New Mutual Fund Categorisation Introduced by SEBI

Securities and Exchange Board of India (SEBI) introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before Investing in a scheme.

SEBI intends to make Mutual Fund investment easier for the investors so that investors could invest according to their needs, Financial goals and risk appetite. SEBI has circulated new Mutual Fund categorisation on 6th October 2017. This mandates Mutual Fund Houses to categories all their schemes (existing & future scheme) into 5 broad categories and 36 sub-categories.

Let’s see the new distinct categories introduced by SEBI in Equity Funds, Debt Funds, Hybrid Funds, Solution Oriented Funds and other schemes

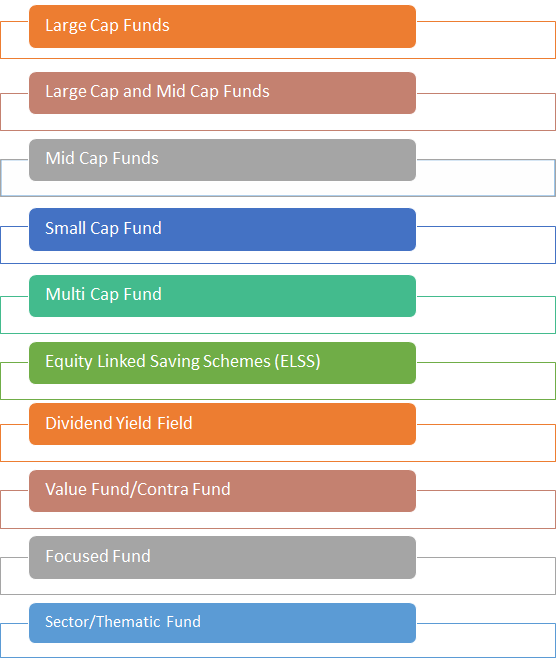

New Categorisation in Equity Schemes

SEBI has set a clear classification as to what is a large cap, mid cap and small cap:

| Market Capitalization | Description |

|---|---|

| Large cap company | 1st to 100th company in terms of full market capitalization |

| Mid cap company | 101st to 250th company in terms of full market capitalization |

| Small cap company | 251st company onwards in terms of full market capitalization |

Here’s the list of new equity fund categories with their Asset Allocation plan:

1. Large Cap Fund

These are the funds that predominantly invest in the large-cap stocks. The exposure in large-cap stocks has to be a minimum 80 percent of the scheme’s total assets.

2. Large and Mid Cap Fund

These are the schemes that invest in both large & mid cap stocks. These funds will invest a minimum of 35 percent each in mid and large cap stocks.

3. Mid Cap Fund

This is a scheme that mainly invests in mid-cap stocks. The scheme will invest 65 percent of its total assets in mid-cap stocks.

4. Small Cap Fund

The Portfolio should have at least 65 percent of its total assets in small-cap stocks.

5. Multi Cap Fund

This equity scheme invests across market cap, i.e., large cap, mid cap and small cap. A minimum of 65 percent of its total assets should be allocated to equities.

6. ELSS

Equity Linked Savings Schemes (ELSS) is a tax saving fund that comes with a lock-in period of three years. A minimum of 80 percent of its total assets has to be invested in equities.

7. Dividend Yield Fund

This fund will predominantly invest in dividend yielding stocks. This scheme will invest a minimum 65 percent of its total assets in equities, but in dividend yielding stocks.

8. Value Fund

This is an equity fund that will follow the value investment strategy.

9. Contra Fund

This equity scheme will follow the contrarian investment strategy. Value/Contra will invest at least 65 percent of its total assets in equities, but a Mutual Fund house can either offer a value fund or a contra fund, but not both.

10. Focused Fund

This fund will focus on large, mid, small or multi-cap stocks, but can have a maximum of 30 stocks. focused fund can invest at least 65 percent of its total assets in equities.

11. Sector/Thematic Fund

These are the funds that invest in a particular sector or a theme. At least 80 percent of the total assets of these schemes will be invested in a particular sector or theme.

Talk to our investment specialist

New Categorisation in Debt Schemes

As per SEBI’s new categorisation, Debt fund schemes will have 16 categories. Here’s the list:

1. Overnight Fund

This debt scheme will invest in overnight securities having a maturity of one day.

2. Liquid Fund

These schemes will invest in debt and money market securities with a maturity of up to 91 days.

3.Ultra Short Duration Fund

This scheme will invest in debt and money market securities with a Macaulay duration between three to six months. Macaulay duration measures how long it will take the scheme to recoup the investment.

4. Low Duration Fund

The scheme will invest in debt and money market securities with a Macaulay duration between six to 12 months.

5. Money Market Fund

This scheme will invest in money market instruments having a maturity up to one year.

6. Short Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of one to three years.

7. Medium Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of three to four years.

8. Medium to Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration of four to seven years.

9. Long Duration Fund

This scheme will invest in debt and money market instruments with a Macaulay duration greater than seven years.

10. Dynamic Bond Fund

This is a debt scheme that invests across all the duration.

11. Corporate Bond Fund

This debt scheme mainly invests in the highest rated corporate Bonds. The fund can invest a minimum 80 percent of its total assets in the highest-rated corporate bonds

12. Credit Risk Fund

This scheme will invest in AA and below the high-rated corporate bonds. The Credit Risk Fund should invest at least 65 percent of its assets below the highest-rated instruments.

13. Banking and PSU Fund

This scheme predominantly invests in debt instruments of Banks, Public Financial Institutional, Public Sector Undertakings.

14. Gilt Fund

This scheme invests in government securities across maturity. Gilt Funds will invest a minimum 80 percent of its total assets in government securities.

15. Gilt Fund with 10-year Constant Duration

This scheme will invest in government securities with a maturity of 10 years. Gilt Funds with 10-year Constant Duration will invest a minimum 80 percent in government securities.

16. Floater Fund

This debt scheme mainly invests in Floating Rate instruments. Floater Fund will invest a minimum of 65 percent of its total assets in floating rate instruments.

New Categorisation in Hybrid Schemes

According to the new SEBI’s regulation, there will be six categories of Hybrid Funds:

1. Conservative Hybrid Fund

This scheme will majorly invested in debt instruments. About 75 to 90 percent of their total assets will be invest in debt instruments and about 10 to 25 percent in equity-related instruments.

2. Balanced Hybrid Fund

This fund will invest around 40-60 percent of its total assets in both debt and equity instruments.

3. Aggressive Hybrid Fund

This fund will invest around 65 to 85 percent of its total assets in equity-related instruments and about 20 to 35 percent of their assets in debt instruments. Mutual fund houses can offer either a balanced hybrid or an aggressive Hybrid Fund, not both.

4. Dynamic Asset Allocation or Balanced Advantage Fund

This scheme would dynamically manage their investments in equity and debt instruments.

5. Multi Asset Allocation

This scheme can invest in three asset classes, which means that they can invest in an extra Asset Class apart from equity and debt. The fund should invest at least 10 percent in each of the asset classes. Foreign securities will not be treated as a separate asset class.

6. Arbitrage Fund

This fund will follow the arbitrage strategy and will invest at least 65 percent of its assets in equity-related instruments.

7. Equity Savings

This scheme will invest in equity, arbitrage and debt. Equity savings will invest at least 65 percent of the total assets in stocks and a minimum 10 percent in debt. The scheme would state the minimum hedged and unhedged investments in the scheme information document.

Solution Oriented Schemes

1. Retirement Fund

This is a retirement solution oriented scheme that will have a lock-in of five years or till the age of retirement.

2. Children’s Fund

This is children oriented scheme having a lock-on for five years or until the child attains the age of majority, whichever is earlier.

Other Schemes

1. Index Fund/ETF

This fund can invest at least 95 percent of its total asset in securities of a particular index.

2. FOFs (Overseas & Domestic)

This fund can invest a minimum of 95 percent of its total assets in the Underlying fund.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.