म्युच्युअल फंडात एकरकमी गुंतवणूक

तुम्हाला माहीत आहे का की तुम्ही एकरकमी रक्कम गुंतवू शकताम्युच्युअल फंड? जर होय, तर ते चांगले आहे. तथापि, जर नाही, तर काळजी करू नका. हा लेख तुम्हाला त्याच माध्यमातून मार्गदर्शन करेल. म्युच्युअल फंडातील एकरकमी गुंतवणूक म्हणजे अशी परिस्थिती जेव्हा एखादी व्यक्ती म्युच्युअल फंडात पैसे गुंतवते. येथे, ठेव अनेक वेळा होत नाही. मध्ये खूप फरक आहेSIP आणि गुंतवणुकीची एकरकमी पद्धत. तर, म्युच्युअल फंडातील एकरकमी गुंतवणूक ही संकल्पना समजून घेऊया,सर्वोत्तम म्युच्युअल फंड एकरकमी गुंतवणुकीसाठी, एकरकमी गुंतवणूक करताना विचारात घ्यायच्या गोष्टी, म्युच्युअल फंड एकरकमी परतावा कॅल्क्युलेटर आणि इतर संबंधित बाबी या लेखाद्वारे.

म्युच्युअल फंडातील एकरकमी गुंतवणूक म्हणजे काय?

म्युच्युअल फंडात एकरकमी गुंतवणूक ही एक अशी परिस्थिती आहे जिथे व्यक्तीम्युच्युअल फंडात गुंतवणूक करा फक्त एकदाच. तथापि, गुंतवणुकीच्या एसआयपी पद्धतीच्या विरूद्ध जेथे व्यक्ती एकरकमी मोडमध्ये लहान रक्कम जमा करतात, व्यक्ती लक्षणीय रक्कम जमा करतात. दुसऱ्या शब्दांत, ते एक-शॉट तंत्र आहेगुंतवणूक म्युच्युअल फंड मध्ये. एकरकमी गुंतवणुकीची पद्धत ज्या गुंतवणूकदारांकडे जास्त निधी आहे त्यांच्यासाठी योग्य आहेबँक खाते आणि अधिक कमाई करण्यासाठी चॅनेल शोधत आहातउत्पन्न म्युच्युअल फंडात गुंतवणूक करून.

2022 - 2023 मध्ये एकरकमी गुंतवणुकीसाठी सर्वोत्तम म्युच्युअल फंड

तुम्ही एकरकमी पद्धतीने म्युच्युअल फंडामध्ये गुंतवणूक करण्यापूर्वी, व्यक्तींनी विविध पॅरामीटर्स जसे की AUM, गुंतवणूक रक्कम आणि बरेच काही विचारात घेणे आवश्यक आहे. तर, या पॅरामीटर्सच्या आधारे एकरकमी गुंतवणुकीसाठी काही सर्वोत्तम म्युच्युअल फंड खालीलप्रमाणे आहेत.

इक्विटी म्युच्युअल फंडातील सर्वोत्तम एकरकमी गुंतवणूक

इक्विटी फंड अशा योजना आहेत ज्या विविध कंपन्यांच्या इक्विटी आणि इक्विटी-संबंधित साधनांमध्ये त्यांचे कॉर्पस गुंतवतात. या योजना दीर्घकालीन गुंतवणुकीसाठी चांगला पर्याय मानल्या जातात. जरी व्यक्ती इक्विटी फंडांमध्ये एकरकमी रक्कम गुंतवू शकतात तरीही इक्विटी फंडांमध्ये गुंतवणूक करण्याचे शिफारस केलेले तंत्र एकतर एसआयपीद्वारे किंवापद्धतशीर हस्तांतरण योजना (STP) मोड. एसटीपी मोडमध्ये, व्यक्ती प्रथम मोठ्या प्रमाणात पैसे जमा करतातकर्ज निधी जसेलिक्विड फंड आणि नंतर पैसे इक्विटी फंडांमध्ये नियमित अंतराने हस्तांतरित केले जातात. गुंतवणुकीसाठी विचारात घेतलेले काही इक्विटी म्युच्युअल फंड खालीलप्रमाणे आहेत.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,756 1,000 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.2959

↓ -0.41 ₹5,817 5,000 6.6 15.7 30.7 33.8 27.7 11.3 ICICI Prudential Infrastructure Fund Growth ₹196.22

↓ -2.38 ₹8,134 5,000 -1 0.7 15.8 24.9 26.5 6.7 Invesco India PSU Equity Fund Growth ₹67.82

↓ -1.04 ₹1,449 5,000 1.8 9.3 29.3 31.5 25.8 10.3 DSP India T.I.G.E.R Fund Growth ₹322.81

↓ -3.55 ₹5,323 1,000 2.1 4.6 23 25.9 24.4 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Highest AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹5,323 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.74% (upper mid). 5Y return: 26.53% (lower mid). 5Y return: 25.82% (bottom quartile). 5Y return: 24.39% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 33.84% (upper mid). 3Y return: 24.88% (bottom quartile). 3Y return: 31.51% (lower mid). 3Y return: 25.91% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 30.67% (upper mid). 1Y return: 15.80% (bottom quartile). 1Y return: 29.25% (lower mid). 1Y return: 22.96% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.42 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.12 (bottom quartile). Sharpe: 0.27 (lower mid). Sharpe: -0.31 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.37 (lower mid). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Talk to our investment specialist

डेट म्युच्युअल फंडात सर्वोत्तम एकरकमी गुंतवणूक

डेट फंड त्यांच्या फंडाचे पैसे वेगवेगळ्या ठिकाणी गुंतवतातनिश्चित उत्पन्न ट्रेझरी बिले, कॉर्पोरेट सारखी साधनेबंध, आणि बरेच काही. या योजना अल्प आणि मध्यम मुदतीसाठी चांगला पर्याय मानल्या जातात. अनेक व्यक्ती डेट म्युच्युअल फंडामध्ये एकरकमी पैसे गुंतवण्याचा पर्याय निवडतात. काहीसर्वोत्तम कर्ज निधी जे एकरकमी गुंतवणुकीसाठी निवडले जाऊ शकतात ते खालीलप्रमाणे आहेत.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.3253

↓ -0.01 ₹206 1,000 -0.5 0.9 18.8 14.1 21 7.1% 2Y 4M 17D 3Y 3M 14D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3116

↓ -0.01 ₹1,092 1,000 4.9 7.4 13.2 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 5,000 2.9 5 7.5 11 0% Aditya Birla Sun Life Medium Term Plan Growth ₹42.276

↓ -0.01 ₹2,905 1,000 2.9 5.1 10.2 10.1 10.9 7.78% 3Y 4M 24D 4Y 6M 7D Invesco India Credit Risk Fund Growth ₹1,994.18

↓ -0.27 ₹156 5,000 1.1 2.7 8.9 9.3 9.2 7.03% 2Y 3M 7D 3Y 11D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Aditya Birla Sun Life Credit Risk Fund Franklin India Credit Risk Fund Aditya Birla Sun Life Medium Term Plan Invesco India Credit Risk Fund Point 1 Lower mid AUM (₹206 Cr). Upper mid AUM (₹1,092 Cr). Bottom quartile AUM (₹104 Cr). Highest AUM (₹2,905 Cr). Bottom quartile AUM (₹156 Cr). Point 2 Oldest track record among peers (22 yrs). Established history (10+ yrs). Established history (14+ yrs). Established history (16+ yrs). Established history (11+ yrs). Point 3 Top rated. Not Rated. Rating: 1★ (bottom quartile). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 18.80% (top quartile). 1Y return: 13.24% (upper mid). 1Y return: 7.45% (bottom quartile). 1Y return: 10.22% (lower mid). 1Y return: 8.86% (bottom quartile). Point 6 1M return: -0.92% (bottom quartile). 1M return: 0.90% (upper mid). 1M return: 0.91% (top quartile). 1M return: 0.82% (lower mid). 1M return: 0.51% (bottom quartile). Point 7 Sharpe: 1.53 (lower mid). Sharpe: 2.08 (top quartile). Sharpe: 0.29 (bottom quartile). Sharpe: 2.01 (upper mid). Sharpe: 1.24 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.10% (lower mid). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.78% (upper mid). Yield to maturity (debt): 7.03% (bottom quartile). Point 10 Modified duration: 2.38 yrs (lower mid). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). Modified duration: 3.40 yrs (bottom quartile). Modified duration: 2.27 yrs (upper mid). DSP Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Franklin India Credit Risk Fund

Aditya Birla Sun Life Medium Term Plan

Invesco India Credit Risk Fund

एकरकमी गुंतवणुकीसाठी सर्वोत्तम हायब्रिड फंड

हायब्रीड फंड म्हणूनही ओळखले जातेसंतुलित निधी त्यांचे पैसे इक्विटी आणि निश्चित उत्पन्न साधनांमध्ये गुंतवा. या योजना शोधत असलेल्या व्यक्तींसाठी योग्य आहेतभांडवल नियमित उत्पन्नासह निर्मिती. संतुलित योजना म्हणूनही ओळखल्या जाणार्या, व्यक्ती संकरित योजनांमध्ये एकरकमी रक्कम गुंतवणे निवडू शकतात. एकरकमी गुंतवणुकीसाठी काही सर्वोत्कृष्ट हायब्रिड फंड खाली सूचीबद्ध आहेत.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.3414

↓ -0.62 ₹6,720 5,000 0.8 6.8 14.5 20.2 14.5 11.1 SBI Multi Asset Allocation Fund Growth ₹66.9273

↑ 0.12 ₹13,033 5,000 5.3 13 23.2 20.1 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹825.148

↑ 1.95 ₹78,179 5,000 2.7 8.9 17.4 19.8 19.6 18.6 ICICI Prudential Equity and Debt Fund Growth ₹407.45

↓ -4.17 ₹49,641 5,000 -0.8 2.9 14.2 18.9 19 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.13

↓ -0.39 ₹1,349 5,000 -0.6 0.7 13.7 18.6 18.4 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 19 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,720 Cr). Lower mid AUM (₹13,033 Cr). Highest AUM (₹78,179 Cr). Upper mid AUM (₹49,641 Cr). Bottom quartile AUM (₹1,349 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.52% (bottom quartile). 5Y return: 14.77% (bottom quartile). 5Y return: 19.60% (top quartile). 5Y return: 19.02% (upper mid). 5Y return: 18.41% (lower mid). Point 6 3Y return: 20.20% (top quartile). 3Y return: 20.06% (upper mid). 3Y return: 19.75% (lower mid). 3Y return: 18.90% (bottom quartile). 3Y return: 18.65% (bottom quartile). Point 7 1Y return: 14.53% (lower mid). 1Y return: 23.16% (top quartile). 1Y return: 17.35% (upper mid). 1Y return: 14.20% (bottom quartile). 1Y return: 13.72% (bottom quartile). Point 8 1M return: -0.65% (bottom quartile). 1M return: 1.02% (upper mid). 1M return: 0.91% (lower mid). 1M return: 0.48% (bottom quartile). 1M return: 1.63% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 4.49 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.55 (bottom quartile). Sharpe: 1.60 (upper mid). Sharpe: 1.86 (top quartile). Sharpe: 0.83 (lower mid). Sharpe: -0.29 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

एकरकमी गुंतवणुकीसाठी सर्वोत्तम इंडेक्स फंड

इंडेक्स फंडाच्या पोर्टफोलिओमध्ये शेअर्स आणि इतर साधने निर्देशांकात असतात त्याच प्रमाणात असतात. दुसऱ्या शब्दांत, या योजना निर्देशांकाच्या कामगिरीची नक्कल करतात. हे निष्क्रीयपणे व्यवस्थापित केलेले फंड आहेत आणि एकरकमी गुंतवणुकीसाठी एक चांगला पर्याय मानला जाऊ शकतो. काही उत्तमइंडेक्स फंड जे एकरकमी गुंतवणुकीसाठी निवडले जाऊ शकतात ते खालीलप्रमाणे आहेत.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Index Fund - Sensex Plan Growth ₹42.0105

↓ -0.63 ₹992 -3.2 1 9.3 11.3 10.8 9.8 LIC MF Index Fund Sensex Growth ₹153.956

↓ -2.31 ₹94 -3.4 0.7 8.6 10.7 10.2 9.1 Franklin India Index Fund Nifty Plan Growth ₹205.437

↓ -2.94 ₹787 -2.3 1.9 11.5 12.9 11.7 11.3 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Nippon India Index Fund - Nifty Plan Growth ₹43.2445

↓ -0.62 ₹3,061 -2.3 1.9 11.7 13 11.6 11.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 19 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex Franklin India Index Fund Nifty Plan IDBI Nifty Index Fund Nippon India Index Fund - Nifty Plan Point 1 Upper mid AUM (₹992 Cr). Bottom quartile AUM (₹94 Cr). Lower mid AUM (₹787 Cr). Bottom quartile AUM (₹208 Cr). Highest AUM (₹3,061 Cr). Point 2 Established history (15+ yrs). Established history (23+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 1★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.78% (bottom quartile). 5Y return: 10.25% (bottom quartile). 5Y return: 11.70% (upper mid). 5Y return: 11.74% (top quartile). 5Y return: 11.64% (lower mid). Point 6 3Y return: 11.28% (bottom quartile). 3Y return: 10.67% (bottom quartile). 3Y return: 12.91% (lower mid). 3Y return: 20.28% (top quartile). 3Y return: 13.02% (upper mid). Point 7 1Y return: 9.30% (bottom quartile). 1Y return: 8.56% (bottom quartile). 1Y return: 11.53% (lower mid). 1Y return: 16.16% (top quartile). 1Y return: 11.70% (upper mid). Point 8 1M return: -0.90% (bottom quartile). 1M return: -0.96% (bottom quartile). 1M return: -0.58% (lower mid). 1M return: 3.68% (top quartile). 1M return: -0.50% (upper mid). Point 9 Alpha: -0.51 (upper mid). Alpha: -1.15 (bottom quartile). Alpha: -0.53 (lower mid). Alpha: -1.03 (bottom quartile). Alpha: -0.47 (top quartile). Point 10 Sharpe: 0.36 (bottom quartile). Sharpe: 0.30 (bottom quartile). Sharpe: 0.47 (lower mid). Sharpe: 1.04 (top quartile). Sharpe: 0.48 (upper mid). Nippon India Index Fund - Sensex Plan

LIC MF Index Fund Sensex

Franklin India Index Fund Nifty Plan

IDBI Nifty Index Fund

Nippon India Index Fund - Nifty Plan

मागील 1 महिन्यावर आधारित सर्वोत्तम म्युच्युअल फंड

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Energy Fund and BlackRock Global Funds – New Energy Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities

and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity

requirements from time to time. Below is the key information for DSP World Energy Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds - Emerging Markets Opportunities Fund, an equity fund which invests primarily in an aggressively managed portfolio of emerging market companies Research Highlights for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Below is the key information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Returns up to 1 year are on The primary investment objective of Reliance Japan Equity Fund is to provide long term capital appreciation to investors by primarily investing in equity and equity related securities of companies listed on the recognized stock exchanges of Japan and the secondary objective is to generate consistent returns by investing in debt and money market securities of India. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved. Research Highlights for Nippon India Japan Equity Fund Below is the key information for Nippon India Japan Equity Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on 1. DSP World Energy Fund

DSP World Energy Fund

Growth Launch Date 14 Aug 09 NAV (18 Feb 26) ₹27.0917 ↑ 0.40 (1.51 %) Net Assets (Cr) ₹93 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk High Expense Ratio 1.18 Sharpe Ratio 1.61 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,118 31 Jan 23 ₹12,143 31 Jan 24 ₹12,127 31 Jan 25 ₹12,430 31 Jan 26 ₹18,530 Returns for DSP World Energy Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 8.6% 3 Month 22.1% 6 Month 29.7% 1 Year 55.4% 3 Year 15.7% 5 Year 12.8% 10 Year 15 Year Since launch 6.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.2% 2023 -6.8% 2022 12.9% 2021 -8.6% 2020 29.5% 2019 0% 2018 18.2% 2017 -11.3% 2016 -1.9% 2015 22.5% Fund Manager information for DSP World Energy Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Energy Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 34.4% Technology 27.82% Utility 24.89% Basic Materials 9.25% Asset Allocation

Asset Class Value Cash 3.62% Equity 96.36% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF Sustainable Energy I2

Investment Fund | -98% ₹101 Cr 417,038 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 2. Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Growth Launch Date 7 Jul 14 NAV (13 Feb 26) ₹23.9895 ↓ -0.33 (-1.35 %) Net Assets (Cr) ₹169 on 31 Dec 25 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.04 Sharpe Ratio 2.63 Information Ratio -0.95 Alpha Ratio -0.64 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,938 31 Jan 23 ₹8,042 31 Jan 24 ₹7,669 31 Jan 25 ₹8,630 31 Jan 26 ₹13,335 Returns for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 8.2% 3 Month 14% 6 Month 31.3% 1 Year 51.7% 3 Year 18.6% 5 Year 4.6% 10 Year 15 Year Since launch 7.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 41.1% 2023 5.9% 2022 5.5% 2021 -16.8% 2020 -5.9% 2019 21.7% 2018 25.1% 2017 -7.2% 2016 30% 2015 9.8% Fund Manager information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 9 Apr 18 7.82 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Data below for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Technology 27.66% Financial Services 24.86% Consumer Cyclical 12.11% Communication Services 11.31% Industrials 5.06% Energy 4.92% Basic Materials 2% Real Estate 1.66% Utility 1.05% Consumer Defensive 0.96% Health Care 0.94% Asset Allocation

Asset Class Value Cash 6.29% Equity 93.03% Other 0.4% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM Emerging Mkts Opps I (acc) USD

Investment Fund | -97% ₹185 Cr 96,682 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -3% ₹7 Cr Net Receivables/(Payables)

CBLO | -0% -₹1 Cr Accrued Interest

CBLO | -0% ₹0 Cr 3. Nippon India Japan Equity Fund

Nippon India Japan Equity Fund

Growth Launch Date 26 Aug 14 NAV (19 Feb 26) ₹25.7207 ↑ 0.25 (0.99 %) Net Assets (Cr) ₹269 on 31 Dec 25 Category Equity - Global AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.45 Sharpe Ratio 1.41 Information Ratio -1.25 Alpha Ratio -6.67 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,175 31 Jan 23 ₹9,578 31 Jan 24 ₹10,854 31 Jan 25 ₹12,069 31 Jan 26 ₹14,825 Returns for Nippon India Japan Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 7.8% 3 Month 19.1% 6 Month 18.4% 1 Year 33.2% 3 Year 19.3% 5 Year 8.9% 10 Year 15 Year Since launch 9.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 19.8% 2023 9.3% 2022 18.7% 2021 -15.3% 2020 5.7% 2019 2018 2017 2016 2015 Fund Manager information for Nippon India Japan Equity Fund

Name Since Tenure Kinjal Desai 25 May 18 7.69 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Japan Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 27.04% Technology 15.87% Consumer Cyclical 15.73% Financial Services 13.48% Consumer Defensive 6.73% Communication Services 6.35% Real Estate 6.27% Basic Materials 3.43% Health Care 2.81% Asset Allocation

Asset Class Value Cash 2.29% Equity 97.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tokyo Electron Ltd (Technology)

Equity, Since 31 Jul 18 | TKY4% ₹12 Cr 4,800 Komatsu Ltd (Industrials)

Equity, Since 30 Jun 17 | KOM14% ₹11 Cr 30,300 Mitsubishi UFJ Financial Group Inc (Financial Services)

Equity, Since 31 Aug 14 | 83064% ₹10 Cr 61,200 Mitsubishi Heavy Industries Ltd (Industrials)

Equity, Since 30 Jun 25 | MHVYF4% ₹10 Cr 37,400 Ajinomoto Co Inc (Consumer Defensive)

Equity, Since 30 Jun 23 | AJI4% ₹10 Cr 48,000 SMC Corp (Industrials)

Equity, Since 30 Jun 23 | QMC4% ₹10 Cr 2,800 Hitachi Ltd (Industrials)

Equity, Since 31 Aug 14 | 65014% ₹10 Cr 31,200 Mitsubishi Corp (Industrials)

Equity, Since 30 Jun 25 | 80584% ₹10 Cr 40,600 Toyota Motor Corp (Consumer Cyclical)

Equity, Since 31 Aug 14 | TOM3% ₹10 Cr 47,000 Shin-Etsu Chemical Co Ltd (Basic Materials)

Equity, Since 30 Jun 17 | 40633% ₹10 Cr 31,700 4. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (18 Feb 26) ₹32.0424 ↑ 1.32 (4.30 %) Net Assets (Cr) ₹154 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.27 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,733 31 Jan 23 ₹14,422 31 Jan 24 ₹12,454 31 Jan 25 ₹12,799 31 Jan 26 ₹25,833 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 7.3% 3 Month 40.2% 6 Month 69.1% 1 Year 93.9% 3 Year 23.5% 5 Year 19% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 5. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (19 Feb 26) ₹36.2959 ↓ -0.41 (-1.12 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 6.6% 3 Month 6.6% 6 Month 15.7% 1 Year 30.7% 3 Year 33.8% 5 Year 27.7% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000

एकरकमी गुंतवणूक करताना विचारात घ्यायच्या गोष्टी

म्युच्युअल फंडामध्ये गुंतवणूक करण्यापूर्वी व्यक्तींनी अनेक बाबींची काळजी घेणे आवश्यक आहे. यात समाविष्ट आहे:

मार्केटची वेळ

एकरकमी गुंतवणुकीचा प्रश्न येतो तेव्हा, व्यक्तींना नेहमी शोधण्याची गरज असतेबाजार विशेषत: इक्विटी-आधारित फंडांच्या संदर्भात वेळ. एकरकमी गुंतवणुकीची चांगली वेळ म्हणजे जेव्हा बाजार कमी असतात आणि त्यांना लवकरच प्रशंसा मिळण्यास वाव असतो. तथापि, जर बाजार आधीच शिखरावर असेल तर, एकरकमी गुंतवणुकीपासून दूर राहणे चांगले.

विविधीकरण

एकरकमी गुंतवणुक करण्यापूर्वी वैविध्यता ही एक महत्त्वाची बाब आहे ज्याचा विचार करणे आवश्यक आहे. एकरकमी गुंतवणुकीच्या बाबतीत व्यक्तींनी त्यांच्या गुंतवणुकीत अनेक मार्गांनी विस्तार करून विविधता आणली पाहिजे. हे सुनिश्चित करण्यात मदत करेल की त्यांच्या एकूण पोर्टफोलिओपैकी एक योजना चांगली कामगिरी करत नसली तरीही.

तुमच्या उद्दिष्टानुसार तुमची गुंतवणूक करा

व्यक्ती जी कोणतीही गुंतवणूक करतात ती विशिष्ट उद्दिष्ट साध्य करण्यासाठी असते. म्हणून, व्यक्तींनी योजनेचा दृष्टीकोन त्याच्याशी सुसंगत आहे की नाही हे तपासावेगुंतवणूकदारचे उद्दिष्ट. येथे, व्यक्तींनी विविध पॅरामीटर्स शोधले पाहिजेत जसे कीCAGR योजनेत गुंतवणूक करण्यापूर्वी परतावा, संपूर्ण परतावा, कर आकारणीचा प्रभाव आणि बरेच काही.

विमोचन योग्य वेळी केले पाहिजे

व्यक्तींनी त्यांचे करावेविमोचन एकरकमी गुंतवणूक योग्य वेळी. जरी ते अद्याप गुंतवणुकीच्या उद्दिष्टानुसार असू शकते; व्यक्तींनी ज्या योजनेत गुंतवणूक करण्याची योजना आखली आहे त्याचा वेळेवर आढावा घ्यावा. तथापि, त्यांना त्यांची गुंतवणूक दीर्घ कालावधीसाठी ठेवण्याची देखील आवश्यकता आहे जेणेकरून ते जास्तीत जास्त लाभ घेऊ शकतील.

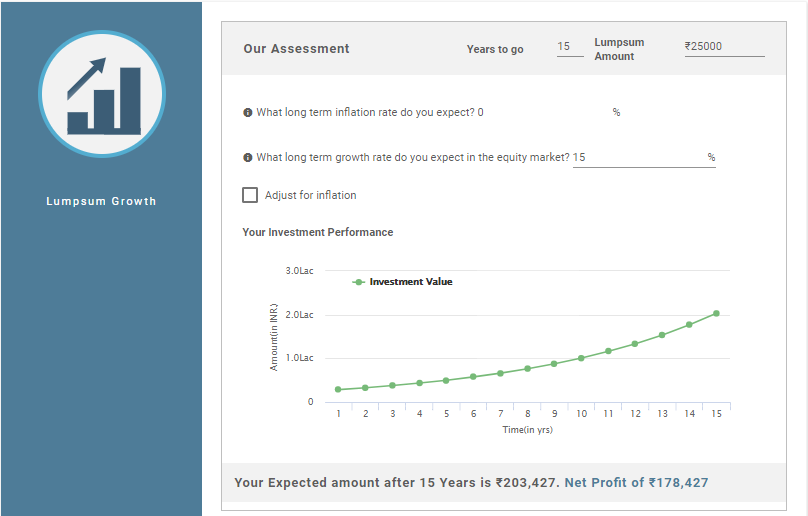

म्युच्युअल फंड एकरकमी परतावा कॅल्क्युलेटर

म्युच्युअल फंड एकरकमी परतावा कॅल्क्युलेटर एखाद्या व्यक्तीची एकरकमी गुंतवणूक दिलेल्या कालावधीत कशी वाढते हे दर्शविण्यास मदत करते. एकरकमी कॅल्क्युलेटरमध्ये इनपुट करणे आवश्यक असलेल्या काही डेटामध्ये गुंतवणुकीचा कालावधी, प्रारंभिक गुंतवणूक रक्कम, दीर्घकालीन अपेक्षित वाढीचा दर आणि बरेच काही समाविष्ट आहे. म्युच्युअल फंड एकरकमी परतावा कॅल्क्युलेटरचे उदाहरण खालीलप्रमाणे आहे.

चित्रण

एकरकमी गुंतवणूक: 25 रुपये,000

गुंतवणुकीचा कालावधी: 15 वर्षे

दीर्घकालीन वाढीचा दर (अंदाजे): १५%

एकरकमी कॅल्क्युलेटरनुसार अपेक्षित परतावा: INR 2,03,427

गुंतवणुकीवर निव्वळ नफा: INR 1,78,427

अशा प्रकारे, वरील गणना दर्शवते की तुमच्या गुंतवणुकीवरील गुंतवणुकीवर निव्वळ नफा INR 1,78,427 आहे तर तुमच्या गुंतवणुकीचे एकूण मूल्य INR 2,03,427 आहे..

म्युच्युअल फंडातील एकवेळच्या गुंतवणुकीचे फायदे आणि तोटे

SIP प्रमाणेच, एकरकमी गुंतवणूकीचे स्वतःचे फायदे आणि तोटे आहेत. तर, हे फायदे आणि तोटे पाहू.

फायदे

एकरकमी गुंतवणुकीचे फायदे खालीलप्रमाणे आहेत.

- मोठी रक्कम गुंतवा: व्यक्ती म्युच्युअल फंडामध्ये मोठ्या प्रमाणात गुंतवणूक करू शकतात आणि निधी निष्क्रिय ठेवण्याऐवजी जास्त परतावा मिळवू शकतात.

- दीर्घ मुदतीसाठी आदर्श: एकरकमी गुंतवणुकीची पद्धत दीर्घकालीन गुंतवणुकीसाठी विशेषत: इक्विटी फंडांच्या बाबतीत चांगली आहे. तथापि, कर्ज निधीच्या बाबतीत, कार्यकाळ अल्प किंवा मध्यम-मुदतीचा असू शकतो

- सुविधा: गुंतवणुकीची एकरकमी पद्धत सोयीस्कर आहे कारण पेमेंट एकदाच केले जाते आणि नियमित अंतराने वजा केले जात नाही.

तोटे

एकरकमी गुंतवणुकीचे तोटे आहेत:

- अनियमित गुंतवणूक: एकरकमी गुंतवणूक ही गुंतवणूकदाराची नियमित बचत सुनिश्चित करत नाही कारण ती नियमित बचतीची सवय लावत नाही.

- उच्च धोका: एकरकमी गुंतवणुकीत, वेळ पाहणे महत्त्वाचे आहे. कारण एकरकमी पद्धतीने गुंतवणूक फक्त एकदाच केली जाते आणि नियमित अंतराने नाही. म्हणून, जर व्यक्तींनी वेळेचा विचार केला नाही तर त्यांचे नुकसान होऊ शकते.

निष्कर्ष

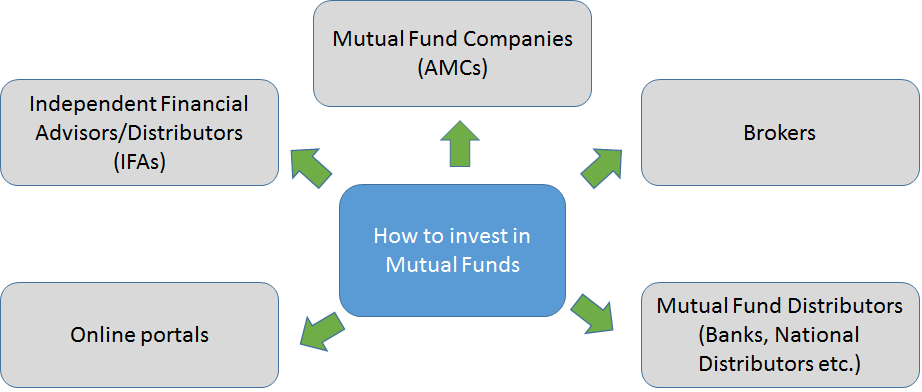

अशाप्रकारे, वरील पॉइंटर्सवरून असे म्हणता येईल की म्युच्युअल फंडामध्ये गुंतवणुकीसाठी एकरकमी मोड देखील एक चांगला मार्ग आहे. तथापि, योजनेमध्ये एकरकमी रक्कम गुंतवताना व्यक्तींनी आत्मविश्वास बाळगणे आवश्यक आहे. नसल्यास, ते गुंतवणुकीचा SIP मोड निवडू शकतात. याशिवाय, लोकांनी गुंतवणूक करण्यापूर्वी योजनेचे स्वरूप समजून घेतले पाहिजे. आवश्यक असल्यास, ते एआर्थिक सल्लागार. हे त्यांना त्यांचे पैसे सुरक्षित असल्याची खात्री करण्यास मदत करेल आणि त्यांची उद्दिष्टे वेळेवर पूर्ण होतील.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for DSP World Energy Fund