سرمایہ کاری کے لیے ٹاپ 5 بہترین ایکویٹی ایس آئی پی فنڈز

اگر آپ چاہتے ہیں کہ آپ کی سرمایہ کاری سب میں پسند کی جائے۔مارکیٹ حالات، پھر اپنی سرمایہ کاری کریں۔گھونٹ راستہ! سیسٹیمیٹک انویسٹمنٹ پلانز (SIPs) کو سب سے زیادہ موثر طریقے سمجھا جاتا ہے۔میوچل فنڈز میں سرمایہ کاری. اور اگر آپ ایکویٹیز میں سرمایہ کاری کرنے کا منصوبہ بنا رہے ہیں، تو SIPs خواہش مند منافع کمانے کا بہترین طریقہ ہیں۔ بہترین ایکویٹی ایس آئی پی فنڈز آپ کو طویل مدتی میں مطلوبہ منافع دے سکتے ہیں۔مالی اہداف. تو، آئیے دیکھتے ہیں کہ SIP کیسے کام کرتا ہے، اس کے فوائدSIP سرمایہ کاریکا اہم استعمال aگھونٹ کیلکولیٹر ایکویٹی سرمایہ کاری کے لیے بہترین کارکردگی کا مظاہرہ کرنے والے SIP فنڈز کے ساتھ۔

Talk to our investment specialist

ایکویٹی میوچل فنڈز کے لیے منظم سرمایہ کاری

مثالی طور پر، جب سرمایہ کار ایکوئٹی میں سرمایہ کاری کرنے کا ارادہ رکھتے ہیں، تو وہ اکثر منافع کے استحکام پر شک کرتے ہیں۔ اس کی وجہ یہ ہے کہ وہ مارکیٹ سے جڑے ہوئے ہیں اور اکثر اتار چڑھاؤ کا شکار رہتے ہیں۔ اس طرح، اس طرح کے اتار چڑھاؤ کو متوازن کرنے اور طویل مدتی مستحکم منافع کو یقینی بنانے کے لیے، ایکویٹی سرمایہ کاری میں SIPs انتہائی قابل سفارش ہیں۔ تاریخی طور پر، مارکیٹ کے خراب مرحلے میں، یہ دیکھا گیا ہے کہ SIP کا راستہ اختیار کرنے والے سرمایہ کاروں نے یکمشت راستہ اختیار کرنے والوں کے مقابلے میں زیادہ مستحکم منافع حاصل کیا۔ SIP کی سرمایہ کاری وقت کے ساتھ ساتھ پھیل جاتی ہے، ایک یکمشت سرمایہ کاری کے برعکس جو ایک ہی وقت میں ہوتی ہے۔ لہذا، SIP میں آپ کی رقم ہر روز بڑھنے لگتی ہے (اسٹاک مارکیٹ میں سرمایہ کاری کی جا رہی ہے)۔

ایک منظمسرمایہ کاری کا منصوبہ جیسے طویل مدتی مالی اہداف کو حاصل کرنے کے لیے بھی وسیع پیمانے پر سمجھا جاتا ہے۔ریٹائرمنٹ پلاننگ، بچے کی تعلیم، گھر/گاڑی کی خریداری یا کوئی اور اثاثہ۔ اس سے پہلے کہ ہم کچھ اور دیکھیںسرمایہ کاری کے فوائد ایس آئی پی میں، آئیے سرمایہ کاری کے لیے کچھ بہترین ایکویٹی ایس آئی پی فنڈز کو دیکھیں۔

ایکویٹی فنڈز 2022 کے لیے بہترین SIP پلان

بہترین لارج کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Indiabulls Blue Chip Fund Growth ₹41.68

↓ -0.80 ₹129 500 -5.4 -2.8 10.4 13 10.2 7.5 Nippon India Large Cap Fund Growth ₹87.6437

↓ -1.61 ₹50,107 100 -5.9 -4 9.4 17 15.8 9.2 ICICI Prudential Bluechip Fund Growth ₹106.98

↓ -1.87 ₹76,646 100 -6.6 -3 9 16.3 14.1 11.3 SBI Bluechip Fund Growth ₹90.0521

↓ -1.73 ₹54,821 500 -5.2 -2.5 8.7 12.9 11 9.7 Aditya Birla Sun Life Frontline Equity Fund Growth ₹501.36

↓ -9.07 ₹30,392 100 -7.5 -4.4 7 13.6 11.7 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Blue Chip Fund Nippon India Large Cap Fund ICICI Prudential Bluechip Fund SBI Bluechip Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹129 Cr). Lower mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Upper mid AUM (₹54,821 Cr). Bottom quartile AUM (₹30,392 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.23% (bottom quartile). 5Y return: 15.82% (top quartile). 5Y return: 14.05% (upper mid). 5Y return: 11.01% (bottom quartile). 5Y return: 11.67% (lower mid). Point 6 3Y return: 12.98% (bottom quartile). 3Y return: 16.96% (top quartile). 3Y return: 16.26% (upper mid). 3Y return: 12.93% (bottom quartile). 3Y return: 13.59% (lower mid). Point 7 1Y return: 10.44% (top quartile). 1Y return: 9.36% (upper mid). 1Y return: 8.97% (lower mid). 1Y return: 8.70% (bottom quartile). 1Y return: 7.04% (bottom quartile). Point 8 Alpha: 0.28 (lower mid). Alpha: 0.30 (upper mid). Alpha: 0.35 (top quartile). Alpha: 0.16 (bottom quartile). Alpha: -0.21 (bottom quartile). Point 9 Sharpe: 0.29 (bottom quartile). Sharpe: 0.30 (top quartile). Sharpe: 0.30 (upper mid). Sharpe: 0.29 (lower mid). Sharpe: 0.26 (bottom quartile). Point 10 Information ratio: -0.32 (bottom quartile). Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: -0.33 (bottom quartile). Information ratio: 0.31 (lower mid). Indiabulls Blue Chip Fund

Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

SBI Bluechip Fund

Aditya Birla Sun Life Frontline Equity Fund

بہترین لارج اور مڈ کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Opportunities Fund Growth ₹336.979

↓ -7.90 ₹29,991 1,000 -3 -0.3 13.2 17.7 15.4 5.6 Invesco India Growth Opportunities Fund Growth ₹93.07

↓ -2.01 ₹8,959 100 -7.6 -8.6 12.1 22.1 15.8 4.7 DSP Equity Opportunities Fund Growth ₹597.767

↓ -12.76 ₹17,434 500 -5.5 -1.7 8.3 18.5 15 7.1 SBI Large and Midcap Fund Growth ₹633.502

↓ -4.93 ₹37,497 500 -2.2 2.3 14.8 17.4 16.7 10.1 Bandhan Core Equity Fund Growth ₹130.205

↓ -2.44 ₹13,968 100 -5.6 -2.7 11.1 21.5 17.6 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Equity Opportunities Fund Invesco India Growth Opportunities Fund DSP Equity Opportunities Fund SBI Large and Midcap Fund Bandhan Core Equity Fund Point 1 Upper mid AUM (₹29,991 Cr). Bottom quartile AUM (₹8,959 Cr). Lower mid AUM (₹17,434 Cr). Highest AUM (₹37,497 Cr). Bottom quartile AUM (₹13,968 Cr). Point 2 Established history (21+ yrs). Established history (18+ yrs). Oldest track record among peers (25 yrs). Established history (20+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.36% (bottom quartile). 5Y return: 15.83% (lower mid). 5Y return: 14.97% (bottom quartile). 5Y return: 16.75% (upper mid). 5Y return: 17.62% (top quartile). Point 6 3Y return: 17.67% (bottom quartile). 3Y return: 22.13% (top quartile). 3Y return: 18.49% (lower mid). 3Y return: 17.44% (bottom quartile). 3Y return: 21.50% (upper mid). Point 7 1Y return: 13.18% (upper mid). 1Y return: 12.05% (lower mid). 1Y return: 8.34% (bottom quartile). 1Y return: 14.79% (top quartile). 1Y return: 11.09% (bottom quartile). Point 8 Alpha: 2.61 (upper mid). Alpha: -0.94 (bottom quartile). Alpha: 1.22 (bottom quartile). Alpha: 3.74 (top quartile). Alpha: 1.38 (lower mid). Point 9 Sharpe: 0.44 (upper mid). Sharpe: 0.19 (bottom quartile). Sharpe: 0.34 (bottom quartile). Sharpe: 0.59 (top quartile). Sharpe: 0.36 (lower mid). Point 10 Information ratio: 0.08 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.30 (lower mid). Information ratio: -0.27 (bottom quartile). Information ratio: 1.08 (top quartile). Kotak Equity Opportunities Fund

Invesco India Growth Opportunities Fund

DSP Equity Opportunities Fund

SBI Large and Midcap Fund

Bandhan Core Equity Fund

بہترین مڈ کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Emerging Equity Scheme Growth ₹130.207

↓ -2.80 ₹59,041 1,000 -3.3 -4.2 15.2 19.6 17.7 1.8 Sundaram Mid Cap Fund Growth ₹1,348.75

↓ -32.70 ₹12,917 100 -5 -2.6 14.7 22.7 17.9 4.1 Taurus Discovery (Midcap) Fund Growth ₹108.97

↓ -2.43 ₹123 1,000 -9.1 -10.5 4.5 13 12.2 0.8 Edelweiss Mid Cap Fund Growth ₹98.514

↓ -2.16 ₹13,802 500 -4.1 -1.9 15.5 23.9 19.8 3.8 HDFC Mid-Cap Opportunities Fund Growth ₹190.773

↓ -3.89 ₹92,187 300 -5.4 -1.2 14.4 23.1 20.7 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Emerging Equity Scheme Sundaram Mid Cap Fund Taurus Discovery (Midcap) Fund Edelweiss Mid Cap Fund HDFC Mid-Cap Opportunities Fund Point 1 Upper mid AUM (₹59,041 Cr). Bottom quartile AUM (₹12,917 Cr). Bottom quartile AUM (₹123 Cr). Lower mid AUM (₹13,802 Cr). Highest AUM (₹92,187 Cr). Point 2 Established history (18+ yrs). Established history (23+ yrs). Oldest track record among peers (31 yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 17.71% (bottom quartile). 5Y return: 17.87% (lower mid). 5Y return: 12.16% (bottom quartile). 5Y return: 19.80% (upper mid). 5Y return: 20.74% (top quartile). Point 6 3Y return: 19.60% (bottom quartile). 3Y return: 22.69% (lower mid). 3Y return: 13.01% (bottom quartile). 3Y return: 23.87% (top quartile). 3Y return: 23.14% (upper mid). Point 7 1Y return: 15.24% (upper mid). 1Y return: 14.72% (lower mid). 1Y return: 4.51% (bottom quartile). 1Y return: 15.49% (top quartile). 1Y return: 14.37% (bottom quartile). Point 8 Alpha: -0.96 (bottom quartile). Alpha: 0.78 (lower mid). Alpha: -5.93 (bottom quartile). Alpha: 1.70 (upper mid). Alpha: 3.73 (top quartile). Point 9 Sharpe: 0.18 (bottom quartile). Sharpe: 0.28 (lower mid). Sharpe: -0.09 (bottom quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.49 (top quartile). Point 10 Information ratio: -0.44 (bottom quartile). Information ratio: 0.23 (lower mid). Information ratio: -1.68 (bottom quartile). Information ratio: 0.49 (top quartile). Information ratio: 0.47 (upper mid). Kotak Emerging Equity Scheme

Sundaram Mid Cap Fund

Taurus Discovery (Midcap) Fund

Edelweiss Mid Cap Fund

HDFC Mid-Cap Opportunities Fund

بہترین سمال کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Small Cap Fund Growth ₹79.6127

↓ -2.10 ₹4,778 1,000 -5.3 -5.9 9 15.8 12.9 -3.7 SBI Small Cap Fund Growth ₹152.794

↓ -2.80 ₹34,449 500 -8.3 -11.7 0.4 11.1 13.6 -4.9 DSP Small Cap Fund Growth ₹182.262

↓ -4.67 ₹16,135 500 -6 -7.4 9.2 17.4 17.9 -2.8 HDFC Small Cap Fund Growth ₹125.645

↓ -3.17 ₹36,941 300 -8.9 -11.5 5.7 15.4 18.7 -0.6 Nippon India Small Cap Fund Growth ₹154.526

↓ -3.10 ₹65,812 100 -5.8 -8.3 5.6 18.3 21 -4.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Small Cap Fund SBI Small Cap Fund DSP Small Cap Fund HDFC Small Cap Fund Nippon India Small Cap Fund Point 1 Bottom quartile AUM (₹4,778 Cr). Lower mid AUM (₹34,449 Cr). Bottom quartile AUM (₹16,135 Cr). Upper mid AUM (₹36,941 Cr). Highest AUM (₹65,812 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.91% (bottom quartile). 5Y return: 13.65% (bottom quartile). 5Y return: 17.85% (lower mid). 5Y return: 18.74% (upper mid). 5Y return: 21.01% (top quartile). Point 6 3Y return: 15.85% (lower mid). 3Y return: 11.14% (bottom quartile). 3Y return: 17.40% (upper mid). 3Y return: 15.42% (bottom quartile). 3Y return: 18.29% (top quartile). Point 7 1Y return: 9.03% (upper mid). 1Y return: 0.38% (bottom quartile). 1Y return: 9.21% (top quartile). 1Y return: 5.68% (lower mid). 1Y return: 5.60% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: -0.64 (bottom quartile). Point 9 Sharpe: 0.01 (upper mid). Sharpe: -0.41 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.05 (top quartile). Sharpe: -0.19 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.02 (top quartile). Aditya Birla Sun Life Small Cap Fund

SBI Small Cap Fund

DSP Small Cap Fund

HDFC Small Cap Fund

Nippon India Small Cap Fund

بہترین ملٹی کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Standard Multicap Fund Growth ₹82.997

↓ -1.89 ₹56,479 500 -3.3 -1.1 12.6 15.8 12.4 9.5 Mirae Asset India Equity Fund Growth ₹107.784

↓ -1.92 ₹40,371 1,000 -7.5 -4.5 7.2 11.4 9.9 10.2 Motilal Oswal Multicap 35 Fund Growth ₹54.0188

↓ -0.92 ₹13,180 500 -11.4 -13.1 -1 18.8 10.7 -5.6 BNP Paribas Multi Cap Fund Growth ₹73.5154

↓ -0.01 ₹588 300 -4.6 -2.6 19.3 17.3 13.6 Aditya Birla Sun Life Equity Fund Growth ₹1,765.31

↓ -33.86 ₹24,700 100 -5.2 -1.3 12.1 16.9 13 11.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Standard Multicap Fund Mirae Asset India Equity Fund Motilal Oswal Multicap 35 Fund BNP Paribas Multi Cap Fund Aditya Birla Sun Life Equity Fund Point 1 Highest AUM (₹56,479 Cr). Upper mid AUM (₹40,371 Cr). Bottom quartile AUM (₹13,180 Cr). Bottom quartile AUM (₹588 Cr). Lower mid AUM (₹24,700 Cr). Point 2 Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (27 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.43% (lower mid). 5Y return: 9.94% (bottom quartile). 5Y return: 10.73% (bottom quartile). 5Y return: 13.57% (top quartile). 5Y return: 13.03% (upper mid). Point 6 3Y return: 15.85% (bottom quartile). 3Y return: 11.43% (bottom quartile). 3Y return: 18.78% (top quartile). 3Y return: 17.28% (upper mid). 3Y return: 16.89% (lower mid). Point 7 1Y return: 12.56% (upper mid). 1Y return: 7.20% (bottom quartile). 1Y return: -0.99% (bottom quartile). 1Y return: 19.34% (top quartile). 1Y return: 12.08% (lower mid). Point 8 Alpha: 3.74 (top quartile). Alpha: 0.02 (lower mid). Alpha: -5.98 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 3.72 (upper mid). Point 9 Sharpe: 0.46 (lower mid). Sharpe: 0.27 (bottom quartile). Sharpe: -0.19 (bottom quartile). Sharpe: 2.86 (top quartile). Sharpe: 0.48 (upper mid). Point 10 Information ratio: 0.19 (lower mid). Information ratio: -0.62 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.76 (top quartile). Kotak Standard Multicap Fund

Mirae Asset India Equity Fund

Motilal Oswal Multicap 35 Fund

BNP Paribas Multi Cap Fund

Aditya Birla Sun Life Equity Fund

بہترین سیکٹر ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹107.258

↓ -0.54 ₹1,765 500 12.2 18.5 30.2 23.1 20.4 17.5 Franklin Build India Fund Growth ₹140.414

↓ -3.35 ₹3,003 500 -0.2 0.5 14.7 24.9 22 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹59.74

↓ -1.48 ₹3,641 1,000 -6.5 0.7 14.5 15 11.2 17.5 ICICI Prudential Banking and Financial Services Fund Growth ₹128.01

↓ -2.71 ₹10,951 100 -7.7 -2.5 10.1 13.6 10.8 15.9 Bandhan Infrastructure Fund Growth ₹44.797

↓ -1.15 ₹1,428 100 -5.2 -9 2.9 21.1 19.1 -6.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund ICICI Prudential Banking and Financial Services Fund Bandhan Infrastructure Fund Point 1 Bottom quartile AUM (₹1,765 Cr). Lower mid AUM (₹3,003 Cr). Upper mid AUM (₹3,641 Cr). Highest AUM (₹10,951 Cr). Bottom quartile AUM (₹1,428 Cr). Point 2 Oldest track record among peers (17 yrs). Established history (16+ yrs). Established history (12+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 20.42% (upper mid). 5Y return: 22.00% (top quartile). 5Y return: 11.25% (bottom quartile). 5Y return: 10.82% (bottom quartile). 5Y return: 19.09% (lower mid). Point 6 3Y return: 23.09% (upper mid). 3Y return: 24.93% (top quartile). 3Y return: 14.95% (bottom quartile). 3Y return: 13.63% (bottom quartile). 3Y return: 21.13% (lower mid). Point 7 1Y return: 30.25% (top quartile). 1Y return: 14.70% (upper mid). 1Y return: 14.47% (lower mid). 1Y return: 10.10% (bottom quartile). 1Y return: 2.92% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.61 (top quartile). Alpha: -2.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.32 (top quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (upper mid). Sharpe: 0.78 (lower mid). Sharpe: -0.27 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.25 (top quartile). Information ratio: -0.01 (bottom quartile). Information ratio: 0.00 (bottom quartile). DSP Natural Resources and New Energy Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Bandhan Infrastructure Fund

بہترین ELSS SIP فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹43.3255

↓ -0.91 ₹4,566 500 -5 -0.9 9.6 14.5 12.5 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹148.022

↓ -2.50 ₹7,060 500 -5.5 -1.9 8.2 14 14.2 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹57.97

↓ -1.01 ₹14,993 500 -6.8 -4.8 9.7 14 7.7 9.3 DSP Tax Saver Fund Growth ₹134.373

↓ -2.97 ₹17,223 500 -6 -1.9 7.5 17.9 15.2 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,566 Cr). Lower mid AUM (₹7,060 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.52% (bottom quartile). 5Y return: 14.18% (lower mid). 5Y return: 7.69% (bottom quartile). 5Y return: 15.16% (upper mid). 5Y return: 17.39% (top quartile). Point 6 3Y return: 14.45% (lower mid). 3Y return: 14.04% (bottom quartile). 3Y return: 13.96% (bottom quartile). 3Y return: 17.85% (upper mid). 3Y return: 20.64% (top quartile). Point 7 1Y return: 9.56% (lower mid). 1Y return: 8.23% (bottom quartile). 1Y return: 9.67% (upper mid). 1Y return: 7.55% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.34 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.14 (bottom quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.35 (bottom quartile). Information ratio: -0.30 (lower mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

بہترین ویلیو ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Equity PE Fund Growth ₹336.266

↓ -6.78 ₹8,819 150 -5.7 -1.6 8.9 17.2 14.8 3.7 JM Value Fund Growth ₹86.703

↓ -2.22 ₹885 500 -8.4 -10.6 -0.2 15.9 15.1 -4.4 HDFC Capital Builder Value Fund Growth ₹718.205

↓ -15.83 ₹7,487 300 -5.9 -1.9 11.6 17.7 14.9 8.6 Aditya Birla Sun Life Pure Value Fund Growth ₹121.038

↓ -2.03 ₹6,246 1,000 -4.4 0.2 9.2 18.3 15.1 2.6 Templeton India Value Fund Growth ₹692.855

↓ -14.89 ₹2,265 500 -4.6 -1.6 7.1 15.6 16.1 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata Equity PE Fund JM Value Fund HDFC Capital Builder Value Fund Aditya Birla Sun Life Pure Value Fund Templeton India Value Fund Point 1 Highest AUM (₹8,819 Cr). Bottom quartile AUM (₹885 Cr). Upper mid AUM (₹7,487 Cr). Lower mid AUM (₹6,246 Cr). Bottom quartile AUM (₹2,265 Cr). Point 2 Established history (21+ yrs). Established history (28+ yrs). Oldest track record among peers (32 yrs). Established history (17+ yrs). Established history (29+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.80% (bottom quartile). 5Y return: 15.14% (upper mid). 5Y return: 14.88% (bottom quartile). 5Y return: 15.07% (lower mid). 5Y return: 16.07% (top quartile). Point 6 3Y return: 17.18% (lower mid). 3Y return: 15.94% (bottom quartile). 3Y return: 17.69% (upper mid). 3Y return: 18.28% (top quartile). 3Y return: 15.58% (bottom quartile). Point 7 1Y return: 8.90% (lower mid). 1Y return: -0.15% (bottom quartile). 1Y return: 11.57% (top quartile). 1Y return: 9.15% (upper mid). 1Y return: 7.15% (bottom quartile). Point 8 Alpha: 0.27 (upper mid). Alpha: -9.27 (bottom quartile). Alpha: 2.68 (top quartile). Alpha: -1.64 (bottom quartile). Alpha: -0.11 (lower mid). Point 9 Sharpe: 0.22 (upper mid). Sharpe: -0.40 (bottom quartile). Sharpe: 0.39 (top quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.18 (lower mid). Point 10 Information ratio: 0.89 (upper mid). Information ratio: 0.35 (bottom quartile). Information ratio: 1.10 (top quartile). Information ratio: 0.57 (lower mid). Information ratio: 0.32 (bottom quartile). Tata Equity PE Fund

JM Value Fund

HDFC Capital Builder Value Fund

Aditya Birla Sun Life Pure Value Fund

Templeton India Value Fund

بہترین فوکسڈ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Focused 25 Fund Growth ₹50.33

↓ -0.74 ₹11,382 500 -8.3 -8.7 4 10.9 5.3 2.5 Aditya Birla Sun Life Focused Equity Fund Growth ₹139.4

↓ -2.23 ₹8,068 1,000 -5.4 -0.4 10.3 15.8 12.4 10.1 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Motilal Oswal Focused 25 Fund Growth ₹41.1958

↓ -0.93 ₹1,445 500 -4.7 -2.3 12 9 6.2 -1.7 HDFC Focused 30 Fund Growth ₹223.989

↓ -5.17 ₹26,332 300 -5.5 -3.7 9.1 19.1 19.7 10.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Focused 25 Fund Aditya Birla Sun Life Focused Equity Fund Sundaram Select Focus Fund Motilal Oswal Focused 25 Fund HDFC Focused 30 Fund Point 1 Upper mid AUM (₹11,382 Cr). Lower mid AUM (₹8,068 Cr). Bottom quartile AUM (₹1,354 Cr). Bottom quartile AUM (₹1,445 Cr). Highest AUM (₹26,332 Cr). Point 2 Established history (13+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Established history (12+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 5.31% (bottom quartile). 5Y return: 12.44% (lower mid). 5Y return: 17.29% (upper mid). 5Y return: 6.23% (bottom quartile). 5Y return: 19.72% (top quartile). Point 6 3Y return: 10.87% (bottom quartile). 3Y return: 15.82% (lower mid). 3Y return: 17.03% (upper mid). 3Y return: 9.00% (bottom quartile). 3Y return: 19.06% (top quartile). Point 7 1Y return: 4.01% (bottom quartile). 1Y return: 10.26% (lower mid). 1Y return: 24.49% (top quartile). 1Y return: 12.03% (upper mid). 1Y return: 9.13% (bottom quartile). Point 8 Alpha: -3.90 (bottom quartile). Alpha: 3.66 (upper mid). Alpha: -5.62 (bottom quartile). Alpha: -2.93 (lower mid). Alpha: 3.79 (top quartile). Point 9 Sharpe: -0.10 (bottom quartile). Sharpe: 0.49 (lower mid). Sharpe: 1.85 (top quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.60 (upper mid). Point 10 Information ratio: -0.76 (bottom quartile). Information ratio: 0.23 (upper mid). Information ratio: -0.52 (lower mid). Information ratio: -0.68 (bottom quartile). Information ratio: 0.98 (top quartile). Axis Focused 25 Fund

Aditya Birla Sun Life Focused Equity Fund

Sundaram Select Focus Fund

Motilal Oswal Focused 25 Fund

HDFC Focused 30 Fund

ایکویٹی فنڈز پر ٹیکس

بجٹ 2018 کی تقریر کے مطابق، ایک نئی لانگ ٹرمسرمایہ ایکویٹی پر مبنی گینز (LTCG) ٹیکسباہمی چندہ اور اسٹاک یکم اپریل سے لاگو ہوں گے۔ مالیاتی بل 2018 14 مارچ 2018 کو لوک سبھا میں صوتی ووٹ سے منظور ہوا۔انکم ٹیکس تبدیلیاں یکم اپریل 2018 سے ایکویٹی سرمایہ کاری کو متاثر کریں گی۔*

1. طویل مدتی کیپٹل گینز

LTCGs جو INR 1 لاکھ سے زیادہ ہیں۔رہائی یکم اپریل 2018 کو یا اس کے بعد میوچل فنڈ یونٹس یا ایکویٹیز پر 10 فیصد (پلس سیس) یا 10.4 فیصد ٹیکس لگے گا۔ طویل مدتیکیپٹل گینز 1 لاکھ روپے تک مستثنیٰ ہوگا۔ مثال کے طور پر، اگر آپ ایک مالی سال میں اسٹاکس یا میوچل فنڈ کی سرمایہ کاری سے مشترکہ طویل مدتی سرمائے میں INR 3 لاکھ کماتے ہیں۔ قابل ٹیکس LTCGs INR 2 لاکھ (INR 3 لاکھ - 1 لاکھ) اورٹیکس کی ذمہ داری 20 روپے ہوں گے،000 (INR 2 لاکھ کا 10 فیصد)۔

طویل مدتی سرمایہ نفع وہ منافع ہے جو فروخت کرنے یا چھڑانے سے حاصل ہوتا ہے۔ایکویٹی فنڈز ایک سال سے زیادہ منعقد.

2. شارٹ ٹرم کیپیٹل گینز

اگر میوچل فنڈ یونٹس ہولڈنگ کے ایک سال سے پہلے فروخت کیے جاتے ہیں، تو شارٹ ٹرم کیپیٹل گینز (STCGs) ٹیکس لاگو ہوگا۔ STCGs ٹیکس کو 15 فیصد پر برقرار رکھا گیا ہے۔

| ایکویٹی اسکیمیں | انعقاد کا دورانیہ | ٹیکس کی شرح |

|---|---|---|

| طویل مدتی کیپیٹل گینز (LTCG) | 1 سال سے زیادہ | 10% (بغیر اشاریہ کے) **** |

| شارٹ ٹرم کیپیٹل گینز (STCG) | ایک سال سے کم یا اس کے برابر | 15% |

| تقسیم شدہ ڈیویڈنڈ پر ٹیکس | - | 10%# |

*1 لاکھ روپے تک کے منافع ٹیکس سے پاک ہیں۔ INR 1 لاکھ سے زیادہ کے منافع پر 10% ٹیکس لاگو ہوتا ہے۔ قبل ازیں شرح 0% لاگت کا حساب 31 جنوری 2018 کو اختتامی قیمت کے طور پر کیا گیا تھا۔ #10% کا ڈیویڈنڈ ٹیکس + سرچارج 12% + 4% = 11.648% صحت اور تعلیم 4% کا سیس متعارف کرایا گیا۔ پہلے تعلیمی سیس 3 تھا۔%

SIP سرمایہ کاری کے فوائد

کچھ اہممنظم سرمایہ کاری کے منصوبوں کے فوائد ہیں:

روپے کی لاگت کا اوسط

SIP کی پیشکش کا سب سے بڑا فائدہ روپی لاگت کا اوسط ہے، جو کسی فرد کو اثاثہ کی خریداری کی لاگت کا اوسط نکالنے میں مدد کرتا ہے۔ میوچل فنڈ میں یکمشت سرمایہ کاری کرتے وقت ایک مخصوص تعداد میں یونٹ خریدے جاتے ہیں۔سرمایہ کار سب ایک ساتھ، ایس آئی پی کی صورت میں یونٹس کی خریداری ایک طویل مدت میں کی جاتی ہے اور یہ ماہانہ وقفوں (عام طور پر) پر یکساں طور پر پھیل جاتی ہیں۔ سرمایہ کاری کو وقت کے ساتھ ساتھ پھیلانے کی وجہ سے، سرمایہ کاری مختلف قیمت پوائنٹس پر اسٹاک مارکیٹ میں کی جاتی ہے جس سے سرمایہ کار کو اوسط لاگت کا فائدہ ہوتا ہے، اس لیے اصطلاح روپیہ لاگت کا اوسط ہے۔

کمپاؤنڈنگ کی طاقت

SIPs کا فائدہ پیش کرتے ہیں۔کمپاؤنڈنگ کی طاقت. سادہ سود تب ہوتا ہے جب آپ صرف اصل پر سود حاصل کرتے ہیں۔ مرکب سود کی صورت میں، سود کی رقم پرنسپل میں شامل کی جاتی ہے، اور سود کا حساب نئے پرنسپل (پرانے پرنسپل کے علاوہ منافع) پر کیا جاتا ہے۔ یہ عمل ہر بار جاری رہتا ہے۔ چونکہ ایس آئی پی میں میوچل فنڈز قسطوں میں ہوتے ہیں، اس لیے وہ مرکب ہوتے ہیں، جو ابتدائی طور پر لگائی گئی رقم میں مزید اضافہ کرتے ہیں۔

استطاعت

SIPs بہت سستی ہیں۔ ایس آئی پی میں ماہانہ کم از کم سرمایہ کاری کی رقم 500 روپے تک کم ہو سکتی ہے۔ کچھ فنڈ ہاؤسز، یہاں تک کہ "مائیکرو ایس آئی پی" کہلانے والی چیز بھی پیش کرتے ہیں جہاں ٹکٹ کا سائز 100 روپے تک کم ہوتا ہے۔ یہ نوجوانوں کے لیے ایک اچھا آپشن فراہم کرتا ہے کہ وہ اپنا طویل سفر شروع کر سکیں۔ زندگی کے ابتدائی مرحلے میں مدتی سرمایہ کاری۔

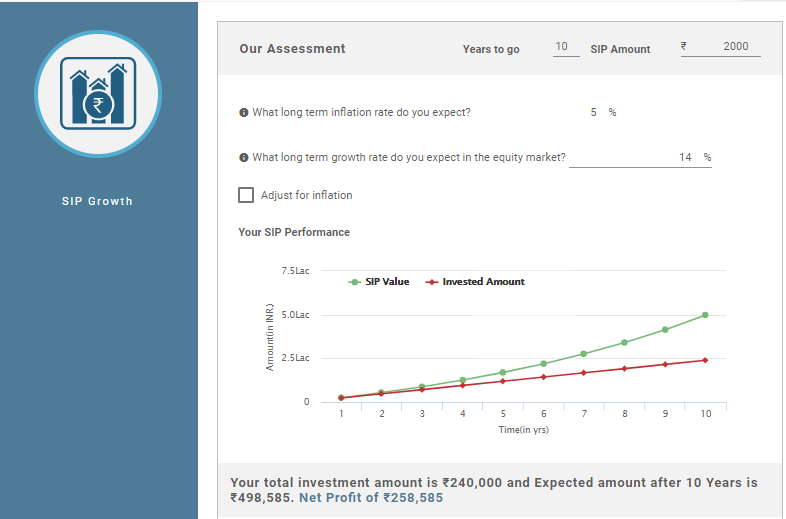

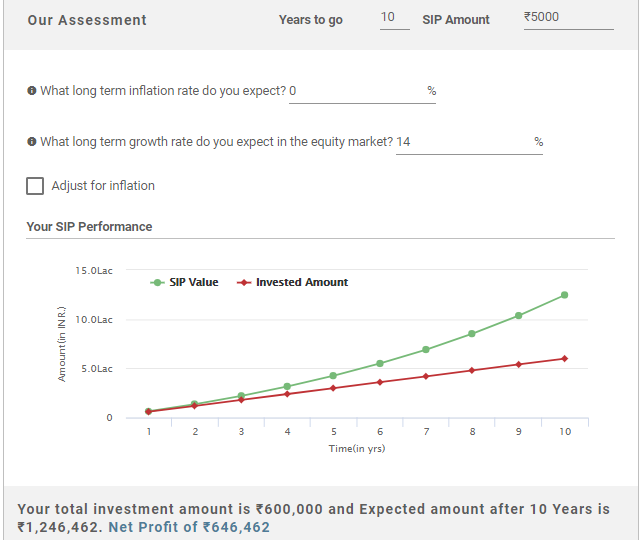

ایس آئی پی کیلکولیٹر

SIP کیلکولیٹر آپ کی سرمایہ کاری میں سب سے مفید ٹول ہو سکتا ہے۔ یہ اس وقت تک آپ کی SIP سرمایہ کاری میں اضافے کا تخمینہ لگاتا ہے جب تک کہ آپ سرمایہ کاری میں رہنا چاہیں گے۔ تو، اس سے پہلے بھیسرمایہ کاری ایک فنڈ میں، کوئی اپنے کل SIP کا پہلے سے تعین کر سکتا ہے۔کمائی ایس آئی پی کیلکولیٹر کے ذریعے۔ کیلکولیٹر عام طور پر ان پٹ لیتے ہیں جیسے SIP سرمایہ کاری کی رقم جو کوئی سرمایہ کاری کرنا چاہتا ہے، سرمایہ کاری کی مدت، متوقعمہنگائی شرحیں (کسی کو اس کا حساب دینا ہوگا)۔ اس کی مثال ذیل میں دی گئی ہے:

فرض کریں، اگر آپ 10 سال کے لیے INR 5,000 کی سرمایہ کاری کرتے ہیں، تو دیکھیں کہ آپ کی SIP سرمایہ کاری کیسے بڑھتی ہے۔

ماہانہ سرمایہ کاری: INR 5,000

سرمایہ کاری کی مدت: 10 سال

سرمایہ کاری کی کل رقم: INR 6,00,000

طویل مدتی ترقی کی شرح (تقریباً): 14%

SIP کیلکولیٹر کے مطابق متوقع واپسی۔: 12,46,462 روپے

خالص منافع: INR 6,46,462

مندرجہ بالا حسابات سے پتہ چلتا ہے کہ اگر آپ 10 سال کے لیے ماہانہ INR 5,000 (مجموعی طور پر 6,00,000 INR) کی سرمایہ کاری کرتے ہیں تو آپ کمائیں گے۔12,46,462 روپے جس کا مطلب ہے کہ آپ جو خالص منافع کماتے ہیں۔INR 6,46,462 کیا یہ بہت اچھا نہیں ہے!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔