2022 मध्ये गुंतवणूक करण्यासाठी शीर्ष 5 म्युच्युअल फंड

म्युच्युअल फंड उशीरा गुंतवणुकीची लोकप्रिय पद्धत बनली आहे आणि बरेच गुंतवणूकदार त्याकडे झुकत आहेतगुंतवणूक त्यात. म्युच्युअल फंड केवळ चांगला परतावा देत नाहीत तर ते साध्य करण्याची पद्धतशीर संधी देखील देतातआर्थिक उद्दिष्टे, जे अलीकडच्या काळात त्यांच्या लोकप्रियतेचे एक कारण आहे. तथापि, इच्छित गुंतवणुकीचे उद्दिष्ट साध्य करण्यासाठी किंवा चांगला परतावा मिळविण्यासाठी, योग्य फंडात गुंतवणूक करणे महत्त्वाचे आहे. म्हणूनच आम्ही येथे आहोत! गुंतवणूकदार योजना करत आहेतम्युच्युअल फंडात गुंतवणूक करा, आम्ही तुमच्यासाठी काही आणतोसर्वोत्तम कामगिरी करणारे म्युच्युअल फंड ज्याचा तुम्ही गुंतवणूक करताना विचार केला पाहिजे. हे फंड एयूएम सारखे महत्त्वाचे पॅरामीटर्स हाती घेऊन शॉर्टलिस्ट केले गेले आहेत.नाही, मागील कामगिरी, समवयस्क सरासरी परतावा, माहिती गुणोत्तर इ.

Talk to our investment specialist

भारतातील शीर्ष 5 सर्वोत्तम कामगिरी करणारे म्युच्युअल फंड

सर्वोत्कृष्ट इक्विटी म्युच्युअल फंड 2022

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Information Ratio Sharpe Ratio DSP World Gold Fund Growth ₹60.3973

↓ -2.23 ₹1,756 1,000 500 32.8 78.1 143 56.3 28.1 167.1 -0.67 3.42 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 5,000 500 7.8 17.7 33.3 34.3 27.5 11.3 -0.47 0.33 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 5,000 500 3.1 11.2 33.1 32.2 25.9 10.3 -0.37 0.27 Franklin India Opportunities Fund Growth ₹258.796

↑ 0.77 ₹8,380 5,000 500 -1.9 3.2 16.6 29.6 20.1 3.1 1.69 -0.1 LIC MF Infrastructure Fund Growth ₹50.751

↑ 0.39 ₹1,003 5,000 1,000 1.2 4.9 27.6 29 23.6 -3.7 0.28 -0.21 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Note: Ratio's shown as on 31 Dec 25 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund Franklin India Opportunities Fund LIC MF Infrastructure Fund Point 1 Lower mid AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,449 Cr). Highest AUM (₹8,380 Cr). Bottom quartile AUM (₹1,003 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (26 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 28.10% (top quartile). 5Y return: 27.55% (upper mid). 5Y return: 25.92% (lower mid). 5Y return: 20.05% (bottom quartile). 5Y return: 23.57% (bottom quartile). Point 6 3Y return: 56.28% (top quartile). 3Y return: 34.34% (upper mid). 3Y return: 32.18% (lower mid). 3Y return: 29.60% (bottom quartile). 3Y return: 28.99% (bottom quartile). Point 7 1Y return: 143.03% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 33.14% (lower mid). 1Y return: 16.63% (bottom quartile). 1Y return: 27.64% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (upper mid). Alpha: -1.90 (lower mid). Alpha: -4.27 (bottom quartile). Alpha: -18.43 (bottom quartile). Point 9 Sharpe: 3.42 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.27 (lower mid). Sharpe: -0.10 (bottom quartile). Sharpe: -0.21 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: -0.37 (lower mid). Information ratio: 1.69 (top quartile). Information ratio: 0.28 (upper mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

Franklin India Opportunities Fund

LIC MF Infrastructure Fund

सर्वोत्कृष्ट कर्ज निधी 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.3253

↓ -0.01 ₹206 -0.5 0.9 18.8 14.1 21 7.1% 2Y 4M 17D 3Y 3M 14D Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3116

↓ -0.01 ₹1,092 4.9 7.4 13.2 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 4.19% 5M 18D 8M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund Point 1 Bottom quartile AUM (₹206 Cr). Bottom quartile AUM (₹297 Cr). Highest AUM (₹1,092 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Point 2 Established history (22+ yrs). Established history (18+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Not Rated. Rating: 2★ (upper mid). Rating: 2★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 18.80% (top quartile). 1Y return: 13.69% (upper mid). 1Y return: 13.24% (lower mid). 1Y return: 12.83% (bottom quartile). 1Y return: 11.79% (bottom quartile). Point 6 1M return: -0.92% (bottom quartile). 1M return: 0.59% (upper mid). 1M return: 0.90% (top quartile). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (lower mid). Point 7 Sharpe: 1.53 (lower mid). Sharpe: 2.57 (top quartile). Sharpe: 2.08 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.10% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Point 10 Modified duration: 2.38 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (lower mid). Modified duration: 0.47 yrs (upper mid). DSP Credit Risk Fund

Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

सर्वोत्कृष्ट हायब्रिड फंड 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.9639

↑ 0.19 ₹6,720 2.1 7.8 15.6 20.5 14.6 11.1 SBI Multi Asset Allocation Fund Growth ₹66.9273

↑ 0.12 ₹13,033 5.3 13 23.2 20.1 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹823.201

↑ 0.61 ₹78,179 2 9.4 17.2 19.7 19.8 18.6 ICICI Prudential Equity and Debt Fund Growth ₹411.62

↑ 0.78 ₹49,641 0.5 4.4 15.7 19.3 19 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.52

↑ 0.22 ₹1,349 0.8 2.1 16.6 19 18.5 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,720 Cr). Lower mid AUM (₹13,033 Cr). Highest AUM (₹78,179 Cr). Upper mid AUM (₹49,641 Cr). Bottom quartile AUM (₹1,349 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.58% (bottom quartile). 5Y return: 14.77% (bottom quartile). 5Y return: 19.81% (top quartile). 5Y return: 18.97% (upper mid). 5Y return: 18.45% (lower mid). Point 6 3Y return: 20.51% (top quartile). 3Y return: 20.06% (upper mid). 3Y return: 19.66% (lower mid). 3Y return: 19.30% (bottom quartile). 3Y return: 19.05% (bottom quartile). Point 7 1Y return: 15.59% (bottom quartile). 1Y return: 23.16% (top quartile). 1Y return: 17.22% (upper mid). 1Y return: 15.67% (bottom quartile). 1Y return: 16.62% (lower mid). Point 8 1M return: 0.52% (bottom quartile). 1M return: 1.02% (lower mid). 1M return: 0.67% (bottom quartile). 1M return: 1.08% (upper mid). 1M return: 1.96% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 4.49 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.55 (bottom quartile). Sharpe: 1.60 (upper mid). Sharpe: 1.86 (top quartile). Sharpe: 0.83 (lower mid). Sharpe: -0.29 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

सर्वोत्कृष्ट गोल्ड म्युच्युअल फंड 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹60.3973

↓ -2.23 ₹1,756 32.8 78.1 143 56.3 28.1 167.1 SBI Gold Fund Growth ₹43.8818

↓ -0.02 ₹10,775 23.5 50.1 72.6 37.3 24.9 71.5 IDBI Gold Fund Growth ₹38.9617

↑ 0.15 ₹623 23.5 49.3 71.5 37.1 24.6 79 ICICI Prudential Regular Gold Savings Fund Growth ₹46.4349

↑ 0.04 ₹4,482 23.6 50.1 72.9 37 24.8 72 Aditya Birla Sun Life Gold Fund Growth ₹43.5454

↓ -0.16 ₹1,266 23.6 50 72.9 37 24.7 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI Gold Fund IDBI Gold Fund ICICI Prudential Regular Gold Savings Fund Aditya Birla Sun Life Gold Fund Point 1 Lower mid AUM (₹1,756 Cr). Highest AUM (₹10,775 Cr). Bottom quartile AUM (₹623 Cr). Upper mid AUM (₹4,482 Cr). Bottom quartile AUM (₹1,266 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (13+ yrs). Point 3 Top rated. Rating: 2★ (lower mid). Not Rated. Rating: 1★ (bottom quartile). Rating: 3★ (upper mid). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 28.10% (top quartile). 5Y return: 24.92% (upper mid). 5Y return: 24.59% (bottom quartile). 5Y return: 24.83% (lower mid). 5Y return: 24.70% (bottom quartile). Point 6 3Y return: 56.28% (top quartile). 3Y return: 37.31% (upper mid). 3Y return: 37.07% (lower mid). 3Y return: 37.03% (bottom quartile). 3Y return: 37.01% (bottom quartile). Point 7 1Y return: 143.03% (top quartile). 1Y return: 72.57% (bottom quartile). 1Y return: 71.46% (bottom quartile). 1Y return: 72.86% (lower mid). 1Y return: 72.94% (upper mid). Point 8 Alpha: 1.32 (top quartile). 1M return: 5.66% (upper mid). 1M return: 5.47% (bottom quartile). 1M return: 5.74% (top quartile). 1M return: 5.58% (lower mid). Point 9 Sharpe: 3.42 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Sharpe: 4.38 (upper mid). Sharpe: 4.30 (bottom quartile). Sharpe: 4.33 (lower mid). Sharpe: 4.49 (top quartile). DSP World Gold Fund

SBI Gold Fund

IDBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

Aditya Birla Sun Life Gold Fund

म्युच्युअल फंडाचे प्रकार: जोखीम आणि परतावा

तुम्ही गुंतवणूक करण्यापूर्वी, खालील म्युच्युअल फंड श्रेणीतील मूलभूत जोखीम आणि सरासरी परतावा जाणून घ्या:

| म्युच्युअल फंड श्रेणी | सरासरी परतावा | धोका | जोखमीचा प्रकार |

|---|---|---|---|

| इक्विटी फंड | 2% -20% | उच्च ते मध्यम | अस्थिरता जोखीम, कामगिरी जोखीम, एकाग्रता जोखीम |

| कर्ज/बंध | ८-१४% | कमी ते मध्यम | व्याजदर जोखीम, क्रेडिट जोखीम |

| मनी मार्केट फंड | ४%-८% | कमी | महागाई जोखीम, संधी गमावणे |

| संतुलित निधी | ५-१५% | मध्यम | इक्विटी, डेट होल्डिंग्समध्ये जास्त एक्सपोजर |

म्युच्युअल फंड कॅल्क्युलेटर: तुमच्या गुंतवणुकीचा परतावा पूर्व-निर्धारित करा

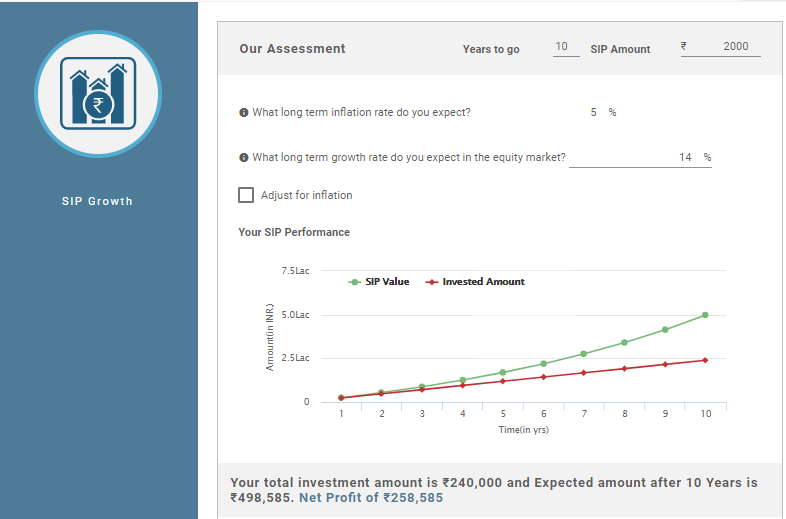

एसिप कॅल्क्युलेटर हे एक स्मार्ट साधन आहे जे गुंतवणूकदारांच्या प्रमुख प्रश्नांचे निराकरण करते जसे की ‘किती गुंतवणूक करावी’, ‘मी किती कमवू’, ‘माझा नफा किती होईल’, इ.म्युच्युअल फंड कॅल्क्युलेटर, खास करून,SIP कॅल्क्युलेटर तुम्ही ज्या कालावधीसाठी गुंतवणूक करू इच्छिता त्या कालावधीसाठी तुमची गुंतवणूक रक्कम पूर्व-निर्धारित करते. हे प्रभावी साधनांपैकी एक आहेआर्थिक नियोजन. एखाद्याला कार, घर खरेदी करण्याची योजना करायची आहे की नाही, यासाठी योजना करासेवानिवृत्ती, मुलाचे उच्च शिक्षण किंवा इतर कोणतेही आर्थिक उद्दिष्ट, त्यासाठी SIP कॅल्क्युलेटर वापरले जाऊ शकते. कॅल्क्युलेटर कसे कार्य करते ते येथे आहे:

चित्रण:

मासिक गुंतवणूक: ₹ 2,000

गुंतवणुकीचा कालावधी: 10 वर्षे

गुंतवणूक केलेली एकूण रक्कम: ₹ 2,40,000

दीर्घकालीन महागाई: ५% (अंदाजे)

दीर्घकालीन वाढीचा दर: 14% (अंदाजे)

एसआयपी कॅल्क्युलेटरनुसार अपेक्षित परतावा: ₹ ४,९८,५८५

SIP कॅल्क्युलेटरमध्ये तुम्हाला फक्त गुंतवणुकीची रक्कम आणि गुंतवणुकीचा कालावधी (अतिरिक्त इनपुट जसे महागाई आणि अपेक्षित) यासारखे काही मूलभूत इनपुट प्रविष्ट करणे आवश्यक आहेबाजार परतावा अधिक वास्तववादी चित्र देईल). या नोंदींचे आउटपुट ही मुदतपूर्ती आणि मिळालेल्या नफ्यावर अंतिम रक्कम असेल.

ध्येय लक्षात घेऊन अशीच गणना ध्येय गाठण्यासाठी एखाद्याने किती गुंतवणूक करावी हे ठरवण्यासाठी देखील केली जाऊ शकते. तुम्हाला खालीलप्रमाणे विशिष्ट ध्येय निवडावे लागेल आणि लक्ष्य कॅल्क्युलेटर वापरून तपशीलांचा अंदाज लावावा लागेल.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.