11 بہترین لارج کیپ ایکویٹی فنڈز 2022

مثالی طور پر، جب کوئی سوچتا ہے۔سرمایہ کاریپہلی سوچ جو کسی کے ذہن میں آتی ہے وہ زیادہ تر ایکویٹی ہوگی۔ جب آپ مزید دریافت کریں گے۔ایکویٹی فنڈز، آپ بڑے ٹوپی فنڈز گے.

بڑی ٹوپیباہمی چندہ ایکویٹی میں سب سے محفوظ سرمایہ کاری میں سے ایک سمجھی جاتی ہے کیونکہ ان میں اچھا منافع ہوتا ہے اور ان کے لیے کم اتار چڑھاؤ ہوتا ہے۔مارکیٹ دیگر ایکویٹی فنڈز کے مقابلے میں اتار چڑھاؤ یعنی وسط اورسمال کیپ فنڈز. یہ فنڈز بڑی کمپنیوں کے اسٹاک میں سرمایہ کاری کرتے ہیں۔ بلیو چپ کمپنیوں کے حصص کی قیمت زیادہ ہونے کے باوجود سرمایہ کار اپنی رقم بڑی سرمایہ کاری میں لگانے کے خواہشمند ہیں۔

بہترین لاج کیپ میوچل فنڈ کا انتخاب ایک اہم کام ہے جسے مناسب اہمیت دینے کی ضرورت ہے۔ آئیے نیچے دیکھتے ہیں۔سرمایہ کاری کے فوائد بڑے کیپ میوچل فنڈز میں، بہترین کا انتخاب کیسے کریں۔بڑے کیپ فنڈز اور آخر میں، 2022 میں سرمایہ کاری کے لیے سرفہرست 10 بہترین بڑے بڑے فنڈز کی فہرست۔

لارج کیپ فنڈز کا انتخاب کیسے کریں؟

صحیح بڑے کیپ میوچل فنڈ کا انتخاب کبھی بھی آسان نہیں ہوتا ہے۔ کچھ فنڈز اچھی کارکردگی کا مظاہرہ کرتے ہیں، جبکہ دیگر فنڈز سست ہو جاتے ہیں۔ لیکن، چند پیرامیٹرز ہیں جو سرمایہ کاروں کو صحیح فنڈ کا انتخاب کرتے وقت دیکھنا ہوں گے۔ کسی فنڈ کے بارے میں فیصلہ کرنے سے پہلے کسی کو متعدد مقداری اور معیاری عوامل کو دیکھنے کی ضرورت ہے۔

مقداری عوامل

باہمیفنڈ کی درجہ بندی ایک اچھا نقطہ آغاز ہو سکتا ہے۔ اس کو دوسرے ڈیٹا جیسے فنڈ کی عمر، اثاثہ جات کے زیر انتظام (AUM)، ماضی کے ریٹرن، اخراجات کا تناسب، وغیرہ کے ساتھ پورا کرنے کی ضرورت ہے۔ مزید برآں، سرمایہ کاروں کو مشورہ دیا جاتا ہے کہ وہ فنڈ کی گزشتہ تین سالوں کی کارکردگی کو چیک کریں۔ ایک فنڈ کے پاس INR 1000 کروڑ سے زیادہ کے خالص اثاثے ہونے چاہئیں اور پچھلے ایک سال کے دوران بڑے کیپ اسٹاکس کے لیے کم از کم اوسطاً 65 فیصد مختص ہونا چاہیے۔

Talk to our investment specialist

قابلیت کے عوامل

اس کو مزید معیار کے عوامل جیسے فنڈ ہاؤس کی ساکھ، فنڈ مینیجر کا ٹریک ریکارڈ اور سرمایہ کاری کے عمل سے فلٹر کرنے کی ضرورت ہے۔ کسی کو وہ فنڈ ہاؤس منتخب کرنا چاہیے جس پر آپ کو اپنا پیسہ لگانے کا یقین ہو۔ ایسے فنڈ ہاؤسز کی نشاندہی کرنا جن کی مارکیٹ میں مضبوط موجودگی ہے اور مختلف قسم کے فنڈز فراہم کرتے ہیں جن کا ٹریک ریکارڈ طویل اور مستقل ہے۔ یہ بھی دیکھنا چاہیے کہ کتنے فنڈز ٹاپ پرفارمرز ہیں۔ اچھے ٹریک ریکارڈ کے ساتھ ایک فنڈ مینیجر ضروری ہے۔ ایکاثاثہ مینجمنٹ کمپنی ایک سیٹ کے ساتھ ادارہ جاتی سرمایہ کاری کا عمل بھی اہم ہے کیونکہ یہ اس بات کو یقینی بناتا ہے کہ یہ ایک ایسا عمل ہے جو آپ کو صرف فنڈ مینیجر (شخص - اور اس وجہ سے کلیدی خطرہ) کے بجائے پیسہ کمانے کے لیے تیار کرتا ہے۔ مندرجہ بالا کام کرنے سے، کوئی بھی بہترین لارج کیپ فنڈ کو آزما سکتا ہے یا منتخب کرنے کے لیے ٹاپ 10 بہترین لاج کیپ فنڈز کی فہرست بھی بنا سکتا ہے۔

ٹاپ 11 بہترین کارکردگی کا مظاہرہ کرنے والے لارج کیپ میوچل فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹89.2487

↓ -0.95 ₹50,107 -4.2 -0.8 13.6 18.3 16.7 9.2 ICICI Prudential Bluechip Fund Growth ₹108.85

↓ -1.20 ₹76,646 -5.3 0.1 13 17.3 14.9 11.3 DSP TOP 100 Equity Growth ₹459.769

↓ -5.48 ₹7,163 -5 0 9.1 17.1 12.8 8.4 Bandhan Large Cap Fund Growth ₹75.844

↓ -0.85 ₹1,980 -4.7 0.2 14.1 16.8 12.7 8.2 Invesco India Largecap Fund Growth ₹66.63

↓ -0.88 ₹1,666 -5.8 -2.5 12.6 16.5 13.2 5.5 BNP Paribas Large Cap Fund Growth ₹217.278

↓ -1.96 ₹2,614 -3.2 1.1 11.1 15.7 12.6 4.4 Aditya Birla Sun Life Frontline Equity Fund Growth ₹510.43

↓ -5.53 ₹30,392 -5.9 -1.2 11.1 14.6 12.5 9.4 TATA Large Cap Fund Growth ₹496.49

↓ -6.28 ₹2,760 -4.3 1.6 12 14.6 12.5 9.2 Edelweiss Large Cap Fund Growth ₹82.95

↓ -1.01 ₹1,444 -3.6 1.4 12.3 14.6 12.4 7.2 Canara Robeco Bluechip Equity Fund Growth ₹60.97

↓ -0.72 ₹17,094 -5.4 -1.4 9.8 14.5 11.6 7.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 11 Funds showcased

Commentary IDBI India Top 100 Equity Fund Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund BNP Paribas Large Cap Fund Aditya Birla Sun Life Frontline Equity Fund TATA Large Cap Fund Edelweiss Large Cap Fund Canara Robeco Bluechip Equity Fund Point 1 Bottom quartile AUM (₹655 Cr). Top quartile AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Upper mid AUM (₹7,163 Cr). Lower mid AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Lower mid AUM (₹2,614 Cr). Upper mid AUM (₹30,392 Cr). Lower mid AUM (₹2,760 Cr). Bottom quartile AUM (₹1,444 Cr). Upper mid AUM (₹17,094 Cr). Point 2 Established history (13+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (23+ yrs). Established history (19+ yrs). Established history (16+ yrs). Established history (21+ yrs). Established history (23+ yrs). Oldest track record among peers (27 yrs). Established history (16+ yrs). Established history (15+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 4★ (upper mid). Top rated. Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.61% (lower mid). 5Y return: 16.67% (top quartile). 5Y return: 14.90% (top quartile). 5Y return: 12.77% (upper mid). 5Y return: 12.73% (upper mid). 5Y return: 13.23% (upper mid). 5Y return: 12.62% (lower mid). 5Y return: 12.51% (lower mid). 5Y return: 12.49% (bottom quartile). 5Y return: 12.43% (bottom quartile). 5Y return: 11.62% (bottom quartile). Point 6 3Y return: 21.88% (top quartile). 3Y return: 18.26% (top quartile). 3Y return: 17.35% (upper mid). 3Y return: 17.11% (upper mid). 3Y return: 16.81% (upper mid). 3Y return: 16.51% (lower mid). 3Y return: 15.73% (lower mid). 3Y return: 14.63% (lower mid). 3Y return: 14.61% (bottom quartile). 3Y return: 14.58% (bottom quartile). 3Y return: 14.52% (bottom quartile). Point 7 1Y return: 15.39% (top quartile). 1Y return: 13.65% (upper mid). 1Y return: 12.99% (upper mid). 1Y return: 9.11% (bottom quartile). 1Y return: 14.07% (top quartile). 1Y return: 12.65% (upper mid). 1Y return: 11.05% (bottom quartile). 1Y return: 11.14% (lower mid). 1Y return: 12.00% (lower mid). 1Y return: 12.31% (lower mid). 1Y return: 9.85% (bottom quartile). Point 8 Alpha: 2.11 (top quartile). Alpha: 0.30 (upper mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (lower mid). Alpha: 0.90 (top quartile). Alpha: -1.06 (lower mid). Alpha: -2.69 (bottom quartile). Alpha: -0.21 (upper mid). Alpha: -0.83 (lower mid). Alpha: -1.75 (bottom quartile). Alpha: -1.81 (bottom quartile). Point 9 Sharpe: 1.09 (top quartile). Sharpe: 0.30 (upper mid). Sharpe: 0.30 (upper mid). Sharpe: 0.17 (lower mid). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (lower mid). Sharpe: 0.06 (bottom quartile). Sharpe: 0.26 (upper mid). Sharpe: 0.21 (lower mid). Sharpe: 0.14 (bottom quartile). Sharpe: 0.13 (bottom quartile). Point 10 Information ratio: 0.14 (bottom quartile). Information ratio: 1.22 (top quartile). Information ratio: 1.01 (top quartile). Information ratio: 0.64 (upper mid). Information ratio: 0.69 (upper mid). Information ratio: 0.72 (upper mid). Information ratio: 0.30 (lower mid). Information ratio: 0.31 (lower mid). Information ratio: 0.13 (bottom quartile). Information ratio: 0.16 (lower mid). Information ratio: -0.04 (bottom quartile). IDBI India Top 100 Equity Fund

Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

BNP Paribas Large Cap Fund

Aditya Birla Sun Life Frontline Equity Fund

TATA Large Cap Fund

Edelweiss Large Cap Fund

Canara Robeco Bluechip Equity Fund

AUM/نیٹ اثاثوں کے ساتھ 11 بہترین لارج کیپ میوچل فنڈز کی فہرست >500 کروڑ. ہونافنڈ کی عمر>=3 پر ترتیب دیا گیا3 سالسی اے جی آر واپسی.

The Investment objective of the Scheme is to provide investors with the opportunities for long-term capital appreciation by investing predominantly in Equity and Equity related Instruments of Large Cap companies. However

there can be no assurance that the investment objective under the Scheme will be realized. Research Highlights for IDBI India Top 100 Equity Fund Below is the key information for IDBI India Top 100 Equity Fund Returns up to 1 year are on (Erstwhile Reliance Top 200 Fund) The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing in equity and equity related instruments of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index. The secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Large Cap Fund Below is the key information for Nippon India Large Cap Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Focused Bluechip Equity Fund) To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among Top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd. If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund

Manager reserves the right to increase the number of companies to more than 20. Research Highlights for ICICI Prudential Bluechip Fund Below is the key information for ICICI Prudential Bluechip Fund Returns up to 1 year are on The Fund is seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. Research Highlights for DSP TOP 100 Equity Below is the key information for DSP TOP 100 Equity Returns up to 1 year are on (Erstwhile IDFC Equity Fund) The investment objective of the scheme is to seek to generate

capital growth from a portfolio of predominantly equity and equity

related instruments (including Equity Derivatives). The scheme

may also invest in debt & money market instruments to generate

reasonable income. However there is no assurance or guarantee that the objectives of the scheme will be realized. Research Highlights for Bandhan Large Cap Fund Below is the key information for Bandhan Large Cap Fund Returns up to 1 year are on (Erstwhile Invesco India Business Leaders Fund) To generate long term capital appreciation by investing in equity and equity related instruments including equity derivatives of companies which in our opinion are leaders in their respective industry or industry segment. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India Largecap Fund Below is the key information for Invesco India Largecap Fund Returns up to 1 year are on (Erstwhile BNP Paribas Equity Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversifi ed and actively managed portfolio of equity and equity related securities. The Scheme will invest in a range of companies, with a bias towards large & medium market capitalisation companies. However, there can be no

assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. Research Highlights for BNP Paribas Large Cap Fund Below is the key information for BNP Paribas Large Cap Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and or sectors as its chosen benchmark index, S&P BSE 200. Research Highlights for Aditya Birla Sun Life Frontline Equity Fund Below is the key information for Aditya Birla Sun Life Frontline Equity Fund Returns up to 1 year are on To provide income distribution and / or medium to long term capital gains while at all times emphasising the importance of capital appreciation. Research Highlights for TATA Large Cap Fund Below is the key information for TATA Large Cap Fund Returns up to 1 year are on (Erstwhile Edelweiss Large Cap Advantage Fund) The investment objective is to seek to generate long-term capital appreciation from a portfolio predominantly consisting equity and equity-related securities of the 100 largest corporate by market capitalisation listed in India.

However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. Research Highlights for Edelweiss Large Cap Fund Below is the key information for Edelweiss Large Cap Fund Returns up to 1 year are on (Erstwhile Canara Robeco Large Cap+ Fund) The Investment Objective of the fund is to provide capital appreciation by predominantly investing in companies having a large market capitalization. However, there can be no assurance that the investment objective of the scheme will be realized. Research Highlights for Canara Robeco Bluechip Equity Fund Below is the key information for Canara Robeco Bluechip Equity Fund Returns up to 1 year are on 1. IDBI India Top 100 Equity Fund

IDBI India Top 100 Equity Fund

Growth Launch Date 15 May 12 NAV (28 Jul 23) ₹44.16 ↑ 0.05 (0.11 %) Net Assets (Cr) ₹655 on 30 Jun 23 Category Equity - Large Cap AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.47 Sharpe Ratio 1.09 Information Ratio 0.14 Alpha Ratio 2.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,080 28 Feb 23 ₹12,376 Returns for IDBI India Top 100 Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3% 3 Month 9.2% 6 Month 12.5% 1 Year 15.4% 3 Year 21.9% 5 Year 12.6% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI India Top 100 Equity Fund

Name Since Tenure Data below for IDBI India Top 100 Equity Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Nippon India Large Cap Fund

Nippon India Large Cap Fund

Growth Launch Date 8 Aug 07 NAV (06 Mar 26) ₹89.2487 ↓ -0.95 (-1.05 %) Net Assets (Cr) ₹50,107 on 31 Jan 26 Category Equity - Large Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.58 Sharpe Ratio 0.3 Information Ratio 1.22 Alpha Ratio 0.3 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,719 28 Feb 23 ₹13,065 29 Feb 24 ₹18,578 28 Feb 25 ₹19,042 28 Feb 26 ₹22,442 Returns for Nippon India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -2.6% 3 Month -4.2% 6 Month -0.8% 1 Year 13.6% 3 Year 18.3% 5 Year 16.7% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.2% 2023 18.2% 2022 32.1% 2021 11.3% 2020 32.4% 2019 4.9% 2018 7.3% 2017 -0.2% 2016 38.4% 2015 2.2% Fund Manager information for Nippon India Large Cap Fund

Name Since Tenure Sailesh Raj Bhan 8 Aug 07 18.5 Yr. Kinjal Desai 25 May 18 7.7 Yr. Bhavik Dave 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Large Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 33.89% Consumer Cyclical 14.78% Consumer Defensive 9.84% Industrials 9.61% Technology 8.16% Health Care 5.68% Basic Materials 5.67% Utility 5.47% Energy 5.44% Real Estate 0.34% Communication Services 0.19% Asset Allocation

Asset Class Value Cash 0.89% Equity 99.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK9% ₹4,607 Cr 49,580,734

↑ 4,200,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹3,208 Cr 23,677,945

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE5% ₹2,726 Cr 19,537,539 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | AXISBANK4% ₹2,140 Cr 15,615,542 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN4% ₹2,055 Cr 19,082,107

↓ -500,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT3% ₹1,730 Cr 4,400,529 Infosys Ltd (Technology)

Equity, Since 30 Sep 07 | INFY3% ₹1,574 Cr 9,590,806 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 24 | TCS3% ₹1,468 Cr 4,700,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 16 | ITC3% ₹1,380 Cr 42,829,812

↑ 7,500,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 21 | BAJFINANCE3% ₹1,362 Cr 14,648,655 3. ICICI Prudential Bluechip Fund

ICICI Prudential Bluechip Fund

Growth Launch Date 23 May 08 NAV (06 Mar 26) ₹108.85 ↓ -1.20 (-1.09 %) Net Assets (Cr) ₹76,646 on 31 Jan 26 Category Equity - Large Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.46 Sharpe Ratio 0.3 Information Ratio 1.01 Alpha Ratio 0.35 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,875 28 Feb 23 ₹12,536 29 Feb 24 ₹17,488 28 Feb 25 ₹17,948 28 Feb 26 ₹20,904 Returns for ICICI Prudential Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.3% 3 Month -5.3% 6 Month 0.1% 1 Year 13% 3 Year 17.3% 5 Year 14.9% 10 Year 15 Year Since launch 14.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 16.9% 2022 27.4% 2021 6.9% 2020 29.2% 2019 13.5% 2018 9.8% 2017 -0.8% 2016 32.7% 2015 7.7% Fund Manager information for ICICI Prudential Bluechip Fund

Name Since Tenure Anish Tawakley 5 Sep 18 7.41 Yr. Vaibhav Dusad 18 Jan 21 5.04 Yr. Sharmila D’mello 31 Jul 22 3.51 Yr. Data below for ICICI Prudential Bluechip Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 28.32% Consumer Cyclical 12.02% Industrials 11.69% Energy 8.9% Basic Materials 6.92% Technology 5.22% Utility 4.99% Communication Services 4.88% Health Care 4.5% Consumer Defensive 3.45% Real Estate 1.22% Asset Allocation

Asset Class Value Cash 3.77% Equity 96.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK10% ₹7,423 Cr 79,879,508

↑ 2,440,640 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 08 | ICICIBANK8% ₹6,426 Cr 47,426,976 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 08 | RELIANCE6% ₹4,948 Cr 35,455,981

↑ 800,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 12 | LT6% ₹4,944 Cr 12,574,023

↑ 130,671 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 14 | AXISBANK5% ₹3,534 Cr 25,789,059 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 09 | BHARTIARTL4% ₹3,337 Cr 16,951,029 Nifty 50 Index

- | -4% ₹3,154 Cr 1,240,525

↑ 1,240,525 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Apr 16 | MARUTI4% ₹2,957 Cr 2,025,668

↑ 24,356 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 17 | ULTRACEMCO3% ₹2,676 Cr 2,107,962

↑ 4,035 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY3% ₹2,666 Cr 16,248,711

↓ -200,000 4. DSP TOP 100 Equity

DSP TOP 100 Equity

Growth Launch Date 10 Mar 03 NAV (06 Mar 26) ₹459.769 ↓ -5.48 (-1.18 %) Net Assets (Cr) ₹7,163 on 31 Jan 26 Category Equity - Large Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 1.94 Sharpe Ratio 0.17 Information Ratio 0.64 Alpha Ratio -1.18 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,955 28 Feb 23 ₹11,613 29 Feb 24 ₹15,576 28 Feb 25 ₹17,027 28 Feb 26 ₹19,178 Returns for DSP TOP 100 Equity

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -2.4% 3 Month -5% 6 Month 0% 1 Year 9.1% 3 Year 17.1% 5 Year 12.8% 10 Year 15 Year Since launch 18.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.4% 2023 20.5% 2022 26.6% 2021 1.4% 2020 19.5% 2019 7.5% 2018 14.8% 2017 -2.7% 2016 26.5% 2015 4.9% Fund Manager information for DSP TOP 100 Equity

Name Since Tenure Abhishek Singh 1 Jun 22 3.67 Yr. Data below for DSP TOP 100 Equity as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 44.89% Consumer Cyclical 10.18% Health Care 8.5% Technology 7.92% Utility 7.42% Consumer Defensive 5.58% Energy 3.83% Communication Services 1.61% Basic Materials 1.02% Industrials 0.77% Asset Allocation

Asset Class Value Cash 8.29% Equity 91.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 14 | HDFCBANK9% ₹677 Cr 7,283,795

↑ 538,378 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 16 | ICICIBANK8% ₹596 Cr 4,401,409 Infosys Ltd (Technology)

Equity, Since 30 Sep 19 | INFY7% ₹471 Cr 2,872,960

↑ 86,613 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | AXISBANK6% ₹446 Cr 3,257,465 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | M&M6% ₹412 Cr 1,201,992 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 21 | ITC6% ₹400 Cr 12,408,865

↑ 1,432,417 NTPC Ltd (Utilities)

Equity, Since 30 Nov 23 | NTPC5% ₹357 Cr 10,021,653 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 May 24 | KOTAKBANK4% ₹310 Cr 7,592,385 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN4% ₹294 Cr 2,732,969 Cipla Ltd (Healthcare)

Equity, Since 30 Jun 20 | CIPLA4% ₹264 Cr 1,993,692

↑ 99,620 5. Bandhan Large Cap Fund

Bandhan Large Cap Fund

Growth Launch Date 9 Jun 06 NAV (06 Mar 26) ₹75.844 ↓ -0.85 (-1.10 %) Net Assets (Cr) ₹1,980 on 31 Jan 26 Category Equity - Large Cap AMC IDFC Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 0.35 Information Ratio 0.69 Alpha Ratio 0.9 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,754 28 Feb 23 ₹11,512 29 Feb 24 ₹15,838 28 Feb 25 ₹16,074 28 Feb 26 ₹18,960 Returns for Bandhan Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -2.8% 3 Month -4.7% 6 Month 0.2% 1 Year 14.1% 3 Year 16.8% 5 Year 12.7% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.2% 2023 18.7% 2022 26.8% 2021 -2.3% 2020 26.8% 2019 17.4% 2018 10.6% 2017 -4.2% 2016 34.2% 2015 5.3% Fund Manager information for Bandhan Large Cap Fund

Name Since Tenure Manish Gunwani 2 Dec 24 1.16 Yr. Prateek Poddar 2 Dec 24 1.16 Yr. Ritika Behera 7 Oct 23 2.32 Yr. Gaurav Satra 7 Jun 24 1.65 Yr. Data below for Bandhan Large Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 32.37% Consumer Cyclical 14.12% Technology 11.26% Basic Materials 8.74% Health Care 7.1% Energy 6.3% Industrials 6.12% Consumer Defensive 4.82% Utility 4.2% Communication Services 3.14% Real Estate 1.3% Asset Allocation

Asset Class Value Cash 0.53% Equity 99.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 07 | HDFCBANK9% ₹179 Cr 1,931,189

↓ -15,076 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK7% ₹144 Cr 1,063,574

↑ 48,343 Reliance Industries Ltd (Energy)

Equity, Since 28 Feb 07 | RELIANCE6% ₹121 Cr 863,977

↓ -140,960 Infosys Ltd (Technology)

Equity, Since 31 Aug 11 | INFY5% ₹101 Cr 612,833

↓ -20,859 State Bank of India (Financial Services)

Equity, Since 31 Dec 24 | SBIN4% ₹77 Cr 713,977

↑ 13,263 NTPC Ltd (Utilities)

Equity, Since 31 Dec 24 | NTPC4% ₹76 Cr 2,140,308

↓ -55,910 Axis Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | AXISBANK4% ₹76 Cr 551,673

↓ -67,863 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 19 | LT3% ₹64 Cr 162,111

↓ -3,898 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL3% ₹62 Cr 315,769

↑ 53,076 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Apr 24 | M&M3% ₹55 Cr 159,168

↓ -10,832 6. Invesco India Largecap Fund

Invesco India Largecap Fund

Growth Launch Date 21 Aug 09 NAV (06 Mar 26) ₹66.63 ↓ -0.88 (-1.30 %) Net Assets (Cr) ₹1,666 on 31 Jan 26 Category Equity - Large Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 0.2 Information Ratio 0.72 Alpha Ratio -1.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,125 28 Feb 23 ₹11,935 29 Feb 24 ₹16,409 28 Feb 25 ₹16,596 28 Feb 26 ₹19,482 Returns for Invesco India Largecap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.8% 3 Month -5.8% 6 Month -2.5% 1 Year 12.6% 3 Year 16.5% 5 Year 13.2% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 5.5% 2023 20% 2022 27.8% 2021 -3% 2020 32.5% 2019 14.1% 2018 10.5% 2017 -0.4% 2016 28.3% 2015 2.8% Fund Manager information for Invesco India Largecap Fund

Name Since Tenure Hiten Jain 1 Dec 23 2.17 Yr. Data below for Invesco India Largecap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 36.97% Industrials 16.59% Consumer Cyclical 13.8% Technology 11.23% Health Care 9.07% Basic Materials 5.78% Communication Services 3.79% Real Estate 1.27% Consumer Defensive 1.06% Utility 0.52% Asset Allocation

Asset Class Value Equity 100.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIBANK8% ₹131 Cr 969,443

↑ 126,814 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 09 | HDFCBANK8% ₹129 Cr 1,384,844 ICICI Prudential Asset Management Co Ltd (Financial Services)

Equity, Since 31 Dec 25 | ICICIAMC6% ₹96 Cr 321,785 Infosys Ltd (Technology)

Equity, Since 30 Apr 18 | INFY6% ₹95 Cr 581,547 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 25 | LT4% ₹68 Cr 173,437 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 19 | BHARTIARTL4% ₹63 Cr 320,404 Bajaj Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | BAJFINANCE4% ₹62 Cr 671,135 Tech Mahindra Ltd (Technology)

Equity, Since 31 May 23 | TECHM4% ₹60 Cr 345,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 May 25 | INDIGO3% ₹52 Cr 113,532 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹48 Cr 1,771,866 7. BNP Paribas Large Cap Fund

BNP Paribas Large Cap Fund

Growth Launch Date 23 Sep 04 NAV (06 Mar 26) ₹217.278 ↓ -1.96 (-0.90 %) Net Assets (Cr) ₹2,614 on 31 Jan 26 Category Equity - Large Cap AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.02 Sharpe Ratio 0.06 Information Ratio 0.3 Alpha Ratio -2.69 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,428 28 Feb 23 ₹11,888 29 Feb 24 ₹16,367 28 Feb 25 ₹16,475 28 Feb 26 ₹18,991 Returns for BNP Paribas Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -1.7% 3 Month -3.2% 6 Month 1.1% 1 Year 11.1% 3 Year 15.7% 5 Year 12.6% 10 Year 15 Year Since launch 15.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.4% 2023 20.1% 2022 24.8% 2021 4.2% 2020 22.1% 2019 16.8% 2018 17.2% 2017 -4% 2016 37% 2015 -5.5% Fund Manager information for BNP Paribas Large Cap Fund

Name Since Tenure Jitendra Sriram 16 Jun 22 3.63 Yr. Kushant Arora 21 Oct 24 1.28 Yr. Data below for BNP Paribas Large Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 29.12% Consumer Cyclical 12.03% Industrials 11.38% Technology 10.14% Energy 7.18% Consumer Defensive 6.68% Basic Materials 6.33% Health Care 5.84% Communication Services 4.13% Utility 4.11% Asset Allocation

Asset Class Value Cash 1.31% Equity 98.12% Debt 0.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK7% ₹188 Cr 2,025,000

↓ -81,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 12 | ICICIBANK6% ₹159 Cr 1,170,000

↓ -90,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Sep 17 | RELIANCE6% ₹158 Cr 1,134,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT4% ₹113 Cr 288,000

↓ -9,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 29 Feb 08 | BHARTIARTL4% ₹108 Cr 549,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | INFY3% ₹86 Cr 522,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 20 | SBIN3% ₹83 Cr 774,000

↑ 45,000 Hitachi Energy India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Aug 23 | POWERINDIA3% ₹81 Cr 42,930

↓ -270 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | KOTAKBANK3% ₹75 Cr 1,845,000 Tech Mahindra Ltd (Technology)

Equity, Since 31 Jul 25 | TECHM2% ₹63 Cr 360,000 8. Aditya Birla Sun Life Frontline Equity Fund

Aditya Birla Sun Life Frontline Equity Fund

Growth Launch Date 30 Aug 02 NAV (06 Mar 26) ₹510.43 ↓ -5.53 (-1.07 %) Net Assets (Cr) ₹30,392 on 31 Jan 26 Category Equity - Large Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.65 Sharpe Ratio 0.26 Information Ratio 0.31 Alpha Ratio -0.21 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,705 28 Feb 23 ₹12,067 29 Feb 24 ₹15,929 28 Feb 25 ₹16,341 28 Feb 26 ₹18,780 Returns for Aditya Birla Sun Life Frontline Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.7% 3 Month -5.9% 6 Month -1.2% 1 Year 11.1% 3 Year 14.6% 5 Year 12.5% 10 Year 15 Year Since launch 18.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.4% 2023 15.6% 2022 23.1% 2021 3.5% 2020 27.9% 2019 14.2% 2018 7.6% 2017 -2.9% 2016 30.6% 2015 7.4% Fund Manager information for Aditya Birla Sun Life Frontline Equity Fund

Name Since Tenure Harish Krishnan 8 Jan 26 0.07 Yr. Data below for Aditya Birla Sun Life Frontline Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 35.55% Consumer Cyclical 14.12% Technology 10.82% Consumer Defensive 7.1% Industrials 6.13% Basic Materials 5.27% Energy 5.21% Health Care 4.85% Communication Services 4.6% Utility 2.32% Real Estate 0.96% Asset Allocation

Asset Class Value Cash 2.22% Equity 97.66% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK8% ₹2,284 Cr 24,579,704 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹2,215 Cr 16,348,292 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY5% ₹1,639 Cr 9,990,550 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE5% ₹1,436 Cr 10,288,650 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 13 | AXISBANK4% ₹1,264 Cr 9,220,970 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Apr 15 | KOTAKBANK4% ₹1,111 Cr 27,238,515

↑ 750,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 17 | BHARTIARTL4% ₹1,110 Cr 5,637,535 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 08 | LT4% ₹1,101 Cr 2,800,000

↓ -345,715 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN4% ₹1,096 Cr 10,175,538 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | M&M3% ₹1,040 Cr 3,031,152 9. TATA Large Cap Fund

TATA Large Cap Fund

Growth Launch Date 7 May 98 NAV (06 Mar 26) ₹496.49 ↓ -6.28 (-1.25 %) Net Assets (Cr) ₹2,760 on 31 Jan 26 Category Equity - Large Cap AMC Tata Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.05 Sharpe Ratio 0.21 Information Ratio 0.13 Alpha Ratio -0.83 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,703 28 Feb 23 ₹12,065 29 Feb 24 ₹16,115 28 Feb 25 ₹16,257 28 Feb 26 ₹18,878 Returns for TATA Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.2% 3 Month -4.3% 6 Month 1.6% 1 Year 12% 3 Year 14.6% 5 Year 12.5% 10 Year 15 Year Since launch 18.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.2% 2023 12.9% 2022 24.5% 2021 3.3% 2020 32.7% 2019 8.3% 2018 12.1% 2017 -3.6% 2016 29.5% 2015 2.9% Fund Manager information for TATA Large Cap Fund

Name Since Tenure Abhinav Sharma 5 Apr 23 2.83 Yr. Hasmukh Vishariya 1 Mar 25 0.92 Yr. Data below for TATA Large Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 36.89% Consumer Cyclical 14.38% Technology 10.64% Basic Materials 8.61% Industrials 7.54% Consumer Defensive 5.39% Energy 5.31% Utility 4.41% Communication Services 3.53% Health Care 1.1% Asset Allocation

Asset Class Value Cash 1.59% Equity 98.41% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 11 | ICICIBANK9% ₹249 Cr 1,840,300

↑ 975,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK9% ₹239 Cr 2,571,900 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE5% ₹147 Cr 1,050,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 18 | AXISBANK4% ₹112 Cr 820,000

↓ -100,000 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY4% ₹111 Cr 678,248 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 16 | KOTAKBANK4% ₹102 Cr 2,495,000

↓ -500,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jul 18 | TCS3% ₹94 Cr 301,873 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 23 | M&M3% ₹93 Cr 272,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 20 | LT3% ₹92 Cr 232,784

↓ -38,000 State Bank of India (Financial Services)

Equity, Since 30 Apr 14 | SBIN3% ₹88 Cr 821,000 10. Edelweiss Large Cap Fund

Edelweiss Large Cap Fund

Growth Launch Date 20 May 09 NAV (06 Mar 26) ₹82.95 ↓ -1.01 (-1.20 %) Net Assets (Cr) ₹1,444 on 31 Jan 26 Category Equity - Large Cap AMC Edelweiss Asset Management Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.19 Sharpe Ratio 0.14 Information Ratio 0.16 Alpha Ratio -1.75 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,396 28 Feb 23 ₹12,018 29 Feb 24 ₹16,030 28 Feb 25 ₹16,165 28 Feb 26 ₹18,757 Returns for Edelweiss Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -2.3% 3 Month -3.6% 6 Month 1.4% 1 Year 12.3% 3 Year 14.6% 5 Year 12.4% 10 Year 15 Year Since launch 13.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.2% 2023 14.6% 2022 25.7% 2021 3.4% 2020 23.4% 2019 17.3% 2018 11.5% 2017 1.7% 2016 33.8% 2015 0.4% Fund Manager information for Edelweiss Large Cap Fund

Name Since Tenure Bhavesh Jain 2 May 17 8.76 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Data below for Edelweiss Large Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 36.2% Consumer Cyclical 11.88% Technology 7.97% Health Care 7.64% Energy 6.88% Industrials 5.98% Basic Materials 5.91% Consumer Defensive 5.39% Communication Services 3.66% Utility 2.34% Asset Allocation

Asset Class Value Cash 3.39% Equity 96.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 20 | HDFCBANK8% ₹111 Cr 1,195,523 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 18 | ICICIBANK7% ₹96 Cr 709,623

↑ 25,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 10 | RELIANCE6% ₹85 Cr 610,000 State Bank of India (Financial Services)

Equity, Since 31 Dec 14 | SBIN4% ₹62 Cr 575,223 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 10 | LT4% ₹59 Cr 150,176 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY4% ₹51 Cr 308,384 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | AXISBANK3% ₹46 Cr 338,554 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 20 | BHARTIARTL3% ₹41 Cr 208,229 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 22 | M&M3% ₹39 Cr 112,287 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Aug 21 | BAJFINANCE3% ₹38 Cr 410,493 11. Canara Robeco Bluechip Equity Fund

Canara Robeco Bluechip Equity Fund

Growth Launch Date 20 Aug 10 NAV (06 Mar 26) ₹60.97 ↓ -0.72 (-1.17 %) Net Assets (Cr) ₹17,094 on 31 Jan 26 Category Equity - Large Cap AMC Canara Robeco Asset Management Co. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 1.66 Sharpe Ratio 0.13 Information Ratio -0.04 Alpha Ratio -1.81 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,514 28 Feb 23 ₹11,693 29 Feb 24 ₹15,245 28 Feb 25 ₹15,952 28 Feb 26 ₹18,111 Returns for Canara Robeco Bluechip Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3% 3 Month -5.4% 6 Month -1.4% 1 Year 9.8% 3 Year 14.5% 5 Year 11.6% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.3% 2023 17.8% 2022 22.2% 2021 0.8% 2020 24.5% 2019 23.1% 2018 15.7% 2017 3.4% 2016 31.4% 2015 1.9% Fund Manager information for Canara Robeco Bluechip Equity Fund

Name Since Tenure Vishal Mishra 1 Jun 21 4.67 Yr. Shridatta Bhandwaldar 5 Jul 16 9.58 Yr. Data below for Canara Robeco Bluechip Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.8% Consumer Cyclical 13.54% Industrials 9.23% Technology 8.53% Consumer Defensive 6.96% Health Care 6.12% Basic Materials 5.52% Energy 5.29% Communication Services 4.77% Utility 2.22% Real Estate 0.38% Asset Allocation

Asset Class Value Cash 2.64% Equity 97.35% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK9% ₹1,552 Cr 16,702,512

↑ 100,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK8% ₹1,369 Cr 10,100,600 Reliance Industries Ltd (Energy)

Equity, Since 28 Feb 17 | RELIANCE5% ₹904 Cr 6,476,500

↓ -75,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 10 | INFY5% ₹776 Cr 4,730,908

↑ 95,055 State Bank of India (Financial Services)

Equity, Since 30 Nov 20 | SBIN5% ₹770 Cr 7,152,795

↓ -200,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹720 Cr 3,655,316 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 16 | LT4% ₹681 Cr 1,732,992 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 22 | M&M3% ₹574 Cr 1,673,515 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jul 18 | AXISBANK3% ₹543 Cr 3,964,200

↑ 455,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jul 19 | BAJFINANCE3% ₹463 Cr 4,979,340

↑ 70,000

بہترین لارج کیپ میوچل فنڈز میں کیوں سرمایہ کاری کریں۔

1. مستحکم سرمایہ کاری

بڑی کمپنیاں اچھی طرح سے قائم ہیں جس کا مطلب ہے کہ ان میں زیادہ مستقل مزاجی ہے۔آمدنی. لارج کیپ فنڈ ان کمپنیوں میں سرمایہ کاری کرتا ہے جو بڑی ہیں، کئی سالوں سے ہیں، ایک مستحکم افرادی قوت ہے اور ایک ایسی مصنوعات/سروس قائم کرتی ہے جو آمدنی پیدا کرتی ہے۔ یہی وجہ ہے کہ لاج کیپ اسٹاکس کا سب سے بڑا فائدہ وہ استحکام ہے جو وہ فراہم کرتے ہیں۔ یہ لاج کیپ میوچل فنڈ کے پورٹ فولیو اور اس کےنہیں ہیں بھی

2. مستحکم واپسی

طویل مدتی میں، اگرچہ بڑے کیپ فنڈز میں مڈ اور سمال کیپ فنڈز کے مقابلے کم منافع ہوتا ہے، لیکن بڑے کیپ میں منافع زیادہ مستحکم ہوتا ہے۔ مڈ کیپس میں اتار چڑھاؤ بہت زیادہ ہوتا ہے اور کسی کو لاج کیپس کے مقابلے مڈ کیپس میں زیادہ نقصانات ہوتے ہیں۔ بطور ایکسرمایہ کار اگر کوئی ایکوئٹی میں سرمایہ کاری کرنا چاہتا ہے، تو بڑے کیپ میوچل فنڈز میں سرمایہ کاری ایک نقطہ آغاز ہو سکتا ہے۔

3. کم اتار چڑھاؤ

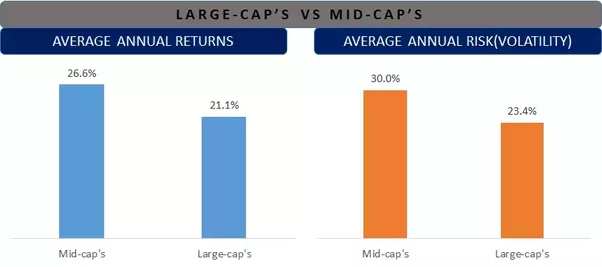

لارج کیپ فنڈز مڈ اور سمال کیپ فنڈز سے کم اتار چڑھاؤ والے ہوتے ہیں۔ یہ بات تاریخی اعداد و شمار سے بھی ثابت ہے۔ نیچے دی گئی تصویر میں لارج کیپ کے پچھلے 15 سالوں کے اوسط سالانہ منافع کا تجزیہ ہے۔ یہ بی ایس ای سینسیکس کو بڑے کیپ اور بی ایس ای کے پراکسی کے طور پر استعمال کرکے کیا جاتا ہے۔درمیانی ٹوپی مڈ کیپس کے لیے۔

4. اعتدال سے زیادہ خطرہ

چونکہ بڑی کمپنیوں میں سرمایہ کاری کی جاتی ہے، ان فنڈز میں مڈ اور سمال کیپ فنڈز کے مقابلے کم خطرہ ہوتا ہے۔ لیکن، ایکوئٹی مختصر مدت میں نقصان کا باعث بن سکتی ہے۔ اس لیے نقصانات کو دیکھنے کے لیے تیار رہنا چاہیے اور اسی پر نیند نہیں کھونی چاہیے۔ اگر کسی کے پاس ہولڈنگ کی طویل مدت ہے (کم از کم 5 سال سے زیادہ) اور وہ سرمایہ کاری کی کچھ بنیادی باتوں پر عمل کرتا ہے، تو کوئی اچھا خاصا منافع کما سکتا ہے۔

آن لائن بہترین لارج کیپ فنڈز میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

نتیجہ

چونکہ بڑے کیپ فنڈز بڑی مارکیٹ کیپٹلائزیشن والی کمپنیوں میں سرمایہ کاری کرتے ہیں، اس لیے ان فرموں کے پاس خراب مارکیٹوں اور معاشی چکروں سے بچنے کے لیے سائز اور پیمانہ ہوتا ہے۔ لہذا، بڑے کیپس میں سرمایہ کاری کو تمام ایکویٹی میوچل فنڈ کیٹیگریز میں سب سے محفوظ سمجھا جاتا ہے۔ تاہم، ایک کو ہمیشہ یاد رکھنا چاہئے کہزیرِ نظر سرمایہ کاری ایکویٹی ہے اور اس میں خطرات ہیں۔ اگرچہ بڑے کیپس کے خطرات نسبتاً کم ہیں، واپسی بھی مستحکم ہوگی اور بیل مارکیٹ کے مراحل کے دوران غیر معمولی واپسی نہیں ہوگی۔ وہ سرمایہ کار جو ایک خاص حد تک خطرے کے ساتھ اعتدال پسند لیکن مستقل منافع کو ترجیح دیتے ہیں۔ بہترین بڑے کیپ فنڈز میں سرمایہ کاری کر سکتے ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Superb. Gave very depth information.

Very good and give us about best largecap fund somtimes