میوچل فنڈز میں یکمشت سرمایہ کاری کے فوائد

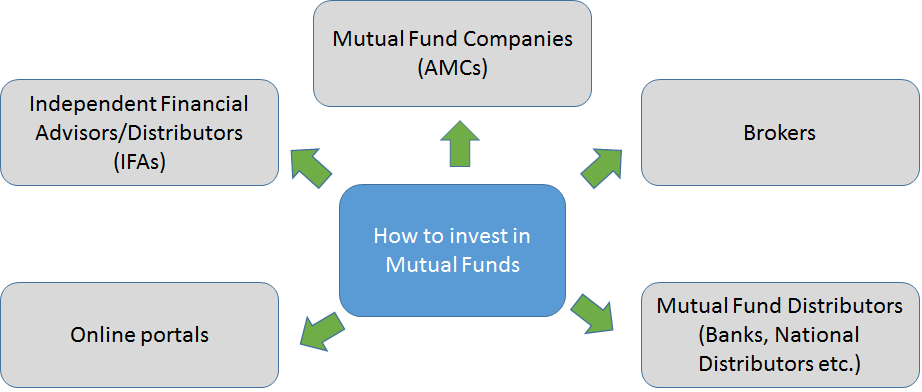

یکمشت سرمایہ کاری سے مراد ہے۔سرمایہ کاری میوچل فنڈ اسکیم میں کافی رقم۔ یکمشت سرمایہ کاری میں، رقم ایک بار کی ادائیگی کے طور پر جمع کی جاتی ہے۔ وہ افراد جن کے پاس بہت زیادہ رقم ہے وہ Mutual Fund میں ایک اہم رقم جمع کر سکتے ہیں۔ سرمایہ کاری کا یکمشت موڈ سسٹمیٹک کے برعکس ہے۔سرمایہ کاری کا منصوبہ یاگھونٹ موڈ کوئی بھی یا تو فکسڈ میں یکمشت رقم کی سرمایہ کاری کر سکتا ہے۔آمدنی یاایکویٹی فنڈز ان کی خطرے کی بھوک، سرمایہ کاری کی مدت، اور سرمایہ کاری کے مقصد پر منحصر ہے۔ اگرچہ زیادہ تر افراد ترجیح دیتے ہیں۔میوچل فنڈز میں سرمایہ کاری SIP کے ذریعے ابھی تک، یکمشت سرمایہ کاری کے کچھ فوائد ہیں۔ تو، آئیے ہم ایک ساتھ سرمایہ کاری کے فوائد کو سمجھتے ہیں۔باہمی چندہ.

یکمشت سرمایہ کاری کے فوائد

میوچل فنڈز میں یکمشت سرمایہ کاری کے کچھ فوائد درج ذیل ہیں:

بڑی رقم کی سرمایہ کاری

یکمشت موڈ کے اختیار کے ذریعہ، افراد میوچل فنڈز میں کافی رقم کی سرمایہ کاری کر سکتے ہیں۔ نتیجے کے طور پر، جبمارکیٹ ترقی کی مدت کو ظاہر کرتا ہے، پھر سرمایہ کاری کی قدر بھی قدر کے مقابلے میں کافی حد تک بڑھ جاتی ہے۔SIP سرمایہ کاری.

طویل مدتی مدت کے لیے مثالی۔

یکمشت سرمایہ کاری ان افراد کے لیے موزوں ہے جو طویل مدتی سرمایہ کاری کو ترجیح دیتے ہیں۔ یکمشت سرمایہ کاری کی صورت میں طویل مدتی سرمایہ کاری پر 10 سال یا اس سے زیادہ کی تخمینی سرمایہ کاری کی مدت کے لیے غور کیا جا سکتا ہے۔ تاہم، میں یکمشت سرمایہ کاری کے لیےقرض فنڈ، افراد درمیانی مدت کے لیے سرمایہ کاری کا انتخاب بھی کر سکتے ہیں۔

سہولت

لمپ سم موڈ عام طور پر افراد کے لیے آسان ہوتا ہے کیونکہ جن لوگوں کے پاس بڑی رقم ہوتی ہے وہ اپنی سرمایہ کاری پھیلا سکتے ہیں۔ تاہم، اگر سرمایہ کاری ایس آئی پی موڈ کے ذریعے کی جاتی ہے تو انہیں محتاط رہنا ہوگا کہ رقم باقاعدگی سے وقفوں پر لگائی جائے۔

وقت کے لیے سرمایہ کاری کریں۔

جب بھی سرمایہ کار طویل مدتی سرمایہ کاری کا انتخاب کرتے ہیں، تو انہیں ہمیشہ مارکیٹ کا وقت تلاش کرنا چاہیے۔ افراد کو عام طور پر اس وقت سرمایہ کاری کا انتخاب کرنا چاہیے جب مارکیٹیں پہلے سے ہی زوال کا شکار ہوں اور ترقی کے امکانات دکھا رہی ہوں۔ اس صورت حال میں، افراد SIP موڈ کے مقابلے میں یکمشت موڈ کے ذریعے زیادہ منافع کما سکتے ہیں۔ تاہم، اگر یکمشت سرمایہ کاری اس وقت کی جاتی ہے جب مارکیٹ پہلے ہی عروج پر پہنچ چکی ہو، اس صورت میں، افراد کو نقصان ہو سکتا ہے۔

Talk to our investment specialist

2022 کے لیے بہترین پرفارمنگ لمپ سم فنڈز

چونکہ یکمشت سرمایہ کاری طویل مدتی مدت کے لیے کی جاتی ہے، اس کے نتیجے میں، ہم خاص طور پر ایکویٹی کے زمرے میں سرمایہ کاری کرنے کا انتخاب کر سکتے ہیں۔بڑے کیپ فنڈز. لہٰذا، آئیے ہم کچھ بہترین کارکردگی کا مظاہرہ کرنے والی بڑی کیپ میوچل فنڈ اسکیموں پر نظر ڈالتے ہیں جن کا انتخاب یکمشت موڈ کے ذریعے طویل مدتی سرمایہ کاری کے لیے کیا جاسکتا ہے۔

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 5,000 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹93.8953

↑ 0.49 ₹50,876 5,000 0.4 3.1 16.6 19.3 17.4 9.2 ICICI Prudential Bluechip Fund Growth ₹114.46

↑ 0.46 ₹78,502 5,000 -0.5 3.3 14.6 18.2 15.5 11.3 DSP TOP 100 Equity Growth ₹483.231

↑ 2.93 ₹7,285 1,000 -0.2 2.8 11.6 18 13.5 8.4 JM Core 11 Fund Growth ₹20.1232

↑ 0.09 ₹299 5,000 -1.3 3.4 13.2 18 14 -1.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 5 Funds showcased

Commentary IDBI India Top 100 Equity Fund Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity JM Core 11 Fund Point 1 Bottom quartile AUM (₹655 Cr). Upper mid AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹299 Cr). Point 2 Established history (13+ yrs). Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (17+ yrs). Point 3 Rating: 3★ (bottom quartile). Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 4★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 12.61% (bottom quartile). 5Y return: 17.39% (top quartile). 5Y return: 15.55% (upper mid). 5Y return: 13.50% (bottom quartile). 5Y return: 13.96% (lower mid). Point 6 3Y return: 21.88% (top quartile). 3Y return: 19.34% (upper mid). 3Y return: 18.21% (lower mid). 3Y return: 18.00% (bottom quartile). 3Y return: 17.98% (bottom quartile). Point 7 1Y return: 15.39% (upper mid). 1Y return: 16.58% (top quartile). 1Y return: 14.55% (lower mid). 1Y return: 11.61% (bottom quartile). 1Y return: 13.19% (bottom quartile). Point 8 Alpha: 2.11 (top quartile). Alpha: -0.94 (lower mid). Alpha: 1.30 (upper mid). Alpha: -1.17 (bottom quartile). Alpha: -9.25 (bottom quartile). Point 9 Sharpe: 1.09 (top quartile). Sharpe: 0.29 (lower mid). Sharpe: 0.48 (upper mid). Sharpe: 0.26 (bottom quartile). Sharpe: -0.39 (bottom quartile). Point 10 Information ratio: 0.14 (bottom quartile). Information ratio: 1.37 (top quartile). Information ratio: 1.26 (upper mid). Information ratio: 0.74 (lower mid). Information ratio: 0.16 (bottom quartile). IDBI India Top 100 Equity Fund

Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

JM Core 11 Fund

ایکمشت اوپر AUM/نیٹ اثاثے رکھنے والے فنڈز100 کروڑ. پر ترتیب دیا گیاآخری 3 سال کی واپسی۔.

The Investment objective of the Scheme is to provide investors with the opportunities for long-term capital appreciation by investing predominantly in Equity and Equity related Instruments of Large Cap companies. However

there can be no assurance that the investment objective under the Scheme will be realized. Below is the key information for IDBI India Top 100 Equity Fund Returns up to 1 year are on (Erstwhile Reliance Top 200 Fund) The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing in equity and equity related instruments of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index. The secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Large Cap Fund Below is the key information for Nippon India Large Cap Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Focused Bluechip Equity Fund) To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among Top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd. If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund

Manager reserves the right to increase the number of companies to more than 20. Research Highlights for ICICI Prudential Bluechip Fund Below is the key information for ICICI Prudential Bluechip Fund Returns up to 1 year are on The Fund is seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. Research Highlights for DSP TOP 100 Equity Below is the key information for DSP TOP 100 Equity Returns up to 1 year are on The investment objective of the Scheme is to provide long-term growth by investing predominantly in a concentrated portfolio of equity / equity related instruments of companies. Research Highlights for JM Core 11 Fund Below is the key information for JM Core 11 Fund Returns up to 1 year are on 1. IDBI India Top 100 Equity Fund

IDBI India Top 100 Equity Fund

Growth Launch Date 15 May 12 NAV (28 Jul 23) ₹44.16 ↑ 0.05 (0.11 %) Net Assets (Cr) ₹655 on 30 Jun 23 Category Equity - Large Cap AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.47 Sharpe Ratio 1.09 Information Ratio 0.14 Alpha Ratio 2.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,389 31 Jan 23 ₹13,450 Returns for IDBI India Top 100 Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3% 3 Month 9.2% 6 Month 12.5% 1 Year 15.4% 3 Year 21.9% 5 Year 12.6% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI India Top 100 Equity Fund

Name Since Tenure Data below for IDBI India Top 100 Equity Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Nippon India Large Cap Fund

Nippon India Large Cap Fund

Growth Launch Date 8 Aug 07 NAV (18 Feb 26) ₹93.8953 ↑ 0.49 (0.52 %) Net Assets (Cr) ₹50,876 on 31 Dec 25 Category Equity - Large Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.58 Sharpe Ratio 0.29 Information Ratio 1.37 Alpha Ratio -0.94 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,601 31 Jan 23 ₹14,610 31 Jan 24 ₹19,910 31 Jan 25 ₹22,484 31 Jan 26 ₹24,543 Returns for Nippon India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 1.9% 3 Month 0.4% 6 Month 3.1% 1 Year 16.6% 3 Year 19.3% 5 Year 17.4% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.2% 2023 18.2% 2022 32.1% 2021 11.3% 2020 32.4% 2019 4.9% 2018 7.3% 2017 -0.2% 2016 38.4% 2015 2.2% Fund Manager information for Nippon India Large Cap Fund

Name Since Tenure Sailesh Raj Bhan 8 Aug 07 18.5 Yr. Kinjal Desai 25 May 18 7.7 Yr. Bhavik Dave 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Large Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.89% Consumer Cyclical 14.78% Consumer Defensive 9.84% Industrials 9.61% Technology 8.16% Health Care 5.68% Basic Materials 5.67% Utility 5.47% Energy 5.44% Real Estate 0.34% Communication Services 0.19% Asset Allocation

Asset Class Value Cash 0.89% Equity 99.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK9% ₹4,607 Cr 49,580,734

↑ 4,200,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹3,208 Cr 23,677,945

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE5% ₹2,726 Cr 19,537,539 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | AXISBANK4% ₹2,140 Cr 15,615,542 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN4% ₹2,055 Cr 19,082,107

↓ -500,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT3% ₹1,730 Cr 4,400,529 Infosys Ltd (Technology)

Equity, Since 30 Sep 07 | INFY3% ₹1,574 Cr 9,590,806 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 24 | TCS3% ₹1,468 Cr 4,700,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 16 | ITC3% ₹1,380 Cr 42,829,812

↑ 7,500,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 21 | BAJFINANCE3% ₹1,362 Cr 14,648,655 3. ICICI Prudential Bluechip Fund

ICICI Prudential Bluechip Fund

Growth Launch Date 23 May 08 NAV (18 Feb 26) ₹114.46 ↑ 0.46 (0.40 %) Net Assets (Cr) ₹78,502 on 31 Dec 25 Category Equity - Large Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.46 Sharpe Ratio 0.48 Information Ratio 1.26 Alpha Ratio 1.3 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,200 31 Jan 23 ₹13,710 31 Jan 24 ₹18,309 31 Jan 25 ₹20,510 31 Jan 26 ₹22,375 Returns for ICICI Prudential Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.9% 3 Month -0.5% 6 Month 3.3% 1 Year 14.6% 3 Year 18.2% 5 Year 15.5% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 16.9% 2022 27.4% 2021 6.9% 2020 29.2% 2019 13.5% 2018 9.8% 2017 -0.8% 2016 32.7% 2015 7.7% Fund Manager information for ICICI Prudential Bluechip Fund

Name Since Tenure Anish Tawakley 5 Sep 18 7.41 Yr. Vaibhav Dusad 18 Jan 21 5.04 Yr. Sharmila D’mello 31 Jul 22 3.51 Yr. Data below for ICICI Prudential Bluechip Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 28.32% Consumer Cyclical 12.02% Industrials 11.69% Energy 8.9% Basic Materials 6.92% Technology 5.22% Utility 4.99% Communication Services 4.88% Health Care 4.5% Consumer Defensive 3.45% Real Estate 1.22% Asset Allocation

Asset Class Value Cash 3.77% Equity 96.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK10% ₹7,423 Cr 79,879,508

↑ 2,440,640 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 08 | ICICIBANK8% ₹6,426 Cr 47,426,976 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 08 | RELIANCE6% ₹4,948 Cr 35,455,981

↑ 800,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 12 | LT6% ₹4,944 Cr 12,574,023

↑ 130,671 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 14 | AXISBANK5% ₹3,534 Cr 25,789,059 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 09 | BHARTIARTL4% ₹3,337 Cr 16,951,029 Nifty 50 Index

- | -4% ₹3,154 Cr 1,240,525

↑ 1,240,525 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Apr 16 | MARUTI4% ₹2,957 Cr 2,025,668

↑ 24,356 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 17 | ULTRACEMCO3% ₹2,676 Cr 2,107,962

↑ 4,035 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY3% ₹2,666 Cr 16,248,711

↓ -200,000 4. DSP TOP 100 Equity

DSP TOP 100 Equity

Growth Launch Date 10 Mar 03 NAV (18 Feb 26) ₹483.231 ↑ 2.93 (0.61 %) Net Assets (Cr) ₹7,285 on 31 Dec 25 Category Equity - Large Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 1.94 Sharpe Ratio 0.26 Information Ratio 0.74 Alpha Ratio -1.17 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,004 31 Jan 23 ₹12,170 31 Jan 24 ₹15,679 31 Jan 25 ₹18,517 31 Jan 26 ₹19,861 Returns for DSP TOP 100 Equity

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 0.4% 3 Month -0.2% 6 Month 2.8% 1 Year 11.6% 3 Year 18% 5 Year 13.5% 10 Year 15 Year Since launch 18.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.4% 2023 20.5% 2022 26.6% 2021 1.4% 2020 19.5% 2019 7.5% 2018 14.8% 2017 -2.7% 2016 26.5% 2015 4.9% Fund Manager information for DSP TOP 100 Equity

Name Since Tenure Abhishek Singh 1 Jun 22 3.67 Yr. Data below for DSP TOP 100 Equity as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 44.89% Consumer Cyclical 10.18% Health Care 8.5% Technology 7.92% Utility 7.42% Consumer Defensive 5.58% Energy 3.83% Communication Services 1.61% Basic Materials 1.02% Industrials 0.77% Asset Allocation

Asset Class Value Cash 8.29% Equity 91.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 14 | HDFCBANK9% ₹677 Cr 7,283,795

↑ 538,378 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 16 | ICICIBANK8% ₹596 Cr 4,401,409 Infosys Ltd (Technology)

Equity, Since 30 Sep 19 | INFY7% ₹471 Cr 2,872,960

↑ 86,613 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | AXISBANK6% ₹446 Cr 3,257,465 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | M&M6% ₹412 Cr 1,201,992 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 21 | ITC6% ₹400 Cr 12,408,865

↑ 1,432,417 NTPC Ltd (Utilities)

Equity, Since 30 Nov 23 | NTPC5% ₹357 Cr 10,021,653 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 May 24 | KOTAKBANK4% ₹310 Cr 7,592,385 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN4% ₹294 Cr 2,732,969 Cipla Ltd (Healthcare)

Equity, Since 30 Jun 20 | CIPLA4% ₹264 Cr 1,993,692

↑ 99,620 5. JM Core 11 Fund

JM Core 11 Fund

Growth Launch Date 5 Mar 08 NAV (18 Feb 26) ₹20.1232 ↑ 0.09 (0.45 %) Net Assets (Cr) ₹299 on 31 Dec 25 Category Equity - Large Cap AMC JM Financial Asset Management Limited Rating ☆☆☆☆ Risk High Expense Ratio 2.38 Sharpe Ratio -0.39 Information Ratio 0.16 Alpha Ratio -9.25 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,270 31 Jan 23 ₹12,543 31 Jan 24 ₹18,111 31 Jan 25 ₹20,012 31 Jan 26 ₹20,072 Returns for JM Core 11 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 1.6% 3 Month -1.3% 6 Month 3.4% 1 Year 13.2% 3 Year 18% 5 Year 14% 10 Year 15 Year Since launch 4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -1.9% 2023 24.3% 2022 32.9% 2021 7.1% 2020 16.3% 2019 6.3% 2018 10.6% 2017 -5% 2016 43.1% 2015 11.1% Fund Manager information for JM Core 11 Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.34 Yr. Asit Bhandarkar 25 Feb 09 16.95 Yr. Ruchi Fozdar 4 Oct 24 1.33 Yr. Deepak Gupta 11 Apr 25 0.81 Yr. Data below for JM Core 11 Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Consumer Cyclical 27.18% Financial Services 26.49% Industrials 14.84% Technology 14.46% Basic Materials 5.4% Health Care 5.36% Communication Services 4.23% Asset Allocation

Asset Class Value Cash 2.05% Equity 97.95% Top Securities Holdings / Portfolio

Name Holding Value Quantity Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 May 25 | UJJIVANSFB6% ₹18 Cr 2,801,722 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 24 | HDFCBANK6% ₹16 Cr 174,000

↑ 40,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 11 | LT5% ₹15 Cr 38,507 IDFC First Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | IDFCFIRSTB5% ₹15 Cr 1,800,000

↑ 100,000 Eicher Motors Ltd (Consumer Cyclical)

Equity, Since 28 Feb 25 | EICHERMOT5% ₹15 Cr 21,000 Titan Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | TITAN5% ₹14 Cr 34,560

↓ -13,000 Eternal Ltd (Consumer Cyclical)

Equity, Since 30 Nov 23 | 5433204% ₹12 Cr 445,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 24 | BHARTIARTL4% ₹12 Cr 61,000 One97 Communications Ltd (Technology)

Equity, Since 31 May 25 | 5433964% ₹12 Cr 105,000

↑ 5,000 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Mar 23 | AMBER4% ₹11 Cr 19,050

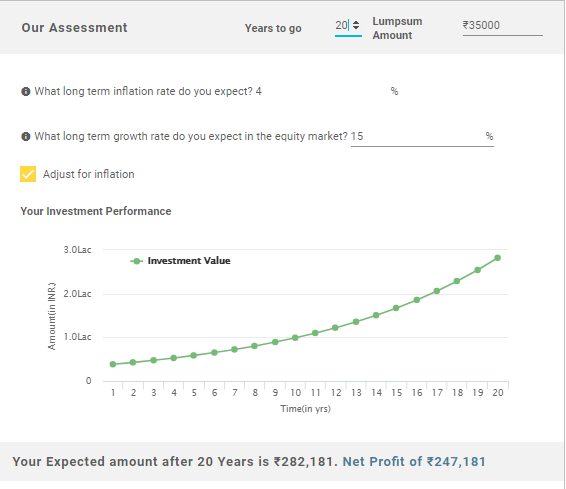

لمپ سم کیلکولیٹر

لمپ سم کیلکولیٹر ایک ایسا آلہ ہے جو افراد کو یہ سمجھنے میں مدد کرتا ہے کہ ان کی قیمت کتنی ہوگیمیوچل فنڈز میں یکمشت سرمایہ کاری سرمایہ کاری کی مدت کے اختتام پر۔ کیلکولیٹر میں جن ان پٹ ڈیٹا کو فیڈ کرنے کی ضرورت ہے اس میں یکمشت سرمایہ کاری کی مدت، یکمشت سرمایہ کاری کی رقم، ایکویٹی مارکیٹوں میں متوقع طویل مدتی ترقی کی شرح، متوقع طویل مدتی شامل ہیں۔مہنگائی شرح تو، آئیے اس تصور کو سمجھیں کہ کس طرح یکمشت کیلکولیٹر استعمال کیا جائے۔

یکمشت سرمایہ کاری: 35 روپے،000

سرمایہ کاری کی مدت: 20 سال

طویل مدتی ترقی کی شرح (تقریباً): 15%

طویل مدتی افراط زر کی شرح (تقریبا): 4%

یکمشت کیلکولیٹر کے مطابق متوقع واپسی: INR 2,82,181

سرمایہ کاری پر خالص منافع: INR 2,47,181

اس طرح، مندرجہ بالا حساب سے پتہ چلتا ہے کہ آپ کی سرمایہ کاری پر سرمایہ کاری پر خالص منافع INR 2,47,181 ہے جبکہ آپ کی سرمایہ کاری کی کل قیمت INR 2,82,181 ہے۔.

اس طرح، مندرجہ بالا نکات سے، یہ کہا جا سکتا ہے کہ سرمایہ کاری کے یکمشت موڈ کے بھی اپنے فوائد ہیں۔ تاہم، افراد کو سرمایہ کاری کے یکمشت موڈ کا انتخاب کرتے وقت محتاط رہنا چاہیے۔ انہیں یہ دیکھنا چاہیے کہ آیا ایسا موڈ ان کے لیے موزوں ہے یا نہیں۔ اگر افراد یکمشت موڈ کے ساتھ بہت زیادہ آرام دہ نہیں ہیں، تو وہ STP یا کے لیے انتخاب کر سکتے ہیں۔منظم منتقلی کا منصوبہ جس میں وہ پہلے یکمشت رقم کو a میں لگاتے ہیں۔مائع فنڈ اور پھر اسے باقاعدہ وقفوں پر ایکویٹی فنڈ میں منظم طریقے سے منتقل کریں۔

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Research Highlights for IDBI India Top 100 Equity Fund