एसआईपी 2022 - 2023 के लिए भारत में सर्वश्रेष्ठ म्यूचुअल फंड

एक व्यवस्थितनिवेश योजना (सिप) को सबसे कारगर तरीका माना जाता हैम्युचुअल फंड में निवेश, विशेष रूप से लंबे समय के लिए-टर्म प्लान. यह लंबी अवधि की बचत योजना को लागू करने के लिए निवेशकों को हर महीने एक विशेष तारीख को एक इकाई खरीदने की अनुमति देता है। निवेशकों के प्रति सहज महसूस करने का एक कारणनिवेश एसआईपी में वे लचीलेपन की पेशकश करते हैं। निवेशक कर सकते हैंएसआईपी में निवेश करें मासिक, त्रैमासिक या साप्ताहिकआधार, उनकी सुविधा के अनुसार। आइए इस बारे में अधिक जानें कि कोई व्यक्ति अपने लक्ष्य को कैसे प्राप्त कर सकता हैवित्तीय लक्ष्यों व्यवस्थित निवेश योजनाओं के साथ, कैसेघूंट कैलकुलेटर निवेश के साथ-साथ सहायक हैसर्वश्रेष्ठ म्युचुअल फंड भारत में एसआईपी के लिए।

एसआईपी- वित्तीय लक्ष्यों को प्राप्त करने का इष्टतम तरीका

SIP को इस तरह से डिज़ाइन किया गया है कि कोई भी आसानी से अपने निवेश की पूर्व-योजना बना सकता है और अपने वित्तीय लक्ष्यों के अनुसार निवेश कर सकता है। लेकिन, एसआईपी के जरिए लक्ष्य हासिल करने के लिए लंबे समय के लिए निवेश करना पड़ता है। आमतौर पर, SIP का उपयोग व्यापक रूप से लक्ष्यों की योजना बनाने के लिए किया जाता है जैसे-

Talk to our investment specialist

- कार ख़रीदना

- घर ख़रीदना

- शादी

- बच्चे की शिक्षा

- अंतरराष्ट्रीय यात्रा के लिए बचत करें

- निवृत्ति

- चिकित्सा आपात स्थिति आदि।

कोई भी न्यूनतम 500 रुपये और 1000 रुपये की राशि से एसआईपी में निवेश शुरू कर सकता है। एक बार जब आप एसआईपी में निवेश करना शुरू कर देते हैं तो आपका पैसा हर दिन जाना शुरू हो जाता है क्योंकि यह स्टॉक के संपर्क में आता है।मंडी. यही कारण है कि एसआईपी को एक मार्ग के रूप में ज्यादातर पसंद किया जाता हैइक्विटी फ़ंड. इसके अलावा, ऐतिहासिक रूप से, इक्विटी शेयरों में निवेश ने अन्य सभी परिसंपत्ति वर्गों के बीच प्रभावशाली रिटर्न दिया है, अगर निवेश अनुशासन के साथ और लंबी अवधि के क्षितिज के साथ किया गया था।

इक्विटी में एसआईपी बाजार के समय के जोखिम से बचने में मदद करता है और निवेश की लागत के औसत से धन सृजन की सुविधा प्रदान करता है। आइए कुछ और देखेंएसआईपी के लाभ जो दीर्घकालिक लक्ष्यों को प्राप्त करने में मदद करता है:

कंपाउंडिंग की शक्ति- साधारण ब्याज तब होता है जब आप केवल मूलधन पर ब्याज प्राप्त करते हैं। चक्रवृद्धि ब्याज के मामले में, ब्याज राशि मूलधन में जोड़ दी जाती है, और ब्याज की गणना नए मूलधन (पुराने मूलधन और लाभ) पर की जाती है। यह प्रक्रिया हर बार जारी रहती है। एसआईपी के बाद सेम्यूचुअल फंड्स किश्तों में हैं, उन्हें संयोजित किया जाता है, जो आरंभ में निवेश की गई राशि में अधिक जोड़ता है।

जोखिम में कटौती- यह देखते हुए कि एक एसआईपी लंबी अवधि में फैला हुआ है, कोई भी शेयर बाजार की सभी अवधियों, उतार-चढ़ाव और अधिक महत्वपूर्ण रूप से मंदी को पकड़ लेता है। मंदी में, जब अधिकांश निवेशकों को डर लगता है, एसआईपी की किस्तें निवेशकों को "कम" खरीदना सुनिश्चित करती हैं।

एसआईपी की सुविधा- सुविधा एक एसआईपी के सबसे बड़े लाभों में से एक है। एक उपयोगकर्ता को एक बार साइन-अप करना होता है और दस्तावेज़ीकरण से गुजरना पड़ता है। एक बार हो जाने के बाद, बाद के निवेशों के लिए डेबिट स्वतः हो जाता है औरइन्वेस्टर बस निवेश की निगरानी करनी है।

SIP 2022 - 2023 के लिए भारत में सर्वश्रेष्ठ म्यूचुअल फंड

SIP के लिए बेस्ट लार्ज कैप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹89.2487

↓ -0.95 ₹50,107 100 -5.3 -1.8 11.3 17.6 16.4 9.2 ICICI Prudential Bluechip Fund Growth ₹108.85

↓ -1.20 ₹76,646 100 -6.3 -1 10.8 16.7 14.6 11.3 DSP TOP 100 Equity Growth ₹459.769

↓ -5.48 ₹7,163 500 -6.1 -1.2 7 16.3 12.5 8.4 Bandhan Large Cap Fund Growth ₹75.844

↓ -0.85 ₹1,980 100 -5.7 -1 11.8 16.1 12.5 8.2 Invesco India Largecap Fund Growth ₹66.63

↓ -0.88 ₹1,666 100 -7 -3.7 10 15.7 12.9 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹7,163 Cr). Bottom quartile AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 16.42% (top quartile). 5Y return: 14.65% (upper mid). 5Y return: 12.50% (bottom quartile). 5Y return: 12.48% (bottom quartile). 5Y return: 12.93% (lower mid). Point 6 3Y return: 17.62% (top quartile). 3Y return: 16.73% (upper mid). 3Y return: 16.34% (lower mid). 3Y return: 16.14% (bottom quartile). 3Y return: 15.73% (bottom quartile). Point 7 1Y return: 11.30% (upper mid). 1Y return: 10.77% (lower mid). 1Y return: 6.97% (bottom quartile). 1Y return: 11.83% (top quartile). 1Y return: 10.04% (bottom quartile). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (bottom quartile). Alpha: 0.90 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.64 (bottom quartile). Information ratio: 0.69 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

SIP के लिए बेस्ट मल्टी कैप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.31

↑ 0.06 ₹1,051 1,000 0.7 3.2 17.9 20.8 14.5 3.5 Nippon India Multi Cap Fund Growth ₹288.449

↓ -2.03 ₹48,809 100 -4.3 -3.8 11.5 20.4 19.7 4.1 HDFC Equity Fund Growth ₹1,987.19

↓ -26.14 ₹97,452 300 -4.6 -0.4 12.5 20.3 19.3 11.4 Mahindra Badhat Yojana Growth ₹34.8417

↓ -0.29 ₹6,046 500 -3.1 0.3 14.8 19.6 17.5 3.4 Motilal Oswal Multicap 35 Fund Growth ₹54.936

↓ -0.41 ₹13,180 500 -11.3 -11.9 0.4 19.3 11.3 -5.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Manufacturing Equity Fund Nippon India Multi Cap Fund HDFC Equity Fund Mahindra Badhat Yojana Motilal Oswal Multicap 35 Fund Point 1 Bottom quartile AUM (₹1,051 Cr). Upper mid AUM (₹48,809 Cr). Highest AUM (₹97,452 Cr). Bottom quartile AUM (₹6,046 Cr). Lower mid AUM (₹13,180 Cr). Point 2 Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (31 yrs). Established history (8+ yrs). Established history (11+ yrs). Point 3 Not Rated. Rating: 2★ (lower mid). Rating: 3★ (upper mid). Not Rated. Top rated. Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.48% (bottom quartile). 5Y return: 19.71% (top quartile). 5Y return: 19.27% (upper mid). 5Y return: 17.51% (lower mid). 5Y return: 11.28% (bottom quartile). Point 6 3Y return: 20.81% (top quartile). 3Y return: 20.36% (upper mid). 3Y return: 20.35% (lower mid). 3Y return: 19.57% (bottom quartile). 3Y return: 19.30% (bottom quartile). Point 7 1Y return: 17.91% (top quartile). 1Y return: 11.48% (bottom quartile). 1Y return: 12.47% (lower mid). 1Y return: 14.82% (upper mid). 1Y return: 0.40% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: -0.46 (bottom quartile). Alpha: 4.79 (top quartile). Alpha: 2.62 (upper mid). Alpha: -5.98 (bottom quartile). Point 9 Sharpe: 0.12 (lower mid). Sharpe: 0.09 (bottom quartile). Sharpe: 0.67 (top quartile). Sharpe: 0.29 (upper mid). Sharpe: -0.19 (bottom quartile). Point 10 Information ratio: 0.00 (bottom quartile). Information ratio: 0.49 (lower mid). Information ratio: 1.25 (top quartile). Information ratio: 0.45 (bottom quartile). Information ratio: 0.56 (upper mid). Aditya Birla Sun Life Manufacturing Equity Fund

Nippon India Multi Cap Fund

HDFC Equity Fund

Mahindra Badhat Yojana

Motilal Oswal Multicap 35 Fund

SIP के लिए बेस्ट मिड कैप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹313.15

↓ -1.61 ₹6,969 100 1.2 6.4 25.1 24.6 19.3 11.1 TATA Mid Cap Growth Fund Growth ₹431.768

↓ -2.20 ₹5,356 150 -3.3 1.3 15.7 20.6 17 5.8 BNP Paribas Mid Cap Fund Growth ₹102.913

↓ -0.59 ₹2,282 300 -1 2.7 14.9 20.2 16.8 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹755.6

↓ -4.40 ₹6,041 1,000 -5.3 -2.6 10.8 18.4 16.2 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹6,969 Cr). Lower mid AUM (₹5,356 Cr). Bottom quartile AUM (₹2,282 Cr). Upper mid AUM (₹6,041 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 19.34% (top quartile). 5Y return: 16.95% (upper mid). 5Y return: 16.75% (lower mid). 5Y return: 16.22% (bottom quartile). Point 6 3Y return: 24.58% (top quartile). 3Y return: 20.63% (upper mid). 3Y return: 20.17% (lower mid). 3Y return: 18.45% (bottom quartile). Point 7 1Y return: 25.08% (top quartile). 1Y return: 15.71% (upper mid). 1Y return: 14.87% (lower mid). 1Y return: 10.77% (bottom quartile). Point 8 Alpha: 5.44 (top quartile). Alpha: -0.44 (lower mid). Alpha: -0.33 (upper mid). Alpha: -1.26 (bottom quartile). Point 9 Sharpe: 0.53 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.21 (upper mid). Sharpe: 0.16 (bottom quartile). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.44 (upper mid). Information ratio: -0.77 (bottom quartile). Information ratio: -0.74 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

SIP के लिए बेस्ट स्मॉल कैप फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹157.625

↓ -0.54 ₹65,812 100 -4.8 -6.1 8.3 19.2 21.6 -4.7 DSP Small Cap Fund Growth ₹186.927

↓ -0.94 ₹16,135 500 -3.9 -4.6 12.7 18.4 18.4 -2.8 Sundaram Small Cap Fund Growth ₹242.234

↓ -0.87 ₹3,285 100 -6.7 -5.3 11.2 17.5 17.9 0.4 Franklin India Smaller Companies Fund Growth ₹155.885

↓ -0.09 ₹12,764 500 -5.6 -7.3 5.3 16.7 17.8 -8.4 Aditya Birla Sun Life Small Cap Fund Growth ₹81.7082

↓ -0.50 ₹4,778 1,000 -3.5 -2.9 12.3 16.7 13.6 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund Aditya Birla Sun Life Small Cap Fund Point 1 Highest AUM (₹65,812 Cr). Upper mid AUM (₹16,135 Cr). Bottom quartile AUM (₹3,285 Cr). Lower mid AUM (₹12,764 Cr). Bottom quartile AUM (₹4,778 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (18+ yrs). Point 3 Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 4★ (bottom quartile). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 21.58% (top quartile). 5Y return: 18.42% (upper mid). 5Y return: 17.87% (lower mid). 5Y return: 17.85% (bottom quartile). 5Y return: 13.56% (bottom quartile). Point 6 3Y return: 19.22% (top quartile). 3Y return: 18.37% (upper mid). 3Y return: 17.51% (lower mid). 3Y return: 16.68% (bottom quartile). 3Y return: 16.68% (bottom quartile). Point 7 1Y return: 8.31% (bottom quartile). 1Y return: 12.71% (top quartile). 1Y return: 11.25% (lower mid). 1Y return: 5.35% (bottom quartile). 1Y return: 12.26% (upper mid). Point 8 Alpha: -0.64 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.29 (top quartile). Alpha: -4.41 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.01 (upper mid). Sharpe: -0.38 (bottom quartile). Sharpe: 0.01 (top quartile). Point 10 Information ratio: 0.02 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.17 (bottom quartile). Information ratio: -0.19 (bottom quartile). Information ratio: 0.00 (lower mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

Aditya Birla Sun Life Small Cap Fund

एसआईपी के लिए सर्वश्रेष्ठ ईएलएसएस (टैक्स सेविंग म्यूचुअल फंड)

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹429.332

↓ -3.98 ₹31,862 500 -4.5 -0.6 8.1 21.9 18.3 6.6 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Motilal Oswal Long Term Equity Fund Growth ₹47.6571

↓ -0.22 ₹4,188 500 -5.3 -6.1 11.3 20.6 16.3 -9.1 HDFC Tax Saver Fund Growth ₹1,374.16

↓ -17.92 ₹16,749 500 -6.3 -2.7 10 19.3 18.3 10.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund IDBI Equity Advantage Fund HDFC Long Term Advantage Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund Point 1 Highest AUM (₹31,862 Cr). Bottom quartile AUM (₹485 Cr). Bottom quartile AUM (₹1,318 Cr). Lower mid AUM (₹4,188 Cr). Upper mid AUM (₹16,749 Cr). Point 2 Established history (18+ yrs). Established history (12+ yrs). Established history (25+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Point 3 Rating: 2★ (lower mid). Top rated. Rating: 3★ (upper mid). Not Rated. Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.29% (top quartile). 5Y return: 9.97% (bottom quartile). 5Y return: 17.39% (lower mid). 5Y return: 16.31% (bottom quartile). 5Y return: 18.29% (upper mid). Point 6 3Y return: 21.89% (top quartile). 3Y return: 20.84% (upper mid). 3Y return: 20.64% (lower mid). 3Y return: 20.56% (bottom quartile). 3Y return: 19.25% (bottom quartile). Point 7 1Y return: 8.08% (bottom quartile). 1Y return: 16.92% (upper mid). 1Y return: 35.51% (top quartile). 1Y return: 11.29% (lower mid). 1Y return: 10.01% (bottom quartile). Point 8 Alpha: -0.63 (bottom quartile). Alpha: 1.78 (upper mid). Alpha: 1.75 (lower mid). Alpha: -5.20 (bottom quartile). Alpha: 2.37 (top quartile). Point 9 Sharpe: 0.13 (bottom quartile). Sharpe: 1.21 (upper mid). Sharpe: 2.27 (top quartile). Sharpe: -0.04 (bottom quartile). Sharpe: 0.41 (lower mid). Point 10 Information ratio: 1.85 (top quartile). Information ratio: -1.13 (bottom quartile). Information ratio: -0.15 (bottom quartile). Information ratio: 0.49 (lower mid). Information ratio: 1.20 (upper mid). SBI Magnum Tax Gain Fund

IDBI Equity Advantage Fund

HDFC Long Term Advantage Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

एसआईपी के लिए बेस्ट सेक्टर फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹107.797

↑ 1.36 ₹1,765 500 12.8 19.1 34 23.6 20.5 17.5 SBI PSU Fund Growth ₹36.0126

↓ -0.17 ₹5,980 500 8.2 16.7 28.2 32.2 26.7 11.3 Invesco India PSU Equity Fund Growth ₹67.37

↑ 0.19 ₹1,492 500 4.1 10.5 26.8 30.2 24.7 10.3 UTI Transportation & Logistics Fund Growth ₹279.258

↓ -3.27 ₹3,906 500 -5.7 -3.1 22.8 23.5 18 19.5 SBI Banking & Financial Services Fund Growth ₹44.1023

↓ -0.88 ₹10,415 500 -3.7 5.7 22 20.1 13.5 20.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund SBI PSU Fund Invesco India PSU Equity Fund UTI Transportation & Logistics Fund SBI Banking & Financial Services Fund Point 1 Bottom quartile AUM (₹1,765 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹3,906 Cr). Highest AUM (₹10,415 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 20.54% (lower mid). 5Y return: 26.72% (top quartile). 5Y return: 24.66% (upper mid). 5Y return: 17.99% (bottom quartile). 5Y return: 13.47% (bottom quartile). Point 6 3Y return: 23.59% (lower mid). 3Y return: 32.21% (top quartile). 3Y return: 30.16% (upper mid). 3Y return: 23.47% (bottom quartile). 3Y return: 20.13% (bottom quartile). Point 7 1Y return: 34.03% (top quartile). 1Y return: 28.24% (upper mid). 1Y return: 26.83% (lower mid). 1Y return: 22.81% (bottom quartile). 1Y return: 22.00% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 0.05 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 4.78 (top quartile). Point 9 Sharpe: 1.32 (upper mid). Sharpe: 0.63 (bottom quartile). Sharpe: 0.53 (bottom quartile). Sharpe: 0.69 (lower mid). Sharpe: 1.36 (top quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 1.02 (top quartile). DSP Natural Resources and New Energy Fund

SBI PSU Fund

Invesco India PSU Equity Fund

UTI Transportation & Logistics Fund

SBI Banking & Financial Services Fund

एसआईपी के लिए सर्वश्रेष्ठ फोकस्ड फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹91.13

↓ -1.18 ₹14,935 100 -6.7 -1.1 15.2 21.2 17.7 15.4 HDFC Focused 30 Fund Growth ₹229.159

↓ -3.38 ₹26,332 300 -4.5 -1.1 11.5 19.9 20.3 10.9 SBI Focused Equity Fund Growth ₹363.667

↓ -3.54 ₹42,998 500 -3.7 3.6 18.3 18.7 14 15.7 DSP Focus Fund Growth ₹52.714

↓ -0.66 ₹2,611 500 -6.8 -0.9 7.3 17.5 12.3 7.3 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Sundaram Select Focus Fund Point 1 Lower mid AUM (₹14,935 Cr). Upper mid AUM (₹26,332 Cr). Highest AUM (₹42,998 Cr). Bottom quartile AUM (₹2,611 Cr). Bottom quartile AUM (₹1,354 Cr). Point 2 Established history (16+ yrs). Established history (21+ yrs). Established history (21+ yrs). Established history (15+ yrs). Oldest track record among peers (23 yrs). Point 3 Rating: 2★ (bottom quartile). Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.74% (upper mid). 5Y return: 20.32% (top quartile). 5Y return: 14.01% (bottom quartile). 5Y return: 12.28% (bottom quartile). 5Y return: 17.29% (lower mid). Point 6 3Y return: 21.22% (top quartile). 3Y return: 19.90% (upper mid). 3Y return: 18.72% (lower mid). 3Y return: 17.48% (bottom quartile). 3Y return: 17.03% (bottom quartile). Point 7 1Y return: 15.19% (lower mid). 1Y return: 11.52% (bottom quartile). 1Y return: 18.27% (upper mid). 1Y return: 7.33% (bottom quartile). 1Y return: 24.49% (top quartile). Point 8 Alpha: 6.91 (top quartile). Alpha: 3.79 (lower mid). Alpha: 5.35 (upper mid). Alpha: 0.58 (bottom quartile). Alpha: -5.62 (bottom quartile). Point 9 Sharpe: 0.70 (upper mid). Sharpe: 0.60 (bottom quartile). Sharpe: 0.62 (lower mid). Sharpe: 0.23 (bottom quartile). Sharpe: 1.85 (top quartile). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.98 (upper mid). Information ratio: 0.42 (lower mid). Information ratio: 0.42 (bottom quartile). Information ratio: -0.52 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Sundaram Select Focus Fund

एसआईपी के लिए बेस्ट वैल्यू फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹220.692

↓ -2.42 ₹8,962 100 -4.7 -1 9.1 21.1 17.6 4.2 ICICI Prudential Value Discovery Fund Growth ₹472.12

↓ -4.50 ₹60,353 100 -5.5 1 12.1 19.1 19.3 13.8 Aditya Birla Sun Life Pure Value Fund Growth ₹123.063

↓ -0.90 ₹6,246 1,000 -4 2.7 11.1 19 15.4 2.6 HDFC Capital Builder Value Fund Growth ₹734.033

↓ -7.24 ₹7,487 300 -4.9 0.9 13.8 18.4 15.6 8.6 Tata Equity PE Fund Growth ₹343.041

↓ -3.38 ₹8,819 150 -5.2 1 10.6 18 15.5 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund ICICI Prudential Value Discovery Fund Aditya Birla Sun Life Pure Value Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹8,962 Cr). Highest AUM (₹60,353 Cr). Bottom quartile AUM (₹6,246 Cr). Bottom quartile AUM (₹7,487 Cr). Lower mid AUM (₹8,819 Cr). Point 2 Established history (20+ yrs). Established history (21+ yrs). Established history (17+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.61% (upper mid). 5Y return: 19.34% (top quartile). 5Y return: 15.42% (bottom quartile). 5Y return: 15.55% (lower mid). 5Y return: 15.46% (bottom quartile). Point 6 3Y return: 21.08% (top quartile). 3Y return: 19.12% (upper mid). 3Y return: 18.96% (lower mid). 3Y return: 18.43% (bottom quartile). 3Y return: 17.97% (bottom quartile). Point 7 1Y return: 9.12% (bottom quartile). 1Y return: 12.11% (upper mid). 1Y return: 11.11% (lower mid). 1Y return: 13.81% (top quartile). 1Y return: 10.60% (bottom quartile). Point 8 Alpha: -0.62 (bottom quartile). Alpha: 3.44 (top quartile). Alpha: -1.64 (bottom quartile). Alpha: 2.68 (upper mid). Alpha: 0.27 (lower mid). Point 9 Sharpe: 0.15 (bottom quartile). Sharpe: 0.51 (top quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.39 (upper mid). Sharpe: 0.22 (lower mid). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.80 (bottom quartile). Information ratio: 0.57 (bottom quartile). Information ratio: 1.10 (upper mid). Information ratio: 0.89 (lower mid). Nippon India Value Fund

ICICI Prudential Value Discovery Fund

Aditya Birla Sun Life Pure Value Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

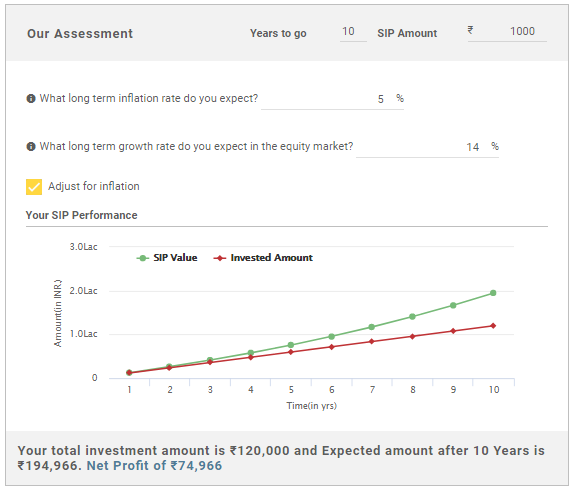

एसआईपी कैलकुलेटर

एसआईपी कैलकुलेटर एक कुशल उपकरण है जिसका उपयोग निवेशक म्यूचुअल फंड में निवेश करते समय कर सकता है। चाहे कोई कार/घर खरीदने के लिए निवेश करना चाहता हो, सेवानिवृत्ति की योजना बनाना चाहता हो, किसी बच्चे की उच्च शिक्षा या किसी अन्य संपत्ति में निवेश करना चाहता हो, उसके लिए SIP कैलकुलेटर का उपयोग किया जा सकता है। यह विशेष वित्तीय लक्ष्य तक पहुंचने के लिए निवेश के लिए आवश्यक निवेश की मात्रा और समय अवधि की गणना करने में मदद करता है। तो, सामान्य प्रश्न जैसे "कितना करेंSIP में निवेश करें या उस समय तक मुझे कैसे निवेश करना चाहिए", इस कैलकुलेटर का उपयोग करके हल करता है।

SIP कैलकुलेटर का उपयोग करते समय, किसी को कुछ चर भरने होते हैं, जिनमें शामिल हैं (चित्रण नीचे दिया गया है) -

- वांछित निवेश अवधि

- अनुमानित मासिक एसआईपी राशि

- अपेक्षित होनामुद्रास्फीति आने वाले वर्षों के लिए दर (वार्षिक)

- निवेश पर दीर्घकालिक विकास दर

एक बार जब आप उपरोक्त सभी जानकारी फीड कर लेते हैं, तो कैलकुलेटर आपको वह राशि देगा जो आपको उल्लिखित वर्षों की संख्या के बाद प्राप्त होगी (आपका एसआईपी रिटर्न)। आपके शुद्ध लाभ को भी हाइलाइट किया जाएगा ताकि आप अपने लक्ष्य की पूर्ति का अनुमान लगा सकें।

सर्वश्रेष्ठ म्यूचुअल फंड में निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।