سرمایہ کاری کرکے 1 کروڑ کیسے حاصل کریں۔

ماہانہ میوچل فنڈز SIP کے ذریعے سرمایہ کاری کرنا

سرمایہ کاری ایکویٹی میوچل فنڈ اسکیم میں ایک کے ذریعےگھونٹ آپ کے طویل مدتی اہداف کو حاصل کرنے کا بہترین طریقہ ہے۔ ایکویٹی میں دیگر اثاثوں کی کلاسوں کے مقابلے اعلیٰ منافع کی پیشکش کی صلاحیت ہے۔ اس سے آپ کو شکست دینے میں بھی مدد مل سکتی ہے۔مہنگائی جو طویل مدتی اہداف کے حصول کے لیے ضروری ہے۔ وہ سازگار ٹیکس سے بھی لطف اندوز ہوتے ہیں۔ اب، طویل مدتیسرمایہ ایک سال سے زیادہ کی سرمایہ کاری پر ٹیکس سے پاک تھا (مالی سال 18-19 کے یونین بجٹ سے یکم فروری سے 1 لاکھ سے زیادہ کے منافع پر 10% ٹیکس لگے گا یعنی اگر کسی کو طویل مدتی میں ایک مالی سال میں 1.1 لاکھ کا فائدہ ہوتا ہے۔کیپٹل گینز اسے 1,10 پر ٹیکس ادا کرنا ہوگا،000 - 1,00,000 = 10,000۔ 10% پر 10,000 = 1,000 انچٹیکس)۔

Talk to our investment specialist

1 کروڑ کیسے حاصل کریں؟

ذیل میں مختلف ٹائم فریموں میں 1 کروڑ حاصل کرنے کے طریقے کی مثالیں ہیں۔SIP میں سرمایہ کاری (منظمسرمایہ کاری کا منصوبہ) کابہترین باہمی فنڈز.

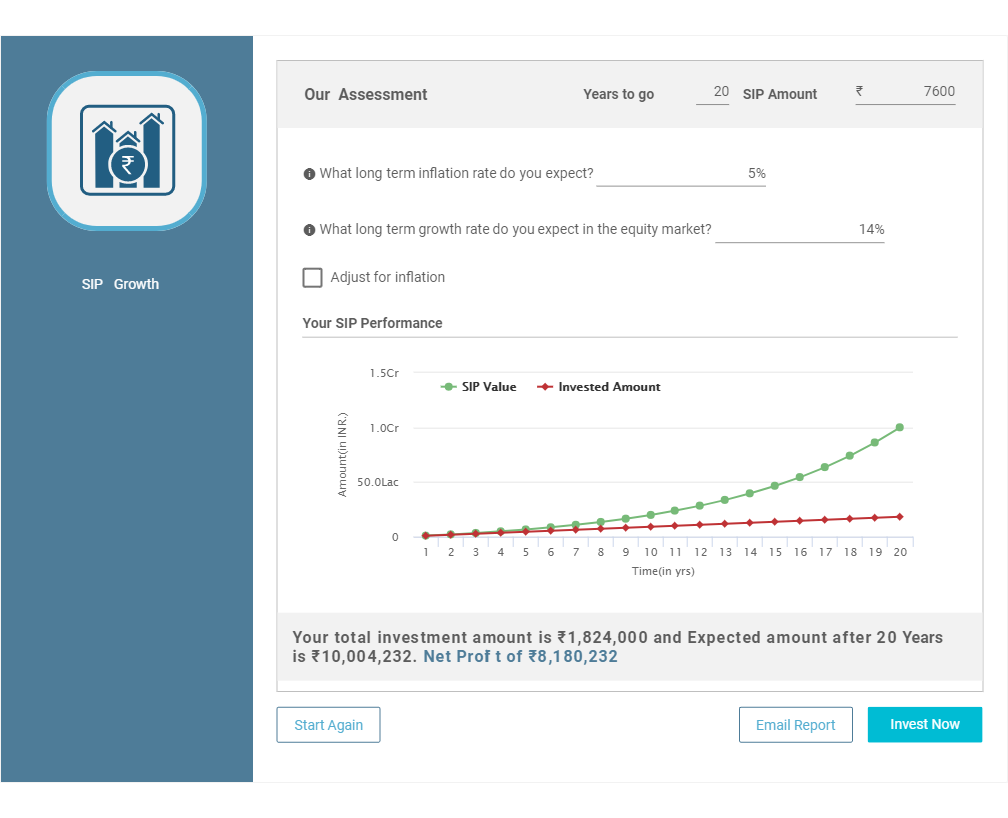

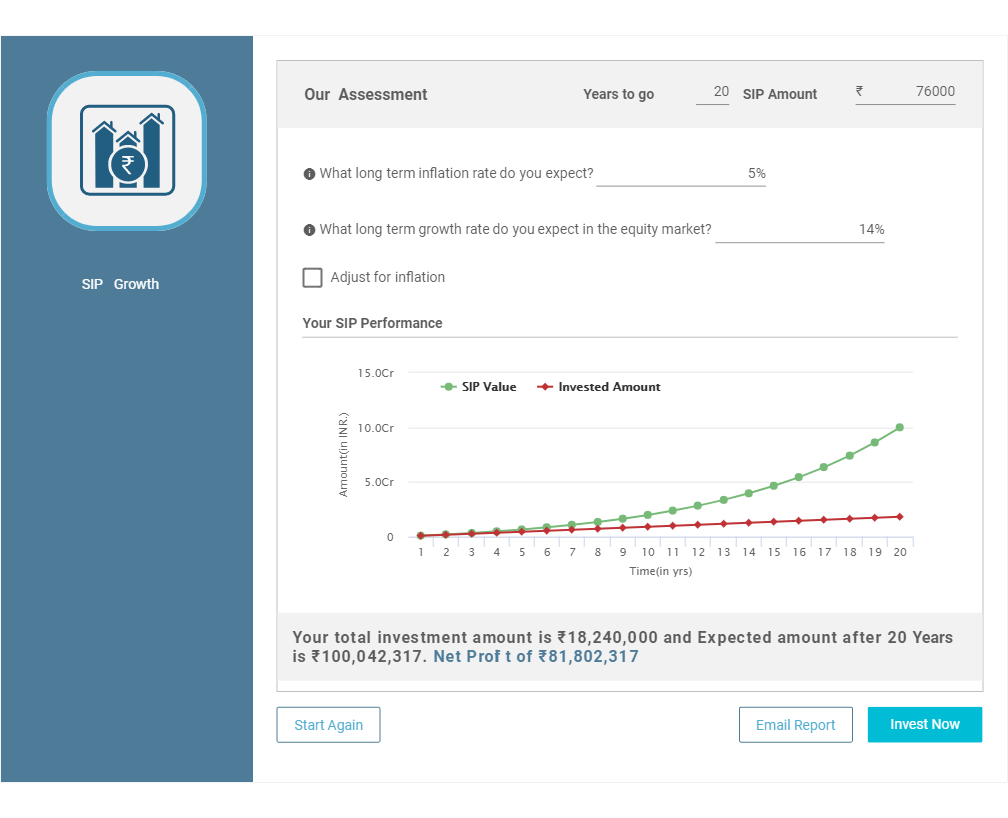

1. 20 سالوں میں 1 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 7,600 فی مہینہ

اگر آپ ہر ماہ 7,600 روپے بچا سکتے ہیں تو فوری طور پر ایس آئی پی شروع کریں۔ایکویٹی میوچل فنڈز. اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے، تو آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی بنیاد پر ایک پورٹ فولیو چن سکتے ہیں۔خطرے کی بھوک اور SIP کی رقم۔ اگر آپ کا پورٹ فولیوباہمی چندہ 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو اس سے کم ہے۔سی اے جی آر 1979 میں آغاز کے بعد سے SENSEX کی طرف سے پیش کردہ)، آپ 20 سالوں میں 1 کروڑ روپے کا کارپس بنانے کے قابل ہو جائیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔

تاریخی واپسیوں پر مبنی کلیدی مفروضہ ذیل میں ہیں۔

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 7,600 |

| وقت کی مدت | 20 سال |

| سرمایہ کاری کی گئی رقم | 18,24,000 |

| کل کارپس | 1,00,04,232 |

| نیٹ حاصلات | 81,80,232 |

مزید تفصیلات ہمارا استعمال کرتے ہوئے کام کیا جا سکتا ہےگھونٹ کیلکولیٹر نیچے والے بٹن پر کلک کرکے

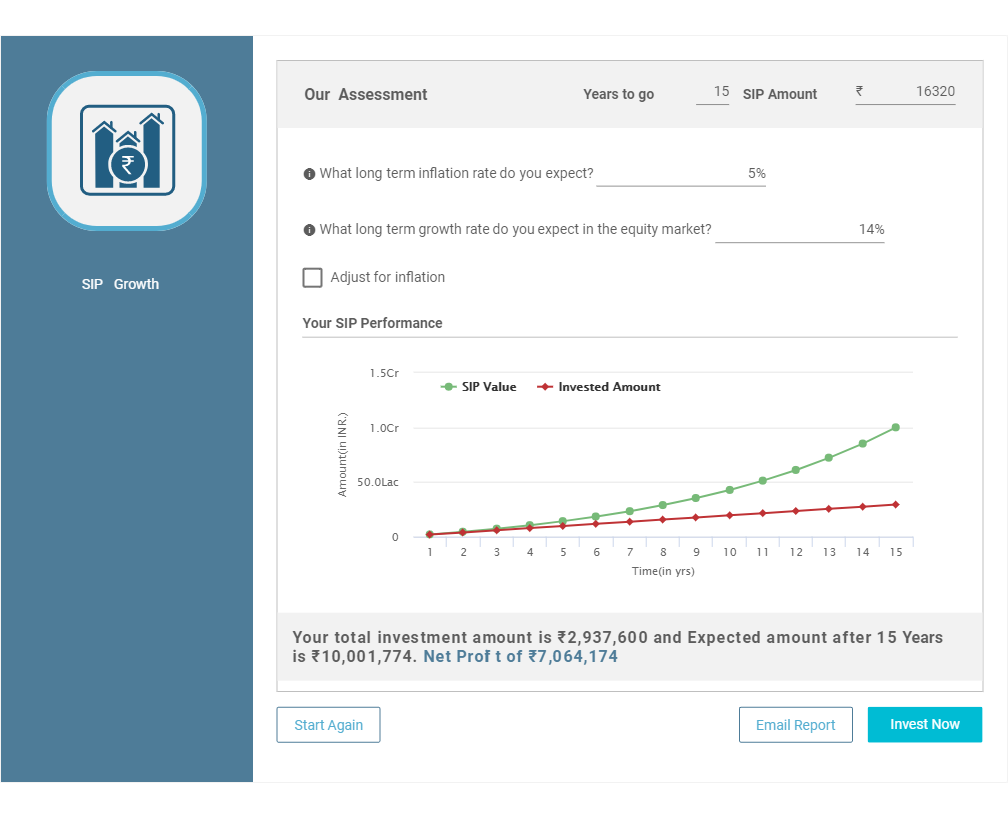

2. 15 سالوں میں 1 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 16,320 فی مہینہ

اگر آپ ہر ماہ 16,320 روپے بچا سکتے ہیں تو ایکویٹی میوچل فنڈز میں فوری طور پر ایک SIP شروع کریں۔ اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے تو، آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی خطرے کی بھوک اور SIP رقم کی بنیاد پر ایک پورٹ فولیو منتخب کر سکتے ہیں۔ اگر آپ کا میوچل فنڈز کا پورٹ فولیو 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو 1979 میں SENSEX کے آغاز سے پیش کردہ CAGR سے کم ہے)، تو آپ 15 سالوں میں 1 کروڑ روپے کا کارپس بنا سکیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔

تاریخی واپسیوں پر مبنی کلیدی مفروضہ ذیل میں ہیں۔

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 16,320 |

| وقت کی مدت | 15 سال |

| سرمایہ کاری کی گئی رقم | 29,37,600 |

| کل کارپس | 1,00,01,774 |

| نیٹ حاصلات | 70,64,174 |

ذیل کے بٹن پر کلک کر کے ہمارے SIP کیلکولیٹر کا استعمال کرتے ہوئے مزید تفصیلات پر کام کیا جا سکتا ہے۔

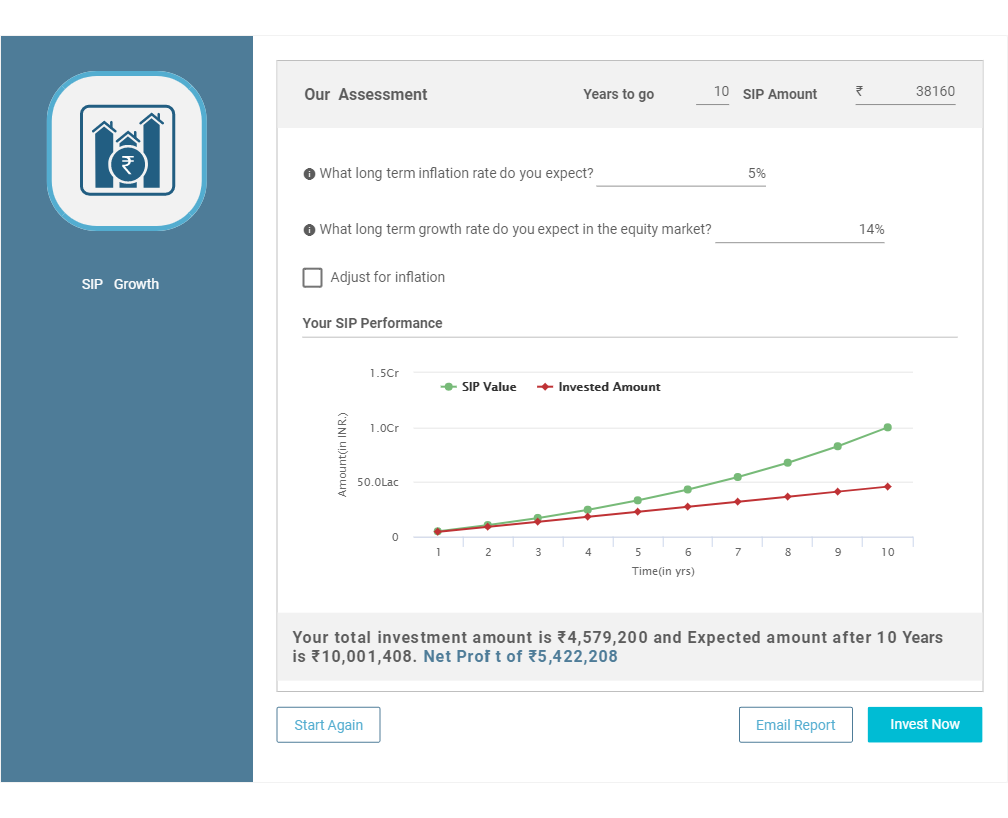

3. 10 سالوں میں 1 کروڑ کیسے حاصل کریں۔

Mutual Funds SIP کے ذریعے روپے کی سرمایہ کاری شروع کریں۔ 38,160 فی مہینہ

اگر آپ ہر ماہ 38,160 روپے بچا سکتے ہیں تو ایکویٹی میوچل فنڈز میں فوری طور پر ایک SIP شروع کریں۔ اگر آپ کو اسکیموں کے انتخاب میں مدد کی ضرورت ہے تو، آپ ہمارے تجویز کردہ ایکویٹی میوچل فنڈ پورٹ فولیوز کو چیک کر سکتے ہیں اور اپنی خطرے کی بھوک اور SIP رقم کی بنیاد پر ایک پورٹ فولیو منتخب کر سکتے ہیں۔ اگر آپ کا میوچل فنڈز کا پورٹ فولیو 14 فیصد سالانہ ریٹرن پیش کرنے کا انتظام کرتا ہے (جو کہ 1979 میں SENSEX کی طرف سے پیش کردہ CAGR سے کم ہے)، تو آپ 10 سالوں میں 1 کروڑ روپے کا کارپس بنا سکیں گے جیسا کہ ذیل میں دکھایا گیا ہے۔

تاریخی واپسیوں پر مبنی کلیدی مفروضہ ذیل میں ہیں۔

| مفروضے | ڈیٹا |

|---|---|

| اضافے کی شرح | 14% |

| مہنگائی | فیکٹرڈ نہیں |

| سرمایہ کاری کی رقم (pm) | 38,160 |

| وقت کی مدت | 10 سال |

| سرمایہ کاری کی گئی رقم | 45,79,200 |

| کل کارپس | 1,00,01,408 |

| نیٹ حاصلات | 54,22,208 |

| ذیل کے بٹن پر کلک کر کے ہمارے SIP کیلکولیٹر کا استعمال کرتے ہوئے مزید تفصیلات پر کام کیا جا سکتا ہے۔ |

سرفہرست 10 بہترین کارکردگی کا مظاہرہ کرنے والے SIP میوچل فنڈز

ذیل میں بہترین میوچل فنڈز کی فہرست دی گئی ہے جن کے اوپر خالص اثاثے/AUM ہیں۔500 کروڑ اور ترتیب دیا گیا5 سالہ CAGR ریٹرن. جس میں دیے گئے مقصد کو حاصل کرنے کے لیے سرمایہ کاری کی تلاش کی جا سکتی ہے۔

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Small Cap Fund Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (17 Feb 26) ₹60.3973 ↓ -2.23 (-3.56 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.5% 3 Month 32.8% 6 Month 78.1% 1 Year 143% 3 Year 56.3% 5 Year 28.1% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (18 Feb 26) ₹36.7055 ↑ 0.18 (0.49 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 7.4% 3 Month 7.8% 6 Month 17.7% 1 Year 33.3% 3 Year 34.3% 5 Year 27.5% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (18 Feb 26) ₹198.6 ↑ 0.98 (0.50 %) Net Assets (Cr) ₹8,134 on 31 Dec 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.12 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.6% 3 Month 0.1% 6 Month 2.5% 1 Year 18.5% 3 Year 25.4% 5 Year 26.5% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (18 Feb 26) ₹68.86 ↑ 0.52 (0.76 %) Net Assets (Cr) ₹1,449 on 31 Dec 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.27 Information Ratio -0.37 Alpha Ratio -1.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.6% 3 Month 3.1% 6 Month 11.2% 1 Year 33.1% 3 Year 32.2% 5 Year 25.9% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (18 Feb 26) ₹326.36 ↑ 1.58 (0.49 %) Net Assets (Cr) ₹5,323 on 31 Dec 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio -0.31 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 5.3% 3 Month 2.1% 6 Month 4.6% 1 Year 23% 3 Year 25.9% 5 Year 24.4% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (18 Feb 26) ₹355.176 ↑ 2.24 (0.64 %) Net Assets (Cr) ₹7,117 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.2 Information Ratio 0.34 Alpha Ratio -15.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,955 31 Jan 23 ₹16,453 31 Jan 24 ₹27,930 31 Jan 25 ₹30,936 31 Jan 26 ₹31,936 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 6% 3 Month 0.3% 6 Month 4.4% 1 Year 21.3% 3 Year 26.6% 5 Year 23.9% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Rahul Modi 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.76% Utility 24.23% Consumer Cyclical 11.14% Energy 10.76% Basic Materials 7.94% Technology 4.08% Communication Services 3.05% Financial Services 2.82% Health Care 2.16% Real Estate 1.9% Asset Allocation

Asset Class Value Cash 0.17% Equity 99.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹650 Cr 4,660,000

↑ 110,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | NTPC9% ₹605 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹389 Cr 989,337

↓ -75,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | TATAPOWER4% ₹289 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL3% ₹207 Cr 1,050,000

↓ -150,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO3% ₹203 Cr 160,000

↓ -10,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | CGPOWER3% ₹176 Cr 3,020,014 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | BHEL3% ₹171 Cr 6,500,000

↓ -400,000 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | BHARATFORG3% ₹170 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹158 Cr 18,358,070

↑ 860,913 7. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (18 Feb 26) ₹47.986 ↑ 0.17 (0.35 %) Net Assets (Cr) ₹2,452 on 31 Dec 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio -0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,059 31 Jan 23 ₹16,950 31 Jan 24 ₹28,499 31 Jan 25 ₹31,485 31 Jan 26 ₹33,227 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.9% 3 Month -1% 6 Month 1.2% 1 Year 18.6% 3 Year 27.5% 5 Year 23.7% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.62 Yr. Ashish Shah 1 Nov 25 0.25 Yr. Data below for HDFC Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 40.3% Financial Services 21.02% Basic Materials 10.31% Energy 7.4% Utility 7.38% Communication Services 4.32% Real Estate 2.99% Health Care 1.84% Technology 1.33% Consumer Cyclical 0.67% Asset Allocation

Asset Class Value Cash 2.44% Equity 97.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹159 Cr 403,500

↑ 6,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹149 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹130 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹87 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹80 Cr 1,400,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | NTPC3% ₹78 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹76 Cr 704,361 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹70 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹69 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹69 Cr 350,000 8. Nippon India Small Cap Fund

Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (18 Feb 26) ₹164.458 ↑ 0.53 (0.32 %) Net Assets (Cr) ₹68,287 on 31 Dec 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.44 Sharpe Ratio -0.42 Information Ratio -0.02 Alpha Ratio -1.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹17,257 31 Jan 23 ₹18,306 31 Jan 24 ₹28,687 31 Jan 25 ₹31,667 31 Jan 26 ₹31,833 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 1.9% 3 Month -3.6% 6 Month -1.7% 1 Year 14.3% 3 Year 21.2% 5 Year 23.6% 10 Year 15 Year Since launch 19.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 -4.7% 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 9.09 Yr. Kinjal Desai 25 May 18 7.7 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Small Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 19.87% Financial Services 17.63% Consumer Cyclical 13.65% Consumer Defensive 11.02% Basic Materials 11% Health Care 9.06% Technology 6.72% Utility 3.16% Energy 1.39% Communication Services 1.17% Real Estate 1.08% Asset Allocation

Asset Class Value Cash 4.26% Equity 95.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX3% ₹2,219 Cr 8,778,789

↓ -476,261 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,422 Cr 15,300,000

↑ 2,000,000 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN2% ₹1,115 Cr 10,347,848 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900032% ₹1,082 Cr 35,913,511

↓ -2,227,363 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | AXISBANK1% ₹819 Cr 5,977,976 eClerx Services Ltd (Technology)

Equity, Since 31 Jul 20 | ECLERX1% ₹797 Cr 1,712,794 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 22 | BHEL1% ₹775 Cr 29,507,422 Emami Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | EMAMILTD1% ₹772 Cr 15,948,302

↑ 150,000 Zydus Wellness Ltd (Consumer Defensive)

Equity, Since 31 Aug 16 | ZYDUSWELL1% ₹764 Cr 17,048,030 TD Power Systems Ltd (Industrials)

Equity, Since 31 Dec 15 | TDPOWERSYS1% ₹743 Cr 10,178,244 9. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (18 Feb 26) ₹50.751 ↑ 0.39 (0.76 %) Net Assets (Cr) ₹1,003 on 31 Dec 25 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio -0.21 Information Ratio 0.28 Alpha Ratio -18.43 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 6% 3 Month 1.2% 6 Month 4.9% 1 Year 27.6% 3 Year 29% 5 Year 23.6% 10 Year 15 Year Since launch 9.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065 10. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (18 Feb 26) ₹149.671 ↑ 0.76 (0.51 %) Net Assets (Cr) ₹3,036 on 31 Dec 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio -0.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 6.4% 3 Month 2.8% 6 Month 6.3% 1 Year 23.9% 3 Year 28.1% 5 Year 23.6% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000

میوچل فنڈ ایس آئی پی میں آن لائن سرمایہ کاری کیسے کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

You Might Also Like

Research Highlights for DSP World Gold Fund