6 Investment Decisions to Make During Coronavirus Pandemic

Coronavirus pandemic has been changing the economic and social atmosphere. Countries across the globe are fighting to keep up with economic stability. Financial markets worldwide have been hit severely, five times more than normal. Investors are in a dilemma because of the increasing Volatility in the market.

As a mutual fund investor, if you are in a state of panic, it is advised you to follow the following investment tips:

1. Don’t Panic

The current situation is not to create a panic, but to maintain calmness. As an investor make use of your past experiences. Keep in mind the situation and think about the situation one year down the line before disrupting or withdrawing your Portfolio completely.

Take the systematic accumulation and become a long-term investor. Experts suggest that there might be good growth by 2021.

2. Don’t withdraw investments from global funds

The situation right now might seem unfavourable if you have invested in global fund. Countries are in a state of lockdown. However, the economies in every country differ and they are dealing with their economic situation differently. This is a plus point for those who have invested in global funds. Their returns depend on the same. Therefore, try to make a combination of both national and international fund before taking a major step to quit.

3. Don’t predict stock success

While buying low price stocks might seem tempting enough to purchase, refrain from doing so. Investors are bound to feel that these stocks might provide great returns down the line. Investors should seek advice from their financial advisors regarding the matter before jumping to a quick decision. This is crucial, especially when the economy is in turmoil. Commit yourself to complete fund research before making a choice for investment.

Talk to our investment specialist

4. Rebalancing Portfolio

During an economic slowdown, investors should rebalance portfolios on a periodic basis. Refrain from being overtaken by fear or greed at this point. Consult with your financial advisor and buy an equity asset than has become underweight by selling the overweight asset. Rebalance so that you become underweight on Equity Funds.

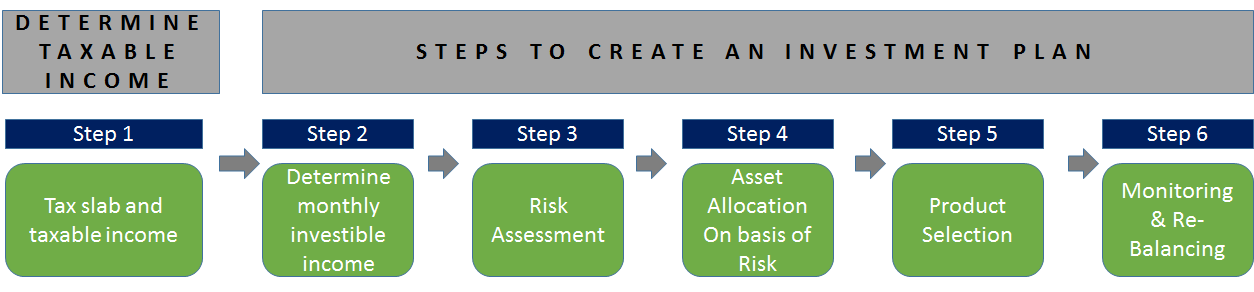

Fund Selection Methodology used to find 5 funds

5. Don’t discontinue investing in SIPs/STPs

Investing in the Systematic Investment plan (SIP) and Systematic Transfer Plan (STP) is one of the most ideal ways to invest in a mutual fund, especially during a recession. It offers benefits of the advantage of rupee cost averaging wherein during a market fall you are able to purchase more units. Additionally, it allows you to be disciplined with finances and monthly investments.

Best SIP Funds to Invest in 2026

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹36.5276

↑ 0.18 ₹5,817 500 6.8 17.1 33.3 34.1 28.3 11.3 DSP World Gold Fund Growth ₹62.625

↓ -0.10 ₹1,756 500 34.3 83.1 153 55.4 28.2 167.1 ICICI Prudential Infrastructure Fund Growth ₹197.62

↑ 1.04 ₹8,134 100 -1.3 2.8 17.4 25.2 26.8 6.7 Invesco India PSU Equity Fund Growth ₹68.34

↑ 0.60 ₹1,449 500 1.9 10.3 31.4 31.8 26.5 10.3 DSP India T.I.G.E.R Fund Growth ₹324.783

↑ 1.00 ₹5,323 500 1.1 5.2 21.7 25.7 24.4 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI PSU Fund DSP World Gold Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,756 Cr). Highest AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹5,323 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 28.26% (top quartile). 5Y return: 28.18% (upper mid). 5Y return: 26.82% (lower mid). 5Y return: 26.47% (bottom quartile). 5Y return: 24.39% (bottom quartile). Point 6 3Y return: 34.12% (upper mid). 3Y return: 55.43% (top quartile). 3Y return: 25.17% (bottom quartile). 3Y return: 31.84% (lower mid). 3Y return: 25.71% (bottom quartile). Point 7 1Y return: 33.26% (upper mid). 1Y return: 153.01% (top quartile). 1Y return: 17.42% (bottom quartile). 1Y return: 31.42% (lower mid). 1Y return: 21.75% (bottom quartile). Point 8 Alpha: -0.22 (bottom quartile). Alpha: 1.32 (top quartile). Alpha: 0.00 (upper mid). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 0.33 (upper mid). Sharpe: 3.42 (top quartile). Sharpe: 0.12 (bottom quartile). Sharpe: 0.27 (lower mid). Sharpe: -0.31 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.67 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.37 (lower mid). Information ratio: 0.00 (upper mid). SBI PSU Fund

DSP World Gold Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

200 Crore in Equity Category of Mutual Funds ordered based on 5 year CAGR returns.

6. Don’t shift focus away from financial goals

It is highly-possible to fall prey to panic during a global recession. However, make sure you stay calm and focus on your Financial goals. Remind yourself of the reason you prepared those financial goals and why you’re investing for it. Reanalyse your short-term and long-term goals and stick to them. Become familiar with your Credit Report and make efforts to understand it thoroughly. Understand your assets and debts before making a big decision.

Maintain Accountability with a financial advisor, spouse or a friend and get all the support you can to stay focused on your goal.

Conclusion

With the global panic increasing every day due to coronavirus, ensure to look at the positive side of the situation. Find or create solutions to keep yourself motivated through this season of panic and keep investing. Don’t make rash investment decisions and make sure to keep your financial advisor or a trusted friend in the loop.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.