سرمایہ کاری کے لیے ٹاپ 5 بہترین ایکویٹی ایس آئی پی فنڈز

اگر آپ چاہتے ہیں کہ آپ کی سرمایہ کاری سب میں پسند کی جائے۔مارکیٹ حالات، پھر اپنی سرمایہ کاری کریں۔گھونٹ راستہ! سیسٹیمیٹک انویسٹمنٹ پلانز (SIPs) کو سب سے زیادہ موثر طریقے سمجھا جاتا ہے۔میوچل فنڈز میں سرمایہ کاری. اور اگر آپ ایکویٹیز میں سرمایہ کاری کرنے کا منصوبہ بنا رہے ہیں، تو SIPs خواہش مند منافع کمانے کا بہترین طریقہ ہیں۔ بہترین ایکویٹی ایس آئی پی فنڈز آپ کو طویل مدتی میں مطلوبہ منافع دے سکتے ہیں۔مالی اہداف. تو، آئیے دیکھتے ہیں کہ SIP کیسے کام کرتا ہے، اس کے فوائدSIP سرمایہ کاریکا اہم استعمال aگھونٹ کیلکولیٹر ایکویٹی سرمایہ کاری کے لیے بہترین کارکردگی کا مظاہرہ کرنے والے SIP فنڈز کے ساتھ۔

Talk to our investment specialist

ایکویٹی میوچل فنڈز کے لیے منظم سرمایہ کاری

مثالی طور پر، جب سرمایہ کار ایکوئٹی میں سرمایہ کاری کرنے کا ارادہ رکھتے ہیں، تو وہ اکثر منافع کے استحکام پر شک کرتے ہیں۔ اس کی وجہ یہ ہے کہ وہ مارکیٹ سے جڑے ہوئے ہیں اور اکثر اتار چڑھاؤ کا شکار رہتے ہیں۔ اس طرح، اس طرح کے اتار چڑھاؤ کو متوازن کرنے اور طویل مدتی مستحکم منافع کو یقینی بنانے کے لیے، ایکویٹی سرمایہ کاری میں SIPs انتہائی قابل سفارش ہیں۔ تاریخی طور پر، مارکیٹ کے خراب مرحلے میں، یہ دیکھا گیا ہے کہ SIP کا راستہ اختیار کرنے والے سرمایہ کاروں نے یکمشت راستہ اختیار کرنے والوں کے مقابلے میں زیادہ مستحکم منافع حاصل کیا۔ SIP کی سرمایہ کاری وقت کے ساتھ ساتھ پھیل جاتی ہے، ایک یکمشت سرمایہ کاری کے برعکس جو ایک ہی وقت میں ہوتی ہے۔ لہذا، SIP میں آپ کی رقم ہر روز بڑھنے لگتی ہے (اسٹاک مارکیٹ میں سرمایہ کاری کی جا رہی ہے)۔

ایک منظمسرمایہ کاری کا منصوبہ جیسے طویل مدتی مالی اہداف کو حاصل کرنے کے لیے بھی وسیع پیمانے پر سمجھا جاتا ہے۔ریٹائرمنٹ پلاننگ، بچے کی تعلیم، گھر/گاڑی کی خریداری یا کوئی اور اثاثہ۔ اس سے پہلے کہ ہم کچھ اور دیکھیںسرمایہ کاری کے فوائد ایس آئی پی میں، آئیے سرمایہ کاری کے لیے کچھ بہترین ایکویٹی ایس آئی پی فنڈز کو دیکھیں۔

ایکویٹی فنڈز 2022 کے لیے بہترین SIP پلان

بہترین لارج کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Indiabulls Blue Chip Fund Growth ₹44.69

↑ 0.18 ₹132 500 1 4.1 16.9 15 11.7 7.5 Nippon India Large Cap Fund Growth ₹93.8953

↑ 0.49 ₹50,876 100 0.4 3.1 16.6 19.3 17.4 9.2 SBI Bluechip Fund Growth ₹96.2147

↑ 0.50 ₹55,879 500 1.4 4.6 14.9 14.7 12.4 9.7 ICICI Prudential Bluechip Fund Growth ₹114.46

↑ 0.46 ₹78,502 100 -0.5 3.3 14.6 18.2 15.5 11.3 Aditya Birla Sun Life Frontline Equity Fund Growth ₹540.23

↑ 1.80 ₹31,386 100 -0.7 2.8 14 15.8 13.3 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Blue Chip Fund Nippon India Large Cap Fund SBI Bluechip Fund ICICI Prudential Bluechip Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹132 Cr). Lower mid AUM (₹50,876 Cr). Upper mid AUM (₹55,879 Cr). Highest AUM (₹78,502 Cr). Bottom quartile AUM (₹31,386 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 11.74% (bottom quartile). 5Y return: 17.39% (top quartile). 5Y return: 12.36% (bottom quartile). 5Y return: 15.55% (upper mid). 5Y return: 13.26% (lower mid). Point 6 3Y return: 14.99% (bottom quartile). 3Y return: 19.34% (top quartile). 3Y return: 14.66% (bottom quartile). 3Y return: 18.21% (upper mid). 3Y return: 15.76% (lower mid). Point 7 1Y return: 16.93% (top quartile). 1Y return: 16.58% (upper mid). 1Y return: 14.93% (lower mid). 1Y return: 14.55% (bottom quartile). 1Y return: 14.03% (bottom quartile). Point 8 Alpha: -2.54 (bottom quartile). Alpha: -0.94 (bottom quartile). Alpha: -0.41 (upper mid). Alpha: 1.30 (top quartile). Alpha: -0.70 (lower mid). Point 9 Sharpe: 0.16 (bottom quartile). Sharpe: 0.29 (bottom quartile). Sharpe: 0.34 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.31 (lower mid). Point 10 Information ratio: -0.28 (bottom quartile). Information ratio: 1.37 (top quartile). Information ratio: -0.28 (bottom quartile). Information ratio: 1.26 (upper mid). Information ratio: 0.58 (lower mid). Indiabulls Blue Chip Fund

Nippon India Large Cap Fund

SBI Bluechip Fund

ICICI Prudential Bluechip Fund

Aditya Birla Sun Life Frontline Equity Fund

بہترین لارج اور مڈ کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Invesco India Growth Opportunities Fund Growth ₹100.89

↑ 0.29 ₹9,344 100 -1.8 -1.2 21.4 25.1 17.5 4.7 Kotak Equity Opportunities Fund Growth ₹361.242

↑ 1.19 ₹30,039 1,000 2.8 6.4 20.9 20.2 17.2 5.6 DSP Equity Opportunities Fund Growth ₹644.26

↑ 2.29 ₹17,576 500 1.5 5.9 16.9 21.2 16.6 7.1 SBI Large and Midcap Fund Growth ₹658.003

↑ 2.78 ₹37,443 500 1.2 7.1 18.7 19.1 17.7 10.1 Aditya Birla Sun Life Equity Advantage Fund Growth ₹930.83

↑ 4.17 ₹5,784 1,000 1.6 4 18.6 16.2 11 3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Invesco India Growth Opportunities Fund Kotak Equity Opportunities Fund DSP Equity Opportunities Fund SBI Large and Midcap Fund Aditya Birla Sun Life Equity Advantage Fund Point 1 Bottom quartile AUM (₹9,344 Cr). Upper mid AUM (₹30,039 Cr). Lower mid AUM (₹17,576 Cr). Highest AUM (₹37,443 Cr). Bottom quartile AUM (₹5,784 Cr). Point 2 Established history (18+ yrs). Established history (21+ yrs). Established history (25+ yrs). Established history (20+ yrs). Oldest track record among peers (31 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.52% (upper mid). 5Y return: 17.19% (lower mid). 5Y return: 16.62% (bottom quartile). 5Y return: 17.67% (top quartile). 5Y return: 10.99% (bottom quartile). Point 6 3Y return: 25.10% (top quartile). 3Y return: 20.19% (lower mid). 3Y return: 21.19% (upper mid). 3Y return: 19.10% (bottom quartile). 3Y return: 16.25% (bottom quartile). Point 7 1Y return: 21.36% (top quartile). 1Y return: 20.94% (upper mid). 1Y return: 16.92% (bottom quartile). 1Y return: 18.70% (lower mid). 1Y return: 18.58% (bottom quartile). Point 8 Alpha: -3.20 (bottom quartile). Alpha: -2.40 (lower mid). Alpha: -0.86 (upper mid). Alpha: 2.06 (top quartile). Alpha: -4.42 (bottom quartile). Point 9 Sharpe: 0.01 (bottom quartile). Sharpe: 0.04 (lower mid). Sharpe: 0.13 (upper mid). Sharpe: 0.37 (top quartile). Sharpe: -0.07 (bottom quartile). Point 10 Information ratio: 0.75 (top quartile). Information ratio: -0.05 (lower mid). Information ratio: 0.34 (upper mid). Information ratio: -0.38 (bottom quartile). Information ratio: -1.41 (bottom quartile). Invesco India Growth Opportunities Fund

Kotak Equity Opportunities Fund

DSP Equity Opportunities Fund

SBI Large and Midcap Fund

Aditya Birla Sun Life Equity Advantage Fund

بہترین مڈ کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Mid Cap Fund Growth ₹1,445.54

↑ 6.50 ₹13,293 100 0.4 4.4 22.9 25.5 20.1 4.1 Kotak Emerging Equity Scheme Growth ₹138.119

↑ 0.88 ₹60,637 1,000 0.3 1.4 21.8 21.8 19.6 1.8 Taurus Discovery (Midcap) Fund Growth ₹117.54

↑ 0.10 ₹129 1,000 -4.9 -1.7 13.1 15.6 14.5 0.8 HDFC Mid-Cap Opportunities Fund Growth ₹205.107

↑ 0.60 ₹92,642 300 0.7 6.1 22.3 26.2 23 6.8 Edelweiss Mid Cap Fund Growth ₹104.124

↑ 0.66 ₹13,650 500 0.1 3.2 21.7 26.1 21.3 3.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Sundaram Mid Cap Fund Kotak Emerging Equity Scheme Taurus Discovery (Midcap) Fund HDFC Mid-Cap Opportunities Fund Edelweiss Mid Cap Fund Point 1 Bottom quartile AUM (₹13,293 Cr). Upper mid AUM (₹60,637 Cr). Bottom quartile AUM (₹129 Cr). Highest AUM (₹92,642 Cr). Lower mid AUM (₹13,650 Cr). Point 2 Established history (23+ yrs). Established history (18+ yrs). Oldest track record among peers (31 yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 20.06% (lower mid). 5Y return: 19.60% (bottom quartile). 5Y return: 14.49% (bottom quartile). 5Y return: 23.01% (top quartile). 5Y return: 21.35% (upper mid). Point 6 3Y return: 25.51% (lower mid). 3Y return: 21.85% (bottom quartile). 3Y return: 15.64% (bottom quartile). 3Y return: 26.24% (top quartile). 3Y return: 26.05% (upper mid). Point 7 1Y return: 22.89% (top quartile). 1Y return: 21.83% (lower mid). 1Y return: 13.13% (bottom quartile). 1Y return: 22.26% (upper mid). 1Y return: 21.70% (bottom quartile). Point 8 Alpha: -1.77 (upper mid). Alpha: -3.77 (bottom quartile). Alpha: -5.00 (bottom quartile). Alpha: 0.63 (top quartile). Alpha: -1.98 (lower mid). Point 9 Sharpe: -0.01 (upper mid). Sharpe: -0.11 (bottom quartile). Sharpe: -0.18 (bottom quartile). Sharpe: 0.12 (top quartile). Sharpe: -0.02 (lower mid). Point 10 Information ratio: 0.13 (lower mid). Information ratio: -0.44 (bottom quartile). Information ratio: -1.62 (bottom quartile). Information ratio: 0.44 (top quartile). Information ratio: 0.40 (upper mid). Sundaram Mid Cap Fund

Kotak Emerging Equity Scheme

Taurus Discovery (Midcap) Fund

HDFC Mid-Cap Opportunities Fund

Edelweiss Mid Cap Fund

بہترین سمال کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Small Cap Fund Growth ₹85.6928

↑ 0.39 ₹4,938 1,000 -2 1.2 20.3 18.6 15.6 -3.7 SBI Small Cap Fund Growth ₹163.676

↑ 0.49 ₹36,268 500 -4.6 -4.8 9.4 13.5 15.9 -4.9 DSP Small Cap Fund Growth ₹196.515

↑ 0.84 ₹16,935 500 -0.8 1 20 20.6 20.5 -2.8 HDFC Small Cap Fund Growth ₹135.293

↑ 0.33 ₹37,753 300 -4.7 -3.8 15.5 18.8 20.8 -0.6 Nippon India Small Cap Fund Growth ₹164.458

↑ 0.53 ₹68,287 100 -3.6 -1.7 14.3 21.2 23.6 -4.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Small Cap Fund SBI Small Cap Fund DSP Small Cap Fund HDFC Small Cap Fund Nippon India Small Cap Fund Point 1 Bottom quartile AUM (₹4,938 Cr). Lower mid AUM (₹36,268 Cr). Bottom quartile AUM (₹16,935 Cr). Upper mid AUM (₹37,753 Cr). Highest AUM (₹68,287 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.60% (bottom quartile). 5Y return: 15.95% (bottom quartile). 5Y return: 20.47% (lower mid). 5Y return: 20.83% (upper mid). 5Y return: 23.59% (top quartile). Point 6 3Y return: 18.63% (bottom quartile). 3Y return: 13.53% (bottom quartile). 3Y return: 20.64% (upper mid). 3Y return: 18.83% (lower mid). 3Y return: 21.19% (top quartile). Point 7 1Y return: 20.26% (top quartile). 1Y return: 9.39% (bottom quartile). 1Y return: 20.03% (upper mid). 1Y return: 15.51% (lower mid). 1Y return: 14.26% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: -1.23 (bottom quartile). Point 9 Sharpe: -0.32 (lower mid). Sharpe: -0.54 (bottom quartile). Sharpe: -0.25 (upper mid). Sharpe: -0.23 (top quartile). Sharpe: -0.42 (bottom quartile). Point 10 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: -0.02 (bottom quartile). Aditya Birla Sun Life Small Cap Fund

SBI Small Cap Fund

DSP Small Cap Fund

HDFC Small Cap Fund

Nippon India Small Cap Fund

بہترین ملٹی کیپ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Standard Multicap Fund Growth ₹88.868

↑ 0.32 ₹56,460 500 1.8 5.1 20.5 17.9 14.1 9.5 Mirae Asset India Equity Fund Growth ₹116.041

↑ 0.31 ₹41,802 1,000 -0.9 3.2 14.3 13.6 11.5 10.2 Motilal Oswal Multicap 35 Fund Growth ₹58.5129

↓ -0.02 ₹13,862 500 -6.6 -4.5 7.4 22.2 13 -5.6 BNP Paribas Multi Cap Fund Growth ₹73.5154

↓ -0.01 ₹588 300 -4.6 -2.6 19.3 17.3 13.6 Aditya Birla Sun Life Equity Fund Growth ₹1,883.43

↑ 5.24 ₹25,098 100 0.6 5.5 18.9 18.7 14.5 11.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Standard Multicap Fund Mirae Asset India Equity Fund Motilal Oswal Multicap 35 Fund BNP Paribas Multi Cap Fund Aditya Birla Sun Life Equity Fund Point 1 Highest AUM (₹56,460 Cr). Upper mid AUM (₹41,802 Cr). Bottom quartile AUM (₹13,862 Cr). Bottom quartile AUM (₹588 Cr). Lower mid AUM (₹25,098 Cr). Point 2 Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (27 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.09% (upper mid). 5Y return: 11.45% (bottom quartile). 5Y return: 13.02% (bottom quartile). 5Y return: 13.57% (lower mid). 5Y return: 14.53% (top quartile). Point 6 3Y return: 17.85% (lower mid). 3Y return: 13.62% (bottom quartile). 3Y return: 22.15% (top quartile). 3Y return: 17.28% (bottom quartile). 3Y return: 18.72% (upper mid). Point 7 1Y return: 20.48% (top quartile). 1Y return: 14.31% (bottom quartile). 1Y return: 7.39% (bottom quartile). 1Y return: 19.34% (upper mid). 1Y return: 18.91% (lower mid). Point 8 Alpha: 1.61 (upper mid). Alpha: 0.23 (lower mid). Alpha: -12.91 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 3.22 (top quartile). Point 9 Sharpe: 0.28 (bottom quartile). Sharpe: 0.38 (lower mid). Sharpe: -0.51 (bottom quartile). Sharpe: 2.86 (top quartile). Sharpe: 0.41 (upper mid). Point 10 Information ratio: -0.04 (bottom quartile). Information ratio: -0.35 (bottom quartile). Information ratio: 0.54 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.82 (top quartile). Kotak Standard Multicap Fund

Mirae Asset India Equity Fund

Motilal Oswal Multicap 35 Fund

BNP Paribas Multi Cap Fund

Aditya Birla Sun Life Equity Fund

بہترین سیکٹر ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹106.79

↓ -0.56 ₹1,573 500 9.2 21.7 34.4 22.9 21.4 17.5 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹65.47

↑ 0.43 ₹3,694 1,000 1.4 7.9 25.7 18.1 12.8 17.5 Franklin Build India Fund Growth ₹149.671

↑ 0.76 ₹3,036 500 2.8 6.3 23.9 28.1 23.6 3.7 ICICI Prudential Banking and Financial Services Fund Growth ₹139.62

↑ 0.80 ₹11,154 100 0.4 3.9 18.6 16.8 12.4 15.9 Bandhan Infrastructure Fund Growth ₹47.922

↑ 0.14 ₹1,522 100 -3.6 -2.9 13.4 24.1 21.5 -6.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund ICICI Prudential Banking and Financial Services Fund Bandhan Infrastructure Fund Point 1 Bottom quartile AUM (₹1,573 Cr). Upper mid AUM (₹3,694 Cr). Lower mid AUM (₹3,036 Cr). Highest AUM (₹11,154 Cr). Bottom quartile AUM (₹1,522 Cr). Point 2 Oldest track record among peers (17 yrs). Established history (12+ yrs). Established history (16+ yrs). Established history (17+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.39% (lower mid). 5Y return: 12.81% (bottom quartile). 5Y return: 23.56% (top quartile). 5Y return: 12.41% (bottom quartile). 5Y return: 21.51% (upper mid). Point 6 3Y return: 22.86% (lower mid). 3Y return: 18.07% (bottom quartile). 3Y return: 28.07% (top quartile). 3Y return: 16.81% (bottom quartile). 3Y return: 24.14% (upper mid). Point 7 1Y return: 34.36% (top quartile). 1Y return: 25.66% (upper mid). 1Y return: 23.89% (lower mid). 1Y return: 18.59% (bottom quartile). 1Y return: 13.43% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: -1.32 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -0.56 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 0.74 (lower mid). Sharpe: 0.84 (upper mid). Sharpe: -0.05 (bottom quartile). Sharpe: 0.88 (top quartile). Sharpe: -0.43 (bottom quartile). Point 10 Information ratio: 0.00 (lower mid). Information ratio: 0.25 (top quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.16 (upper mid). Information ratio: 0.00 (bottom quartile). DSP Natural Resources and New Energy Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

ICICI Prudential Banking and Financial Services Fund

Bandhan Infrastructure Fund

بہترین ELSS SIP فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹46.3289

↑ 0.16 ₹4,748 500 0.5 5.8 17.3 16.6 13.8 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹157.482

↑ 0.52 ₹7,333 500 0.2 4.3 14.2 16 15.8 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹62.42

↑ 0.12 ₹15,415 500 0.1 2.7 18.2 16.2 9.8 9.3 DSP Tax Saver Fund Growth ₹145.728

↑ 0.56 ₹17,609 500 1.5 6 16.4 20.9 17.1 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,748 Cr). Lower mid AUM (₹7,333 Cr). Upper mid AUM (₹15,415 Cr). Highest AUM (₹17,609 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.85% (bottom quartile). 5Y return: 15.84% (lower mid). 5Y return: 9.78% (bottom quartile). 5Y return: 17.06% (upper mid). 5Y return: 17.39% (top quartile). Point 6 3Y return: 16.65% (lower mid). 3Y return: 16.03% (bottom quartile). 3Y return: 16.17% (bottom quartile). 3Y return: 20.87% (top quartile). 3Y return: 20.64% (upper mid). Point 7 1Y return: 17.29% (lower mid). 1Y return: 14.19% (bottom quartile). 1Y return: 18.22% (upper mid). 1Y return: 16.45% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: -2.63 (bottom quartile). Alpha: 0.45 (lower mid). Alpha: 1.55 (upper mid). Alpha: -0.15 (bottom quartile). Alpha: 1.75 (top quartile). Point 9 Sharpe: 0.00 (bottom quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.29 (upper mid). Sharpe: 0.16 (bottom quartile). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.26 (bottom quartile). Information ratio: -0.08 (upper mid). Information ratio: -0.74 (bottom quartile). Information ratio: 0.96 (top quartile). Information ratio: -0.15 (lower mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

بہترین ویلیو ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Equity PE Fund Growth ₹358.373

↑ 0.46 ₹9,061 150 -1 4.6 15.5 19.9 16.3 3.7 JM Value Fund Growth ₹94.7997

↑ 0.95 ₹957 500 -2.9 -0.3 7.6 19.8 17.1 -4.4 HDFC Capital Builder Value Fund Growth ₹775.081

↑ 1.83 ₹7,652 300 0.5 5 18.8 20.3 16.6 8.6 Aditya Birla Sun Life Pure Value Fund Growth ₹128.721

↑ 0.56 ₹6,411 1,000 0.5 6.3 16.7 20.8 16.6 2.6 Templeton India Value Fund Growth ₹739.655

↑ 2.56 ₹2,326 500 0.7 4.4 13.2 18.3 17.6 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata Equity PE Fund JM Value Fund HDFC Capital Builder Value Fund Aditya Birla Sun Life Pure Value Fund Templeton India Value Fund Point 1 Highest AUM (₹9,061 Cr). Bottom quartile AUM (₹957 Cr). Upper mid AUM (₹7,652 Cr). Lower mid AUM (₹6,411 Cr). Bottom quartile AUM (₹2,326 Cr). Point 2 Established history (21+ yrs). Established history (28+ yrs). Oldest track record among peers (32 yrs). Established history (17+ yrs). Established history (29+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 16.29% (bottom quartile). 5Y return: 17.12% (upper mid). 5Y return: 16.63% (lower mid). 5Y return: 16.56% (bottom quartile). 5Y return: 17.60% (top quartile). Point 6 3Y return: 19.92% (lower mid). 3Y return: 19.76% (bottom quartile). 3Y return: 20.33% (upper mid). 3Y return: 20.82% (top quartile). 3Y return: 18.35% (bottom quartile). Point 7 1Y return: 15.52% (lower mid). 1Y return: 7.63% (bottom quartile). 1Y return: 18.83% (top quartile). 1Y return: 16.66% (upper mid). 1Y return: 13.18% (bottom quartile). Point 8 Alpha: -3.79 (lower mid). Alpha: -11.77 (bottom quartile). Alpha: 0.83 (top quartile). Alpha: -4.92 (bottom quartile). Alpha: -0.62 (upper mid). Point 9 Sharpe: -0.07 (lower mid). Sharpe: -0.52 (bottom quartile). Sharpe: 0.23 (top quartile). Sharpe: -0.08 (bottom quartile). Sharpe: 0.12 (upper mid). Point 10 Information ratio: 0.96 (upper mid). Information ratio: 0.55 (bottom quartile). Information ratio: 1.10 (top quartile). Information ratio: 0.58 (lower mid). Information ratio: 0.35 (bottom quartile). Tata Equity PE Fund

JM Value Fund

HDFC Capital Builder Value Fund

Aditya Birla Sun Life Pure Value Fund

Templeton India Value Fund

بہترین فوکسڈ ایکویٹی ایس آئی پی فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Focused 25 Fund Growth ₹53.68

↑ 0.26 ₹11,972 500 -3.9 -3.1 9.4 12.2 6.4 2.5 Aditya Birla Sun Life Focused Equity Fund Growth ₹149.707

↑ 0.44 ₹8,209 1,000 1.8 7.3 17.2 17.9 13.9 10.1 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Motilal Oswal Focused 25 Fund Growth ₹43.6307

↑ 0.17 ₹1,513 500 -1.8 2.8 20.5 10.6 7.3 -1.7 HDFC Focused 30 Fund Growth ₹242.704

↑ 0.83 ₹26,537 300 1.4 4.7 17.4 22 21.5 10.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Focused 25 Fund Aditya Birla Sun Life Focused Equity Fund Sundaram Select Focus Fund Motilal Oswal Focused 25 Fund HDFC Focused 30 Fund Point 1 Upper mid AUM (₹11,972 Cr). Lower mid AUM (₹8,209 Cr). Bottom quartile AUM (₹1,354 Cr). Bottom quartile AUM (₹1,513 Cr). Highest AUM (₹26,537 Cr). Point 2 Established history (13+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Established history (12+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 6.40% (bottom quartile). 5Y return: 13.91% (lower mid). 5Y return: 17.29% (upper mid). 5Y return: 7.34% (bottom quartile). 5Y return: 21.52% (top quartile). Point 6 3Y return: 12.17% (bottom quartile). 3Y return: 17.89% (upper mid). 3Y return: 17.03% (lower mid). 3Y return: 10.63% (bottom quartile). 3Y return: 22.03% (top quartile). Point 7 1Y return: 9.44% (bottom quartile). 1Y return: 17.15% (bottom quartile). 1Y return: 24.49% (top quartile). 1Y return: 20.50% (upper mid). 1Y return: 17.37% (lower mid). Point 8 Alpha: -4.94 (lower mid). Alpha: 2.34 (upper mid). Alpha: -5.62 (bottom quartile). Alpha: -8.70 (bottom quartile). Alpha: 3.31 (top quartile). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: 0.35 (lower mid). Sharpe: 1.85 (top quartile). Sharpe: -0.21 (bottom quartile). Sharpe: 0.52 (upper mid). Point 10 Information ratio: -0.92 (bottom quartile). Information ratio: 0.15 (upper mid). Information ratio: -0.52 (lower mid). Information ratio: -0.72 (bottom quartile). Information ratio: 0.99 (top quartile). Axis Focused 25 Fund

Aditya Birla Sun Life Focused Equity Fund

Sundaram Select Focus Fund

Motilal Oswal Focused 25 Fund

HDFC Focused 30 Fund

ایکویٹی فنڈز پر ٹیکس

بجٹ 2018 کی تقریر کے مطابق، ایک نئی لانگ ٹرمسرمایہ ایکویٹی پر مبنی گینز (LTCG) ٹیکسباہمی چندہ اور اسٹاک یکم اپریل سے لاگو ہوں گے۔ مالیاتی بل 2018 14 مارچ 2018 کو لوک سبھا میں صوتی ووٹ سے منظور ہوا۔انکم ٹیکس تبدیلیاں یکم اپریل 2018 سے ایکویٹی سرمایہ کاری کو متاثر کریں گی۔*

1. طویل مدتی کیپٹل گینز

LTCGs جو INR 1 لاکھ سے زیادہ ہیں۔رہائی یکم اپریل 2018 کو یا اس کے بعد میوچل فنڈ یونٹس یا ایکویٹیز پر 10 فیصد (پلس سیس) یا 10.4 فیصد ٹیکس لگے گا۔ طویل مدتیکیپٹل گینز 1 لاکھ روپے تک مستثنیٰ ہوگا۔ مثال کے طور پر، اگر آپ ایک مالی سال میں اسٹاکس یا میوچل فنڈ کی سرمایہ کاری سے مشترکہ طویل مدتی سرمائے میں INR 3 لاکھ کماتے ہیں۔ قابل ٹیکس LTCGs INR 2 لاکھ (INR 3 لاکھ - 1 لاکھ) اورٹیکس کی ذمہ داری 20 روپے ہوں گے،000 (INR 2 لاکھ کا 10 فیصد)۔

طویل مدتی سرمایہ نفع وہ منافع ہے جو فروخت کرنے یا چھڑانے سے حاصل ہوتا ہے۔ایکویٹی فنڈز ایک سال سے زیادہ منعقد.

2. شارٹ ٹرم کیپیٹل گینز

اگر میوچل فنڈ یونٹس ہولڈنگ کے ایک سال سے پہلے فروخت کیے جاتے ہیں، تو شارٹ ٹرم کیپیٹل گینز (STCGs) ٹیکس لاگو ہوگا۔ STCGs ٹیکس کو 15 فیصد پر برقرار رکھا گیا ہے۔

| ایکویٹی اسکیمیں | انعقاد کا دورانیہ | ٹیکس کی شرح |

|---|---|---|

| طویل مدتی کیپیٹل گینز (LTCG) | 1 سال سے زیادہ | 10% (بغیر اشاریہ کے) **** |

| شارٹ ٹرم کیپیٹل گینز (STCG) | ایک سال سے کم یا اس کے برابر | 15% |

| تقسیم شدہ ڈیویڈنڈ پر ٹیکس | - | 10%# |

*1 لاکھ روپے تک کے منافع ٹیکس سے پاک ہیں۔ INR 1 لاکھ سے زیادہ کے منافع پر 10% ٹیکس لاگو ہوتا ہے۔ قبل ازیں شرح 0% لاگت کا حساب 31 جنوری 2018 کو اختتامی قیمت کے طور پر کیا گیا تھا۔ #10% کا ڈیویڈنڈ ٹیکس + سرچارج 12% + 4% = 11.648% صحت اور تعلیم 4% کا سیس متعارف کرایا گیا۔ پہلے تعلیمی سیس 3 تھا۔%

SIP سرمایہ کاری کے فوائد

کچھ اہممنظم سرمایہ کاری کے منصوبوں کے فوائد ہیں:

روپے کی لاگت کا اوسط

SIP کی پیشکش کا سب سے بڑا فائدہ روپی لاگت کا اوسط ہے، جو کسی فرد کو اثاثہ کی خریداری کی لاگت کا اوسط نکالنے میں مدد کرتا ہے۔ میوچل فنڈ میں یکمشت سرمایہ کاری کرتے وقت ایک مخصوص تعداد میں یونٹ خریدے جاتے ہیں۔سرمایہ کار سب ایک ساتھ، ایس آئی پی کی صورت میں یونٹس کی خریداری ایک طویل مدت میں کی جاتی ہے اور یہ ماہانہ وقفوں (عام طور پر) پر یکساں طور پر پھیل جاتی ہیں۔ سرمایہ کاری کو وقت کے ساتھ ساتھ پھیلانے کی وجہ سے، سرمایہ کاری مختلف قیمت پوائنٹس پر اسٹاک مارکیٹ میں کی جاتی ہے جس سے سرمایہ کار کو اوسط لاگت کا فائدہ ہوتا ہے، اس لیے اصطلاح روپیہ لاگت کا اوسط ہے۔

کمپاؤنڈنگ کی طاقت

SIPs کا فائدہ پیش کرتے ہیں۔کمپاؤنڈنگ کی طاقت. سادہ سود تب ہوتا ہے جب آپ صرف اصل پر سود حاصل کرتے ہیں۔ مرکب سود کی صورت میں، سود کی رقم پرنسپل میں شامل کی جاتی ہے، اور سود کا حساب نئے پرنسپل (پرانے پرنسپل کے علاوہ منافع) پر کیا جاتا ہے۔ یہ عمل ہر بار جاری رہتا ہے۔ چونکہ ایس آئی پی میں میوچل فنڈز قسطوں میں ہوتے ہیں، اس لیے وہ مرکب ہوتے ہیں، جو ابتدائی طور پر لگائی گئی رقم میں مزید اضافہ کرتے ہیں۔

استطاعت

SIPs بہت سستی ہیں۔ ایس آئی پی میں ماہانہ کم از کم سرمایہ کاری کی رقم 500 روپے تک کم ہو سکتی ہے۔ کچھ فنڈ ہاؤسز، یہاں تک کہ "مائیکرو ایس آئی پی" کہلانے والی چیز بھی پیش کرتے ہیں جہاں ٹکٹ کا سائز 100 روپے تک کم ہوتا ہے۔ یہ نوجوانوں کے لیے ایک اچھا آپشن فراہم کرتا ہے کہ وہ اپنا طویل سفر شروع کر سکیں۔ زندگی کے ابتدائی مرحلے میں مدتی سرمایہ کاری۔

ایس آئی پی کیلکولیٹر

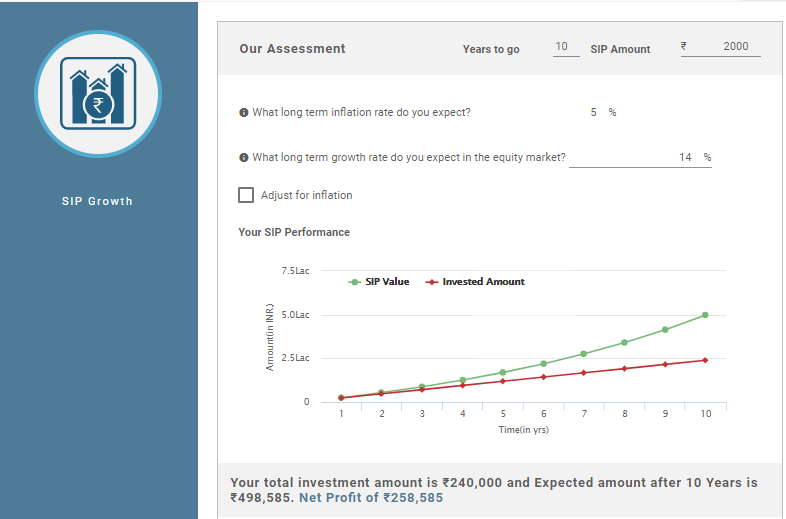

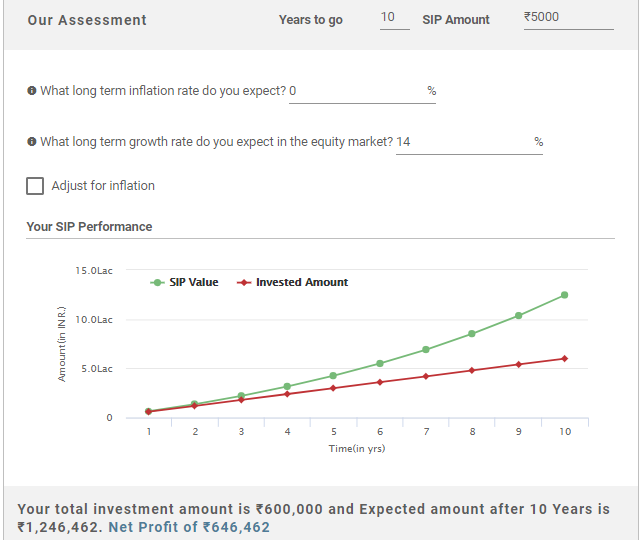

SIP کیلکولیٹر آپ کی سرمایہ کاری میں سب سے مفید ٹول ہو سکتا ہے۔ یہ اس وقت تک آپ کی SIP سرمایہ کاری میں اضافے کا تخمینہ لگاتا ہے جب تک کہ آپ سرمایہ کاری میں رہنا چاہیں گے۔ تو، اس سے پہلے بھیسرمایہ کاری ایک فنڈ میں، کوئی اپنے کل SIP کا پہلے سے تعین کر سکتا ہے۔کمائی ایس آئی پی کیلکولیٹر کے ذریعے۔ کیلکولیٹر عام طور پر ان پٹ لیتے ہیں جیسے SIP سرمایہ کاری کی رقم جو کوئی سرمایہ کاری کرنا چاہتا ہے، سرمایہ کاری کی مدت، متوقعمہنگائی شرحیں (کسی کو اس کا حساب دینا ہوگا)۔ اس کی مثال ذیل میں دی گئی ہے:

فرض کریں، اگر آپ 10 سال کے لیے INR 5,000 کی سرمایہ کاری کرتے ہیں، تو دیکھیں کہ آپ کی SIP سرمایہ کاری کیسے بڑھتی ہے۔

ماہانہ سرمایہ کاری: INR 5,000

سرمایہ کاری کی مدت: 10 سال

سرمایہ کاری کی کل رقم: INR 6,00,000

طویل مدتی ترقی کی شرح (تقریباً): 14%

SIP کیلکولیٹر کے مطابق متوقع واپسی۔: 12,46,462 روپے

خالص منافع: INR 6,46,462

مندرجہ بالا حسابات سے پتہ چلتا ہے کہ اگر آپ 10 سال کے لیے ماہانہ INR 5,000 (مجموعی طور پر 6,00,000 INR) کی سرمایہ کاری کرتے ہیں تو آپ کمائیں گے۔12,46,462 روپے جس کا مطلب ہے کہ آپ جو خالص منافع کماتے ہیں۔INR 6,46,462 کیا یہ بہت اچھا نہیں ہے!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔