2022 मध्ये गुंतवणूक करण्यासाठी टॉप 5 सर्वोत्तम कमी जोखीम म्युच्युअल फंड

साधारणपणे, गुंतवणुकीसाठी नवशिक्या किंवा ज्येष्ठ नागरिक ज्यांना त्यांचा निधी सुरक्षित ठेवायचा आहे ते कमी जोखीम शोधतात.म्युच्युअल फंड. जेव्हा एगुंतवणूकदार त्याला कमी जोखीम असलेल्या म्युच्युअल फंडामध्ये गुंतवणूक करायची आहे कारण त्याला त्याचे पैसे सुरक्षित करायचे असतात किंवा कमी कालावधीत इष्टतम परतावा मिळवायचा असतो.

म्हणून, जर तुम्ही त्यापैकी एक असाल तर तुम्ही अधिक वाचू शकता

लो रिस्क इन्व्हेस्टमेंट फंड म्हणजे काय?

अनेक गुंतवणूकदार उत्सुक आहेतगुंतवणूक म्युच्युअल फंडांमध्ये ते जास्त परतावा देतात आणि मुदत ठेवींसारख्या इतर साधनांपेक्षा अधिक करक्षम असतात. परंतु, जोखीम-प्रतिरोधक गुंतवणूकदारांचा विचार केल्यास, हे असे गुंतवणूकदार आहेत जे सुरक्षित परतावा शोधत आहेत आणि गुंतवणूकीतील जोखीम सहन करू शकत नाहीत. तसेच, जोखीम-प्रतिरोधक गुंतवणूकदार गुंतवणूक करण्यास प्राधान्य देणार नाहीइक्विटी, कारण ते अत्यंत धोकादायक फंड आहेत.

कर्ज निधी जोखीम-प्रतिरोधक किंवा अगदी इच्छुक असलेल्या नवशिक्या गुंतवणूकदारासाठी उपयुक्त आहेतम्युच्युअल फंडात गुंतवणूक करा. जसे डेट फंड सरकारमध्ये गुंतवणूक करतातबंध,मनी मार्केट फंड, इत्यादी, ते तुलनेने अधिक सुरक्षित आहेत. डेट फंडाचे विविध प्रकार आहेत जसेलिक्विड फंड, अति-अल्पकालीन निधी, शॉर्ट टर्म फंड, डायनॅमिक बॉण्ड्स, गिल्ट्स फंड इ., जे जोखमींमध्ये भिन्न असतात.दीर्घकालीन कर्ज निधी हे धोकादायक फंड आहेत, त्यामुळे गुंतवणूकदारांना कमी-जोखीम भूक या फंडांमध्ये गुंतवणूक करणे टाळावे.

लिक्विड फंड आणि अल्ट्रा-शॉर्ट टर्म फंड हे सर्वात कमी जोखमीचे फंड आहेत ज्यांचा उद्देश अल्प कालावधीसाठी इष्टतम परतावा निर्माण करणे आहे. अशा प्रकारे एक नवशिक्या गुंतवणूकदार ज्याला त्यांच्या निष्क्रिय पैशावर कमी कालावधीत चांगले परतावा मिळवायचा आहे ते येथे गुंतवणूक करू शकतात.

Talk to our investment specialist

सर्वोत्तम कमी जोखीम म्युच्युअल फंड FY 22 - 23

लिक्विड फंड

लिक्विड फंड अशा सिक्युरिटीजमध्ये गुंतवणूक करतात ज्यांचा परिपक्वता कालावधी कमी असतो, साधारणतः त्यापेक्षा कमी असतो91 दिवस. हे निधी सहज प्रदान करताततरलता आणि इतर प्रकारच्या कर्ज साधनांपेक्षा कमीत कमी अस्थिर असतात. तसेच, पारंपारिकपेक्षा द्रव हा एक चांगला पर्याय आहेबँक बचत खाते. बँक खात्याच्या तुलनेत, लिक्विड फंड वार्षिक व्याजाच्या 7-8% देतात. ज्या गुंतवणूकदारांना जोखीममुक्त गुंतवणूक हवी आहे ते आदर्शपणे या फंडांमध्ये गुंतवणूक करण्यास प्राधान्य देऊ शकतात. येथे शीर्ष 5 आहेतसर्वोत्तम लिक्विड फंड.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,619.32

↑ 0.38 ₹165 1.5 2.9 6.4 6.9 6.6 6.02% 2M 2M 1D PGIM India Insta Cash Fund Growth ₹352.575

↑ 0.05 ₹505 1.5 2.9 6.4 6.9 6.5 5.96% 1M 11D 1M 13D JM Liquid Fund Growth ₹73.8599

↑ 0.01 ₹2,851 1.5 2.9 6.2 6.8 6.4 5.91% 1M 10D 1M 14D Axis Liquid Fund Growth ₹3,016.26

↑ 0.37 ₹35,653 1.5 3 6.4 7 6.6 6.06% 1M 28D 2M 2D Tata Liquid Fund Growth ₹4,265.6

↑ 0.50 ₹18,946 1.5 2.9 6.4 6.9 6.5 6.08% 1M 28D 1M 28D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund Axis Liquid Fund Tata Liquid Fund Point 1 Bottom quartile AUM (₹165 Cr). Bottom quartile AUM (₹505 Cr). Lower mid AUM (₹2,851 Cr). Highest AUM (₹35,653 Cr). Upper mid AUM (₹18,946 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (28 yrs). Established history (16+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.37% (upper mid). 1Y return: 6.35% (lower mid). 1Y return: 6.24% (bottom quartile). 1Y return: 6.38% (top quartile). 1Y return: 6.35% (bottom quartile). Point 6 1M return: 0.53% (upper mid). 1M return: 0.53% (lower mid). 1M return: 0.53% (bottom quartile). 1M return: 0.54% (top quartile). 1M return: 0.52% (bottom quartile). Point 7 Sharpe: 3.18 (lower mid). Sharpe: 3.16 (bottom quartile). Sharpe: 2.52 (bottom quartile). Sharpe: 3.47 (top quartile). Sharpe: 3.23 (upper mid). Point 8 Information ratio: -0.71 (bottom quartile). Information ratio: -0.10 (lower mid). Information ratio: -1.88 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.02% (lower mid). Yield to maturity (debt): 5.96% (bottom quartile). Yield to maturity (debt): 5.91% (bottom quartile). Yield to maturity (debt): 6.06% (upper mid). Yield to maturity (debt): 6.08% (top quartile). Point 10 Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.11 yrs (upper mid). Modified duration: 0.11 yrs (top quartile). Modified duration: 0.16 yrs (lower mid). Modified duration: 0.16 yrs (bottom quartile). Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

Axis Liquid Fund

Tata Liquid Fund

अल्ट्रा शॉर्ट टर्म फंड

हे फंड ट्रेझरी बिले, कमर्शियल पेपर्स, डिपॉझिट्सचे प्रमाणपत्र आणि कॉर्पोरेट बाँड्स यांसारख्या डेट इन्स्ट्रुमेंट्सच्या संयोजनात गुंतवणूक करतात. या फंडांमध्ये कमी अवशिष्ट परिपक्वता असते6 महिने ते 1 वर्ष.अल्ट्रा शॉर्ट टर्म फंड खूप कमी सह चांगले परतावा देतातबाजार अस्थिरता लिक्विड फंडांपेक्षा चांगले परतावा शोधणाऱ्या नवख्या गुंतवणूकदारांनी या फंडांमध्ये गुंतवणूक करण्यास प्राधान्य दिले पाहिजे कारण ते लिक्विड फंडांपेक्षा चांगले परतावा देतात. येथे शीर्ष 5 सर्वोत्तम अल्ट्रा-शॉर्ट टर्म फंड आहेत.

The investment objective of the Scheme will be to provide investors with high level of liquidity along with regular income for their investment. The Scheme will endeavour to achieve this objective through an allocation of the investment corpus in a low risk portfolio of money market and debt instruments with maturity of up to 91 days. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for IDBI Liquid Fund Below is the key information for IDBI Liquid Fund Returns up to 1 year are on The objective of the Scheme will be to provide investors with regular income for their investment by investing in debt and money market instruments with relatively lower interest rate risk, such that the Macaulay duration of the portfolio is maintained between 3 months to 6 months. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for IDBI Ultra Short Term Fund Below is the key information for IDBI Ultra Short Term Fund Returns up to 1 year are on Objective The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through a portfolio of debt and money market instruments.

However there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for BOI AXA Liquid Fund Below is the key information for BOI AXA Liquid Fund Returns up to 1 year are on The Scheme seeks to generate reasonable returns commensurate with low risk from a portfolio constituted of money market and high quality debts Research Highlights for DSP Liquidity Fund Below is the key information for DSP Liquidity Fund Returns up to 1 year are on To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Research Highlights for Axis Liquid Fund Below is the key information for Axis Liquid Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹570.293

↑ 0.06 ₹23,615 1.4 3 7.2 7.4 7.4 6.81% 5M 19D 6M 11D UTI Ultra Short Term Fund Growth ₹4,391.78

↑ 0.08 ₹3,655 1.3 2.7 6.4 6.8 6.6 6.78% 5M 21D 6M 24D BOI AXA Ultra Short Duration Fund Growth ₹3,271.07

↑ 0.10 ₹159 1.2 2.6 6.2 6.4 6.5 6.34% 4M 13D 4M 17D Indiabulls Ultra Short Term Fund Growth ₹2,021.64

↑ 0.84 ₹18 0.8 1.5 4.2 6.2 3.23% 1D 1D ICICI Prudential Ultra Short Term Fund Growth ₹28.7729

↑ 0.00 ₹16,907 1.3 2.9 6.9 7.1 7.1 6.82% 5M 19D 7M 10D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Savings Fund UTI Ultra Short Term Fund BOI AXA Ultra Short Duration Fund Indiabulls Ultra Short Term Fund ICICI Prudential Ultra Short Term Fund Point 1 Highest AUM (₹23,615 Cr). Lower mid AUM (₹3,655 Cr). Bottom quartile AUM (₹159 Cr). Bottom quartile AUM (₹18 Cr). Upper mid AUM (₹16,907 Cr). Point 2 Oldest track record among peers (22 yrs). Established history (22+ yrs). Established history (17+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderate. Point 5 1Y return: 7.15% (top quartile). 1Y return: 6.43% (lower mid). 1Y return: 6.20% (bottom quartile). 1Y return: 4.17% (bottom quartile). 1Y return: 6.88% (upper mid). Point 6 1M return: 0.65% (top quartile). 1M return: 0.58% (lower mid). 1M return: 0.54% (bottom quartile). 1M return: 0.24% (bottom quartile). 1M return: 0.60% (upper mid). Point 7 Sharpe: 3.14 (top quartile). Sharpe: 1.85 (lower mid). Sharpe: 1.15 (bottom quartile). Sharpe: 0.98 (bottom quartile). Sharpe: 2.94 (upper mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.81% (upper mid). Yield to maturity (debt): 6.78% (lower mid). Yield to maturity (debt): 6.34% (bottom quartile). Yield to maturity (debt): 3.23% (bottom quartile). Yield to maturity (debt): 6.82% (top quartile). Point 10 Modified duration: 0.47 yrs (lower mid). Modified duration: 0.47 yrs (bottom quartile). Modified duration: 0.37 yrs (upper mid). Modified duration: 0.00 yrs (top quartile). Modified duration: 0.47 yrs (bottom quartile). Aditya Birla Sun Life Savings Fund

UTI Ultra Short Term Fund

BOI AXA Ultra Short Duration Fund

Indiabulls Ultra Short Term Fund

ICICI Prudential Ultra Short Term Fund

1. IDBI Liquid Fund

IDBI Liquid Fund

Growth Launch Date 9 Jul 10 NAV (28 Jul 23) ₹2,454.04 ↑ 0.35 (0.01 %) Net Assets (Cr) ₹503 on 30 Jun 23 Category Debt - Liquid Fund AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Low Expense Ratio 0.17 Sharpe Ratio 0.2 Information Ratio -5.96 Alpha Ratio -0.21 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.66% Effective Maturity 1 Month 10 Days Modified Duration 1 Month 7 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,343 31 Jan 23 ₹10,873 Returns for IDBI Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.4% 1 Year 6.6% 3 Year 4.5% 5 Year 5.3% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Liquid Fund

Name Since Tenure Data below for IDBI Liquid Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. IDBI Ultra Short Term Fund

IDBI Ultra Short Term Fund

Growth Launch Date 3 Sep 10 NAV (28 Jul 23) ₹2,424.68 ↑ 0.44 (0.02 %) Net Assets (Cr) ₹146 on 30 Jun 23 Category Debt - Ultrashort Bond AMC IDBI Asset Management Limited Rating ☆ Risk Moderately Low Expense Ratio 0.6 Sharpe Ratio -0.57 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.83% Effective Maturity 2 Months 23 Days Modified Duration 2 Months 10 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,391 31 Jan 23 ₹10,885 Returns for IDBI Ultra Short Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.5% 3 Month 1.6% 6 Month 3.4% 1 Year 6.4% 3 Year 4.8% 5 Year 5.5% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Ultra Short Term Fund

Name Since Tenure Data below for IDBI Ultra Short Term Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. BOI AXA Liquid Fund

BOI AXA Liquid Fund

Growth Launch Date 16 Jul 08 NAV (18 Feb 26) ₹3,120.44 ↑ 0.32 (0.01 %) Net Assets (Cr) ₹1,107 on 31 Dec 25 Category Debt - Liquid Fund AMC BOI AXA Investment Mngrs Private Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.13 Sharpe Ratio 4.02 Information Ratio 1.26 Alpha Ratio 0.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 5.94% Effective Maturity 1 Month 20 Days Modified Duration 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,332 31 Jan 23 ₹10,867 31 Jan 24 ₹11,643 31 Jan 25 ₹12,506 31 Jan 26 ₹13,309 Returns for BOI AXA Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 7% 5 Year 5.9% 10 Year 15 Year Since launch 6.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.6% 2023 7.4% 2022 7% 2021 4.9% 2020 3.3% 2019 4.1% 2018 6.4% 2017 7.4% 2016 6.7% 2015 7.6% Fund Manager information for BOI AXA Liquid Fund

Name Since Tenure Mithraem Bharucha 17 Aug 21 4.46 Yr. Data below for BOI AXA Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.7% Other 0.3% Debt Sector Allocation

Sector Value Cash Equivalent 58.46% Corporate 38.54% Government 2.7% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tbill

Sovereign Bonds | -8% ₹148 Cr 15,000,000

↑ 15,000,000 Indian Bank

Certificate of Deposit | -5% ₹99 Cr 10,000,000 Union Bank of India

Domestic Bonds | -5% ₹99 Cr 10,000,000 HDFC Securities Limited

Commercial Paper | -4% ₹79 Cr 8,000,000 19/02/2026 Maturing 182 DTB

Sovereign Bonds | -4% ₹75 Cr 7,500,000

↑ 7,500,000 Bank Of Baroda

Certificate of Deposit | -4% ₹74 Cr 7,500,000 Canara Bank

Certificate of Deposit | -4% ₹74 Cr 7,500,000

↑ 2,500,000 State Bank Of India

Certificate of Deposit | -3% ₹64 Cr 6,500,000

↑ 6,500,000 Blue Star Ltd -

Commercial Paper | -3% ₹50 Cr 5,000,000 Icici Securities Primary Dealership Ltd

Commercial Paper | -3% ₹50 Cr 5,000,000 4. DSP Liquidity Fund

DSP Liquidity Fund

Growth Launch Date 23 Nov 05 NAV (18 Feb 26) ₹3,867.22 ↑ 0.47 (0.01 %) Net Assets (Cr) ₹17,777 on 31 Dec 25 Category Debt - Liquid Fund AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.21 Sharpe Ratio 3.55 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 5.98% Effective Maturity 1 Month 6 Days Modified Duration 1 Month 2 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,330 31 Jan 23 ₹10,854 31 Jan 24 ₹11,620 31 Jan 25 ₹12,475 31 Jan 26 ₹13,269 Returns for DSP Liquidity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.4% 2022 7% 2021 4.8% 2020 3.3% 2019 4.2% 2018 6.5% 2017 7.4% 2016 6.6% 2015 7.6% Fund Manager information for DSP Liquidity Fund

Name Since Tenure Karan Mundhra 31 May 21 4.68 Yr. Shalini Vasanta 1 Aug 24 1.5 Yr. Kunal Khudania 1 Jan 26 0.08 Yr. Data below for DSP Liquidity Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.71% Other 0.29% Debt Sector Allocation

Sector Value Cash Equivalent 55.96% Corporate 41.39% Government 2.36% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps / Reverse Repo Investments

CBLO/Reverse Repo | -11% -₹1,845 Cr HDFC Bank Ltd.

Debentures | -5% ₹793 Cr 16,000 Tbill

Sovereign Bonds | -5% ₹770 Cr 77,500,000 5.63% Gs 2026

Sovereign Bonds | -4% ₹616 Cr 60,500,000

↑ 24,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹574 Cr 11,500 HDFC Bank Limited

Certificate of Deposit | -3% ₹548 Cr 11,000 Small Industries Development Bank Of India

Commercial Paper | -3% ₹497 Cr 10,000 Punjab National Bank (18/03/2026)

Certificate of Deposit | -3% ₹496 Cr 10,000 Union Bank Of India

Certificate of Deposit | -3% ₹494 Cr 10,000

↑ 10,000 Bank Of Baroda

Certificate of Deposit | -3% ₹448 Cr 9,000 5. Axis Liquid Fund

Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (18 Feb 26) ₹3,016.26 ↑ 0.37 (0.01 %) Net Assets (Cr) ₹35,653 on 31 Dec 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.47 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.06% Effective Maturity 2 Months 2 Days Modified Duration 1 Month 28 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,333 31 Jan 23 ₹10,864 31 Jan 24 ₹11,639 31 Jan 25 ₹12,497 31 Jan 26 ₹13,296 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 7% 5 Year 5.9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.6% 2023 7.4% 2022 7.1% 2021 4.9% 2020 3.3% 2019 4.3% 2018 6.6% 2017 7.5% 2016 6.7% 2015 7.6% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 13.25 Yr. Aditya Pagaria 13 Aug 16 9.48 Yr. Sachin Jain 3 Jul 23 2.59 Yr. Data below for Axis Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 73.04% Corporate 24.53% Government 2.17% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -7% ₹2,872 Cr 27/03/2026 Maturing 91 DTB

Sovereign Bonds | -4% ₹1,434 Cr 144,500,000 Export Import Bank Of India

Commercial Paper | -3% ₹1,197 Cr 24,000 19/02/2026 Maturing 91 DTB

Sovereign Bonds | -3% ₹1,150 Cr 115,307,200

↓ -15,500,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹998 Cr 20,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹996 Cr 20,000 Indian Bank (25/02/2026) **

Certificate of Deposit | -3% ₹996 Cr 20,000 HDFC Bank Limited

Certificate of Deposit | -3% ₹992 Cr 20,000

↓ -500 HDFC Bank Ltd.

Debentures | -2% ₹967 Cr 19,500 Export Import Bank Of India

Commercial Paper | -2% ₹747 Cr 15,000

सतत विचारले जाणारे प्रश्न

1. मी सर्वोत्तम फंड कसा निवडू शकतो?

ए. गुंतवणूकीची निवड विविध घटकांवर आधारित असते, जसे की फंड व्यवस्थापक, ऐतिहासिक परतावा, शुल्क आणि भार, गुंतवणूक शैली, गुंतवणुकीचे उद्दिष्ट, गुंतवणुकीचे क्षितिज आणि बरेच काही. अशा प्रकारे, सर्वोत्कृष्ट निधी निवडण्यासाठी, आपण प्रत्येक महत्त्वाच्या गोष्टींचे विश्लेषण केल्याची खात्री कराघटक पुढे जाण्यापूर्वी सावधपणे.

2. सर्वात कमी जोखीम असलेला योग्य गुंतवणूक प्रकार कोणता आहे?

ए. च्या अप्रत्याशित परिस्थितीमुळेअर्थव्यवस्था आणि गुंतवणुकीच्या विविध पर्यायांची उपलब्धता, सुरक्षित पर्यायाचे मूल्यांकन करणे खूप कठीण आहे. तथापि, तुम्ही विचार करू शकता अशा काही पर्यायांमध्ये बँक मुदत ठेवी, म्युनिसिपल बॉण्ड्स, ठेवींचे प्रमाणपत्र आणि बरेच काही समाविष्ट आहे.

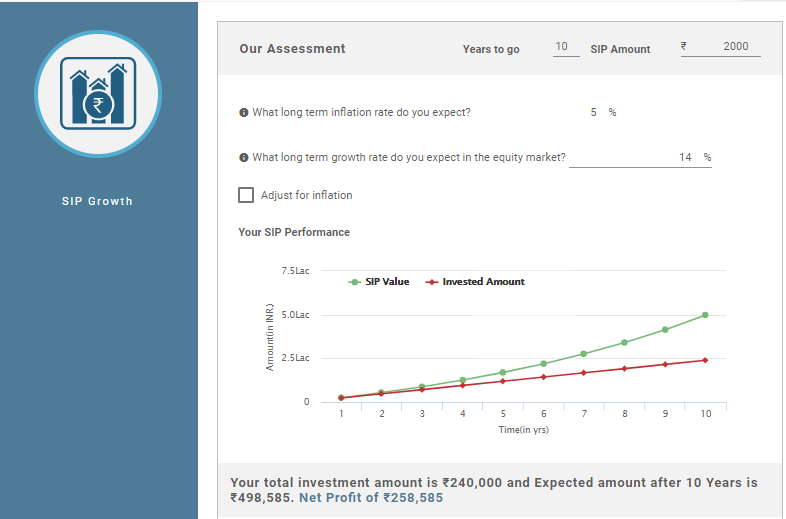

3. म्युच्युअल फंड कॅल्क्युलेटरचा उपयोग काय आहे?

ए. दम्युच्युअल फंड कॅल्क्युलेटर गुंतवणूकीच्या क्षितिजानुसार परताव्याचे मूल्यमापन करून परिपक्वतेवर गुंतवणूक मूल्य देते. तुमचे फायदे जाणून घेण्यासाठी तुम्ही कॅल्क्युलेटरचे वेगवेगळे व्हेरिएबल्स सेट करू शकता, जसे की कालावधी, अपेक्षित परतावा दर, वारंवारता, गुंतवणूक रक्कम आणि बरेच काही.

4. मी किती गुंतवणूक करू शकतो?

ए. रक्कम प्रामुख्याने तुमच्या गरजा, बजेट आणि गुंतवणुकीची उद्दिष्टे यावर अवलंबून असते. तथापि, लक्षात ठेवा की रक्कम कितीही असली तरीही तुम्ही फक्त अतिरिक्त पैसे गुंतवता.

5. गुंतवणुकीसाठी योग्य वेळ आहे का?

ए. गुंतवणुकीसाठी योग्य वेळ नाही. चांगल्या आणि उत्तम परताव्यासाठी, अशी शिफारस केली जाते की तुम्ही लगेचच गुंतवणूक सुरू करावी.

6. म्युच्युअल फंडात गुंतवणूक करण्यासाठी मला बँक खाते आवश्यक आहे का?

ए. होय, KYC/ सह बँक खाते असणे आवश्यक आहेcKYC,आधार कार्ड आणिपॅन कार्ड म्युच्युअल फंडात गुंतवणूक करणे.

7. निधी व्यवस्थापकाशी संपर्क साधणे आवश्यक आहे का?

ए. होय! म्युच्युअल फंडात गुंतवणूक करताना, चांगली कामगिरी निर्माण करण्यासाठी अनुभव महत्त्वाची भूमिका बजावतो. अनुभव जितका अधिक असेल तितका चांगला परतावा मिळण्याची शक्यता असेल. अशा प्रकारे, तुम्ही अनुभवी फंड मॅनेजरच्या संपर्कात असल्याची खात्री करा.

8. मी माझे गुंतवलेले पैसे काढू शकतो का?

ए. म्युच्युअल फंडातील बहुतांश योजना या ओपन-एंड योजना असतात. हे तुम्हाला गुंतवलेली संपूर्ण रक्कम कोणत्याही वेळी काढू देते. तथापि, अशा काही परिस्थिती असू शकतात जिथे तुम्हाला निर्बंध येऊ शकतात.

9. मी लवकर पैसे काढल्यास मला कोणताही दंड भरावा लागेल का?

ए. तुम्ही ओपन-एंड योजनांमध्ये गुंतवणूक केली असल्यास, तुम्हाला कदाचित दंड भरावा लागणार नाही. तथापि, काही योजना इतरांसारख्या तरल नसतील. त्यामुळे, गुंतवणूक करण्यापूर्वी तुम्हाला हा घटक पुन्हा तपासावा लागेल.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

It was very valuable useful messages messagesThankyou

Very Good

good information on funds. appreciated!!!