Best Mutual Funds in India for SIP 2026 – 2027

A Systematic Investment plan (SIP) is considered to be the most efficient way to invest in Mutual Funds, especially for the long-term plan. It permits investors to purchase a unit on a particular date every month in order to implement a long-term savings plan. One of the reasons why investors feel comfortable towards Investing in SIP is the flexibility they offer. Investors can invest in SIP on either monthly, quarterly or weekly basis, as per their convenience. Let’s learn more about how one can achieve their Financial goals with systematic investment plans, how sip calculator is helpful in investment, along with best mutual funds in India for SIP.

SIP- Optimal Way to Achieve Financial Goals

SIP is designed in a way that one can easily pre-plan their investments and invest according to their financial goals. But, one has to invest for a long-time to achieve goals via SIP. Generally, SIP is widely used for planning goals like-

Talk to our investment specialist

- Buying a car

- Buying a house

- Marriage

- Child’s education

- Save for an international trip

- retirement

- Medical emergencies etc.

One can start investing in SIPs with an amount as minimum as INR 500 and INR 1000. Once you begin investing in SIP your money start going each day as it is exposed to the stock market. That is why SIPs as a route is mostly preferred in Equity Funds. Moreover, historically, investment in equity stocks has given impressive returns amongst all the other asset classes, if the investment was done with discipline and with a long-term horizon.

SIP in equity helps to avoid the risk of timing the market and facilitate wealth creation by averaging the cost of investment. Let’s look at some more Benefits of SIP that helps in achieving long-term goals:

Power of Compounding- Simple interest is when you gain interest on only the principal. In the case of compound interest, the interest amount is added to the principal, and interest is calculated on the new principal (old principal plus gains). This process continues every time. Since SIP in Mutual Funds are in instalments, they are compounded, which adds more to the initially invested sum.

Risk reduction- Given that a SIP is spread over a long period of time, one catches all periods of the stock market, the ups and more importantly the downturns. In downturns, when fear catches most investors, SIP instalments continue ensuring the investors buy “low”.

Convenience of SIPs- Convenience is one of the biggest benefits of a SIP. A user has to sign-up one-time and go through documentation. Once done, thereafter debits for subsequent investments take place automatically and the investor just has to monitor the investments.

Best Mutual Funds in India for SIP 2026 - 2027

Fund Selection Methodology used to find 5 funds

Best Large Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹88.6966

↑ 1.05 ₹50,107 100 -4.6 -3.2 11.4 17.8 16 9.2 ICICI Prudential Bluechip Fund Growth ₹108.2

↑ 1.22 ₹76,646 100 -5.4 -2.1 10.8 17 14.2 11.3 DSP TOP 100 Equity Growth ₹457.699

↑ 6.46 ₹7,163 500 -5.4 -3 7.2 16.7 12.1 8.4 Bandhan Large Cap Fund Growth ₹75.42

↑ 0.87 ₹1,980 100 -4.6 -2.2 12.2 16.5 12 8.2 Invesco India Largecap Fund Growth ₹66.61

↑ 1.15 ₹1,666 100 -5 -4.9 10.9 16.3 12.7 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹7,163 Cr). Bottom quartile AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.98% (top quartile). 5Y return: 14.20% (upper mid). 5Y return: 12.14% (bottom quartile). 5Y return: 12.03% (bottom quartile). 5Y return: 12.67% (lower mid). Point 6 3Y return: 17.79% (top quartile). 3Y return: 17.03% (upper mid). 3Y return: 16.73% (lower mid). 3Y return: 16.45% (bottom quartile). 3Y return: 16.31% (bottom quartile). Point 7 1Y return: 11.35% (upper mid). 1Y return: 10.84% (bottom quartile). 1Y return: 7.23% (bottom quartile). 1Y return: 12.24% (top quartile). 1Y return: 10.89% (lower mid). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (bottom quartile). Alpha: 0.90 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.64 (bottom quartile). Information ratio: 0.69 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

Best Multi Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.19

↑ 0.57 ₹1,051 1,000 1.5 1.6 17.9 21 14.4 3.5 HDFC Equity Fund Growth ₹1,974.26

↑ 27.29 ₹97,452 300 -3.9 -1.8 12.4 20.5 18.7 11.4 Nippon India Multi Cap Fund Growth ₹287.104

↑ 4.17 ₹48,809 100 -3.6 -5.1 11.9 20.4 19.6 4.1 Mahindra Badhat Yojana Growth ₹34.5998

↑ 0.48 ₹6,046 500 -1.7 -1.8 15.7 19.5 16.9 3.4 Motilal Oswal Multicap 35 Fund Growth ₹54.3606

↑ 0.34 ₹13,180 500 -9.3 -13.6 1.4 19.4 10.7 -5.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Manufacturing Equity Fund HDFC Equity Fund Nippon India Multi Cap Fund Mahindra Badhat Yojana Motilal Oswal Multicap 35 Fund Point 1 Bottom quartile AUM (₹1,051 Cr). Highest AUM (₹97,452 Cr). Upper mid AUM (₹48,809 Cr). Bottom quartile AUM (₹6,046 Cr). Lower mid AUM (₹13,180 Cr). Point 2 Established history (11+ yrs). Oldest track record among peers (31 yrs). Established history (20+ yrs). Established history (8+ yrs). Established history (11+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Not Rated. Top rated. Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.37% (bottom quartile). 5Y return: 18.73% (upper mid). 5Y return: 19.58% (top quartile). 5Y return: 16.93% (lower mid). 5Y return: 10.74% (bottom quartile). Point 6 3Y return: 21.01% (top quartile). 3Y return: 20.54% (upper mid). 3Y return: 20.36% (lower mid). 3Y return: 19.48% (bottom quartile). 3Y return: 19.45% (bottom quartile). Point 7 1Y return: 17.86% (top quartile). 1Y return: 12.37% (lower mid). 1Y return: 11.89% (bottom quartile). 1Y return: 15.70% (upper mid). 1Y return: 1.44% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 4.79 (top quartile). Alpha: -0.46 (bottom quartile). Alpha: 2.62 (upper mid). Alpha: -5.98 (bottom quartile). Point 9 Sharpe: 0.12 (lower mid). Sharpe: 0.67 (top quartile). Sharpe: 0.09 (bottom quartile). Sharpe: 0.29 (upper mid). Sharpe: -0.19 (bottom quartile). Point 10 Information ratio: 0.00 (bottom quartile). Information ratio: 1.25 (top quartile). Information ratio: 0.49 (lower mid). Information ratio: 0.45 (bottom quartile). Information ratio: 0.56 (upper mid). Aditya Birla Sun Life Manufacturing Equity Fund

HDFC Equity Fund

Nippon India Multi Cap Fund

Mahindra Badhat Yojana

Motilal Oswal Multicap 35 Fund

Best Mid Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹310.45

↑ 3.47 ₹6,969 100 2.2 3.9 26.4 24.6 18.9 11.1 TATA Mid Cap Growth Fund Growth ₹428.528

↑ 5.17 ₹5,356 150 -2.7 -0.9 16.2 20.7 16.5 5.8 BNP Paribas Mid Cap Fund Growth ₹102.107

↑ 1.42 ₹2,282 300 -0.6 0.8 15.7 20.2 16.4 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹746.88

↑ 9.83 ₹6,041 1,000 -4.9 -5.4 11 18.5 15.8 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹6,969 Cr). Lower mid AUM (₹5,356 Cr). Bottom quartile AUM (₹2,282 Cr). Upper mid AUM (₹6,041 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 18.94% (top quartile). 5Y return: 16.54% (upper mid). 5Y return: 16.41% (lower mid). 5Y return: 15.79% (bottom quartile). Point 6 3Y return: 24.64% (top quartile). 3Y return: 20.67% (upper mid). 3Y return: 20.20% (lower mid). 3Y return: 18.55% (bottom quartile). Point 7 1Y return: 26.37% (top quartile). 1Y return: 16.22% (upper mid). 1Y return: 15.73% (lower mid). 1Y return: 10.98% (bottom quartile). Point 8 Alpha: 5.44 (top quartile). Alpha: -0.44 (lower mid). Alpha: -0.33 (upper mid). Alpha: -1.26 (bottom quartile). Point 9 Sharpe: 0.53 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.21 (upper mid). Sharpe: 0.16 (bottom quartile). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.44 (upper mid). Information ratio: -0.77 (bottom quartile). Information ratio: -0.74 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

Best Small Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹157.109

↑ 2.58 ₹65,812 100 -3.9 -7.4 9.2 19.2 21.2 -4.7 DSP Small Cap Fund Growth ₹185.396

↑ 3.13 ₹16,135 500 -3.8 -6.6 13.5 18.3 18 -2.8 Sundaram Small Cap Fund Growth ₹242.195

↑ 4.93 ₹3,285 100 -5.4 -6.7 12.5 17.9 17.5 0.4 Franklin India Smaller Companies Fund Growth ₹154.809

↑ 2.48 ₹12,764 500 -4.7 -9.1 5.9 16.8 17.5 -8.4 Aditya Birla Sun Life Small Cap Fund Growth ₹80.871

↑ 1.26 ₹4,778 1,000 -3.4 -5.2 12.6 16.7 13.1 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund Aditya Birla Sun Life Small Cap Fund Point 1 Highest AUM (₹65,812 Cr). Upper mid AUM (₹16,135 Cr). Bottom quartile AUM (₹3,285 Cr). Lower mid AUM (₹12,764 Cr). Bottom quartile AUM (₹4,778 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (18+ yrs). Point 3 Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 4★ (bottom quartile). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 21.16% (top quartile). 5Y return: 18.02% (upper mid). 5Y return: 17.47% (bottom quartile). 5Y return: 17.49% (lower mid). 5Y return: 13.13% (bottom quartile). Point 6 3Y return: 19.18% (top quartile). 3Y return: 18.26% (upper mid). 3Y return: 17.88% (lower mid). 3Y return: 16.75% (bottom quartile). 3Y return: 16.75% (bottom quartile). Point 7 1Y return: 9.17% (bottom quartile). 1Y return: 13.47% (top quartile). 1Y return: 12.52% (lower mid). 1Y return: 5.89% (bottom quartile). 1Y return: 12.63% (upper mid). Point 8 Alpha: -0.64 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.29 (top quartile). Alpha: -4.41 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.01 (upper mid). Sharpe: -0.38 (bottom quartile). Sharpe: 0.01 (top quartile). Point 10 Information ratio: 0.02 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.17 (bottom quartile). Information ratio: -0.19 (bottom quartile). Information ratio: 0.00 (lower mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

Aditya Birla Sun Life Small Cap Fund

Best ELSS (Tax Saving Mutual Funds) for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹425.449

↑ 5.32 ₹31,862 500 -4.2 -2.5 7.9 21.9 17.7 6.6 Motilal Oswal Long Term Equity Fund Growth ₹47.9188

↑ 0.67 ₹4,188 500 -2.6 -7.6 13.5 21.3 16.2 -9.1 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 HDFC Tax Saver Fund Growth ₹1,363.93

↑ 19.12 ₹16,749 500 -5.6 -4.1 9.7 19.3 17.8 10.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund IDBI Equity Advantage Fund HDFC Long Term Advantage Fund HDFC Tax Saver Fund Point 1 Highest AUM (₹31,862 Cr). Lower mid AUM (₹4,188 Cr). Bottom quartile AUM (₹485 Cr). Bottom quartile AUM (₹1,318 Cr). Upper mid AUM (₹16,749 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Established history (12+ yrs). Established history (25+ yrs). Oldest track record among peers (29 yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Top rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.73% (upper mid). 5Y return: 16.16% (bottom quartile). 5Y return: 9.97% (bottom quartile). 5Y return: 17.39% (lower mid). 5Y return: 17.83% (top quartile). Point 6 3Y return: 21.87% (top quartile). 3Y return: 21.30% (upper mid). 3Y return: 20.84% (lower mid). 3Y return: 20.64% (bottom quartile). 3Y return: 19.33% (bottom quartile). Point 7 1Y return: 7.94% (bottom quartile). 1Y return: 13.50% (lower mid). 1Y return: 16.92% (upper mid). 1Y return: 35.51% (top quartile). 1Y return: 9.75% (bottom quartile). Point 8 Alpha: -0.63 (bottom quartile). Alpha: -5.20 (bottom quartile). Alpha: 1.78 (upper mid). Alpha: 1.75 (lower mid). Alpha: 2.37 (top quartile). Point 9 Sharpe: 0.13 (bottom quartile). Sharpe: -0.04 (bottom quartile). Sharpe: 1.21 (upper mid). Sharpe: 2.27 (top quartile). Sharpe: 0.41 (lower mid). Point 10 Information ratio: 1.85 (top quartile). Information ratio: 0.49 (lower mid). Information ratio: -1.13 (bottom quartile). Information ratio: -0.15 (bottom quartile). Information ratio: 1.20 (upper mid). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

IDBI Equity Advantage Fund

HDFC Long Term Advantage Fund

HDFC Tax Saver Fund

Best Sector Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹35.3611

↑ 0.36 ₹5,980 500 8.2 13.2 27.9 31.7 26.4 11.3 DSP Natural Resources and New Energy Fund Growth ₹105.262

↓ -2.00 ₹1,765 500 11.7 16.6 27.7 22.5 20.2 17.5 Invesco India PSU Equity Fund Growth ₹66.35

↑ 0.92 ₹1,492 500 4.2 7.6 26.4 29.8 24.4 10.3 Invesco India Financial Services Fund Growth ₹141.23

↑ 3.34 ₹1,628 100 -1.4 4.6 23.3 21.4 14.6 15.1 UTI Transportation & Logistics Fund Growth ₹275.939

↑ 5.74 ₹3,906 500 -4.9 -5.4 23 23.4 17.6 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI PSU Fund DSP Natural Resources and New Energy Fund Invesco India PSU Equity Fund Invesco India Financial Services Fund UTI Transportation & Logistics Fund Point 1 Highest AUM (₹5,980 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹1,492 Cr). Bottom quartile AUM (₹1,628 Cr). Upper mid AUM (₹3,906 Cr). Point 2 Established history (15+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (17+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 26.35% (top quartile). 5Y return: 20.19% (lower mid). 5Y return: 24.41% (upper mid). 5Y return: 14.55% (bottom quartile). 5Y return: 17.64% (bottom quartile). Point 6 3Y return: 31.74% (top quartile). 3Y return: 22.48% (bottom quartile). 3Y return: 29.76% (upper mid). 3Y return: 21.45% (bottom quartile). 3Y return: 23.35% (lower mid). Point 7 1Y return: 27.92% (top quartile). 1Y return: 27.74% (upper mid). 1Y return: 26.36% (lower mid). 1Y return: 23.31% (bottom quartile). 1Y return: 22.99% (bottom quartile). Point 8 Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 1.75 (top quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 0.63 (bottom quartile). Sharpe: 1.32 (top quartile). Sharpe: 0.53 (bottom quartile). Sharpe: 1.06 (upper mid). Sharpe: 0.69 (lower mid). Point 10 Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.50 (bottom quartile). Information ratio: 0.96 (top quartile). Information ratio: 0.00 (lower mid). SBI PSU Fund

DSP Natural Resources and New Energy Fund

Invesco India PSU Equity Fund

Invesco India Financial Services Fund

UTI Transportation & Logistics Fund

Best Focused Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹90.6

↑ 1.12 ₹14,935 100 -5.8 -2.7 15.6 21.5 17.4 15.4 HDFC Focused 30 Fund Growth ₹227.453

↑ 3.46 ₹26,332 300 -3.8 -2.5 11.4 20 20 10.9 SBI Focused Equity Fund Growth ₹358.906

↓ -4.76 ₹42,998 500 -4.7 0.5 14.7 17.9 13.5 15.7 DSP Focus Fund Growth ₹52.056

↑ 0.52 ₹2,611 500 -6.7 -3.8 6.9 17.5 11.7 7.3 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Sundaram Select Focus Fund Point 1 Lower mid AUM (₹14,935 Cr). Upper mid AUM (₹26,332 Cr). Highest AUM (₹42,998 Cr). Bottom quartile AUM (₹2,611 Cr). Bottom quartile AUM (₹1,354 Cr). Point 2 Established history (16+ yrs). Established history (21+ yrs). Established history (21+ yrs). Established history (15+ yrs). Oldest track record among peers (23 yrs). Point 3 Rating: 2★ (bottom quartile). Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.35% (upper mid). 5Y return: 20.02% (top quartile). 5Y return: 13.49% (bottom quartile). 5Y return: 11.72% (bottom quartile). 5Y return: 17.29% (lower mid). Point 6 3Y return: 21.51% (top quartile). 3Y return: 20.00% (upper mid). 3Y return: 17.86% (lower mid). 3Y return: 17.49% (bottom quartile). 3Y return: 17.03% (bottom quartile). Point 7 1Y return: 15.58% (upper mid). 1Y return: 11.42% (bottom quartile). 1Y return: 14.73% (lower mid). 1Y return: 6.89% (bottom quartile). 1Y return: 24.49% (top quartile). Point 8 Alpha: 6.91 (top quartile). Alpha: 3.79 (lower mid). Alpha: 5.35 (upper mid). Alpha: 0.58 (bottom quartile). Alpha: -5.62 (bottom quartile). Point 9 Sharpe: 0.70 (upper mid). Sharpe: 0.60 (bottom quartile). Sharpe: 0.62 (lower mid). Sharpe: 0.23 (bottom quartile). Sharpe: 1.85 (top quartile). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.98 (upper mid). Information ratio: 0.42 (lower mid). Information ratio: 0.42 (bottom quartile). Information ratio: -0.52 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Sundaram Select Focus Fund

Best Value Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹218.783

↑ 3.09 ₹8,962 100 -4 -2.6 9.4 21.3 17.1 4.2 ICICI Prudential Value Discovery Fund Growth ₹469.48

↑ 4.35 ₹60,353 100 -5 -0.5 11.9 19.3 18.9 13.8 Aditya Birla Sun Life Pure Value Fund Growth ₹122.939

↑ 1.90 ₹6,246 1,000 -2.5 1 12.1 19.3 15.2 2.6 HDFC Capital Builder Value Fund Growth ₹727.431

↑ 9.23 ₹7,487 300 -4.3 -1.3 13.9 18.5 15 8.6 Tata Equity PE Fund Growth ₹341.746

↑ 5.48 ₹8,819 150 -3.8 -0.6 11.9 18.1 15.1 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund ICICI Prudential Value Discovery Fund Aditya Birla Sun Life Pure Value Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹8,962 Cr). Highest AUM (₹60,353 Cr). Bottom quartile AUM (₹6,246 Cr). Bottom quartile AUM (₹7,487 Cr). Lower mid AUM (₹8,819 Cr). Point 2 Established history (20+ yrs). Established history (21+ yrs). Established history (17+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.11% (upper mid). 5Y return: 18.86% (top quartile). 5Y return: 15.19% (lower mid). 5Y return: 15.02% (bottom quartile). 5Y return: 15.10% (bottom quartile). Point 6 3Y return: 21.26% (top quartile). 3Y return: 19.35% (upper mid). 3Y return: 19.30% (lower mid). 3Y return: 18.50% (bottom quartile). 3Y return: 18.13% (bottom quartile). Point 7 1Y return: 9.40% (bottom quartile). 1Y return: 11.86% (bottom quartile). 1Y return: 12.06% (upper mid). 1Y return: 13.90% (top quartile). 1Y return: 11.87% (lower mid). Point 8 Alpha: -0.62 (bottom quartile). Alpha: 3.44 (top quartile). Alpha: -1.64 (bottom quartile). Alpha: 2.68 (upper mid). Alpha: 0.27 (lower mid). Point 9 Sharpe: 0.15 (bottom quartile). Sharpe: 0.51 (top quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.39 (upper mid). Sharpe: 0.22 (lower mid). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.80 (bottom quartile). Information ratio: 0.57 (bottom quartile). Information ratio: 1.10 (upper mid). Information ratio: 0.89 (lower mid). Nippon India Value Fund

ICICI Prudential Value Discovery Fund

Aditya Birla Sun Life Pure Value Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

SIP Calculator

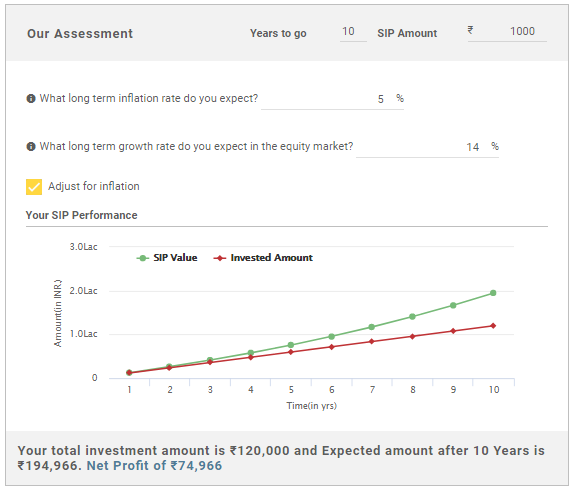

SIP calculator is one of the efficient tools an investor can use while investing in mutual funds. Whether one wants to invest to buy a car/house, plan for retirement, a child's higher education or any other asset, the SIP calculator can be used for the same. It helps to calculate the amount of investment and time period that is required for investing to reach the particular financial goal. So, common questions like "how much to invest in a SIP or how till that time should I invest", resolves using this calculator.

When using a SIP calculator, one has to fill certain variables, that include (illustration is given below)-

- The desired investment duration

- The estimated monthly SIP amount

- Expected inflation rate (annual) for the years to come

- Long-term growth rate on investments

Once you feed all the above-mentioned information, the calculator will end up giving you the amount you will receive (your SIP returns) after the number of years mentioned. Your net profit will be highlighted as well so that you can estimate your goal fulfilment accordingly.

How to Invest in Best Mutual Funds?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.