11 શ્રેષ્ઠ લાર્જ કેપ ઇક્વિટી ફંડ 2022

આદર્શરીતે, જ્યારે કોઈ વ્યક્તિ વિચારે છેરોકાણ, પ્રથમ વિચાર જે કોઈના મનમાં આવે છે તે મોટે ભાગે ઇક્વિટી હશે. જ્યારે તમે વધુ અન્વેષણ કરો છોઇક્વિટી ફંડ્સ, તમે લાર્જ-કેપ ફંડ્સ કરશો.

મોટી કેપમ્યુચ્યુઅલ ફંડ ઇક્વિટીમાં સૌથી સુરક્ષિત રોકાણોમાંનું એક માનવામાં આવે છે કારણ કે તેમાં સારું વળતર છે અને ઓછા અસ્થિર છેબજાર અન્ય ઇક્વિટી ફંડની સરખામણીમાં વધઘટ એટલે કે, મધ્ય અનેસ્મોલ કેપ ફંડ્સ. આ ફંડ્સ મોટી કંપનીઓના સ્ટોકમાં રોકાણ કરે છે. બ્લુ-ચિપ કંપનીઓના શેરના ભાવ ઊંચા હોવા છતાં રોકાણકારો તેમના નાણાં લાર્જ-કેપમાં રોકાણ કરવા ઉત્સુક છે.

શ્રેષ્ઠ લાર્જ કેપ મ્યુચ્યુઅલ ફંડની પસંદગી એ એક મહત્વપૂર્ણ કાર્ય છે જેને યોગ્ય મહત્વ આપવાની જરૂર છે. ચાલો નીચે જોઈએરોકાણના ફાયદા લાર્જ કેપ મ્યુચ્યુઅલ ફંડમાં, શ્રેષ્ઠ કેવી રીતે પસંદ કરવુંલાર્જ કેપ ફંડ્સ અને અંતે, 2022 માં રોકાણ કરવા માટે ટોચના 10 શ્રેષ્ઠ લાર્જ કેપ ફંડ્સની સૂચિ.

લાર્જ કેપ ફંડ કેવી રીતે પસંદ કરવું?

યોગ્ય લાર્જ-કેપ મ્યુચ્યુઅલ ફંડ પસંદ કરવું ક્યારેય સરળ નથી. કેટલાક ફંડ સારી કામગીરી બજાવે છે, જ્યારે અન્ય ફંડ નિસ્તેજ રહે છે. પરંતુ, રોકાણકારોએ યોગ્ય ફંડની પસંદગી કરતી વખતે કેટલાક માપદંડો જોવાના હોય છે. ફંડ અંગે નિર્ણય લેતા પહેલા વ્યક્તિએ સંખ્યાબંધ જથ્થાત્મક તેમજ ગુણાત્મક પરિબળોને જોવાની જરૂર છે.

જથ્થાત્મક પરિબળો

પરસ્પરફંડ રેટિંગ એક સારો પ્રારંભિક બિંદુ હોઈ શકે છે. આને ફંડની ઉંમર, અસ્કયામતો અન્ડર મેનેજમેન્ટ (AUM), પાછલું વળતર, ખર્ચ ગુણોત્તર વગેરે જેવા અન્ય ડેટા સાથે પૂરક બનાવવાની જરૂર છે. વધુમાં, રોકાણકારોને ફંડની છેલ્લા ત્રણ વર્ષની કામગીરી તપાસવાની સલાહ આપવામાં આવે છે. ફંડ પાસે INR 1000 કરોડથી વધુની નેટ એસેટ્સ હોવી જોઈએ અને છેલ્લા એક વર્ષમાં લાર્જ કેપ શેરોમાં લઘુત્તમ સરેરાશ 65 ટકા ફાળવણી પણ હોવી જોઈએ.

Talk to our investment specialist

ગુણાત્મક પરિબળો

આને વધુ ગુણાત્મક પરિબળો જેમ કે ફંડ હાઉસની પ્રતિષ્ઠા, ફંડ મેનેજર ટ્રેક રેકોર્ડ અને રોકાણ પ્રક્રિયા સાથે ફિલ્ટર કરવાની જરૂર છે. વ્યક્તિએ એવા ફંડ હાઉસની પસંદગી કરવી જોઈએ કે જેના પર તમે તમારા નાણાંનું રોકાણ કરવા માટે વિશ્વાસ ધરાવો છો. એવા ફંડ હાઉસની ઓળખ કરવી કે જેઓ બજારમાં મજબૂત હાજરી ધરાવે છે અને લાંબા અને સાતત્યપૂર્ણ ટ્રેક રેકોર્ડ ધરાવતા વિવિધ પ્રકારના ફંડ પ્રદાન કરે છે. વ્યક્તિએ એ પણ જોવું જોઈએ કે કેટલા ફંડ્સ ટોપ પરફોર્મર છે. સારા ટ્રેક રેકોર્ડ સાથે ફંડ મેનેજર આવશ્યક છે. એનએસેટ મેનેજમેન્ટ કંપની સમૂહ સાથે સંસ્થાકીય રોકાણ પ્રક્રિયા પણ મહત્વપૂર્ણ છે કારણ કે આ ખાતરી કરે છે કે તે એક એવી પ્રક્રિયા છે જે તમને માત્ર ફંડ મેનેજર (વ્યક્તિ - અને તેથી કીમેન જોખમ)ને બદલે પૈસા કમાવવા માટે બનાવે છે. ઉપરોક્ત કરવાથી, વ્યક્તિ શ્રેષ્ઠ લાર્જ કેપ ફંડને અજમાવી અને પસંદ કરી શકે છે અથવા પસંદ કરવા માટે ટોચના 10 શ્રેષ્ઠ લાર્જ કેપ ફંડ્સની સૂચિ પણ બનાવી શકે છે.

ટોચના 11 શ્રેષ્ઠ પ્રદર્શન કરનાર લાર્જ કેપ મ્યુચ્યુઅલ ફંડ નાણાકીય વર્ષ 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹92.6201

↓ -1.05 ₹50,876 -1 2.8 13.9 19.1 17.4 9.2 ICICI Prudential Bluechip Fund Growth ₹112.89

↓ -1.22 ₹78,502 -1.8 3.2 12.2 18 15.4 11.3 Invesco India Largecap Fund Growth ₹69.68

↓ -0.90 ₹1,718 -2.7 2.6 11.9 17.7 13.8 5.5 DSP TOP 100 Equity Growth ₹475.436

↓ -5.22 ₹7,285 -1.8 1.9 9.2 17.6 12.9 8.4 Bandhan Large Cap Fund Growth ₹78.839

↓ -1.09 ₹2,051 -1.3 3.3 13.7 17.5 12.7 8.2 HDFC Top 100 Fund Growth ₹1,167.4

↓ -14.46 ₹40,604 -0.3 4.1 10.3 16 14.4 7.9 BNP Paribas Large Cap Fund Growth ₹223.48

↓ -2.74 ₹2,702 -0.5 2.9 10.2 16 12.7 4.4 Aditya Birla Sun Life Frontline Equity Fund Growth ₹534.27

↓ -6.08 ₹31,386 -1.7 2.7 11.9 15.6 13.1 9.4 Kotak Bluechip Fund Growth ₹587.437

↓ -6.40 ₹11,087 -0.8 4.1 13.1 15.5 12.9 8.7 TATA Large Cap Fund Growth ₹515.997

↓ -6.42 ₹2,840 -0.8 5.6 11 15.4 12.9 9.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 11 Funds showcased

Commentary IDBI India Top 100 Equity Fund Nippon India Large Cap Fund ICICI Prudential Bluechip Fund Invesco India Largecap Fund DSP TOP 100 Equity Bandhan Large Cap Fund HDFC Top 100 Fund BNP Paribas Large Cap Fund Aditya Birla Sun Life Frontline Equity Fund Kotak Bluechip Fund TATA Large Cap Fund Point 1 Bottom quartile AUM (₹655 Cr). Top quartile AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Bottom quartile AUM (₹1,718 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹2,051 Cr). Upper mid AUM (₹40,604 Cr). Lower mid AUM (₹2,702 Cr). Upper mid AUM (₹31,386 Cr). Upper mid AUM (₹11,087 Cr). Lower mid AUM (₹2,840 Cr). Point 2 Established history (13+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (22+ yrs). Established history (19+ yrs). Oldest track record among peers (29 yrs). Established history (21+ yrs). Established history (23+ yrs). Established history (27+ yrs). Established history (27+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 4★ (top quartile). Top rated. Rating: 3★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.61% (bottom quartile). 5Y return: 17.40% (top quartile). 5Y return: 15.37% (top quartile). 5Y return: 13.81% (upper mid). 5Y return: 12.86% (lower mid). 5Y return: 12.69% (bottom quartile). 5Y return: 14.44% (upper mid). 5Y return: 12.73% (bottom quartile). 5Y return: 13.09% (upper mid). 5Y return: 12.88% (lower mid). 5Y return: 12.89% (lower mid). Point 6 3Y return: 21.88% (top quartile). 3Y return: 19.08% (top quartile). 3Y return: 18.04% (upper mid). 3Y return: 17.66% (upper mid). 3Y return: 17.62% (upper mid). 3Y return: 17.49% (lower mid). 3Y return: 16.03% (lower mid). 3Y return: 16.01% (lower mid). 3Y return: 15.58% (bottom quartile). 3Y return: 15.54% (bottom quartile). 3Y return: 15.37% (bottom quartile). Point 7 1Y return: 15.39% (top quartile). 1Y return: 13.92% (top quartile). 1Y return: 12.24% (upper mid). 1Y return: 11.88% (lower mid). 1Y return: 9.19% (bottom quartile). 1Y return: 13.69% (upper mid). 1Y return: 10.34% (bottom quartile). 1Y return: 10.21% (bottom quartile). 1Y return: 11.89% (lower mid). 1Y return: 13.07% (upper mid). 1Y return: 11.03% (lower mid). Point 8 Alpha: 2.11 (top quartile). Alpha: -0.94 (upper mid). Alpha: 1.30 (top quartile). Alpha: -5.05 (bottom quartile). Alpha: -1.17 (lower mid). Alpha: -2.13 (bottom quartile). Alpha: -1.63 (lower mid). Alpha: -5.54 (bottom quartile). Alpha: -0.70 (upper mid). Alpha: -1.48 (lower mid). Alpha: -0.83 (upper mid). Point 9 Sharpe: 1.09 (top quartile). Sharpe: 0.29 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.26 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.21 (lower mid). Sharpe: -0.06 (bottom quartile). Sharpe: 0.31 (upper mid). Sharpe: 0.25 (lower mid). Sharpe: 0.30 (upper mid). Point 10 Information ratio: 0.14 (bottom quartile). Information ratio: 1.37 (top quartile). Information ratio: 1.26 (top quartile). Information ratio: 0.67 (upper mid). Information ratio: 0.74 (upper mid). Information ratio: 0.72 (upper mid). Information ratio: 0.54 (lower mid). Information ratio: 0.47 (lower mid). Information ratio: 0.58 (lower mid). Information ratio: 0.46 (bottom quartile). Information ratio: 0.30 (bottom quartile). IDBI India Top 100 Equity Fund

Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

Invesco India Largecap Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

HDFC Top 100 Fund

BNP Paribas Large Cap Fund

Aditya Birla Sun Life Frontline Equity Fund

Kotak Bluechip Fund

TATA Large Cap Fund

*એયુએમ/નેટ અસ્કયામતો સાથેના 11 શ્રેષ્ઠ લાર્જ કેપ મ્યુચ્યુઅલ ફંડની યાદી >500 કરોડ. કર્યાભંડોળની ઉંમર >=3 પર છટણી3 વર્ષCAGR પરત કરે છે.

The Investment objective of the Scheme is to provide investors with the opportunities for long-term capital appreciation by investing predominantly in Equity and Equity related Instruments of Large Cap companies. However

there can be no assurance that the investment objective under the Scheme will be realized. Research Highlights for IDBI India Top 100 Equity Fund Below is the key information for IDBI India Top 100 Equity Fund Returns up to 1 year are on (Erstwhile Reliance Top 200 Fund) The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing in equity and equity related instruments of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index. The secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Large Cap Fund Below is the key information for Nippon India Large Cap Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Focused Bluechip Equity Fund) To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among Top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd. If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund

Manager reserves the right to increase the number of companies to more than 20. Research Highlights for ICICI Prudential Bluechip Fund Below is the key information for ICICI Prudential Bluechip Fund Returns up to 1 year are on (Erstwhile Invesco India Business Leaders Fund) To generate long term capital appreciation by investing in equity and equity related instruments including equity derivatives of companies which in our opinion are leaders in their respective industry or industry segment. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India Largecap Fund Below is the key information for Invesco India Largecap Fund Returns up to 1 year are on The Fund is seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. Research Highlights for DSP TOP 100 Equity Below is the key information for DSP TOP 100 Equity Returns up to 1 year are on (Erstwhile IDFC Equity Fund) The investment objective of the scheme is to seek to generate

capital growth from a portfolio of predominantly equity and equity

related instruments (including Equity Derivatives). The scheme

may also invest in debt & money market instruments to generate

reasonable income. However there is no assurance or guarantee that the objectives of the scheme will be realized. Research Highlights for Bandhan Large Cap Fund Below is the key information for Bandhan Large Cap Fund Returns up to 1 year are on (Erstwhile HDFC Top 200) To generate long term capital appreciation from a portfolio of equity and equity linked instruments. The investment portfolio for equity and equity linked instruments will be primarily drawn from the companies in the BSE 200 Index.

Further, the Scheme may also invest in listed companies that would qualify to be in the top 200 by market capitalisation on the BSE even though they may not be listed on the BSE. This includes participation in large Ipos where in the market

capitalisation of the company based on issue price would make the company a part of the top 200 companies listed on the BSE based on market capitalisation. Research Highlights for HDFC Top 100 Fund Below is the key information for HDFC Top 100 Fund Returns up to 1 year are on (Erstwhile BNP Paribas Equity Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversifi ed and actively managed portfolio of equity and equity related securities. The Scheme will invest in a range of companies, with a bias towards large & medium market capitalisation companies. However, there can be no

assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. Research Highlights for BNP Paribas Large Cap Fund Below is the key information for BNP Paribas Large Cap Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and or sectors as its chosen benchmark index, S&P BSE 200. Research Highlights for Aditya Birla Sun Life Frontline Equity Fund Below is the key information for Aditya Birla Sun Life Frontline Equity Fund Returns up to 1 year are on (Erstwhile Kotak 50 Fund) To generate capital appreciation from a portfolio of predominantly equity and

equity related securities. The portfolio will generally comprise of equity and equity

related instruments of around 50 companies which may go up to 59 companies but will not exceed 59 at any point in time. However, there is no assurance that the objective of the scheme

will be realized Research Highlights for Kotak Bluechip Fund Below is the key information for Kotak Bluechip Fund Returns up to 1 year are on To provide income distribution and / or medium to long term capital gains while at all times emphasising the importance of capital appreciation. Research Highlights for TATA Large Cap Fund Below is the key information for TATA Large Cap Fund Returns up to 1 year are on 1. IDBI India Top 100 Equity Fund

IDBI India Top 100 Equity Fund

Growth Launch Date 15 May 12 NAV (28 Jul 23) ₹44.16 ↑ 0.05 (0.11 %) Net Assets (Cr) ₹655 on 30 Jun 23 Category Equity - Large Cap AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.47 Sharpe Ratio 1.09 Information Ratio 0.14 Alpha Ratio 2.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,389 31 Jan 23 ₹13,450 Returns for IDBI India Top 100 Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3% 3 Month 9.2% 6 Month 12.5% 1 Year 15.4% 3 Year 21.9% 5 Year 12.6% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI India Top 100 Equity Fund

Name Since Tenure Data below for IDBI India Top 100 Equity Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Nippon India Large Cap Fund

Nippon India Large Cap Fund

Growth Launch Date 8 Aug 07 NAV (13 Feb 26) ₹92.6201 ↓ -1.05 (-1.12 %) Net Assets (Cr) ₹50,876 on 31 Dec 25 Category Equity - Large Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.58 Sharpe Ratio 0.29 Information Ratio 1.37 Alpha Ratio -0.94 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,601 31 Jan 23 ₹14,610 31 Jan 24 ₹19,910 31 Jan 25 ₹22,484 31 Jan 26 ₹24,543 Returns for Nippon India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.4% 3 Month -1% 6 Month 2.8% 1 Year 13.9% 3 Year 19.1% 5 Year 17.4% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.2% 2023 18.2% 2022 32.1% 2021 11.3% 2020 32.4% 2019 4.9% 2018 7.3% 2017 -0.2% 2016 38.4% 2015 2.2% Fund Manager information for Nippon India Large Cap Fund

Name Since Tenure Sailesh Raj Bhan 8 Aug 07 18.41 Yr. Kinjal Desai 25 May 18 7.61 Yr. Bhavik Dave 19 Aug 24 1.37 Yr. Lokesh Maru 5 Sep 25 0.32 Yr. Divya Sharma 5 Sep 25 0.32 Yr. Data below for Nippon India Large Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.32% Consumer Cyclical 16.11% Consumer Defensive 9.76% Industrials 9.5% Technology 7.66% Energy 6.03% Health Care 5.93% Basic Materials 5.55% Utility 5.23% Communication Services 0.19% Asset Allocation

Asset Class Value Cash 0.68% Equity 99.32% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK9% ₹4,498 Cr 45,380,734 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE6% ₹3,068 Cr 19,537,539 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321746% ₹2,978 Cr 22,177,945

↑ 2,098,100 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | 5322154% ₹1,982 Cr 15,615,542 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN4% ₹1,923 Cr 19,582,107 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT4% ₹1,797 Cr 4,400,529 Infosys Ltd (Technology)

Equity, Since 30 Sep 07 | INFY3% ₹1,549 Cr 9,590,806

↓ -409,688 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 24 | TCS3% ₹1,507 Cr 4,700,000

↑ 700,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 21 | 5000343% ₹1,446 Cr 14,648,655 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 16 | ITC3% ₹1,424 Cr 35,329,812 3. ICICI Prudential Bluechip Fund

ICICI Prudential Bluechip Fund

Growth Launch Date 23 May 08 NAV (13 Feb 26) ₹112.89 ↓ -1.22 (-1.07 %) Net Assets (Cr) ₹78,502 on 31 Dec 25 Category Equity - Large Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.46 Sharpe Ratio 0.48 Information Ratio 1.26 Alpha Ratio 1.3 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,200 31 Jan 23 ₹13,710 31 Jan 24 ₹18,309 31 Jan 25 ₹20,510 31 Jan 26 ₹22,375 Returns for ICICI Prudential Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.6% 3 Month -1.8% 6 Month 3.2% 1 Year 12.2% 3 Year 18% 5 Year 15.4% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 16.9% 2022 27.4% 2021 6.9% 2020 29.2% 2019 13.5% 2018 9.8% 2017 -0.8% 2016 32.7% 2015 7.7% Fund Manager information for ICICI Prudential Bluechip Fund

Name Since Tenure Anish Tawakley 5 Sep 18 7.33 Yr. Vaibhav Dusad 18 Jan 21 4.96 Yr. Sharmila D’mello 31 Jul 22 3.42 Yr. Data below for ICICI Prudential Bluechip Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 27.84% Consumer Cyclical 12.05% Industrials 11.3% Energy 9.58% Basic Materials 6.62% Technology 5.32% Communication Services 5.09% Utility 4.5% Health Care 4.4% Consumer Defensive 3.74% Real Estate 1.06% Asset Allocation

Asset Class Value Cash 4.92% Equity 95.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK10% ₹7,676 Cr 77,438,868

↑ 1,505,980 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 08 | 5321748% ₹6,369 Cr 47,426,976

↑ 56,308 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 08 | RELIANCE7% ₹5,442 Cr 34,655,981 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 12 | LT6% ₹5,081 Cr 12,443,352

↓ -259,473 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 09 | BHARTIARTL5% ₹3,569 Cr 16,951,029 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Apr 16 | MARUTI4% ₹3,342 Cr 2,001,312 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 14 | 5322154% ₹3,274 Cr 25,789,059 Nifty 50 Index

- | -4% ₹2,816 Cr 1,070,875

↑ 1,070,875 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY3% ₹2,657 Cr 16,448,711

↓ -1,694,306 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 17 | 5325383% ₹2,479 Cr 2,103,927 4. Invesco India Largecap Fund

Invesco India Largecap Fund

Growth Launch Date 21 Aug 09 NAV (13 Feb 26) ₹69.68 ↓ -0.90 (-1.28 %) Net Assets (Cr) ₹1,718 on 31 Dec 25 Category Equity - Large Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 0.04 Information Ratio 0.67 Alpha Ratio -5.05 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,567 31 Jan 23 ₹12,674 31 Jan 24 ₹16,959 31 Jan 25 ₹19,204 31 Jan 26 ₹20,742 Returns for Invesco India Largecap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.4% 3 Month -2.7% 6 Month 2.6% 1 Year 11.9% 3 Year 17.7% 5 Year 13.8% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 5.5% 2023 20% 2022 27.8% 2021 -3% 2020 32.5% 2019 14.1% 2018 10.5% 2017 -0.4% 2016 28.3% 2015 2.8% Fund Manager information for Invesco India Largecap Fund

Name Since Tenure Hiten Jain 1 Dec 23 2.09 Yr. Data below for Invesco India Largecap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.49% Industrials 16.65% Consumer Cyclical 15.48% Technology 10.58% Health Care 9.3% Basic Materials 5.09% Communication Services 3.93% Real Estate 1.34% Consumer Defensive 1% Utility 0.55% Asset Allocation

Asset Class Value Cash 0.53% Equity 99.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 09 | HDFCBANK8% ₹137 Cr 1,384,844 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 19 | 5321747% ₹113 Cr 842,629 Infosys Ltd (Technology)

Equity, Since 30 Apr 18 | INFY5% ₹94 Cr 581,547

↓ -51,232 ICICI Prudential Asset Management Co Ltd (Financial Services)

Equity, Since 31 Dec 25 | ICICIAMC5% ₹86 Cr 321,785

↑ 321,785 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 25 | KOTAKBANK4% ₹73 Cr 330,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 25 | LT4% ₹71 Cr 173,437 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 19 | BHARTIARTL4% ₹67 Cr 320,404 Bajaj Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | 5000344% ₹66 Cr 671,135 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 May 25 | INDIGO3% ₹57 Cr 113,532

↑ 26,532 Tech Mahindra Ltd (Technology)

Equity, Since 31 May 23 | 5327553% ₹55 Cr 345,000 5. DSP TOP 100 Equity

DSP TOP 100 Equity

Growth Launch Date 10 Mar 03 NAV (13 Feb 26) ₹475.436 ↓ -5.22 (-1.09 %) Net Assets (Cr) ₹7,285 on 31 Dec 25 Category Equity - Large Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 1.94 Sharpe Ratio 0.26 Information Ratio 0.74 Alpha Ratio -1.17 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,004 31 Jan 23 ₹12,170 31 Jan 24 ₹15,679 31 Jan 25 ₹18,517 31 Jan 26 ₹19,861 Returns for DSP TOP 100 Equity

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.9% 3 Month -1.8% 6 Month 1.9% 1 Year 9.2% 3 Year 17.6% 5 Year 12.9% 10 Year 15 Year Since launch 18.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.4% 2023 20.5% 2022 26.6% 2021 1.4% 2020 19.5% 2019 7.5% 2018 14.8% 2017 -2.7% 2016 26.5% 2015 4.9% Fund Manager information for DSP TOP 100 Equity

Name Since Tenure Abhishek Singh 1 Jun 22 3.59 Yr. Data below for DSP TOP 100 Equity as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 43.57% Consumer Cyclical 10.51% Health Care 9.09% Technology 7.44% Utility 7% Consumer Defensive 6.07% Energy 4.38% Communication Services 1.49% Basic Materials 1.11% Industrials 0.72% Asset Allocation

Asset Class Value Cash 8.61% Equity 91.39% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 14 | HDFCBANK9% ₹669 Cr 6,745,417

↑ 720,015 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 16 | 5321748% ₹591 Cr 4,401,409 Infosys Ltd (Technology)

Equity, Since 30 Sep 19 | INFY6% ₹450 Cr 2,786,347

↓ -81,124 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | M&M6% ₹446 Cr 1,201,992 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 21 | ITC6% ₹442 Cr 10,976,448

↑ 895,419 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | 5322156% ₹414 Cr 3,257,465 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 May 24 | KOTAKBANK5% ₹334 Cr 1,518,477

↓ -246,371 NTPC Ltd (Utilities)

Equity, Since 30 Nov 23 | 5325555% ₹330 Cr 10,021,653 Cipla Ltd (Healthcare)

Equity, Since 30 Jun 20 | 5000874% ₹286 Cr 1,894,072 Samvardhana Motherson International Ltd (Consumer Cyclical)

Equity, Since 31 Dec 22 | MOTHERSON4% ₹269 Cr 22,464,614 6. Bandhan Large Cap Fund

Bandhan Large Cap Fund

Growth Launch Date 9 Jun 06 NAV (13 Feb 26) ₹78.839 ↓ -1.09 (-1.37 %) Net Assets (Cr) ₹2,051 on 31 Dec 25 Category Equity - Large Cap AMC IDFC Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 0.21 Information Ratio 0.72 Alpha Ratio -2.13 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,803 31 Jan 23 ₹12,233 31 Jan 24 ₹16,259 31 Jan 25 ₹18,015 31 Jan 26 ₹19,816 Returns for Bandhan Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.5% 3 Month -1.3% 6 Month 3.3% 1 Year 13.7% 3 Year 17.5% 5 Year 12.7% 10 Year 15 Year Since launch 11.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.2% 2023 18.7% 2022 26.8% 2021 -2.3% 2020 26.8% 2019 17.4% 2018 10.6% 2017 -4.2% 2016 34.2% 2015 5.3% Fund Manager information for Bandhan Large Cap Fund

Name Since Tenure Manish Gunwani 2 Dec 24 1.08 Yr. Prateek Poddar 2 Dec 24 1.08 Yr. Ritika Behera 7 Oct 23 2.24 Yr. Gaurav Satra 7 Jun 24 1.57 Yr. Data below for Bandhan Large Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 30.69% Consumer Cyclical 13.72% Technology 12.15% Energy 7.7% Basic Materials 7.61% Health Care 7.1% Industrials 6.02% Consumer Defensive 5.04% Utility 3.89% Communication Services 2.7% Real Estate 2.58% Asset Allocation

Asset Class Value Cash 0.31% Equity 99.69% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 07 | HDFCBANK9% ₹193 Cr 1,946,265

↑ 74,334 Reliance Industries Ltd (Energy)

Equity, Since 28 Feb 07 | RELIANCE8% ₹158 Cr 1,004,937

↓ -5,093 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | 5321747% ₹136 Cr 1,015,231

↓ -5,195 Infosys Ltd (Technology)

Equity, Since 31 Aug 11 | INFY5% ₹102 Cr 633,692

↑ 81,009 Axis Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | 5322154% ₹79 Cr 619,536

↑ 112,671 NTPC Ltd (Utilities)

Equity, Since 31 Dec 24 | 5325554% ₹72 Cr 2,196,218

↓ -11,130 State Bank of India (Financial Services)

Equity, Since 31 Dec 24 | SBIN3% ₹69 Cr 700,714

↑ 42,693 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 19 | LT3% ₹68 Cr 166,009

↓ -841 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Apr 24 | M&M3% ₹63 Cr 170,000

↓ -861 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL3% ₹55 Cr 262,693

↓ -1,331 7. HDFC Top 100 Fund

HDFC Top 100 Fund

Growth Launch Date 11 Oct 96 NAV (13 Feb 26) ₹1,167.4 ↓ -14.46 (-1.22 %) Net Assets (Cr) ₹40,604 on 31 Dec 25 Category Equity - Large Cap AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.61 Sharpe Ratio 0.21 Information Ratio 0.54 Alpha Ratio -1.63 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,170 31 Jan 23 ₹14,039 31 Jan 24 ₹18,799 31 Jan 25 ₹20,355 31 Jan 26 ₹21,665 Returns for HDFC Top 100 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.4% 3 Month -0.3% 6 Month 4.1% 1 Year 10.3% 3 Year 16% 5 Year 14.4% 10 Year 15 Year Since launch 18.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 11.6% 2022 30% 2021 10.6% 2020 28.5% 2019 5.9% 2018 7.7% 2017 0.1% 2016 32% 2015 8.5% Fund Manager information for HDFC Top 100 Fund

Name Since Tenure Rahul Baijal 29 Jul 22 3.43 Yr. Dhruv Muchhal 22 Jun 23 2.53 Yr. Data below for HDFC Top 100 Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 34.58% Consumer Cyclical 18.18% Health Care 10.44% Industrials 7.61% Communication Services 6.18% Energy 6.09% Basic Materials 5.25% Consumer Defensive 4.57% Technology 3.19% Utility 2.41% Real Estate 0.36% Asset Allocation

Asset Class Value Cash 1.15% Equity 98.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | HDFCBANK9% ₹3,792 Cr 38,252,638 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 05 | 5321749% ₹3,655 Cr 27,215,474 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 20 | BHARTIARTL6% ₹2,510 Cr 11,921,785 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 06 | RELIANCE6% ₹2,473 Cr 15,750,234 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | KOTAKBANK4% ₹1,795 Cr 8,153,010 Titan Co Ltd (Consumer Cyclical)

Equity, Since 28 Feb 23 | TITAN4% ₹1,670 Cr 4,121,802 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 07 | 5322153% ₹1,360 Cr 10,711,912 Infosys Ltd (Technology)

Equity, Since 31 Aug 04 | INFY3% ₹1,279 Cr 7,916,403

↓ -697,415 Ambuja Cements Ltd (Basic Materials)

Equity, Since 31 Jul 16 | 5004253% ₹1,240 Cr 22,293,419 Torrent Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 25 | TORNTPHARM3% ₹1,225 Cr 3,180,904 8. BNP Paribas Large Cap Fund

BNP Paribas Large Cap Fund

Growth Launch Date 23 Sep 04 NAV (13 Feb 26) ₹223.48 ↓ -2.74 (-1.21 %) Net Assets (Cr) ₹2,702 on 31 Dec 25 Category Equity - Large Cap AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.02 Sharpe Ratio -0.06 Information Ratio 0.47 Alpha Ratio -5.54 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,531 31 Jan 23 ₹12,764 31 Jan 24 ₹16,668 31 Jan 25 ₹18,725 31 Jan 26 ₹19,839 Returns for BNP Paribas Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.2% 3 Month -0.5% 6 Month 2.9% 1 Year 10.2% 3 Year 16% 5 Year 12.7% 10 Year 15 Year Since launch 15.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.4% 2023 20.1% 2022 24.8% 2021 4.2% 2020 22.1% 2019 16.8% 2018 17.2% 2017 -4% 2016 37% 2015 -5.5% Fund Manager information for BNP Paribas Large Cap Fund

Name Since Tenure Jitendra Sriram 16 Jun 22 3.55 Yr. Kushant Arora 21 Oct 24 1.2 Yr. Data below for BNP Paribas Large Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 29.3% Consumer Cyclical 12.19% Industrials 11.39% Technology 9.65% Energy 7.74% Consumer Defensive 7.16% Health Care 5.98% Basic Materials 4.94% Communication Services 4.28% Utility 3.82% Asset Allocation

Asset Class Value Cash 2.05% Equity 97.41% Debt 0.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK8% ₹209 Cr 2,106,000

↓ -54,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Sep 17 | RELIANCE7% ₹178 Cr 1,134,000

↓ -54,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 12 | 5321746% ₹169 Cr 1,260,000

↓ -90,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT4% ₹121 Cr 297,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 29 Feb 08 | BHARTIARTL4% ₹116 Cr 549,000

↓ -18,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | INFY3% ₹84 Cr 522,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | KOTAKBANK3% ₹81 Cr 369,000

↓ -81,000 Hitachi Energy India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Aug 23 | POWERINDIA3% ₹79 Cr 43,200

↓ -900 State Bank of India (Financial Services)

Equity, Since 31 Jul 20 | SBIN3% ₹72 Cr 729,000

↓ -36,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 18 | TCS2% ₹63 Cr 198,000 9. Aditya Birla Sun Life Frontline Equity Fund

Aditya Birla Sun Life Frontline Equity Fund

Growth Launch Date 30 Aug 02 NAV (13 Feb 26) ₹534.27 ↓ -6.08 (-1.13 %) Net Assets (Cr) ₹31,386 on 31 Dec 25 Category Equity - Large Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.65 Sharpe Ratio 0.31 Information Ratio 0.58 Alpha Ratio -0.7 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,006 31 Jan 23 ₹13,141 31 Jan 24 ₹16,714 31 Jan 25 ₹18,683 31 Jan 26 ₹20,294 Returns for Aditya Birla Sun Life Frontline Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -1.2% 3 Month -1.7% 6 Month 2.7% 1 Year 11.9% 3 Year 15.6% 5 Year 13.1% 10 Year 15 Year Since launch 18.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.4% 2023 15.6% 2022 23.1% 2021 3.5% 2020 27.9% 2019 14.2% 2018 7.6% 2017 -2.9% 2016 30.6% 2015 7.4% Fund Manager information for Aditya Birla Sun Life Frontline Equity Fund

Name Since Tenure Harish Krishnan 8 Jan 26 0 Yr. Data below for Aditya Birla Sun Life Frontline Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.01% Consumer Cyclical 13.75% Technology 9.69% Industrials 7.7% Consumer Defensive 7.4% Energy 5.64% Health Care 5.09% Basic Materials 4.88% Communication Services 4.77% Utility 2.31% Real Estate 1.19% Asset Allocation

Asset Class Value Cash 1.18% Equity 98.7% Debt 0.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK8% ₹2,436 Cr 24,579,704 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321747% ₹2,195 Cr 16,348,292 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE5% ₹1,616 Cr 10,288,650 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY5% ₹1,614 Cr 9,990,550

↓ -880,143 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 08 | LT4% ₹1,285 Cr 3,145,715

↓ -135,740 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 17 | BHARTIARTL4% ₹1,187 Cr 5,637,535 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 13 | 5322154% ₹1,171 Cr 9,220,970 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Apr 15 | KOTAKBANK4% ₹1,166 Cr 5,297,703 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | M&M4% ₹1,124 Cr 3,031,152 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN3% ₹999 Cr 10,175,538 10. Kotak Bluechip Fund

Kotak Bluechip Fund

Growth Launch Date 29 Dec 98 NAV (13 Feb 26) ₹587.437 ↓ -6.40 (-1.08 %) Net Assets (Cr) ₹11,087 on 31 Dec 25 Category Equity - Large Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.75 Sharpe Ratio 0.25 Information Ratio 0.46 Alpha Ratio -1.48 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-18 Months (1%),18 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,876 31 Jan 23 ₹13,033 31 Jan 24 ₹16,325 31 Jan 25 ₹18,386 31 Jan 26 ₹20,023 Returns for Kotak Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.2% 3 Month -0.8% 6 Month 4.1% 1 Year 13.1% 3 Year 15.5% 5 Year 12.9% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.7% 2023 16.2% 2022 22.9% 2021 2% 2020 27.7% 2019 16.4% 2018 14.2% 2017 -2.1% 2016 29.2% 2015 2.9% Fund Manager information for Kotak Bluechip Fund

Name Since Tenure Rohit Tandon 22 Jan 24 1.95 Yr. Data below for Kotak Bluechip Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 29.96% Consumer Cyclical 12.94% Technology 9.89% Industrials 8.65% Energy 8.39% Basic Materials 7.61% Consumer Defensive 7.27% Health Care 4.65% Communication Services 3.9% Utility 2.9% Real Estate 0.87% Asset Allocation

Asset Class Value Cash 2.81% Equity 97.19% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | HDFCBANK8% ₹851 Cr 8,581,297 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321747% ₹768 Cr 5,722,505 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 06 | RELIANCE7% ₹757 Cr 4,817,416 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 12 | LT4% ₹445 Cr 1,089,221

↑ 12,472 Infosys Ltd (Technology)

Equity, Since 31 Oct 04 | INFY4% ₹434 Cr 2,689,216

↓ -28,916 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL4% ₹418 Cr 1,983,050 State Bank of India (Financial Services)

Equity, Since 30 Jun 21 | SBIN4% ₹397 Cr 4,043,439

↓ -136,307 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 13 | 5322153% ₹352 Cr 2,770,625 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 20 | M&M3% ₹325 Cr 876,422 ITC Ltd (Consumer Defensive)

Equity, Since 30 Jun 06 | ITC3% ₹312 Cr 7,736,205

↑ 122,654 11. TATA Large Cap Fund

TATA Large Cap Fund

Growth Launch Date 7 May 98 NAV (13 Feb 26) ₹515.997 ↓ -6.42 (-1.23 %) Net Assets (Cr) ₹2,840 on 31 Dec 25 Category Equity - Large Cap AMC Tata Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.05 Sharpe Ratio 0.3 Information Ratio 0.3 Alpha Ratio -0.83 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,435 31 Jan 23 ₹13,424 31 Jan 24 ₹17,311 31 Jan 25 ₹19,044 31 Jan 26 ₹20,550 Returns for TATA Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -0.1% 3 Month -0.8% 6 Month 5.6% 1 Year 11% 3 Year 15.4% 5 Year 12.9% 10 Year 15 Year Since launch 18.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.2% 2023 12.9% 2022 24.5% 2021 3.3% 2020 32.7% 2019 8.3% 2018 12.1% 2017 -3.6% 2016 29.5% 2015 2.9% Fund Manager information for TATA Large Cap Fund

Name Since Tenure Abhinav Sharma 5 Apr 23 2.74 Yr. Hasmukh Vishariya 1 Mar 25 0.84 Yr. Data below for TATA Large Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.49% Consumer Cyclical 16.12% Technology 10.2% Basic Materials 8.23% Industrials 8.1% Energy 5.81% Consumer Defensive 5.73% Utility 4.41% Communication Services 3.52% Health Care 1.12% Asset Allocation

Asset Class Value Cash 3.13% Equity 96.87% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK9% ₹255 Cr 2,571,900 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE6% ₹165 Cr 1,050,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 16 | KOTAKBANK5% ₹132 Cr 599,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 18 | 5322154% ₹117 Cr 920,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 11 | 5321744% ₹116 Cr 865,300 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 20 | LT4% ₹111 Cr 270,784 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY4% ₹110 Cr 678,248

↓ -59,752 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 May 25 | MARUTI4% ₹109 Cr 65,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 23 | M&M4% ₹101 Cr 272,000

↓ -20,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jul 18 | TCS3% ₹97 Cr 301,873

શા માટે શ્રેષ્ઠ લાર્જ કેપ મ્યુચ્યુઅલ ફંડમાં રોકાણ કરવું

1. સ્થિર રોકાણ

મોટી કંપનીઓ સારી રીતે સ્થાપિત છે જેનો અર્થ છે કે તેઓ વધુ સુસંગત છેઆવક. લાર્જ કેપ ફંડ એવી કંપનીઓમાં રોકાણ કરે છે જે મોટી હોય, ઘણા વર્ષોથી હોય, સ્થિર કાર્યબળ હોય અને આવક પેદા કરતી પ્રોડક્ટ/સેવા સ્થાપિત કરે. એટલા માટે લાર્જ કેપ શેરોનો સૌથી મોટો ફાયદો એ છે કે તેઓ પ્રદાન કરે છે તે સ્થિરતા. આ લાર્જ કેપ મ્યુચ્યુઅલ ફંડના પોર્ટફોલિયોમાં પ્રતિબિંબિત થાય છે અને તેનાનથી પણ

2. સ્થિર વળતર

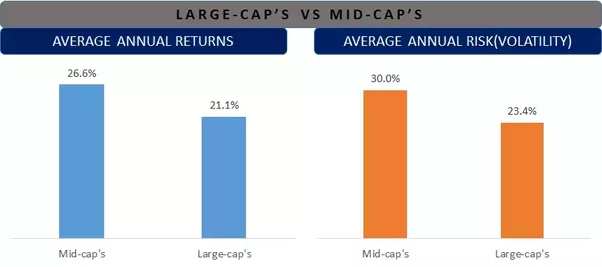

લાંબા ગાળામાં, જો કે લાર્જ-કેપ ફંડ્સમાં મિડ- અને સ્મોલ-કેપ ફંડ્સ કરતાં ઓછું વળતર હોય છે, લાર્જ-કેપમાં વળતર વધુ સ્થિર હોય છે. મિડ-કેપ્સમાં વોલેટિલિટી ઘણી વધારે હોય છે અને લાર્જ કેપ્સ કરતાં મિડ-કેપ્સમાં નુકસાનનો સમયગાળો વધુ જોવા મળે છે. એક તરીકેરોકાણકાર જો કોઈ ઈક્વિટીમાં રોકાણ કરવા ઈચ્છે છે, તો લાર્જ કેપ મ્યુચ્યુઅલ ફંડમાં રોકાણ એ એક પ્રારંભિક બિંદુ હોઈ શકે છે.

3. ઓછી અસ્થિર

લાર્જ કેપ ફંડ્સ મિડ- અને સ્મોલ-કેપ ફંડ્સ કરતાં ઓછા અસ્થિર હોય છે. ઐતિહાસિક માહિતી દ્વારા પણ આ સાબિત થયું છે. નીચેની છબી લાર્જ કેપના છેલ્લા 15 વર્ષના સરેરાશ વાર્ષિક વળતરનું વિશ્લેષણ ધરાવે છે. આ લાર્જ-કેપ અને BSE માટે પ્રોક્સી તરીકે BSE સેન્સેક્સનો ઉપયોગ કરીને કરવામાં આવે છેમિડ-કેપ મિડ-કેપ્સ માટે.

4. સાધારણ ઉચ્ચ-જોખમ

મોટી કંપનીઓમાં રોકાણ કરવામાં આવતું હોવાથી, આ ફંડ્સમાં મિડ- અને સ્મોલ-કેપ ફંડ્સની સરખામણીમાં ઓછું જોખમ હોય છે. પરંતુ, ઇક્વિટી ટૂંકા ગાળામાં નુકસાન તરફ દોરી શકે છે. તેથી, વ્યક્તિએ નુકસાન જોવા માટે તૈયાર રહેવું જોઈએ અને તેના પર ઊંઘ ન ગુમાવવી જોઈએ. જો કોઈ વ્યક્તિ પાસે હોલ્ડિંગનો સમયગાળો લાંબો હોય (ઓછામાં ઓછા 5 વર્ષથી વધુ) અને રોકાણની કેટલીક મૂળભૂત બાબતોનું પાલન કરે, તો વ્યક્તિ સારો નફો કરી શકે છે.

શ્રેષ્ઠ લાર્જ કેપ ફંડમાં ઓનલાઈન કેવી રીતે રોકાણ કરવું?

Fincash.com પર આજીવન માટે મફત રોકાણ ખાતું ખોલો

તમારી નોંધણી અને KYC પ્રક્રિયા પૂર્ણ કરો

દસ્તાવેજો અપલોડ કરો (PAN, આધાર, વગેરે).અને, તમે રોકાણ કરવા માટે તૈયાર છો!

નિષ્કર્ષ

લાર્જ કેપ ફંડ્સ મોટી માર્કેટ કેપિટલાઇઝેશન ધરાવતી કંપનીઓમાં રોકાણ કરે છે, તેથી આ કંપનીઓ પાસે ખરાબ બજારો અને આર્થિક ચક્રમાં ટકી રહેવાનું કદ અને માપ છે. તેથી, તમામ ઇક્વિટી મ્યુચ્યુઅલ ફંડ કેટેગરીમાં લાર્જ કેપ્સમાં રોકાણને સૌથી સુરક્ષિત ગણવામાં આવે છે. જો કે, એક હંમેશા યાદ રાખવું જોઈએ કેઅંતર્ગત રોકાણ એ ઇક્વિટી છે અને તેમાં જોખમો છે. જ્યારે લાર્જ કેપ્સના જોખમો પ્રમાણમાં ઓછા હોય છે, ત્યારે વળતર પણ સ્થિર રહેશે અને તેજીના બજારના તબક્કા દરમિયાન અપવાદરૂપ વળતર નહીં. રોકાણકારો કે જેઓ ચોક્કસ જોખમ સાથે મધ્યમ છતાં ટકાઉ વળતર પસંદ કરે છે; શ્રેષ્ઠ લાર્જ કેપ ફંડમાં રોકાણ કરી શકો છો!

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.

Superb. Gave very depth information.

Very good and give us about best largecap fund somtimes