ELSS بمقابلہ ٹیکس سیونگ FD

ایکویٹی سے منسلک بچت اسکیم (ELSS)

ای ایل ایس ایس واحد ہےمشترکہ فنڈ 80C کٹوتیوں کے لیے اہل۔ یہ ایک متنوع ایکویٹی میوچل فنڈ ہے جو روپے تک ٹیکس کٹوتیوں کی پیشکش کرتا ہے۔ 1.5 لاکھ سالانہ کے تحتسیکشن 80 سی کیانکم ٹیکس ایکٹ (آئی ٹی ایکٹ 1961)۔

فروری بجٹ 2018 کے متعارف ہونے سے پہلے، اس کے ریٹرن مکمل طور پر ٹیکس سے پاک تھے۔ تاہم، اب یہ 10٪ طویل مدتی سے مشروط ہے۔سرمایہ منافع ٹیکس اگر آپ کےکیپٹل گینز روپے سے زیادہ ایک سال بعد ایک لاکھ۔ 10% ٹیکس کٹوتی کے بعد بھی، ELSS میں ٹیکس بچانے والے دیگر آلات کے مقابلے اعلیٰ منافع فراہم کرنے کی صلاحیت ہے۔ ELSS سرمایہ کاری کے مراعات صرف تک محدود نہیں ہیں۔ٹیکس محفوظ کر لیا دیکمپاؤنڈنگ کی طاقت اس بات کو یقینی بناتا ہے کہ اگر آپ 5 سال (ٹیکس کی بچت کی مدت) کے لیے سرمایہ کاری کرتے ہیں تو آپ کی سرمایہ کاری دوگنی ہو جاتی ہے۔ایف ڈی)۔ اس میں اضافہ کرنے کے لیے، کم از کم لاک ان مدت صرف 3 سال ہے۔

ٹیکس کی بچت فکسڈ ڈپازٹس

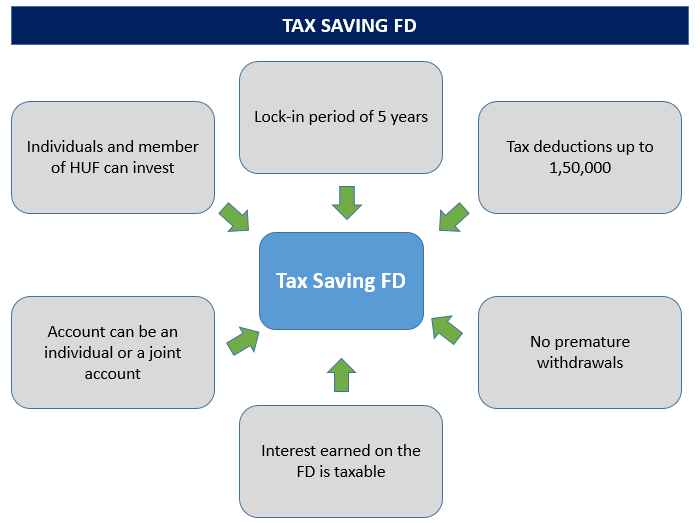

سرمایہ کاری بینکوں میں فکسڈ ڈپازٹ میں رقم افراد اور HUFs کو ٹیکس کا دعوی کرنے کی اجازت دیتی ہے۔کٹوتی روپے تک 1,50،000 ایک مالی سال میں. ان ڈپازٹس کا لاک ان پیریڈ 5 سال ہوتا ہے۔ تاہم، آپ اس ڈپازٹ کو وقت سے پہلے واپس نہیں لے سکتے۔ لیکن آپ مسابقتی شرحوں پر اپنی ایف ڈی کے خلاف قرض حاصل کر سکتے ہیں۔ تاہم، ان ڈپازٹس پر حاصل ہونے والا سود فرد کے ٹیکس کے قابل ٹیکس کی معمولی شرح ہے (ٹیکس بریکٹ کے مطابق)۔

ٹیکس سیور ایف ڈی کی جھلکیاں

آئیے کی اہم جھلکیاں دیکھتے ہیں۔ٹیکس بچانے والا ایف ڈی -

- صرف افراد اور ممبرانہندو غیر منقسم خاندان (HUF) میں سرمایہ کاری کر سکتے ہیں۔ٹیکس بچانے والی ایف ڈی سکیم

- ٹیکس سیور FD کی کم از کم سرمایہ کاری کی رقم مختلف ہوتی ہے۔بینک بینک کو

- ٹیکس بچانے والی ایف ڈی کی لاک ان مدت پانچ سال ہے۔

- آپ روپے تک ٹیکس کی کٹوتیاں حاصل کر سکتے ہیں۔ 1,50,000

- قبل از وقت واپسی کا کوئی بندوبست نہیں ہے۔

- آپ ان ٹیکس سیور ایف ڈی کے خلاف قرض کے لیے درخواست نہیں دے سکتے

- ان ٹیکس سیور FDs میں سرمایہ کاری کسی بھی نجی یا پبلک سیکٹر کے بینک میں کی جا سکتی ہے (سوائے کوآپریٹو اور دیہی بینکوں کے)

- میں کی گئی سرمایہ کاریڈاک خانہ پانچ سال سے زیادہ کی مدت کے لیے ٹائم ڈپازٹ بھی ٹیکس بچانے والی FD کے طور پر اہل ہے۔

- آپ پوسٹ آفس ایف ڈی کو ایک پوسٹ آفس سے دوسرے پوسٹ آفس میں منتقل کر سکتے ہیں۔

- اس قسم کی FD سے حاصل ہونے والا سود قابل ٹیکس ہے اور اسے ذریعہ سے کاٹا جائے گا۔

- ٹیکس سیونگ ڈپازٹ اکاؤنٹ انفرادی اور مشترکہ طور پر کھولا جا سکتا ہے۔

- مشترکہ اکاؤنٹ کی صورت میں، ٹیکس کا فائدہ مشترکہ اکاؤنٹ کے پہلے ہولڈر کو حاصل ہوگا۔

Talk to our investment specialist

ELSS بمقابلہ FD - موازنہ

مختلف پیرامیٹرز پر ELSS اور ٹیکس سیونگ FDs کے درمیان فرق کا ایک سرسری جائزہ یہ ہے:

| پیرامیٹر | ایف ڈی | ای ایل ایس ایس |

|---|---|---|

| دور | 5 سال کا لاک ان | 3 سال کا لاک ان |

| واپسی | 7.00 - 8.00 % (سالانہ مرکب) | کوئی یقینی ڈیویڈنڈ نہیں / اس کے طور پر واپسیمارکیٹ عام طور پر 16 - 17٪ سالانہ کے ارد گرد منسلک |

| کم از کم سرمایہ کاری | روپے 1000 | روپے 500 |

| زیادہ سے زیادہ سرمایہ کاری | کوئی بالائی حد نہیں۔ | کوئی بالائی حد نہیں۔ |

| 80c کے تحت کٹوتی کے لیے اہل رقم | روپے 1.5 لاکھ | روپے 1.5 لاکھ |

| سود/واپسی کے لیے ٹیکس | قابل ٹیکس سود | روپے تک کا فائدہ 1 لاکھ ٹیکس سے پاک ہیں۔ روپے سے اوپر کے منافع پر 10% ٹیکس لاگو ہوتا ہے۔ 1 لاکھ |

| حفاظت/درجہ بندی | محفوظ | تھوڑا خطرہ |

| لیکویڈیٹی | آپ 5 سال سے پہلے ٹیکس بچانے والی ایف ڈی واپس نہیں لے سکتے | آپ 3 سال کے بعد ELSS سے نکل سکتے ہیں یا نکال سکتے ہیں۔ |

| آن لائن آپشن | تمام بینک آن لائن پیش نہیں کرتے ہیں۔سہولت ایف ڈی کھولنے کے لیے | کوئی ایک ELSS آن لائن شروع کر سکتا ہے – بطور یکمشت یاگھونٹ |

ٹاپ ELSS میوچل فنڈز مالی سال 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Motilal Oswal Long Term Equity Fund Growth ₹48.3635

↓ -0.20 ₹4,188 -7.1 -3.5 14.3 22 17.2 -9.1 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 BNP Paribas Long Term Equity Fund (ELSS) Growth ₹96.747

↓ -1.37 ₹911 -3.5 2.1 16.2 19.7 13.8 4.8 JM Tax Gain Fund Growth ₹47.196

↓ -0.61 ₹216 -7.2 -2.1 9.8 18.9 15.3 2.5 Nippon India Tax Saver Fund (ELSS) Growth ₹129.745

↓ -1.55 ₹14,881 -1.9 1.9 17 18.8 16.1 6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Motilal Oswal Long Term Equity Fund IDBI Equity Advantage Fund BNP Paribas Long Term Equity Fund (ELSS) JM Tax Gain Fund Nippon India Tax Saver Fund (ELSS) Point 1 Upper mid AUM (₹4,188 Cr). Bottom quartile AUM (₹485 Cr). Lower mid AUM (₹911 Cr). Bottom quartile AUM (₹216 Cr). Highest AUM (₹14,881 Cr). Point 2 Established history (11+ yrs). Established history (12+ yrs). Oldest track record among peers (20 yrs). Established history (17+ yrs). Established history (20+ yrs). Point 3 Not Rated. Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.20% (top quartile). 5Y return: 9.97% (bottom quartile). 5Y return: 13.80% (bottom quartile). 5Y return: 15.29% (lower mid). 5Y return: 16.08% (upper mid). Point 6 3Y return: 21.97% (top quartile). 3Y return: 20.84% (upper mid). 3Y return: 19.65% (lower mid). 3Y return: 18.85% (bottom quartile). 3Y return: 18.85% (bottom quartile). Point 7 1Y return: 14.33% (bottom quartile). 1Y return: 16.92% (upper mid). 1Y return: 16.17% (lower mid). 1Y return: 9.82% (bottom quartile). 1Y return: 17.04% (top quartile). Point 8 Alpha: -5.20 (bottom quartile). Alpha: 1.78 (top quartile). Alpha: 0.43 (lower mid). Alpha: -4.56 (bottom quartile). Alpha: 0.95 (upper mid). Point 9 Sharpe: -0.04 (bottom quartile). Sharpe: 1.21 (top quartile). Sharpe: 0.23 (lower mid). Sharpe: -0.12 (bottom quartile). Sharpe: 0.26 (upper mid). Point 10 Information ratio: 0.49 (upper mid). Information ratio: -1.13 (bottom quartile). Information ratio: 0.60 (top quartile). Information ratio: 0.46 (lower mid). Information ratio: 0.22 (bottom quartile). Motilal Oswal Long Term Equity Fund

IDBI Equity Advantage Fund

BNP Paribas Long Term Equity Fund (ELSS)

JM Tax Gain Fund

Nippon India Tax Saver Fund (ELSS)

*ذیل میں 100 - 15000 کروڑ کے درمیان AUM رکھنے والے فنڈز کی فہرست ہے اور فنڈ کی عمر 3 سال سے اوپر ہے۔ 3 سالہ کارکردگی کی بنیاد پر۔ (Erstwhile Motilal Oswal MOSt Focused Long Term Fund) The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Below is the key information for Motilal Oswal Long Term Equity Fund Returns up to 1 year are on The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. Research Highlights for IDBI Equity Advantage Fund Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on The investment objective of the Scheme is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities along with income tax rebate, as may be prevalent fromtime to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. Research Highlights for BNP Paribas Long Term Equity Fund (ELSS) Below is the key information for BNP Paribas Long Term Equity Fund (ELSS) Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. Research Highlights for JM Tax Gain Fund Below is the key information for JM Tax Gain Fund Returns up to 1 year are on The primary objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. However, there can be no assurance that the scheme’s

investment objective shall be achieved. Research Highlights for Nippon India Tax Saver Fund (ELSS) Below is the key information for Nippon India Tax Saver Fund (ELSS) Returns up to 1 year are on 1. Motilal Oswal Long Term Equity Fund

Motilal Oswal Long Term Equity Fund

Growth Launch Date 21 Jan 15 NAV (27 Feb 26) ₹48.3635 ↓ -0.20 (-0.41 %) Net Assets (Cr) ₹4,188 on 31 Jan 26 Category Equity - ELSS AMC Motilal Oswal Asset Management Co. Ltd Rating Risk Moderately High Expense Ratio 1.65 Sharpe Ratio -0.04 Information Ratio 0.49 Alpha Ratio -5.2 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,557 28 Feb 23 ₹12,203 29 Feb 24 ₹18,441 28 Feb 25 ₹18,888 28 Feb 26 ₹22,113 Returns for Motilal Oswal Long Term Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 2.8% 3 Month -7.1% 6 Month -3.5% 1 Year 14.3% 3 Year 22% 5 Year 17.2% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -9.1% 2023 47.7% 2022 37% 2021 1.8% 2020 32.1% 2019 8.8% 2018 13.2% 2017 -8.7% 2016 44% 2015 12.5% Fund Manager information for Motilal Oswal Long Term Equity Fund

Name Since Tenure Ajay Khandelwal 11 Dec 23 2.14 Yr. Rakesh Shetty 22 Nov 22 3.2 Yr. Atul Mehra 1 Oct 24 1.34 Yr. Data below for Motilal Oswal Long Term Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 33.05% Industrials 22.97% Consumer Cyclical 16.09% Technology 9.79% Basic Materials 8.83% Real Estate 3.76% Health Care 2.64% Consumer Defensive 1.83% Asset Allocation

Asset Class Value Cash 1.03% Equity 98.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 29 Feb 24 | MCX8% ₹328 Cr 1,296,040 Piramal Finance Ltd (Financial Services)

Equity, Since 30 Sep 25 | PIRAMALFIN6% ₹244 Cr 1,401,921

↑ 113,688 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5433205% ₹219 Cr 8,000,000 Muthoot Finance Ltd (Financial Services)

Equity, Since 30 Jun 25 | MUTHOOTFIN5% ₹209 Cr 546,874 Billionbrains Garage Ventures Ltd (Financial Services)

Equity, Since 30 Nov 25 | GROWW5% ₹194 Cr 10,941,411

↑ 797,603 PTC Industries Ltd (Industrials)

Equity, Since 30 Sep 24 | 5390064% ₹185 Cr 102,631

↑ 2,310 Waaree Energies Ltd (Technology)

Equity, Since 31 Oct 24 | 5442774% ₹163 Cr 583,979 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Apr 24 | BEL4% ₹162 Cr 3,598,038 Jain Resource Recycling Ltd (Basic Materials)

Equity, Since 31 Oct 25 | JAINREC4% ₹159 Cr 3,870,864

↑ 1,023,142 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 31 Oct 23 | PRESTIGE4% ₹157 Cr 1,077,437 2. IDBI Equity Advantage Fund

IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,657 28 Feb 23 ₹11,985 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. BNP Paribas Long Term Equity Fund (ELSS)

BNP Paribas Long Term Equity Fund (ELSS)

Growth Launch Date 5 Jan 06 NAV (27 Feb 26) ₹96.747 ↓ -1.37 (-1.40 %) Net Assets (Cr) ₹911 on 31 Jan 26 Category Equity - ELSS AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.21 Sharpe Ratio 0.23 Information Ratio 0.6 Alpha Ratio 0.43 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,318 28 Feb 23 ₹11,129 29 Feb 24 ₹15,576 28 Feb 25 ₹16,103 28 Feb 26 ₹19,084 Returns for BNP Paribas Long Term Equity Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 1% 3 Month -3.5% 6 Month 2.1% 1 Year 16.2% 3 Year 19.7% 5 Year 13.8% 10 Year 15 Year Since launch 11.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.8% 2023 23.6% 2022 31.3% 2021 -2.1% 2020 23.6% 2019 17.8% 2018 14.3% 2017 -9.3% 2016 42.3% 2015 -6.6% Fund Manager information for BNP Paribas Long Term Equity Fund (ELSS)

Name Since Tenure Sanjay Chawla 14 Mar 22 3.89 Yr. Pratish Krishnan 14 Mar 22 3.89 Yr. Data below for BNP Paribas Long Term Equity Fund (ELSS) as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 32.35% Consumer Cyclical 15.45% Industrials 11.56% Technology 11.49% Basic Materials 8.15% Health Care 6.35% Consumer Defensive 4.21% Energy 3.92% Communication Services 3.13% Utility 1.23% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK7% ₹61 Cr 656,320 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | ICICIBANK5% ₹45 Cr 329,900 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 18 | RELIANCE4% ₹36 Cr 255,800 State Bank of India (Financial Services)

Equity, Since 31 Mar 22 | SBIN3% ₹30 Cr 278,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 19 | BHARTIARTL3% ₹29 Cr 144,966 Infosys Ltd (Technology)

Equity, Since 29 Feb 24 | INFY3% ₹26 Cr 158,994 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT3% ₹25 Cr 62,520 Tech Mahindra Ltd (Technology)

Equity, Since 31 May 25 | TECHM3% ₹23 Cr 134,100 Sagility Ltd (Healthcare)

Equity, Since 30 Nov 24 | SAGILITY2% ₹23 Cr 4,551,400 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TVSMOTOR2% ₹22 Cr 60,500 4. JM Tax Gain Fund

JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (27 Feb 26) ₹47.196 ↓ -0.61 (-1.27 %) Net Assets (Cr) ₹216 on 31 Jan 26 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.37 Sharpe Ratio -0.12 Information Ratio 0.46 Alpha Ratio -4.56 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,792 28 Feb 23 ₹12,113 29 Feb 24 ₹17,481 28 Feb 25 ₹18,094 28 Feb 26 ₹20,367 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 1.3% 3 Month -7.2% 6 Month -2.1% 1 Year 9.8% 3 Year 18.9% 5 Year 15.3% 10 Year 15 Year Since launch 9% Historical performance (Yearly) on absolute basis

Year Returns 2024 2.5% 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.34 Yr. Asit Bhandarkar 31 Dec 21 4.09 Yr. Ruchi Fozdar 4 Oct 24 1.33 Yr. Deepak Gupta 11 Apr 25 0.81 Yr. Data below for JM Tax Gain Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 28.42% Consumer Cyclical 15.57% Technology 11.47% Industrials 10.28% Basic Materials 8.65% Health Care 8.39% Consumer Defensive 3.74% Real Estate 3.59% Energy 3.45% Communication Services 3.01% Asset Allocation

Asset Class Value Cash 3.43% Equity 96.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK4% ₹9 Cr 98,262 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT4% ₹8 Cr 19,647 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 25 | RELIANCE3% ₹7 Cr 53,400 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK3% ₹7 Cr 48,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹6 Cr 32,950

↑ 7,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | 5900033% ₹6 Cr 199,000 Max Financial Services Ltd (Financial Services)

Equity, Since 31 May 25 | MFSL3% ₹6 Cr 36,400 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 3,956 CarTrade Tech Ltd (Consumer Cyclical)

Equity, Since 30 Sep 25 | 5433333% ₹5 Cr 20,655

↑ 3,300 Lupin Ltd (Healthcare)

Equity, Since 31 May 25 | LUPIN2% ₹5 Cr 25,000 5. Nippon India Tax Saver Fund (ELSS)

Nippon India Tax Saver Fund (ELSS)

Growth Launch Date 21 Sep 05 NAV (27 Feb 26) ₹129.745 ↓ -1.55 (-1.18 %) Net Assets (Cr) ₹14,881 on 31 Jan 26 Category Equity - ELSS AMC Nippon Life Asset Management Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.7 Sharpe Ratio 0.26 Information Ratio 0.22 Alpha Ratio 0.95 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,008 28 Feb 23 ₹12,537 29 Feb 24 ₹17,589 28 Feb 25 ₹17,662 28 Feb 26 ₹21,075 Returns for Nippon India Tax Saver Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 3.4% 3 Month -1.9% 6 Month 1.9% 1 Year 17% 3 Year 18.8% 5 Year 16.1% 10 Year 15 Year Since launch 13.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 6% 2023 17.6% 2022 28.6% 2021 6.9% 2020 37.6% 2019 -0.4% 2018 1.5% 2017 -20.7% 2016 46% 2015 4.2% Fund Manager information for Nippon India Tax Saver Fund (ELSS)

Name Since Tenure Rupesh Patel 1 Jul 21 4.59 Yr. Ritesh Rathod 19 Aug 24 1.45 Yr. Kinjal Desai 25 May 18 7.7 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Tax Saver Fund (ELSS) as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 36.53% Consumer Cyclical 11.62% Industrials 10.36% Consumer Defensive 9.83% Utility 6.95% Health Care 6.35% Energy 5.44% Technology 4.74% Communication Services 4% Basic Materials 2.78% Asset Allocation

Asset Class Value Cash 1.39% Equity 98.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | ICICIBANK7% ₹1,095 Cr 8,083,481

↑ 183,481 HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK7% ₹1,041 Cr 11,200,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 20 | AXISBANK5% ₹699 Cr 5,100,000

↓ -500,000 State Bank of India (Financial Services)

Equity, Since 31 Dec 13 | SBIN4% ₹582 Cr 5,400,000

↓ -200,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 20 | INFY4% ₹574 Cr 3,500,000

↓ -268,044 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 20 | RELIANCE3% ₹509 Cr 3,650,000 NTPC Ltd (Utilities)

Equity, Since 28 Feb 19 | NTPC3% ₹498 Cr 14,000,000 Samvardhana Motherson International Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | MOTHERSON3% ₹433 Cr 38,319,861 TVS Holdings Ltd (Consumer Cyclical)

Equity, Since 30 Jun 13 | TVSHLTD3% ₹428 Cr 284,018

↓ -130 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 31 Oct 21 | 8901572% ₹358 Cr 2,290,000

کیا آپ کو ELSS یا ٹیکس بچانے والی FDs میں سرمایہ کاری کرنی چاہیے؟

نئے سرمایہ کاری کرنے سے پہلے لوگ بہت سی چیزوں پر غور کرتے ہیں۔ عمر، سرمایہ کاری کا افق اورخطرے کی بھوک چند اہم عوامل ہیں. جو لوگ دولت میں اضافے اور ٹیکس کے فوائد کے دوہرے فوائد چاہتے ہیں وہ ELSS کو ترجیح دیتے ہیں۔ مثال کے طور پر، طویل سرمایہ کاری کے افق کے ساتھ نئے سرمایہ کار اور زیادہ خطرے کی بھوک ELSS کو ایک معقول آپشن سمجھتے ہیں۔ قریب آنے والے لوگریٹائرمنٹ ٹیکس بچانے والی FDs میں سرمایہ کاری کر سکتے ہیں کیونکہ ان میں کم خطرات ہوتے ہیں اور طویل مدتی (کم از کم 5 سال یا اس سے زیادہ) میں واپسی کی ضمانت ہوتی ہے۔

ELSS آن لائن میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Research Highlights for Motilal Oswal Long Term Equity Fund