Best Mutual Funds in India for SIP 2026 – 2027

A Systematic Investment plan (SIP) is considered to be the most efficient way to invest in Mutual Funds, especially for the long-term plan. It permits investors to purchase a unit on a particular date every month in order to implement a long-term savings plan. One of the reasons why investors feel comfortable towards Investing in SIP is the flexibility they offer. Investors can invest in SIP on either monthly, quarterly or weekly basis, as per their convenience. Let’s learn more about how one can achieve their Financial goals with systematic investment plans, how sip calculator is helpful in investment, along with best mutual funds in India for SIP.

SIP- Optimal Way to Achieve Financial Goals

SIP is designed in a way that one can easily pre-plan their investments and invest according to their financial goals. But, one has to invest for a long-time to achieve goals via SIP. Generally, SIP is widely used for planning goals like-

Talk to our investment specialist

- Buying a car

- Buying a house

- Marriage

- Child’s education

- Save for an international trip

- retirement

- Medical emergencies etc.

One can start investing in SIPs with an amount as minimum as INR 500 and INR 1000. Once you begin investing in SIP your money start going each day as it is exposed to the stock market. That is why SIPs as a route is mostly preferred in Equity Funds. Moreover, historically, investment in equity stocks has given impressive returns amongst all the other asset classes, if the investment was done with discipline and with a long-term horizon.

SIP in equity helps to avoid the risk of timing the market and facilitate wealth creation by averaging the cost of investment. Let’s look at some more Benefits of SIP that helps in achieving long-term goals:

Power of Compounding- Simple interest is when you gain interest on only the principal. In the case of compound interest, the interest amount is added to the principal, and interest is calculated on the new principal (old principal plus gains). This process continues every time. Since SIP in Mutual Funds are in instalments, they are compounded, which adds more to the initially invested sum.

Risk reduction- Given that a SIP is spread over a long period of time, one catches all periods of the stock market, the ups and more importantly the downturns. In downturns, when fear catches most investors, SIP instalments continue ensuring the investors buy “low”.

Convenience of SIPs- Convenience is one of the biggest benefits of a SIP. A user has to sign-up one-time and go through documentation. Once done, thereafter debits for subsequent investments take place automatically and the investor just has to monitor the investments.

Best Mutual Funds in India for SIP 2026 - 2027

Fund Selection Methodology used to find 5 funds

Best Large Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹93.8953

↑ 0.49 ₹50,876 100 0.4 3.1 16.6 19.3 17.4 9.2 ICICI Prudential Bluechip Fund Growth ₹114.46

↑ 0.46 ₹78,502 100 -0.5 3.3 14.6 18.2 15.5 11.3 DSP TOP 100 Equity Growth ₹483.231

↑ 2.93 ₹7,285 500 -0.2 2.8 11.6 18 13.5 8.4 Bandhan Large Cap Fund Growth ₹79.957

↑ 0.37 ₹2,051 100 0.2 3.8 16.8 17.8 13.1 8.2 Invesco India Largecap Fund Growth ₹70.44

↑ 0.21 ₹1,718 100 -1.3 2.4 15.4 17.7 14 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹2,051 Cr). Bottom quartile AUM (₹1,718 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.39% (top quartile). 5Y return: 15.55% (upper mid). 5Y return: 13.50% (bottom quartile). 5Y return: 13.15% (bottom quartile). 5Y return: 13.96% (lower mid). Point 6 3Y return: 19.34% (top quartile). 3Y return: 18.21% (upper mid). 3Y return: 18.00% (lower mid). 3Y return: 17.77% (bottom quartile). 3Y return: 17.70% (bottom quartile). Point 7 1Y return: 16.58% (upper mid). 1Y return: 14.55% (bottom quartile). 1Y return: 11.61% (bottom quartile). 1Y return: 16.85% (top quartile). 1Y return: 15.40% (lower mid). Point 8 Alpha: -0.94 (upper mid). Alpha: 1.30 (top quartile). Alpha: -1.17 (lower mid). Alpha: -2.13 (bottom quartile). Alpha: -5.05 (bottom quartile). Point 9 Sharpe: 0.29 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.26 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.04 (bottom quartile). Point 10 Information ratio: 1.37 (top quartile). Information ratio: 1.26 (upper mid). Information ratio: 0.74 (lower mid). Information ratio: 0.72 (bottom quartile). Information ratio: 0.67 (bottom quartile). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

Best Multi Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,096.5

↑ 6.02 ₹96,295 300 1.1 4.8 17.4 22.3 20.2 11.4 Motilal Oswal Multicap 35 Fund Growth ₹58.5129

↓ -0.02 ₹13,862 500 -6.6 -4.5 7.4 22.2 13 -5.6 Nippon India Multi Cap Fund Growth ₹301.432

↑ 1.28 ₹50,352 100 -0.8 0.5 17.9 22.1 21.6 4.1 Mahindra Badhat Yojana Growth ₹36.2846

↑ 0.15 ₹6,133 500 -0.1 3.4 18.7 21.4 18.6 3.4 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.99

↑ 0.23 ₹1,099 1,000 1.9 7.4 21.8 21.3 15.3 3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Equity Fund Motilal Oswal Multicap 35 Fund Nippon India Multi Cap Fund Mahindra Badhat Yojana Aditya Birla Sun Life Manufacturing Equity Fund Point 1 Highest AUM (₹96,295 Cr). Lower mid AUM (₹13,862 Cr). Upper mid AUM (₹50,352 Cr). Bottom quartile AUM (₹6,133 Cr). Bottom quartile AUM (₹1,099 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (11+ yrs). Established history (20+ yrs). Established history (8+ yrs). Established history (11+ yrs). Point 3 Rating: 3★ (upper mid). Top rated. Rating: 2★ (lower mid). Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 20.17% (upper mid). 5Y return: 13.02% (bottom quartile). 5Y return: 21.55% (top quartile). 5Y return: 18.62% (lower mid). 5Y return: 15.29% (bottom quartile). Point 6 3Y return: 22.33% (top quartile). 3Y return: 22.15% (upper mid). 3Y return: 22.09% (lower mid). 3Y return: 21.36% (bottom quartile). 3Y return: 21.31% (bottom quartile). Point 7 1Y return: 17.44% (bottom quartile). 1Y return: 7.39% (bottom quartile). 1Y return: 17.87% (lower mid). 1Y return: 18.72% (upper mid). 1Y return: 21.83% (top quartile). Point 8 Alpha: 3.70 (top quartile). Alpha: -12.91 (bottom quartile). Alpha: -1.30 (lower mid). Alpha: -1.73 (bottom quartile). Alpha: 0.00 (upper mid). Point 9 Sharpe: 0.53 (top quartile). Sharpe: -0.51 (bottom quartile). Sharpe: -0.05 (lower mid). Sharpe: -0.07 (bottom quartile). Sharpe: -0.05 (upper mid). Point 10 Information ratio: 1.24 (top quartile). Information ratio: 0.54 (lower mid). Information ratio: 0.64 (upper mid). Information ratio: 0.17 (bottom quartile). Information ratio: 0.00 (bottom quartile). HDFC Equity Fund

Motilal Oswal Multicap 35 Fund

Nippon India Multi Cap Fund

Mahindra Badhat Yojana

Aditya Birla Sun Life Manufacturing Equity Fund

Best Mid Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹321.25

↑ 3.53 ₹7,132 100 2.9 8.1 29.4 25.3 20.6 11.1 TATA Mid Cap Growth Fund Growth ₹450.965

↑ 1.81 ₹5,497 150 0.6 5.4 21.2 22.6 18.4 5.8 BNP Paribas Mid Cap Fund Growth ₹106.439

↑ 0.83 ₹2,313 300 1.2 6.5 19.1 21.7 18.5 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹798.55

↑ 3.10 ₹6,301 1,000 -0.8 1.9 18.8 20.9 18.1 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹7,132 Cr). Lower mid AUM (₹5,497 Cr). Bottom quartile AUM (₹2,313 Cr). Upper mid AUM (₹6,301 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.64% (top quartile). 5Y return: 18.39% (lower mid). 5Y return: 18.48% (upper mid). 5Y return: 18.07% (bottom quartile). Point 6 3Y return: 25.32% (top quartile). 3Y return: 22.61% (upper mid). 3Y return: 21.65% (lower mid). 3Y return: 20.94% (bottom quartile). Point 7 1Y return: 29.36% (top quartile). 1Y return: 21.18% (upper mid). 1Y return: 19.06% (lower mid). 1Y return: 18.80% (bottom quartile). Point 8 Alpha: 4.76 (top quartile). Alpha: -0.26 (upper mid). Alpha: -3.59 (bottom quartile). Alpha: -1.66 (lower mid). Point 9 Sharpe: 0.33 (top quartile). Sharpe: 0.07 (upper mid). Sharpe: -0.14 (bottom quartile). Sharpe: -0.01 (lower mid). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.48 (upper mid). Information ratio: -0.91 (bottom quartile). Information ratio: -0.60 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

Best Small Cap Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹164.458

↑ 0.53 ₹68,287 100 -3.6 -1.7 14.3 21.2 23.6 -4.7 DSP Small Cap Fund Growth ₹196.515

↑ 0.84 ₹16,935 500 -0.8 1 20 20.6 20.5 -2.8 Sundaram Small Cap Fund Growth ₹259.069

↓ -0.24 ₹3,401 100 -2.3 2 20.8 20.5 20.2 0.4 Franklin India Smaller Companies Fund Growth ₹164.073

↑ 0.31 ₹13,238 500 -4.2 -2.6 11.3 19.4 19.8 -8.4 HDFC Small Cap Fund Growth ₹135.293

↑ 0.33 ₹37,753 300 -4.7 -3.8 15.5 18.8 20.8 -0.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund HDFC Small Cap Fund Point 1 Highest AUM (₹68,287 Cr). Lower mid AUM (₹16,935 Cr). Bottom quartile AUM (₹3,401 Cr). Bottom quartile AUM (₹13,238 Cr). Upper mid AUM (₹37,753 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.59% (top quartile). 5Y return: 20.47% (lower mid). 5Y return: 20.17% (bottom quartile). 5Y return: 19.83% (bottom quartile). 5Y return: 20.83% (upper mid). Point 6 3Y return: 21.19% (top quartile). 3Y return: 20.64% (upper mid). 3Y return: 20.53% (lower mid). 3Y return: 19.36% (bottom quartile). 3Y return: 18.83% (bottom quartile). Point 7 1Y return: 14.26% (bottom quartile). 1Y return: 20.03% (upper mid). 1Y return: 20.77% (top quartile). 1Y return: 11.27% (bottom quartile). 1Y return: 15.51% (lower mid). Point 8 Alpha: -1.23 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.98 (top quartile). Alpha: -5.23 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.42 (bottom quartile). Sharpe: -0.25 (lower mid). Sharpe: -0.16 (top quartile). Sharpe: -0.60 (bottom quartile). Sharpe: -0.23 (upper mid). Point 10 Information ratio: -0.02 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: -0.20 (bottom quartile). Information ratio: -0.26 (bottom quartile). Information ratio: 0.00 (upper mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

HDFC Small Cap Fund

Best ELSS (Tax Saving Mutual Funds) for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹451.682

↑ 2.46 ₹32,609 500 0.7 4.2 13.5 23.9 19.2 6.6 Motilal Oswal Long Term Equity Fund Growth ₹49.4264

↑ 0.29 ₹4,341 500 -7.5 -2.7 15.6 21.9 16.9 -9.1 HDFC Tax Saver Fund Growth ₹1,456.65

↑ 5.11 ₹17,163 500 -0.2 2.6 14.7 21.3 19.4 10.3 DSP Tax Saver Fund Growth ₹145.728

↑ 0.56 ₹17,609 500 1.5 6 16.4 20.9 17.1 7.5 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund DSP Tax Saver Fund IDBI Equity Advantage Fund Point 1 Highest AUM (₹32,609 Cr). Bottom quartile AUM (₹4,341 Cr). Lower mid AUM (₹17,163 Cr). Upper mid AUM (₹17,609 Cr). Bottom quartile AUM (₹485 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (19+ yrs). Established history (12+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.21% (upper mid). 5Y return: 16.94% (bottom quartile). 5Y return: 19.40% (top quartile). 5Y return: 17.06% (lower mid). 5Y return: 9.97% (bottom quartile). Point 6 3Y return: 23.90% (top quartile). 3Y return: 21.95% (upper mid). 3Y return: 21.34% (lower mid). 3Y return: 20.87% (bottom quartile). 3Y return: 20.84% (bottom quartile). Point 7 1Y return: 13.49% (bottom quartile). 1Y return: 15.59% (lower mid). 1Y return: 14.72% (bottom quartile). 1Y return: 16.45% (upper mid). 1Y return: 16.92% (top quartile). Point 8 Alpha: -0.86 (bottom quartile). Alpha: -16.15 (bottom quartile). Alpha: 2.58 (top quartile). Alpha: -0.15 (lower mid). Alpha: 1.78 (upper mid). Point 9 Sharpe: 0.10 (bottom quartile). Sharpe: -0.43 (bottom quartile). Sharpe: 0.41 (upper mid). Sharpe: 0.16 (lower mid). Sharpe: 1.21 (top quartile). Point 10 Information ratio: 1.95 (top quartile). Information ratio: 0.53 (bottom quartile). Information ratio: 1.27 (upper mid). Information ratio: 0.96 (lower mid). Information ratio: -1.13 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

DSP Tax Saver Fund

IDBI Equity Advantage Fund

Best Sector Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹106.79

↓ -0.56 ₹1,573 500 9.2 21.7 34.4 22.9 21.4 17.5 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 500 7.8 17.7 33.3 34.3 27.5 11.3 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 500 3.1 11.2 33.1 32.2 25.9 10.3 UTI Transportation & Logistics Fund Growth ₹295.897

↑ 0.66 ₹4,084 500 0.8 6.9 29 25.4 19.1 19.5 SBI Banking & Financial Services Fund Growth ₹46.82

↑ 0.28 ₹10,106 500 3.4 9.3 28.4 22.6 14.1 20.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund SBI PSU Fund Invesco India PSU Equity Fund UTI Transportation & Logistics Fund SBI Banking & Financial Services Fund Point 1 Bottom quartile AUM (₹1,573 Cr). Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹4,084 Cr). Highest AUM (₹10,106 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (10+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.39% (lower mid). 5Y return: 27.55% (top quartile). 5Y return: 25.92% (upper mid). 5Y return: 19.13% (bottom quartile). 5Y return: 14.11% (bottom quartile). Point 6 3Y return: 22.86% (bottom quartile). 3Y return: 34.34% (top quartile). 3Y return: 32.18% (upper mid). 3Y return: 25.42% (lower mid). 3Y return: 22.60% (bottom quartile). Point 7 1Y return: 34.36% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 33.14% (lower mid). 1Y return: 29.01% (bottom quartile). 1Y return: 28.43% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: -0.22 (bottom quartile). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 1.96 (top quartile). Point 9 Sharpe: 0.74 (lower mid). Sharpe: 0.33 (bottom quartile). Sharpe: 0.27 (bottom quartile). Sharpe: 0.90 (upper mid). Sharpe: 1.08 (top quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.47 (bottom quartile). Information ratio: -0.37 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.89 (top quartile). DSP Natural Resources and New Energy Fund

SBI PSU Fund

Invesco India PSU Equity Fund

UTI Transportation & Logistics Fund

SBI Banking & Financial Services Fund

Best Focused Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹97.41

↑ 0.05 ₹14,569 100 1.3 6 21.8 23.6 19 15.4 HDFC Focused 30 Fund Growth ₹242.704

↑ 0.83 ₹26,537 300 1.4 4.7 17.4 22 21.5 10.9 SBI Focused Equity Fund Growth ₹376.732

↑ 0.23 ₹43,173 500 0.2 8.5 18.1 19.4 14.6 15.7 DSP Focus Fund Growth ₹56.092

↑ 0.16 ₹2,687 500 0.3 5.2 15 19.2 13.5 7.3 Aditya Birla Sun Life Focused Equity Fund Growth ₹149.707

↑ 0.44 ₹8,209 1,000 1.8 7.3 17.2 17.9 13.9 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Aditya Birla Sun Life Focused Equity Fund Point 1 Lower mid AUM (₹14,569 Cr). Upper mid AUM (₹26,537 Cr). Highest AUM (₹43,173 Cr). Bottom quartile AUM (₹2,687 Cr). Bottom quartile AUM (₹8,209 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (15+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.03% (upper mid). 5Y return: 21.52% (top quartile). 5Y return: 14.61% (lower mid). 5Y return: 13.49% (bottom quartile). 5Y return: 13.91% (bottom quartile). Point 6 3Y return: 23.56% (top quartile). 3Y return: 22.03% (upper mid). 3Y return: 19.41% (lower mid). 3Y return: 19.21% (bottom quartile). 3Y return: 17.89% (bottom quartile). Point 7 1Y return: 21.82% (top quartile). 1Y return: 17.37% (lower mid). 1Y return: 18.11% (upper mid). 1Y return: 14.95% (bottom quartile). 1Y return: 17.15% (bottom quartile). Point 8 Alpha: 7.16 (upper mid). Alpha: 3.31 (lower mid). Alpha: 7.50 (top quartile). Alpha: -0.18 (bottom quartile). Alpha: 2.34 (bottom quartile). Point 9 Sharpe: 0.70 (upper mid). Sharpe: 0.52 (lower mid). Sharpe: 0.79 (top quartile). Sharpe: 0.15 (bottom quartile). Sharpe: 0.35 (bottom quartile). Point 10 Information ratio: 1.72 (top quartile). Information ratio: 0.99 (upper mid). Information ratio: 0.32 (bottom quartile). Information ratio: 0.52 (lower mid). Information ratio: 0.15 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Aditya Birla Sun Life Focused Equity Fund

Best Value Funds for SIP

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹232.309

↑ 0.64 ₹9,153 100 -0.9 4.5 14.9 23 18.9 4.2 Aditya Birla Sun Life Pure Value Fund Growth ₹128.721

↑ 0.56 ₹6,411 1,000 0.5 6.3 16.7 20.8 16.6 2.6 ICICI Prudential Value Discovery Fund Growth ₹492

↑ 1.61 ₹61,272 100 -0.2 4.8 15.3 20.7 20.2 13.8 HDFC Capital Builder Value Fund Growth ₹775.081

↑ 1.83 ₹7,652 300 0.5 5 18.8 20.3 16.6 8.6 Tata Equity PE Fund Growth ₹358.373

↑ 0.46 ₹9,061 150 -1 4.6 15.5 19.9 16.3 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund Aditya Birla Sun Life Pure Value Fund ICICI Prudential Value Discovery Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹9,153 Cr). Bottom quartile AUM (₹6,411 Cr). Highest AUM (₹61,272 Cr). Bottom quartile AUM (₹7,652 Cr). Lower mid AUM (₹9,061 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (21+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.86% (upper mid). 5Y return: 16.56% (bottom quartile). 5Y return: 20.19% (top quartile). 5Y return: 16.63% (lower mid). 5Y return: 16.29% (bottom quartile). Point 6 3Y return: 23.01% (top quartile). 3Y return: 20.82% (upper mid). 3Y return: 20.66% (lower mid). 3Y return: 20.33% (bottom quartile). 3Y return: 19.92% (bottom quartile). Point 7 1Y return: 14.85% (bottom quartile). 1Y return: 16.66% (upper mid). 1Y return: 15.33% (bottom quartile). 1Y return: 18.83% (top quartile). 1Y return: 15.52% (lower mid). Point 8 Alpha: -3.34 (lower mid). Alpha: -4.92 (bottom quartile). Alpha: 5.80 (top quartile). Alpha: 0.83 (upper mid). Alpha: -3.79 (bottom quartile). Point 9 Sharpe: -0.07 (lower mid). Sharpe: -0.08 (bottom quartile). Sharpe: 0.74 (top quartile). Sharpe: 0.23 (upper mid). Sharpe: -0.07 (bottom quartile). Point 10 Information ratio: 1.54 (top quartile). Information ratio: 0.58 (bottom quartile). Information ratio: 0.97 (lower mid). Information ratio: 1.10 (upper mid). Information ratio: 0.96 (bottom quartile). Nippon India Value Fund

Aditya Birla Sun Life Pure Value Fund

ICICI Prudential Value Discovery Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

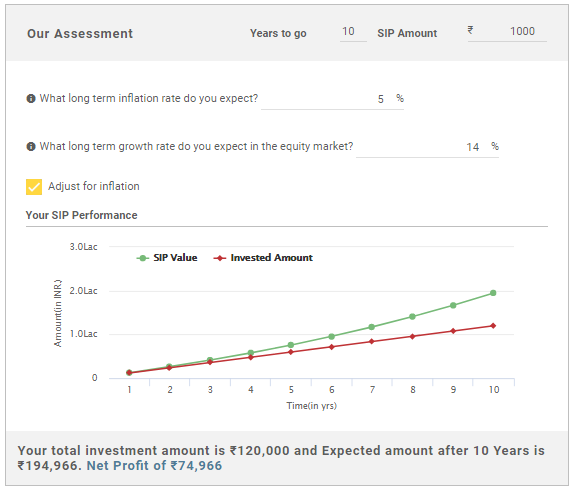

SIP Calculator

SIP calculator is one of the efficient tools an investor can use while investing in mutual funds. Whether one wants to invest to buy a car/house, plan for retirement, a child's higher education or any other asset, the SIP calculator can be used for the same. It helps to calculate the amount of investment and time period that is required for investing to reach the particular financial goal. So, common questions like "how much to invest in a SIP or how till that time should I invest", resolves using this calculator.

When using a SIP calculator, one has to fill certain variables, that include (illustration is given below)-

- The desired investment duration

- The estimated monthly SIP amount

- Expected inflation rate (annual) for the years to come

- Long-term growth rate on investments

Once you feed all the above-mentioned information, the calculator will end up giving you the amount you will receive (your SIP returns) after the number of years mentioned. Your net profit will be highlighted as well so that you can estimate your goal fulfilment accordingly.

How to Invest in Best Mutual Funds?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.