2022 ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰਨ ਲਈ ਚੋਟੀ ਦੇ 5 ਮਿਉਚੁਅਲ ਫੰਡ

ਮਿਉਚੁਅਲ ਫੰਡ ਦੇਰ ਨਾਲ ਨਿਵੇਸ਼ ਦਾ ਇੱਕ ਪ੍ਰਸਿੱਧ ਢੰਗ ਬਣ ਗਿਆ ਹੈ, ਅਤੇ ਬਹੁਤ ਸਾਰੇ ਨਿਵੇਸ਼ਕ ਇਸ ਵੱਲ ਝੁਕ ਰਹੇ ਹਨਨਿਵੇਸ਼ ਇਸ ਵਿੱਚ. ਮਿਉਚੁਅਲ ਫੰਡ ਨਾ ਸਿਰਫ਼ ਚੰਗੇ ਰਿਟਰਨ ਦੀ ਪੇਸ਼ਕਸ਼ ਕਰਦੇ ਹਨ, ਬਲਕਿ ਪ੍ਰਾਪਤ ਕਰਨ ਦਾ ਇੱਕ ਯੋਜਨਾਬੱਧ ਮੌਕਾ ਵੀ ਦਿੰਦੇ ਹਨਵਿੱਤੀ ਟੀਚੇ, ਜੋ ਕਿ ਅਜੋਕੇ ਸਮੇਂ ਵਿੱਚ ਉਹਨਾਂ ਦੀ ਪ੍ਰਸਿੱਧੀ ਦਾ ਇੱਕ ਕਾਰਨ ਹੈ। ਹਾਲਾਂਕਿ, ਲੋੜੀਂਦੇ ਨਿਵੇਸ਼ ਟੀਚੇ ਨੂੰ ਪ੍ਰਾਪਤ ਕਰਨ ਲਈ ਜਾਂ ਚੰਗੀ ਰਿਟਰਨ ਕਮਾਉਣ ਲਈ, ਸਹੀ ਫੰਡ ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰਨਾ ਮਹੱਤਵਪੂਰਨ ਹੈ। ਇਸ ਲਈ ਅਸੀਂ ਇੱਥੇ ਹਾਂ! ਨਿਵੇਸ਼ਕ ਕਰਨ ਦੀ ਯੋਜਨਾ ਬਣਾ ਰਹੇ ਹਨਮਿਉਚੁਅਲ ਫੰਡਾਂ ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰੋ, ਅਸੀਂ ਤੁਹਾਡੇ ਲਈ ਕੁਝ ਲਿਆਉਂਦੇ ਹਾਂਵਧੀਆ ਪ੍ਰਦਰਸ਼ਨ ਕਰਨ ਵਾਲੇ ਮਿਉਚੁਅਲ ਫੰਡ ਜੋ ਤੁਹਾਨੂੰ ਨਿਵੇਸ਼ ਕਰਨ ਵੇਲੇ ਵਿਚਾਰਨ ਦੀ ਲੋੜ ਹੈ। ਇਹ ਫੰਡ ਮਹੱਤਵਪੂਰਨ ਮਾਪਦੰਡ ਜਿਵੇਂ ਕਿ ਏ.ਯੂ.ਐਮ., ਦੁਆਰਾ ਸ਼ਾਰਟਲਿਸਟ ਕੀਤੇ ਗਏ ਹਨ।ਨਹੀ ਹਨ, ਪਿਛਲੇ ਪ੍ਰਦਰਸ਼ਨ, ਪੀਅਰ ਔਸਤ ਰਿਟਰਨ, ਜਾਣਕਾਰੀ ਅਨੁਪਾਤ, ਆਦਿ।

Talk to our investment specialist

ਭਾਰਤ ਵਿੱਚ ਚੋਟੀ ਦੇ 5 ਵਧੀਆ ਪ੍ਰਦਰਸ਼ਨ ਕਰਨ ਵਾਲੇ ਮਿਉਚੁਅਲ ਫੰਡ

ਸਰਬੋਤਮ ਇਕੁਇਟੀ ਮਿਉਚੁਅਲ ਫੰਡ 2022

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Information Ratio Sharpe Ratio DSP World Gold Fund Growth ₹62.799

↑ 0.52 ₹1,975 1,000 500 28.2 58.2 154.1 60.6 29.4 167.1 -0.47 3.41 SBI PSU Fund Growth ₹35.3611

↑ 0.36 ₹5,980 5,000 500 8.2 13.2 27.9 31.7 26.4 11.3 -0.63 0.63 Invesco India PSU Equity Fund Growth ₹66.35

↑ 0.92 ₹1,492 5,000 500 4.2 7.6 26.4 29.8 24.4 10.3 -0.5 0.53 LIC MF Infrastructure Fund Growth ₹48.8886

↑ 0.85 ₹946 5,000 1,000 2.1 -0.9 18.7 27.4 22.4 -3.7 0.29 0.03 UTI Healthcare Fund Growth ₹282.415

↑ 4.38 ₹1,055 5,000 500 -0.8 -4.3 10.4 25.8 15.3 -3.1 0 -0.29 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Note: Ratio's shown as on 31 Jan 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund LIC MF Infrastructure Fund UTI Healthcare Fund Point 1 Upper mid AUM (₹1,975 Cr). Highest AUM (₹5,980 Cr). Lower mid AUM (₹1,492 Cr). Bottom quartile AUM (₹946 Cr). Bottom quartile AUM (₹1,055 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (26 yrs). Point 3 Top rated. Rating: 2★ (lower mid). Rating: 3★ (upper mid). Not Rated. Rating: 1★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.40% (top quartile). 5Y return: 26.35% (upper mid). 5Y return: 24.41% (lower mid). 5Y return: 22.38% (bottom quartile). 5Y return: 15.27% (bottom quartile). Point 6 3Y return: 60.64% (top quartile). 3Y return: 31.74% (upper mid). 3Y return: 29.76% (lower mid). 3Y return: 27.43% (bottom quartile). 3Y return: 25.78% (bottom quartile). Point 7 1Y return: 154.15% (top quartile). 1Y return: 27.92% (upper mid). 1Y return: 26.36% (lower mid). 1Y return: 18.73% (bottom quartile). 1Y return: 10.43% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: -6.08 (bottom quartile). Alpha: 0.48 (upper mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.53 (lower mid). Sharpe: 0.03 (bottom quartile). Sharpe: -0.28 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.29 (top quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

LIC MF Infrastructure Fund

UTI Healthcare Fund

ਸਰਬੋਤਮ ਕਰਜ਼ਾ ਫੰਡ 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3524

↑ 0.02 ₹1,138 4.8 7.2 13.3 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 4.19% 5M 18D 8M 1D BOI AXA Credit Risk Fund Growth ₹13.2889

↑ 0.00 ₹106 6.1 8 11.6 7.8 6.5 6.73% 7M 10D 9M 4D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Aug 22 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund BOI AXA Credit Risk Fund Point 1 Bottom quartile AUM (₹297 Cr). Highest AUM (₹1,138 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Bottom quartile AUM (₹106 Cr). Point 2 Established history (18+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Established history (11+ yrs). Point 3 Rating: 1★ (lower mid). Not Rated. Top rated. Rating: 2★ (upper mid). Not Rated. Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderate. Point 5 1Y return: 13.69% (top quartile). 1Y return: 13.31% (upper mid). 1Y return: 12.83% (lower mid). 1Y return: 11.79% (bottom quartile). 1Y return: 11.57% (bottom quartile). Point 6 1M return: 0.59% (top quartile). 1M return: 0.54% (upper mid). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (bottom quartile). 1M return: 0.39% (lower mid). Point 7 Sharpe: 2.57 (top quartile). Sharpe: 2.38 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Sharpe: 1.12 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Yield to maturity (debt): 6.73% (upper mid). Point 10 Modified duration: 0.00 yrs (top quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (bottom quartile). Modified duration: 0.47 yrs (upper mid). Modified duration: 0.61 yrs (lower mid). Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

BOI AXA Credit Risk Fund

ਸਰਵੋਤਮ ਹਾਈਬ੍ਰਿਡ ਫੰਡ 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹77.7764

↑ 0.87 ₹6,848 -0.4 3 14.7 19.4 13.9 11.1 SBI Multi Asset Allocation Fund Growth ₹65.8993

↑ 0.53 ₹14,944 2.6 9.5 22.2 19.2 14.7 18.6 ICICI Prudential Multi-Asset Fund Growth ₹796.15

↓ -8.43 ₹80,768 -1.4 3.5 13.7 18.5 18.6 18.6 ICICI Prudential Equity and Debt Fund Growth ₹396.79

↑ 3.53 ₹49,257 -2.5 -0.1 12.6 18.1 17.8 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹37.35

↑ 0.48 ₹1,329 0.2 -1.6 12.9 17.8 16.7 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.93% (bottom quartile). 5Y return: 14.67% (bottom quartile). 5Y return: 18.56% (top quartile). 5Y return: 17.81% (upper mid). 5Y return: 16.72% (lower mid). Point 6 3Y return: 19.35% (top quartile). 3Y return: 19.17% (upper mid). 3Y return: 18.51% (lower mid). 3Y return: 18.10% (bottom quartile). 3Y return: 17.81% (bottom quartile). Point 7 1Y return: 14.72% (upper mid). 1Y return: 22.17% (top quartile). 1Y return: 13.74% (lower mid). 1Y return: 12.62% (bottom quartile). 1Y return: 12.87% (bottom quartile). Point 8 1M return: -3.30% (lower mid). 1M return: -2.08% (top quartile). 1M return: -3.80% (bottom quartile). 1M return: -3.90% (bottom quartile). 1M return: -2.76% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

ਸਰਬੋਤਮ ਗੋਲਡ ਮਿਉਚੁਅਲ ਫੰਡ 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.799

↑ 0.52 ₹1,975 28.2 58.2 154.1 60.6 29.4 167.1 ICICI Prudential Regular Gold Savings Fund Growth ₹49.3115

↑ 0.33 ₹6,338 24.4 45.4 82.7 40.5 27.3 72 SBI Gold Fund Growth ₹46.6562

↑ 0.31 ₹15,024 24.6 45.5 83.1 40.4 27.5 71.5 Aditya Birla Sun Life Gold Fund Growth ₹46.1787

↑ 0.35 ₹1,781 24.2 45.1 83.1 40.2 27.2 72 Nippon India Gold Savings Fund Growth ₹60.8727

↑ 0.39 ₹7,160 24.3 45.1 82.4 40.2 27.2 71.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund ICICI Prudential Regular Gold Savings Fund SBI Gold Fund Aditya Birla Sun Life Gold Fund Nippon India Gold Savings Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Lower mid AUM (₹6,338 Cr). Highest AUM (₹15,024 Cr). Bottom quartile AUM (₹1,781 Cr). Upper mid AUM (₹7,160 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 29.40% (top quartile). 5Y return: 27.32% (lower mid). 5Y return: 27.47% (upper mid). 5Y return: 27.19% (bottom quartile). 5Y return: 27.20% (bottom quartile). Point 6 3Y return: 60.64% (top quartile). 3Y return: 40.52% (upper mid). 3Y return: 40.37% (lower mid). 3Y return: 40.24% (bottom quartile). 3Y return: 40.22% (bottom quartile). Point 7 1Y return: 154.15% (top quartile). 1Y return: 82.68% (bottom quartile). 1Y return: 83.12% (upper mid). 1Y return: 83.11% (lower mid). 1Y return: 82.45% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). 1M return: 3.02% (upper mid). 1M return: 3.09% (top quartile). 1M return: 2.86% (bottom quartile). 1M return: 2.98% (lower mid). Point 9 Sharpe: 3.41 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Sharpe: 3.10 (lower mid). Sharpe: 3.25 (upper mid). Sharpe: 3.08 (bottom quartile). Sharpe: 3.01 (bottom quartile). DSP World Gold Fund

ICICI Prudential Regular Gold Savings Fund

SBI Gold Fund

Aditya Birla Sun Life Gold Fund

Nippon India Gold Savings Fund

ਮਿਉਚੁਅਲ ਫੰਡ ਦੀਆਂ ਕਿਸਮਾਂ: ਜੋਖਮ ਅਤੇ ਵਾਪਸੀ

ਨਿਵੇਸ਼ ਕਰਨ ਤੋਂ ਪਹਿਲਾਂ, ਹੇਠ ਲਿਖੀਆਂ ਮਿਉਚੁਅਲ ਫੰਡ ਸ਼੍ਰੇਣੀਆਂ ਦੇ ਬੁਨਿਆਦੀ ਜੋਖਮ ਅਤੇ ਔਸਤ ਰਿਟਰਨ ਨੂੰ ਜਾਣੋ:

| ਮਿਉਚੁਅਲ ਫੰਡ ਸ਼੍ਰੇਣੀ | ਔਸਤ ਵਾਪਸੀ | ਜੋਖਮ | ਜੋਖਮ ਦੀ ਕਿਸਮ |

|---|---|---|---|

| ਇਕੁਇਟੀ ਫੰਡ | 2% -20% | ਉੱਚ ਤੋਂ ਦਰਮਿਆਨੀ | ਅਸਥਿਰਤਾ ਜੋਖਮ, ਪ੍ਰਦਰਸ਼ਨ ਜੋਖਮ, ਇਕਾਗਰਤਾ ਜੋਖਮ |

| ਕਰਜ਼ਾ/ਬਾਂਡ | 8-14% | ਘੱਟ ਤੋਂ ਦਰਮਿਆਨੀ | ਵਿਆਜ ਦਰ ਜੋਖਮ, ਕ੍ਰੈਡਿਟ ਜੋਖਮ |

| ਮਨੀ ਮਾਰਕੀਟ ਫੰਡ | 4%-8% | ਘੱਟ | ਮਹਿੰਗਾਈ ਜੋਖਮ, ਮੌਕੇ ਦਾ ਨੁਕਸਾਨ |

| ਸੰਤੁਲਿਤ ਫੰਡ | 5-15% | ਮੱਧਮ | ਇਕੁਇਟੀ, ਕਰਜ਼ਾ ਹੋਲਡਿੰਗਜ਼ ਲਈ ਉੱਚ ਐਕਸਪੋਜਰ |

ਮਿਉਚੁਅਲ ਫੰਡ ਕੈਲਕੁਲੇਟਰ: ਆਪਣੇ ਨਿਵੇਸ਼ ਰਿਟਰਨਾਂ ਨੂੰ ਪਹਿਲਾਂ ਤੋਂ ਨਿਰਧਾਰਤ ਕਰੋ

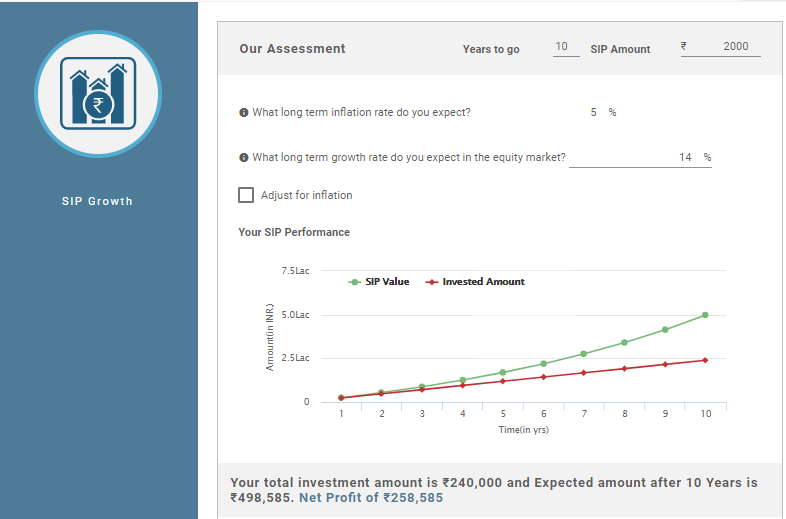

ਏsip ਕੈਲਕੁਲੇਟਰ ਇੱਕ ਸਮਾਰਟ ਟੂਲ ਹੈ ਜੋ ਨਿਵੇਸ਼ਕਾਂ ਦੇ ਮੁੱਖ ਸਵਾਲਾਂ ਨੂੰ ਹੱਲ ਕਰਦਾ ਹੈ ਜਿਵੇਂ ਕਿ 'ਕਿੰਨਾ ਨਿਵੇਸ਼ ਕਰਨਾ ਹੈ', 'ਮੈਂ ਕਿੰਨਾ ਕਮਾਵਾਂਗਾ', 'ਮੇਰਾ ਲਾਭ ਕਿੰਨਾ ਹੋਵੇਗਾ', ਆਦਿ।ਮਿਉਚੁਅਲ ਫੰਡ ਕੈਲਕੁਲੇਟਰ, ਹੋਰ ਖਾਸ ਤੌਰ 'ਤੇ,SIP ਕੈਲਕੁਲੇਟਰ ਉਸ ਕਾਰਜਕਾਲ ਲਈ ਤੁਹਾਡੀ ਨਿਵੇਸ਼ ਰਕਮ ਨੂੰ ਪਹਿਲਾਂ ਤੋਂ ਨਿਰਧਾਰਤ ਕਰਦਾ ਹੈ ਜਿਸ ਲਈ ਤੁਸੀਂ ਨਿਵੇਸ਼ ਕਰਨਾ ਚਾਹੁੰਦੇ ਹੋ। ਇਹ ਪ੍ਰਭਾਵਸ਼ਾਲੀ ਲਈ ਸਭ ਤੋਂ ਵਧੀਆ ਸਾਧਨਾਂ ਵਿੱਚੋਂ ਇੱਕ ਹੈਵਿੱਤੀ ਯੋਜਨਾਬੰਦੀ. ਕੀ ਕੋਈ ਕਾਰ, ਘਰ ਖਰੀਦਣ ਦੀ ਯੋਜਨਾ ਬਣਾਉਣਾ ਚਾਹੁੰਦਾ ਹੈ, ਯੋਜਨਾ ਬਣਾਉਣਾ ਚਾਹੁੰਦਾ ਹੈਸੇਵਾਮੁਕਤੀ, ਇੱਕ ਬੱਚੇ ਦੀ ਉੱਚ ਸਿੱਖਿਆ ਜਾਂ ਕੋਈ ਹੋਰ ਵਿੱਤੀ ਟੀਚਾ, SIP ਕੈਲਕੁਲੇਟਰ ਨੂੰ ਉਸੇ ਲਈ ਵਰਤਿਆ ਜਾ ਸਕਦਾ ਹੈ। ਇੱਥੇ ਦੱਸਿਆ ਗਿਆ ਹੈ ਕਿ ਕੈਲਕੁਲੇਟਰ ਕਿਵੇਂ ਕੰਮ ਕਰਦਾ ਹੈ:

ਉਦਾਹਰਣ:

ਮਹੀਨਾਵਾਰ ਨਿਵੇਸ਼: ₹ 2,000

ਨਿਵੇਸ਼ ਦੀ ਮਿਆਦ: 10 ਸਾਲ

ਨਿਵੇਸ਼ ਕੀਤੀ ਕੁੱਲ ਰਕਮ: ₹ 2,40,000

ਲੰਬੇ ਸਮੇਂ ਦੀ ਮਹਿੰਗਾਈ: 5% (ਲਗਭਗ)

ਲੰਬੇ ਸਮੇਂ ਦੀ ਵਿਕਾਸ ਦਰ: 14% (ਲਗਭਗ)

SIP ਕੈਲਕੁਲੇਟਰ ਦੇ ਅਨੁਸਾਰ ਸੰਭਾਵਿਤ ਰਿਟਰਨ: ₹ 4,98,585

ਤੁਹਾਨੂੰ ਸਿਰਫ਼ ਇੱਕ SIP ਕੈਲਕੁਲੇਟਰ ਵਿੱਚ ਕੁਝ ਬੁਨਿਆਦੀ ਇਨਪੁਟ ਦਾਖਲ ਕਰਨ ਦੀ ਲੋੜ ਹੈ ਜਿਵੇਂ ਕਿ ਨਿਵੇਸ਼ ਦੀ ਰਕਮ ਅਤੇ ਨਿਵੇਸ਼ ਦੀ ਮਿਆਦ (ਵਾਧੂ ਇਨਪੁੱਟ ਜਿਵੇਂ ਮਹਿੰਗਾਈ ਅਤੇ ਉਮੀਦ ਕੀਤੀ ਜਾਂਦੀ ਹੈ।ਬਜ਼ਾਰ ਰਿਟਰਨ ਇੱਕ ਹੋਰ ਯਥਾਰਥਵਾਦੀ ਤਸਵੀਰ ਦੇਵੇਗਾ). ਇਹਨਾਂ ਐਂਟਰੀਆਂ ਦਾ ਆਉਟਪੁੱਟ ਪਰਿਪੱਕਤਾ ਅਤੇ ਕੀਤੇ ਲਾਭਾਂ 'ਤੇ ਅੰਤਮ ਰਕਮ ਹੋਵੇਗੀ।

ਟੀਚੇ ਨੂੰ ਧਿਆਨ ਵਿੱਚ ਰੱਖਦੇ ਹੋਏ ਇੱਕ ਸਮਾਨ ਗਣਨਾ ਵੀ ਇਹ ਨਿਰਧਾਰਤ ਕਰਨ ਲਈ ਕੀਤੀ ਜਾ ਸਕਦੀ ਹੈ ਕਿ ਟੀਚੇ ਤੱਕ ਪਹੁੰਚਣ ਲਈ ਕਿੰਨਾ ਨਿਵੇਸ਼ ਕਰਨਾ ਚਾਹੀਦਾ ਹੈ। ਤੁਹਾਨੂੰ ਇੱਕ ਖਾਸ ਟੀਚਾ ਚੁਣਨਾ ਹੋਵੇਗਾ, ਜਿਵੇਂ ਕਿ ਹੇਠਾਂ ਦਿੱਤਾ ਗਿਆ ਹੈ, ਅਤੇ ਟੀਚਾ ਕੈਲਕੁਲੇਟਰ ਦੀ ਵਰਤੋਂ ਕਰਕੇ ਵੇਰਵਿਆਂ ਦਾ ਅੰਦਾਜ਼ਾ ਲਗਾਉਣਾ ਹੋਵੇਗਾ।

ਇਹ ਯਕੀਨੀ ਬਣਾਉਣ ਲਈ ਸਾਰੇ ਯਤਨ ਕੀਤੇ ਗਏ ਹਨ ਕਿ ਇੱਥੇ ਦਿੱਤੀ ਗਈ ਜਾਣਕਾਰੀ ਸਹੀ ਹੈ। ਹਾਲਾਂਕਿ, ਡੇਟਾ ਦੀ ਸ਼ੁੱਧਤਾ ਬਾਰੇ ਕੋਈ ਗਾਰੰਟੀ ਨਹੀਂ ਦਿੱਤੀ ਗਈ ਹੈ। ਕਿਰਪਾ ਕਰਕੇ ਕੋਈ ਵੀ ਨਿਵੇਸ਼ ਕਰਨ ਤੋਂ ਪਹਿਲਾਂ ਸਕੀਮ ਜਾਣਕਾਰੀ ਦਸਤਾਵੇਜ਼ ਨਾਲ ਤਸਦੀਕ ਕਰੋ।