FD बनाम डेट म्यूचुअल फंड

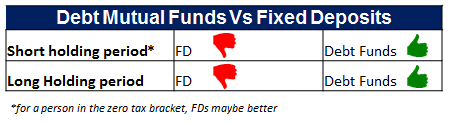

एफडी बनामडेट फंड? विचारधाराकहां निवेश करें अच्छा रिटर्न अर्जित करने के लिए आपकी बचत। आम तौर पर लोग मानते हैंनिवेश सावधि जमा या एफडी में यह सबसे सुविधाजनक विकल्प है क्योंकि यह सुरक्षित है और निश्चित रिटर्न प्रदान करता है। लेकिन क्या यह सबसे अच्छा तरीका है? हालांकि सावधि जमा सभी के लिए एक आसान निवेश विकल्प है, हालांकि, सावधि जमा पर कर योग्य होने का रिटर्न डेट फंड की तुलना में बहुत कम है। इसके अलावा, जब लंबी अवधि के लिए धारण किया जाता है, तो ऋणम्यूचुअल फंड्स अच्छा रिटर्न देते हैं। डेट म्यूचुअल फंड या सावधि जमा में निवेश करने का अंतिम निर्णय लेने से पहले, इन निवेशों की विस्तृत तुलना को देखें।

सारांश:

डेट म्यूचुअल फंड (डेट फंड) बनाम फिक्स्ड डिपॉजिट (FD)

हमें इसे जोखिम लेने की क्षमता और की इच्छित होल्डिंग अवधि के आधार पर तोड़ना होगाइन्वेस्टर प्रश्न में।

शॉर्ट होल्डिंग अवधि (1 वर्ष या उससे कम)

यहां डेट फंड के विकल्प सीमित होंगेलिक्विड फंड, अति-शॉर्ट टर्म फंड्स और अल्पकालिकआय धन। जबकि रिटर्न या यील्ड आमतौर पर लिक्विड से अल्ट्रा-शॉर्ट से शॉर्ट टर्म फंड में जाता है, इन डेट फंड और फिक्स्ड डिपॉजिट के बीच यील्ड अंतर पिछले एक साल में उनके रिटर्न को देखते हुए निर्धारित किया जा सकता है।

डेट म्यूचुअल फंड (श्रेणी औसत रिटर्न)

| डेट म्यूचुअल फंड का प्रकार | पिछले 1 साल। वापसी (%) |

|---|---|

| लिक्विड फंड | 7.36 |

| अल्ट्रा शॉर्ट-टर्म डेट फंड | 9.18 |

| शॉर्ट टर्म डेट फंड | 9.78 |

| डायनेमिक डेट फंड | 13.89 |

| लंबी अवधि के ऋण कोष | 13.19 |

| गिल्ट शॉर्ट टर्म फंड | 11.76 |

| गिल्ट लॉन्ग टर्म फंड | 15.06 |

| 20 फरवरी 2017 तक के आंकड़े |

सावधि जमा या FD औसत वापसी दर

सावधि जमा की औसत वापसी दर 8-8.5% प्रति वर्ष के बीच थी। वर्ष 2016 में (इसलिए तालिका में उपरोक्त रिटर्न की तुलना की जा सकती है)। हालांकि, पिछले एक साल में रिटर्न रेट घटकर 6.6-7.5% प्रति वर्ष हो गया है।

उपरोक्त दृष्टांत से, यह स्पष्ट है कि डेट फंड की वापसी की औसत दर सावधि जमा की तुलना में बेहतर है।

Talk to our investment specialist

लंबी अवधि की होल्डिंग अवधि

लंबे समय तक होल्डिंग अवधि के साथ, डेट फंड FD से बेहतर साबित हो सकते हैं।

यहां निवेश करने के विकल्प होंगे:

- लॉन्ग टर्म इनकम फंड

- लंबे समय तक गिल्ट,

- निगमितगहरा संबंध फंड (हाई यील्ड फंड), लिक्विड के ऊपर बताए गए विकल्पों के अलावा, अल्ट्रा-शॉर्ट और शॉर्ट टर्म फंड का भी इस्तेमाल किया जा सकता है।

यह देखते हुए कि होल्डिंग अवधि 3 वर्ष या उससे अधिक हो सकती है, हम निम्नलिखित कह सकते हैं:

- साथराजधानी इंडेक्सेशन बेनिफिट्स के साथ 20% पर गेन टैक्स, शुद्ध कर की घटना न्यूनतम होगी (हालाँकि किसी को कर लगाने के वर्ष को देखते हुए कर की गणना करनी चाहिए)

- लॉन्ग टर्म इनकम फंड/गिल्ट फंड उच्च प्रतिफल के साथ और इसके अतिरिक्त, यदि ब्याज दरें नीचे जाती हैं तो बहुत अधिक प्रतिफल मिलेगा।

- इन डेट फंडों के साथ उच्च दोहरे अंकों का रिटर्न मिल सकता है।

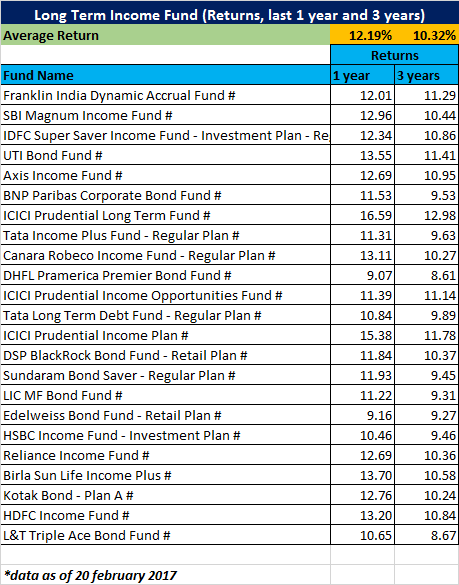

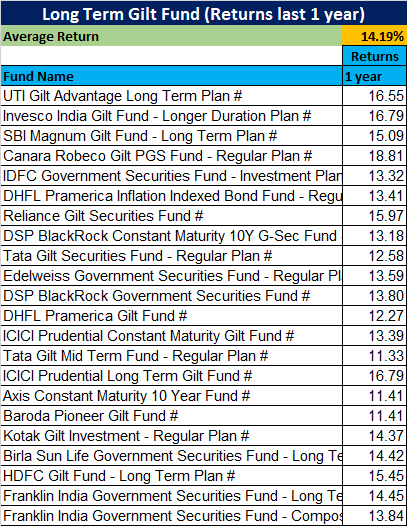

लंबी अवधि की आय वाले फंड पर रिटर्न का उदाहरण नीचे लें, श्रेणी के लिए पिछले 1 साल का औसत रिटर्न 12.19% है और पिछले 3 वर्षों में 10.32% प्रति वर्ष है। इस अवधि में कोई भी FD इतना रिटर्न नहीं दे सकता था। गिल्ट फंड का रिटर्न और भी ज्यादा होता है। इसी अवधि में, पिछले साल अधिकांश बैंकों में FD दरें 8-8.5% प्रति वर्ष के करीब रही होंगी, (यद्यपि आज दरें और गिरकर 6.5 - 7.5%) हो गई हैं

इसलिए एक निवेशक के पास लंबे समय तक रखने की अवधि और ब्याज दरों में गिरावट के साथ, एक डेट फंड (दीर्घकालिक आय या गिल्ट) FD की तुलना में बहुत बेहतर रिटर्न देगा। ब्याज दरें न गिरने की स्थिति में भी, उच्च प्रतिफल वाले कॉरपोरेट बॉन्ड फंड उसी अवधि में FD को मात देंगे।

डेट म्युचुअल फंड और सावधि जमा पर कराधान

डेट फंड और सावधि जमा के रिटर्न को निर्धारित करने में कराधान भी महत्वपूर्ण भूमिका निभाता है। आमतौर पर, सावधि जमा पर कराधान 33% (कर की सीमांत दर) है, जबकि डेट फंड पर अगर कोई 3 साल से कम के साथ निवेश करता है तो लाभांश वितरण कर लगाना एक बेहतर विकल्प होगा, क्योंकि डीडीटी (लाभांश वितरण कर) काटा जाता है। लगभग 25% (+ अधिभार आदि) पर। इससे पता चलता है कि फिक्स्ड डिपॉजिट की तुलना में डेट म्यूचुअल फंड पर टैक्स अपेक्षाकृत कम है।

डेट फंड के साथ आने वाले अतिरिक्त लाभ हैं:

- लिक्विडिटी: से 1-2 दिनों के भीतर पैसा उपलब्ध हैमोचन

- व्यावसायिक प्रबंधन: रणनीति को गतिशील रूप से बदलने और बाजारों का लाभ उठाने की क्षमता

- कोई समयपूर्व निकासी दंड नहीं।

सारांश में:

| मापदंडों | म्यूचुअल फंड्स | सावधि जमा |

|---|---|---|

| रिटर्न की दर | कोई सुनिश्चित रिटर्न नहीं | निश्चित रिटर्न |

| मुद्रास्फीति समायोजित रिटर्न | उच्च मुद्रास्फीति समायोजित रिटर्न की संभावना | आम तौर पर कम मुद्रास्फीति समायोजित रिटर्न |

| जोखिम | कम से उच्च जोखिम (फंड पर निर्भर) | कम जोखिम |

| लिक्विडिटी | तरल | तरल |

| समयपूर्व निकासी | एक्जिट लोड/नो लोड के साथ अनुमत | दंड के साथ अनुमत |

| निवेश की लागत | प्रबंधन लागत/व्यय अनुपात | कोई लागत नहीं अाना |

शीर्ष 8 सर्वश्रेष्ठ प्रदर्शन करने वाले डेट फंड 2022

नीचे नेट एसेट/एयूएम वाले डेट फंडों की सूची ऊपर दी गई है1000 करोड़ और 3 साल के चक्रवृद्धि के आधार पर छाँटा गया (सीएजीआर) रिटर्न।

(Erstwhile Aditya Birla Sun Life Corporate Bond Fund) The investment objective of the Scheme is to generate returns by predominantly investing in a portfolio of corporate debt securities with short to medium term maturities across the credit spectrum within the investment grade. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Below is the key information for Aditya Birla Sun Life Credit Risk Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate regular income through investments in debt & money market instruments in order to make regular dividend payments to unit holders & secondary objective is growth of capital. Research Highlights for Aditya Birla Sun Life Medium Term Plan Below is the key information for Aditya Birla Sun Life Medium Term Plan Returns up to 1 year are on (Erstwhile Reliance Regular Savings Fund - Debt Plan) The primary investment objective of this option is to generate optimal returns consistent with moderate level of risk. This income may be complemented by capital appreciation of the portfolio. Accordingly investments shall predominantly be made in Debt & Money Market Instruments. Research Highlights for Nippon India Credit Risk Fund Below is the key information for Nippon India Credit Risk Fund Returns up to 1 year are on The fund’s objective is to provide reasonable returns, by maintaining an optimum balance of safety, liquidity and yield, through investments in a basket of debt and money market instruments with a view to delivering consistent performance. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Savings Fund Below is the key information for ICICI Prudential Regular Savings Fund Returns up to 1 year are on The investment objective of the scheme is to generate regular income and capital appreciation by investing in a portfolio of medium term debt and money market instruments. There is no assurance or guarantee that the investment objective of the scheme will be achieved Research Highlights for Kotak Medium Term Fund Below is the key information for Kotak Medium Term Fund Returns up to 1 year are on The Scheme aims to provide reasonable returns by investing in portfolio of Government Securities with average maturity of around 10 years. However, there can be no assurance that the investment objective of the

Scheme will be realized. Research Highlights for ICICI Prudential Constant Maturity Gilt Fund Below is the key information for ICICI Prudential Constant Maturity Gilt Fund Returns up to 1 year are on (Erstwhile SBI Corporate Bond Fund) The investment objective will be to actively manage a portfolio of good

quality corporate debt as well as Money Market Instruments so as to provide

reasonable returns and liquidity to the Unit holders. However there is no

guarantee or assurance that the investment objective of the scheme will

be achieved. Research Highlights for SBI Credit Risk Fund Below is the key information for SBI Credit Risk Fund Returns up to 1 year are on (Erstwhile Axis Income Fund) To generate optimal returns in the medium term while maintaining liquidity of the portfolio by investing in debt and money market instruments. Research Highlights for Axis Strategic Bond Fund Below is the key information for Axis Strategic Bond Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Growth Launch Date 17 Apr 15 NAV (06 Mar 26) ₹24.361 ↓ 0.00 (0.00 %) Net Assets (Cr) ₹1,138 on 31 Jan 26 Category Debt - Credit Risk AMC Birla Sun Life Asset Management Co Ltd Rating Risk Moderate Expense Ratio 1.54 Sharpe Ratio 2.38 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.96% Effective Maturity 3 Years 2 Months 23 Days Modified Duration 2 Years 4 Months 28 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,615 28 Feb 23 ₹11,394 29 Feb 24 ₹12,226 28 Feb 25 ₹14,145 28 Feb 26 ₹16,036 Returns for Aditya Birla Sun Life Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.7% 3 Month 4.6% 6 Month 7.4% 1 Year 13.2% 3 Year 12% 5 Year 9.8% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.4% 2023 11.9% 2022 6.9% 2021 7.1% 2020 6.4% 2019 9.4% 2018 2.1% 2017 6.6% 2016 8.1% 2015 10.3% Fund Manager information for Aditya Birla Sun Life Credit Risk Fund

Name Since Tenure Sunaina Cunha 17 Apr 15 10.8 Yr. Mohit Sharma 6 Aug 20 5.49 Yr. Data below for Aditya Birla Sun Life Credit Risk Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 9.54% Equity 7.14% Debt 83.01% Other 0.31% Debt Sector Allocation

Sector Value Corporate 60.11% Government 22.9% Cash Equivalent 9.54% Credit Quality

Rating Value A 14.57% AA 54.68% AAA 30.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Gs 2034

Sovereign Bonds | -4% ₹50 Cr 5,000,000

↓ -1,000,000 Aditya Birla Real Estate Limited

Debentures | -4% ₹45 Cr 4,500 Jubilant Bevco Limited

Debentures | -4% ₹43 Cr 4,000

↑ 1,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹40 Cr 4,000 GMR Airports Limited

Debentures | -3% ₹38 Cr 3,700 7.10% Gs 2034

Sovereign Bonds | -3% ₹36 Cr 3,500,000 IKF Finance Limited

Debentures | -3% ₹35 Cr 3,500 National Bank For Agriculture And Rural Development

Debentures | -3% ₹35 Cr 3,500 Hinduja Leyland Finance Limited

Debentures | -3% ₹34 Cr 3,500 Kogta Financial (India) Limited

Debentures | -3% ₹32 Cr 3,250 2. Aditya Birla Sun Life Medium Term Plan

Aditya Birla Sun Life Medium Term Plan

Growth Launch Date 25 Mar 09 NAV (06 Mar 26) ₹42.3589 ↓ -0.01 (-0.02 %) Net Assets (Cr) ₹2,982 on 31 Jan 26 Category Debt - Medium term Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.57 Sharpe Ratio 2.33 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.78% Effective Maturity 4 Years 6 Months 7 Days Modified Duration 3 Years 4 Months 24 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,001 28 Feb 23 ₹13,264 29 Feb 24 ₹14,263 28 Feb 25 ₹16,044 28 Feb 26 ₹17,708 Returns for Aditya Birla Sun Life Medium Term Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.7% 3 Month 2.7% 6 Month 5% 1 Year 10.2% 3 Year 10% 5 Year 12% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.9% 2023 10.5% 2022 6.9% 2021 24.8% 2020 7.1% 2019 8.1% 2018 -4.4% 2017 5.6% 2016 7% 2015 10.9% Fund Manager information for Aditya Birla Sun Life Medium Term Plan

Name Since Tenure Sunaina Cunha 1 Sep 14 11.43 Yr. Mohit Sharma 6 Aug 20 5.49 Yr. Data below for Aditya Birla Sun Life Medium Term Plan as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 3.17% Equity 4% Debt 92.55% Other 0.27% Debt Sector Allocation

Sector Value Corporate 57.6% Government 34.95% Cash Equivalent 3.17% Credit Quality

Rating Value A 10.07% AA 38.92% AAA 51.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Gs 2034

Sovereign Bonds | -9% ₹281 Cr 28,000,000 7.10% Gs 2034

Sovereign Bonds | -8% ₹227 Cr 22,196,700

↓ -1,500,000 7.18% Gs 2033

Sovereign Bonds | -6% ₹190 Cr 18,500,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹113 Cr 11,500 Hinduja Leyland Finance Limited

Debentures | -4% ₹108 Cr 11,000 Nuvama Wealth Finance Limited

Debentures | -3% ₹96 Cr 9,500 GMR Airports Limited

Debentures | -3% ₹82 Cr 8,000 Jubilant Bevco Limited

Debentures | -3% ₹80 Cr 7,400 Jtpm Metal TRaders Limited

Debentures | -3% ₹79 Cr 7,673 Kogta Financial (India) Limited

Debentures | -2% ₹72 Cr 7,250 3. Nippon India Credit Risk Fund

Nippon India Credit Risk Fund

Growth Launch Date 8 Jun 05 NAV (06 Mar 26) ₹36.8294 Net Assets (Cr) ₹1,031 on 31 Jan 26 Category Debt - Credit Risk AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 2.16 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Yield to Maturity 8.73% Effective Maturity 2 Years 5 Months 12 Days Modified Duration 2 Years 25 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,340 28 Feb 23 ₹11,770 29 Feb 24 ₹12,752 28 Feb 25 ₹13,811 28 Feb 26 ₹15,050 Returns for Nippon India Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.9% 3 Month 1.6% 6 Month 3.7% 1 Year 8.9% 3 Year 8.5% 5 Year 8.5% 10 Year 15 Year Since launch 6.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.9% 2023 8.3% 2022 7.9% 2021 3.9% 2020 13.5% 2019 -5.9% 2018 1.9% 2017 6.1% 2016 7% 2015 10% Fund Manager information for Nippon India Credit Risk Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Sushil Budhia 1 Feb 20 6.01 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Credit Risk Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 12.38% Debt 87.33% Other 0.29% Debt Sector Allocation

Sector Value Corporate 69.67% Government 17.66% Cash Equivalent 12.38% Credit Quality

Rating Value A 29.3% AA 37.99% AAA 32.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.02% Gs 2031

Sovereign Bonds | -7% ₹77 Cr 7,500,000 Renew Solar Energy (Jharkhand Five) Private Limited

Debentures | -5% ₹47 Cr 5,000 TRuhome Finance Limited

Debentures | -4% ₹41 Cr 4,000 Navi Finserv Limited

Debentures | -4% ₹40 Cr 40,000 GAursons India Private Limited

Debentures | -4% ₹40 Cr 4,000 The Sandur Manganese And Iron Ores Limited

Debentures | -4% ₹37 Cr 4,000 Mancherial Repallewada Road Private Limited

Debentures | -3% ₹36 Cr 4,500 Delhi International Airport Limited

Debentures | -3% ₹36 Cr 3,500 Vedanta Limited

Debentures | -3% ₹35 Cr 3,500 Renserv Global Private Limited

Debentures | -3% ₹35 Cr 3,500 4. ICICI Prudential Regular Savings Fund

ICICI Prudential Regular Savings Fund

Growth Launch Date 3 Dec 10 NAV (06 Mar 26) ₹33.5257 ↑ 0.04 (0.12 %) Net Assets (Cr) ₹5,940 on 31 Jan 26 Category Debt - Credit Risk AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderate Expense Ratio 1.43 Sharpe Ratio 2.9 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Yield to Maturity 8.68% Effective Maturity 3 Years 7 Months 17 Days Modified Duration 2 Years 3 Months 7 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,707 28 Feb 23 ₹11,195 29 Feb 24 ₹12,150 28 Feb 25 ₹13,105 28 Feb 26 ₹14,315 Returns for ICICI Prudential Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.4% 3 Month 1.1% 6 Month 3.9% 1 Year 9.2% 3 Year 8.5% 5 Year 7.4% 10 Year 15 Year Since launch 8.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.5% 2023 8.5% 2022 7.2% 2021 5.1% 2020 6.2% 2019 9.8% 2018 9.5% 2017 6.6% 2016 6.8% 2015 9.5% Fund Manager information for ICICI Prudential Regular Savings Fund

Name Since Tenure Manish Banthia 7 Nov 16 9.24 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Data below for ICICI Prudential Regular Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 13.75% Equity 9.52% Debt 76.34% Other 0.38% Debt Sector Allocation

Sector Value Corporate 62.53% Government 14.64% Cash Equivalent 12.93% Credit Quality

Rating Value A 21.46% AA 57.58% AAA 20.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.68% Gs 2040

Sovereign Bonds | -6% ₹336 Cr 34,926,400 Embassy Office Parks REIT (Real Estate)

-, Since 30 Apr 25 | EMBASSY4% ₹252 Cr 5,791,885 Keystone Realtors Limited

Debentures | -4% ₹234 Cr 23,500 Millennia Realtors Private Limited

Debentures | -4% ₹210 Cr 2,100 Vedanta Limited

Debentures | -3% ₹201 Cr 20,000 Adani Enterprises Limited

Debentures | -3% ₹198 Cr 20,000 Bamboo Hotel And Global Centre (Delhi) Private Limited

Debentures | -3% ₹187 Cr 18,500 Jtpm Metal TRaders Limited

Debentures | -3% ₹186 Cr 18,000 Varroc Engineering Limited

Debentures | -3% ₹172 Cr 25,000 Nirma Limited

Debentures | -3% ₹151 Cr 15,000 5. Kotak Medium Term Fund

Kotak Medium Term Fund

Growth Launch Date 25 Mar 14 NAV (06 Mar 26) ₹23.8484 ↑ 0.03 (0.11 %) Net Assets (Cr) ₹1,987 on 31 Jan 26 Category Debt - Medium term Bond AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 1.63 Sharpe Ratio 1.32 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-18 Months (2%),18 Months and above(NIL) Yield to Maturity 8.24% Effective Maturity 4 Years 4 Months 10 Days Modified Duration 3 Years 29 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,665 28 Feb 23 ₹10,911 29 Feb 24 ₹11,821 28 Feb 25 ₹12,770 28 Feb 26 ₹13,888 Returns for Kotak Medium Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.4% 3 Month 0.9% 6 Month 3.7% 1 Year 8.6% 3 Year 8.3% 5 Year 6.7% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.9% 2023 9% 2022 6.1% 2021 3.2% 2020 4.7% 2019 8.5% 2018 7% 2017 5.4% 2016 6.6% 2015 10.9% Fund Manager information for Kotak Medium Term Fund

Name Since Tenure Deepak Agrawal 25 Mar 14 11.87 Yr. Vihag Mishra 1 Jun 25 0.67 Yr. Data below for Kotak Medium Term Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.59% Equity 9.74% Debt 82.39% Other 0.29% Debt Sector Allocation

Sector Value Corporate 72.02% Government 10.36% Cash Equivalent 7.59% Credit Quality

Rating Value A 8.05% AA 53.96% AAA 37.99% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jtpm Metal TRaders Limited

Debentures | -5% ₹103 Cr 10,000 L&T Metro Rail (Hyderabad) Limited

Debentures | -5% ₹100 Cr 10,000 Bamboo Hotel And Global Centre (Delhi) Private Limited

Debentures | -5% ₹91 Cr 9,000 Adani Power Ltd

Debentures | -5% ₹90 Cr 9,000

↑ 9,000 Embassy Office Parks REIT (Real Estate)

-, Since 31 May 21 | EMBASSY4% ₹87 Cr 1,998,346 TATA Steel Limited

Debentures | -4% ₹76 Cr 750 Pipeline Infrastructure Limited

Debentures | -3% ₹64 Cr 6,280 Aditya Birla Renewables Limited

Debentures | -3% ₹60 Cr 6,000 Aditya Birla Real Estate Limited

Debentures | -3% ₹55 Cr 5,500 Indigrid Infrastructure Trust

Debentures | -3% ₹51 Cr 5,000 6. ICICI Prudential Constant Maturity Gilt Fund

ICICI Prudential Constant Maturity Gilt Fund

Growth Launch Date 12 Sep 14 NAV (06 Mar 26) ₹25.465 ↓ -0.05 (-0.19 %) Net Assets (Cr) ₹2,509 on 31 Jan 26 Category Debt - 10 Yr Govt Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.39 Sharpe Ratio 0.24 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Yield to Maturity 6.94% Effective Maturity 10 Years Modified Duration 6 Years 10 Months 20 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,494 28 Feb 23 ₹10,692 29 Feb 24 ₹11,681 28 Feb 25 ₹12,678 28 Feb 26 ₹13,608 Returns for ICICI Prudential Constant Maturity Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 1.1% 3 Month 0.9% 6 Month 2.3% 1 Year 7.1% 3 Year 8.3% 5 Year 6.4% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 9.3% 2022 7.7% 2021 1.2% 2020 2.8% 2019 13.6% 2018 12.8% 2017 9.7% 2016 2.4% 2015 16.2% Fund Manager information for ICICI Prudential Constant Maturity Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 2.03 Yr. Raunak Surana 22 Jan 24 2.03 Yr. Data below for ICICI Prudential Constant Maturity Gilt Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 7.5% Debt 92.5% Debt Sector Allocation

Sector Value Government 92.5% Cash Equivalent 7.5% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.64% Gs 2035

Sovereign Bonds | -29% ₹725 Cr 73,000,000 7.18% Gs 2037

Sovereign Bonds | -17% ₹420 Cr 41,200,000 7.10% Gs 2034

Sovereign Bonds | -16% ₹406 Cr 39,719,850 7.41% Gs 2036

Sovereign Bonds | -14% ₹348 Cr 33,500,000 6.68% Gs 2040

Sovereign Bonds | -13% ₹318 Cr 32,992,500 6.79% Gs 2034

Sovereign Bonds | -7% ₹173 Cr 17,208,200 6.19% Gs 2034

Sovereign Bonds | -1% ₹29 Cr 3,000,000 6.48% Gs 2035

Sovereign Bonds | -1% ₹26 Cr 2,666,300

↓ -1,000,000 6.67% Gs 2035

Sovereign Bonds | -1% ₹25 Cr 2,500,000 Interest Rate Swaps- Md -06-Jan-2031 (Pay Fixed/Receive Float)

- | -6% -₹150 Cr 7. SBI Credit Risk Fund

SBI Credit Risk Fund

Growth Launch Date 19 Jul 04 NAV (06 Mar 26) ₹47.6076 ↓ -0.01 (-0.01 %) Net Assets (Cr) ₹2,164 on 31 Jan 26 Category Debt - Credit Risk AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.55 Sharpe Ratio 1.31 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (3%),12-24 Months (1.5%),24-36 Months (0.75%),36 Months and above(NIL) Yield to Maturity 8.66% Effective Maturity 2 Years 6 Months 7 Days Modified Duration 1 Year 11 Months 26 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,585 28 Feb 23 ₹11,036 29 Feb 24 ₹12,016 28 Feb 25 ₹12,958 28 Feb 26 ₹13,991 Returns for SBI Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.6% 3 Month 1.3% 6 Month 3.1% 1 Year 7.8% 3 Year 8.2% 5 Year 6.9% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 8.1% 2022 8.3% 2021 4.2% 2020 5% 2019 9.8% 2018 6.5% 2017 6.2% 2016 6.9% 2015 10.5% Fund Manager information for SBI Credit Risk Fund

Name Since Tenure Lokesh Mallya 1 Feb 17 9.01 Yr. Data below for SBI Credit Risk Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 14.08% Equity 4.2% Debt 81.34% Other 0.38% Debt Sector Allocation

Sector Value Corporate 64.06% Government 17.28% Cash Equivalent 14.08% Credit Quality

Rating Value A 18.19% AA 60.03% AAA 21.78% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.02% Gs 2031

Sovereign Bonds | -7% ₹153 Cr 15,000,000 Infopark Properties Limited

Debentures | -5% ₹105 Cr 10,500 Renew Solar Energy (Jharkhand Five) Private Limited

Debentures | -5% ₹103 Cr 11,000 H.G. Infra Engineering Limited

Debentures | -5% ₹99 Cr 10,000 Nj Capital Private Limited

Debentures | -5% ₹99 Cr 10,000 6.48% Gs 2035

Sovereign Bonds | -5% ₹98 Cr 10,000,000 Jtpm Metal TRaders Limited

Debentures | -4% ₹93 Cr 9,000 Renserv Global Private Limited

Debentures | -4% ₹80 Cr 8,000 Avanse Financial Services Limited

Debentures | -4% ₹80 Cr 8,000 The Sandur Manganese And Iron Ores Limited

Debentures | -4% ₹80 Cr 8,500 8. Axis Strategic Bond Fund

Axis Strategic Bond Fund

Growth Launch Date 28 Mar 12 NAV (06 Mar 26) ₹29.2304 ↓ -0.01 (-0.03 %) Net Assets (Cr) ₹2,044 on 31 Jan 26 Category Debt - Medium term Bond AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.08 Sharpe Ratio 1.06 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Yield to Maturity 8.16% Effective Maturity 4 Years 4 Months 6 Days Modified Duration 3 Years 2 Months 19 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,601 28 Feb 23 ₹11,016 29 Feb 24 ₹11,916 28 Feb 25 ₹12,891 28 Feb 26 ₹13,955 Returns for Axis Strategic Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 0.7% 3 Month 1.2% 6 Month 3.2% 1 Year 8% 3 Year 8.1% 5 Year 6.9% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.2% 2023 8.7% 2022 7.3% 2021 3.8% 2020 5.2% 2019 10.5% 2018 7.1% 2017 6.7% 2016 7.5% 2015 11.6% Fund Manager information for Axis Strategic Bond Fund

Name Since Tenure Devang Shah 5 Nov 12 13.25 Yr. Sachin Jain 1 Feb 23 3 Yr. Akhil Thakker 1 Feb 23 3 Yr. Data below for Axis Strategic Bond Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 3.04% Equity 2.39% Debt 94.28% Other 0.29% Debt Sector Allocation

Sector Value Corporate 64.52% Government 29.75% Cash Equivalent 3.04% Credit Quality

Rating Value A 12.29% AA 48.07% AAA 39.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.48% Gs 2035

Sovereign Bonds | -8% ₹156 Cr 15,800,000

↓ -5,000,000 7.10% Gs 2034

Sovereign Bonds | -6% ₹115 Cr 11,200,000 Jubilant Beverages Limited

Debentures | -3% ₹70 Cr 6,500 GMR Hyderabad International Airport Ltd

Debentures | -3% ₹66 Cr 6,500 7.18% Tamilnadu Sgs 2033

Sovereign Bonds | -3% ₹63 Cr 6,358,600

↑ 6,358,600 Vedanta Limited

Debentures | -3% ₹60 Cr 6,000 Adani Power Ltd

Debentures | -3% ₹60 Cr 6,000

↑ 6,000 Jubilant Bevco Limited

Debentures | -3% ₹59 Cr 5,500 Nuvama Wealth Finance Limited

Debentures | -3% ₹58 Cr 5,800 Delhi International Airport Limited

Debentures | -3% ₹56 Cr 5,500

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।

Research Highlights for Aditya Birla Sun Life Credit Risk Fund