What Is the Best Date for SIPs and Does It Really Affect Returns?

Quick Answer - The SIP date does not materially affect long‑term mutual fund returns. Over 10 years or more, the difference between Investing on different dates (such as the 1st, 10th or 15th) is usually less than 0.3–0.5% annually. What matters far more is consistency, time in the market, fund quality and staying invested through market cycles.

If you invest in Mutual Funds through SIPs, chances are you’ve asked this question — or heard it from someone else - “Which SIP date is best for higher returns?”

Some investors prefer the 1st of the month. Others believe the 10th or 15th gives better NAVs. Many even change SIP dates every year hoping it will improve performance.

- But does the SIP date actually make any real difference?

- Or is it one of the most common myths in Mutual Fund Investing?

Let’s break this down with clear reasoning, real SIP return data, and practical investing logic.

What Is an SIP?

A Systematic Investment plan (SIP) is a method of investing a fixed amount in a mutual fund at regular intervals, usually monthly. Instead of trying to time the market, SIPs help investors:

- Invest with discipline

- Reduce emotional decision‑making

- Benefit from rupee cost averaging

- Build wealth gradually through compounding

You can choose almost any SIP date — 1st, 5th, 10th, 15th, 20th or even the 28th of the month.

That flexibility often leads to confusion.

Talk to our investment specialist

Why Do Investors Worry About the SIP Date?

The concern is logical. Markets change every day. NAVs rise and fall daily. A lower NAV means more units.

So investors naturally assume:

- “If I invest on the right date, I’ll accumulate more units and earn higher returns.”

While this logic works for one transaction, SIP investing is not about one transaction. It’s about hundreds of transactions spread across years. That difference changes everything.

Does SIP Date Really Affect Returns?

In short — No, not in the long term.

The impact is extremely small and financially insignificant. Multiple long‑term studies comparing SIP dates — such as the 1st, 5th, 10th, 15th and 25th — show that:

- SIP returns across different dates remain almost identical

- Annual return variation is usually within 0.2% to 0.5%

- Over 10–15 years, this difference becomes negligible

In simple terms:

- If one SIP date delivers 12.4% CAGR, another may deliver 12.1% CAGR.

- That difference looks meaningful on paper — but barely changes your actual wealth.

Example: SIP Date Comparison

Assume the following:

- Monthly SIP: ₹10,000

- Investment period: 15 years

- Equity mutual fund Portfolio

| SIP Date | Approx SIP | CAGR Final Value |

|---|---|---|

| 1st | 12.2% | ₹50.1 lakh |

| 10th | 12.3% | ₹50.6 lakh |

| 15th | 12.1% | ₹49.8 lakh |

Difference between the highest and lowest outcome: about ₹70,000–₹80,000.

Total investment during this period - ₹10,000 × 180 months = ₹18 lakh.

On a final corpus of nearly ₹50 lakh, this difference translates to roughly 1.5–2% variation over 15 years.

It’s important to note that this variation is not predictable or repeatable. In another market cycle, the same SIP dates could produce the opposite result.

In real life, such differences are often outweighed by factors like inflation, SIP step‑ups, market Volatility, fund selection, and — most importantly — staying invested for the long term.

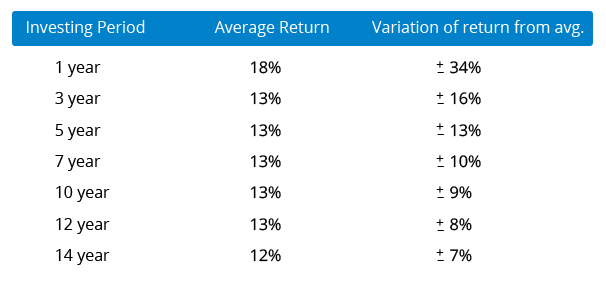

SIP Returns Over the Last 10 Years (India)

To understand what actually drives SIP performance, it helps to look at real data.

Based on SIP return data calculated from various resources, here’s how different equity categories have performed over the last decade -

10‑Year Average SIP Returns (Approx.)

| Mutual Fund Category | 10‑Year SIP CAGR |

|---|---|

| Large‑Cap Funds | 13–14% |

| Flexi‑Cap Funds | 15–16% |

| Large & Mid‑Cap | 16–17% |

| Multi‑Cap Funds | 17–18% |

| Mid‑Cap Funds | 18–19% |

| Small‑Cap Funds | 19–20% |

These returns were achieved across multiple market phases:

Bull markets, bear markets, COVID crash, global inflation cycle, interest‑rate hikes. Yet SIPs delivered strong long‑term outcomes — regardless of monthly investment dates.

Why SIP Date Has Minimal Impact

1. Rupee Cost Averaging Works Automatically

Some months you buy at high NAVs. Some months you buy at low NAVs. Over time, the purchase cost averages out. This mechanism works independently of the SIP date.

2. Long‑Term Market Growth Drives Returns

SIP performance depends far more on:

- Economic growth

- Corporate earnings

- Market valuation cycles

- Duration of investment

Not on whether you invested on the 5th or the 15th.

3. Markets Don’t Follow Calendars

There is no fixed pattern that says:

- The 1st will always be cheaper

- The 10th will always be expensive

Some months the market falls early. Some months it falls mid‑month. Over years, these movements cancel out.

So Is There Any “Best” SIP Date?

Yes — but not for return optimisation.

The Top SIP date is - The date you can maintain consistently without missing instalments.

How to Choose the Right SIP Date

Choose a date after salary credit

If your salary comes on the 1st or 2nd, SIP dates between the 3rd and 7th usually work well.

Avoid dates close to month‑end expenses

Rent, EMIs and bills can create cash‑flow pressure. Choose a comfortable buffer.

Stay consistent

Missing SIPs during market corrections damages returns far more than choosing a “wrong” date.

When SIP Date Can Matter Slightly

The SIP date may show minor variation only when:

- Investment horizon is very short (less than 2 years)

- Market volatility is extreme

- SIP amount is unusually large

Even then, outcomes remain unpredictable. For long‑term investors, these differences are noise.

What Actually Improves SIP Returns

If your goal is higher wealth creation, focus on:

- Staying invested for long periods

- Choosing quality Mutual Funds

- Increasing SIP amounts regularly (step‑up SIP)

- Avoiding panic during market falls

- Reviewing funds annually — not monthly

These factors can improve outcomes by lakhs or even crores, unlike SIP date optimisation.

Final Verdict: Does SIP Date Affect Returns?

- Yes, technically: minor variations exist

- No, practically: the difference is negligible

- No, financially: it does not change long‑term wealth

The best SIP date is not the 1st, 10th or 15th. The best SIP date is - The one you never miss.

If your SIP runs smoothly every month, grows with income, and stays invested through market cycles — you are already doing it right.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.