ELSS vs Equity Funds - Break the Confusion!

ELSS vs Equity Funds? Typically, Equity Linked Savings Scheme (ELSS) is a type of Equity Mutual Fund that offers tax benefits along with providing good market linked returns. For this reason, ELSS funds are also termed as a Tax Saving Mutual Funds. Investments upto INR 1,50,000 in ELSS Mutual Funds are liable for tax deductions from the income, as per Section 80C of the income tax Act.

Though ELSS is a type of Equity Funds, it offers various unique features that make it different from the usual equity funds. What are they? Read below to know the answer.

What are the Unique Features Offered by ELSS?

Equity Linked Savings Schemes (ELSS) have some unique features:

- 3 years lock-in period while equity funds have no lock-in period.

- Tax deduction in investments upto INR 1,50,000 under section 80C of the Income Tax(IT) Act.

- Gains up to INR 1 lakh are free of tax. Tax at 10% applies to gains above INR 1 lakh.

We have not listed the other features of ELSS since they are the same as those being offered by the other Equity Mutual Funds. The first 3 points are indeed unique to equity funds.

Talk to our investment specialist

Fund Selection Methodology used to find 8 funds

Best ELSS Funds to Invest

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.6508

↑ 0.35 ₹5,980 7.6 16.8 29.9 34.6 28 11.3 Invesco India PSU Equity Fund Growth ₹68.35

↑ 0.53 ₹1,492 2.2 10 28.4 32 26 10.3 Franklin India Opportunities Fund Growth ₹255.949

↓ -2.85 ₹8,271 -2.4 0.4 15.1 29.3 20.1 3.1 LIC MF Infrastructure Fund Growth ₹50.4298

↑ 0.39 ₹946 0.8 3.5 21.6 28.7 23.6 -3.7 Franklin Build India Fund Growth ₹149.452

↑ 1.49 ₹3,003 2.3 5.3 21.1 28.1 23.9 3.7 HDFC Infrastructure Fund Growth ₹47.605

↑ 0.28 ₹2,366 -1.8 -0.3 15.9 27.3 23.9 2.2 Invesco India Mid Cap Fund Growth ₹179.8

↓ -0.15 ₹10,058 -3.5 -2.4 20.1 26.9 21.1 6.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 8 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund Franklin India Opportunities Fund LIC MF Infrastructure Fund Franklin Build India Fund HDFC Infrastructure Fund Invesco India Mid Cap Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Top quartile AUM (₹8,271 Cr). Bottom quartile AUM (₹946 Cr). Upper mid AUM (₹3,003 Cr). Lower mid AUM (₹2,366 Cr). Highest AUM (₹10,058 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (26 yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (17+ yrs). Established history (18+ yrs). Point 3 Rating: 3★ (top quartile). Rating: 2★ (lower mid). Rating: 3★ (upper mid). Rating: 3★ (upper mid). Not Rated. Top rated. Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.99% (top quartile). 5Y return: 26.01% (upper mid). 5Y return: 20.10% (bottom quartile). 5Y return: 23.65% (lower mid). 5Y return: 23.93% (lower mid). 5Y return: 23.94% (upper mid). 5Y return: 21.05% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 34.56% (top quartile). 3Y return: 32.03% (upper mid). 3Y return: 29.25% (upper mid). 3Y return: 28.73% (lower mid). 3Y return: 28.09% (lower mid). 3Y return: 27.29% (bottom quartile). 3Y return: 26.85% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 29.87% (top quartile). 1Y return: 28.36% (upper mid). 1Y return: 15.07% (bottom quartile). 1Y return: 21.61% (upper mid). 1Y return: 21.11% (lower mid). 1Y return: 15.86% (bottom quartile). 1Y return: 20.11% (lower mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (top quartile). Alpha: -2.70 (bottom quartile). Alpha: -1.01 (lower mid). Alpha: -6.08 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (top quartile). Sharpe: 0.53 (upper mid). Sharpe: 0.12 (lower mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.06 (bottom quartile). Sharpe: 0.35 (upper mid). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 1.66 (top quartile). Information ratio: 0.29 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

Franklin India Opportunities Fund

LIC MF Infrastructure Fund

Franklin Build India Fund

HDFC Infrastructure Fund

Invesco India Mid Cap Fund

*Above is list of funds having AUM/Net Assets above than 100 Crore and having fund age >= 3 years. Sorted on 3 Year CAGR returns.

Data Analysis

Firstly, Let’s look at some historical data (as on 20 April 2017) to figure out if indeed ELSS are better performers.

We did some data crunching over the last 3 years and 5 years. The results clearly show that ELSS as a category has performed much better than Equity Mutual Funds, that too the average returns in the category seem to be higher.

| Type | 3 Year Comparison | 5 Year Comparison |

|---|---|---|

| Large Cap | Min - 22%, Max - 78%, Avg - 44% |

Min - 79%, Max - 185%, Avg - 116% |

| ELSS | Min - 32%, Max - 95%, Avg - 60% |

Min - 106%, Max - 194%, Avg - 145% |

Why ELSS Over Equity Mutual Funds?

Normal equity funds do not have a lock-in, though there is an exit load. So fund managers are constantly making sure they have a liquid enough Portfolio to meet redemption pressures if any.

How is this different in ELSS? Since each cash flow has a lock-in of 3 years, what it does mean is that the fund manager can take long term calls on stocks and on the overall portfolio. It also means that the fund manager does not worry about meeting redemption pressures in the short run.

Typically, you would see churn ratios (also called turnover ratio) being lower in ELSS as against Large cap funds. This is one of the main reasons that returns are a bit higher. The fund manager then can choose value stocks or growth stocks depending on his mandate of the fund. However, one thing remains is that his holding period can be much higher in ELSS than usual equity funds.

Where Investors Benefit?

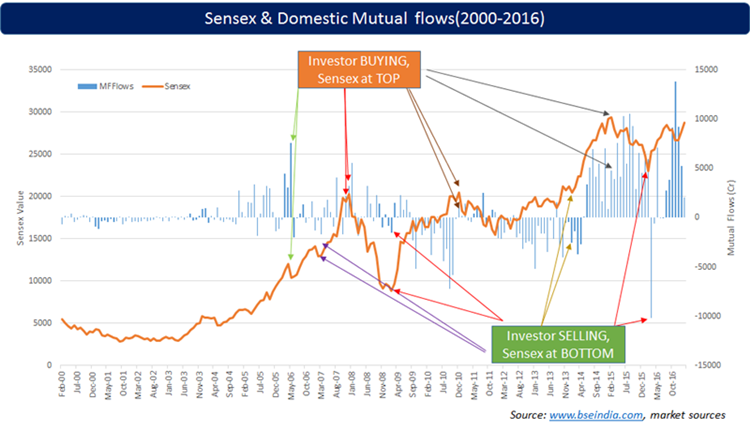

The below chart overlays the BSE Sensex value with domestic mutual fund flows from 2000 to 2016. One thing that comes out is that when the market falls is that investors tend to exit. This puts a huge pressure on normal equity funds. What happens in ELSS? Investors are locked in and the fund manager does not face such pressures on redemptions. This ensures that the portfolio does not suffer and the investment, if they are strong, are not redeemed.

To conclude, Some of the Final Tips for Investors

If you wish to save tax apart from getting good returns, invest in ELSS funds. You can choose from the above mentioned Best elss Funds.

As mentioned above, generally, ELSS Mutual funds tend to offer better returns than most of the equity funds. Therefore, even the investors who do not want to save tax can invest in ELSS Mutual Funds to create wealth over a long run.

However, the investors who are not willing to lock their money can invest in Flexi-cap funds. Starting a SIP (Systematic Investment plan) in these funds might also offer good returns with the benefit of liquidity.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.