How to Add Biller for SIP Transactions in Kotak Mahindra Bank?

SIP or Systematic Investment plan is a mode of investment in Mutual Funds where people invest small amounts at regular intervals. SIP is one of the beauties of Mutual Funds as people can attain their objectives by Investing in small amounts. With the advancements in technology, the process of SIP through Net Banking has become very easy. Here, people just need to add a biller to their accounts for Mutual Fund payments so that their SIP payment process gets automated.

In case of SIP payments through Net Banking Channel, people need to add a Unique Registration Number or URN to their Bank accounts. However, the process of adding biller is different for each account. So, let us see steps of adding biller in case of Kotak Mahindra Bank.

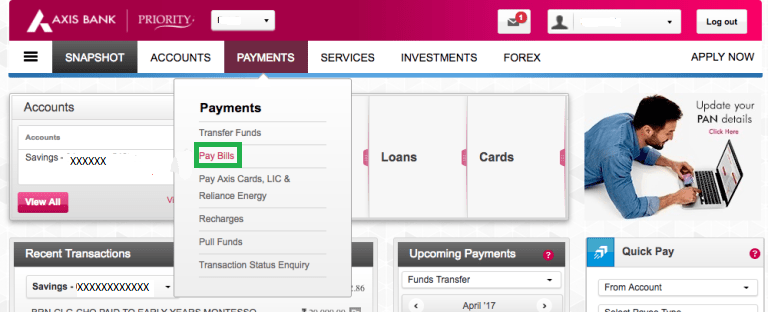

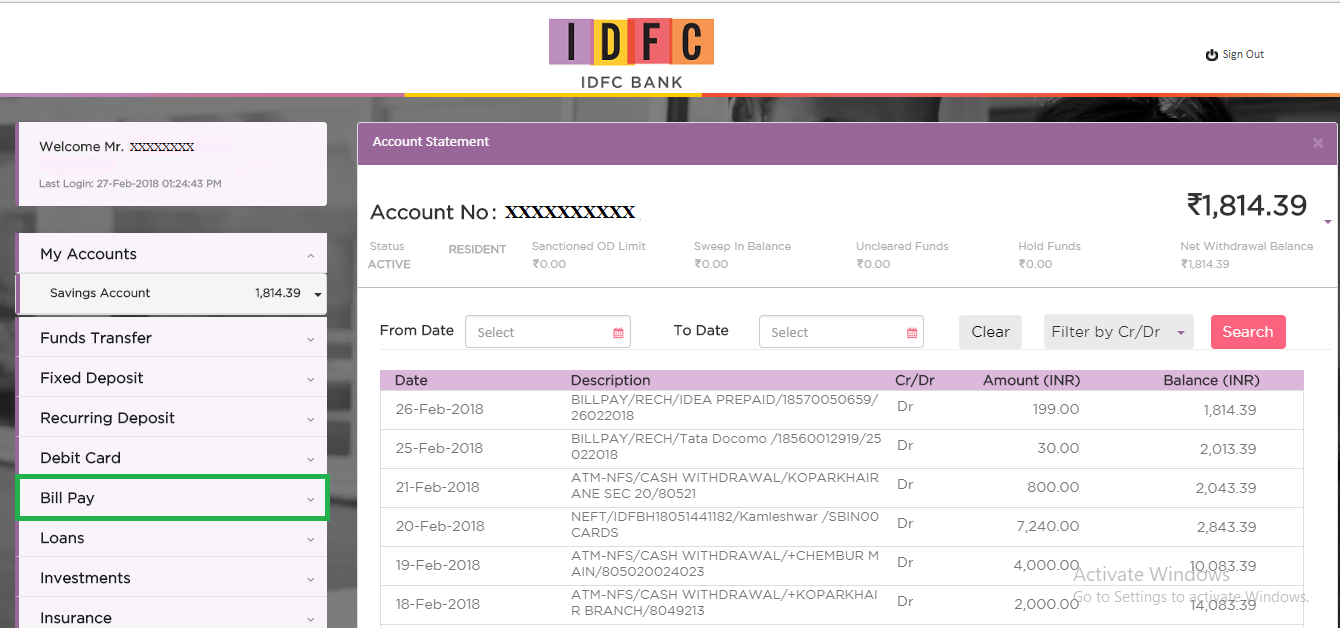

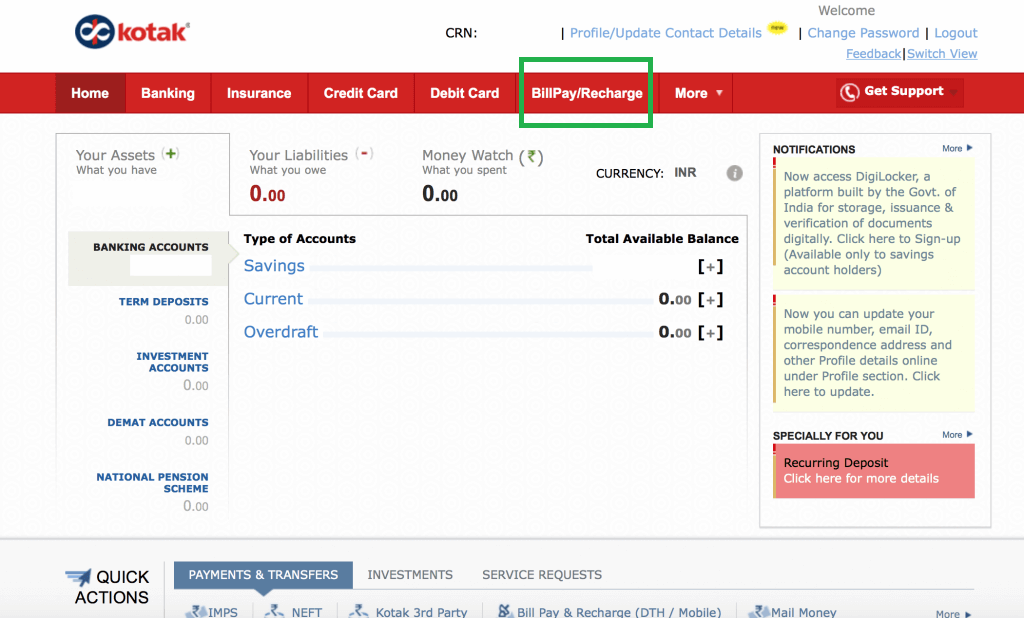

Log into Your Account & Click on BillPay/Recharge

The process of in case of Net Banking starts with logging into your account. First-of-all, you need to log into your account using your credentials. Once you log in and the home screen opens, click on the BillPay/Recharge tab which is on top of the screen. The image for this step is given below where BillPay/Recharge section is highlighted in Green.

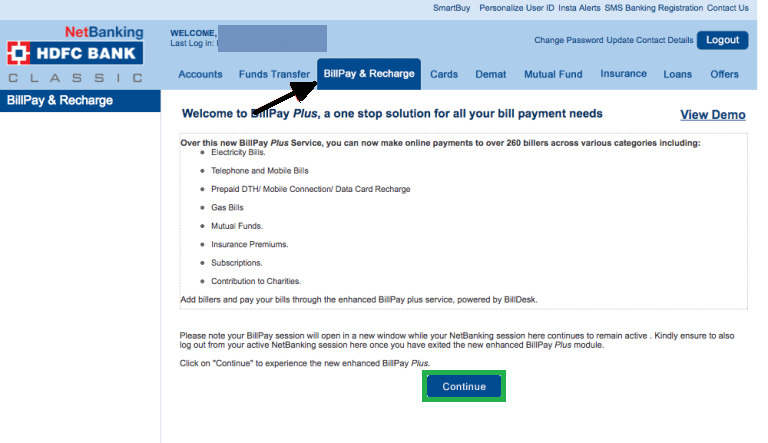

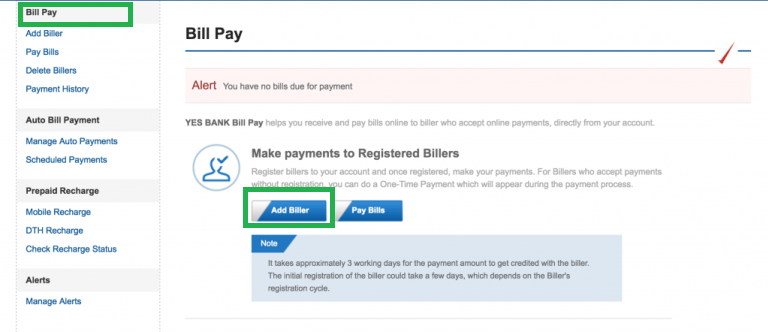

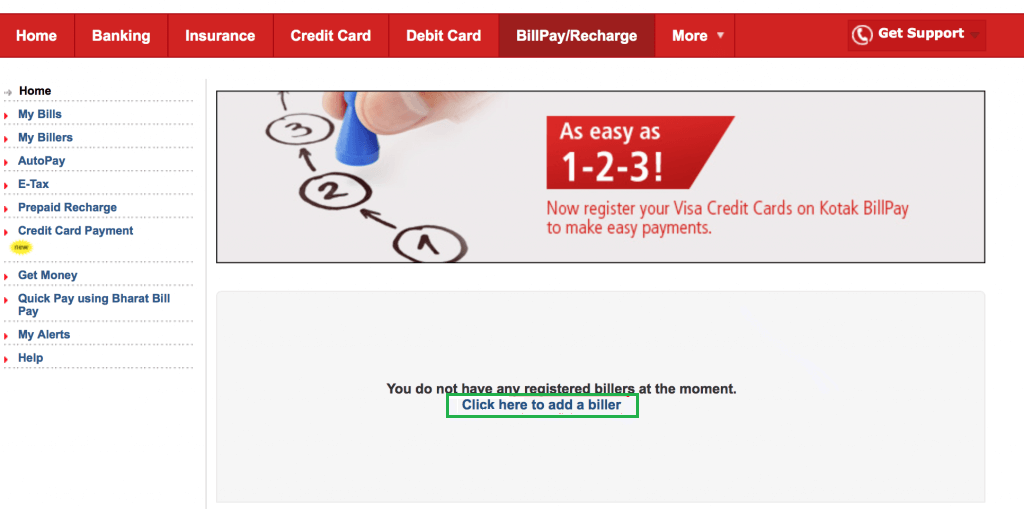

Click on Add a Biller

This is the second step. Once you click on BillPay/Recharge section, a new screen pops up wherein; you can find a sentence as Click here to add a biller. You need to click on this tab so that you can add a biller. The image for this step is given below where the Click here to add a biller is highlighted in Green.

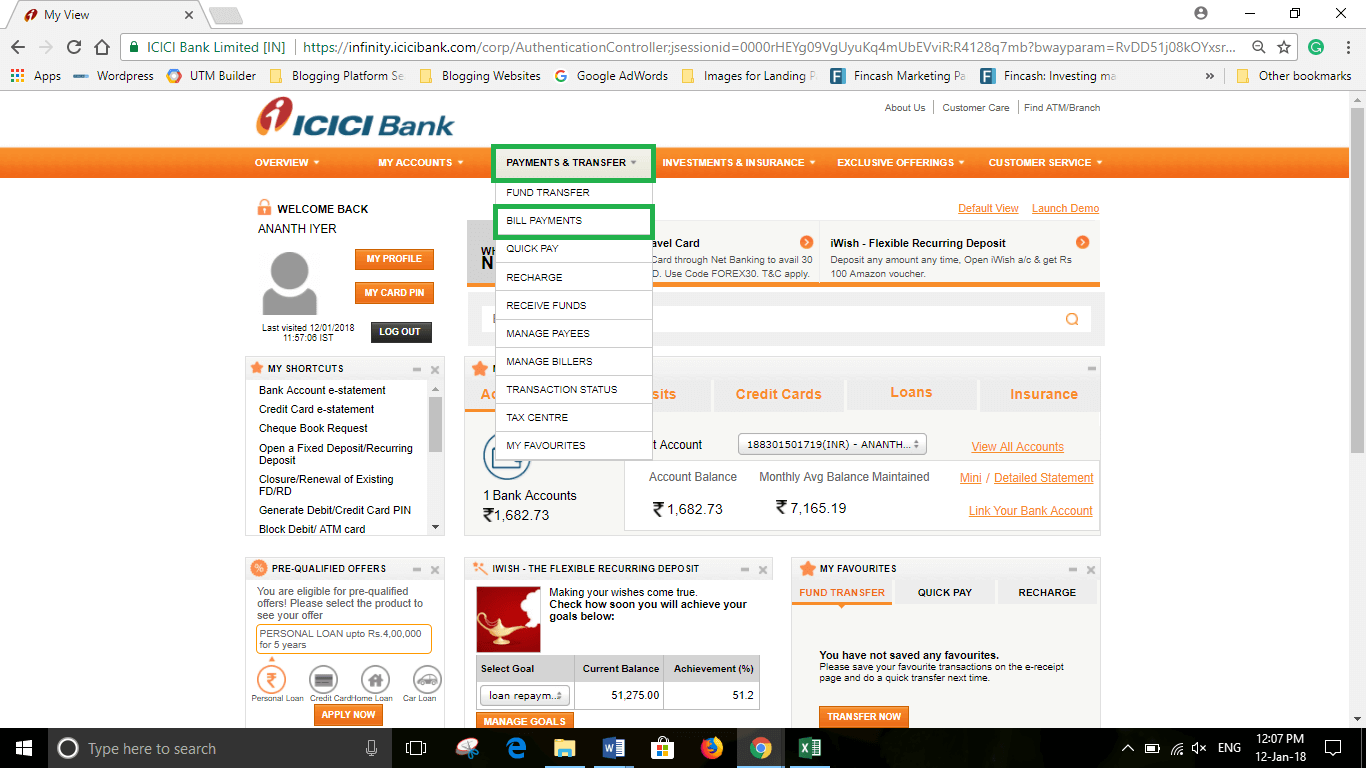

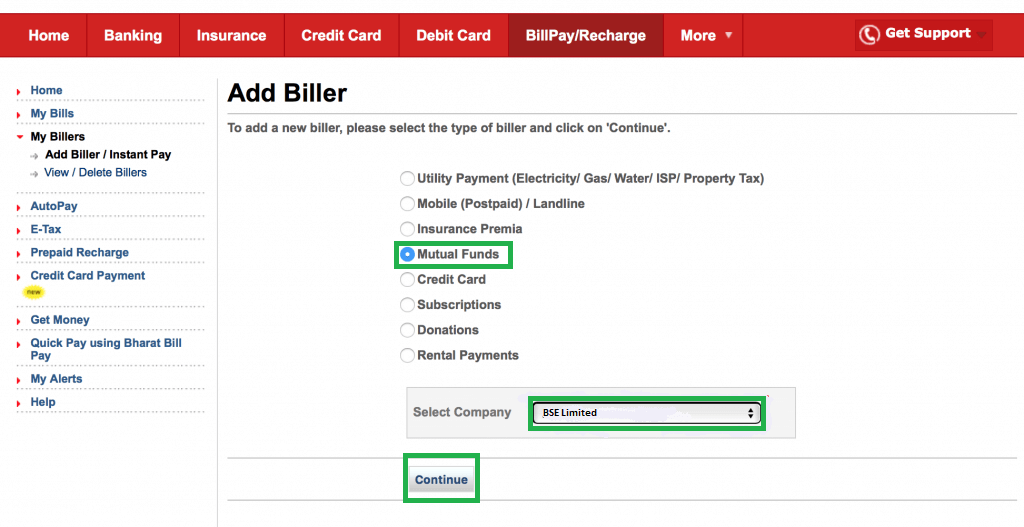

Select Mutual Funds & Click on BSE Limited

Once you click on Click here to add a biller, a new screen opens where you can find various payment options such as Utility Payments, insurance Premia, Credit Card, and much more. In this section, you need to click on Mutual Funds option. Once you click on this section, a drop-down stating Select Company below gets enabled. Here, you need to select BSE Limited option. Once you select on BSE Limited, you need to click Continue. The image for this step is given below where Mutual Funds, BSE Limited, and, Continue buttons are highlighted in Green.

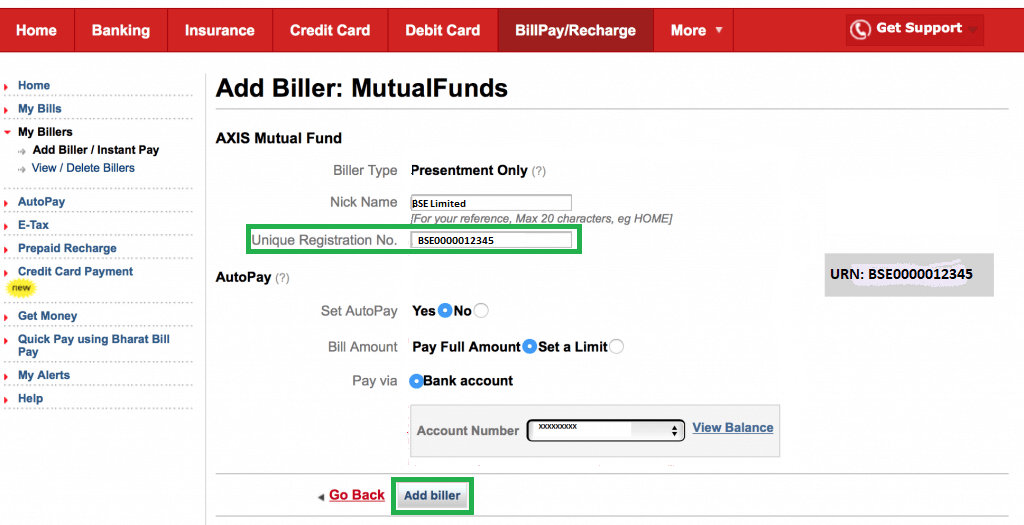

Add URN & Other Details

Once you click on Continue, a new screen opens up where you need to enter the URN. You receive this URN number from Fincash in your registered email after making the first SIP payment. However, if you do not receive it then, you can access the same data by visiting the website of www.fincash.com logging into your account and visiting your My SIPs section. In this section, you can find the details under the Mandate column. Along with the URN you also need to enter certain other details related to AutoPay option. In AutoPay option, you need to click on Yes and then select Pay Full Amount in Bill Amount. Once you add you the details, you need to click on Add Biller button. The image for this step is given below where the URN and Add Biller options are highlighted in Green.

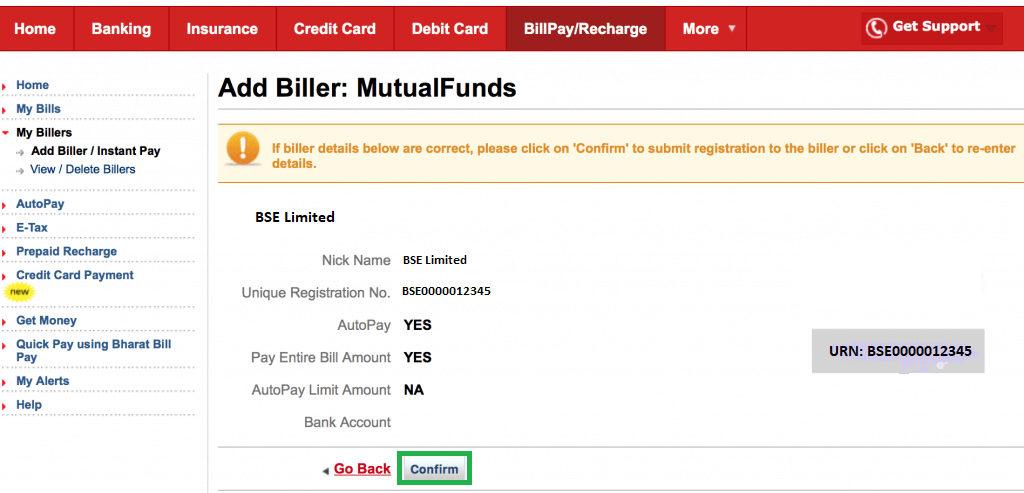

URN Summary & Confirmation

This is the second last step in the biller addition process in case of Kotak Mahindra Bank. In this step, you get to very your URN details. If you think, the details entered are correct then; you can click on Confirm. Or else, you can click on Go Back option and rectify your details. The image for this step is given below where the Confirm button is highlighted in Green.

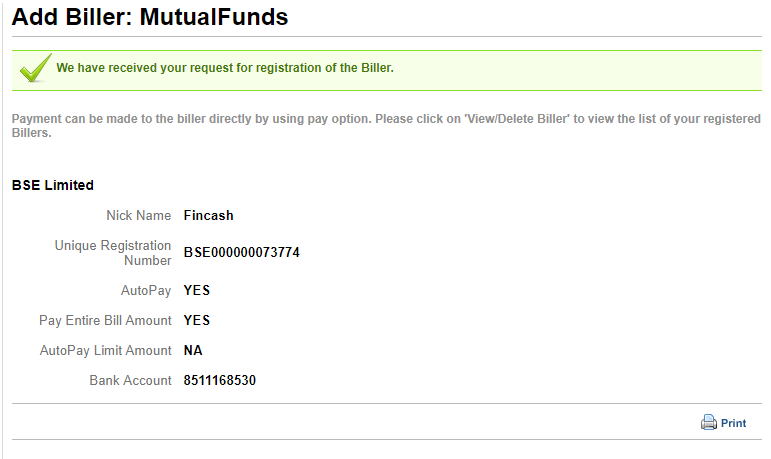

Final Confirmation

This is the last step in the biller addition process for Kotak Mahindra Bank wherein; you get a confirmation stating that the biller has been added successfully. The image for this step is given below.

Thus from the above-given steps, we can say that the biller addition process for SIP transactions in Kotak Mahindra Bank is simple.

Fund Selection Methodology used to find 5 funds

Best SIPs to Invest to Earn Better Returns

Here are some of the recommend SIPs as per 5 year returns and AUM of more than INR 500 Cr:

| Fund | NAV | Net Assets (Cr) | Min SIP Investment | 3 MO (%) | 6 MO (%) | 1 YR (%) | 3 YR (%) | 5 YR (%) | 2024 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| DSP World Gold Fund Growth | ₹70.6728 ↑ 0.61 | ₹1,975 | 500 | 42.7 | 87.9 | 203.9 | 64.5 | 33.4 | 167.1 | |

| SBI Gold Fund Growth | ₹47.2042 ↓ -1.62 | ₹15,024 | 500 | 26.3 | 51.9 | 84.7 | 40.7 | 27.7 | 71.5 | |

| IDBI Gold Fund Growth | ₹41.7034 ↓ -1.68 | ₹809 | 500 | 25.3 | 50.3 | 83.3 | 40.3 | 27.6 | 79 | |

| Nippon India Gold Savings Fund Growth | ₹61.686 ↓ -2.01 | ₹7,160 | 100 | 26.3 | 51.6 | 84.2 | 40.5 | 27.6 | 71.2 | |

| ICICI Prudential Regular Gold Savings Fund Growth | ₹49.7732 ↓ -1.88 | ₹6,338 | 100 | 25.8 | 51.3 | 83.9 | 40.5 | 27.5 | 72 | |

| Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 | ||||||||||

Research Highlights & Commentary of 5 Funds showcased

| Commentary | DSP World Gold Fund | SBI Gold Fund | IDBI Gold Fund | Nippon India Gold Savings Fund | ICICI Prudential Regular Gold Savings Fund |

|---|---|---|---|---|---|

| Point 1 | Bottom quartile AUM (₹1,975 Cr). | Highest AUM (₹15,024 Cr). | Bottom quartile AUM (₹809 Cr). | Upper mid AUM (₹7,160 Cr). | Lower mid AUM (₹6,338 Cr). |

| Point 2 | Oldest track record among peers (18 yrs). | Established history (14+ yrs). | Established history (13+ yrs). | Established history (15+ yrs). | Established history (14+ yrs). |

| Point 3 | Top rated. | Rating: 2★ (upper mid). | Not Rated. | Rating: 2★ (lower mid). | Rating: 1★ (bottom quartile). |

| Point 4 | Risk profile: High. | Risk profile: Moderately High. | Risk profile: Moderately High. | Risk profile: Moderately High. | Risk profile: Moderately High. |

| Point 5 | 5Y return: 33.40% (top quartile). | 5Y return: 27.71% (upper mid). | 5Y return: 27.56% (lower mid). | 5Y return: 27.55% (bottom quartile). | 5Y return: 27.54% (bottom quartile). |

| Point 6 | 3Y return: 64.51% (top quartile). | 3Y return: 40.68% (upper mid). | 3Y return: 40.25% (bottom quartile). | 3Y return: 40.46% (bottom quartile). | 3Y return: 40.47% (lower mid). |

| Point 7 | 1Y return: 203.87% (top quartile). | 1Y return: 84.72% (upper mid). | 1Y return: 83.26% (bottom quartile). | 1Y return: 84.24% (lower mid). | 1Y return: 83.87% (bottom quartile). |

| Point 8 | Alpha: 2.12 (top quartile). | 1M return: 2.92% (bottom quartile). | 1M return: 4.99% (upper mid). | 1M return: 3.34% (lower mid). | 1M return: 2.65% (bottom quartile). |

| Point 9 | Sharpe: 3.41 (upper mid). | Alpha: 0.00 (upper mid). | Alpha: 0.00 (lower mid). | Alpha: 0.00 (bottom quartile). | Alpha: 0.00 (bottom quartile). |

| Point 10 | Information ratio: -0.47 (bottom quartile). | Sharpe: 3.25 (lower mid). | Sharpe: 3.48 (top quartile). | Sharpe: 3.01 (bottom quartile). | Sharpe: 3.10 (bottom quartile). |

DSP World Gold Fund

- Bottom quartile AUM (₹1,975 Cr).

- Oldest track record among peers (18 yrs).

- Top rated.

- Risk profile: High.

- 5Y return: 33.40% (top quartile).

- 3Y return: 64.51% (top quartile).

- 1Y return: 203.87% (top quartile).

- Alpha: 2.12 (top quartile).

- Sharpe: 3.41 (upper mid).

- Information ratio: -0.47 (bottom quartile).

SBI Gold Fund

- Highest AUM (₹15,024 Cr).

- Established history (14+ yrs).

- Rating: 2★ (upper mid).

- Risk profile: Moderately High.

- 5Y return: 27.71% (upper mid).

- 3Y return: 40.68% (upper mid).

- 1Y return: 84.72% (upper mid).

- 1M return: 2.92% (bottom quartile).

- Alpha: 0.00 (upper mid).

- Sharpe: 3.25 (lower mid).

IDBI Gold Fund

- Bottom quartile AUM (₹809 Cr).

- Established history (13+ yrs).

- Not Rated.

- Risk profile: Moderately High.

- 5Y return: 27.56% (lower mid).

- 3Y return: 40.25% (bottom quartile).

- 1Y return: 83.26% (bottom quartile).

- 1M return: 4.99% (upper mid).

- Alpha: 0.00 (lower mid).

- Sharpe: 3.48 (top quartile).

Nippon India Gold Savings Fund

- Upper mid AUM (₹7,160 Cr).

- Established history (15+ yrs).

- Rating: 2★ (lower mid).

- Risk profile: Moderately High.

- 5Y return: 27.55% (bottom quartile).

- 3Y return: 40.46% (bottom quartile).

- 1Y return: 84.24% (lower mid).

- 1M return: 3.34% (lower mid).

- Alpha: 0.00 (bottom quartile).

- Sharpe: 3.01 (bottom quartile).

ICICI Prudential Regular Gold Savings Fund

- Lower mid AUM (₹6,338 Cr).

- Established history (14+ yrs).

- Rating: 1★ (bottom quartile).

- Risk profile: Moderately High.

- 5Y return: 27.54% (bottom quartile).

- 3Y return: 40.47% (lower mid).

- 1Y return: 83.87% (bottom quartile).

- 1M return: 2.65% (bottom quartile).

- Alpha: 0.00 (bottom quartile).

- Sharpe: 3.10 (bottom quartile).

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.