ਮਿਉਚੁਅਲ ਫੰਡ ਬਨਾਮ FD (ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ)

ਮਿਉਚੁਅਲ ਫੰਡ ਬਨਾਮਐੱਫ.ਡੀ? ਜਦੋਂ ਪੈਸੇ ਬਚਾਉਣ ਬਾਰੇ ਸੋਚਦੇ ਹੋ, ਤਾਂ ਸਭ ਤੋਂ ਪਹਿਲੀ ਗੱਲ ਇਹ ਹੈ ਕਿ ਜ਼ਿਆਦਾਤਰ ਲੋਕ ਅਜਿਹਾ ਕਰਨ ਬਾਰੇ ਸੋਚਦੇ ਹਨਨਿਵੇਸ਼ ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ (FDs) ਵਿੱਚ। ਇਹ ਆਮ ਤੌਰ 'ਤੇ ਇਸ ਲਈ ਹੈ ਕਿਉਂਕਿ ਇਹ ਸਮਝਣਾ ਆਸਾਨ ਹੈ ਅਤੇ ਪੀੜ੍ਹੀਆਂ ਤੋਂ ਕੀਤਾ ਜਾ ਰਿਹਾ ਹੈ। ਪਰ ਕੀ ਇਹ ਸਭ ਤੋਂ ਢੁਕਵਾਂ ਨਿਵੇਸ਼ ਹੈ? ਅਤੇ ਕੀ ਇਹ ਸਭ ਤੋਂ ਵਧੀਆ ਰਿਟਰਨ ਪ੍ਰਦਾਨ ਕਰਦਾ ਹੈ? ਜਾਂ ਮਿਉਚੁਅਲ ਫੰਡ ਨਿਵੇਸ਼ ਉਦੇਸ਼ ਨੂੰ ਬਿਹਤਰ ਢੰਗ ਨਾਲ ਪੂਰਾ ਕਰ ਸਕਦੇ ਹਨ? ਇਹਨਾਂ ਸਵਾਲਾਂ ਦੇ ਜਵਾਬ ਜਾਣਨ ਲਈ, ਹੇਠਾਂ ਪੜ੍ਹੋ!

FD ਜਾਂ ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ

ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ, ਜਿਸਨੂੰ FD ਵੀ ਕਿਹਾ ਜਾਂਦਾ ਹੈ, ਇੱਕ ਪ੍ਰਸਿੱਧ ਹੈਬੈਂਕ ਨਿਵੇਸ਼ ਵਿਕਲਪ ਲੰਬੇ ਸਮੇਂ ਅਤੇ ਥੋੜ੍ਹੇ ਸਮੇਂ ਦੇ ਨਿਵੇਸ਼ਾਂ ਲਈ ਢੁਕਵਾਂ ਹੈ। FD ਰਿਟਰਨ ਫਿਕਸ ਕੀਤੇ ਜਾਂਦੇ ਹਨ ਕਿਉਂਕਿ FD ਵਿਆਜ ਦਰ ਭਾਰਤ ਸਰਕਾਰ ਦੁਆਰਾ ਪਹਿਲਾਂ ਤੋਂ ਤੈਅ ਕੀਤੀ ਜਾਂਦੀ ਹੈ। ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ 'ਤੇ ਵਿਆਜ ਦਰ ਫਿਕਸ ਕੀਤੀ ਜਾ ਰਹੀ ਹੈ, ਦਾ ਕੋਈ ਪ੍ਰਭਾਵ ਨਹੀਂ ਹੈਮਹਿੰਗਾਈ ਇਹਨਾਂ ਨਿਵੇਸ਼ਾਂ 'ਤੇ.

ਨਾਲ ਹੀ, ਐਫਡੀ ਰਿਟਰਨ ਨਿਵੇਸ਼ਕਾਂ ਦੇ ਹੱਥਾਂ ਵਿੱਚ ਟੈਕਸਯੋਗ ਹਨ। ਹਾਲਾਂਕਿ, FD ਨਿਵੇਸ਼ ਅਧੀਨ ਟੈਕਸ ਕਟੌਤੀਆਂ ਲਈ ਜਵਾਬਦੇਹ ਹਨਧਾਰਾ 80C ਦੇਆਮਦਨ ਟੈਕਸ ਐਕਟ.

ਮਿਉਚੁਅਲ ਫੰਡ

ਮਿਉਚੁਅਲ ਫੰਡ ਤਿੰਨ ਤਰ੍ਹਾਂ ਦਾ ਹੁੰਦਾ ਹੈ, ਕਰਜ਼ਾ, ਇਕੁਇਟੀ ਅਤੇ ਸੰਤੁਲਿਤਮਿਉਚੁਅਲ ਫੰਡ.ਕਰਜ਼ਾ ਮਿਉਚੁਅਲ ਫੰਡ ਉਹ ਹਨ ਜੋ ਸਰਕਾਰ ਵਿੱਚ ਜ਼ਿਆਦਾਤਰ ਜਾਇਦਾਦਾਂ ਦਾ ਨਿਵੇਸ਼ ਕਰਦੇ ਹਨਬਾਂਡ, ਕਾਰਪੋਰੇਟ ਬਾਂਡ ਅਤੇ ਬਾਕੀ ਸ਼ੇਅਰ ਬਾਜ਼ਾਰਾਂ ਵਿੱਚ। ਇਸ ਦੇ ਉਲਟ, ਇਕੁਇਟੀ ਮਿਉਚੁਅਲ ਫੰਡ ਆਪਣੀ ਜਾਇਦਾਦ ਦਾ 65% ਤੋਂ ਵੱਧ ਹਿੱਸਾ ਇਕੁਇਟੀ ਬਜ਼ਾਰਾਂ ਵਿੱਚ ਅਤੇ ਬਾਕੀ ਸਰਕਾਰੀ ਬਾਂਡਾਂ, ਕਾਰਪੋਰੇਟ ਬਾਂਡਾਂ ਅਤੇ ਪ੍ਰਤੀਭੂਤੀਆਂ ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰਦੇ ਹਨ। ਜਦੋਂ ਕਿ ਸੰਤੁਲਿਤ ਮਿਉਚੁਅਲ ਫੰਡ ਉਹ ਹੁੰਦੇ ਹਨ ਜੋ ਅੰਸ਼ਕ ਤੌਰ 'ਤੇ ਕਰਜ਼ੇ ਵਿੱਚ ਅਤੇ ਅੰਸ਼ਕ ਤੌਰ 'ਤੇ ਨਿਵੇਸ਼ ਕਰਦੇ ਹਨਇਕੁਇਟੀ ਫੰਡ. ਮਿਉਚੁਅਲ ਫੰਡ ਇੱਕ ਮਹਿੰਗਾਈ ਨੂੰ ਹਰਾਉਣ ਵਾਲਾ ਸਾਧਨ ਹੈ, ਇਸਲਈ ਇਹ ਵਧੇਰੇ ਟੈਕਸ ਕੁਸ਼ਲ ਹੈ ਅਤੇ ਲੰਬੇ ਸਮੇਂ ਦੇ ਨਿਵੇਸ਼ਾਂ 'ਤੇ ਬਿਹਤਰ ਰਿਟਰਨ ਦੀ ਪੇਸ਼ਕਸ਼ ਕਰਨ ਦੀ ਉਮੀਦ ਕੀਤੀ ਜਾਂਦੀ ਹੈ।

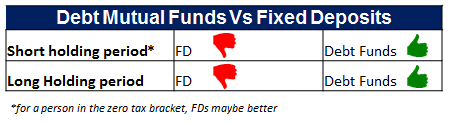

ਲੰਮੀ ਮਿਆਦ ਦਾ ਬਿਹਤਰ ਨਿਵੇਸ਼ ਕਿਹੜਾ ਹੈ?

ਹੁਣ ਜਦੋਂ ਅਸੀਂ ਜਾਣਦੇ ਹਾਂ ਕਿ ਮਿਉਚੁਅਲ ਫੰਡ ਅਤੇ ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ (FDs) ਦੋਵੇਂ ਹਨਟੈਕਸ ਬਚਤ ਨਿਵੇਸ਼, ਇਹ ਸਵਾਲ ਉੱਠਦਾ ਹੈ - ਕਿੱਥੇ ਨਿਵੇਸ਼ ਕਰਨਾ ਚਾਹੀਦਾ ਹੈ? ਹਾਲਾਂਕਿ ਇਹ ਇੱਕ ਵਿਅਕਤੀਗਤ ਸਵਾਲ ਹੈ ਅਤੇ ਇਸਦਾ ਜਵਾਬ ਵਿਅਕਤੀ ਤੋਂ ਦੂਜੇ ਵਿਅਕਤੀ ਵਿੱਚ ਵੱਖੋ-ਵੱਖਰਾ ਹੋ ਸਕਦਾ ਹੈ, ਹੇਠਾਂ ਵੱਖ-ਵੱਖ ਮਾਪਦੰਡਾਂ ਦੇ ਆਧਾਰ 'ਤੇ ਤੁਲਨਾ ਕੀਤੀ ਗਈ ਹੈ ਜੋ ਤੁਹਾਨੂੰ ਬਿਹਤਰ ਚੋਣ ਕਰਨ ਵਿੱਚ ਮਦਦ ਕਰ ਸਕਦੀ ਹੈ।

1. ਮਿਉਚੁਅਲ ਫੰਡ ਰਿਟਰਨ ਅਤੇ FD ਰਿਟਰਨ

ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ 'ਤੇ ਰਿਟਰਨ ਪਹਿਲਾਂ ਤੋਂ ਨਿਰਧਾਰਤ ਹੈ ਅਤੇ ਪੂਰੇ ਕਾਰਜਕਾਲ ਦੌਰਾਨ ਨਹੀਂ ਬਦਲਦਾ ਹੈ। ਜਦੋਂ ਕਿ ਮਿਉਚੁਅਲ ਫੰਡ, ਵਿੱਤੀ ਨਾਲ ਜੁੜੇ ਹੋਏ ਹਨਬਜ਼ਾਰ, ਲੰਬੇ ਸਮੇਂ ਦੇ ਨਿਵੇਸ਼ਾਂ 'ਤੇ ਬਿਹਤਰ ਰਿਟਰਨ ਦੀ ਪੇਸ਼ਕਸ਼ ਕਰਦੇ ਹਨ।

2. FD ਵਿਆਜ ਦਰਾਂ ਅਤੇ ਮਿਉਚੁਅਲ ਫੰਡ ਰਿਟਰਨ

FD 'ਤੇ ਵਿਆਜ ਦਰ FD ਦੀ ਕਿਸਮ ਜਾਂ FD ਦੀ ਮਿਆਦ 'ਤੇ ਨਿਰਭਰ ਕਰਦੀ ਹੈ, ਇਸਲਈ ਕੋਈ ਵੀ ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ 'ਤੇ ਉੱਚੀਆਂ ਵਿਆਜ ਦਰਾਂ ਦੀ ਉਮੀਦ ਨਹੀਂ ਕਰ ਸਕਦਾ ਹੈ। ਦੂਜੇ ਪਾਸੇ, ਮਿਉਚੁਅਲ ਫੰਡਾਂ 'ਤੇ ਰਿਟਰਨ ਵੱਖ-ਵੱਖ ਹੁੰਦੇ ਹਨ ਕਿਉਂਕਿ ਵੱਖ-ਵੱਖ ਕਿਸਮਾਂ ਦੇ ਫੰਡ ਅਸਥਿਰ ਰਿਟਰਨ ਪੇਸ਼ ਕਰਦੇ ਹਨ। ਜੇਕਰ ਬਜ਼ਾਰ ਉੱਚਾ ਚਲਾ ਜਾਂਦਾ ਹੈ ਤਾਂ ਰਿਟਰਨ ਵਧਦਾ ਹੈ ਅਤੇ ਇਸਦੇ ਉਲਟ।

3. ਜੋਖਮ ਦੇ ਕਾਰਕ

ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ ਵਿੱਚ ਕੋਈ ਖਤਰਾ ਨਹੀਂ ਹੁੰਦਾ ਕਿਉਂਕਿ ਰਿਟਰਨ ਪਹਿਲਾਂ ਤੋਂ ਨਿਰਧਾਰਤ ਹੁੰਦੇ ਹਨ। ਨਾਲ ਹੀ, ਜੇਕਰ ਬੈਂਕ ਦਾ ਪਰਦਾਫਾਸ਼ ਹੋ ਜਾਂਦਾ ਹੈ ਤਾਂ ਸਾਰੇ ਬੈਂਕ ਖਾਤਿਆਂ ਦਾ 1 ਲੱਖ ਰੁਪਏ ਤੱਕ ਦਾ ਬੀਮਾ ਕੀਤਾ ਜਾਂਦਾ ਹੈ। ਦੂਜੇ ਪਾਸੇ, ਮਿਉਚੁਅਲ ਫੰਡ ਇੱਕ ਉੱਚ ਜੋਖਮ ਰੱਖਦੇ ਹਨ ਕਿਉਂਕਿ ਉਹ ਵਿੱਤੀ ਬਾਜ਼ਾਰ ਵਿੱਚ ਆਪਣੀ ਜਾਇਦਾਦ ਦਾ ਨਿਵੇਸ਼ ਕਰਦੇ ਹਨ। ਇਕੁਇਟੀ ਮਿਉਚੁਅਲ ਫੰਡ, ਆਪਣੀ ਜ਼ਿਆਦਾਤਰ ਸੰਪਤੀਆਂ ਨੂੰ ਇਕੁਇਟੀ ਬਾਜ਼ਾਰਾਂ ਵਿਚ ਨਿਵੇਸ਼ ਕਰਦੇ ਹੋਏ, ਬਹੁਤ ਜ਼ਿਆਦਾ ਜੋਖਮ ਰੱਖਦੇ ਹਨ। ਜਦੋਂ ਕਿ ਡੈਬਟ ਮਿਉਚੁਅਲ ਫੰਡਾਂ ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰਨਾ ਘੱਟ ਜੋਖਮ ਵਾਲਾ ਹੁੰਦਾ ਹੈ, ਕਿਉਂਕਿ ਇਹਨਾਂ ਫੰਡਾਂ ਦਾ ਬਹੁਤ ਘੱਟ ਹਿੱਸਾ ਸਟਾਕ ਮਾਰਕੀਟ ਵਿੱਚ ਨਿਵੇਸ਼ ਕੀਤਾ ਜਾਂਦਾ ਹੈ।

Talk to our investment specialist

4. ਮਹਿੰਗਾਈ ਦਾ ਪ੍ਰਭਾਵ

ਵਿਆਜ ਦਰ ਪਹਿਲਾਂ ਤੋਂ ਤੈਅ ਕੀਤੀ ਜਾ ਰਹੀ ਹੈ, ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ 'ਤੇ ਮਹਿੰਗਾਈ ਦਾ ਕੋਈ ਪ੍ਰਭਾਵ ਨਹੀਂ ਹੈ। ਜਦੋਂ ਕਿ, ਮਿਉਚੁਅਲ ਫੰਡਾਂ ਲਈ, ਰਿਟਰਨ ਮਹਿੰਗਾਈ-ਵਿਵਸਥਿਤ ਹੁੰਦੇ ਹਨ ਜੋ ਬਿਹਤਰ ਰਿਟਰਨ ਕਮਾਉਣ ਦੀ ਸੰਭਾਵਨਾ ਨੂੰ ਵਧਾਉਂਦੇ ਹਨ।

5. ਪੂੰਜੀ ਲਾਭ

ਕੋਈ ਹਨਪੂੰਜੀ FDs ਦੇ ਮਾਮਲੇ ਵਿੱਚ ਲਾਭ ਸੰਭਵ ਹੈ। ਮਿਉਚੁਅਲ ਫੰਡਾਂ ਲਈ,ਪੂੰਜੀ ਲਾਭ ਹੋਲਡਿੰਗ ਦੀ ਮਿਆਦ 'ਤੇ ਨਿਰਭਰ ਕਰਦਾ ਹੈ. ਵੱਖ-ਵੱਖ ਮਿਉਚੁਅਲ ਫੰਡ ਵੱਖ-ਵੱਖ ਪੂੰਜੀ ਲਾਭਾਂ ਦੀ ਪੇਸ਼ਕਸ਼ ਕਰਦੇ ਹਨ।

6. ਤਰਲਤਾ

ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ ਹਨਇਲੀਕੁਇਡ, ਕਿਉਂਕਿ ਨਿਵੇਸ਼ ਕੀਤੀ ਰਕਮ ਨਿਸ਼ਚਿਤ ਸਮੇਂ ਲਈ ਲਾਕ ਕੀਤੀ ਜਾਂਦੀ ਹੈ। ਜੇਕਰ ਉਸ ਮਿਆਦ ਤੋਂ ਪਹਿਲਾਂ ਪੈਸੇ ਕਢਵਾ ਲਏ ਜਾਂਦੇ ਹਨ, ਤਾਂ ਇੱਕ ਨਿਸ਼ਚਿਤ ਜੁਰਮਾਨਾ ਕੱਟਿਆ ਜਾਂਦਾ ਹੈ। ਜਦੋਂ ਕਿ ਮਿਉਚੁਅਲ ਫੰਡ ਤਰਲ ਹੁੰਦੇ ਹਨ ਕਿਉਂਕਿ ਉਹ ਥੋੜ੍ਹੇ ਸਮੇਂ ਵਿੱਚ ਬਿਨਾਂ ਕਿਸੇ ਕਾਰਨ ਦੇ ਵੇਚੇ ਜਾ ਸਕਦੇ ਹਨਘਟਾਓ ਫੰਡ ਮੁੱਲ ਵਿੱਚ. ਹਾਲਾਂਕਿ, ਕੁਝ ਮਿਉਚੁਅਲ ਫੰਡਾਂ ਨੂੰ ਵੇਚਣ 'ਤੇ ਲਾਗੂ ਹੋਣ ਵਾਲੇ ਐਗਜ਼ਿਟ ਲੋਡ ਦੀ ਜਾਂਚ ਕਰਨਾ ਮਹੱਤਵਪੂਰਨ ਹੈ।

7. ਟੈਕਸੇਸ਼ਨ

ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ 'ਤੇ ਵਿਆਜ ਵਿਅਕਤੀ ਦੇ ਟੈਕਸ ਸਲੈਬ ਦੇ ਅਨੁਸਾਰ ਲਗਾਇਆ ਜਾਂਦਾ ਹੈ। ਦੂਜੇ ਹਥ੍ਥ ਤੇ,ਮਿਉਚੁਅਲ ਫੰਡ ਟੈਕਸੇਸ਼ਨ ਮੁੱਖ ਤੌਰ 'ਤੇ ਹੋਲਡਿੰਗ ਦੀ ਮਿਆਦ 'ਤੇ ਨਿਰਭਰ ਕਰਦਾ ਹੈ। ਸ਼ਾਰਟ ਟਰਮ ਕੈਪੀਟਲ ਗੇਨ (STCG) ਅਤੇ ਲੌਂਗ ਟਰਮ ਕੈਪੀਟਲ ਗੇਨ (LTCG) ਦੋਵਾਂ 'ਤੇ ਵੱਖ-ਵੱਖ ਟੈਕਸ ਲਗਾਇਆ ਜਾਂਦਾ ਹੈ।

8. ਟੈਕਸ ਸੇਵਿੰਗ FD ਦੀਆਂ V/S ਇਕੁਇਟੀ ਲਿੰਕਡ ਸੇਵਿੰਗ ਸਕੀਮਾਂ (ELSS)

ਨਿਵੇਸ਼ਕਾਂ ਲਈ ਜੋ IT ਐਕਟ ਦੀ ਧਾਰਾ 80c ਦੇ ਤਹਿਤ ਟੈਕਸ ਬਚਾਉਣ ਦੇ ਉਦੇਸ਼ ਲਈ FD 'ਤੇ ਵਿਚਾਰ ਕਰ ਰਹੇ ਹਨ। (5 ਸਾਲ ਲੌਕਿਨ)ELSS ਮਿਉਚੁਅਲ ਫੰਡ ਵਧੀਆ ਵਿਕਲਪ ਹਨ ਕਿਉਂਕਿ ਉਹਨਾਂ ਨੇ 3 ਸਾਲਾਂ ਦਾ ਲਾਕ ਇਨ ਕੀਤਾ ਹੈ ਅਤੇ ਇਤਿਹਾਸਕ ਤੌਰ 'ਤੇ ਬਿਹਤਰ ਰਿਟਰਨ ਦੀ ਪੇਸ਼ਕਸ਼ ਕੀਤੀ ਹੈ।

ਇੱਕ ਬਿਹਤਰ ਨਿਵੇਸ਼ ਯੋਜਨਾ ਕਿਹੜੀ ਹੈ?

ਆਓ ਸੰਖੇਪ ਵਿੱਚ ਵੇਖੀਏ:

| ਪੈਰਾਮੀਟਰ | ਮਿਉਚੁਅਲ ਫੰਡ | ਫਿਕਸਡ ਡਿਪਾਜ਼ਿਟ |

|---|---|---|

| ਰਿਟਰਨ ਦੀ ਦਰ | ਕੋਈ ਨਿਸ਼ਚਿਤ ਰਿਟਰਨ ਨਹੀਂ | ਸਥਿਰ ਰਿਟਰਨ |

| ਮੁਦਰਾਸਫੀਤੀ ਵਿਵਸਥਿਤ ਰਿਟਰਨ | ਉੱਚ ਮੁਦਰਾਸਫੀਤੀ ਵਿਵਸਥਿਤ ਰਿਟਰਨਾਂ ਲਈ ਸੰਭਾਵੀ | ਆਮ ਤੌਰ 'ਤੇ ਘੱਟ ਮਹਿੰਗਾਈ ਐਡਜਸਟਡ ਰਿਟਰਨ |

| ਜੋਖਮ | ਮੱਧਮ ਤੋਂ ਉੱਚ ਜੋਖਮ | ਘੱਟ ਜੋਖਮ |

| ਤਰਲਤਾ | ਤਰਲ | ਤਰਲ |

| ਸਮੇਂ ਤੋਂ ਪਹਿਲਾਂ ਕਢਵਾਉਣਾ | ਐਗਜ਼ਿਟ ਲੋਡ/ਨੋ ਲੋਡ ਨਾਲ ਆਗਿਆ ਹੈ | ਜੁਰਮਾਨੇ ਦੇ ਨਾਲ ਇਜਾਜ਼ਤ ਦਿੱਤੀ ਗਈ |

| ਨਿਵੇਸ਼ ਦੀ ਲਾਗਤ | ਪ੍ਰਬੰਧਨ ਲਾਗਤ/ਖਰਚ ਅਨੁਪਾਤ | ਕੋਈ ਲਾਗਤ ਨਹੀਂ |

| ਟੈਕਸ ਸਥਿਤੀ | ਅਨੁਕੂਲ ਟੈਕਸ ਸਥਿਤੀ | ਟੈਕਸ ਸਲੈਬ ਦੇ ਅਨੁਸਾਰ |

2022 ਵਿੱਚ ਨਿਵੇਸ਼ ਕਰਨ ਲਈ ਸਰਬੋਤਮ ਮਿਉਚੁਅਲ ਫੰਡ

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.2959

↓ -0.41 ₹5,980 6.6 15.7 30.7 33.8 27.7 11.3 ICICI Prudential Infrastructure Fund Growth ₹196.22

↓ -2.38 ₹8,077 -1 0.7 15.8 24.9 26.5 6.7 Invesco India PSU Equity Fund Growth ₹67.82

↓ -1.04 ₹1,492 1.8 9.3 29.3 31.5 25.8 10.3 DSP India T.I.G.E.R Fund Growth ₹322.81

↓ -3.55 ₹5,184 1.1 2.9 20.2 25.5 24.4 -2.5 HDFC Infrastructure Fund Growth ₹47.327

↓ -0.66 ₹2,366 -2.3 -0.7 15.8 26.9 23.8 2.2 Franklin Build India Fund Growth ₹147.965

↓ -1.71 ₹3,003 1.5 4.6 21.2 27.6 23.7 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 7 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund HDFC Infrastructure Fund Franklin Build India Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Upper mid AUM (₹5,184 Cr). Lower mid AUM (₹2,366 Cr). Lower mid AUM (₹3,003 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Established history (16+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.74% (upper mid). 5Y return: 26.53% (upper mid). 5Y return: 25.82% (lower mid). 5Y return: 24.38% (lower mid). 5Y return: 23.80% (bottom quartile). 5Y return: 23.68% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 33.84% (upper mid). 3Y return: 24.88% (bottom quartile). 3Y return: 31.51% (upper mid). 3Y return: 25.45% (bottom quartile). 3Y return: 26.87% (lower mid). 3Y return: 27.58% (lower mid). Point 7 1Y return: 156.17% (top quartile). 1Y return: 30.67% (upper mid). 1Y return: 15.80% (bottom quartile). 1Y return: 29.25% (upper mid). 1Y return: 20.23% (lower mid). 1Y return: 15.81% (bottom quartile). 1Y return: 21.22% (lower mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (lower mid). Sharpe: 0.53 (upper mid). Sharpe: 0.08 (bottom quartile). Sharpe: 0.06 (bottom quartile). Sharpe: 0.21 (lower mid). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

HDFC Infrastructure Fund

Franklin Build India Fund

*ਹੇਠਾਂ 7 ਦੀ ਸੂਚੀ ਹੈਵਧੀਆ ਮਿਉਚੁਅਲ ਫੰਡ ਤੋਂ ਵੱਧ ਕੁੱਲ ਸੰਪਤੀਆਂ/ਏਯੂਐਮ ਹੋਣ "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on 100 ਕਰੋੜ. 5 ਸਾਲ 'ਤੇ ਕ੍ਰਮਬੱਧਸੀ.ਏ.ਜੀ.ਆਰ/ ਸਲਾਨਾ ਵਾਪਸੀ1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (18 Feb 26) ₹62.6234 ↑ 2.23 (3.69 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 6.2% 3 Month 39.2% 6 Month 84.2% 1 Year 156.2% 3 Year 58.2% 5 Year 29.3% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (19 Feb 26) ₹36.2959 ↓ -0.41 (-1.12 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 6.6% 3 Month 6.6% 6 Month 15.7% 1 Year 30.7% 3 Year 33.8% 5 Year 27.7% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (19 Feb 26) ₹196.22 ↓ -2.38 (-1.20 %) Net Assets (Cr) ₹8,077 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.15 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 2% 3 Month -1% 6 Month 0.7% 1 Year 15.8% 3 Year 24.9% 5 Year 26.5% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (19 Feb 26) ₹67.82 ↓ -1.04 (-1.51 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 1.4% 3 Month 1.8% 6 Month 9.3% 1 Year 29.3% 3 Year 31.5% 5 Year 25.8% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (19 Feb 26) ₹322.81 ↓ -3.55 (-1.09 %) Net Assets (Cr) ₹5,184 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 4.8% 3 Month 1.1% 6 Month 2.9% 1 Year 20.2% 3 Year 25.5% 5 Year 24.4% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (19 Feb 26) ₹47.327 ↓ -0.66 (-1.37 %) Net Assets (Cr) ₹2,366 on 31 Jan 26 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio 0.06 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,059 31 Jan 23 ₹16,950 31 Jan 24 ₹28,499 31 Jan 25 ₹31,485 31 Jan 26 ₹33,227 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 2.3% 3 Month -2.3% 6 Month -0.7% 1 Year 15.8% 3 Year 26.9% 5 Year 23.8% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.62 Yr. Ashish Shah 1 Nov 25 0.25 Yr. Data below for HDFC Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 40.3% Financial Services 21.02% Basic Materials 10.31% Energy 7.4% Utility 7.38% Communication Services 4.32% Real Estate 2.99% Health Care 1.84% Technology 1.33% Consumer Cyclical 0.67% Asset Allocation

Asset Class Value Cash 2.44% Equity 97.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹159 Cr 403,500

↑ 6,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹149 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹130 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹87 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹80 Cr 1,400,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | NTPC3% ₹78 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹76 Cr 704,361 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹70 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹69 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹69 Cr 350,000 7. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (19 Feb 26) ₹147.965 ↓ -1.71 (-1.14 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.7% 3 Month 1.5% 6 Month 4.6% 1 Year 21.2% 3 Year 27.6% 5 Year 23.7% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000

ਵਿੱਤੀ ਯੋਜਨਾਬੰਦੀ ਤੁਹਾਡੇ ਪ੍ਰਬੰਧਨ ਦੀ ਕੁੰਜੀ ਹੈਆਮਦਨ ਅਤੇ ਖਰਚੇ। ਇਸ ਲਈ, ਤੁਹਾਡਾ ਕੀ ਹੈਵਿੱਤੀ ਟੀਚਾ? ਵਿਸ਼ਲੇਸ਼ਣ ਕਰੋ ਅਤੇ ਸਮਝਦਾਰੀ ਨਾਲ ਨਿਵੇਸ਼ ਕਰੋ!

ਇਹ ਯਕੀਨੀ ਬਣਾਉਣ ਲਈ ਸਾਰੇ ਯਤਨ ਕੀਤੇ ਗਏ ਹਨ ਕਿ ਇੱਥੇ ਦਿੱਤੀ ਗਈ ਜਾਣਕਾਰੀ ਸਹੀ ਹੈ। ਹਾਲਾਂਕਿ, ਡੇਟਾ ਦੀ ਸ਼ੁੱਧਤਾ ਬਾਰੇ ਕੋਈ ਗਾਰੰਟੀ ਨਹੀਂ ਦਿੱਤੀ ਗਈ ਹੈ। ਕਿਰਪਾ ਕਰਕੇ ਕੋਈ ਵੀ ਨਿਵੇਸ਼ ਕਰਨ ਤੋਂ ਪਹਿਲਾਂ ਸਕੀਮ ਜਾਣਕਾਰੀ ਦਸਤਾਵੇਜ਼ ਨਾਲ ਤਸਦੀਕ ਕਰੋ।

Great Read. Clarified my doubts.