Lumpsum vs SIP for NRIs: Practical Examples and Calculations

Deciding between a lumpsum and an SIP approach in Mutual Funds is crucial for NRIs aiming to invest in India. Here’s an in-depth, practical comparison of these two investment strategies with calculations to illustrate the potential returns under different Market conditions.

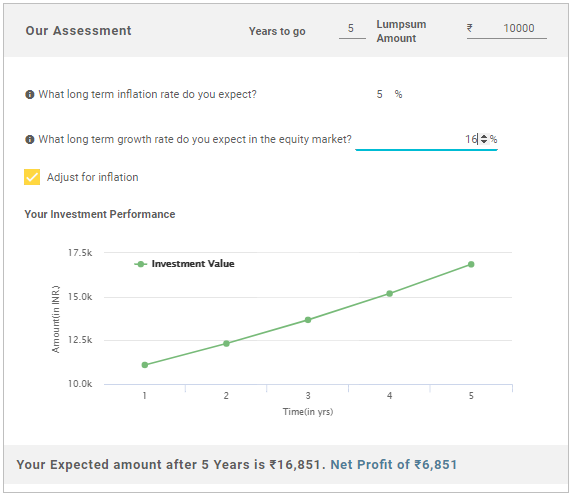

Lumpsum Investment Example

Consider an NRI investor, Raj, who has ₹5,00,000 ready for a one-time investment. Raj believes that the Indian equity market will perform well over the next 10 years, making lumpsum investment an attractive option.

Scenario:

- Investment: ₹5,00,000 (one-time)

- Expected Annual Return: 12% (compounded annually)

- Investment Duration: 10 years

Using the compound interest formula:

Where:

𝐴 - is the future value of the investment 𝑃 - is the initial investment (₹5,00,000) 𝑟 - is the rate of return (12%) 𝑛 - is the number of years (10)

Plugging in the values:

So, after 10 years, Raj’s lumpsum investment would grow to approximately ₹15,52,900.

Key Insight:

A lumpsum investment allows Raj to maximize his Capital due to compounding. However, this approach carries higher risk, as the entire investment amount is exposed to market Volatility from day one.

Talk to our investment specialist

SIP Investment Example

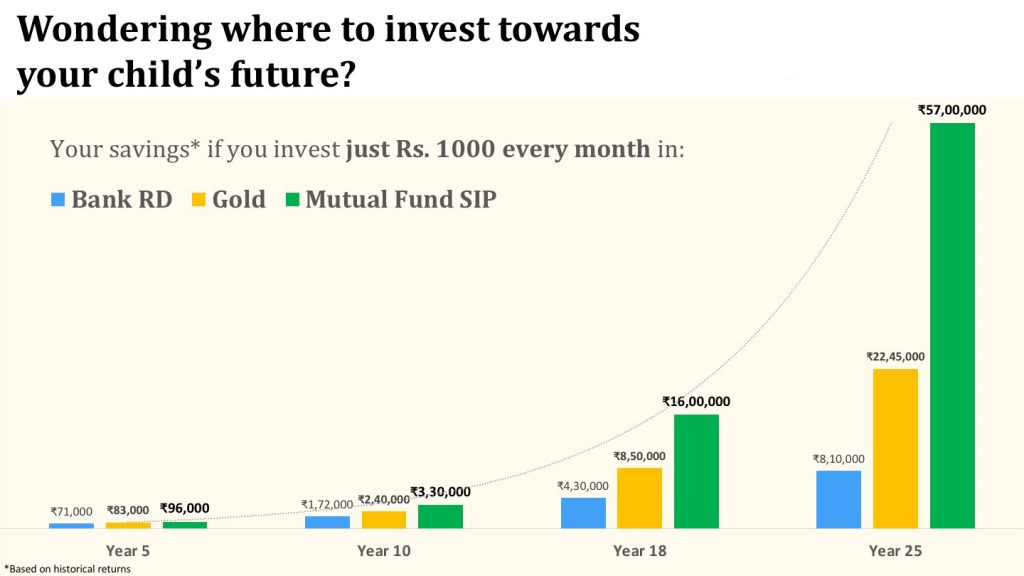

Now consider an NRI, Priya, who prefers a disciplined approach by Investing a fixed amount each month rather than a single large investment. Priya chooses an SIP of ₹10,000 every month in a similar equity mutual fund over 10 years.

Scenario:

- Monthly SIP: ₹10,000

- Expected Annual Return: 12%

- Investment Duration: 10 years (120 months)

Using the future value formula for SIPs:

Where:

𝐴 - is the future value of the SIP investment 𝑃 - is the monthly investment amount (₹10,000) 𝑟 - is the monthly rate of return (12% annually or 1% monthly) 𝑛 - is the number of months (120)

Plugging in the values:

This comes out to approximately:

A = 10,000 × 230.2199 = ₹23,02,199

Key Insight:

With an SIP, Priya benefits from rupee cost averaging, which helps reduce the impact of market volatility. Although her returns are slightly lower due to the staggered investment, her approach balances growth with lower risk.

Unique Situations and Factors for NRIs

To further differentiate the article, let’s dive into scenarios NRIs specifically face, such as exchange rate fluctuations and tax implications.

Impact of Exchange Rate Fluctuations

Let’s assume Raj and Priya live in the U.S., and they plan to remit their gains back after 10 years. When they invested, the USD/INR exchange rate was 74. If, after 10 years, the rate changes to 84, they would receive different returns in USD terms.

- For Raj (Lumpsum): His final amount in INR was ₹15,52,900. At an exchange rate of 84, this equals:

15,52,900 / 84 = $18,488

If the rate had stayed at 74, it would be worth $20,978 instead, showing the importance of exchange rates.

- For Priya (SIP): Her final amount in INR was ₹23,02,199. At an exchange rate of 84, this would be:

23,02,199 / 84 = $27,407

In this case, she would have received $31,106 if the rate stayed at 74, indicating that exchange rate fluctuations could notably affect NRI investments.

Key Insight:

Fluctuating exchange rates impact the final returns for NRIs, with a depreciating INR against the foreign currency benefitting the investor on repatriation.

Taxation Implications for NRIs: Lumpsum vs SIP

Tax treatment for NRIs differs slightly, making this a significant Factor:

Equity Mutual Funds:

- Short-term gains (holding period less than 1 year): Taxed at 15%.

- Long-term gains (holding period more than 1 year): Taxed at 10% for gains above ₹1 lakh.

Debt Mutual Funds:

- Short-term gains: Taxed as per Income slab rates.

- Long-term gains: Taxed at 20% with indexation benefits.

NRIs should factor in this tax structure while choosing between lumpsum and SIP. For example, if Raj’s lumpsum investment generated ₹5,00,000 in long-term gains, he’d pay 10% tax on the gains exceeding ₹1 lakh. Priya’s SIP investment, meanwhile, would likely have smaller individual Capital Gains, potentially reducing her Tax Liability each year.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹70.6728

↑ 0.61 ₹1,975 500 42.7 87.9 203.9 64.5 33.4 167.1 SBI PSU Fund Growth ₹35.6915

↓ -1.03 ₹5,980 500 7.9 15.7 32.4 32.1 26 11.3 ICICI Prudential Infrastructure Fund Growth ₹187.26

↓ -4.23 ₹8,077 100 -3.1 -0.1 17.1 24.2 24.8 6.7 Invesco India PSU Equity Fund Growth ₹66.02

↓ -1.70 ₹1,492 500 3.6 10.3 37.2 31.5 24.6 10.3 DSP India T.I.G.E.R Fund Growth ₹316.274

↓ -6.60 ₹5,184 500 2.3 3.7 24.7 26.2 23.7 -2.5 HDFC Infrastructure Fund Growth ₹45.356

↓ -1.12 ₹2,366 300 -2.7 -0.7 17.4 26.3 22.8 2.2 Canara Robeco Infrastructure Growth ₹159.17

↓ -3.24 ₹879 1,000 1.2 1.9 25.3 25.7 22.8 0.1 Nippon India Power and Infra Fund Growth ₹337.521

↓ -8.73 ₹6,773 100 -0.5 1.6 21.9 26.1 22.4 -0.5 Franklin Build India Fund Growth ₹142.426

↓ -3.50 ₹3,003 500 -0.2 1.9 19.8 26.1 22.1 3.7 LIC MF Infrastructure Fund Growth ₹48.3212

↓ -1.16 ₹946 1,000 -1 -0.2 21.5 27.2 21.8 -3.7 BOI AXA Manufacturing and Infrastructure Fund Growth ₹57.22

↓ -1.24 ₹661 1,000 -0.5 4.3 27.6 24.9 21.5 7.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 11 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund HDFC Infrastructure Fund Canara Robeco Infrastructure Nippon India Power and Infra Fund Franklin Build India Fund LIC MF Infrastructure Fund BOI AXA Manufacturing and Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Lower mid AUM (₹1,492 Cr). Upper mid AUM (₹5,184 Cr). Lower mid AUM (₹2,366 Cr). Bottom quartile AUM (₹879 Cr). Top quartile AUM (₹6,773 Cr). Upper mid AUM (₹3,003 Cr). Bottom quartile AUM (₹946 Cr). Bottom quartile AUM (₹661 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Established history (20+ yrs). Established history (21+ yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (16+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Rating: 3★ (upper mid). Not Rated. Rating: 4★ (upper mid). Top rated. Not Rated. Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 33.40% (top quartile). 5Y return: 26.00% (top quartile). 5Y return: 24.77% (upper mid). 5Y return: 24.60% (upper mid). 5Y return: 23.68% (upper mid). 5Y return: 22.79% (lower mid). 5Y return: 22.78% (lower mid). 5Y return: 22.35% (lower mid). 5Y return: 22.09% (bottom quartile). 5Y return: 21.84% (bottom quartile). 5Y return: 21.53% (bottom quartile). Point 6 3Y return: 64.51% (top quartile). 3Y return: 32.11% (top quartile). 3Y return: 24.23% (bottom quartile). 3Y return: 31.47% (upper mid). 3Y return: 26.19% (lower mid). 3Y return: 26.30% (upper mid). 3Y return: 25.75% (bottom quartile). 3Y return: 26.14% (lower mid). 3Y return: 26.09% (lower mid). 3Y return: 27.21% (upper mid). 3Y return: 24.95% (bottom quartile). Point 7 1Y return: 203.87% (top quartile). 1Y return: 32.38% (upper mid). 1Y return: 17.08% (bottom quartile). 1Y return: 37.22% (top quartile). 1Y return: 24.71% (lower mid). 1Y return: 17.37% (bottom quartile). 1Y return: 25.27% (upper mid). 1Y return: 21.88% (lower mid). 1Y return: 19.82% (bottom quartile). 1Y return: 21.55% (lower mid). 1Y return: 27.64% (upper mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (top quartile). Alpha: 0.00 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: -6.78 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -6.08 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (top quartile). Sharpe: 0.15 (lower mid). Sharpe: 0.53 (upper mid). Sharpe: 0.08 (lower mid). Sharpe: 0.06 (bottom quartile). Sharpe: 0.13 (lower mid). Sharpe: -0.03 (bottom quartile). Sharpe: 0.21 (upper mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.29 (upper mid). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.26 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.29 (top quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

HDFC Infrastructure Fund

Canara Robeco Infrastructure

Nippon India Power and Infra Fund

Franklin Build India Fund

LIC MF Infrastructure Fund

BOI AXA Manufacturing and Infrastructure Fund

200 Crore in Equity Category of mutual funds ordered based on 5 year calendar year returns.

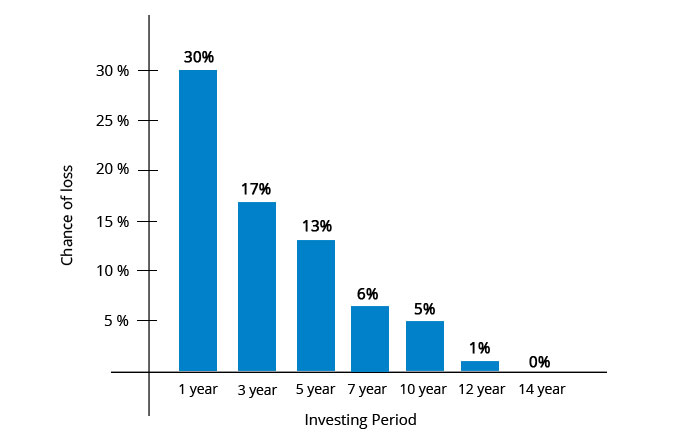

Scenario Analysis: Comparing Returns in Different Market Conditions

Let’s consider hypothetical scenarios where the market behaves differently over the 10-year period to illustrate which approach might be more beneficial.

Bull Market Scenario

- In a bull market, a lumpsum investment tends to outperform because the invested amount has the full period to grow.

- If the market grows at 15% instead of 12%, Raj’s ₹5,00,000 would grow to approximately ₹20,22,600.

- Priya’s SIP, due to the staggered investment, would grow to about ₹25,38,000. While still substantial, it might not reach the same growth as the lumpsum due to missed compounding on the full amount from the beginning.

Volatile Market Scenario:

- In a volatile market, SIPs perform better as they buy more units during market dips.

- If returns varied significantly each year (e.g., from 5% to 15%), Priya’s SIP would benefit from rupee cost averaging, yielding a higher return on her invested amount than a lumpsum.

Conclusion: Choosing the Right Approach

1. Lumpsum:

Best for investors with a high-risk tolerance and capital to invest upfront. Works well in rising markets and for investors who are not dependent on steady income from their investment.

2. SIP:

- Suited for NRIs with consistent disposable income.

- Ideal for volatile markets, as rupee cost averaging minimizes risk and helps accumulate wealth over time.

By carefully considering market conditions, taxation, currency fluctuation, and personal Financial goals, NRIs can choose the strategy that aligns best with their objectives. Both approaches have their strengths, and an investor's unique circumstances should guide the final decision. This expanded article provides NRIs with a detailed analysis of both lumpsum and SIP approaches, highlighting practical examples, unique challenges, and calculations that few sources cover comprehensively.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.