Best Gold Mutual Funds in India 2026 – Returns, SIP & Tax

Gold has always been one of the most trusted assets for Indian households — whether in the form of jewellery, coins, or bars. But over the last few years, gold has evolved from a traditional store of value into an important financial asset class.

With gold prices trading near record highs in 2025 and 2026, investors are actively searching for safe, systematic and hassle-free ways to invest in gold — without the risks of physical storage or large lump-sum investments.

This is where Gold Mutual Funds have gained massive popularity. Let’s explore what are gold funds, how taxation works, the top-performing funds in India, and many more insights.

What Are Gold Mutual Funds?

Gold mutual funds are open-ended mutual fund schemes that invest primarily in Gold Exchange Traded Fund (Gold ETFs). These ETFs, in turn, hold physical gold bullion of 99.5% purity, as per SEBI regulations.

When you invest in a gold mutual fund, your money is not kept in cash. The fund uses your investment to Buy Gold through Gold ETFs, which hold actual physical gold on behalf of investors.

So even though you don’t own gold coins or bars yourself, your investment value still moves exactly in line with gold prices. This structure allows investors to benefit from gold price movements without owning physical gold.

Why Gold Funds Are Gaining Popularity?

India has a strong emotional and cultural connection with gold, but modern investors are increasingly shifting from physical gold to financial gold due to the following advantages:

- SIP investment starts from as low as ₹100

- No storage or locker costs

- No purity or making-charge concerns

- No Demat account required

- Easy liquidity through fund houses

- Transparent pricing linked to daily gold rates

- Suitable for long-term Portfolio diversification

For retail investors, gold mutual funds are among the most cost-efficient ways to invest in gold.

Talk to our investment specialist

How Do Gold Mutual Funds Work?

- The fund house collects money from investors

- The corpus is invested in Gold ETFs

- gold ETF prices track domestic gold prices

- NAV of the gold fund moves in line with gold prices

Unlike jewellery or coins, investors pay:

- No making charges

- No storage fees

- No resale deductions

Returns purely depend on gold price movement.

Taxation on Gold Mutual Funds

Gold Mutual Funds are taxed as non-Equity Funds, meaning their tax rules differ from equity mutual funds:

Short-Term Capital Gains (STCG): If redeemed within 36 months, gains are taxed as per your income tax slab.

Long-Term Capital Gains (LTCG): If held for more than 36 months, gains are taxed at a flat 20% with indexation benefit (updated as per the Finance Act, 2024).

This makes gold funds particularly attractive for long-term investors, as indexation significantly reduces tax liability compared to physical gold.Taxation on Gold Mutual Funds & Gold ETFs (Updated for 2026)

Gold mutual funds and gold ETFs are taxed differently based on their holding period and structure.

Gold ETFs (Listed)

- If held for 12 months or less, gains are taxed as short-term capital gains at the investor’s income tax slab rate.

- If held for more than 12 months, gains are taxed as long-term capital gains at 12.5%, without indexation benefit.

Gold Mutual Funds (Fund of Fund)

- If held for 24 months or less, gains are treated as short-term capital gains and taxed as per slab rate.

- If held for more than 24 months, gains are taxed as long-term capital gains at 12.5%, without indexation.

These tax rules are applicable as per current capital gains provisions and may change in future budgets.

Fund Selection Methodology used to find 8 funds

Top Performing Gold Funds to Invest in India (2026)

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹43.8818

↓ -0.02 ₹10,775 23.5 50.1 72.6 37.3 24.9 71.5 IDBI Gold Fund Growth ₹38.9617

↑ 0.15 ₹623 23.5 49.3 71.5 37.1 24.6 79 ICICI Prudential Regular Gold Savings Fund Growth ₹46.4349

↑ 0.04 ₹4,482 23.6 50.1 72.9 37 24.8 72 Aditya Birla Sun Life Gold Fund Growth ₹43.5454

↓ -0.16 ₹1,266 23.6 50 72.9 37 24.7 72 Nippon India Gold Savings Fund Growth ₹57.4018

↑ 0.03 ₹5,301 23.4 50.3 72.5 37 24.8 71.2 HDFC Gold Fund Growth ₹44.7704

↓ -0.07 ₹8,501 23.3 49.8 72.2 37 24.7 71.3 Axis Gold Fund Growth ₹43.6124

↑ 0.06 ₹2,167 24 50 71.5 36.9 24.9 69.8 Kotak Gold Fund Growth ₹57.5909

↓ -0.07 ₹5,213 23.5 50 72.2 36.8 24.6 70.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 8 Funds showcased

Commentary SBI Gold Fund IDBI Gold Fund ICICI Prudential Regular Gold Savings Fund Aditya Birla Sun Life Gold Fund Nippon India Gold Savings Fund HDFC Gold Fund Axis Gold Fund Kotak Gold Fund Point 1 Highest AUM (₹10,775 Cr). Bottom quartile AUM (₹623 Cr). Lower mid AUM (₹4,482 Cr). Bottom quartile AUM (₹1,266 Cr). Upper mid AUM (₹5,301 Cr). Top quartile AUM (₹8,501 Cr). Lower mid AUM (₹2,167 Cr). Upper mid AUM (₹5,213 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Rating: 2★ (top quartile). Not Rated. Rating: 1★ (upper mid). Top rated. Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 24.92% (top quartile). 5Y return: 24.59% (bottom quartile). 5Y return: 24.83% (upper mid). 5Y return: 24.70% (lower mid). 5Y return: 24.75% (upper mid). 5Y return: 24.70% (lower mid). 5Y return: 24.86% (top quartile). 5Y return: 24.62% (bottom quartile). Point 6 3Y return: 37.31% (top quartile). 3Y return: 37.07% (top quartile). 3Y return: 37.03% (upper mid). 3Y return: 37.01% (upper mid). 3Y return: 37.00% (lower mid). 3Y return: 36.99% (lower mid). 3Y return: 36.93% (bottom quartile). 3Y return: 36.78% (bottom quartile). Point 7 1Y return: 72.57% (upper mid). 1Y return: 71.46% (bottom quartile). 1Y return: 72.86% (top quartile). 1Y return: 72.94% (top quartile). 1Y return: 72.47% (upper mid). 1Y return: 72.18% (lower mid). 1Y return: 71.46% (bottom quartile). 1Y return: 72.22% (lower mid). Point 8 1M return: 5.66% (lower mid). 1M return: 5.47% (bottom quartile). 1M return: 5.74% (upper mid). 1M return: 5.58% (lower mid). 1M return: 5.76% (top quartile). 1M return: 5.56% (bottom quartile). 1M return: 5.72% (upper mid). 1M return: 5.98% (top quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 4.38 (lower mid). Sharpe: 4.30 (bottom quartile). Sharpe: 4.33 (bottom quartile). Sharpe: 4.49 (top quartile). Sharpe: 4.46 (upper mid). Sharpe: 4.39 (upper mid). Sharpe: 4.36 (lower mid). Sharpe: 4.63 (top quartile). SBI Gold Fund

IDBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

Aditya Birla Sun Life Gold Fund

Nippon India Gold Savings Fund

HDFC Gold Fund

Axis Gold Fund

Kotak Gold Fund

All the funds mentioned above are ideal, we are giving you detailed analysis of 5 funds.

The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). Research Highlights for SBI Gold Fund Below is the key information for SBI Gold Fund Returns up to 1 year are on The investment objective of the Scheme will be to generate returns that correspond closely to the returns generated by IDBI Gold Exchange Traded Fund (IDBI GOLD ETF). Research Highlights for IDBI Gold Fund Below is the key information for IDBI Gold Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Gold Savings Fund Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Research Highlights for Aditya Birla Sun Life Gold Fund Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Research Highlights for Nippon India Gold Savings Fund Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on 1. SBI Gold Fund

SBI Gold Fund

Growth Launch Date 12 Sep 11 NAV (18 Feb 26) ₹43.8818 ↓ -0.02 (-0.04 %) Net Assets (Cr) ₹10,775 on 31 Dec 25 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.3 Sharpe Ratio 4.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,629 31 Jan 23 ₹11,359 31 Jan 24 ₹12,462 31 Jan 25 ₹16,115 31 Jan 26 ₹30,818 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.7% 3 Month 23.5% 6 Month 50.1% 1 Year 72.6% 3 Year 37.3% 5 Year 24.9% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.5% 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% Fund Manager information for SBI Gold Fund

Name Since Tenure Raviprakash Sharma 12 Sep 11 14.4 Yr. Data below for SBI Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.93% Other 98.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹14,966 Cr 1,097,211,666

↑ 145,868,881 Treps

CBLO/Reverse Repo | -2% ₹306 Cr Net Receivable / Payable

CBLO | -2% -₹248 Cr 2. IDBI Gold Fund

IDBI Gold Fund

Growth Launch Date 14 Aug 12 NAV (18 Feb 26) ₹38.9617 ↑ 0.15 (0.38 %) Net Assets (Cr) ₹623 on 31 Dec 25 Category Gold - Gold AMC IDBI Asset Management Limited Rating Risk Moderately High Expense Ratio 0.64 Sharpe Ratio 4.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,393 31 Jan 24 ₹12,454 31 Jan 25 ₹16,090 31 Jan 26 ₹31,809 Returns for IDBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.5% 3 Month 23.5% 6 Month 49.3% 1 Year 71.5% 3 Year 37.1% 5 Year 24.6% 10 Year 15 Year Since launch 10.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 18.7% 2022 14.8% 2021 12% 2020 -4% 2019 24.2% 2018 21.6% 2017 5.8% 2016 1.4% 2015 8.3% Fund Manager information for IDBI Gold Fund

Name Since Tenure Sumit Bhatnagar 1 Jun 24 1.67 Yr. Data below for IDBI Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 2% Other 98% Top Securities Holdings / Portfolio

Name Holding Value Quantity LIC MF Gold ETF

- | -99% ₹803 Cr 537,952

↑ 44,100 Treps

CBLO/Reverse Repo | -2% ₹16 Cr Net Receivables / (Payables)

Net Current Assets | -1% -₹11 Cr 3. ICICI Prudential Regular Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (18 Feb 26) ₹46.4349 ↑ 0.04 (0.08 %) Net Assets (Cr) ₹4,482 on 31 Dec 25 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.38 Sharpe Ratio 4.33 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,361 31 Jan 24 ₹12,399 31 Jan 25 ₹16,060 31 Jan 26 ₹31,216 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.7% 3 Month 23.6% 6 Month 50.1% 1 Year 72.9% 3 Year 37% 5 Year 24.8% 10 Year 15 Year Since launch 11.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 13.36 Yr. Nishit Patel 29 Dec 20 5.1 Yr. Ashwini Bharucha 1 Nov 25 0.25 Yr. Venus Ahuja 1 Nov 25 0.25 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 2.73% Other 97.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -99% ₹6,265 Cr 448,751,665

↑ 56,893,421 Treps

CBLO/Reverse Repo | -3% ₹174 Cr Net Current Assets

Net Current Assets | -2% -₹101 Cr 4. Aditya Birla Sun Life Gold Fund

Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (18 Feb 26) ₹43.5454 ↓ -0.16 (-0.37 %) Net Assets (Cr) ₹1,266 on 31 Dec 25 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 4.49 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,602 31 Jan 23 ₹11,314 31 Jan 24 ₹12,322 31 Jan 25 ₹15,883 31 Jan 26 ₹31,280 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.6% 3 Month 23.6% 6 Month 50% 1 Year 72.9% 3 Year 37% 5 Year 24.7% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 1.09 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 2.07% Other 97.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -99% ₹1,770 Cr 122,558,766

↑ 14,664,583 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -3% ₹45 Cr Net Receivables / (Payables)

Net Current Assets | -2% -₹34 Cr 5. Nippon India Gold Savings Fund

Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (18 Feb 26) ₹57.4018 ↑ 0.03 (0.05 %) Net Assets (Cr) ₹5,301 on 31 Dec 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.35 Sharpe Ratio 4.46 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,635 31 Jan 23 ₹11,321 31 Jan 24 ₹12,369 31 Jan 25 ₹15,957 31 Jan 26 ₹31,222 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 5.8% 3 Month 23.4% 6 Month 50.3% 1 Year 72.5% 3 Year 37% 5 Year 24.8% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.2% 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 2.11 Yr. Data below for Nippon India Gold Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.5% Other 98.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -100% ₹7,154 Cr 527,059,679

↑ 44,753,946 Triparty Repo

CBLO/Reverse Repo | -1% ₹36 Cr Net Current Assets

Net Current Assets | -0% -₹29 Cr Cash Margin - Ccil

CBLO/Reverse Repo | -0% ₹0 Cr Cash

Net Current Assets | -0% ₹0 Cr 00

Gold at Record Highs – Is It Still Worth Investing?

In 2025 and 2026, gold prices in India have remained close to all-time highs, supported by:

- Persistent global inflation

- Central Bank gold accumulation

- Geopolitical tensions

- Weakening rupee

- High global debt levels

- Equity market Volatility

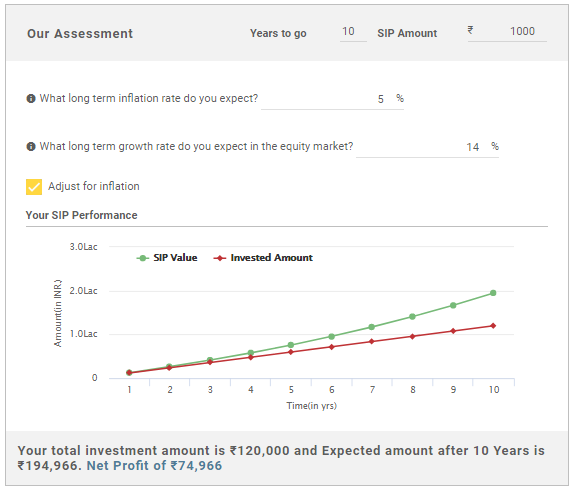

While Investing a lump sum at peak levels carries short-term risk, gold mutual funds offer a more disciplined approach through Systematic Investment plan (SIPs). SIP investing helps:

- Average purchase cost over time

- Reduce timing risk

- Remove emotional decision-making

This makes gold mutual funds one of the most practical investment options even when gold prices are elevated.

Top 4 Benefits of Gold Investments

1. Hedge Against Inflation

Gold maintains purchasing power when inflation rises, unlike cash or fixed deposits that lose value.

2. Liquidity

Gold funds can be redeemed quickly through Mutual Fund Houses, making them far more liquid than jewellery or coins.

3. Diversification

Gold prices move differently from stocks and Bonds. In times of equity market stress, gold often provides stability, making it a risk-balancing tool in portfolios.

4. Timeless Asset

Gold has held value for centuries. While returns may not always be explosive, they are steady, making it a safe-haven asset during crises (e.g., COVID-19, 2008 Global Financial Crisis).

Gold Mutual Fund vs Gold ETF – Which Is Better?

| Basis | Gold Mutual Fund | Gold ETF |

|---|---|---|

| Demat account | Not required | Required |

| Minimum investment | ₹100 SIP | Market price |

| Expense ratio | Slightly higher | Lower |

| Ease of investing | Very easy | Moderate |

| Suitable for | Beginners | Experienced investors |

Who Should Invest in Gold Mutual Funds?

Gold mutual funds are ideal for:

- Investors without a Demat account.

- Those who want to start with small amounts (SIP from ₹100).

- People looking for diversification against market volatility.

- Investors seeking a long-term hedge against inflation.

They are not meant for overnight profits, but for long-term portfolio balance.

Risks of Investing in Gold Mutual Funds

Despite being considered safe, investors must understand:

- Short-term price volatility

- No regular income or dividends

- Returns fully depend on gold prices

- Not ideal for short-term goals

Gold works best as portfolio insurance, not as a growth engine.

How Invest in Gold Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Gold mutual funds are one of the most effective ways for Indians to invest in gold without storage hassles or large capital requirements. With SIPs starting from ₹100, professional management, and long-term inflation-hedging benefits, they’re a must-have in a diversified portfolio. With global uncertainty and rising inflation, allocating a portion of your wealth to gold funds can provide safety, stability, and steady returns.

FAQs

1. What should I look for while investing in gold mutual funds?

A: Compare 3-year CAGR, expense ratio, fund manager reputation, and AUM size before investing.

2. Are gold funds better than physical gold?

A: Yes — because they are liquid, cost-efficient, and transparent. No making charges or purity concerns.

3. How much should I allocate to gold funds?

A: Financial planners recommend 5–15% of portfolio allocation to gold.

4. Are gold mutual funds safe?

A: They carry market risks, but as a long-term hedge, they are safer and more stable than many other asset classes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Really a useful knowledge. for investment decision.espically for gold and global fund investments.

Very informative.

Which gold investment fund will be good for me pls suggest for 1- 1.3 years