+91-22-48913909

+91-22-48913909

Table of Contents

6 Best Liquid Mutual Funds 2025

In common terms, Best Liquid Funds are Debt Mutual Funds or rather money market Mutual Funds with the only difference being in the investment duration. Liquid Funds invest in very short money Market instruments like the Certificate of Deposit, treasury bills, commercial papers etc.

The investment duration of these funds is very short, generally ranging from a couple of days to a few weeks (it can even be one day!). The average residual maturity of liquid funds is less than 91 days as they invest in securities which individually have a maturity upto 91 days. Being a short-term Debt fund, these funds are highly suitable for investors looking for low-risk investments for short duration.

The low maturity period of best liquid funds helps fund managers to fulfil the Redemption demand of investors easily. In the market, there are various liquid fund investments available.

Why Invest in Liquid Funds?

- Liquid funds have no lock-in or very low lock-in period.

- The interest rate of liquid mutual funds is the lowest among all short-term investments due to low maturity period.

- No entry and exit loads are applicable.

- Liquid funds are a perfect solution for investors who wish to park their idle cash for a short duration without the risk of Capital Loss.

Liquid Funds better than Saving Bank Account?

Investing in liquid funds are any day a better option on investment as compared to putting money in popular saving Bank account schemes.

Owing to its familiarity and institutionalized nature of saving bank accounts, an average Indian taxpayer has more trust in them. However, it seems they are not the most popular short-term investment anymore. This is due to the rising acceptance of mutual funds by investors with different investment goals. Your hard earned money that lies in a savings bank account fetches you only 3.5% interest per annum. However, the best liquid funds have returned as high as 6.5-7.5% on an average in the past 1 year period, on an annualized Basis.

So, on returns alone, liquid funds score over a savings bank account. If you have a raise or a bonus coming your way, invest in liquid funds and party later.

Talk to our investment specialist

6 Best Liquid Funds India FY 25 - 26

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,908.31

↑ 0.76 ₹36,089 0.5 1.7 3.5 7.2 7.4 6.3% 1M 8D 1M 11D LIC MF Liquid Fund Growth ₹4,721.66

↑ 1.13 ₹11,165 0.5 1.6 3.4 7.1 7.4 6.25% 1M 20D 1M 20D DSP BlackRock Liquidity Fund Growth ₹3,728.94

↑ 0.96 ₹17,752 0.5 1.7 3.5 7.2 7.4 6.51% 1M 6D 1M 10D Invesco India Liquid Fund Growth ₹3,590.11

↑ 0.93 ₹14,737 0.5 1.7 3.5 7.2 7.4 6.19% 1M 22D 1M 22D ICICI Prudential Liquid Fund Growth ₹386.668

↑ 0.11 ₹50,000 0.5 1.7 3.5 7.1 7.4 6.33% 1M 17D 1M 21D Aditya Birla Sun Life Liquid Fund Growth ₹420.875

↑ 0.11 ₹44,546 0.5 1.7 3.5 7.2 7.3 6.39% 1M 17D 1M 17D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 1 Jul 25 Liquid funds having AUM/Net Assets above 10,000 Crore and managing funds for 5 or more years. Sorted on Last 1 Calendar Year Return.

To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Axis Liquid Fund is a Debt - Liquid Fund fund was launched on 9 Oct 09. It is a fund with Low risk and has given a Below is the key information for Axis Liquid Fund Returns up to 1 year are on An open ended scheme which seeks to generate reasonable returns with low risk and high liquidity through a judicious mix of investment in money market

instruments and quality debt instruments. However, there is no assurance that the investment objective of the Scheme will be realised. LIC MF Liquid Fund is a Debt - Liquid Fund fund was launched on 11 Mar 02. It is a fund with Low risk and has given a Below is the key information for LIC MF Liquid Fund Returns up to 1 year are on The Scheme seeks to generate reasonable returns commensurate with low risk from a portfolio constituted of money market and high quality debts DSP BlackRock Liquidity Fund is a Debt - Liquid Fund fund was launched on 23 Nov 05. It is a fund with Low risk and has given a Below is the key information for DSP BlackRock Liquidity Fund Returns up to 1 year are on To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. Invesco India Liquid Fund is a Debt - Liquid Fund fund was launched on 17 Nov 06. It is a fund with Low risk and has given a Below is the key information for Invesco India Liquid Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Liquid Plan) To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through investments made primarily in money market and debt securities. ICICI Prudential Liquid Fund is a Debt - Liquid Fund fund was launched on 17 Nov 05. It is a fund with Low risk and has given a Below is the key information for ICICI Prudential Liquid Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Aditya Birla Sun Life Liquid Fund is a Debt - Liquid Fund fund was launched on 30 Mar 04. It is a fund with Low risk and has given a Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on 1. Axis Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 21 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7.1% and 2022 was 4.9% . Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (01 Jul 25) ₹2,908.31 ↑ 0.76 (0.03 %) Net Assets (Cr) ₹36,089 on 31 May 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.36 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.3% Effective Maturity 1 Month 11 Days Modified Duration 1 Month 8 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,320 30 Jun 22 ₹10,692 30 Jun 23 ₹11,383 30 Jun 24 ₹12,217 30 Jun 25 ₹13,098 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.5% 1 Year 7.2% 3 Year 7% 5 Year 5.5% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.1% 2022 4.9% 2021 3.3% 2020 4.3% 2019 6.6% 2018 7.5% 2017 6.7% 2016 7.6% 2015 8.4% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 12.58 Yr. Aditya Pagaria 13 Aug 16 8.81 Yr. Sachin Jain 3 Jul 23 1.91 Yr. Data below for Axis Liquid Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 99.8% Other 0.2% Debt Sector Allocation

Sector Value Cash Equivalent 84.19% Corporate 13.01% Government 2.6% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -7% ₹2,740 Cr Canara Bank

Domestic Bonds | -5% ₹1,978 Cr 40,000 Indian Oil Corp Ltd.

Commercial Paper | -4% ₹1,802 Cr 36,500

↑ 36,500 HDFC Bank Limited

Certificate of Deposit | -4% ₹1,584 Cr 32,000 Reliance Jio Infocomm Ltd.

Commercial Paper | -4% ₹1,492 Cr 30,000 182 DTB 17072025

Sovereign Bonds | -3% ₹1,244 Cr 125,000,000 Reliance Industries Ltd.

Commercial Paper | -2% ₹1,048 Cr 21,000

↓ -5,000 Bharti Airtel Ltd.

Commercial Paper | -2% ₹1,012 Cr 20,500

↑ 20,500 Reliance Jio Infocomm Ltd.

Commercial Paper | -2% ₹999 Cr 20,000 National Bank for Agriculture and Rural Development

Commercial Paper | -2% ₹996 Cr 20,000 2. LIC MF Liquid Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 25 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.7% . LIC MF Liquid Fund

Growth Launch Date 11 Mar 02 NAV (01 Jul 25) ₹4,721.66 ↑ 1.13 (0.02 %) Net Assets (Cr) ₹11,165 on 31 May 25 Category Debt - Liquid Fund AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.24 Sharpe Ratio 3.28 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.25% Effective Maturity 1 Month 20 Days Modified Duration 1 Month 20 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,318 30 Jun 22 ₹10,680 30 Jun 23 ₹11,356 30 Jun 24 ₹12,184 30 Jun 25 ₹13,051 Returns for LIC MF Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.6% 6 Month 3.4% 1 Year 7.1% 3 Year 6.9% 5 Year 5.5% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.7% 2021 3.3% 2020 4.3% 2019 6.5% 2018 7.3% 2017 6.6% 2016 7.6% 2015 8.4% Fund Manager information for LIC MF Liquid Fund

Name Since Tenure Rahul Singh 5 Oct 15 9.74 Yr. Data below for LIC MF Liquid Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 98.56% Debt 1.2% Other 0.23% Debt Sector Allocation

Sector Value Cash Equivalent 75.12% Corporate 15.34% Government 9.3% Credit Quality

Rating Value AA 0.45% AAA 99.55% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps

CBLO/Reverse Repo | -5% ₹631 Cr India (Republic of)

- | -4% ₹546 Cr 55,000,000 182 DTB 03/07/2025

Sovereign Bonds | -4% ₹499 Cr 50,000,000

↑ 50,000,000 Small Industries Development Bank Of India

Commercial Paper | -4% ₹494 Cr 10,000 India (Republic of)

- | -4% ₹448 Cr 45,000,000 Indian Oil Corporation Limited

Commercial Paper | -3% ₹395 Cr 8,000

↑ 8,000 Indian Bank

Domestic Bonds | -3% ₹395 Cr 8,000

↑ 8,000 Motilal Oswal Financial Services Ltd

Commercial Paper | -3% ₹394 Cr 8,000

↑ 8,000 HDFC Bank Ltd. ** #

Certificate of Deposit | -2% ₹300 Cr 6,000

↑ 4,000 Reliance Industries Ltd.

Commercial Paper | -2% ₹300 Cr 6,000 3. DSP BlackRock Liquidity Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 36 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . DSP BlackRock Liquidity Fund

Growth Launch Date 23 Nov 05 NAV (01 Jul 25) ₹3,728.94 ↑ 0.96 (0.03 %) Net Assets (Cr) ₹17,752 on 31 May 25 Category Debt - Liquid Fund AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.25 Sharpe Ratio 3.85 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.51% Effective Maturity 1 Month 10 Days Modified Duration 1 Month 6 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,317 30 Jun 22 ₹10,685 30 Jun 23 ₹11,365 30 Jun 24 ₹12,191 30 Jun 25 ₹13,069 Returns for DSP BlackRock Liquidity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.5% 1 Year 7.2% 3 Year 6.9% 5 Year 5.5% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.3% 2020 4.2% 2019 6.5% 2018 7.4% 2017 6.6% 2016 7.6% 2015 8.3% Fund Manager information for DSP BlackRock Liquidity Fund

Name Since Tenure Karan Mundhra 31 May 21 4.09 Yr. Shalini Vasanta 1 Aug 24 0.91 Yr. Data below for DSP BlackRock Liquidity Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 99.79% Other 0.21% Debt Sector Allocation

Sector Value Cash Equivalent 91.25% Corporate 6.26% Government 2.28% Credit Quality

Rating Value AA 0.39% AAA 99.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps / Reverse Repo Investments

CBLO/Reverse Repo | -14% ₹2,942 Cr Bank of Baroda

Debentures | -4% ₹815 Cr 16,500

↑ 16,500 Punjab National Bank

Domestic Bonds | -3% ₹667 Cr 13,500 National Bank for Agriculture and Rural Development

Commercial Paper | -3% ₹592 Cr 12,000

↑ 12,000 Indian Oil Corporation Limited

Commercial Paper | -2% ₹500 Cr 10,000 Small Industries Development Bank of India

Commercial Paper | -2% ₹494 Cr 10,000

↑ 10,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹494 Cr 10,000

↑ 10,000 Indian Bank

Domestic Bonds | -2% ₹493 Cr 10,000

↑ 10,000 HDFC Bank Ltd.

Debentures | -2% ₹493 Cr 10,000

↑ 10,000 India (Republic of)

- | -2% ₹469 Cr 47,500,000

↑ 47,500,000 4. Invesco India Liquid Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 9 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . Invesco India Liquid Fund

Growth Launch Date 17 Nov 06 NAV (01 Jul 25) ₹3,590.11 ↑ 0.93 (0.03 %) Net Assets (Cr) ₹14,737 on 31 May 25 Category Debt - Liquid Fund AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.22 Sharpe Ratio 3.5 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.19% Effective Maturity 1 Month 22 Days Modified Duration 1 Month 22 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,316 30 Jun 22 ₹10,685 30 Jun 23 ₹11,367 30 Jun 24 ₹12,195 30 Jun 25 ₹13,073 Returns for Invesco India Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.5% 1 Year 7.2% 3 Year 7% 5 Year 5.5% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.3% 2020 4.1% 2019 6.5% 2018 7.4% 2017 6.7% 2016 7.6% 2015 8.4% Fund Manager information for Invesco India Liquid Fund

Name Since Tenure Krishna Cheemalapati 25 Apr 11 14.11 Yr. Prateek Jain 14 Feb 22 3.3 Yr. Data below for Invesco India Liquid Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 99.8% Other 0.2% Debt Sector Allocation

Sector Value Cash Equivalent 85.57% Corporate 9.37% Government 4.86% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Triparty Repo

CBLO/Reverse Repo | -11% ₹1,715 Cr 182 DTB 24072025

Sovereign Bonds | -3% ₹547 Cr 55,000,000 Canara Bank

Certificate of Deposit | -2% ₹396 Cr 40,000,000 Small Industries Development Bank Of India

Commercial Paper | -2% ₹395 Cr 40,000,000 Indian Oil Corp Ltd.

Commercial Paper | -2% ₹395 Cr 40,000,000

↑ 40,000,000 National Bank for Agriculture and Rural Development

Commercial Paper | -2% ₹299 Cr 30,000,000 Export-Import Bank Of India

Commercial Paper | -2% ₹297 Cr 30,000,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹297 Cr 30,000,000 India (Republic of)

- | -2% ₹297 Cr 30,000,000 Punjab National Bank

Domestic Bonds | -2% ₹297 Cr 30,000,000 5. ICICI Prudential Liquid Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 20 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . ICICI Prudential Liquid Fund

Growth Launch Date 17 Nov 05 NAV (01 Jul 25) ₹386.668 ↑ 0.11 (0.03 %) Net Assets (Cr) ₹50,000 on 31 May 25 Category Debt - Liquid Fund AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.29 Sharpe Ratio 3.19 Information Ratio -1.12 Alpha Ratio -0.1 Min Investment 500 Min SIP Investment 99 Exit Load NIL Yield to Maturity 6.33% Effective Maturity 1 Month 21 Days Modified Duration 1 Month 17 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,317 30 Jun 22 ₹10,681 30 Jun 23 ₹11,360 30 Jun 24 ₹12,187 30 Jun 25 ₹13,059 Returns for ICICI Prudential Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.5% 1 Year 7.1% 3 Year 6.9% 5 Year 5.5% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.8% 2021 3.2% 2020 4.3% 2019 6.6% 2018 7.4% 2017 6.6% 2016 7.7% 2015 8.3% Fund Manager information for ICICI Prudential Liquid Fund

Name Since Tenure Nikhil Kabra 1 Dec 23 1.5 Yr. Darshil Dedhia 12 Jun 23 1.97 Yr. Data below for ICICI Prudential Liquid Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 99.73% Other 0.27% Debt Sector Allocation

Sector Value Cash Equivalent 76.28% Corporate 17.29% Government 6.16% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Current Assets

Net Current Assets | -11% -₹5,707 Cr 91 Days Tbill Red 21-08-2025

Sovereign Bonds | -6% ₹3,161 Cr 320,000,000

↑ 320,000,000 Punjab National Bank ** #

Certificate of Deposit | -4% ₹2,243 Cr 45,000 91 Days Tbill Red 19-06-2025

Sovereign Bonds | -4% ₹2,144 Cr 215,000,000

↓ -35,000,000 Small Industries Development Bank of India

Commercial Paper | -3% ₹1,492 Cr 30,000 Bank of India Ltd.

Debentures | -3% ₹1,478 Cr 30,000

↑ 30,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹1,235 Cr 25,000

↑ 25,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹1,233 Cr 25,000

↑ 25,000 Small Industries Development Bank Of India

Commercial Paper | -2% ₹1,232 Cr 25,000

↑ 25,000 India (Republic of)

- | -2% ₹1,193 Cr 120,000,000 6. Aditya Birla Sun Life Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 15 in Liquid Fund category. Return for 2024 was 7.3% , 2023 was 7.1% and 2022 was 4.8% . Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (01 Jul 25) ₹420.875 ↑ 0.11 (0.03 %) Net Assets (Cr) ₹44,546 on 31 May 25 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 3.23 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.39% Effective Maturity 1 Month 17 Days Modified Duration 1 Month 17 Days Growth of 10,000 investment over the years.

Date Value 30 Jun 20 ₹10,000 30 Jun 21 ₹10,320 30 Jun 22 ₹10,688 30 Jun 23 ₹11,378 30 Jun 24 ₹12,206 30 Jun 25 ₹13,082 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Jul 25 Duration Returns 1 Month 0.5% 3 Month 1.7% 6 Month 3.5% 1 Year 7.2% 3 Year 7% 5 Year 5.5% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.3% 2023 7.1% 2022 4.8% 2021 3.3% 2020 4.3% 2019 6.7% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.4% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 13.89 Yr. Kaustubh Gupta 15 Jul 11 13.89 Yr. Sanjay Pawar 1 Jul 22 2.92 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 31 May 25

Asset Allocation

Asset Class Value Cash 99.79% Other 0.21% Debt Sector Allocation

Sector Value Cash Equivalent 89.73% Corporate 9.02% Government 1.04% Credit Quality

Rating Value AA 0.12% AAA 99.88% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables / (Payables)

Net Current Assets | -6% -₹3,171 Cr 91 Days Tbill (Md 28/08/2025)

Sovereign Bonds | -3% ₹1,840 Cr 186,000,000

↑ 186,000,000 182 DTB 27062025

Sovereign Bonds | -2% ₹1,308 Cr 131,000,000 National Bank for Agriculture and Rural Development

Commercial Paper | -2% ₹1,274 Cr 25,500

↓ -4,500 Bank Of Baroda

Certificate of Deposit | -2% ₹991 Cr 20,000 National Bank For Agriculture And Rural Development

Commercial Paper | -2% ₹970 Cr 19,500 Punjab National Bank

Domestic Bonds | -2% ₹964 Cr 19,500

↓ -500 Bharti Airtel Ltd.

Commercial Paper | -2% ₹962 Cr 19,500

↑ 19,500 Indian Oil Corp Ltd.

Commercial Paper | -1% ₹799 Cr 16,000 Bank of Baroda

Debentures | -1% ₹748 Cr 15,000

How to evaluate Liquid Mutual Funds?

When looking for a liquid mutual fund, the past return should not be the only Factor for consideration. Other factors like fund size, track record, credit quality of Underlying securities should also be kept in mind.

1. Investment Plans

Liquid funds come with different plans like a daily dividend plan, weekly dividend plan, monthly dividend plan and growth plans. In the growth option, profits made by the scheme are invested back into it. This results in the NAV (Net Asset Value) of the scheme rising over time. In the dividend option, the profits made by the fund are not re-invested. Dividends are distributed to the investor from time to time. Investors can choose their plan as per their convenience and liquidity needs.

2. Expense Ratio

Mutual funds charge a fee to manage your funds called an expense ratio. As per SEBI norms, the upper limit of expense ratio is 2.25%. In case of liquid funds, they maintain a lower expense ratio to provide relatively higher returns over a short period of time.

3. Investment Horizon

Plan your investment horizon. Liquid funds are exclusively meant to invest surplus cash over a very short period of time that is for 91 days. So, if you have an idle cash, you can invest here for a short period and earn better returns than bank Savings Account. In case you have a longer investment horizon of up to 1 year, then you may consider investing in short duration funds to get relatively higher returns.

Features of Liquid Mutual Funds

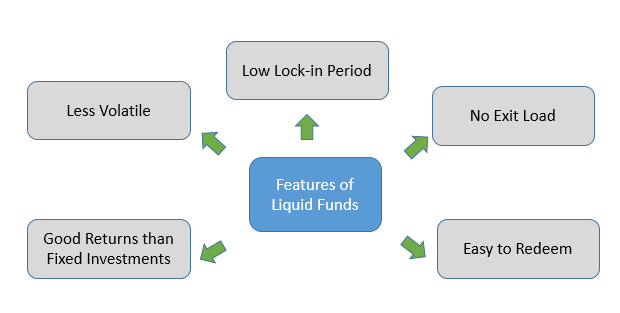

1. Exit Load Of Liquid Mutual Funds

Considering the fact that liquid mutual funds are short-term investments with a low maturity period, the majority of the funds under this category do not levy any exit load on redemption. Also, if there exists any exit load, it is very nominal and usually not more than a week. Liquid funds generally do not have an exit load given they are very short investment products.

2. Volatility Of Liquid Fund Investment

Generally, the Volatility of liquid funds is low as the investment lasts for a few days to weeks. So, the risk of loss in investment is quite less. However, it is suggested to make a liquid fund investment considering the market condition to avoid the opportunity of loss.

3. Lock-in Period Of Best Liquid Funds

Given that liquid mutual funds are very short-term investment options, liquid funds do not have any lock-in period. Liquid Funds can be invested for a time period as short as one day going upto a couple of weeks.

4. Liquid Fund Returns

Liquid funds are one of the best short-term investments during a high Inflation period. In the high inflation period, the interest rate on the liquid fund is high. Thus, helping liquid mutual funds to earn good returns. The liquid fund returns are usually higher than that of other traditional investments like bank fixed deposits or savings accounts. However, it is suggested to invest in best liquid funds choosing a right option (growth, dividend payout, dividend re-investment) suiting your needs.

5. Liquid Funds Taxation

Generally, liquid fund returns receive in the form of dividends are not taxed in the hands of investors. However, a Dividend Distribution Tax (DDT) of approximately 28% is deducted by the mutual fund company from the dividends. Moreover, for the investors who have opted for growth option, a short-term Capital Gain tax is deducted as per the individual’s tax slab. This tax Deduction is same as that of a savings account.

How to Invest in Liquid Funds Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Due to the lack of awareness about liquid funds, people don’t invest in them and instead keep huge sums in a savings account. But, it’s never too late to begin something good. So, invest in best liquid funds today!

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good knowledgeable information, you should have to give an example