Table of Contents

Mutual Fund Taxation: How are Mutual Fund Returns Taxed?

Mutual Fund taxation or tax on Mutual Funds is something that has always kept people curious. Mutual Fund Capital gains are taxed considering certain rules and regulations. Generally, to save tax people tend to invest in Mutual Funds. But, not many people are aware that Mutual Fund returns are taxed as well under the head income tax Capital Gains. So before Investing in Mutual Funds, it is important to understand the mutual fund taxation or taxation of Mutual Funds.

Mutual Fund Taxation

Taxation of Mutual funds or Mutual Fund Taxation can be classified by 2 broad parameters:

1. Type of funds:

Category 1

Equity Funds (or ELSS funds)

Category 2

Debt, Money market funds, fund of funds (FoF), International Equity fund

2. Type of Investor

a. Resident Indian

b. NRI

c. Non-Individual

Before knowing the taxation on Mutual Funds you must know the two options to invest in Mutual Funds. They include -

Growth Option Or Mutual Fund Capital Gains

Under this option, the returns from Mutual Funds are automatically re-invested and you get these gains only when you sell the Mutual Fund units.

Dividend Option Of Mutual Funds

Contrarily, with the dividend option, you can earn the Mutual Fund returns at regular intervals in the form of dividends. It works as a regular Income for Mutual Fund unit holders.

Now, these different options are taxed according to the type of Mutual Funds. Also, Mutual Fund Taxation depends on the types of Asset Class – equity or debt, and each is taxed differently.

Talk to our investment specialist

Tax on Mutual Funds (Mutual Fund Taxation)

1) Taxation on Equity Mutual Funds (Including all Equity Oriented Schemes)

| Equity Schemes | Holding Period | Tax Rate |

|---|---|---|

| Long Term Capital Gains (LTCG) | More than 1 Year | 10% (with no indexation)***** |

| Short Term Capital Gains (STCG) | Less than or equal to a year | 15% |

| Tax on Distributed Dividend | 10%# |

Gains up to INR 1 lakh are free of tax. Tax at 10% applies to gains above INR 1 lakh. Earlier rate was 0% cost calculated as closing price on Jan 31, 2018. #Dividend tax of 10% + Surcharge 12% + Cess 4% =11.648% Health & Education Cess of 4% introduced. Earlier, education Cess was 3*%

Equity Mutual Funds are those funds that invest more than 65% in equity related instruments and the remaining in debt securities. Taxation on these funds varies for both dividend and growth options.

Growth option of Equity Mutual Funds - Depending on the holding period of Mutual Funds, there are two types of mutual fund taxation on growth options-

Short Term Capital Gains - When Equity Mutual Funds with growth option are sold or redeemed within a one-year period, one is liable to pay a short term Capital Gain tax of 15% on returns.

Long Term Capital Gains - When you sell or redeem your equity funds after a year of investment, you are taxed at 10% (with no indexation) under long term capital gain tax.

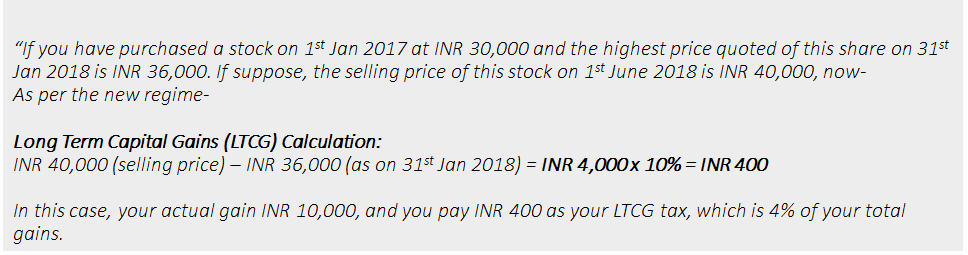

New Tax Rules on Long Term Capital Gains Applicable from 1st April 2018

As per the Budget 2018 speech, a new Long Term Capital Gains (LTCG) tax on equity oriented mutual funds & stocks will be applicable from 1st April. Long-term capital gains exceeding INR 1 lakh arising from Redemption of Mutual Fund units or equities on or after 1st April 2018, will be taxed at 10 percent (plus cess) or at 10.4 percent. Long-term capital gains till INR 1 lakh will be exempt. For example, if you earn INR 3 lakhs in combined long-term capital gains from stocks or Mutual Fund investments in a financial year. The taxable LTCGs will be INR 2 lakh (INR 3 lakh - 1 lakh) and Tax Liability will be INR 20,000 (10 per cent of INR 2 lakh).

*Illustrations *

| Description | INR |

|---|---|

| Purchase of shares on 1st January, 2017 | 1,000,000 |

| Sale of shares on 1st April, 2018 | 2,000,000 |

| Actual gains | 1,000,000 |

| Fair Market Value of shares on 31st January, 2018 | 1,500,000 |

| Taxable gains | 500,000 |

| Tax | 50,000 |

Fair Market value of the shares as on January 31, 2018 to be the cost of acquisition as per the grandfathering provision.

Process of Determining Capital Gains Tax on Equity, which will be applicable from 1st April 2018

- On each sale/redemption find out if the asset is long term or short term capital gains

- If its short term, then 15% tax will be applicable on gains

- If its long term, then find out if its acquired after 31st Jan 2018

- If its acquired after 31st Jan 2018 then:

LTCG = Sale Price / Redemption Value - Actual Cost of Acquisition

- If its acquired on or before 31st January 2018 then the following process shall be used for arriving at the gains:

LTCG= Sale price /Redemption Value - Cost of acquisition

For better understanding, let us illustrate the LTCG on equity based on the Budget 2018 clarification-

How are the Capital Gains Calculated?

As per the Finance Bill 2018, the cost of acquisition of the capital asset are as follows:

- a) the actual cost of acquisition of such asset; and

- b) the lower of fair market value on 31st Jan and Sale price/Redemption Value.

- i) All such long term gains to be added up and a Deduction of INR 1 lac to be allowed. ii) On the balance amount (if its positive) one needs to pay tax @10% ++.

2) Taxation on Debt/Money Market Funds

| Debt Schemes | Holding Period | Tax Rate |

|---|---|---|

| Long Term Capital Gains (LTCG) | More than 3 years | 20% after indexation |

| Short Term Capital Gains (STCG) | Less than or equal to 3 years | Personal Income Tax rate |

| Tax on Dividend | 25%# |

#Dividend tax at 25% + Surcharge 12% + Cess 4% = 29.12% Health & Education Cess of 4% introduced. Earlier education Cess was 3%

The other kind of Mutual Fund is debt mutual fund, which invests mostly (less than 65%) in debt instruments. Some of them include ultra-short term Mutual Funds, Liquid Funds, funds of funds etc. As for the equity funds, mutual fund taxation for debt Mutual Funds varies as well.

Growth option of Debt Mutual Funds

- Short Term Capital Gains - If the holding period of debt investment is less than 3 years, a short term capital gain tax of 30 % is liable.

- Long Term Capital Gains - When the debt investments are held for more than 3 years, the returns are taxed at 20% with indexation benefit or 10% depending on the investment.

Dividend Option of Debt Mutual Fund (Debt Mutual Fund Dividend Tax)

Unlike equity Mutual Funds, a DDT (Dividend Distribution Tax) is deducted from the Mutual Fund NAV (Net Asset Value) of your debt investment.

Sample Calculation on Indexation

Taking a simple example with a purchase value of investment being INR 1 lakh in 2017 and selling it after 4 years for INR 1.5 lakhs. Index numbers are given below (illustrative). The most critical step involved here is a calculation of the indexed cost of the investment.

- Indexed cost = Cost value of the investment to be taken in calculations.

- Final value = sale value of the investment (INR 1.5 lakhs in the above case)

| Years of Purchase | Index Cost | Value of Investment |

|---|---|---|

| 2017 | 100 | 100,000 |

| 2021 | 130 | 150,000 |

| Holding Period - 4 years (qualifies for LTCG) | ||

| Index Value of Investment = 130/100 * 1,00,000 = 130,000 | ||

| Capital Gains = 150,000 - 130,000 = 20,000 | ||

| Capital Gains Tax = 20% of 20,000 = 4,000* | ||

| Surcharge and cess to be added |

Now that you know the Taxes liable on different kinds of Mutual Funds, you should try to get the best out of it by choosing the right Mutual Funds. The above is a guidance Basis the tax structure for FY 2017-18, choosing an investment one should look at the relevant tax structures, for e.g. in debt schemes going for dividend option in the short run may invite lower tax. However, before making any decision one should get an opinion from an independent tax adviser and take action. Earn better returns, save more!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very good information.

That is the professional way to go. Thorough, easy to understand, illustrations to make an average investor get clear understanding of the subject. Keep it up. Thanks.