میوچل فنڈ بمقابلہ ایف ڈی (فکسڈ ڈپازٹ)

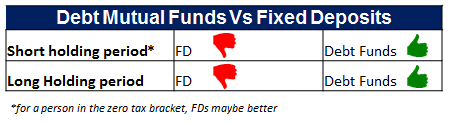

میوچل فنڈ بمقابلہایف ڈی? پیسہ بچانے کے بارے میں سوچتے وقت، سب سے پہلی چیز جس پر زیادہ تر لوگ غور کرتے ہیں وہ ہے۔سرمایہ کاری فکسڈ ڈپازٹس (FDs) میں۔ یہ عام طور پر اس وجہ سے ہے کہ اسے سمجھنا آسان ہے اور نسلوں سے کیا جا رہا ہے۔ لیکن کیا یہ سب سے مناسب سرمایہ کاری ہے؟ اور کیا یہ بہترین منافع فراہم کرتا ہے؟ یا میوچل فنڈ کی سرمایہ کاری اس مقصد کو بہتر طریقے سے پورا کر سکتی ہے؟ ان سوالات کے جوابات جاننے کے لیے ذیل میں پڑھیں!

ایف ڈی یا فکسڈ ڈپازٹ

فکسڈ ڈپازٹ، جسے FD بھی کہا جاتا ہے ایک مقبول ہے۔بینک سرمایہ کاری کا اختیار طویل مدتی اور قلیل مدتی سرمایہ کاری دونوں کے لیے موزوں ہے۔ FD ریٹرن مقرر ہیں کیونکہ FD سود کی شرح حکومت ہند کے ذریعہ پہلے سے طے شدہ ہے۔ فکسڈ ڈپازٹس پر جو شرح سود طے کی جا رہی ہے، اس کا کوئی اثر نہیں ہے۔مہنگائی ان سرمایہ کاری پر.

نیز، FD ریٹرن سرمایہ کاروں کے ہاتھ میں قابل ٹیکس ہیں۔ تاہم، ایف ڈی سرمایہ کاری کے تحت ٹیکس کٹوتیوں کے لیے ذمہ دار ہیں۔سیکشن 80 سی کیانکم ٹیکس ایکٹ

باہمی چندہ

میوچل فنڈ تین طرح کا ہوتا ہے، قرض، ایکویٹی اور متوازنباہمی چندہ.قرض باہمی فنڈ وہ ہیں جو حکومت میں زیادہ تر اثاثے لگاتے ہیں۔بانڈز، کارپوریٹ بانڈز اور باقی ایکویٹی مارکیٹوں میں۔ اس کے برعکس، ایکویٹی میوچل فنڈز اپنے اثاثوں کا 65% سے زیادہ ایکویٹی مارکیٹوں میں اور باقی سرکاری بانڈز، کارپوریٹ بانڈز اور سیکیورٹیز میں لگاتا ہے۔ جبکہ بیلنسڈ میوچل فنڈز وہ ہیں جو جزوی طور پر قرض میں اور جزوی طور پر سرمایہ کاری کرتے ہیں۔ایکویٹی فنڈز. میوچل فنڈ افراط زر کو شکست دینے والا ایک آلہ ہے، اس لیے یہ زیادہ ٹیکس موثر ہے اور اس سے طویل مدتی سرمایہ کاری پر بہتر منافع کی پیشکش کی جاتی ہے۔

کون سی بہتر طویل مدتی سرمایہ کاری ہے؟

اب جب کہ ہم جانتے ہیں کہ میوچل فنڈز اور فکسڈ ڈپازٹ (FDs) دونوں ہیں۔ٹیکس کی بچت کی سرمایہ کاریسوال یہ پیدا ہوتا ہے کہ سرمایہ کاری کہاں کرنی چاہیے؟ اگرچہ یہ ایک موضوعی سوال ہے اور اس کا جواب ہر شخص سے مختلف ہو سکتا ہے، ذیل میں مختلف پیرامیٹرز کی بنیاد پر ایک موازنہ دیا گیا ہے جو آپ کو بہتر انتخاب کرنے میں مدد کر سکتا ہے۔

1. میوچل فنڈ ریٹرن اور ایف ڈی ریٹرن

فکسڈ ڈپازٹ پر واپسی پہلے سے متعین ہے اور پوری مدت میں تبدیل نہیں ہوتی ہے۔ جبکہ میوچل فنڈز، مالیاتی سے منسلک ہیں۔مارکیٹطویل مدتی سرمایہ کاری پر بہتر منافع پیش کرتے ہیں۔

2. ایف ڈی کی شرح سود اور میوچل فنڈ ریٹرن

FDs پر سود کی شرح FD کی قسم یا FD کی مدت کے لحاظ سے طے کی جاتی ہے، لہذا کوئی بھی فکسڈ ڈپازٹ پر زیادہ شرح سود کی توقع نہیں کر سکتا۔ دوسری طرف، میوچل فنڈز پر منافع مختلف ہوتا ہے کیونکہ مختلف قسم کے فنڈز غیر مستحکم منافع پیش کرتے ہیں۔ اگر مارکیٹ زیادہ جاتی ہے تو منافع میں اضافہ ہوتا ہے اور اس کے برعکس۔

3. خطرے کے عوامل

فکسڈ ڈپازٹس کو شاید ہی کوئی خطرہ لاحق ہوتا ہے کیونکہ ریٹرن پہلے سے طے شدہ ہوتے ہیں۔ نیز، اگر بینک کا پردہ فاش ہو جاتا ہے تو تمام بینک کھاتوں کا INR 1 لاکھ تک بیمہ کیا جاتا ہے۔ دوسری طرف، میوچل فنڈز زیادہ خطرہ رکھتے ہیں کیونکہ وہ اپنے اثاثوں کو مالیاتی منڈی میں لگاتے ہیں۔ ایکویٹی میوچل فنڈز، جس کے زیادہ تر اثاثے ایکویٹی مارکیٹوں میں لگائے گئے ہیں، بہت زیادہ خطرہ رکھتے ہیں۔ جبکہ ڈیبٹ میوچل فنڈز میں سرمایہ کاری کم خطرہ ہے، کیونکہ ان فنڈز کا بہت کم حصہ اسٹاک مارکیٹ میں لگایا جاتا ہے۔

Talk to our investment specialist

4. افراط زر کا اثر

سود کی شرح پہلے سے طے شدہ ہے، فکسڈ ڈپازٹس پر افراط زر کا کوئی اثر نہیں ہے۔ جبکہ، میوچل فنڈز کے لیے، ریٹرن افراط زر کے مطابق ہوتے ہیں جو بہتر منافع کمانے کی صلاحیت کو بڑھاتے ہیں۔

5. کیپٹل گینز

نہیں ہیںسرمایہ ایف ڈی کی صورت میں فائدہ ممکن ہے۔ میوچل فنڈز کے لیے،کیپٹل گینز انعقاد کی مدت پر منحصر ہے. مختلف میوچل فنڈز مختلف کیپیٹل گینز پیش کرتے ہیں۔

6. لیکویڈیٹی

فکسڈ ڈپازٹس ہیں۔غیر قانونیکیونکہ سرمایہ کاری کی گئی رقم ایک خاص وقت کے لیے مقفل ہے۔ اگر اس مدت سے پہلے رقم نکال لی جائے تو ایک مخصوص جرمانہ کاٹا جاتا ہے۔ جبکہ میوچل فنڈز مائع ہوتے ہیں کیونکہ وہ بہت کم وقت میں فروخت کیے جاسکتے ہیں۔فرسودگی فنڈ کی قیمت میں. تاہم، چند میوچل فنڈز کی فروخت پر لاگو ہونے والے ایگزٹ بوجھ کو چیک کرنا ضروری ہے۔

7. ٹیکس لگانا

فکسڈ ڈپازٹ پر سود پر فرد کے ٹیکس سلیب کے مطابق ٹیکس لگایا جاتا ہے۔ دوسری جانب،میوچل فنڈ ٹیکسیشن زیادہ تر انعقاد کی مدت پر منحصر ہے۔ شارٹ ٹرم کیپیٹل گینز (STCG) اور لانگ ٹرم کیپیٹل گینز (LTCG) دونوں پر مختلف ٹیکس لگایا جاتا ہے۔

8. ٹیکس سیونگ ایف ڈی کی V/S ایکویٹی لنکڈ سیونگ سکیمز (ELSS)

ان سرمایہ کاروں کے لیے جو IT ایکٹ کے سیکشن 80c کے تحت ٹیکس بچانے کے مقصد کے لیے ایف ڈی پر غور کر رہے ہیں۔ (5 سالہ لاکن)ای ایل ایس ایس میوچل فنڈز ایک اچھا متبادل ہیں کیونکہ ان کا 3 سال کا لاک ان ہے اور تاریخی طور پر بہتر منافع کی پیشکش کی ہے۔

کون سا بہتر سرمایہ کاری منصوبہ ہے؟

آئیے مختصراً دیکھتے ہیں:

| پیرامیٹر | مشترکہ فنڈ | معیاد مقررہ تک جمع |

|---|---|---|

| واپسی کی شرح | کوئی یقینی واپسی نہیں۔ | فکسڈ ریٹرن |

| انفلیشن ایڈجسٹ ریٹرن | اعلی افراط زر کی ایڈجسٹ شدہ واپسیوں کا امکان | عام طور پر کم افراط زر کی ایڈجسٹ شدہ واپسی |

| خطرہ | درمیانے درجے سے زیادہ خطرہ | کم خطرہ |

| لیکویڈیٹی | مائع | مائع |

| قبل از وقت واپسی | ایگزٹ لوڈ/کوئی لوڈ کے ساتھ اجازت ہے۔ | جرمانے کے ساتھ اجازت ہے۔ |

| سرمایہ کاری کی لاگت | انتظامی لاگت/خرچ کا تناسب | کوی قیمت نہیں |

| ٹیکس کی حیثیت | سازگار ٹیکس کی حیثیت | ٹیکس سلیب کے مطابق |

2022 میں سرمایہ کاری کے لیے بہترین میوچل فنڈز

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹60.3973

↓ -2.23 ₹1,756 32.8 78.1 143 56.3 28.1 167.1 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 7.8 17.7 33.3 34.3 27.5 11.3 ICICI Prudential Infrastructure Fund Growth ₹198.6

↑ 0.98 ₹8,134 0.1 2.5 18.5 25.4 26.5 6.7 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 3.1 11.2 33.1 32.2 25.9 10.3 DSP India T.I.G.E.R Fund Growth ₹326.36

↑ 1.58 ₹5,323 2.1 4.6 23 25.9 24.4 -2.5 Nippon India Power and Infra Fund Growth ₹355.176

↑ 2.24 ₹7,117 0.3 4.4 21.3 26.6 23.9 -0.5 HDFC Infrastructure Fund Growth ₹47.986

↑ 0.17 ₹2,452 -1 1.2 18.6 27.5 23.7 2.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 7 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Nippon India Power and Infra Fund HDFC Infrastructure Fund Point 1 Bottom quartile AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Highest AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹5,323 Cr). Upper mid AUM (₹7,117 Cr). Lower mid AUM (₹2,452 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (17+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 28.10% (top quartile). 5Y return: 27.55% (upper mid). 5Y return: 26.52% (upper mid). 5Y return: 25.92% (lower mid). 5Y return: 24.39% (lower mid). 5Y return: 23.85% (bottom quartile). 5Y return: 23.67% (bottom quartile). Point 6 3Y return: 56.28% (top quartile). 3Y return: 34.34% (upper mid). 3Y return: 25.38% (bottom quartile). 3Y return: 32.18% (upper mid). 3Y return: 25.91% (bottom quartile). 3Y return: 26.64% (lower mid). 3Y return: 27.46% (lower mid). Point 7 1Y return: 143.03% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 18.45% (bottom quartile). 1Y return: 33.14% (upper mid). 1Y return: 22.96% (lower mid). 1Y return: 21.29% (lower mid). 1Y return: 18.58% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (lower mid). Alpha: 0.00 (upper mid). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -15.06 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.42 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.12 (lower mid). Sharpe: 0.27 (upper mid). Sharpe: -0.31 (bottom quartile). Sharpe: -0.20 (bottom quartile). Sharpe: -0.12 (lower mid). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.37 (lower mid). Information ratio: 0.00 (upper mid). Information ratio: 0.34 (top quartile). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Nippon India Power and Infra Fund

HDFC Infrastructure Fund

*نیچے 7 کی فہرست ہے۔بہترین باہمی فنڈز خالص اثاثے/AUM سے زیادہ ہونا "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on 100 کروڑ. 5 سال پر ترتیب دیا گیا۔سی اے جی آر/سالانہ واپسی1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (17 Feb 26) ₹60.3973 ↓ -2.23 (-3.56 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.5% 3 Month 32.8% 6 Month 78.1% 1 Year 143% 3 Year 56.3% 5 Year 28.1% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (18 Feb 26) ₹36.7055 ↑ 0.18 (0.49 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 7.4% 3 Month 7.8% 6 Month 17.7% 1 Year 33.3% 3 Year 34.3% 5 Year 27.5% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (18 Feb 26) ₹198.6 ↑ 0.98 (0.50 %) Net Assets (Cr) ₹8,134 on 31 Dec 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.12 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.6% 3 Month 0.1% 6 Month 2.5% 1 Year 18.5% 3 Year 25.4% 5 Year 26.5% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (18 Feb 26) ₹68.86 ↑ 0.52 (0.76 %) Net Assets (Cr) ₹1,449 on 31 Dec 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.27 Information Ratio -0.37 Alpha Ratio -1.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.6% 3 Month 3.1% 6 Month 11.2% 1 Year 33.1% 3 Year 32.2% 5 Year 25.9% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (18 Feb 26) ₹326.36 ↑ 1.58 (0.49 %) Net Assets (Cr) ₹5,323 on 31 Dec 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio -0.31 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 5.3% 3 Month 2.1% 6 Month 4.6% 1 Year 23% 3 Year 25.9% 5 Year 24.4% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (18 Feb 26) ₹355.176 ↑ 2.24 (0.64 %) Net Assets (Cr) ₹7,117 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.2 Information Ratio 0.34 Alpha Ratio -15.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,955 31 Jan 23 ₹16,453 31 Jan 24 ₹27,930 31 Jan 25 ₹30,936 31 Jan 26 ₹31,936 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 6% 3 Month 0.3% 6 Month 4.4% 1 Year 21.3% 3 Year 26.6% 5 Year 23.9% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Rahul Modi 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.76% Utility 24.23% Consumer Cyclical 11.14% Energy 10.76% Basic Materials 7.94% Technology 4.08% Communication Services 3.05% Financial Services 2.82% Health Care 2.16% Real Estate 1.9% Asset Allocation

Asset Class Value Cash 0.17% Equity 99.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹650 Cr 4,660,000

↑ 110,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | NTPC9% ₹605 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹389 Cr 989,337

↓ -75,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | TATAPOWER4% ₹289 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL3% ₹207 Cr 1,050,000

↓ -150,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO3% ₹203 Cr 160,000

↓ -10,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | CGPOWER3% ₹176 Cr 3,020,014 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | BHEL3% ₹171 Cr 6,500,000

↓ -400,000 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | BHARATFORG3% ₹170 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹158 Cr 18,358,070

↑ 860,913 7. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (18 Feb 26) ₹47.986 ↑ 0.17 (0.35 %) Net Assets (Cr) ₹2,452 on 31 Dec 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio -0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,059 31 Jan 23 ₹16,950 31 Jan 24 ₹28,499 31 Jan 25 ₹31,485 31 Jan 26 ₹33,227 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.9% 3 Month -1% 6 Month 1.2% 1 Year 18.6% 3 Year 27.5% 5 Year 23.7% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.62 Yr. Ashish Shah 1 Nov 25 0.25 Yr. Data below for HDFC Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 40.3% Financial Services 21.02% Basic Materials 10.31% Energy 7.4% Utility 7.38% Communication Services 4.32% Real Estate 2.99% Health Care 1.84% Technology 1.33% Consumer Cyclical 0.67% Asset Allocation

Asset Class Value Cash 2.44% Equity 97.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹159 Cr 403,500

↑ 6,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹149 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹130 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹87 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹80 Cr 1,400,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | NTPC3% ₹78 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹76 Cr 704,361 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹70 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹69 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹69 Cr 350,000

معاشی منصوبہ بندی آپ کے انتظام کی کلید ہے۔آمدنی اور اخراجات. تو، آپ کا کیا ہےمالی مقصد? تجزیہ کریں اور سمجھداری سے سرمایہ کاری کریں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Great Read. Clarified my doubts.