How to Add Biller for SIP Transactions in IndusInd Bank?

SIP or Systematic Investment plan is an investment mode in Mutual Fund through which individuals deposit small amounts at regular intervals. One of the important points that individuals should understand here is, the amounts get deducted at regular intervals. As a consequence, to make sure that the entire SIP investment process takes place smoothly; individuals can add biller to their Bank accounts. For adding biller in the bank accounts, individuals require the Unique Registration Number or URN of the SIP which needs to be added to the bank account either through net banking or mobile banking process. The process of adding biller for each bank is different. So, let us check the process of adding biller for SIP transactions in IndusInd Bank.

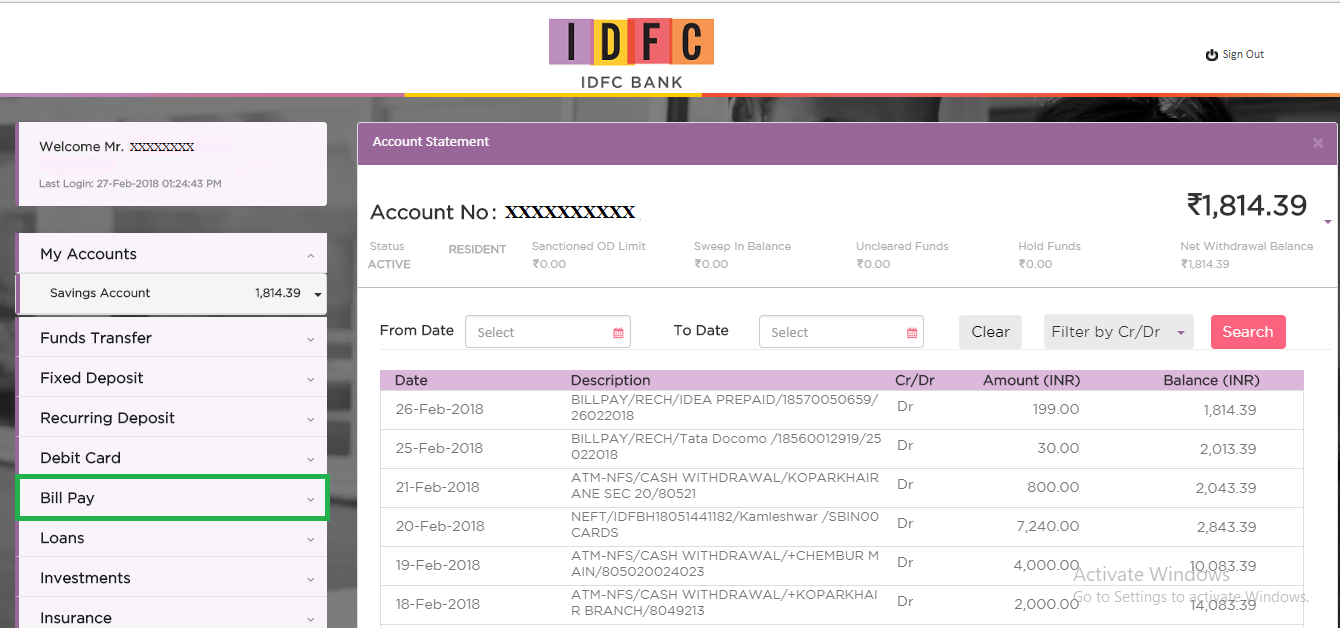

Login to Your IndusInd Bank Account & Click on Bill Pay Option

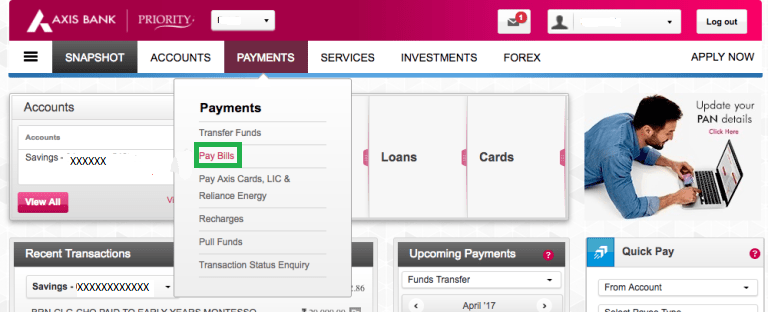

The first step is almost similar in most of the banks in which individuals need to log into their bank accounts. Even in this case, you first need to log into your account using your login credentials. After logging in, once you reach the home screen, you need to click on Bill Payments tab which is on the top of the screen. The image for this step is given below where Bill Payments tab is highlighted in Green.

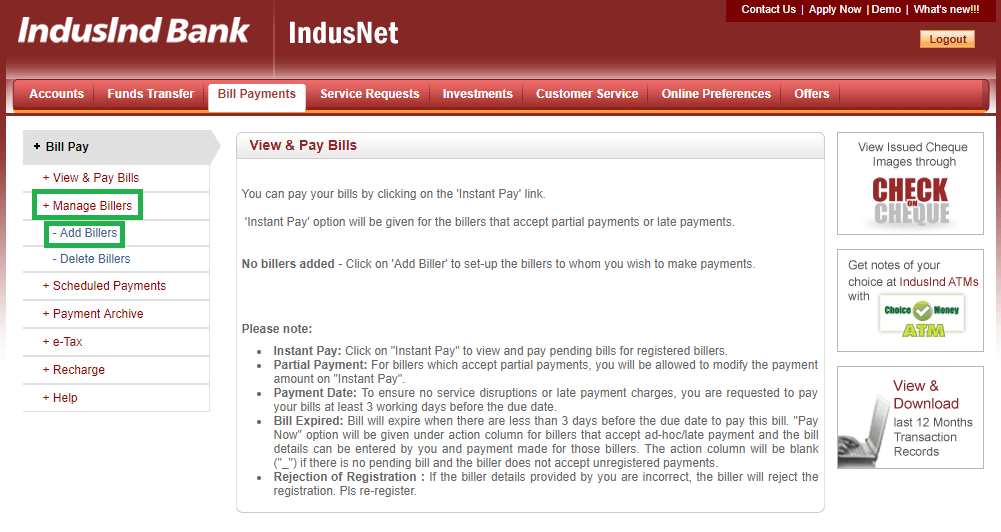

Click on Manage Biller Tab & Select Add Biller Option

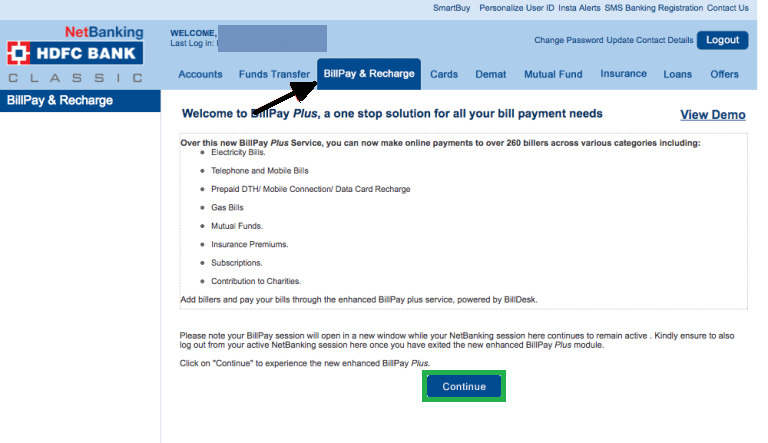

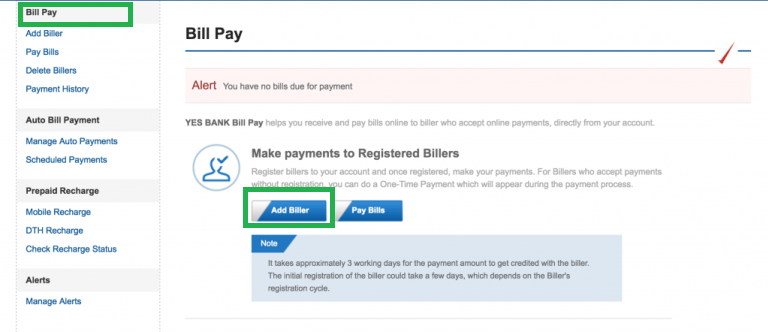

Once you click on Bill Payments, a new screen opens. In this screen, you need to click on the Manage Billers tab which is on the left side of the screen. Once, you click on Manage Biller option, the tab expands and in that tab, you need to click on Add Billers option. The image for this step is given below where Manage Billers and Add Billers option is highlighted in Green.

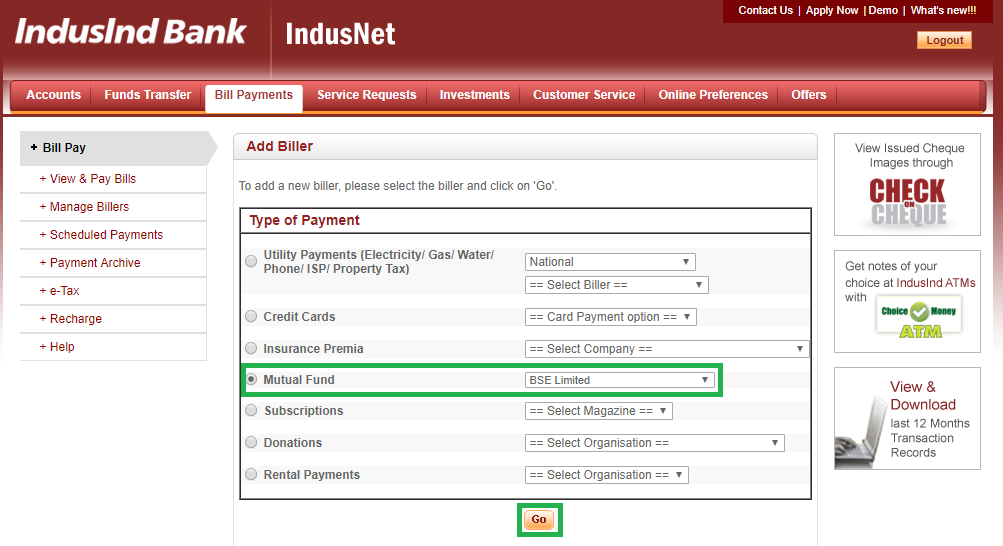

Click on Mutual Fund Option & Select BSE Limited

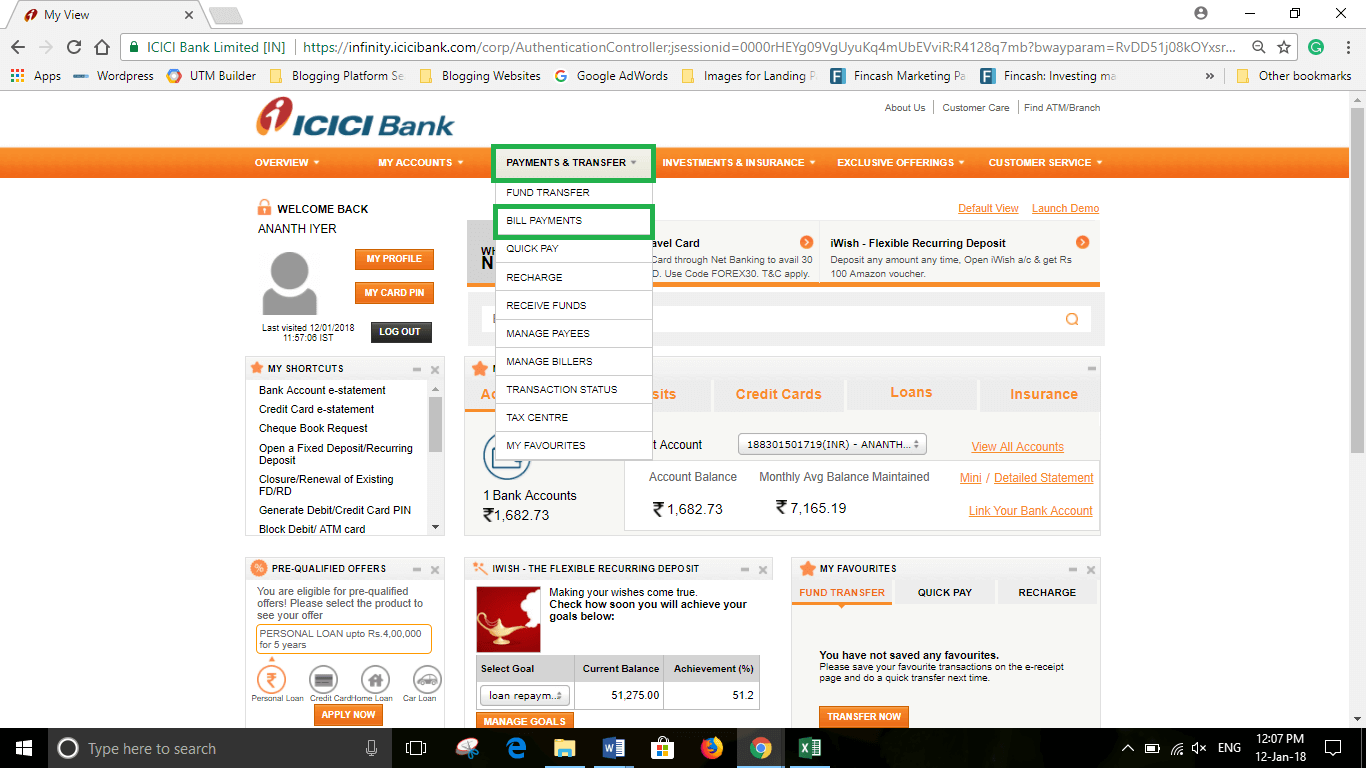

Once you click on Add Biller in the previous step, you will be redirected to a new screen which shows as Type of Payment. In this section, there are various options such as Utility Payments, credit cards, insurance Premia, and much more. In this section, you need to click on the Mutual Fund option and select BSE Limited in the drop down next to it. After selecting BSE Limited option you need to click on Go option. The image for this step is given below where the Mutual Fund, BSE Limited, and Go Button are highlighted in Green.

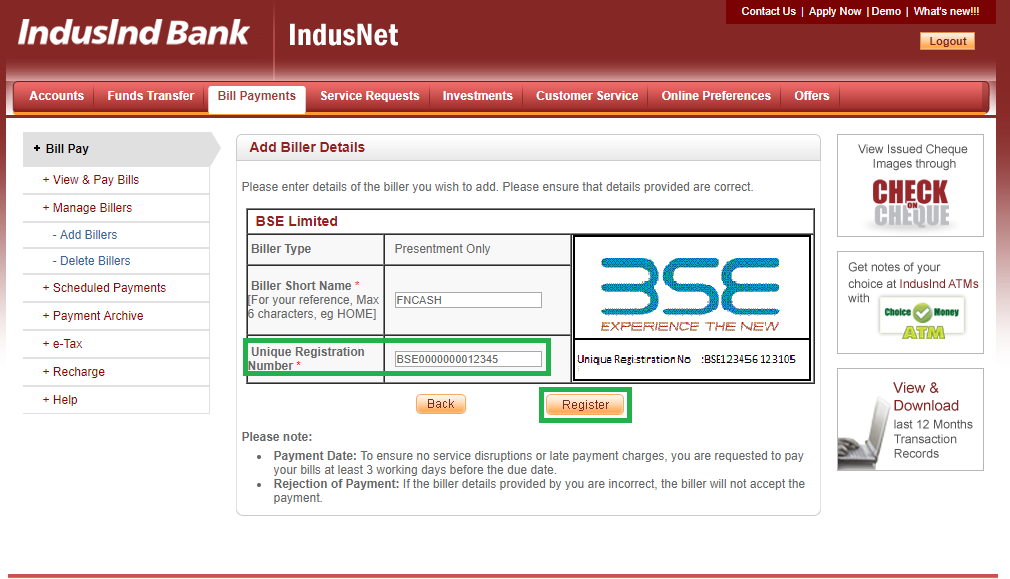

Enter URN Details

This is the important step in the add biller process. Once you click on Go, in this step, you are redirected to a new screen, in which you need to enter your URN and other details. You will receive this URN number for your SIP through email from Fincash once you make the initial payment. If you do not receive it then you can find the same from the My SIPs section of your Fincash Account. After getting the URN, you need to enter the same here and add other details. After entering the details, you need to click on Register option. The image for this step is given below where the URN details and Register button both are highlighted in Green.

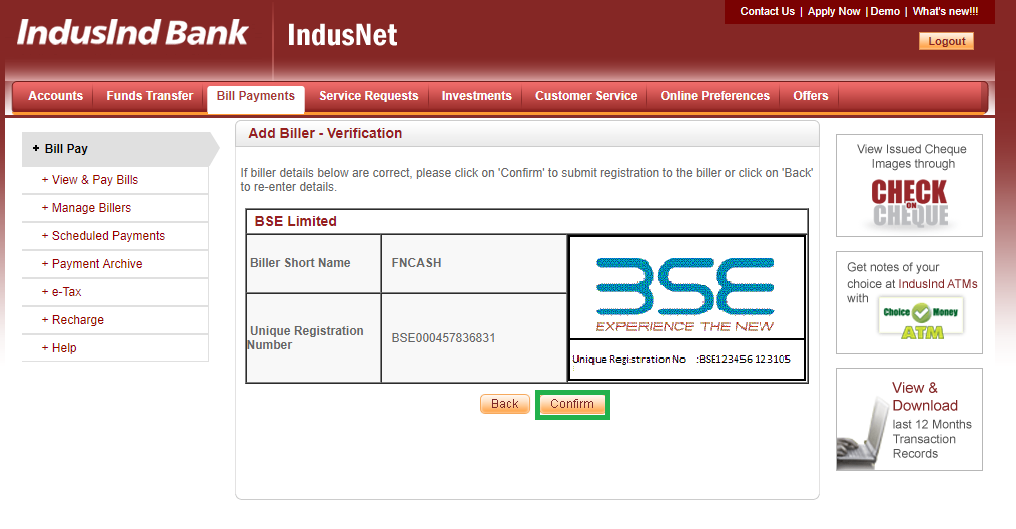

Summary Confirmation

Once you click on Register in the previous step, a new screen opens up in which you can see the summary of your details entered. In this step, you need to verify whether the details entered are correct or not. Once you verify with the details, then you need to click on Confirm. The image for this step is given below where the Confirm button is highlighted in Green.

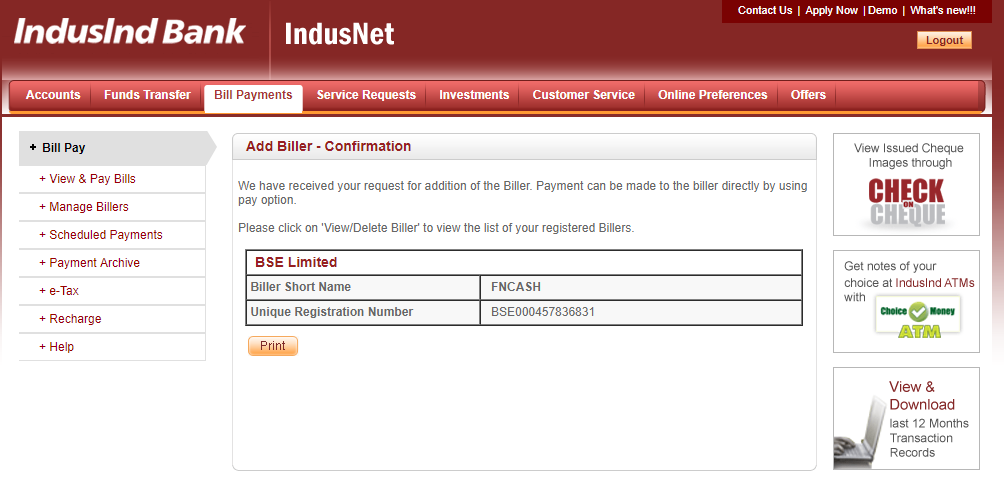

Biller Confirmation

In this step, you receive the biller confirmation stating that your biller has been added successfully. The image for this step is given below.

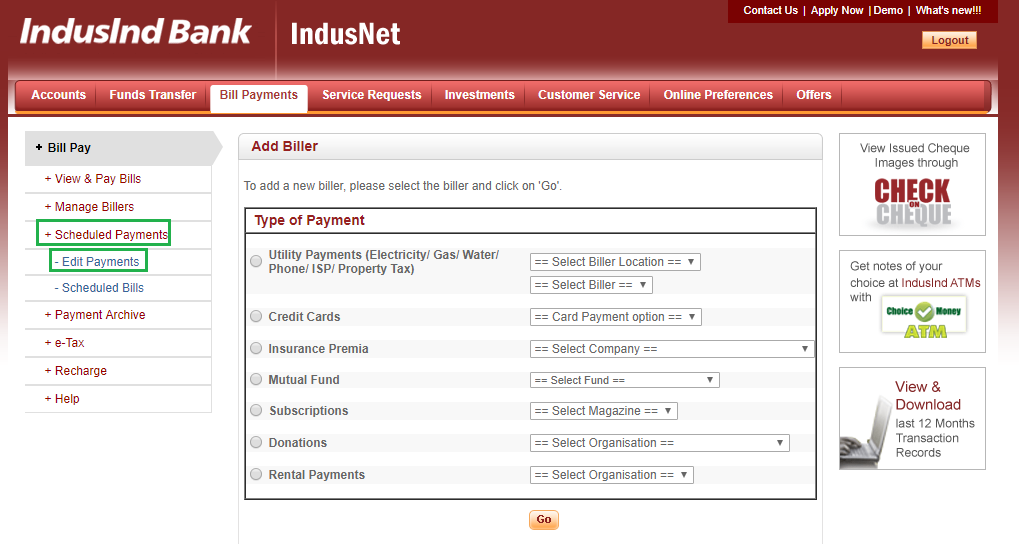

Click on Schedule Payments & Select Edit Payments

Your process of adding biller doesn’t stop just by adding biller. Once you successfully add biller, then you need to click on the Schedule Payments tab which is on the left side of the screen. Once you click, on it the tab expands and shows multiple options under it. Here, you need to click on Edit Payments option. The image for this step is given below where the Schedule Payments tab and Edit Payments option both are highlighted in Green.

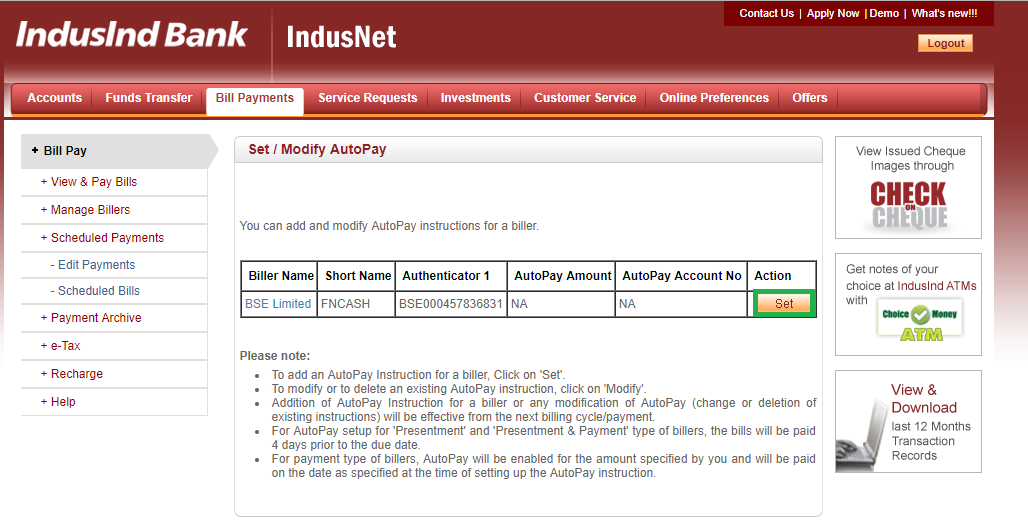

Click Set Option in Modify AutoPay Screen

Once you click on Edit Payments, a new screen opens up in which you can see the Mutual Fund Biller added. You can also see the URN of the SIP against the biller. Here, you need to click on Set option against the Mutual Fund Biller. The image for this step is given below where the Set option is highlighted in Green.

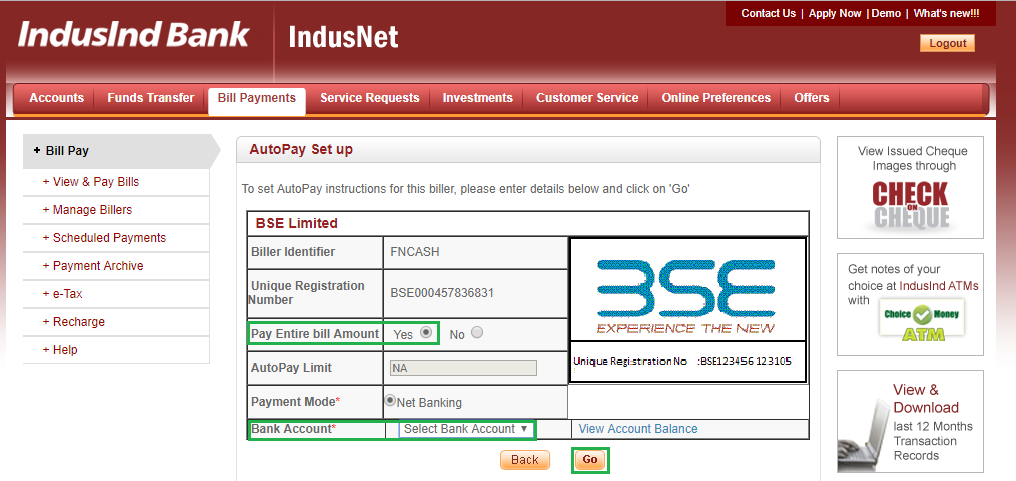

Enter Payments Details & Click on Go

In this step, you need to enter the payment details. Once you click on Set in the previous step, a new screen opens in which you need to enter the payment details. Here, against thePay Entire Bill Amount option, you need to select Yes option. Then you need to select the Payment Mode as Net Banking. Moreover, you need to select the bank account number from which you wish to make the payments. After entering all the details, you need to click on Go button which is at the bottom of the screen. The image for this step is given below where the Pay Entire Bill Amount option, Bank Account tab and Go button are highlighted in Green.

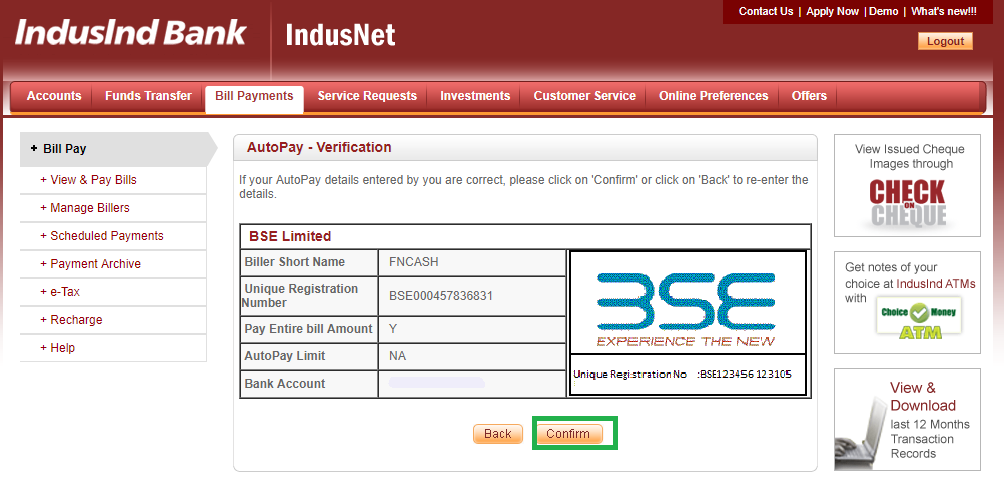

Verification of Payment Details

Once you enter the payment details and click on Go, you are redirected to a new screen in which you can verify all the details that you have entered. If you find all the details are entered correctly, then you can click on Confirm. If not, then click on Back so that you can edit the relevant details. The image for this step is given below where the Confirm button is highlighted in Green.

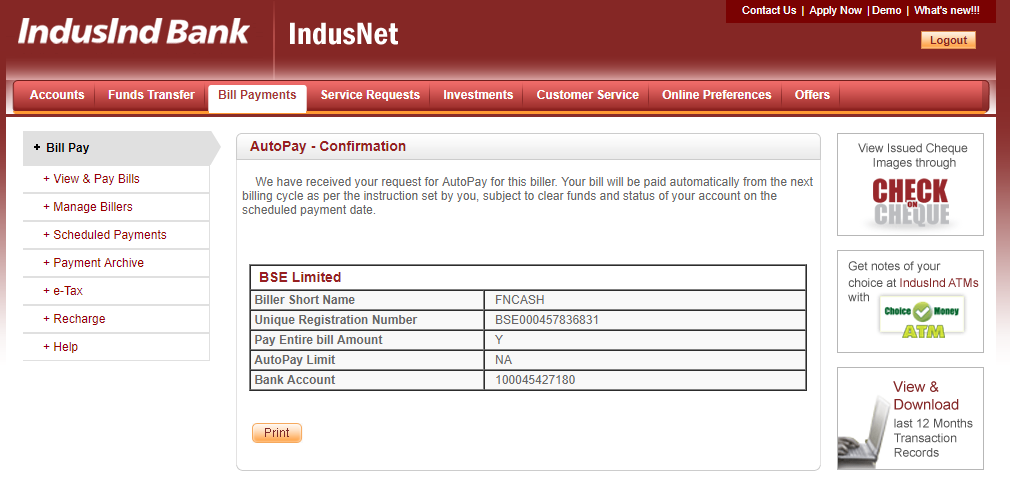

Confirmation of AutoPay Details

In this step, you get a confirmation about the AutoPay status. The image for this step is given below.

Thus, from the above steps, it can be said that the process of adding biller for SIP transactions in IndusInd Bank is not difficult. By adding it, individuals can ensure that their SIP deductions take place in a timely manner. They just need to ensure that they have enough balance in their bank account.

Fund Selection Methodology used to find 5 funds

Best SIPs to Invest to Earn Better Returns

Here are some of the recommend SIPs as per 5 year returns and AUM of more than INR 500 Cr

| Fund | NAV | Net Assets (Cr) | Min SIP Investment | 3 MO (%) | 6 MO (%) | 1 YR (%) | 3 YR (%) | 5 YR (%) | 2024 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| DSP World Gold Fund Growth | ₹62.6234 ↑ 2.23 | ₹1,975 | 500 | 39.2 | 84.2 | 156.2 | 58.2 | 29.3 | 167.1 | |

| SBI PSU Fund Growth | ₹36.2959 ↓ -0.41 | ₹5,980 | 500 | 6.6 | 15.7 | 30.7 | 33.8 | 27.7 | 11.3 | |

| ICICI Prudential Infrastructure Fund Growth | ₹196.22 ↓ -2.38 | ₹8,077 | 100 | -1 | 0.7 | 15.8 | 24.9 | 26.5 | 6.7 | |

| Invesco India PSU Equity Fund Growth | ₹67.82 ↓ -1.04 | ₹1,492 | 500 | 1.8 | 9.3 | 29.3 | 31.5 | 25.8 | 10.3 | |

| Axis Gold Fund Growth | ₹44.5747 ↑ 0.96 | ₹2,835 | 1,000 | 24.3 | 54.2 | 73.8 | 37.9 | 25.6 | 69.8 | |

| Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 | ||||||||||

Research Highlights & Commentary of 5 Funds showcased

| Commentary | DSP World Gold Fund | SBI PSU Fund | ICICI Prudential Infrastructure Fund | Invesco India PSU Equity Fund | Axis Gold Fund |

|---|---|---|---|---|---|

| Point 1 | Bottom quartile AUM (₹1,975 Cr). | Upper mid AUM (₹5,980 Cr). | Highest AUM (₹8,077 Cr). | Bottom quartile AUM (₹1,492 Cr). | Lower mid AUM (₹2,835 Cr). |

| Point 2 | Established history (18+ yrs). | Established history (15+ yrs). | Oldest track record among peers (20 yrs). | Established history (16+ yrs). | Established history (14+ yrs). |

| Point 3 | Top rated. | Rating: 2★ (bottom quartile). | Rating: 3★ (upper mid). | Rating: 3★ (lower mid). | Rating: 1★ (bottom quartile). |

| Point 4 | Risk profile: High. | Risk profile: High. | Risk profile: High. | Risk profile: High. | Risk profile: Moderately High. |

| Point 5 | 5Y return: 29.25% (top quartile). | 5Y return: 27.74% (upper mid). | 5Y return: 26.53% (lower mid). | 5Y return: 25.82% (bottom quartile). | 5Y return: 25.62% (bottom quartile). |

| Point 6 | 3Y return: 58.17% (top quartile). | 3Y return: 33.84% (lower mid). | 3Y return: 24.88% (bottom quartile). | 3Y return: 31.51% (bottom quartile). | 3Y return: 37.92% (upper mid). |

| Point 7 | 1Y return: 156.17% (top quartile). | 1Y return: 30.67% (lower mid). | 1Y return: 15.80% (bottom quartile). | 1Y return: 29.25% (bottom quartile). | 1Y return: 73.79% (upper mid). |

| Point 8 | Alpha: 2.12 (top quartile). | Alpha: 0.05 (upper mid). | Alpha: 0.00 (lower mid). | Alpha: -2.70 (bottom quartile). | 1M return: 4.72% (lower mid). |

| Point 9 | Sharpe: 3.41 (upper mid). | Sharpe: 0.63 (lower mid). | Sharpe: 0.15 (bottom quartile). | Sharpe: 0.53 (bottom quartile). | Alpha: 0.00 (bottom quartile). |

| Point 10 | Information ratio: -0.47 (lower mid). | Information ratio: -0.63 (bottom quartile). | Information ratio: 0.00 (top quartile). | Information ratio: -0.50 (bottom quartile). | Sharpe: 3.44 (top quartile). |

DSP World Gold Fund

- Bottom quartile AUM (₹1,975 Cr).

- Established history (18+ yrs).

- Top rated.

- Risk profile: High.

- 5Y return: 29.25% (top quartile).

- 3Y return: 58.17% (top quartile).

- 1Y return: 156.17% (top quartile).

- Alpha: 2.12 (top quartile).

- Sharpe: 3.41 (upper mid).

- Information ratio: -0.47 (lower mid).

SBI PSU Fund

- Upper mid AUM (₹5,980 Cr).

- Established history (15+ yrs).

- Rating: 2★ (bottom quartile).

- Risk profile: High.

- 5Y return: 27.74% (upper mid).

- 3Y return: 33.84% (lower mid).

- 1Y return: 30.67% (lower mid).

- Alpha: 0.05 (upper mid).

- Sharpe: 0.63 (lower mid).

- Information ratio: -0.63 (bottom quartile).

ICICI Prudential Infrastructure Fund

- Highest AUM (₹8,077 Cr).

- Oldest track record among peers (20 yrs).

- Rating: 3★ (upper mid).

- Risk profile: High.

- 5Y return: 26.53% (lower mid).

- 3Y return: 24.88% (bottom quartile).

- 1Y return: 15.80% (bottom quartile).

- Alpha: 0.00 (lower mid).

- Sharpe: 0.15 (bottom quartile).

- Information ratio: 0.00 (top quartile).

Invesco India PSU Equity Fund

- Bottom quartile AUM (₹1,492 Cr).

- Established history (16+ yrs).

- Rating: 3★ (lower mid).

- Risk profile: High.

- 5Y return: 25.82% (bottom quartile).

- 3Y return: 31.51% (bottom quartile).

- 1Y return: 29.25% (bottom quartile).

- Alpha: -2.70 (bottom quartile).

- Sharpe: 0.53 (bottom quartile).

- Information ratio: -0.50 (bottom quartile).

Axis Gold Fund

- Lower mid AUM (₹2,835 Cr).

- Established history (14+ yrs).

- Rating: 1★ (bottom quartile).

- Risk profile: Moderately High.

- 5Y return: 25.62% (bottom quartile).

- 3Y return: 37.92% (upper mid).

- 1Y return: 73.79% (upper mid).

- 1M return: 4.72% (lower mid).

- Alpha: 0.00 (bottom quartile).

- Sharpe: 3.44 (top quartile).

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.