Motilal Oswal Demat Account – Learn Quick Steps to Open!

Motilal Oswal Securities Ltd. (MOSL) is a complete-service broker. It provides customers with entire hand-holdings related to trading tips, financial planning, research, and regular trend analysis according to the requirements and portfolios of customers. Incorporated in 1987, it is a Mumbai, India-based diverse financial service provider with a team of expert researchers.

Motilal Oswal Demat account is one of the best options that you must consider while going for a Demat/ Trading Account and its services. Below, you will find all the details related to the Motilal Demat account, their opening charges, and required documents.

Types of Motilal Oswal Account Opening

There are three different types of accounts which can be opened with MOSL. Here is a description of their functionalities:

1. Default Account

The regular trading and Demat account provide various investment alternatives that can be tailored to your time horizon and risk tolerance. This account allows you to trade in stocks, derivatives, commodities, currencies, Mutual Funds, IPOs, PMS, insurance, and fixed income products. Casual traders and long-term stock market participants can use the default account type. This is a fundamental strategy. The bulk of services are present, including access to research and consulting services and free online trading software. This plan has the highest brokerage fees, as follows:

| Segment | Brokerage |

|---|---|

| Delivery of Equity | 0.50% |

| Future or Intraday Cash - Equity and Commodity | 0.05% (both side) |

| Equity Options | Rs. 100 per lot (both side) |

| Currency F&O | Rs. 20 per lot (both side) |

2. Value Pack

The Value Pack Account is an upfront membership plan that offers significant brokerage rate cuts. Customers can choose from various value packs and take advantage of the benefits of placing trades at a lower cost. Value packs are best for regular traders dealing on a daily basis. This Value pack is a brokerage plan which is prepaid and allows you to save money on brokerage by paying a one-time cost. There are seven options, ranging in price from Rs 2500 to Rs 1 lakh in the value pack. Here are the brokerage fees for it:

| Segment | Brokerage |

|---|---|

| Delivery of Equity | 0.10% to 0.40% |

| Future or Intraday Cash - Equity and Commodity | 0.01% to 0.04% (both side) |

| Equity Options | Rs. 20 to Rs. 50 per lot (both side) |

| Currency F&O | Rs. 10 to Rs. 22 per lot (both side) |

Talk to our investment specialist

3. Margin Pack

The Margin Pack Account is a committed margin account that offers large brokerage reductions upfront. Customers can choose from a variety of margin packs and reap the benefits of trading at a lower cost. The Margin Scheme is designed for regular traders who deal on a daily basis. When you commit more margin money to your trading account, the brokerage rates in this plan decrease. Here are its brokerage fees:

| Segment | Brokerage |

|---|---|

| Delivery of Equity | 0.15% to 0.50% |

| Future or Intraday Cash - Equity and Commodity | 0.015% to 0.05% (both side) |

| Equity Options | Rs. 25 to Rs. 100 per lot (both side) |

| Currency F&O | Rs. 20 per lot (both side) |

Motilal Oswal Demat Account Review: Pros and Cons

As every coin has both positive and negative aspects, so does the motilal oswal demat account. Here are some of the pros:

- Free call and trade services are available.

- For a limited period, you may also get some free in-depth stock or scheme analysis and recommendations.

- The 'Trend guidance tool' combines the power of AI, machine learning, and deep industry insights to create a specifically built tool for traders.

- Traders and investors can benefit from several trading platforms.

Here are some of the disadvantages associated with MOSL:

- There are no flat-fee or bargain brokerage programmes available.

- In mutual funds, only regular plans are available.

- An additional fee is required for some Investing services.

- Motilal Oswal Demat Account Charges

Here is a table showing the Motilal Oswal Demat charges that you would have to pay for availing the services:

| Transaction | Charges |

|---|---|

| Opening Trading Account | Rs. 1000 (One Time) |

| Maintenance of Trading Annual (AMC) | Rs. 0 |

| Opening Demat Account | Rs. 0 |

| Motilal Oswal Annual Maintenance Charges of Demat Account (AMC) | Rs. 299 |

Motilal Oswal Trading Applications

Motilal Oswal has a variety of online trading software available. It offers the following popular ones:

- MO Investor (Mobile App and Trading Website)

- Application for MO Trader

- Application for MO Trader

- Smart Watch (App for Apple Watch and Android)

Motilal Oswal Demat Account Opening Documents

To complete the application form for a Motilal Oswal account, provide the following papers to ensure a smooth process. Here is a list of all the essential documents that you need to provide:

- Coloured passport photograph – 1

- Proof of Bank statement, including a bank statement copy, passbook's first page's copy, and a cancelled cheque in the account holder's name

- Address proof – a copy of passport, driving license, ration card, electricity, or phone bill

- PAN Card

Motilal Oswal Demat Account Opening Process

It's simple to open a Motilal Oswal Demat account. The whole procedure is painless and stress-free. To open this account, follow these steps:

- Visit the Motilal Oswal website and fill in the required details in the available form (including your full name, phone number, and OTP) to begin with your Demat account.

- Then, upload all of your identity verification in the following stage. The Pan Card, Aadhar Card, and bank account information are among them.

- After you've submitted all of your documents, you'll need to go through the verification process.

- Your account will be active within 24 hours after the verification is completed.

All of this can be done from the comfort of your own home. However, if you wish to start an account in the physical form, you must sign the physical copy and mail it to the registered office closest to your location. After the procedure is completed, you can immediately begin trading.

Working of Motilal Oswal Demat Account

Let's have a look at how a Motilal Oswal Demat account works:

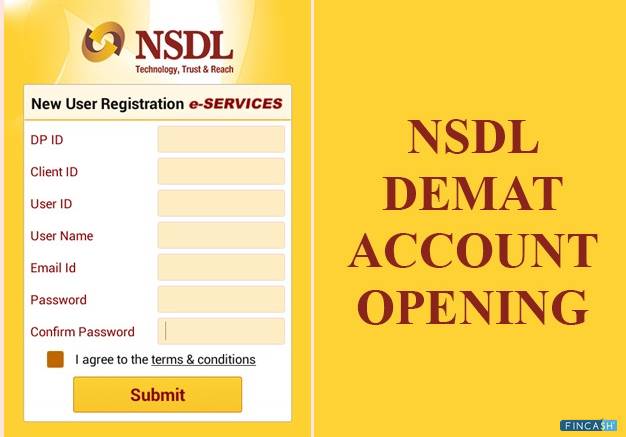

- The Indian repositories, CDSL and NSDL, keep all of a shareholder's Demat accounts and details in a single account.

- Each of the Demat accounts has some unique identification code that you will be given when you make a transaction.

- The depository participant is responsible for providing access to CDSL and NSDL. The bank functions as a link between the central depository and the investor, known as the depository participant.

- When an investor successfully creates a Demat account, they will be able to hold all of their shares and securities and view their account's details.

What is the Process of Closing Motilal Oswal Demat Account?

To close the account, you must follow the given steps:

- Visit the nearest branch and take a form from there to fill and submit for closing the account.

- Sign the form and submit a copy to the branch while keeping one with you.

When you return the completed form to the nearest branch, the person in charge will take the necessary steps to cancel your account. The account will be closed in 7-10 business days. There will be no fees associated with cancelling your account.

Here are some key points that you must remember while closing MOSL the Demat account:

- There must not be any negative balance in your account.

- The balance of the payment must be cleared at the time of closing.

- In the Demat account, there should be no stock.

Motilal Oswal Demat Account Customer Service

As Motilal Oswal offers customer-oriented services, you have various options to reach out to their customer support executives. Here are a few ways to connect with customer assistance:

- Directly visit the branch

- Send a mail at

query@motilaloswal.com - Call at

91 22 399825151/ 67490600 - Fill web-based query form

Conclusion

MOSL is one of the best complete broking services providers. It is highly reliable and is a trusted advisory service, and none, other ones in the entire industry, manage to beat it in those aspects. They also offer the best trading platforms, making them a great investment opportunity. It is highly recommended to avail of the broker services from MOSL for an amazing trading experience.

Frequently Asked Questions (FAQs)

1. Who all are eligible to open a Demat account with MOSL?

A. If you are a resident of India, you are allowed to open a bank account. A Demat account or trading account with Motilal Oswal can also be opened by an NRI, a partnership firm, or a corporate.

2. How long should I wait for the Demat account to be activated?

A. Your account will be promptly activated after the in-person verification process is completed, and then you can begin trading.

3. Is there a feature of freezing accounts with Motilal Oswal Demat accounts?

A. Yes, it is available. So, if you have a Demat account, you can freeze it for a particular amount of time if necessary.

4. In which cases can I transfer my shares from one Demat account to another?

A. In the following situations, you can transfer shares from one Demat account to another:

- If you have 4-5 Demat accounts and want to combine them to save money, you can do so.

- You already have a Demat account but wish to keep a separate one for your trading.

5. What steps do I have to follow to log in to the Motilal Oswal Demat/ trading account?

A. If you are not yet a registered user, go to the account section and sign up for a free trading account, which you can use to start trading and investing online right away. You have to enter your login credentials and answer a few security questions to log in to the Motilal Oswal trading/ Demat account.

6. Is it safer to invest in the Motilal Oswal Demat account?

A. Yes, investing in this account is entirely safe. You will rapidly get over the difficult times with the assistance of the top financial advisor's team. Additionally, you will be highly satisfied, thanks to various attractive schemes that they offer.

7. Is there a co-applicant feature available with the Motilal Oswal Demat account?

A. A co-applicant function is currently unavailable.

8. Can I get the nominee details added to my Demat account?

A. Without a doubt! You can include information about the nominee in the Demat account. Take a printout of the nominee page, select a photograph, and upload it in the place where you were asked, and the candidate will be added.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.