.1 13.8 11.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Axis Dynamic Equity Fund Franklin India Multi - Asset Solution Fund ICICI Prudential Balanced Advantage Fund Point 1 Lower mid AUM (₹3,773 Cr). Bottom quartile AUM (₹114 Cr). Highest AUM (₹70,343 Cr). Point 2 Established history (8+ yrs). Established history (11+ yrs). Oldest track record among peers (19 yrs). Point 3 Not Rated. Not Rated. Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 11.39% (bottom quartile). 5Y return: 12.67% (upper mid). 5Y return: 11.85% (lower mid). Point 6 3Y return: 14.92% (upper mid). 3Y return: 13.90% (lower mid). 3Y return: 13.81% (bottom quartile). Point 7 1Y return: 10.02% (bottom quartile). 1Y return: 12.75% (lower mid). 1Y return: 14.09% (upper mid). Point 8 1M return: 1.75% (upper mid). 1M return: 0.63% (bottom quartile). 1M return: 1.75% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.09 (bottom quartile). Sharpe: 1.34 (upper mid). Sharpe: 0.79 (lower mid). Axis Dynamic Equity Fund

Franklin India Multi - Asset Solution Fund

ICICI Prudential Balanced Advantage Fund

টপ পারফর্মিং ইক্যুইটি সেভিংস ফান্ড

এই স্কিমটি ইক্যুইটি, আরবিট্রেজ এবং ঋণে বিনিয়োগ করবে। ইক্যুইটি সঞ্চয় মোট সম্পদের কমপক্ষে 65 শতাংশ স্টকে এবং ন্যূনতম 10 শতাংশ ঋণে বিনিয়োগ করবে। স্কিমটি স্কিম তথ্য নথিতে ন্যূনতম হেজড এবং আনহেজড বিনিয়োগের কথা বলবে।Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Equity Savings Fund Growth ₹24.474

↑ 0.01 ₹5,816 -0.2 2.7 10.4 11.7 9.3 Edelweiss Equity Savings Fund Growth ₹26.1615

↑ 0.02 ₹1,223 0.6 3 10.2 11.6 9.3 Kotak Equity Savings Fund Growth ₹27.092

↑ 0.03 ₹9,619 -0.5 3.2 10.8 11.4 10.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary SBI Equity Savings Fund Edelweiss Equity Savings Fund Kotak Equity Savings Fund Point 1 Lower mid AUM (₹5,816 Cr). Bottom quartile AUM (₹1,223 Cr). Highest AUM (₹9,619 Cr). Point 2 Established history (10+ yrs). Oldest track record among peers (11 yrs). Established history (11+ yrs). Point 3 Not Rated. Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 9.30% (bottom quartile). 5Y return: 9.34% (lower mid). 5Y return: 10.16% (upper mid). Point 6 3Y return: 11.72% (upper mid). 3Y return: 11.56% (lower mid). 3Y return: 11.44% (bottom quartile). Point 7 1Y return: 10.38% (lower mid). 1Y return: 10.23% (bottom quartile). 1Y return: 10.79% (upper mid). Point 8 1M return: 1.15% (bottom quartile). 1M return: 1.42% (lower mid). 1M return: 1.63% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.22 (bottom quartile). Sharpe: 0.54 (upper mid). Sharpe: 0.23 (lower mid). SBI Equity Savings Fund

Edelweiss Equity Savings Fund

Kotak Equity Savings Fund

টপ পারফর্মিং মাল্টি অ্যাসেট অ্যালোকেশন ফান্ড

এই স্কিমটি তিনটি সম্পদ শ্রেণিতে বিনিয়োগ করতে পারে, যার অর্থ হল তারা ইক্যুইটি এবং ঋণ ছাড়াও একটি অতিরিক্ত সম্পদ শ্রেণিতে বিনিয়োগ করতে পারে। তহবিলের প্রতিটি সম্পদ শ্রেণিতে কমপক্ষে 10 শতাংশ বিনিয়োগ করা উচিত। বিদেশী সিকিউরিটিজ একটি পৃথক সম্পদ শ্রেণী হিসাবে গণ্য করা হবে না. (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile SBI Magnum Monthly Income Plan Floater) To provide regular income, liquidity and attractive returns to investors in addition

to mitigating the impact of interest rate risk through an actively managed

portfolio of floating rate and fixed rate debt instruments, equity, money market

instruments and derivatives. Research Highlights for SBI Multi Asset Allocation Fund Below is the key information for SBI Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized Research Highlights for BOI AXA Mid and Small Cap Equity and Debt Fund Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. Research Highlights for ICICI Prudential Equity and Debt Fund Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. Research Highlights for JM Equity Hybrid Fund Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on To generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold exchange traded funds. Research Highlights for Axis Triple Advantage Fund Below is the key information for Axis Triple Advantage Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Research Highlights for Edelweiss Multi Asset Allocation Fund Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile UTI Balanced Fund) The scheme aims to invest in a portfolio of equity/equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation. Research Highlights for UTI Hybrid Equity Fund Below is the key information for UTI Hybrid Equity Fund Returns up to 1 year are on (Erstwhile IDFC Balanced Fund) The Fund seeks to generate long term capital appreciation along with current income by investing in a mix of equity and equity related securities, debt securities and money market instruments. There is no assurance or guarantee that the objectives of the scheme will be realised. Research Highlights for Bandhan Hybrid Equity Fund Below is the key information for Bandhan Hybrid Equity Fund Returns up to 1 year are on (Erstwhile Kotak Balance Fund) The objective of the Scheme is to achieve growth by investing in equity and equity related instruments, balanced with income generation by investing in debt and money market instruments. Research Highlights for Kotak Equity Hybrid Fund Below is the key information for Kotak Equity Hybrid Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.9601

↓ 0.00 ₹6,848 1.2 7.9 16.7 20.9 14.9 SBI Multi Asset Allocation Fund Growth ₹67.3255

↑ 0.03 ₹14,944 5.4 13.9 24.3 20.4 15.3 ICICI Prudential Multi-Asset Fund Growth ₹825.846

↑ 3.45 ₹80,768 2.8 8.1 18.3 20.2 19.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Point 5 5Y return: 14.93% (bottom quartile). 5Y return: 15.26% (lower mid). 5Y return: 19.23% (upper mid). Point 6 3Y return: 20.91% (upper mid). 3Y return: 20.35% (lower mid). 3Y return: 20.19% (bottom quartile). Point 7 1Y return: 16.67% (bottom quartile). 1Y return: 24.34% (upper mid). 1Y return: 18.30% (lower mid). Point 8 1M return: 1.18% (bottom quartile). 1M return: 1.79% (lower mid). 1M return: 2.11% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (bottom quartile). Sharpe: 2.05 (upper mid). Sharpe: 1.48 (lower mid). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

AUM >= 200 কোটি & সাজানো হয়েছে3 বছরসিএজিআর প্রত্যাবর্তন.1. UTI Multi Asset Fund

UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (26 Feb 26) ₹79.9601 ↓ 0.00 (-0.01 %) Net Assets (Cr) ₹6,848 on 31 Jan 26 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.76 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,256 31 Jan 23 ₹11,655 31 Jan 24 ₹15,639 31 Jan 25 ₹18,105 31 Jan 26 ₹20,438 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.2% 3 Month 1.2% 6 Month 7.9% 1 Year 16.7% 3 Year 20.9% 5 Year 14.9% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 4.22 Yr. Jaydeep Bhowal 1 Oct 24 1.34 Yr. Data below for UTI Multi Asset Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.68% Equity 68.24% Debt 9.48% Other 14.6% Equity Sector Allocation

Sector Value Financial Services 15.97% Technology 11.06% Consumer Defensive 8.74% Consumer Cyclical 8.66% Industrials 5.58% Basic Materials 4.97% Health Care 4.22% Real Estate 3.79% Energy 3.27% Communication Services 2.96% Debt Sector Allocation

Sector Value Government 6.42% Cash Equivalent 6.3% Corporate 4.44% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -15% ₹1,009 Cr 75,949,369

↓ -69,567 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN3% ₹185 Cr 1,716,730 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹178 Cr 1,086,475

↑ 30,677 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | ASIANPAINT2% ₹158 Cr 650,377 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹152 Cr 1,142,201

↑ 22,681 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC2% ₹149 Cr 4,622,966

↑ 369,276 Coal India Ltd (Energy)

Equity, Since 31 Oct 22 | COALINDIA2% ₹147 Cr 3,341,545 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹139 Cr 444,634

↑ 12,793 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹137 Cr 697,974

↑ 20,408 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | MARUTI2% ₹130 Cr 89,156

↑ 2,752 2. SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund

Growth Launch Date 21 Dec 05 NAV (26 Feb 26) ₹67.3255 ↑ 0.03 (0.04 %) Net Assets (Cr) ₹14,944 on 31 Jan 26 Category Hybrid - Multi Asset AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 2.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,431 31 Jan 23 ₹11,977 31 Jan 24 ₹15,246 31 Jan 25 ₹16,963 31 Jan 26 ₹20,613 Returns for SBI Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.8% 3 Month 5.4% 6 Month 13.9% 1 Year 24.3% 3 Year 20.4% 5 Year 15.3% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for SBI Multi Asset Allocation Fund

Name Since Tenure Dinesh Balachandran 31 Oct 21 4.26 Yr. Mansi Sajeja 1 Dec 23 2.17 Yr. Vandna Soni 1 Jan 24 2.09 Yr. Data below for SBI Multi Asset Allocation Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 14.55% Equity 46.65% Debt 29.4% Other 9.4% Equity Sector Allocation

Sector Value Financial Services 12.84% Real Estate 5.6% Basic Materials 5.35% Consumer Cyclical 4.86% Energy 4.05% Technology 3.18% Consumer Defensive 2.54% Utility 2.11% Industrials 1.84% Communication Services 1.75% Health Care 1.67% Debt Sector Allocation

Sector Value Corporate 25.73% Cash Equivalent 13.22% Government 5.01% Credit Quality

Rating Value A 2.03% AA 55.85% AAA 42.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Silver ETF

- | -6% ₹920 Cr 32,296,178

↓ -8,000,000 Brookfield India Real Estate Trust (Real Estate)

-, Since 30 Apr 25 | BIRET4% ₹535 Cr 15,164,234 SBI Gold ETF

- | -3% ₹508 Cr 37,241,000 Adani Power Limited

Debentures | -2% ₹299 Cr 30,000

↑ 30,000 Punjab National Bank (Financial Services)

Equity, Since 31 Oct 24 | PNB2% ₹263 Cr 21,000,000 Jtpm Metal TRaders Limited

Debentures | -2% ₹258 Cr 25,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | HDFCBANK2% ₹247 Cr 2,662,000 Union Bank of India

Domestic Bonds | -2% ₹244 Cr 5,000

↑ 5,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 Mar 21 | GAIL2% ₹240 Cr 14,350,297 Reliance Industries Ltd (Energy)

Equity, Since 15 Sep 24 | RELIANCE2% ₹240 Cr 1,720,000 3. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (25 Feb 26) ₹825.846 ↑ 3.45 (0.42 %) Net Assets (Cr) ₹80,768 on 31 Jan 26 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.48 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,181 31 Jan 23 ₹15,831 31 Jan 24 ₹20,109 31 Jan 25 ₹23,330 31 Jan 26 ₹27,072 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 2.1% 3 Month 2.8% 6 Month 8.1% 1 Year 18.3% 3 Year 20.2% 5 Year 19.2% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 14.01 Yr. Manish Banthia 22 Jan 24 2.03 Yr. Ihab Dalwai 3 Jun 17 8.67 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Sri Sharma 30 Apr 21 4.76 Yr. Gaurav Chikane 2 Aug 21 4.5 Yr. Sharmila D'Silva 31 Jul 22 3.51 Yr. Masoomi Jhurmarvala 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 17.14% Equity 64.5% Debt 8.61% Other 9.75% Equity Sector Allocation

Sector Value Financial Services 21.64% Consumer Cyclical 11.89% Consumer Defensive 6.97% Industrials 6.24% Technology 5.51% Basic Materials 5.43% Energy 4.1% Health Care 3.53% Utility 2.33% Communication Services 1.97% Real Estate 1.93% Debt Sector Allocation

Sector Value Cash Equivalent 15.9% Corporate 5.03% Government 4.81% Credit Quality

Rating Value A 1.28% AA 17.26% AAA 81.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -9% ₹7,375 Cr 528,202,636

↑ 38,731,754 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK4% ₹3,153 Cr 23,271,875 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK4% ₹2,932 Cr 31,556,280

↑ 8,362,197 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹2,292 Cr 16,726,017

↓ -950,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹2,208 Cr 68,525,718

↑ 19,307,692 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,142 Cr 15,349,805 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,842 Cr 11,225,639

↓ -188,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO2% ₹1,705 Cr 3,709,974

↑ 1,141,295 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 24 | BAJAJFINSV2% ₹1,580 Cr 8,094,127

↑ 2,792,657 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,487 Cr 1,018,654

↑ 100,000 4. BOI AXA Mid and Small Cap Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Growth Launch Date 20 Jul 16 NAV (26 Feb 26) ₹38.57 ↑ 0.11 (0.29 %) Net Assets (Cr) ₹1,329 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.27 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,099 31 Jan 23 ₹14,650 31 Jan 24 ₹20,648 31 Jan 25 ₹22,842 31 Jan 26 ₹24,240 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5.6% 3 Month 0.8% 6 Month 2.6% 1 Year 16.1% 3 Year 19.8% 5 Year 18.6% 10 Year 15 Year Since launch 15.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.96 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 14.93% Equity 71.7% Debt 13.38% Equity Sector Allocation

Sector Value Basic Materials 16.1% Financial Services 15.09% Industrials 13.85% Health Care 9.77% Consumer Cyclical 8.98% Technology 3.72% Consumer Defensive 2.75% Utility 0.94% Energy 0.47% Real Estate 0.02% Debt Sector Allocation

Sector Value Cash Equivalent 10.12% Government 9.58% Corporate 8.61% Credit Quality

Rating Value AA 0.7% AAA 99.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity Hindustan Copper Ltd (Basic Materials)

Equity, Since 31 Oct 24 | HINDCOPPER4% ₹49 Cr 708,412

↓ -392,588 Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | INDIANB3% ₹46 Cr 505,000 Abbott India Ltd (Healthcare)

Equity, Since 31 Jan 23 | ABBOTINDIA3% ₹36 Cr 13,000

↑ 4,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA3% ₹35 Cr 294,000

↓ -20,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹33 Cr 202,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL2% ₹33 Cr 400,000

↓ -166,000 Bank of Maharashtra (Financial Services)

Equity, Since 31 May 24 | MAHABANK2% ₹30 Cr 4,641,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | 5405302% ₹30 Cr 1,580,000 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Jul 25 | GLENMARK2% ₹30 Cr 150,000 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 24 | BDL2% ₹30 Cr 196,000 5. ICICI Prudential Equity and Debt Fund

ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (26 Feb 26) ₹410.64 ↑ 0.44 (0.11 %) Net Assets (Cr) ₹49,257 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.6 Sharpe Ratio 0.62 Information Ratio 1.78 Alpha Ratio 3.54 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,720 31 Jan 23 ₹15,731 31 Jan 24 ₹20,942 31 Jan 25 ₹23,632 31 Jan 26 ₹26,355 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.2% 3 Month -0.4% 6 Month 4.1% 1 Year 16.4% 3 Year 19.6% 5 Year 19.1% 10 Year 15 Year Since launch 15.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 10.16 Yr. Manish Banthia 19 Sep 13 12.38 Yr. Mittul Kalawadia 29 Dec 20 5.1 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Sri Sharma 30 Apr 21 4.76 Yr. Sharmila D'Silva 31 Jul 22 3.51 Yr. Nitya Mishra 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 6.36% Equity 76.7% Debt 16.9% Other 0% Equity Sector Allocation

Sector Value Financial Services 19.7% Consumer Cyclical 11.2% Energy 7.7% Industrials 7.23% Consumer Defensive 6.67% Health Care 6.43% Utility 5.97% Technology 3.91% Real Estate 3.01% Basic Materials 2.64% Communication Services 2.28% Debt Sector Allocation

Sector Value Government 10.1% Corporate 8.8% Cash Equivalent 4.4% Credit Quality

Rating Value A 1.7% AA 19.74% AAA 78.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK6% ₹3,075 Cr 22,692,140

↓ -270,713 NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | NTPC5% ₹2,663 Cr 74,795,559

↓ -1,565,210 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE5% ₹2,643 Cr 18,943,909

↑ 400,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK5% ₹2,382 Cr 25,630,965

↑ 3,908,272 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA5% ₹2,262 Cr 14,178,073

↑ 616,988 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 21 | AXISBANK3% ₹1,570 Cr 11,459,322 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 28 Feb 18 | TVSMOTOR3% ₹1,464 Cr 3,981,427

↓ -30,966 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Jan 23 | DMART2% ₹1,187 Cr 3,218,463 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO2% ₹1,166 Cr 2,535,996

↑ 76,418 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI2% ₹1,132 Cr 775,315

↓ -14,852 6. JM Equity Hybrid Fund

JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (26 Feb 26) ₹117.534 ↑ 0.12 (0.10 %) Net Assets (Cr) ₹753 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.3 Sharpe Ratio -0.36 Information Ratio 0.62 Alpha Ratio -6.31 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,731 31 Jan 23 ₹13,411 31 Jan 24 ₹19,573 31 Jan 25 ₹21,726 31 Jan 26 ₹22,012 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 2% 3 Month -4.1% 6 Month -1.3% 1 Year 5.6% 3 Year 17.8% 5 Year 15.1% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.33 Yr. Asit Bhandarkar 31 Dec 21 4.09 Yr. Ruchi Fozdar 4 Oct 24 1.33 Yr. Deepak Gupta 11 Apr 25 0.81 Yr. Data below for JM Equity Hybrid Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 8.79% Equity 72.79% Debt 18.42% Equity Sector Allocation

Sector Value Financial Services 25.96% Technology 12.56% Industrials 10.21% Consumer Cyclical 9.98% Health Care 4.26% Communication Services 3.8% Basic Materials 3.64% Consumer Defensive 2.36% Real Estate 0.03% Debt Sector Allocation

Sector Value Corporate 15.78% Government 9.02% Cash Equivalent 2.4% Credit Quality

Rating Value AA 9.56% AAA 90.44% Top Securities Holdings / Portfolio

Name Holding Value Quantity Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jan 25 | UJJIVANSFB5% ₹36 Cr 5,474,365

↓ -500,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX5% ₹35 Cr 139,380 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹33 Cr 350,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 21 | LT4% ₹31 Cr 78,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹29 Cr 145,246 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | BAJFINANCE4% ₹27 Cr 285,040 6.48% Gs 2035

Sovereign Bonds | -3% ₹20 Cr 2,075,000

↓ -200,000 Tech Mahindra Ltd (Technology)

Equity, Since 31 Dec 23 | TECHM3% ₹20 Cr 113,000 Coforge Ltd (Technology)

Equity, Since 31 May 25 | COFORGE3% ₹19 Cr 116,000

↓ -9,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 25 | VEDL3% ₹19 Cr 280,000 7. Axis Triple Advantage Fund

Axis Triple Advantage Fund

Growth Launch Date 23 Aug 10 NAV (25 Feb 26) ₹45.7194 ↑ 0.11 (0.25 %) Net Assets (Cr) ₹2,051 on 31 Jan 26 Category Hybrid - Multi Asset AMC Axis Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 1.69 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,316 31 Jan 23 ₹11,603 31 Jan 24 ₹13,362 31 Jan 25 ₹15,261 31 Jan 26 ₹18,429 Returns for Axis Triple Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 2% 3 Month 6.3% 6 Month 12.7% 1 Year 25.3% 3 Year 17.1% 5 Year 11.9% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Axis Triple Advantage Fund

Name Since Tenure Devang Shah 5 Apr 24 1.82 Yr. Aditya Pagaria 1 Jun 24 1.67 Yr. Ashish Naik 22 Jun 16 9.62 Yr. Hardik Shah 5 Apr 24 1.82 Yr. Pratik Tibrewal 1 Feb 25 1 Yr. Krishnaa N 16 Dec 24 1.13 Yr. Data below for Axis Triple Advantage Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 9.13% Equity 64.69% Debt 9.38% Other 16.79% Equity Sector Allocation

Sector Value Financial Services 23.2% Consumer Cyclical 8.51% Technology 6.26% Health Care 6.22% Basic Materials 6.15% Industrials 5.66% Consumer Defensive 4.56% Energy 3.3% Communication Services 2.46% Real Estate 0.94% Utility 0.07% Debt Sector Allocation

Sector Value Cash Equivalent 9.74% Corporate 6.29% Government 2.48% Credit Quality

Rating Value A 10.39% AA 38.79% AAA 50.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -13% ₹264 Cr 20,259,852

↓ -3,988,399 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK7% ₹141 Cr 1,518,753

↑ 509,735 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | ICICIBANK5% ₹103 Cr 756,550

↑ 55,032 Axis Silver ETF

- | -4% ₹87 Cr 2,917,000

↓ -333,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN4% ₹77 Cr 716,029

↑ 86,532 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 19 | RELIANCE3% ₹64 Cr 455,456

↑ 328,114 Future on BANK Index

- | -3% -₹55 Cr 584,650

↑ 182,050 Infosys Ltd (Technology)

Equity, Since 31 May 18 | INFY2% ₹45 Cr 276,762 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | KOTAKBANK2% ₹42 Cr 1,023,663

↑ 281,083 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹40 Cr 202,647 8. Edelweiss Multi Asset Allocation Fund

Edelweiss Multi Asset Allocation Fund

Growth Launch Date 12 Aug 09 NAV (26 Feb 26) ₹64.5 ↑ 0.10 (0.16 %) Net Assets (Cr) ₹3,453 on 31 Jan 26 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 1.98 Sharpe Ratio 0.11 Information Ratio 1.05 Alpha Ratio -1.2 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,912 31 Jan 23 ₹13,504 31 Jan 24 ₹17,456 31 Jan 25 ₹19,853 31 Jan 26 ₹21,174 Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.1% 3 Month -1.2% 6 Month 2.1% 1 Year 12.5% 3 Year 17% 5 Year 15.2% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Kedar Karnik 15 Jan 26 0.04 Yr. Bhavesh Jain 14 Oct 15 10.31 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Rahul Dedhia 1 Jul 24 1.59 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 9.82% Equity 77.53% Debt 12.63% Other 0.02% Equity Sector Allocation

Sector Value Financial Services 24.64% Consumer Cyclical 10.23% Health Care 9.26% Basic Materials 5.95% Technology 5.78% Communication Services 5.23% Energy 4.53% Industrials 4.4% Consumer Defensive 2.9% Utility 2.58% Real Estate 0.53% Debt Sector Allocation

Sector Value Corporate 9.57% Cash Equivalent 7.75% Government 5.14% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK5% ₹167 Cr 1,235,789

↑ 125,000 Edelweiss Liquid Dir Gr

Investment Fund | -5% ₹160 Cr 454,381

↑ 454,381 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK4% ₹150 Cr 1,613,634 National Bank For Agriculture And Rural Development

Debentures | -4% ₹141 Cr 14,000,000 State Bank of India (Financial Services)

Equity, Since 30 Jun 15 | SBIN4% ₹136 Cr 1,264,882 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹115 Cr 583,607 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹93 Cr 566,220 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 20 | RELIANCE3% ₹90 Cr 647,748 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | NTPC3% ₹89 Cr 2,497,975 Aditya Birla Capital Limited

Debentures | -2% ₹75 Cr 7,500,000 9. UTI Hybrid Equity Fund

UTI Hybrid Equity Fund

Growth Launch Date 2 Jan 95 NAV (26 Feb 26) ₹413.996 ↑ 0.43 (0.10 %) Net Assets (Cr) ₹6,654 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.88 Sharpe Ratio 0.15 Information Ratio 1.35 Alpha Ratio -0.75 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,110 31 Jan 23 ₹13,641 31 Jan 24 ₹17,450 31 Jan 25 ₹20,086 31 Jan 26 ₹21,499 Returns for UTI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.7% 3 Month -1% 6 Month 3.8% 1 Year 11.9% 3 Year 16.9% 5 Year 15.1% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for UTI Hybrid Equity Fund

Name Since Tenure V Srivatsa 24 Sep 09 16.36 Yr. Sunil Patil 5 Feb 18 7.99 Yr. Jaydeep Bhowal 3 Nov 25 0.24 Yr. Data below for UTI Hybrid Equity Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 3.59% Equity 72.04% Debt 24.37% Equity Sector Allocation

Sector Value Financial Services 21.57% Technology 8.37% Consumer Cyclical 6.59% Industrials 6.48% Energy 5.96% Basic Materials 5.28% Consumer Defensive 4.52% Health Care 4.39% Communication Services 4.37% Real Estate 2.86% Utility 1.66% Debt Sector Allocation

Sector Value Government 16.84% Corporate 9.05% Cash Equivalent 2.07% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK6% ₹374 Cr 4,027,946 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 10 | ICICIBANK5% ₹301 Cr 2,218,644 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹274 Cr 1,667,495 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 19 | RELIANCE3% ₹186 Cr 1,336,366

↓ -82,222 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 12 | LT2% ₹163 Cr 413,309

↑ 39,000 Vedanta Ltd (Basic Materials)

Equity, Since 30 Apr 24 | VEDL2% ₹158 Cr 2,325,494

↓ -235,080 ITC Ltd (Consumer Defensive)

Equity, Since 31 Aug 06 | ITC2% ₹158 Cr 4,904,969 Wipro Ltd (Technology)

Equity, Since 30 Jun 24 | WIPRO2% ₹138 Cr 5,840,657

↑ 200,000 7.32% Gs 2030

Sovereign Bonds | -2% ₹124 Cr 1,200,000,000 6.48% Gs 2035

Sovereign Bonds | -2% ₹124 Cr 1,260,260,000

↑ 460,260,000 10. Bandhan Hybrid Equity Fund

Bandhan Hybrid Equity Fund

Growth Launch Date 30 Dec 16 NAV (26 Feb 26) ₹27.014 ↑ 0.03 (0.11 %) Net Assets (Cr) ₹1,632 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC IDFC Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.35 Sharpe Ratio 0.57 Information Ratio 0.55 Alpha Ratio 4.01 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,888 31 Jan 23 ₹12,821 31 Jan 24 ₹15,921 31 Jan 25 ₹17,745 31 Jan 26 ₹19,939 Returns for Bandhan Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 4% 3 Month -0.3% 6 Month 4.3% 1 Year 18.6% 3 Year 16.9% 5 Year 14.1% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Bandhan Hybrid Equity Fund

Name Since Tenure Harshal Joshi 28 Jul 21 4.52 Yr. Brijesh Shah 10 Jun 24 1.64 Yr. Prateek Poddar 7 Jun 24 1.65 Yr. Ritika Behera 7 Oct 23 2.32 Yr. Gaurav Satra 7 Jun 24 1.65 Yr. Data below for Bandhan Hybrid Equity Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 4.99% Equity 77.63% Debt 17.38% Equity Sector Allocation

Sector Value Financial Services 22.64% Consumer Cyclical 11.99% Technology 8% Health Care 6.39% Industrials 6.05% Basic Materials 5.97% Consumer Defensive 4.92% Energy 3.96% Utility 3.5% Communication Services 3.01% Real Estate 1.17% Debt Sector Allocation

Sector Value Corporate 9.43% Government 7.95% Cash Equivalent 4.99% Credit Quality

Rating Value AA 4.37% AAA 95.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK6% ₹92 Cr 992,042

↓ -2,027 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | ICICIBANK5% ₹78 Cr 574,500

↑ 109,372 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 20 | RELIANCE4% ₹62 Cr 440,969

↓ -47,022 Tata Capital Limited

Debentures | -3% ₹50 Cr 5,000,000 7.30% Gs 2053

Sovereign Bonds | -3% ₹50 Cr 5,000,000 LIC Housing Finance Ltd

Debentures | -3% ₹45 Cr 4,500,000

↑ 4,500,000 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN3% ₹45 Cr 416,237

↑ 15,707 Infosys Ltd (Technology)

Equity, Since 31 Jan 17 | INFY3% ₹44 Cr 266,662

↑ 15,696 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 17 | AXISBANK3% ₹43 Cr 316,843

↓ -34,434 NTPC Ltd (Utilities)

Equity, Since 28 Feb 23 | NTPC2% ₹39 Cr 1,090,788

↑ 39,365 11. Kotak Equity Hybrid Fund

Kotak Equity Hybrid Fund

Growth Launch Date 3 Nov 14 NAV (26 Feb 26) ₹64.211 ↑ 0.25 (0.38 %) Net Assets (Cr) ₹8,431 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 0.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,883 31 Jan 23 ₹13,259 31 Jan 24 ₹16,303 31 Jan 25 ₹18,814 31 Jan 26 ₹20,137 Returns for Kotak Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5.2% 3 Month 0.6% 6 Month 3.6% 1 Year 16.1% 3 Year 16% 5 Year 14% 10 Year 15 Year Since launch 12.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Kotak Equity Hybrid Fund

Name Since Tenure Abhishek Bisen 4 Jun 09 16.67 Yr. Atul Bhole 22 Jan 24 2.03 Yr. Data below for Kotak Equity Hybrid Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.78% Equity 79.42% Debt 12.8% Equity Sector Allocation

Sector Value Financial Services 26.55% Industrials 11.15% Technology 9.84% Basic Materials 8.75% Consumer Cyclical 7.96% Health Care 6.49% Communication Services 3.13% Consumer Defensive 1.96% Energy 1.5% Real Estate 1.34% Utility 0.75% Debt Sector Allocation

Sector Value Government 10.44% Cash Equivalent 7.49% Corporate 2.65% Credit Quality

Rating Value AA 10.63% AAA 89.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 11 | HDFCBANK4% ₹362 Cr 3,891,624 GE Vernova T&D India Ltd (Industrials)

Equity, Since 30 Sep 24 | GVT&D4% ₹296 Cr 917,501 Fortis Healthcare Ltd (Healthcare)

Equity, Since 31 Mar 24 | FORTIS3% ₹273 Cr 3,201,167

↑ 213,000 State Bank of India (Financial Services)

Equity, Since 31 Aug 25 | SBIN3% ₹259 Cr 2,400,000 Eternal Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5433203% ₹255 Cr 9,329,208 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jul 25 | CHOLAFIN3% ₹239 Cr 1,467,811

↑ 100,000 7.34% Gs 2064

Sovereign Bonds | -3% ₹237 Cr 24,000,000

↓ -3,799,600 Bajaj Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | BAJFINANCE3% ₹232 Cr 2,490,321 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 24 | ULTRACEMCO3% ₹228 Cr 179,764 Infosys Ltd (Technology)

Equity, Since 30 Apr 10 | INFY2% ₹195 Cr 1,185,372

অনলাইনে ব্যালেন্সড মিউচুয়াল ফান্ডে কীভাবে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন।

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।

Research Highlights for UTI Multi Asset Fund