SIP 2022 - 2023 साठी भारतातील सर्वोत्तम म्युच्युअल फंड

एक पद्धतशीरगुंतवणूक योजना (SIP) हा सर्वात प्रभावी मार्ग मानला जातोम्युच्युअल फंडात गुंतवणूक करा, विशेषतः लांब साठी -मुदत योजना. दीर्घकालीन बचत योजना लागू करण्यासाठी गुंतवणूकदारांना दर महिन्याच्या एका विशिष्ट तारखेला युनिट खरेदी करण्याची परवानगी देते. गुंतवणूकदारांना सोयीस्कर वाटण्याचे एक कारण आहेगुंतवणूक SIP मध्ये ते देतात लवचिकता. गुंतवणूकदार करू शकतातSIP मध्ये गुंतवणूक करा एकतर मासिक, त्रैमासिक किंवा साप्ताहिक वरआधार, त्यांच्या सोयीनुसार. ते कसे साध्य करू शकतात याबद्दल अधिक जाणून घेऊयाआर्थिक उद्दिष्टे पद्धतशीर गुंतवणूक योजनांसह, कसेसिप कॅल्क्युलेटर सोबत गुंतवणुकीसाठी उपयुक्त आहेसर्वोत्तम म्युच्युअल फंड SIP साठी भारतात.

SIP- आर्थिक उद्दिष्टे साध्य करण्याचा इष्टतम मार्ग

SIP ची रचना अशा प्रकारे केली आहे की एखादी व्यक्ती त्यांच्या गुंतवणुकीची पूर्व-नियोजन करू शकते आणि त्यांच्या आर्थिक उद्दिष्टांनुसार गुंतवणूक करू शकते. परंतु, एसआयपीद्वारे उद्दिष्टे साध्य करण्यासाठी दीर्घकाळ गुंतवणूक करावी लागते. साधारणपणे, SIP चा वापर मोठ्या प्रमाणावर लक्ष्यांच्या नियोजनासाठी केला जातो जसे-

Talk to our investment specialist

- कार खरेदी करणे

- घर खरेदी करणे

- लग्न

- मुलाचे शिक्षण

- आंतरराष्ट्रीय सहलीसाठी बचत करा

- सेवानिवृत्ती

- वैद्यकीय आणीबाणी इ.

किमान INR 500 आणि INR 1000 एवढ्या रकमेतून कोणीही SIP मध्ये गुंतवणूक करण्यास सुरुवात करू शकते. एकदा का तुम्ही SIP मध्ये गुंतवणूक करायला सुरुवात केली की तुमचे पैसे स्टॉकच्या संपर्कात आल्याने दररोज जाऊ लागतात.बाजार. म्हणूनच मार्ग म्हणून SIPs ला प्राधान्य दिले जातेइक्विटी फंड. शिवाय, ऐतिहासिकदृष्ट्या, इक्विटी स्टॉकमधील गुंतवणुकीने इतर सर्व मालमत्ता वर्गांमध्ये प्रभावी परतावा दिला आहे, जर गुंतवणूक शिस्तीने आणि दीर्घकालीन क्षितिजासह केली गेली असेल.

इक्विटीमधील एसआयपी बाजाराच्या वेळेचा धोका टाळण्यास आणि गुंतवणुकीच्या खर्चाची सरासरी काढून संपत्ती निर्माण करण्यास मदत करते. आणखी काही पाहूSIP चे फायदे जे दीर्घकालीन उद्दिष्टे साध्य करण्यात मदत करते:

कंपाउंडिंगची शक्ती- जेव्हा तुम्ही फक्त मुद्दलावर व्याज मिळवता तेव्हा साधे व्याज असते. चक्रवाढ व्याजाच्या बाबतीत, व्याजाची रक्कम मुद्दलामध्ये जोडली जाते आणि व्याज नवीन मुद्दल (जुने मुद्दल अधिक नफा) वर मोजले जाते. ही प्रक्रिया प्रत्येक वेळी चालू राहते. मध्ये SIP पासूनम्युच्युअल फंड हप्त्यांमध्ये आहेत, ते चक्रवाढ आहेत, जे सुरुवातीला गुंतवलेल्या रकमेमध्ये अधिक जोडतात.

जोखीम कमी करणे- एसआयपी दीर्घ कालावधीसाठी पसरलेली असते हे लक्षात घेता, शेअर बाजारातील सर्व कालावधी, चढ-उतार आणि सर्वात महत्त्वाचे म्हणजे मंदीचा समावेश होतो. मंदीच्या काळात, जेव्हा बहुतेक गुंतवणूकदारांना भीती वाटते तेव्हा, गुंतवणूकदार “कमी” खरेदी करतात याची खात्री करून SIP हप्ते चालू राहतात.

SIP ची सोय- सुविधा हा SIP चा सर्वात मोठा फायदा आहे. वापरकर्त्यास एकदाच साइन-अप करावे लागेल आणि कागदपत्रांमधून जावे लागेल. एकदा पूर्ण झाल्यानंतर, त्यानंतरच्या गुंतवणुकीसाठी डेबिट आपोआप होतात आणिगुंतवणूकदार फक्त गुंतवणुकीचे निरीक्षण करावे लागेल.

SIP 2022 - 2023 साठी भारतातील सर्वोत्तम म्युच्युअल फंड

SIP साठी सर्वोत्तम लार्ज कॅप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹92.9805

↑ 0.57 ₹50,107 100 -1.5 1.1 14.4 19.1 17.5 9.2 ICICI Prudential Bluechip Fund Growth ₹113.45

↑ 0.62 ₹76,646 100 -2.2 1.8 13.3 18 15.6 11.3 DSP TOP 100 Equity Growth ₹479.217

↑ 1.57 ₹7,163 500 -1.9 1.5 9.8 17.8 13.6 8.4 Bandhan Large Cap Fund Growth ₹79.063

↑ 0.29 ₹1,980 100 -1.8 1.7 14.8 17.5 13.1 8.2 Invesco India Largecap Fund Growth ₹69.68

↑ 0.22 ₹1,666 100 -3.2 0.2 13.5 17.4 14 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹7,163 Cr). Bottom quartile AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.50% (top quartile). 5Y return: 15.64% (upper mid). 5Y return: 13.56% (bottom quartile). 5Y return: 13.14% (bottom quartile). 5Y return: 14.01% (lower mid). Point 6 3Y return: 19.09% (top quartile). 3Y return: 17.98% (upper mid). 3Y return: 17.79% (lower mid). 3Y return: 17.47% (bottom quartile). 3Y return: 17.39% (bottom quartile). Point 7 1Y return: 14.41% (upper mid). 1Y return: 13.29% (bottom quartile). 1Y return: 9.84% (bottom quartile). 1Y return: 14.83% (top quartile). 1Y return: 13.49% (lower mid). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (bottom quartile). Alpha: 0.90 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.64 (bottom quartile). Information ratio: 0.69 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

SIP साठी सर्वोत्तम मल्टी कॅप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,079.89

↑ 8.72 ₹97,452 300 -0.4 3.5 15.9 22.2 20.4 11.4 Nippon India Multi Cap Fund Growth ₹299.26

↑ 2.08 ₹48,809 100 -1.9 -1.3 15 21.9 21.8 4.1 Motilal Oswal Multicap 35 Fund Growth ₹57.439

↓ -0.01 ₹13,180 500 -9 -7.2 3.7 21.5 12.8 -5.6 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.77

↑ 0.20 ₹1,051 1,000 0.7 5.3 18.3 21.2 15.4 3.5 Mahindra Badhat Yojana Growth ₹35.9116

↑ 0.09 ₹6,046 500 -1.3 1.3 15 20.9 18.7 3.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Equity Fund Nippon India Multi Cap Fund Motilal Oswal Multicap 35 Fund Aditya Birla Sun Life Manufacturing Equity Fund Mahindra Badhat Yojana Point 1 Highest AUM (₹97,452 Cr). Upper mid AUM (₹48,809 Cr). Lower mid AUM (₹13,180 Cr). Bottom quartile AUM (₹1,051 Cr). Bottom quartile AUM (₹6,046 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (20+ yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (8+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (lower mid). Top rated. Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.44% (upper mid). 5Y return: 21.80% (top quartile). 5Y return: 12.79% (bottom quartile). 5Y return: 15.42% (bottom quartile). 5Y return: 18.68% (lower mid). Point 6 3Y return: 22.19% (top quartile). 3Y return: 21.87% (upper mid). 3Y return: 21.52% (lower mid). 3Y return: 21.20% (bottom quartile). 3Y return: 20.86% (bottom quartile). Point 7 1Y return: 15.91% (upper mid). 1Y return: 14.96% (bottom quartile). 1Y return: 3.70% (bottom quartile). 1Y return: 18.33% (top quartile). 1Y return: 14.98% (lower mid). Point 8 Alpha: 4.79 (top quartile). Alpha: -0.46 (bottom quartile). Alpha: -5.98 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 2.62 (upper mid). Point 9 Sharpe: 0.67 (top quartile). Sharpe: 0.09 (bottom quartile). Sharpe: -0.19 (bottom quartile). Sharpe: 0.12 (lower mid). Sharpe: 0.29 (upper mid). Point 10 Information ratio: 1.25 (top quartile). Information ratio: 0.49 (lower mid). Information ratio: 0.56 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.45 (bottom quartile). HDFC Equity Fund

Nippon India Multi Cap Fund

Motilal Oswal Multicap 35 Fund

Aditya Birla Sun Life Manufacturing Equity Fund

Mahindra Badhat Yojana

SIP साठी सर्वोत्तम मिड कॅप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹319.81

↑ 2.82 ₹6,969 100 1.9 6.4 25.2 25.1 20.8 11.1 TATA Mid Cap Growth Fund Growth ₹447.194

↑ 1.96 ₹5,356 150 -0.3 3.5 17.8 22.2 18.5 5.8 BNP Paribas Mid Cap Fund Growth ₹105.19

↑ 0.50 ₹2,282 300 -0.4 3.7 15.7 21.4 18.5 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹789.68

↑ 2.33 ₹6,041 1,000 -2 -0.1 15.1 20.5 18.1 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹6,969 Cr). Lower mid AUM (₹5,356 Cr). Bottom quartile AUM (₹2,282 Cr). Upper mid AUM (₹6,041 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.85% (top quartile). 5Y return: 18.48% (upper mid). 5Y return: 18.47% (lower mid). 5Y return: 18.12% (bottom quartile). Point 6 3Y return: 25.07% (top quartile). 3Y return: 22.24% (upper mid). 3Y return: 21.38% (lower mid). 3Y return: 20.52% (bottom quartile). Point 7 1Y return: 25.18% (top quartile). 1Y return: 17.83% (upper mid). 1Y return: 15.70% (lower mid). 1Y return: 15.09% (bottom quartile). Point 8 Alpha: 5.44 (top quartile). Alpha: -0.44 (lower mid). Alpha: -0.33 (upper mid). Alpha: -1.26 (bottom quartile). Point 9 Sharpe: 0.53 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.21 (upper mid). Sharpe: 0.16 (bottom quartile). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.44 (upper mid). Information ratio: -0.77 (bottom quartile). Information ratio: -0.74 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

SIP साठी सर्वोत्तम स्मॉल कॅप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹162.878

↑ 0.31 ₹65,812 100 -4.3 -4 10.3 20.8 23.5 -4.7 DSP Small Cap Fund Growth ₹194.633

↑ 0.59 ₹16,135 500 -1.4 -1.2 15.3 20.4 20.4 -2.8 Sundaram Small Cap Fund Growth ₹255.077

↓ -0.60 ₹3,285 100 -3.8 -0.7 15.3 19.9 20 0.4 Franklin India Smaller Companies Fund Growth ₹162.406

↓ 0.00 ₹12,764 500 -4.9 -4.6 7.7 19 19.9 -8.4 HDFC Small Cap Fund Growth ₹134.259

↑ 0.27 ₹36,941 300 -5.5 -5.9 11.4 18.3 20.8 -0.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund HDFC Small Cap Fund Point 1 Highest AUM (₹65,812 Cr). Lower mid AUM (₹16,135 Cr). Bottom quartile AUM (₹3,285 Cr). Bottom quartile AUM (₹12,764 Cr). Upper mid AUM (₹36,941 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.53% (top quartile). 5Y return: 20.43% (lower mid). 5Y return: 20.02% (bottom quartile). 5Y return: 19.86% (bottom quartile). 5Y return: 20.77% (upper mid). Point 6 3Y return: 20.84% (top quartile). 3Y return: 20.38% (upper mid). 3Y return: 19.95% (lower mid). 3Y return: 18.97% (bottom quartile). 3Y return: 18.33% (bottom quartile). Point 7 1Y return: 10.26% (bottom quartile). 1Y return: 15.26% (upper mid). 1Y return: 15.31% (top quartile). 1Y return: 7.68% (bottom quartile). 1Y return: 11.43% (lower mid). Point 8 Alpha: -0.64 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.29 (top quartile). Alpha: -4.41 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.01 (upper mid). Sharpe: -0.38 (bottom quartile). Sharpe: 0.05 (top quartile). Point 10 Information ratio: 0.02 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.17 (bottom quartile). Information ratio: -0.19 (bottom quartile). Information ratio: 0.00 (lower mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

HDFC Small Cap Fund

SIP साठी सर्वोत्तम ELSS (टॅक्स सेव्हिंग म्युच्युअल फंड).

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹447.463

↑ 1.59 ₹31,862 500 -0.7 2.5 11.4 23.7 19.3 6.6 Motilal Oswal Long Term Equity Fund Growth ₹48.8639

↑ 0.10 ₹4,188 500 -7.5 -4.4 10.4 21.6 17 -9.1 HDFC Tax Saver Fund Growth ₹1,442.28

↑ 6.42 ₹16,749 500 -1.8 1.1 13.4 21.2 19.5 10.3 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund IDBI Equity Advantage Fund HDFC Long Term Advantage Fund Point 1 Highest AUM (₹31,862 Cr). Lower mid AUM (₹4,188 Cr). Upper mid AUM (₹16,749 Cr). Bottom quartile AUM (₹485 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (12+ yrs). Established history (25+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.30% (upper mid). 5Y return: 16.97% (bottom quartile). 5Y return: 19.48% (top quartile). 5Y return: 9.97% (bottom quartile). 5Y return: 17.39% (lower mid). Point 6 3Y return: 23.69% (top quartile). 3Y return: 21.56% (upper mid). 3Y return: 21.18% (lower mid). 3Y return: 20.84% (bottom quartile). 3Y return: 20.64% (bottom quartile). Point 7 1Y return: 11.39% (bottom quartile). 1Y return: 10.35% (bottom quartile). 1Y return: 13.42% (lower mid). 1Y return: 16.92% (upper mid). 1Y return: 35.51% (top quartile). Point 8 Alpha: -0.63 (bottom quartile). Alpha: -5.20 (bottom quartile). Alpha: 2.37 (top quartile). Alpha: 1.78 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.13 (bottom quartile). Sharpe: -0.04 (bottom quartile). Sharpe: 0.41 (lower mid). Sharpe: 1.21 (upper mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: 1.85 (top quartile). Information ratio: 0.49 (lower mid). Information ratio: 1.20 (upper mid). Information ratio: -1.13 (bottom quartile). Information ratio: -0.15 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

IDBI Equity Advantage Fund

HDFC Long Term Advantage Fund

SIP साठी सर्वोत्तम सेक्टर फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹107.583

↓ -0.23 ₹1,765 500 11.4 20.5 33.2 23.2 21.5 17.5 SBI PSU Fund Growth ₹36.6508

↑ 0.35 ₹5,980 500 7.6 16.8 29.9 34.6 28 11.3 Invesco India PSU Equity Fund Growth ₹68.35

↑ 0.53 ₹1,492 500 2.2 10 28.4 32 26 10.3 SBI Banking & Financial Services Fund Growth ₹46.5185

↑ 0.26 ₹10,415 500 2.1 8.9 26.7 22.6 14.4 20.4 SBI Magnum COMMA Fund Growth ₹113.997

↑ 0.68 ₹896 500 5.9 8.7 25 20.3 17.2 12.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 19 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund SBI PSU Fund Invesco India PSU Equity Fund SBI Banking & Financial Services Fund SBI Magnum COMMA Fund Point 1 Lower mid AUM (₹1,765 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Highest AUM (₹10,415 Cr). Bottom quartile AUM (₹896 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (10+ yrs). Oldest track record among peers (20 yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Not Rated. Rating: 4★ (upper mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.51% (lower mid). 5Y return: 27.99% (top quartile). 5Y return: 26.01% (upper mid). 5Y return: 14.41% (bottom quartile). 5Y return: 17.21% (bottom quartile). Point 6 3Y return: 23.16% (lower mid). 3Y return: 34.56% (top quartile). 3Y return: 32.03% (upper mid). 3Y return: 22.61% (bottom quartile). 3Y return: 20.34% (bottom quartile). Point 7 1Y return: 33.22% (top quartile). 1Y return: 29.87% (upper mid). 1Y return: 28.36% (lower mid). 1Y return: 26.68% (bottom quartile). 1Y return: 24.95% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 0.05 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 4.78 (top quartile). Alpha: -1.28 (bottom quartile). Point 9 Sharpe: 1.32 (upper mid). Sharpe: 0.63 (bottom quartile). Sharpe: 0.53 (bottom quartile). Sharpe: 1.36 (top quartile). Sharpe: 0.73 (lower mid). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 1.02 (top quartile). Information ratio: -0.23 (lower mid). DSP Natural Resources and New Energy Fund

SBI PSU Fund

Invesco India PSU Equity Fund

SBI Banking & Financial Services Fund

SBI Magnum COMMA Fund

एसआयपीसाठी सर्वोत्तम केंद्रित निधी

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹95.9

↑ 0.12 ₹14,935 100 -1.3 3 19.3 23.1 19 15.4 HDFC Focused 30 Fund Growth ₹240.372

↑ 1.04 ₹26,332 300 -0.1 3.2 15.4 21.8 21.6 10.9 SBI Focused Equity Fund Growth ₹372.186

↓ -6.21 ₹42,998 500 -0.9 5.5 16 18.9 14.5 15.7 DSP Focus Fund Growth ₹55.393

↑ 0.03 ₹2,611 500 -1.7 3.1 12 18.8 13.4 7.3 Aditya Birla Sun Life Focused Equity Fund Growth ₹148.327

↑ 0.66 ₹8,068 1,000 -0.1 5.2 15.4 17.6 14 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Aditya Birla Sun Life Focused Equity Fund Point 1 Lower mid AUM (₹14,935 Cr). Upper mid AUM (₹26,332 Cr). Highest AUM (₹42,998 Cr). Bottom quartile AUM (₹2,611 Cr). Bottom quartile AUM (₹8,068 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (15+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.98% (upper mid). 5Y return: 21.65% (top quartile). 5Y return: 14.51% (lower mid). 5Y return: 13.44% (bottom quartile). 5Y return: 13.98% (bottom quartile). Point 6 3Y return: 23.05% (top quartile). 3Y return: 21.78% (upper mid). 3Y return: 18.93% (lower mid). 3Y return: 18.83% (bottom quartile). 3Y return: 17.63% (bottom quartile). Point 7 1Y return: 19.31% (top quartile). 1Y return: 15.42% (lower mid). 1Y return: 15.95% (upper mid). 1Y return: 11.99% (bottom quartile). 1Y return: 15.36% (bottom quartile). Point 8 Alpha: 6.91 (top quartile). Alpha: 3.79 (lower mid). Alpha: 5.35 (upper mid). Alpha: 0.58 (bottom quartile). Alpha: 3.66 (bottom quartile). Point 9 Sharpe: 0.70 (top quartile). Sharpe: 0.60 (lower mid). Sharpe: 0.62 (upper mid). Sharpe: 0.23 (bottom quartile). Sharpe: 0.49 (bottom quartile). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.98 (upper mid). Information ratio: 0.42 (lower mid). Information ratio: 0.42 (bottom quartile). Information ratio: 0.23 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Aditya Birla Sun Life Focused Equity Fund

एसआयपीसाठी सर्वोत्तम मूल्य निधी

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹230.43

↑ 0.92 ₹8,962 100 -2 2.7 12.4 22.8 19 4.2 Aditya Birla Sun Life Pure Value Fund Growth ₹127.546

↑ 0.58 ₹6,246 1,000 -0.8 4.1 12.8 20.5 16.8 2.6 ICICI Prudential Value Discovery Fund Growth ₹488.9

↑ 2.15 ₹60,353 100 -1.5 3.4 14.6 20.5 20.3 13.8 HDFC Capital Builder Value Fund Growth ₹767.144

↑ 2.96 ₹7,487 300 -1.1 3.4 16.5 20 16.7 8.6 Tata Equity PE Fund Growth ₹355.124

↑ 1.66 ₹8,819 150 -2.2 2.8 12.6 19.8 16.3 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund Aditya Birla Sun Life Pure Value Fund ICICI Prudential Value Discovery Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹8,962 Cr). Bottom quartile AUM (₹6,246 Cr). Highest AUM (₹60,353 Cr). Bottom quartile AUM (₹7,487 Cr). Lower mid AUM (₹8,819 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (21+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.00% (upper mid). 5Y return: 16.82% (lower mid). 5Y return: 20.34% (top quartile). 5Y return: 16.69% (bottom quartile). 5Y return: 16.35% (bottom quartile). Point 6 3Y return: 22.80% (top quartile). 3Y return: 20.51% (upper mid). 3Y return: 20.50% (lower mid). 3Y return: 20.04% (bottom quartile). 3Y return: 19.78% (bottom quartile). Point 7 1Y return: 12.43% (bottom quartile). 1Y return: 12.80% (lower mid). 1Y return: 14.64% (upper mid). 1Y return: 16.48% (top quartile). 1Y return: 12.64% (bottom quartile). Point 8 Alpha: -0.62 (bottom quartile). Alpha: -1.64 (bottom quartile). Alpha: 3.44 (top quartile). Alpha: 2.68 (upper mid). Alpha: 0.27 (lower mid). Point 9 Sharpe: 0.15 (bottom quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.51 (top quartile). Sharpe: 0.39 (upper mid). Sharpe: 0.22 (lower mid). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.57 (bottom quartile). Information ratio: 0.80 (bottom quartile). Information ratio: 1.10 (upper mid). Information ratio: 0.89 (lower mid). Nippon India Value Fund

Aditya Birla Sun Life Pure Value Fund

ICICI Prudential Value Discovery Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

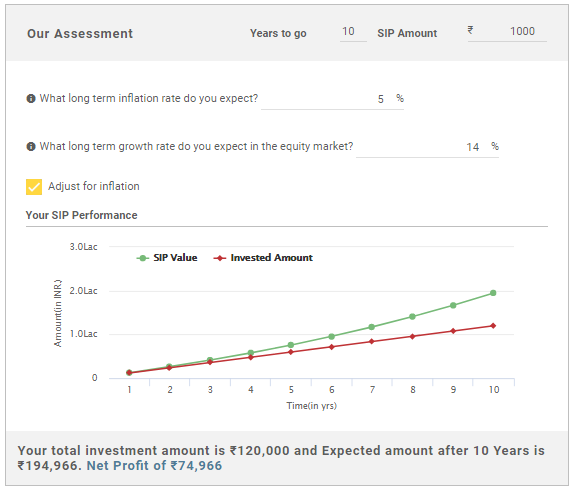

एसआयपी कॅल्क्युलेटर

एसआयपी कॅल्क्युलेटर हे म्युच्युअल फंडामध्ये गुंतवणूक करताना गुंतवणूकदार वापरू शकतो अशा कार्यक्षम साधनांपैकी एक आहे. एखाद्याला कार/घर, सेवानिवृत्तीची योजना, मुलाचे उच्च शिक्षण किंवा इतर कोणतीही मालमत्ता खरेदी करण्यासाठी गुंतवणूक करायची असेल, त्यासाठी SIP कॅल्क्युलेटरचा वापर केला जाऊ शकतो. विशिष्ट आर्थिक उद्दिष्ट गाठण्यासाठी गुंतवणुकीसाठी आवश्यक असलेल्या गुंतवणुकीची रक्कम आणि कालावधीची गणना करण्यात हे मदत करते. तर, सामान्य प्रश्न जसे की "कितीSIP मध्ये गुंतवणूक करा किंवा तोपर्यंत मी गुंतवणूक कशी करावी", हे कॅल्क्युलेटर वापरून निराकरण करते.

एसआयपी कॅल्क्युलेटर वापरताना, विशिष्ट व्हेरिएबल्स भरावे लागतील, ज्यामध्ये समाविष्ट आहे (चित्र खाली दिलेले आहे)-

- इच्छित गुंतवणूक कालावधी

- अंदाजे मासिक SIP रक्कम

- अपेक्षितमहागाई पुढील वर्षांसाठी दर (वार्षिक).

- गुंतवणुकीवर दीर्घकालीन वाढीचा दर

एकदा तुम्ही वर नमूद केलेली सर्व माहिती फीड केल्यावर, कॅल्क्युलेटर तुम्हाला नमूद केलेल्या वर्षांच्या संख्येनंतर तुम्हाला मिळणारी रक्कम (तुमचा SIP परतावा) देईल. तुमचा निव्वळ नफा देखील हायलाइट केला जाईल जेणेकरून तुम्ही त्यानुसार तुमच्या ध्येयपूर्तीचा अंदाज लावू शकता.

सर्वोत्तम म्युच्युअल फंडात गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.