এসআইপি 2022 - 2023 এর জন্য ভারতের সেরা মিউচুয়াল ফান্ড

একটি পদ্ধতিগতবিনিয়োগ পরিকল্পনা (চুমুক) সবচেয়ে কার্যকর উপায় বলে মনে করা হয়মিউচুয়াল ফান্ডে বিনিয়োগ করুনবিশেষ করে দীর্ঘ সময়ের জন্য-মেয়াদী পরিকল্পনা. এটি বিনিয়োগকারীদের দীর্ঘমেয়াদী সঞ্চয় পরিকল্পনা বাস্তবায়নের জন্য প্রতি মাসে একটি নির্দিষ্ট তারিখে একটি ইউনিট কেনার অনুমতি দেয়। বিনিয়োগকারীদের প্রতি স্বাচ্ছন্দ্য বোধ করার একটি কারণবিনিয়োগ এসআইপি-তে তারা যে নমনীয়তা দেয় তা। বিনিয়োগকারীরা পারেনএসআইপিতে বিনিয়োগ করুন হয় মাসিক, ত্রৈমাসিক বা সাপ্তাহিকভিত্তি, তাদের সুবিধা অনুযায়ী। আসুন আমরা কীভাবে তাদের অর্জন করতে পারি সে সম্পর্কে আরও জানুনআর্থিক লক্ষ্য পদ্ধতিগত বিনিয়োগ পরিকল্পনা সহ, কিভাবেচুমুক ক্যালকুলেটর বিনিয়োগে সহায়ক, সহসেরা মিউচুয়াল ফান্ড SIP এর জন্য ভারতে।

SIP- আর্থিক লক্ষ্য অর্জনের সর্বোত্তম উপায়

এসআইপি এমনভাবে ডিজাইন করা হয়েছে যাতে কেউ সহজেই তাদের বিনিয়োগের পূর্ব পরিকল্পনা করতে পারে এবং তাদের আর্থিক লক্ষ্য অনুযায়ী বিনিয়োগ করতে পারে। কিন্তু, এসআইপি-এর মাধ্যমে লক্ষ্য অর্জনের জন্য একজনকে দীর্ঘ সময়ের জন্য বিনিয়োগ করতে হবে। সাধারণত, SIP ব্যাপকভাবে লক্ষ্য পরিকল্পনার জন্য ব্যবহৃত হয় যেমন-

Talk to our investment specialist

- একটি গাড়ি কেনা

- একটি বাড়ি কেনা

- বিবাহ

- সন্তানের শিক্ষা

- একটি আন্তর্জাতিক ভ্রমণের জন্য সংরক্ষণ করুন

- অবসর

- মেডিকেল ইমার্জেন্সি ইত্যাদি

কেউ ন্যূনতম INR 500 এবং INR 1000 পরিমাণের সাথে SIP-এ বিনিয়োগ শুরু করতে পারেন৷ একবার আপনি SIP-এ বিনিয়োগ শুরু করলে আপনার টাকা প্রতিদিন যেতে শুরু করবে কারণ এটি স্টকের সংস্পর্শে আসবে৷বাজার. সেজন্য রুট হিসেবে SIP-কে বেশিরভাগ ক্ষেত্রেই পছন্দ করা হয়ইক্যুইটি ফান্ড. অধিকন্তু, ঐতিহাসিকভাবে, ইক্যুইটি স্টকগুলিতে বিনিয়োগ অন্যান্য সমস্ত সম্পদ শ্রেণীর মধ্যে চিত্তাকর্ষক রিটার্ন দিয়েছে, যদি বিনিয়োগটি শৃঙ্খলার সাথে এবং দীর্ঘমেয়াদী দিগন্তের সাথে করা হয়।

ইক্যুইটিতে এসআইপি বাজারের সময় নির্ধারণের ঝুঁকি এড়াতে এবং বিনিয়োগের খরচ গড় করে সম্পদ তৈরির সুবিধা দেয়। আসুন আরও কিছু তাকানSIP এর সুবিধা যা দীর্ঘমেয়াদী লক্ষ্য অর্জনে সাহায্য করে:

যৌগিক শক্তি- সাধারণ সুদ হল যখন আপনি শুধুমাত্র মূলের উপর সুদ পান। চক্রবৃদ্ধি সুদের ক্ষেত্রে, সুদের পরিমাণ মূলে যোগ করা হয়, এবং সুদের নতুন মূল (পুরাতন মূল এবং লাভ) এর উপর গণনা করা হয়। এই প্রক্রিয়া প্রতিবার চলতে থাকে। যেহেতু এসআইপি ইনযৌথ পুঁজি কিস্তিতে আছে, সেগুলি চক্রবৃদ্ধি করা হয়, যা প্রাথমিকভাবে বিনিয়োগ করা যোগফলকে আরও যোগ করে।

ঝুঁকি হ্রাস- প্রদত্ত যে একটি SIP দীর্ঘ সময়ের মধ্যে ছড়িয়ে পড়ে, একজন স্টক মার্কেটের সমস্ত সময়কাল, উত্থান এবং আরও গুরুত্বপূর্ণভাবে মন্দা দেখা দেয়। মন্দার সময়ে, যখন ভয় বেশির ভাগ বিনিয়োগকারীকে ধরে ফেলে, তখন SIP কিস্তি বিনিয়োগকারীদের "নিম্ন" কেনা নিশ্চিত করে।

SIP এর সুবিধা- সুবিধা হল একটি SIP এর সবচেয়ে বড় সুবিধাগুলির মধ্যে একটি৷ একজন ব্যবহারকারীকে একবার সাইন আপ করতে হবে এবং ডকুমেন্টেশনের মাধ্যমে যেতে হবে। একবার হয়ে গেলে, তারপরে পরবর্তী বিনিয়োগের জন্য ডেবিট স্বয়ংক্রিয়ভাবে সঞ্চালিত হয় এবংবিনিয়োগকারী শুধু বিনিয়োগ নিরীক্ষণ করতে হবে।

SIP 2022 - 2023-এর জন্য ভারতের সেরা মিউচুয়াল ফান্ড

এসআইপির জন্য সেরা লার্জ ক্যাপ ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹92.7235

↓ -0.77 ₹50,107 100 -0.6 1.4 15.9 19.7 17.3 9.2 ICICI Prudential Bluechip Fund Growth ₹112.93

↓ -1.15 ₹76,646 100 -1.9 1.9 14.5 18.5 15.5 11.3 DSP TOP 100 Equity Growth ₹478.727

↓ -2.88 ₹7,163 500 -1.1 1.9 11.1 18.3 13.5 8.4 Bandhan Large Cap Fund Growth ₹78.658

↓ -0.74 ₹1,980 100 -1.1 1.6 16.1 18 13.1 8.2 Invesco India Largecap Fund Growth ₹69.31

↓ -0.70 ₹1,666 100 -2.7 0.2 14.9 17.8 13.9 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹7,163 Cr). Bottom quartile AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.28% (top quartile). 5Y return: 15.45% (upper mid). 5Y return: 13.50% (bottom quartile). 5Y return: 13.12% (bottom quartile). 5Y return: 13.85% (lower mid). Point 6 3Y return: 19.69% (top quartile). 3Y return: 18.51% (upper mid). 3Y return: 18.28% (lower mid). 3Y return: 18.00% (bottom quartile). 3Y return: 17.78% (bottom quartile). Point 7 1Y return: 15.92% (upper mid). 1Y return: 14.50% (bottom quartile). 1Y return: 11.08% (bottom quartile). 1Y return: 16.10% (top quartile). 1Y return: 14.90% (lower mid). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (bottom quartile). Alpha: 0.90 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.64 (bottom quartile). Information ratio: 0.69 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

এসআইপির জন্য সেরা মাল্টি ক্যাপ ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,069.56

↓ -22.96 ₹97,452 300 -0.1 3.6 16.7 22.6 20.3 11.4 Nippon India Multi Cap Fund Growth ₹297.891

↓ -2.20 ₹48,809 100 -0.9 -1.3 16 22.2 21.4 4.1 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.8

↓ -0.07 ₹1,051 1,000 2.7 5.8 20.5 21.8 15.4 3.5 Motilal Oswal Multicap 35 Fund Growth ₹56.7382

↓ -0.71 ₹13,180 500 -8.1 -8.6 3.9 21.4 12.3 -5.6 Mahindra Badhat Yojana Growth ₹35.7331

↓ -0.24 ₹6,046 500 -0.4 1.3 16.8 21.3 18.4 3.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Equity Fund Nippon India Multi Cap Fund Aditya Birla Sun Life Manufacturing Equity Fund Motilal Oswal Multicap 35 Fund Mahindra Badhat Yojana Point 1 Highest AUM (₹97,452 Cr). Upper mid AUM (₹48,809 Cr). Bottom quartile AUM (₹1,051 Cr). Lower mid AUM (₹13,180 Cr). Bottom quartile AUM (₹6,046 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (20+ yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (8+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (lower mid). Not Rated. Top rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 20.27% (upper mid). 5Y return: 21.41% (top quartile). 5Y return: 15.35% (bottom quartile). 5Y return: 12.32% (bottom quartile). 5Y return: 18.44% (lower mid). Point 6 3Y return: 22.61% (top quartile). 3Y return: 22.18% (upper mid). 3Y return: 21.79% (lower mid). 3Y return: 21.41% (bottom quartile). 3Y return: 21.30% (bottom quartile). Point 7 1Y return: 16.72% (lower mid). 1Y return: 16.02% (bottom quartile). 1Y return: 20.54% (top quartile). 1Y return: 3.86% (bottom quartile). 1Y return: 16.79% (upper mid). Point 8 Alpha: 4.79 (top quartile). Alpha: -0.46 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: -5.98 (bottom quartile). Alpha: 2.62 (upper mid). Point 9 Sharpe: 0.67 (top quartile). Sharpe: 0.09 (bottom quartile). Sharpe: 0.12 (lower mid). Sharpe: -0.19 (bottom quartile). Sharpe: 0.29 (upper mid). Point 10 Information ratio: 1.25 (top quartile). Information ratio: 0.49 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.45 (bottom quartile). HDFC Equity Fund

Nippon India Multi Cap Fund

Aditya Birla Sun Life Manufacturing Equity Fund

Motilal Oswal Multicap 35 Fund

Mahindra Badhat Yojana

এসআইপির জন্য সেরা মিড ক্যাপ ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹319.45

↓ -0.76 ₹6,969 100 3.7 6.8 27.5 26.2 20.7 11.1 TATA Mid Cap Growth Fund Growth ₹443.651

↓ -2.67 ₹5,356 150 0.2 2.9 19.4 22.5 18.3 5.8 BNP Paribas Mid Cap Fund Growth ₹105.487

↓ -0.22 ₹2,282 300 1.3 4.4 18.3 22 18.3 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹781.96

↓ -6.80 ₹6,041 1,000 -1.5 -0.6 16.1 20.5 17.8 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹6,969 Cr). Lower mid AUM (₹5,356 Cr). Bottom quartile AUM (₹2,282 Cr). Upper mid AUM (₹6,041 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.68% (top quartile). 5Y return: 18.26% (lower mid). 5Y return: 18.28% (upper mid). 5Y return: 17.81% (bottom quartile). Point 6 3Y return: 26.17% (top quartile). 3Y return: 22.54% (upper mid). 3Y return: 22.00% (lower mid). 3Y return: 20.52% (bottom quartile). Point 7 1Y return: 27.49% (top quartile). 1Y return: 19.39% (upper mid). 1Y return: 18.29% (lower mid). 1Y return: 16.10% (bottom quartile). Point 8 Alpha: 5.44 (top quartile). Alpha: -0.44 (lower mid). Alpha: -0.33 (upper mid). Alpha: -1.26 (bottom quartile). Point 9 Sharpe: 0.53 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.21 (upper mid). Sharpe: 0.16 (bottom quartile). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.44 (upper mid). Information ratio: -0.77 (bottom quartile). Information ratio: -0.74 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

এসআইপির জন্য সেরা ছোট ক্যাপ ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹162.374

↓ -1.14 ₹65,812 100 -3.2 -3.8 11.8 21.2 23.3 -4.7 DSP Small Cap Fund Growth ₹193.803

↓ -0.81 ₹16,135 500 -0.4 -1.4 16.7 20.5 20.2 -2.8 Sundaram Small Cap Fund Growth ₹253.354

↓ -3.32 ₹3,285 100 -3 -1.4 16.6 20.2 19.7 0.4 HDFC Small Cap Fund Growth ₹134.235

↓ -0.84 ₹36,941 300 -4.2 -5.4 12.9 19.1 20.7 -0.6 Franklin India Smaller Companies Fund Growth ₹161.681

↓ -1.43 ₹12,764 500 -3.5 -4.6 9 18.9 19.5 -8.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund HDFC Small Cap Fund Franklin India Smaller Companies Fund Point 1 Highest AUM (₹65,812 Cr). Lower mid AUM (₹16,135 Cr). Bottom quartile AUM (₹3,285 Cr). Upper mid AUM (₹36,941 Cr). Bottom quartile AUM (₹12,764 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.31% (top quartile). 5Y return: 20.19% (lower mid). 5Y return: 19.72% (bottom quartile). 5Y return: 20.71% (upper mid). 5Y return: 19.47% (bottom quartile). Point 6 3Y return: 21.17% (top quartile). 3Y return: 20.52% (upper mid). 3Y return: 20.22% (lower mid). 3Y return: 19.08% (bottom quartile). 3Y return: 18.87% (bottom quartile). Point 7 1Y return: 11.83% (bottom quartile). 1Y return: 16.66% (top quartile). 1Y return: 16.61% (upper mid). 1Y return: 12.89% (lower mid). 1Y return: 9.04% (bottom quartile). Point 8 Alpha: -0.64 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.29 (top quartile). Alpha: 0.00 (lower mid). Alpha: -4.41 (bottom quartile). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.01 (upper mid). Sharpe: 0.05 (top quartile). Sharpe: -0.38 (bottom quartile). Point 10 Information ratio: 0.02 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.17 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.19 (bottom quartile). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

HDFC Small Cap Fund

Franklin India Smaller Companies Fund

SIP এর জন্য সেরা ELSS (ট্যাক্স সেভিং মিউচুয়াল ফান্ড)

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹445.631

↓ -3.69 ₹31,862 500 -0.4 2.5 12.5 24 19.3 6.6 Motilal Oswal Long Term Equity Fund Growth ₹48.5252

↓ -0.47 ₹4,188 500 -5.7 -4.6 11.6 21.9 16.8 -9.1 HDFC Tax Saver Fund Growth ₹1,435.52

↓ -17.01 ₹16,749 500 -1.4 1.2 14.4 21.6 19.3 10.3 DSP Tax Saver Fund Growth ₹143.791

↓ -1.07 ₹17,223 500 0.6 4.4 15.5 21 16.9 7.5 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund DSP Tax Saver Fund IDBI Equity Advantage Fund Point 1 Highest AUM (₹31,862 Cr). Bottom quartile AUM (₹4,188 Cr). Lower mid AUM (₹16,749 Cr). Upper mid AUM (₹17,223 Cr). Bottom quartile AUM (₹485 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (19+ yrs). Established history (12+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.31% (upper mid). 5Y return: 16.78% (bottom quartile). 5Y return: 19.32% (top quartile). 5Y return: 16.91% (lower mid). 5Y return: 9.97% (bottom quartile). Point 6 3Y return: 24.03% (top quartile). 3Y return: 21.92% (upper mid). 3Y return: 21.64% (lower mid). 3Y return: 20.98% (bottom quartile). 3Y return: 20.84% (bottom quartile). Point 7 1Y return: 12.51% (bottom quartile). 1Y return: 11.56% (bottom quartile). 1Y return: 14.41% (lower mid). 1Y return: 15.45% (upper mid). 1Y return: 16.92% (top quartile). Point 8 Alpha: -0.63 (bottom quartile). Alpha: -5.20 (bottom quartile). Alpha: 2.37 (top quartile). Alpha: 1.75 (lower mid). Alpha: 1.78 (upper mid). Point 9 Sharpe: 0.13 (bottom quartile). Sharpe: -0.04 (bottom quartile). Sharpe: 0.41 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 1.21 (top quartile). Point 10 Information ratio: 1.85 (top quartile). Information ratio: 0.49 (bottom quartile). Information ratio: 1.20 (upper mid). Information ratio: 0.93 (lower mid). Information ratio: -1.13 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

DSP Tax Saver Fund

IDBI Equity Advantage Fund

SIP এর জন্য সেরা সেক্টর ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹36.9616

↑ 0.09 ₹5,980 500 10.5 18.9 33.4 35.8 27.9 11.3 DSP Natural Resources and New Energy Fund Growth ₹108.36

↑ 0.07 ₹1,765 500 14.1 21.8 31.7 23.9 21.1 17.5 Invesco India PSU Equity Fund Growth ₹68.22

↓ -0.17 ₹1,492 500 4.9 10.9 31 32.5 25.9 10.3 SBI Banking & Financial Services Fund Growth ₹46.6617

↓ -0.27 ₹10,415 500 3.6 9.9 29 23.7 14.2 20.4 SBI Magnum COMMA Fund Growth ₹114.417

↑ 0.34 ₹896 500 8.7 9.9 27.5 21.1 16.7 12.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI PSU Fund DSP Natural Resources and New Energy Fund Invesco India PSU Equity Fund SBI Banking & Financial Services Fund SBI Magnum COMMA Fund Point 1 Upper mid AUM (₹5,980 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹1,492 Cr). Highest AUM (₹10,415 Cr). Bottom quartile AUM (₹896 Cr). Point 2 Established history (15+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (11+ yrs). Oldest track record among peers (20 yrs). Point 3 Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (lower mid). Not Rated. Rating: 4★ (upper mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 27.86% (top quartile). 5Y return: 21.14% (lower mid). 5Y return: 25.88% (upper mid). 5Y return: 14.17% (bottom quartile). 5Y return: 16.69% (bottom quartile). Point 6 3Y return: 35.81% (top quartile). 3Y return: 23.85% (lower mid). 3Y return: 32.54% (upper mid). 3Y return: 23.71% (bottom quartile). 3Y return: 21.11% (bottom quartile). Point 7 1Y return: 33.44% (top quartile). 1Y return: 31.68% (upper mid). 1Y return: 31.04% (lower mid). 1Y return: 28.96% (bottom quartile). 1Y return: 27.54% (bottom quartile). Point 8 Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 4.78 (top quartile). Alpha: -1.28 (bottom quartile). Point 9 Sharpe: 0.63 (bottom quartile). Sharpe: 1.32 (upper mid). Sharpe: 0.53 (bottom quartile). Sharpe: 1.36 (top quartile). Sharpe: 0.73 (lower mid). Point 10 Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.50 (bottom quartile). Information ratio: 1.02 (top quartile). Information ratio: -0.23 (lower mid). SBI PSU Fund

DSP Natural Resources and New Energy Fund

Invesco India PSU Equity Fund

SBI Banking & Financial Services Fund

SBI Magnum COMMA Fund

এসআইপির জন্য সেরা ফোকাসড ফান্ড

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹94.72

↓ -1.30 ₹14,935 100 -1.7 2.2 20 23.2 18.7 15.4 HDFC Focused 30 Fund Growth ₹240.102

↓ -2.17 ₹26,332 300 0.4 3.6 16.6 22.4 21.5 10.9 SBI Focused Equity Fund Growth ₹376.458

↑ 0.88 ₹42,998 500 0.7 7.2 19.2 20.1 15 15.7 DSP Focus Fund Growth ₹55.191

↓ -0.34 ₹2,611 500 -0.8 2.8 13.3 19.2 13.4 7.3 Aditya Birla Sun Life Focused Equity Fund Growth ₹146.534

↓ -1.88 ₹8,068 1,000 -0.6 4.4 15.8 17.9 13.7 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Aditya Birla Sun Life Focused Equity Fund Point 1 Lower mid AUM (₹14,935 Cr). Upper mid AUM (₹26,332 Cr). Highest AUM (₹42,998 Cr). Bottom quartile AUM (₹2,611 Cr). Bottom quartile AUM (₹8,068 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (15+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.67% (upper mid). 5Y return: 21.49% (top quartile). 5Y return: 15.03% (lower mid). 5Y return: 13.39% (bottom quartile). 5Y return: 13.70% (bottom quartile). Point 6 3Y return: 23.21% (top quartile). 3Y return: 22.36% (upper mid). 3Y return: 20.06% (lower mid). 3Y return: 19.25% (bottom quartile). 3Y return: 17.90% (bottom quartile). Point 7 1Y return: 20.04% (top quartile). 1Y return: 16.62% (lower mid). 1Y return: 19.20% (upper mid). 1Y return: 13.28% (bottom quartile). 1Y return: 15.84% (bottom quartile). Point 8 Alpha: 6.91 (top quartile). Alpha: 3.79 (lower mid). Alpha: 5.35 (upper mid). Alpha: 0.58 (bottom quartile). Alpha: 3.66 (bottom quartile). Point 9 Sharpe: 0.70 (top quartile). Sharpe: 0.60 (lower mid). Sharpe: 0.62 (upper mid). Sharpe: 0.23 (bottom quartile). Sharpe: 0.49 (bottom quartile). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.98 (upper mid). Information ratio: 0.42 (lower mid). Information ratio: 0.42 (bottom quartile). Information ratio: 0.23 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Aditya Birla Sun Life Focused Equity Fund

এসআইপির জন্য সেরা মূল্যের তহবিল

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹229.273

↓ -1.40 ₹8,962 100 -1.2 2.8 14 23.3 18.7 4.2 Aditya Birla Sun Life Pure Value Fund Growth ₹126.895

↓ -0.94 ₹6,246 1,000 0.1 4.3 14.9 21.1 16.5 2.6 ICICI Prudential Value Discovery Fund Growth ₹486.58

↓ -4.31 ₹60,353 100 -1.4 3.3 15.5 20.8 20.3 13.8 HDFC Capital Builder Value Fund Growth ₹762.054

↓ -7.47 ₹7,487 300 -0.7 3.1 18 20.4 16.5 8.6 Tata Equity PE Fund Growth ₹354.207

↓ -1.68 ₹8,819 150 -1.2 3.7 14.8 20.3 16.3 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund Aditya Birla Sun Life Pure Value Fund ICICI Prudential Value Discovery Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹8,962 Cr). Bottom quartile AUM (₹6,246 Cr). Highest AUM (₹60,353 Cr). Bottom quartile AUM (₹7,487 Cr). Lower mid AUM (₹8,819 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (21+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.70% (upper mid). 5Y return: 16.54% (lower mid). 5Y return: 20.34% (top quartile). 5Y return: 16.46% (bottom quartile). 5Y return: 16.33% (bottom quartile). Point 6 3Y return: 23.29% (top quartile). 3Y return: 21.11% (upper mid). 3Y return: 20.78% (lower mid). 3Y return: 20.41% (bottom quartile). 3Y return: 20.25% (bottom quartile). Point 7 1Y return: 13.98% (bottom quartile). 1Y return: 14.91% (lower mid). 1Y return: 15.47% (upper mid). 1Y return: 18.03% (top quartile). 1Y return: 14.84% (bottom quartile). Point 8 Alpha: -0.62 (bottom quartile). Alpha: -1.64 (bottom quartile). Alpha: 3.44 (top quartile). Alpha: 2.68 (upper mid). Alpha: 0.27 (lower mid). Point 9 Sharpe: 0.15 (bottom quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.51 (top quartile). Sharpe: 0.39 (upper mid). Sharpe: 0.22 (lower mid). Point 10 Information ratio: 1.55 (top quartile). Information ratio: 0.57 (bottom quartile). Information ratio: 0.80 (bottom quartile). Information ratio: 1.10 (upper mid). Information ratio: 0.89 (lower mid). Nippon India Value Fund

Aditya Birla Sun Life Pure Value Fund

ICICI Prudential Value Discovery Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

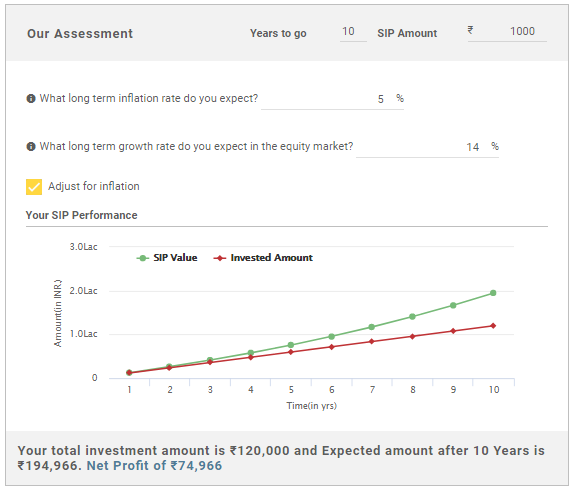

এসআইপি ক্যালকুলেটর

মিউচুয়াল ফান্ডে বিনিয়োগ করার সময় একজন বিনিয়োগকারী ব্যবহার করতে পারেন এমন একটি দক্ষ টুল SIP ক্যালকুলেটর। কেউ একটি গাড়ি/বাড়ি কিনতে, অবসর নেওয়ার পরিকল্পনা, সন্তানের উচ্চশিক্ষা বা অন্য কোনো সম্পদ কেনার জন্য বিনিয়োগ করতে চায় কি না, তার জন্য SIP ক্যালকুলেটর ব্যবহার করা যেতে পারে। এটি নির্দিষ্ট আর্থিক লক্ষ্যে পৌঁছানোর জন্য বিনিয়োগের জন্য প্রয়োজনীয় বিনিয়োগের পরিমাণ এবং সময়কাল গণনা করতে সহায়তা করে। সুতরাং, সাধারণ প্রশ্ন যেমন "কত করতে হবেএকটি এসআইপিতে বিনিয়োগ করুন বা কিভাবে আমি সেই সময় পর্যন্ত বিনিয়োগ করব", এই ক্যালকুলেটর ব্যবহার করে সমাধান করে।

একটি এসআইপি ক্যালকুলেটর ব্যবহার করার সময়, একজনকে নির্দিষ্ট ভেরিয়েবল পূরণ করতে হবে, যার মধ্যে রয়েছে (নিচের চিত্রটি দেওয়া হল)-

- কাঙ্ক্ষিত বিনিয়োগের সময়কাল

- আনুমানিক মাসিক SIP পরিমাণ

- প্রত্যাশিতমুদ্রাস্ফীতি আগামী বছরের জন্য হার (বার্ষিক)

- বিনিয়োগের উপর দীর্ঘমেয়াদী বৃদ্ধির হার

একবার আপনি উপরে উল্লিখিত সমস্ত তথ্য ফিড করলে, ক্যালকুলেটর আপনাকে উল্লেখ করা বছরের সংখ্যার পরে আপনি যে পরিমাণ পাবেন (আপনার এসআইপি রিটার্ন) তা প্রদান করবে। আপনার নিট লাভও হাইলাইট করা হবে যাতে আপনি সেই অনুযায়ী আপনার লক্ষ্য পূরণের অনুমান করতে পারেন।

সেরা মিউচুয়াল ফান্ডে কীভাবে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন।

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।