Best Pharma Mutual Funds in India 2026

The pharma sector is often called India’s “sunrise industry” – it not only meets domestic healthcare needs but also supplies medicines to the world. For investors, this sector has delivered resilience during crises (like Covid-19) and continues to show strong long-term growth potential.

That’s where Pharma Mutual Funds come in. These are sectoral funds that invest in pharmaceutical, healthcare, and allied companies, giving you exposure to one of India’s most promising industries.

But are they right for your Portfolio? Let’s explore.

What are Pharma Mutual Funds?

Pharma Mutual Funds are sectoral Equity Funds that invest primarily in companies from:

- Pharmaceuticals

- Biotechnology

- Hospitals & healthcare services

- Medical equipment & diagnostics

Since they are sector-specific, they carry higher risk than Diversified Funds, but also offer the chance to capture outsized gains when the sector outperforms.

Why Invest in Pharma Sector Funds?

Here’s why the Indian pharma industry is considered a strong bet:

1. India: The Pharmacy of the World

- India supplies 20% of global generic medicines and is the largest vaccine manufacturer.

- Nearly 40% of US generic drug demand is met by Indian companies.

2. Rising Domestic Demand

- With growing middle-class income, lifestyle changes, and rising health awareness, healthcare spending in India is expected to rise sharply.

- health insurance penetration is improving, further fuelling demand.

3. Government Push

- Schemes like PLI (Production Linked Incentives) aim to boost domestic manufacturing of critical drugs and APIs.

- Ayushman Bharat and other healthcare programmes are expanding access.

4. Export Growth & Innovation

- Indian pharma is moving up the value chain with biosimilars, specialty drugs, and contract research.

- Exports remain a major driver – particularly to regulated markets like the US and EU.

In short: Pharma funds allow you to benefit from both domestic consumption growth and global demand for cost-effective drugs.

Talk to our investment specialist

Fund Selection Methodology used to find 10 funds

Best Pharma Sector Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) TATA India Pharma & Healthcare Fund Growth ₹29.6258

↓ -0.29 ₹1,240 -3.5 -3.8 10.6 23.6 14.9 -4.9 Nippon India Pharma Fund Growth ₹505.94

↓ -6.92 ₹7,875 -2.1 -1.9 10.6 23.5 15 -3.3 UTI Healthcare Fund Growth ₹278.169

↓ -4.16 ₹1,055 -3.9 -4.9 11.3 25 14.9 -3.1 SBI Healthcare Opportunities Fund Growth ₹429.167

↓ -2.24 ₹3,823 -0.8 0 12.1 26.2 16.9 -3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 4 Funds showcased

Commentary TATA India Pharma & Healthcare Fund Nippon India Pharma Fund UTI Healthcare Fund SBI Healthcare Opportunities Fund Point 1 Lower mid AUM (₹1,240 Cr). Highest AUM (₹7,875 Cr). Bottom quartile AUM (₹1,055 Cr). Upper mid AUM (₹3,823 Cr). Point 2 Established history (10+ yrs). Established history (21+ yrs). Oldest track record among peers (26 yrs). Established history (21+ yrs). Point 3 Not Rated. Top rated. Rating: 1★ (lower mid). Rating: 2★ (upper mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 14.93% (lower mid). 5Y return: 14.96% (upper mid). 5Y return: 14.86% (bottom quartile). 5Y return: 16.93% (top quartile). Point 6 3Y return: 23.59% (lower mid). 3Y return: 23.53% (bottom quartile). 3Y return: 25.01% (upper mid). 3Y return: 26.19% (top quartile). Point 7 1Y return: 10.59% (bottom quartile). 1Y return: 10.64% (lower mid). 1Y return: 11.31% (upper mid). 1Y return: 12.10% (top quartile). Point 8 Alpha: -4.48 (bottom quartile). Alpha: 0.68 (top quartile). Alpha: 0.48 (upper mid). Alpha: -2.03 (lower mid). Point 9 Sharpe: -0.47 (bottom quartile). Sharpe: -0.26 (top quartile). Sharpe: -0.28 (upper mid). Sharpe: -0.46 (lower mid). Point 10 Information ratio: -0.26 (lower mid). Information ratio: -0.60 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.15 (upper mid). TATA India Pharma & Healthcare Fund

Nippon India Pharma Fund

UTI Healthcare Fund

SBI Healthcare Opportunities Fund

All the funds mentioned above are ideal, we are giving you detailed analysis of 3 funds.

The investment objective of the scheme is to seek long term capital appreciation by investing atleast 80% of its net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in India.However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.The Scheme does not assure or guarantee any returns. Research Highlights for TATA India Pharma & Healthcare Fund Below is the key information for TATA India Pharma & Healthcare Fund Returns up to 1 year are on The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related or fixed income securities of Pharma and other associated companies. Research Highlights for Nippon India Pharma Fund Below is the key information for Nippon India Pharma Fund Returns up to 1 year are on (Erstwhile UTI Pharma & Healthcare Fund) The Investment objective of the Scheme is capital appreciation through investments in equities and equity related instruments of the Pharma & Healthcare sectors. Research Highlights for UTI Healthcare Fund Below is the key information for UTI Healthcare Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. Research Highlights for SBI Healthcare Opportunities Fund Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on 1. TATA India Pharma & Healthcare Fund

TATA India Pharma & Healthcare Fund

Growth Launch Date 28 Dec 15 NAV (04 Mar 26) ₹29.6258 ↓ -0.29 (-0.96 %) Net Assets (Cr) ₹1,240 on 31 Jan 26 Category Equity - Sectoral AMC Tata Asset Management Limited Rating Risk High Expense Ratio 2.17 Sharpe Ratio -0.47 Information Ratio -0.26 Alpha Ratio -4.48 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-3 Months (0.25%),3 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,428 28 Feb 23 ₹10,926 29 Feb 24 ₹17,487 28 Feb 25 ₹18,531 28 Feb 26 ₹20,939 Returns for TATA India Pharma & Healthcare Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 4 Mar 26 Duration Returns 1 Month 2.3% 3 Month -3.5% 6 Month -3.8% 1 Year 10.6% 3 Year 23.6% 5 Year 14.9% 10 Year 15 Year Since launch 11.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -4.9% 2023 40.4% 2022 36.6% 2021 -8% 2020 19.1% 2019 64.4% 2018 5.5% 2017 -2.6% 2016 4.7% 2015 -14.7% Fund Manager information for TATA India Pharma & Healthcare Fund

Name Since Tenure Rajat Srivastava 16 Sep 24 1.38 Yr. Data below for TATA India Pharma & Healthcare Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Health Care 95.73% Basic Materials 3.34% Asset Allocation

Asset Class Value Cash 0.93% Equity 99.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Jan 16 | SUNPHARMA9% ₹115 Cr 723,130

↑ 122,408 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 25 | MAXHEALTH6% ₹77 Cr 807,996

↑ 71,325 Abbott India Ltd (Healthcare)

Equity, Since 30 Sep 25 | ABBOTINDIA6% ₹74 Cr 26,881

↑ 2,125 Divi's Laboratories Ltd (Healthcare)

Equity, Since 30 Sep 17 | DIVISLAB5% ₹67 Cr 110,044

↑ 7,337 HealthCare Global Enterprises Ltd (Healthcare)

Equity, Since 31 Dec 18 | HCG5% ₹64 Cr 1,075,346

↑ 116,771 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 16 | APOLLOHOSP5% ₹62 Cr 88,528 Cipla Ltd (Healthcare)

Equity, Since 30 Apr 20 | CIPLA5% ₹58 Cr 438,828

↑ 79,588 Rainbow Childrens Medicare Ltd (Healthcare)

Equity, Since 31 Jul 25 | 5435244% ₹46 Cr 408,375

↑ 34,047 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | MANKIND3% ₹42 Cr 196,981 Bayer CropScience Ltd (Basic Materials)

Equity, Since 30 Nov 25 | BAYERCROP3% ₹41 Cr 92,824 2. Nippon India Pharma Fund

Nippon India Pharma Fund

Growth Launch Date 5 Jun 04 NAV (04 Mar 26) ₹505.94 ↓ -6.92 (-1.35 %) Net Assets (Cr) ₹7,875 on 31 Jan 26 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk High Expense Ratio 1.81 Sharpe Ratio -0.26 Information Ratio -0.6 Alpha Ratio 0.68 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,521 28 Feb 23 ₹11,001 29 Feb 24 ₹17,725 28 Feb 25 ₹18,634 28 Feb 26 ₹21,244 Returns for Nippon India Pharma Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 4 Mar 26 Duration Returns 1 Month 1.9% 3 Month -2.1% 6 Month -1.9% 1 Year 10.6% 3 Year 23.5% 5 Year 15% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.3% 2023 34% 2022 39.2% 2021 -9.9% 2020 23.9% 2019 66.4% 2018 1.7% 2017 3.6% 2016 7.6% 2015 -10.6% Fund Manager information for Nippon India Pharma Fund

Name Since Tenure Sailesh Raj Bhan 1 Apr 05 20.85 Yr. Kinjal Desai 25 May 18 7.69 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Pharma Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Health Care 98.97% Asset Allocation

Asset Class Value Cash 1.03% Equity 98.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 09 | SUNPHARMA13% ₹998 Cr 6,256,349 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 08 | LUPIN8% ₹621 Cr 2,883,991 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB7% ₹515 Cr 850,754 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 30 Jun 11 | DRREDDY6% ₹477 Cr 3,916,074 Cipla Ltd (Healthcare)

Equity, Since 31 May 08 | CIPLA6% ₹463 Cr 3,495,054 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Sep 20 | APOLLOHOSP6% ₹452 Cr 648,795 Medplus Health Services Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5434274% ₹290 Cr 3,627,277 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 30 Sep 21 | 5433504% ₹277 Cr 2,886,684 Ajanta Pharma Ltd (Healthcare)

Equity, Since 30 Apr 22 | AJANTPHARM3% ₹267 Cr 959,323 GlaxoSmithKline Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Aug 22 | GLAXO3% ₹219 Cr 913,226 3. UTI Healthcare Fund

UTI Healthcare Fund

Growth Launch Date 28 Jun 99 NAV (04 Mar 26) ₹278.169 ↓ -4.16 (-1.47 %) Net Assets (Cr) ₹1,055 on 31 Jan 26 Category Equity - Sectoral AMC UTI Asset Management Company Ltd Rating ☆ Risk High Expense Ratio 2.26 Sharpe Ratio -0.29 Information Ratio 0 Alpha Ratio 0.48 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,103 28 Feb 23 ₹10,525 29 Feb 24 ₹16,576 28 Feb 25 ₹18,397 28 Feb 26 ₹21,110 Returns for UTI Healthcare Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 4 Mar 26 Duration Returns 1 Month 0.7% 3 Month -3.9% 6 Month -4.9% 1 Year 11.3% 3 Year 25% 5 Year 14.9% 10 Year 15 Year Since launch 14.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.1% 2023 42.9% 2022 38.2% 2021 -12.3% 2020 19.1% 2019 67.4% 2018 1.2% 2017 -7.5% 2016 6.2% 2015 -9.7% Fund Manager information for UTI Healthcare Fund

Name Since Tenure Kamal Gada 2 May 22 3.76 Yr. Data below for UTI Healthcare Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Health Care 97.64% Basic Materials 1.15% Asset Allocation

Asset Class Value Cash 1.21% Equity 98.79% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 06 | SUNPHARMA9% ₹96 Cr 600,000 Ajanta Pharma Ltd (Healthcare)

Equity, Since 31 Jul 17 | AJANTPHARM7% ₹77 Cr 276,882

↓ -8,118 Lupin Ltd (Healthcare)

Equity, Since 28 Feb 25 | LUPIN6% ₹64 Cr 294,991 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 24 | GLENMARK4% ₹44 Cr 220,000 Gland Pharma Ltd (Healthcare)

Equity, Since 30 Nov 20 | GLAND4% ₹42 Cr 227,578

↓ -2,422 Alkem Laboratories Ltd (Healthcare)

Equity, Since 31 May 21 | ALKEM4% ₹39 Cr 68,000 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Apr 21 | APOLLOHOSP3% ₹37 Cr 53,000 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 28 Feb 18 | DRREDDY3% ₹36 Cr 299,461 Procter & Gamble Health Ltd (Healthcare)

Equity, Since 31 Dec 20 | PGHL3% ₹32 Cr 60,000

↓ -6,803 Jupiter Life Line Hospitals Ltd (Healthcare)

Equity, Since 30 Sep 23 | JLHL3% ₹31 Cr 226,961

↓ -11 4. SBI Healthcare Opportunities Fund

SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (02 Mar 26) ₹429.167 ↓ -2.24 (-0.52 %) Net Assets (Cr) ₹3,823 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.97 Sharpe Ratio -0.47 Information Ratio -0.15 Alpha Ratio -2.03 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,124 28 Feb 23 ₹11,119 29 Feb 24 ₹17,867 28 Feb 25 ₹19,943 28 Feb 26 ₹22,473 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 4 Mar 26 Duration Returns 1 Month 6.4% 3 Month -0.8% 6 Month 0% 1 Year 12.1% 3 Year 26.2% 5 Year 16.9% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.5% 2023 42.2% 2022 38.2% 2021 -6% 2020 20.1% 2019 65.8% 2018 -0.5% 2017 -9.9% 2016 2.1% 2015 -14% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 14.68 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Health Care 90.37% Basic Materials 8.17% Asset Allocation

Asset Class Value Cash 1.38% Equity 98.55% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA10% ₹383 Cr 2,400,000

↓ -300,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB7% ₹266 Cr 440,000 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Jan 26 | APOLLOHOSP5% ₹209 Cr 300,000

↑ 300,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH5% ₹191 Cr 2,000,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | LUPIN5% ₹181 Cr 840,000 Acutaas Chemicals Ltd (Basic Materials)

Equity, Since 30 Jun 24 | 5433495% ₹172 Cr 900,000 Torrent Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 21 | TORNTPHARM4% ₹158 Cr 400,000 Aether Industries Ltd (Basic Materials)

Equity, Since 31 May 22 | 5435344% ₹140 Cr 1,400,000 Biocon Ltd (Healthcare)

Equity, Since 30 Nov 24 | BIOCON4% ₹138 Cr 3,750,000

↑ 550,000 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | ASTERDM3% ₹133 Cr 2,400,000

↑ 400,000

Benchmark: The Nifty Pharma Index

Pharma Mutual Funds generally track or take cues from the Nifty Pharma Index.

Key Highlights:

- Launched in 2005 by NSE.

- Represents major listed pharma companies.

- Includes top names like Sun Pharma, Dr. Reddy’s, Cipla, Divi’s Labs, Lupin, Aurobindo Pharma, etc.

- The index gives investors a snapshot of the overall sector’s performance.

To more about index can be read on official website Nifty Pharma Index Document

Who Should Invest in Pharma Mutual Funds?

Pharma funds are not for everyone. They are suitable if you are:

- An investor with high risk appetite who can handle sectoral Volatility.

- Looking to diversify your portfolio with exposure to a defensive but growing industry.

- A long-term investor (5+ years) seeking to benefit from structural growth trends in healthcare.

Not suitable for:

- Conservative investors.

- Those looking for short-term quick returns.

Pros & Cons of Investing in Pharma Funds

✅ Pros:

- Strong long-term growth drivers (domestic + exports).

- Defensive nature during downturns (people don’t stop consuming medicines).

- India’s global dominance in generics provides steady demand.

- Sector supported by government incentives.

❌ Cons:

- High volatility as it depends on global regulations (like USFDA warnings).

- Concentration risk – one sector only.

- Currency fluctuations affect export-heavy companies.

- Can underperform diversified funds during phases when pharma lags.

Unique Investor Angles to Consider

Here’s what most articles miss, but you should keep in mind:

Ageing Population = Permanent Demand

Globally, populations are ageing, particularly in developed countries. Indian companies are well-placed to serve this demand.

Shift Towards Wellness & Preventive Healthcare

Pharma is no longer just about medicines. Healthcare funds now capture hospitals, diagnostics, and preventive care businesses – expanding growth scope.

Regulatory Risk is Real

One USFDA ban can wipe out a stock’s value overnight. That’s why pharma funds spread risk across multiple companies.

Covid-19 Lesson

The pandemic proved how pharma can outperform when healthcare demand spikes – but it also showed the need to stay cautious about hype-driven rallies.

How to Invest in Pharma Sector Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Public vs Private Healthcare: Why It Matters for Pharma Investors

India’s healthcare system is unique — while public hospitals account for only 30% of total hospital beds, the rest come from the private sector. This means the majority of patients depend on private care, which directly drives higher demand for medicines, diagnostics, and health insurance.

For pharma investors, this is critical. Unlike other industries, demand here is not cyclical — healthcare is a necessity. The more patients turn to private care, the more they rely on affordable medicines, making pharmaceutical companies long-term revenue generators.

The imbalance also highlights another important point: out-of-pocket expenditure in India is one of the highest in the world, around 48–50% of total healthcare spend. This forces households to prioritise low-cost drugs, generic medicines, and insurance-backed treatments — exactly the segments where Indian pharma companies have a competitive advantage.

Add to this the rise of medical tourism (expected to reach $13 billion+ by 2026), demand for speciality care in tier-2 cities, and a growing middle class that spends more on preventive healthcare. All of these trends ensure steady tailwinds for pharma companies and, by extension, pharma mutual funds.

This trend explains why pharma mutual funds are seen as a defensive bet — they combine healthcare demand certainty with the growth potential of India’s expanding private medical sector. In other words, the gap between public and private healthcare isn’t just a social challenge — it’s an investment signal, and one that smart investors can capture through pharma-focused fund.

Final Thoughts

Pharma Mutual Funds give investors a chance to tap into one of India’s strongest industries – with global leadership in generics, a growing domestic market, and government support. However, these are high-risk, high-reward funds. Don’t allocate more than 10–15% of your portfolio to sectoral funds, and always combine them with diversified mutual funds for stability.

If you believe in the long-term growth of healthcare and India’s role as the “Pharmacy of the World,” pharma funds can be a smart addition to your portfolio.

FAQs on Pharma Mutual Funds

Q1. Are pharma funds risky?

A: Yes, since they are concentrated sector funds. Suitable only for those who can take high risk.

Q2. How do pharma funds compare to diversified equity funds?

A: Diversified funds spread risk across sectors, pharma funds focus only on one. They can outperform in pharma bull runs but underperform otherwise.

Q3. What is the ideal investment horizon?

A: At least 5 years. Short-term Investing in sector funds is not recommended.

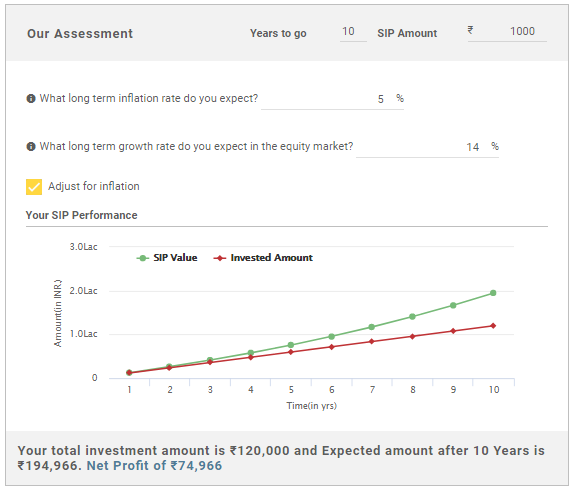

Q4. Are pharma funds good for SIPs?

A: Yes, SIPs help average out volatility in sectoral funds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Please send list of funds which has the option of changing the sector of funds so that overall performance of mutual funds are always very good. Thanks and Regards

Are largecap is best investment on longterm