SWP Vs Dividend

Which is Better?

SWP Vs Dividend? Individuals are always confused whenever they need to make choices between both of them. Though both the options seem to be same, however, there are vast differences between them. On a holistic note, it can be said that in SWP (Systematic Withdrawal Plan), individuals can redeem a pre-fixed amount from their Mutual Fund investment at regular intervals. While in the dividend option, the Mutual Fund scheme credits a certain amount into the investor’s account out of the profits generated. So, let us understand the differences between SWP and dividend in case of Mutual Funds with respect to various parameters such as tenure of crediting money, the amount that is paid back to the investor, and so on.

What does SWP in Mutual Fund mean?

Systematic Withdrawal Plan or SWP in Mutual Funds is a systematic technique of redeeming money. It is opposite of SIP. In SWP, individuals first invest a considerable amount in a Mutual Fund scheme generally having a low level of risk (example, Liquid Funds or ultra short-term funds). After Investing, individuals start to withdraw a fixed sum of money from the Mutual Fund investment at regular intervals. This scheme is suitable for individuals who are looking for a source that gives a fixed income. In this case, the money invested in Mutual Fund schemes also generates returns based on the scheme category. The redemption frequency can be customized by individuals based on their frequency such as weekly, monthly, or quarterly.

How does Dividend Plan in Mutual Fund Work?

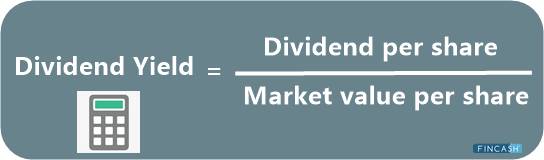

Mutual Fund Dividend refers to the share of profits distributed among the unitholders that is earned by a Mutual Fund scheme. Here, the Mutual Fund scheme can distribute the dividend to the unitholders of the same scheme only. This dividend is distributed out of the realized profits of the scheme. Realized profits refer to the profits generated by the scheme by selling the underlying assets forming part of the Portfolio. However, it doesn’t include the profits on account of increase in the NAV. The frequency of dividend can be quarterly, monthly, daily, and so on. Since the dividend is given out of the profits, it results in the reduction of the NAV value. This scheme is suitable for individuals who are looking for a periodic income. In case of dividends, individuals need not pay any tax to the government.

VALUE AT END OF TENOR:₹5,927SWP Calculator

SWP Vs Dividend: Understanding the Differences

Though both SWP and dividend result in earning regular income for individuals, however, there exist differences between both of them. So, let us understand the differences between both SWP and dividend.

Returns

Since SWP is a process of systematic redemption of money from Mutual Funds, therefore, individuals get a pre-determined amount in this case. However, in case of dividends, the returns are not fixed. This is because the Mutual Fund scheme generates profits by selling the underlying assets which are a part of its portfolio.

Suitability

SWP is generally suitable for individuals looking for a fixed income source especially, retirees. It is because retirees can use it as a substitute for pension. Also, the investment generates expected returns. However, dividend option is suitable for individuals who are looking for periodic income though the amount may be fixed or not.

Talk to our investment specialist

Capital Erosion

SWP results in a reduction of capital investment or capital erosion as the redemption takes place from the investment done and not from the revenue generated on investments. However, in case of dividends, there is no reduction in the capital.

Reduction in NAV

In case of Mutual Fund dividend, there is a reduction in the NAV as the profits are distributed forming part of the NAV. However, in SWP, there is no reduction in the NAV only the investment amount or number of units get reduced.

Type of Scheme

Individuals resorting to SWP generally choose Mutual Fund schemes that carry a low risk-appetite such as liquid funds or ultra short-term funds. This is because, in such schemes, the capital position remains intact. However, in case of Mutual Fund dividend, individuals can choose any type of scheme depending on the tenure of investment and risk appetite.

Taxation Impact

SWP is considered as a redemption from Mutual Funds and therefore, attracts tax in the form of Capital Gains. In case of investment in debt funds, If the withdrawal process starts within 36 months then it falls under Short Term Capital Gain (STCG) which is charged as per the individual’s income slab rates. However, if SWP starts after 36 months then it attracts Long Term Capital Gain (LTCG) which attracts 20% tax along with indexation benefits. For investments in an equity fund, if the SWP is within 12 months, it attracts STCG which is charged at 15%. In Equity Funds, LTCG was exempt till F.Y. 2017-18. However, from F.Y. 2018-19, equity funds attract LTCG of above INR 1 Lakh attracts a tax of 10% (plus cess) without indexation benefits.

But, in Mutual Fund dividends it is not the case. Mutual Fund dividends are not chargeable to tax at the investor’s end. But instead, in case of debt funds, the fund house pays a Dividend Distribution Tax of 25% (plus Surcharge & Cess). Further, in case of equity funds, the fund houses need to pay a Dividend Distribution Tax of 10% (plus surcharge & cess).

Frequency

The frequency in case of SWP can be customized by individuals such as quarterly, monthly or weekly. However, in case of dividends, the frequency is generally pre-determined which can be a daily dividend, monthly dividend, weekly dividend, and so on.

Discontinuing the Option

Individuals can stop SWP if required and can withdraw the entire money from the Mutual Fund scheme. However, it is difficult for individuals to stop the dividend option. This is because, it is a type of scheme in which the investment is done and individuals would require to redeem their entire stake from the scheme to stop the dividends.

Disciplined Withdrawal Habit

SWP creates a disciplined withdrawal habit among individuals as only a fixed sum of money is withdrawn from the scheme. However, dividends do not instil a disciplined withdrawal habit as the dividend amount keeps on varying based on the scheme’s performance.

The above differences between SWP Vs Dividend are summarized in the table given below.

| Parameters | SWP | Dividends |

|---|---|---|

| Returns | Fixed Redemption | Dividends vary on the Scheme’s Performance |

| Suitability | Generally suitable for retired individuals seeking for fixed regular income at regular intervals | Suitable for individuals seeking periodic income |

| Capital Erosion | Yes | No |

| Reduction in NAV | No | Yes |

| Type of Scheme | Generally, choose to invest in low-risk Mutual Fund schemes (Example liquid funds) | Can choose any type of Mutual Fund schemes based on investment tenure and risk-appetite of the individuals |

| Tax Impact on Investors | Attracts capital gains tax at the investor’s end | Does not attract tax at investor’s end |

| Frequency | Quarterly, monthly, weekly, and so on | Daily, weekly, monthly, and so on |

| Stopping | Individuals can stop SWP | Individuals cannot stop dividend arising from the scheme |

| Disciplined Withdrawal Habit | Creates a disciplined withdrawal habit | It is not applicable in case of dividends |

Fund Selection Methodology used to find 5 funds

Best SWP Mutual Funds 2026

For SWP, individuals generally choose to invest in schemes whose risk-capacity is low such as liquid funds. So, some of the Best Liquid Funds that can be chosen for SWP option are listed below as follows.

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,609.74

↑ 0.37 ₹165 0.5 1.4 2.9 6.4 6.6 6.02% 2M 2M 1D PGIM India Insta Cash Fund Growth ₹351.333

↑ 0.05 ₹505 0.5 1.4 2.9 6.4 6.5 5.96% 1M 11D 1M 13D JM Liquid Fund Growth ₹73.5939

↑ 0.01 ₹2,851 0.5 1.4 2.8 6.3 6.4 5.91% 1M 10D 1M 14D Axis Liquid Fund Growth ₹3,005.44

↑ 0.47 ₹35,653 0.5 1.4 2.9 6.4 6.6 6.06% 1M 28D 2M 2D Aditya Birla Sun Life Liquid Fund Growth ₹434.877

↑ 0.06 ₹47,273 0.5 1.4 2.9 6.4 6.5 6.19% 2M 1D 2M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 30 Jan 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund Axis Liquid Fund Aditya Birla Sun Life Liquid Fund Point 1 Bottom quartile AUM (₹165 Cr). Bottom quartile AUM (₹505 Cr). Lower mid AUM (₹2,851 Cr). Upper mid AUM (₹35,653 Cr). Highest AUM (₹47,273 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (28 yrs). Established history (16+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.39% (upper mid). 1Y return: 6.37% (bottom quartile). 1Y return: 6.25% (bottom quartile). 1Y return: 6.40% (top quartile). 1Y return: 6.37% (lower mid). Point 6 1M return: 0.47% (bottom quartile). 1M return: 0.48% (lower mid). 1M return: 0.46% (bottom quartile). 1M return: 0.49% (top quartile). 1M return: 0.48% (upper mid). Point 7 Sharpe: 3.18 (lower mid). Sharpe: 3.16 (bottom quartile). Sharpe: 2.52 (bottom quartile). Sharpe: 3.47 (top quartile). Sharpe: 3.21 (upper mid). Point 8 Information ratio: -0.71 (bottom quartile). Information ratio: -0.10 (lower mid). Information ratio: -1.88 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.02% (lower mid). Yield to maturity (debt): 5.96% (bottom quartile). Yield to maturity (debt): 5.91% (bottom quartile). Yield to maturity (debt): 6.06% (upper mid). Yield to maturity (debt): 6.19% (top quartile). Point 10 Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.11 yrs (upper mid). Modified duration: 0.11 yrs (top quartile). Modified duration: 0.16 yrs (lower mid). Modified duration: 0.17 yrs (bottom quartile). Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

Axis Liquid Fund

Aditya Birla Sun Life Liquid Fund

How to Invest in Mutual Fund Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Thus, it can be concluded that there exists a lot of differences between SWP and dividends. However, individuals should choose the correct option that suits their requirements and are in-line with the objectives. This will lead them to attain their objectives on time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.