How to Add Biller for SIP transactions in Punjab National Bank?

In SIP or Systematic Investment plan individuals deposit small amounts in Mutual Fund schemes at fixed intervals. Since the money is deducted at regular intervals, individuals can ease out the payment process by adding billers to their Bank account. To add biller for SIP transactions, individuals need to have Unique Registration Number or URN of the SIP transaction. Individuals get this number once they make the first SIP payments. The process of biller addition is different for each bank. So, let us understand the process of biller addition for SIP transactions in Punjab National Bank. These steps are explained below with the help of mobile banking.

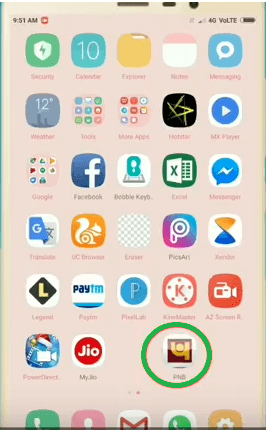

Open Your PNB Mobile Application

The first step in the process of login is to enter the PNB Mobile application on your mobile. The image for this step is given below where the icon of PNB Mobile application is highlighted in Green.

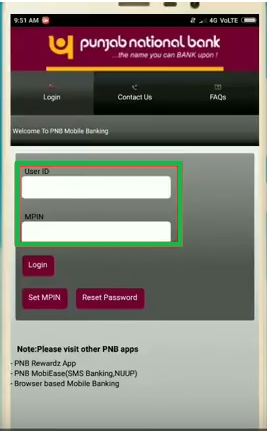

Login into Your Account by Entering User ID and MPIN

Once you click on the PNB application, a new screen opens. In this screen, you need to enter your User ID and MPIN. The image for this step is given below where the User ID and MPIN blocks are highlighted in Green.

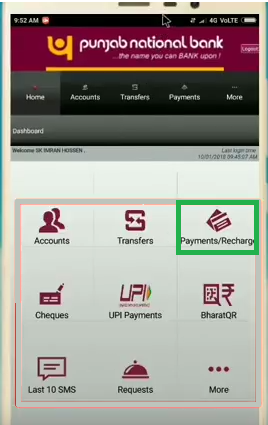

Select Payments Recharge in the Home Screen

Once you log in with your User ID and MPIN, on the home screen, you need to click on the Payments/Recharge option. The image for this step is given below the Payments/Recharge tab is highlighted in Green.

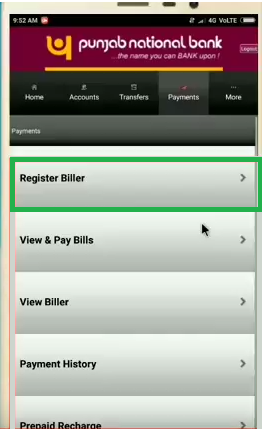

Click on Register Biller

This is the fourth step in the biller addition process. Once you click on Payments/Recharge, a new tab opens in which there are various options such a Register Biller, View & Pay Bills, View Biller, and so on. In this step, you need to click on Register Biller option. The image for this step is as follows where the Register Biller option is highlighted in Green.

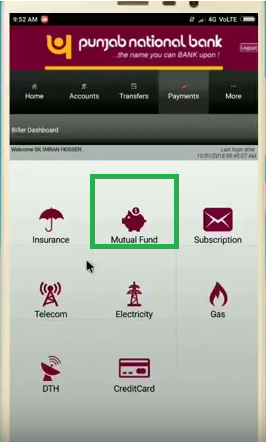

Click on Mutual Fund Option

Once you click on Register Biller, a new screen opens up that shows the various billers that can be added. Some of the options include insurance, Subscription, Telecom, and so on. Here, you need to select the Mutual Fund option. The image for this step is as follows where the Mutual Fund option is highlighted in Green.

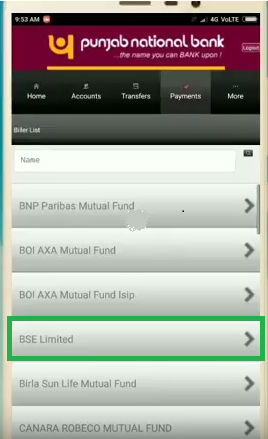

Select BSE Limited

Once you click on Mutual Fund in the previous step, you are redirected to a new screen where there are a lot of options wherein; you need to select BSE Limited. The image for this step is as follows where BSE Limited is highlighted in Green.

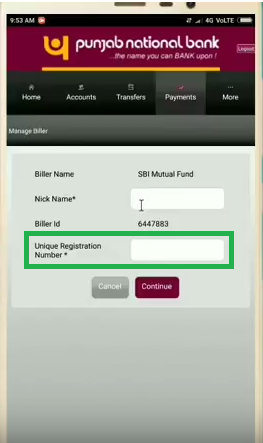

Enter URN and Nickname

In this step, you need to enter the Unique Registration Number or URN of the SIP transaction along with the nickname. This URN number is the one you receive in your email from Fincash. If you don’t receive the URN; then you can get the same by logging onto your fincash account and visiting My SIPs Section. Once you enter the details, you need to click on Continue. The image for this step is as follows where the URN Number box is highlighted in Green.

Once you click on continue, in the new screen you need to add the details related to the Auto pay options wherein; you need to select for auto pay. Then you need to enter the OTP that you receive on your registered mobile number. Once you enter the OTP, the biller addition process gets confirmed.

Thus, from the above steps, we can say that the process of biller addition in Punjab National Bank is easy.

Fund Selection Methodology used to find 5 funds

Best SIPs to Invest to Earn Better Returns

Here are some of the recommend SIPs as per 5 year returns and AUM of more than INR 500 Cr:

| Fund | NAV | Net Assets (Cr) | Min SIP Investment | 3 MO (%) | 6 MO (%) | 1 YR (%) | 3 YR (%) | 5 YR (%) | 2024 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| DSP World Gold Fund Growth | ₹68.0473 ↑ 1.76 | ₹1,975 | 500 | 47 | 92.8 | 185.5 | 64.9 | 31.2 | ||

| SBI PSU Fund Growth | ₹37.3026 ↑ 0.21 | ₹5,980 | 500 | 9.9 | 22 | 36.3 | 36.2 | 28.1 | ||

| ICICI Prudential Infrastructure Fund Growth | ₹198.41 ↑ 0.24 | ₹8,077 | 100 | 0 | 3.5 | 18.8 | 26 | 26.4 | ||

| SBI Gold Fund Growth | ₹46.0569 ↓ -0.38 | ₹15,024 | 500 | 25.4 | 55.9 | 79.2 | 39.6 | 26.3 | ||

| Aditya Birla Sun Life Gold Fund Growth | ₹45.6376 ↓ -0.44 | ₹1,781 | 100 | 24.8 | 55.3 | 78.7 | 39 | 26.2 | ||

| Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 25 Feb 26 | ||||||||||

Research Highlights & Commentary of 5 Funds showcased

| Commentary | DSP World Gold Fund | SBI PSU Fund | ICICI Prudential Infrastructure Fund | SBI Gold Fund | Aditya Birla Sun Life Gold Fund |

|---|---|---|---|---|---|

| Point 1 | Bottom quartile AUM (₹1,975 Cr). | Lower mid AUM (₹5,980 Cr). | Upper mid AUM (₹8,077 Cr). | Highest AUM (₹15,024 Cr). | Bottom quartile AUM (₹1,781 Cr). |

| Point 2 | Established history (18+ yrs). | Established history (15+ yrs). | Oldest track record among peers (20 yrs). | Established history (14+ yrs). | Established history (13+ yrs). |

| Point 3 | Top rated. | Rating: 2★ (bottom quartile). | Rating: 3★ (upper mid). | Rating: 2★ (bottom quartile). | Rating: 3★ (lower mid). |

| Point 4 | Risk profile: High. | Risk profile: High. | Risk profile: High. | Risk profile: Moderately High. | Risk profile: Moderately High. |

| Point 5 | 5Y return: 31.22% (top quartile). | 5Y return: 28.11% (upper mid). | 5Y return: 26.41% (lower mid). | 5Y return: 26.34% (bottom quartile). | 5Y return: 26.18% (bottom quartile). |

| Point 6 | 3Y return: 64.89% (top quartile). | 3Y return: 36.23% (bottom quartile). | 3Y return: 25.96% (bottom quartile). | 3Y return: 39.60% (upper mid). | 3Y return: 39.00% (lower mid). |

| Point 7 | 1Y return: 185.52% (top quartile). | 1Y return: 36.28% (bottom quartile). | 1Y return: 18.76% (bottom quartile). | 1Y return: 79.22% (upper mid). | 1Y return: 78.69% (lower mid). |

| Point 8 | Alpha: 2.12 (top quartile). | Alpha: 0.05 (upper mid). | Alpha: 0.00 (lower mid). | 1M return: 2.48% (bottom quartile). | 1M return: 2.10% (bottom quartile). |

| Point 9 | Sharpe: 3.41 (top quartile). | Sharpe: 0.63 (bottom quartile). | Sharpe: 0.15 (bottom quartile). | Alpha: 0.00 (bottom quartile). | Alpha: 0.00 (bottom quartile). |

| Point 10 | Information ratio: -0.47 (bottom quartile). | Information ratio: -0.63 (bottom quartile). | Information ratio: 0.00 (top quartile). | Sharpe: 3.25 (upper mid). | Sharpe: 3.08 (lower mid). |

DSP World Gold Fund

- Bottom quartile AUM (₹1,975 Cr).

- Established history (18+ yrs).

- Top rated.

- Risk profile: High.

- 5Y return: 31.22% (top quartile).

- 3Y return: 64.89% (top quartile).

- 1Y return: 185.52% (top quartile).

- Alpha: 2.12 (top quartile).

- Sharpe: 3.41 (top quartile).

- Information ratio: -0.47 (bottom quartile).

SBI PSU Fund

- Lower mid AUM (₹5,980 Cr).

- Established history (15+ yrs).

- Rating: 2★ (bottom quartile).

- Risk profile: High.

- 5Y return: 28.11% (upper mid).

- 3Y return: 36.23% (bottom quartile).

- 1Y return: 36.28% (bottom quartile).

- Alpha: 0.05 (upper mid).

- Sharpe: 0.63 (bottom quartile).

- Information ratio: -0.63 (bottom quartile).

ICICI Prudential Infrastructure Fund

- Upper mid AUM (₹8,077 Cr).

- Oldest track record among peers (20 yrs).

- Rating: 3★ (upper mid).

- Risk profile: High.

- 5Y return: 26.41% (lower mid).

- 3Y return: 25.96% (bottom quartile).

- 1Y return: 18.76% (bottom quartile).

- Alpha: 0.00 (lower mid).

- Sharpe: 0.15 (bottom quartile).

- Information ratio: 0.00 (top quartile).

SBI Gold Fund

- Highest AUM (₹15,024 Cr).

- Established history (14+ yrs).

- Rating: 2★ (bottom quartile).

- Risk profile: Moderately High.

- 5Y return: 26.34% (bottom quartile).

- 3Y return: 39.60% (upper mid).

- 1Y return: 79.22% (upper mid).

- 1M return: 2.48% (bottom quartile).

- Alpha: 0.00 (bottom quartile).

- Sharpe: 3.25 (upper mid).

Aditya Birla Sun Life Gold Fund

- Bottom quartile AUM (₹1,781 Cr).

- Established history (13+ yrs).

- Rating: 3★ (lower mid).

- Risk profile: Moderately High.

- 5Y return: 26.18% (bottom quartile).

- 3Y return: 39.00% (lower mid).

- 1Y return: 78.69% (lower mid).

- 1M return: 2.10% (bottom quartile).

- Alpha: 0.00 (bottom quartile).

- Sharpe: 3.08 (lower mid).

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.