इतर कर बचत गुंतवणुकीवर ELSS का

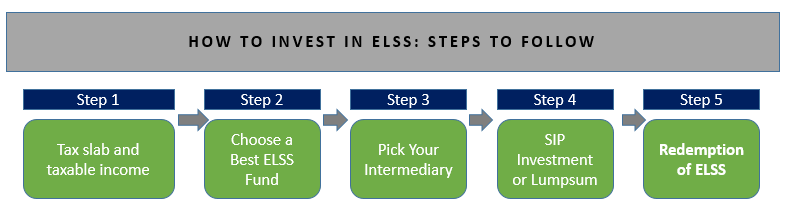

ELSS इक्विटी लिंक्ड सेव्हिंग्ज स्कीम म्हणून ओळखले जाणारे फंड हे इक्विटी-विविध कर बचत करणारे म्युच्युअल फंड आहे जे मुख्यत्वे त्याच्या मालमत्तेमध्ये गुंतवणूक करतेइक्विटी किंवा शेअर बाजारासारखी इक्विटी-लिंक्ड इन्स्ट्रुमेंट्स. ईएलएसएसम्युच्युअल फंड ऑफरबाजार-लिंक केलेले परतावे, जे अस्थिर असतात आणि बाजाराच्या परिस्थितीवर अवलंबून असतात. तथापि,आर्थिक सल्लागार सूचितगुंतवणूक ELSS फंडांमध्ये दीर्घ कालावधीसाठी, कारण हे ELSS म्युच्युअल फंड दीर्घ कालावधीसाठी गुंतवणूक केल्यावर सर्वोत्तम परतावा देतात. अलीकडील अहवालांमध्ये असे दिसून आले आहे की ELSS फंडांनी 3 वर्षांसाठी गुंतवणूक केल्यावर सुमारे 20%-30% परतावा मिळतो, जो इतर म्युच्युअल फंडांद्वारे व्युत्पन्न केलेल्या परताव्यापेक्षा खूपच जास्त आहे.

ELSS आणि इतर कर बचत गुंतवणूक पर्यायांची तुलना

ईएलएसएस आणि इतर कर बचतीची तुलना कार्यकाळ, परतावा, पात्रता यासारख्या पॅरामीटर्सवर आधारित आहेवजावट अंतर्गत80c, इ.

चला एक नझर टाकूया:

| पॅरामीटर | पीपीएफ | NSC | एफडी | ELSS |

|---|---|---|---|---|

| कार्यकाळ | 15 वर्षे | 6 वर्षे | 5 वर्षे | 3 वर्ष |

| परतावा | 7.60 % (वार्षिक चक्रवाढ) | 7.60 % (वार्षिक चक्रवाढ) | 7.00 - 8.00 % (वार्षिक चक्रवाढ) | कोणताही खात्रीशीर लाभांश / परतावा नाही कारण ते मार्केट लिंक आहे |

| मि. गुंतवणूक | रु. ५०० | रु. 100 | रु. 1000 | रु. ५०० |

| कमाल गुंतवणूक | रु. १.५ लाख | कोणतीही उच्च मर्यादा नाही | कोणतीही उच्च मर्यादा नाही | कोणतीही उच्च मर्यादा नाही |

| 80c अंतर्गत कपातीसाठी पात्र रक्कम | रु. १.५ लाख | रु. १.५ लाख | रु. १.५ लाख | रु. १.५ लाख |

| व्याज/परताव्यासाठी कर आकारणी | कर मुक्त | व्याज करपात्र | व्याज करपात्र | १ लाखापर्यंतचे नफा करमुक्त आहेत. 1 लाख रुपयांपेक्षा जास्त नफ्यावर 10% कर लागू होतो |

| सुरक्षितता/रेटिंग | सुरक्षित | सुरक्षित | सुरक्षित | धोका |

2022 मध्ये गुंतवणूक करण्यासाठी शीर्ष 5 ELSS फंड

खाली निव्वळ मालमत्ता/एयूएम असलेल्या फंडाची यादी आहे100 - 200 कोटी.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 BNP Paribas Long Term Equity Fund (ELSS) Growth ₹99.2341

↑ 0.36 ₹941 -0.5 5 16.3 19.4 13.5 4.8 JM Tax Gain Fund Growth ₹48.6406

↑ 0.30 ₹226 -5.1 2 10.9 18.9 15.1 2.5 BOI AXA Tax Advantage Fund Growth ₹162.61

↑ 0.61 ₹1,402 0.1 3.8 15.6 17.9 15.5 -3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 5 Funds showcased

Commentary IDBI Equity Advantage Fund HDFC Long Term Advantage Fund BNP Paribas Long Term Equity Fund (ELSS) JM Tax Gain Fund BOI AXA Tax Advantage Fund Point 1 Bottom quartile AUM (₹485 Cr). Upper mid AUM (₹1,318 Cr). Lower mid AUM (₹941 Cr). Bottom quartile AUM (₹226 Cr). Highest AUM (₹1,402 Cr). Point 2 Established history (12+ yrs). Oldest track record among peers (25 yrs). Established history (20+ yrs). Established history (17+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 9.97% (bottom quartile). 5Y return: 17.39% (top quartile). 5Y return: 13.55% (bottom quartile). 5Y return: 15.10% (lower mid). 5Y return: 15.49% (upper mid). Point 6 3Y return: 20.84% (top quartile). 3Y return: 20.64% (upper mid). 3Y return: 19.45% (lower mid). 3Y return: 18.89% (bottom quartile). 3Y return: 17.88% (bottom quartile). Point 7 1Y return: 16.92% (upper mid). 1Y return: 35.51% (top quartile). 1Y return: 16.29% (lower mid). 1Y return: 10.93% (bottom quartile). 1Y return: 15.64% (bottom quartile). Point 8 Alpha: 1.78 (top quartile). Alpha: 1.75 (upper mid). Alpha: -2.74 (lower mid). Alpha: -4.83 (bottom quartile). Alpha: -10.85 (bottom quartile). Point 9 Sharpe: 1.21 (upper mid). Sharpe: 2.27 (top quartile). Sharpe: 0.00 (lower mid). Sharpe: -0.15 (bottom quartile). Sharpe: -0.36 (bottom quartile). Point 10 Information ratio: -1.13 (bottom quartile). Information ratio: -0.15 (bottom quartile). Information ratio: 0.63 (upper mid). Information ratio: 0.65 (top quartile). Information ratio: 0.01 (lower mid). IDBI Equity Advantage Fund

HDFC Long Term Advantage Fund

BNP Paribas Long Term Equity Fund (ELSS)

JM Tax Gain Fund

BOI AXA Tax Advantage Fund

Talk to our investment specialist

The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments Research Highlights for HDFC Long Term Advantage Fund Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on The investment objective of the Scheme is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities along with income tax rebate, as may be prevalent fromtime to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. Research Highlights for BNP Paribas Long Term Equity Fund (ELSS) Below is the key information for BNP Paribas Long Term Equity Fund (ELSS) Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. Research Highlights for JM Tax Gain Fund Below is the key information for JM Tax Gain Fund Returns up to 1 year are on The Scheme seeks to generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities across all market capitalisations. The Scheme is in the nature of diversified multi-cap fund. The Scheme is not providing any assured or guaranteed returns.(There can be no assurance that the investment objectives of the Scheme will be realized.) Research Highlights for BOI AXA Tax Advantage Fund Below is the key information for BOI AXA Tax Advantage Fund Returns up to 1 year are on 1. IDBI Equity Advantage Fund

IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,897 31 Jan 23 ₹12,807 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. HDFC Long Term Advantage Fund

HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. BNP Paribas Long Term Equity Fund (ELSS)

BNP Paribas Long Term Equity Fund (ELSS)

Growth Launch Date 5 Jan 06 NAV (18 Feb 26) ₹99.2341 ↑ 0.36 (0.36 %) Net Assets (Cr) ₹941 on 31 Dec 25 Category Equity - ELSS AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.21 Sharpe Ratio 0 Information Ratio 0.63 Alpha Ratio -2.74 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,514 31 Jan 23 ₹11,918 31 Jan 24 ₹16,230 31 Jan 25 ₹18,649 31 Jan 26 ₹20,215 Returns for BNP Paribas Long Term Equity Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.4% 3 Month -0.5% 6 Month 5% 1 Year 16.3% 3 Year 19.4% 5 Year 13.5% 10 Year 15 Year Since launch 12.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.8% 2023 23.6% 2022 31.3% 2021 -2.1% 2020 23.6% 2019 17.8% 2018 14.3% 2017 -9.3% 2016 42.3% 2015 -6.6% Fund Manager information for BNP Paribas Long Term Equity Fund (ELSS)

Name Since Tenure Sanjay Chawla 14 Mar 22 3.89 Yr. Pratish Krishnan 14 Mar 22 3.89 Yr. Data below for BNP Paribas Long Term Equity Fund (ELSS) as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 32.35% Consumer Cyclical 15.45% Industrials 11.56% Technology 11.49% Basic Materials 8.15% Health Care 6.35% Consumer Defensive 4.21% Energy 3.92% Communication Services 3.13% Utility 1.23% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK7% ₹61 Cr 656,320 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | ICICIBANK5% ₹45 Cr 329,900 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 18 | RELIANCE4% ₹36 Cr 255,800 State Bank of India (Financial Services)

Equity, Since 31 Mar 22 | SBIN3% ₹30 Cr 278,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 19 | BHARTIARTL3% ₹29 Cr 144,966 Infosys Ltd (Technology)

Equity, Since 29 Feb 24 | INFY3% ₹26 Cr 158,994 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT3% ₹25 Cr 62,520 Tech Mahindra Ltd (Technology)

Equity, Since 31 May 25 | TECHM3% ₹23 Cr 134,100 Sagility Ltd (Healthcare)

Equity, Since 30 Nov 24 | SAGILITY2% ₹23 Cr 4,551,400 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TVSMOTOR2% ₹22 Cr 60,500 4. JM Tax Gain Fund

JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (18 Feb 26) ₹48.6406 ↑ 0.30 (0.62 %) Net Assets (Cr) ₹226 on 31 Dec 25 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.37 Sharpe Ratio -0.15 Information Ratio 0.65 Alpha Ratio -4.83 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,461 31 Jan 23 ₹13,235 31 Jan 24 ₹18,640 31 Jan 25 ₹21,729 31 Jan 26 ₹22,357 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -1.1% 3 Month -5.1% 6 Month 2% 1 Year 10.9% 3 Year 18.9% 5 Year 15.1% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2.5% 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.34 Yr. Asit Bhandarkar 31 Dec 21 4.09 Yr. Ruchi Fozdar 4 Oct 24 1.33 Yr. Deepak Gupta 11 Apr 25 0.81 Yr. Data below for JM Tax Gain Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 28.42% Consumer Cyclical 15.57% Technology 11.47% Industrials 10.28% Basic Materials 8.65% Health Care 8.39% Consumer Defensive 3.74% Real Estate 3.59% Energy 3.45% Communication Services 3.01% Asset Allocation

Asset Class Value Cash 3.43% Equity 96.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK4% ₹9 Cr 98,262 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT4% ₹8 Cr 19,647 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 25 | RELIANCE3% ₹7 Cr 53,400 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK3% ₹7 Cr 48,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹6 Cr 32,950

↑ 7,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | 5900033% ₹6 Cr 199,000 Max Financial Services Ltd (Financial Services)

Equity, Since 31 May 25 | MFSL3% ₹6 Cr 36,400 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 3,956 CarTrade Tech Ltd (Consumer Cyclical)

Equity, Since 30 Sep 25 | 5433333% ₹5 Cr 20,655

↑ 3,300 Lupin Ltd (Healthcare)

Equity, Since 31 May 25 | LUPIN2% ₹5 Cr 25,000 5. BOI AXA Tax Advantage Fund

BOI AXA Tax Advantage Fund

Growth Launch Date 25 Feb 09 NAV (18 Feb 26) ₹162.61 ↑ 0.61 (0.38 %) Net Assets (Cr) ₹1,402 on 31 Dec 25 Category Equity - ELSS AMC BOI AXA Investment Mngrs Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.09 Sharpe Ratio -0.36 Information Ratio 0.01 Alpha Ratio -10.85 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,895 31 Jan 23 ₹13,855 31 Jan 24 ₹20,018 31 Jan 25 ₹21,539 31 Jan 26 ₹22,366 Returns for BOI AXA Tax Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 2.7% 3 Month 0.1% 6 Month 3.8% 1 Year 15.6% 3 Year 17.9% 5 Year 15.5% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.5% 2023 21.6% 2022 34.8% 2021 -1.3% 2020 41.5% 2019 31.2% 2018 14.6% 2017 -16.3% 2016 57.7% 2015 -1.2% Fund Manager information for BOI AXA Tax Advantage Fund

Name Since Tenure Alok Singh 27 Apr 22 3.77 Yr. Data below for BOI AXA Tax Advantage Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 23.83% Industrials 16.76% Basic Materials 14.44% Consumer Cyclical 7.15% Technology 5.52% Consumer Defensive 5.37% Utility 5.15% Communication Services 3.37% Energy 2.29% Health Care 1.77% Real Estate 0.12% Asset Allocation

Asset Class Value Cash 14.11% Equity 85.77% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Oct 21 | SBIN5% ₹72 Cr 664,000 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 23 | HAL4% ₹49 Cr 105,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK4% ₹48 Cr 355,000

↓ -50,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | VEDL3% ₹48 Cr 700,000

↓ -712,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 24 | BHARTIARTL3% ₹46 Cr 235,000 Acutaas Chemicals Ltd (Basic Materials)

Equity, Since 31 May 24 | 5433493% ₹42 Cr 221,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK3% ₹41 Cr 437,532 Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | INDIANB3% ₹38 Cr 415,000

↑ 15,000 ITC Ltd (Consumer Defensive)

Equity, Since 30 Jun 25 | ITC3% ₹36 Cr 1,120,000 Coromandel International Ltd (Basic Materials)

Equity, Since 31 Jan 23 | COROMANDEL3% ₹36 Cr 157,000

इतर कर बचत गुंतवणुकीपेक्षा ELSS किती चांगले?

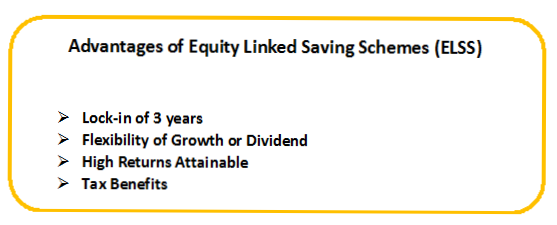

विविध आहेतकर बचत गुंतवणूक भारतातील पर्याय ज्यात ELSS सर्वोत्तम पर्यायांपैकी एक आहे. कसे? येथे काही कारणे नमूद केली आहेत.

दीर्घकालीन उच्च परतावा

ELSS फंड शेअर बाजारातील इतर कर बचत गुंतवणुकींमध्ये सर्वाधिक मालमत्तेचे वाटप करतात. तर, हे फंड उत्तम कमावतातमहागाई- मारहाण सर्वांमध्ये परत येते. दीर्घ कालावधीसाठी गुंतवणूक केल्यास, ELSS चा परताव्याचा दर इतर पारंपारिक कर्ज-केंद्रित गुंतवणुकीच्या परताव्याला सहज मागे टाकू शकतो. त्यामुळे, ELSS म्युच्युअल फंड गुंतवणूकदारांना दोन्ही जगातील सर्वोत्कृष्ट - उच्च परतावा आणि कर लाभ प्रदान करतात.

सर्वात कमी लॉक-इन कालावधी

पारंपारिक कर बचत गुंतवणूक पर्यायांच्या तुलनेत ELSS म्युच्युअल फंडांचा लॉक-इन कालावधी कमी असतो. ईएलएसएस फंडांचा लॉक-इन कालावधी 3 वर्षांचा असतो तर पीपीएफचा कालावधी 15 वर्षे असतो आणिNPS पर्यंत आहेसेवानिवृत्ती. त्यामुळे, ELSS मध्ये गुंतवणूक केल्याने तुमचे पैसे जास्त कालावधीसाठी लॉक होत नाहीत आणि लॉक-इन संपल्यानंतर तुम्ही लवकरच गुंतवणूक करणे थांबवू शकता.

अत्यंत लवचिक गुंतवणूक

ELSS म्युच्युअल फंडांची लवचिकता इतर सर्व कर बचत गुंतवणुकीपेक्षा खूप जास्त आहे. पारंपारिक गुंतवणुकीच्या विपरीत, फक्त एकाच प्रकारच्या पर्यायामध्ये गुंतवणूक करण्याची गरज नाही. ELSS फंड तुम्हाला तुमच्या पोर्टफोलिओमध्ये विविध प्रकारच्या गुंतवणुकीसह विविधता आणण्यास सक्षम करतात. तसेच, लॉक-इन कालावधी संपल्यानंतरही गुंतवणूकदार या फंडांमध्ये गुंतवणूक करू शकतात. त्यामुळे, लॉक-इन संपल्यानंतर, तुम्ही सहजपणे गुंतवणुकीत राहणे किंवा तुमच्या सोयीनुसार रिडीम करणे निवडू शकता.

निष्कर्ष

शेवटी, ELSS फंडांमध्ये गुंतवणूक करणाऱ्या गुंतवणूकदारांसाठी येथे काही टिपा आहेत.

- ELSS मध्ये लवकर गुंतवणूक सुरू करा

- तुमच्या मर्यादेत गुंतवणूक करा

- लाभांश पुनर्गुंतवणूक निवडू नका

- हळूहळू आणि हळूहळू रिडीम करा

- ए द्वारे गुंतवणूक कराSIP

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for IDBI Equity Advantage Fund