Best Dividend Paying Balanced Mutual Funds 2026

Balanced Fund are Mutual Funds that invest more than 65% of their assets in equities and the remaining assets in debt instruments to yield good overall returns. Balanced Mutual Funds are beneficial for investors who are willing to take a market risk while looking for some fixed returns as well. The assets invested in equities and stocks offer market-linked returns while the assets invested in debt instruments offer fixed returns. Being a combination of both Equity and Debt, investors should be very careful when Investing in these funds. Dividend option in these type of mutual funds can actually be good as they generate returns and pay them of as & when there is surplus is generated, This way these type of Option is good for investors looking for consistent income from their investments. Below are some Best Dividend paying balanced mutual funds for year 2026

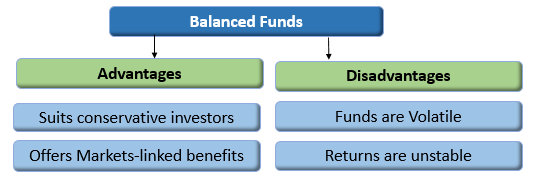

Advantages & Disadvantages Of Top Balanced Funds

Advantages

- Provides stable returns by investing 35-40% of the assets in fixed income options.

- Offers market-linked returns as swell by investing 60-65% of the assets in equities.

- Suitable for conservative investors willing to take moderate risk.

Disadvantages

- The funds invested in equities are volatile and have a high-risk factor.

- The combined returns (returns of both debt and Equity Mutual Funds) may not yield very good returns in the long run.

Talk to our investment specialist

Fund Selection Methodology used to find 6 funds

Top 6 Dividend Paying Balanced Mutual Funds for Regular Income

Fund NAV Net Assets (Cr) Rating 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Multi-Asset Fund Normal Dividend, Payout ₹35.4107

↑ 0.18 ₹80,768 ☆☆ -0.6 5.7 16.3 19 19 18.6 UTI Multi Asset Fund Normal Dividend, Payout ₹29.618

↓ -0.23 ₹6,848 ☆ -2.7 2.4 12.1 18.4 13.6 10.1 Edelweiss Multi Asset Allocation Fund Normal Dividend, Payout ₹63.24

↓ -0.46 ₹3,453 ☆ -3 -0.7 9.3 18.1 18 6 BOI AXA Mid and Small Cap Equity and Debt Fund Normal Dividend, Payout ₹31.27

↓ -0.09 ₹1,329 -0.5 -0.4 11.4 17.8 17 -0.9 HDFC Balanced Advantage Fund Normal Dividend, Payout ₹37.078

↓ -0.29 ₹106,821 ☆☆☆☆ -3.2 0.7 8.4 16.5 16.3 7.2 Axis Triple Advantage Fund Normal Dividend, Payout ₹20.2463

↑ 0.08 ₹2,051 ☆☆ 3 9.7 22.7 16.3 11.9 15.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary ICICI Prudential Multi-Asset Fund UTI Multi Asset Fund Edelweiss Multi Asset Allocation Fund BOI AXA Mid and Small Cap Equity and Debt Fund HDFC Balanced Advantage Fund Axis Triple Advantage Fund Point 1 Upper mid AUM (₹80,768 Cr). Upper mid AUM (₹6,848 Cr). Lower mid AUM (₹3,453 Cr). Bottom quartile AUM (₹1,329 Cr). Highest AUM (₹106,821 Cr). Bottom quartile AUM (₹2,051 Cr). Point 2 Established history (22+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (9+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Point 3 Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Not Rated. Top rated. Rating: 2★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.03% (top quartile). 5Y return: 13.65% (bottom quartile). 5Y return: 17.99% (upper mid). 5Y return: 17.01% (upper mid). 5Y return: 16.27% (lower mid). 5Y return: 11.94% (bottom quartile). Point 6 3Y return: 18.96% (top quartile). 3Y return: 18.43% (upper mid). 3Y return: 18.08% (upper mid). 3Y return: 17.80% (lower mid). 3Y return: 16.53% (bottom quartile). 3Y return: 16.26% (bottom quartile). Point 7 1Y return: 16.32% (upper mid). 1Y return: 12.10% (upper mid). 1Y return: 9.30% (bottom quartile). 1Y return: 11.42% (lower mid). 1Y return: 8.40% (bottom quartile). 1Y return: 22.66% (top quartile). Point 8 1M return: -1.61% (upper mid). 1M return: -2.04% (lower mid). 1M return: -2.27% (bottom quartile). 1M return: -1.50% (upper mid). 1M return: -2.66% (bottom quartile). 1M return: -0.74% (top quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: -1.21 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 1.48 (upper mid). Sharpe: 0.58 (upper mid). Sharpe: 0.11 (bottom quartile). Sharpe: 0.08 (bottom quartile). Sharpe: 0.22 (lower mid). Sharpe: 1.69 (top quartile). ICICI Prudential Multi-Asset Fund

UTI Multi Asset Fund

Edelweiss Multi Asset Allocation Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

HDFC Balanced Advantage Fund

Axis Triple Advantage Fund

*Above is list of best Dividend Paying Balanced funds having AUM/Net Assets above 100 Crore. Sorted on Last 1 Year Return.

(Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Research Highlights for UTI Multi Asset Fund Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Research Highlights for Edelweiss Multi Asset Allocation Fund Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized Research Highlights for BOI AXA Mid and Small Cap Equity and Debt Fund Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile HDFC Growth Fund and HDFC Prudence Fund) Aims to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. Research Highlights for HDFC Balanced Advantage Fund Below is the key information for HDFC Balanced Advantage Fund Returns up to 1 year are on To generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold exchange traded funds. Research Highlights for Axis Triple Advantage Fund Below is the key information for Axis Triple Advantage Fund Returns up to 1 year are on 1. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Normal Dividend, Payout Launch Date 9 Jan 04 NAV (05 Mar 26) ₹35.4107 ↑ 0.18 (0.52 %) Net Assets (Cr) ₹80,768 on 31 Jan 26 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.48 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,621 28 Feb 23 ₹14,121 29 Feb 24 ₹18,452 28 Feb 25 ₹20,546 28 Feb 26 ₹24,472 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -1.6% 3 Month -0.6% 6 Month 5.7% 1 Year 16.3% 3 Year 19% 5 Year 19% 10 Year 15 Year Since launch 17.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.4% 2018 5.9% 2017 -4.3% 2016 28.1% 2015 12.5% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 14.01 Yr. Manish Banthia 22 Jan 24 2.03 Yr. Ihab Dalwai 3 Jun 17 8.67 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Sri Sharma 30 Apr 21 4.76 Yr. Gaurav Chikane 2 Aug 21 4.5 Yr. Sharmila D'Silva 31 Jul 22 3.51 Yr. Masoomi Jhurmarvala 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 17.14% Equity 64.5% Debt 8.61% Other 9.75% Equity Sector Allocation

Sector Value Financial Services 21.64% Consumer Cyclical 11.89% Consumer Defensive 6.97% Industrials 6.24% Technology 5.51% Basic Materials 5.43% Energy 4.1% Health Care 3.53% Utility 2.33% Communication Services 1.97% Real Estate 1.93% Debt Sector Allocation

Sector Value Cash Equivalent 15.9% Corporate 5.03% Government 4.81% Credit Quality

Rating Value A 1.28% AA 17.26% AAA 81.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -9% ₹7,375 Cr 528,202,636

↑ 38,731,754 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK4% ₹3,153 Cr 23,271,875 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK4% ₹2,932 Cr 31,556,280

↑ 8,362,197 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹2,292 Cr 16,726,017

↓ -950,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹2,208 Cr 68,525,718

↑ 19,307,692 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,142 Cr 15,349,805 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,842 Cr 11,225,639

↓ -188,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO2% ₹1,705 Cr 3,709,974

↑ 1,141,295 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 24 | BAJAJFINSV2% ₹1,580 Cr 8,094,127

↑ 2,792,657 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,487 Cr 1,018,654

↑ 100,000 2. UTI Multi Asset Fund

UTI Multi Asset Fund

Normal Dividend, Payout Launch Date 21 Oct 08 NAV (06 Mar 26) ₹29.618 ↓ -0.23 (-0.75 %) Net Assets (Cr) ₹6,848 on 31 Jan 26 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.58 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,814 28 Feb 23 ₹11,301 29 Feb 24 ₹15,711 28 Feb 25 ₹16,773 28 Feb 26 ₹19,520 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -2% 3 Month -2.7% 6 Month 2.4% 1 Year 12.1% 3 Year 18.4% 5 Year 13.6% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.1% 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 12.9% 2018 2.7% 2017 -1.1% 2016 17.1% 2015 7.3% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 4.22 Yr. Jaydeep Bhowal 1 Oct 24 1.33 Yr. Data below for UTI Multi Asset Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.68% Equity 68.24% Debt 9.48% Other 14.6% Equity Sector Allocation

Sector Value Financial Services 15.97% Technology 11.06% Consumer Defensive 8.74% Consumer Cyclical 8.66% Industrials 5.58% Basic Materials 4.97% Health Care 4.22% Real Estate 3.79% Energy 3.27% Communication Services 2.96% Debt Sector Allocation

Sector Value Government 6.42% Cash Equivalent 6.3% Corporate 4.44% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -15% ₹1,009 Cr 75,949,369

↓ -69,567 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN3% ₹185 Cr 1,716,730 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹178 Cr 1,086,475

↑ 30,677 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | ASIANPAINT2% ₹158 Cr 650,377 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹152 Cr 1,142,201

↑ 22,681 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC2% ₹149 Cr 4,622,966

↑ 369,276 Coal India Ltd (Energy)

Equity, Since 31 Oct 22 | COALINDIA2% ₹147 Cr 3,341,545 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹139 Cr 444,634

↑ 12,793 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹137 Cr 697,974

↑ 20,408 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | MARUTI2% ₹130 Cr 89,156

↑ 2,752 3. Edelweiss Multi Asset Allocation Fund

Edelweiss Multi Asset Allocation Fund

Normal Dividend, Payout Launch Date 16 Jun 09 NAV (06 Mar 26) ₹63.24 ↓ -0.46 (-0.72 %) Net Assets (Cr) ₹3,453 on 31 Jan 26 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 1.98 Sharpe Ratio 0.11 Information Ratio 1.86 Alpha Ratio -1.21 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,455 28 Feb 23 ₹13,934 29 Feb 24 ₹19,396 28 Feb 25 ₹20,969 28 Feb 26 ₹23,790

Purchase not allowed Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -2.3% 3 Month -3% 6 Month -0.7% 1 Year 9.3% 3 Year 18.1% 5 Year 18% 10 Year 15 Year Since launch 14.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 6% 2023 23.7% 2022 31.2% 2021 10.4% 2020 34.7% 2019 22.7% 2018 14% 2017 1.1% 2016 33% 2015 6.5% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Kedar Karnik 15 Jan 26 0.04 Yr. Bhavesh Jain 14 Oct 15 10.31 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Rahul Dedhia 1 Jul 24 1.59 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 9.82% Equity 77.53% Debt 12.63% Other 0.02% Equity Sector Allocation

Sector Value Financial Services 24.64% Consumer Cyclical 10.23% Health Care 9.26% Basic Materials 5.95% Technology 5.78% Communication Services 5.23% Energy 4.53% Industrials 4.4% Consumer Defensive 2.9% Utility 2.58% Real Estate 0.53% Debt Sector Allocation

Sector Value Corporate 9.57% Cash Equivalent 7.75% Government 5.14% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK5% ₹167 Cr 1,235,789

↑ 125,000 Edelweiss Liquid Dir Gr

Investment Fund | -5% ₹160 Cr 454,381

↑ 454,381 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK4% ₹150 Cr 1,613,634 National Bank For Agriculture And Rural Development

Debentures | -4% ₹141 Cr 14,000,000 State Bank of India (Financial Services)

Equity, Since 30 Jun 15 | SBIN4% ₹136 Cr 1,264,882 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹115 Cr 583,607 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹93 Cr 566,220 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 20 | RELIANCE3% ₹90 Cr 647,748 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | NTPC3% ₹89 Cr 2,497,975 Aditya Birla Capital Limited

Debentures | -2% ₹75 Cr 7,500,000 4. BOI AXA Mid and Small Cap Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Normal Dividend, Payout Launch Date 20 Jul 16 NAV (06 Mar 26) ₹31.27 ↓ -0.09 (-0.29 %) Net Assets (Cr) ₹1,329 on 31 Jan 26 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.27 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹13,343 28 Feb 23 ₹13,608 29 Feb 24 ₹19,871 28 Feb 25 ₹19,627 28 Feb 26 ₹23,271 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -1.5% 3 Month -0.5% 6 Month -0.4% 1 Year 11.4% 3 Year 17.8% 5 Year 17% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.9% 2023 25.8% 2022 33.7% 2021 -4.8% 2020 54.2% 2019 31.1% 2018 -4.7% 2017 -14.4% 2016 47.3% 2015 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.96 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 14.93% Equity 71.7% Debt 13.38% Equity Sector Allocation

Sector Value Basic Materials 16.1% Financial Services 15.09% Industrials 13.85% Health Care 9.77% Consumer Cyclical 8.98% Technology 3.72% Consumer Defensive 2.75% Utility 0.94% Energy 0.47% Real Estate 0.02% Debt Sector Allocation

Sector Value Cash Equivalent 10.12% Government 9.58% Corporate 8.61% Credit Quality

Rating Value AA 0.7% AAA 99.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity Hindustan Copper Ltd (Basic Materials)

Equity, Since 31 Oct 24 | HINDCOPPER4% ₹49 Cr 708,412

↓ -392,588 Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | INDIANB3% ₹46 Cr 505,000 Abbott India Ltd (Healthcare)

Equity, Since 31 Jan 23 | ABBOTINDIA3% ₹36 Cr 13,000

↑ 4,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA3% ₹35 Cr 294,000

↓ -20,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹33 Cr 202,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL2% ₹33 Cr 400,000

↓ -166,000 Bank of Maharashtra (Financial Services)

Equity, Since 31 May 24 | MAHABANK2% ₹30 Cr 4,641,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | 5405302% ₹30 Cr 1,580,000 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Jul 25 | GLENMARK2% ₹30 Cr 150,000 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 24 | BDL2% ₹30 Cr 196,000 5. HDFC Balanced Advantage Fund

HDFC Balanced Advantage Fund

Normal Dividend, Payout Launch Date 11 Sep 00 NAV (06 Mar 26) ₹37.078 ↓ -0.29 (-0.76 %) Net Assets (Cr) ₹106,821 on 31 Jan 26 Category Hybrid - Dynamic Allocation AMC HDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.36 Sharpe Ratio 0.22 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,567 28 Feb 23 ₹13,330 29 Feb 24 ₹18,720 28 Feb 25 ₹19,494 28 Feb 26 ₹22,013 Returns for HDFC Balanced Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -2.7% 3 Month -3.2% 6 Month 0.7% 1 Year 8.4% 3 Year 16.5% 5 Year 16.3% 10 Year 15 Year Since launch 6% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.2% 2023 16.7% 2022 31.3% 2021 18.7% 2020 26.4% 2019 7% 2018 5% 2017 -11.7% 2016 22.6% 2015 -3.7% Fund Manager information for HDFC Balanced Advantage Fund

Name Since Tenure Anil Bamboli 29 Jul 22 3.51 Yr. Gopal Agrawal 29 Jul 22 3.51 Yr. Arun Agarwal 6 Oct 22 3.32 Yr. Srinivasan Ramamurthy 29 Jul 22 3.51 Yr. Dhruv Muchhal 22 Jun 23 2.61 Yr. Nandita Menezes 29 Mar 25 0.84 Yr. Data below for HDFC Balanced Advantage Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 5.6% Equity 69.51% Debt 24.9% Equity Sector Allocation

Sector Value Financial Services 22.73% Industrials 7.81% Energy 7.42% Consumer Cyclical 7.05% Technology 6.71% Health Care 4.24% Utility 4.18% Communication Services 3.14% Basic Materials 2.2% Consumer Defensive 2.2% Real Estate 1.81% Debt Sector Allocation

Sector Value Corporate 12.72% Government 12.48% Cash Equivalent 5.29% Credit Quality

Rating Value AA 0.92% AAA 99.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | HDFCBANK4% ₹4,785 Cr 51,490,502

↓ -6,318,200 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK4% ₹4,369 Cr 32,244,463

↓ -2,519,300 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE4% ₹3,917 Cr 28,071,742

↑ 99,000 State Bank of India (Financial Services)

Equity, Since 31 May 07 | SBIN4% ₹3,770 Cr 35,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 20 | BHARTIARTL3% ₹2,987 Cr 15,172,037

↓ -1,582,317 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 17 | AXISBANK3% ₹2,717 Cr 19,825,582

↓ -1,875 Infosys Ltd (Technology)

Equity, Since 31 Oct 09 | INFY2% ₹2,669 Cr 16,266,004 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT2% ₹2,587 Cr 6,579,083 NTPC Ltd (Utilities)

Equity, Since 31 Aug 16 | NTPC2% ₹2,261 Cr 63,500,000

↓ -3,437,415 7.18% Gs 2033

Sovereign Bonds | -2% ₹2,243 Cr 218,533,300 6. Axis Triple Advantage Fund

Axis Triple Advantage Fund

Normal Dividend, Payout Launch Date 23 Aug 10 NAV (05 Mar 26) ₹20.2463 ↑ 0.08 (0.39 %) Net Assets (Cr) ₹2,051 on 31 Jan 26 Category Hybrid - Multi Asset AMC Axis Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 1.69 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,813 28 Feb 23 ₹11,307 29 Feb 24 ₹13,342 28 Feb 25 ₹14,359 28 Feb 26 ₹18,154 Returns for Axis Triple Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -0.7% 3 Month 3% 6 Month 9.7% 1 Year 22.7% 3 Year 16.3% 5 Year 11.9% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.2% 2023 15.4% 2022 12.9% 2021 -5.1% 2020 24.4% 2019 17.7% 2018 15% 2017 1.9% 2016 15.9% 2015 7.1% Fund Manager information for Axis Triple Advantage Fund

Name Since Tenure Devang Shah 5 Apr 24 1.9 Yr. Aditya Pagaria 1 Jun 24 1.75 Yr. Ashish Naik 22 Jun 16 9.7 Yr. Hardik Shah 5 Apr 24 1.9 Yr. Pratik Tibrewal 1 Feb 25 1.08 Yr. Krishnaa N 16 Dec 24 1.21 Yr. Data below for Axis Triple Advantage Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 9.13% Equity 64.69% Debt 9.38% Other 16.79% Equity Sector Allocation

Sector Value Financial Services 23.2% Consumer Cyclical 8.51% Technology 6.26% Health Care 6.22% Basic Materials 6.15% Industrials 5.66% Consumer Defensive 4.56% Energy 3.3% Communication Services 2.46% Real Estate 0.94% Utility 0.07% Debt Sector Allocation

Sector Value Cash Equivalent 9.74% Corporate 6.29% Government 2.48% Credit Quality

Rating Value A 10.39% AA 38.79% AAA 50.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -13% ₹264 Cr 20,259,852

↓ -3,988,399 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK7% ₹141 Cr 1,518,753

↑ 509,735 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | ICICIBANK5% ₹103 Cr 756,550

↑ 55,032 Axis Silver ETF

- | -4% ₹87 Cr 2,917,000

↓ -333,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN4% ₹77 Cr 716,029

↑ 86,532 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 19 | RELIANCE3% ₹64 Cr 455,456

↑ 328,114 Future on BANK Index

- | -3% -₹55 Cr 584,650

↑ 182,050 Infosys Ltd (Technology)

Equity, Since 31 May 18 | INFY2% ₹45 Cr 276,762 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | KOTAKBANK2% ₹42 Cr 1,023,663

↑ 281,083 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹40 Cr 202,647

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for ICICI Prudential Multi-Asset Fund