Lump Sum Investment in Mutual Funds

Do you know that you can invest a lump sum amount in Mutual Funds? If yes, then it's good. However, if no, then don’t worry. This article will guide you through the same. Lump sum investment in Mutual Funds refers to a situation when an individual invests money in Mutual Funds at one-time. Here, the deposit does not take place at multiple times. There is a lot of difference between the SIP and lump sum mode of investment. So, let us understand the concept of Lump sum investment in Mutual Funds, best mutual funds for lump sum investment, things to be considered during lump sum investment, Mutual Fund Lump sum return calculator, and other related aspects through this article.

What do you mean by Lump Sum Investment in Mutual Funds?

Lump sum investment in Mutual Fund is a scenario where individuals invest in Mutual Funds for only once. However, in contrast to SIP mode of investment where individuals deposit small amounts in lump sum mode, individuals deposit a considerable amount. In other words, it is a one-shot technique of Investing in Mutual Funds. Lump sum mode of investing in suitable for investors who have excess funds that are lying ideal in their Bank account and are looking to for channels to earn more income by investing in Mutual Funds.

Best Mutual Fund for Lump Sum Investment in 2026 – 2027

Before you invest in Mutual Funds through lump sum mode, individuals need to consider various parameters such as AUM, investment amount, and much more. So, based on these parameters some of the best Mutual Funds for Lump sum investment are as follows.

Fund Selection Methodology used to find 5 funds

Best Lump Investment in Equity Mutual Funds

Equity Funds are the schemes that invest their corpus in equity and equity-related instruments of various companies. These schemes are considered to be a good option for long-term investment. Though individuals can invest lump sum amount in equity funds yet the recommended technique of investing in equity funds is either through SIP or Systematic Transfer Plan (STP) mode. In STP mode, individuals first deposit a considerable money in debt funds such as Liquid Funds and then the money is transferred at regular intervals in equity funds. Some of the Equity Mutual Funds that can be considered for investment are as follows.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 1,000 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.6508

↑ 0.35 ₹5,980 5,000 7.6 16.8 29.9 34.6 28 11.3 ICICI Prudential Infrastructure Fund Growth ₹197.5

↑ 1.28 ₹8,077 5,000 -0.5 1.5 15.5 25.3 26.7 6.7 Invesco India PSU Equity Fund Growth ₹68.35

↑ 0.53 ₹1,492 5,000 2.2 10 28.4 32 26 10.3 DSP India T.I.G.E.R Fund Growth ₹325.034

↑ 2.22 ₹5,184 1,000 1.7 3.3 19.2 25.9 24.5 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹5,184 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.99% (upper mid). 5Y return: 26.69% (lower mid). 5Y return: 26.01% (bottom quartile). 5Y return: 24.55% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 34.56% (upper mid). 3Y return: 25.34% (bottom quartile). 3Y return: 32.03% (lower mid). 3Y return: 25.89% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 29.87% (upper mid). 1Y return: 15.50% (bottom quartile). 1Y return: 28.36% (lower mid). 1Y return: 19.24% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (bottom quartile). Sharpe: 0.53 (lower mid). Sharpe: 0.08 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Talk to our investment specialist

Best Lump Sum Investment in Debt Mutual Funds

Debt Funds invest their fund money in different fixed income instruments like treasury bills, corporate Bonds, and much more. These schemes are considered as a good option for short and medium term. Many individuals choose to invest lump sum money in Debt Mutual Funds. Some of the Best Debt Funds that can be chosen for lump sum investment are as follows.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.3151

↓ -0.01 ₹217 1,000 -0.5 0.8 17.9 14.1 21 7.67% 2Y 5M 5D 3Y 4M 24D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3113

↓ 0.00 ₹1,138 1,000 4.8 7.4 13.1 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 5,000 2.9 5 7.5 11 0% Aditya Birla Sun Life Medium Term Plan Growth ₹42.2606

↓ -0.02 ₹2,982 1,000 2.9 5 10.1 10 10.9 7.78% 3Y 4M 24D 4Y 6M 7D Invesco India Credit Risk Fund Growth ₹1,993.79

↓ -0.39 ₹158 5,000 1 2.6 8.8 9.3 9.2 7.46% 2Y 3M 4D 3Y Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Aditya Birla Sun Life Credit Risk Fund Franklin India Credit Risk Fund Aditya Birla Sun Life Medium Term Plan Invesco India Credit Risk Fund Point 1 Lower mid AUM (₹217 Cr). Upper mid AUM (₹1,138 Cr). Bottom quartile AUM (₹104 Cr). Highest AUM (₹2,982 Cr). Bottom quartile AUM (₹158 Cr). Point 2 Oldest track record among peers (22 yrs). Established history (10+ yrs). Established history (14+ yrs). Established history (16+ yrs). Established history (11+ yrs). Point 3 Top rated. Not Rated. Rating: 1★ (bottom quartile). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 17.89% (top quartile). 1Y return: 13.15% (upper mid). 1Y return: 7.45% (bottom quartile). 1Y return: 10.14% (lower mid). 1Y return: 8.83% (bottom quartile). Point 6 1M return: -0.97% (bottom quartile). 1M return: 1.01% (top quartile). 1M return: 0.91% (upper mid). 1M return: 0.89% (lower mid). 1M return: 0.49% (bottom quartile). Point 7 Sharpe: 1.48 (lower mid). Sharpe: 2.38 (top quartile). Sharpe: 0.29 (bottom quartile). Sharpe: 2.33 (upper mid). Sharpe: 1.11 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.67% (lower mid). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.78% (upper mid). Yield to maturity (debt): 7.46% (bottom quartile). Point 10 Modified duration: 2.43 yrs (bottom quartile). Modified duration: 2.41 yrs (lower mid). Modified duration: 0.00 yrs (top quartile). Modified duration: 3.40 yrs (bottom quartile). Modified duration: 2.26 yrs (upper mid). DSP Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Franklin India Credit Risk Fund

Aditya Birla Sun Life Medium Term Plan

Invesco India Credit Risk Fund

Best Hybrid Funds for Lump Sum Investment

Hybrid funds also known as Balanced Fund invest their money in both equity and fixed income instruments. These schemes are suitable for individuals looking for capital generation along with regular income. Also known as balanced schemes, individuals can choose to invest lump sum amount in hybrid schemes. Some of the best hybrid funds for lump sum investment are listed below.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.6676

↑ 0.33 ₹6,848 5,000 1.2 6.8 14.8 20.3 14.6 11.1 SBI Multi Asset Allocation Fund Growth ₹67.0842

↑ 0.16 ₹14,944 5,000 5.3 12.8 22.7 20.1 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹820.211

↓ -4.94 ₹80,768 5,000 1.7 7.8 16.4 19.5 19.7 18.6 ICICI Prudential Equity and Debt Fund Growth ₹409.05

↑ 1.60 ₹49,257 5,000 -0.7 2.9 14.5 19.1 19.1 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.23

↑ 0.10 ₹1,329 5,000 -0.3 0.6 12.6 18.6 18.5 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.61% (bottom quartile). 5Y return: 14.82% (bottom quartile). 5Y return: 19.74% (top quartile). 5Y return: 19.12% (upper mid). 5Y return: 18.47% (lower mid). Point 6 3Y return: 20.31% (top quartile). 3Y return: 20.08% (upper mid). 3Y return: 19.52% (lower mid). 3Y return: 19.10% (bottom quartile). 3Y return: 18.59% (bottom quartile). Point 7 1Y return: 14.76% (lower mid). 1Y return: 22.69% (top quartile). 1Y return: 16.44% (upper mid). 1Y return: 14.53% (bottom quartile). 1Y return: 12.64% (bottom quartile). Point 8 1M return: 0.44% (bottom quartile). 1M return: 1.35% (lower mid). 1M return: 0.39% (bottom quartile). 1M return: 2.19% (upper mid). 1M return: 3.86% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Best Index Funds for Lump Sum Investment

The Portfolio of an index fund consists of the shares and other instruments in the same proportion as they are in the index. In other words, these schemes mimic the performance of an index. These are passively managed funds and can be considered as a good option for lump sum investment. Some of the best Index Funds that can be chosen for lump sum investment are as follows.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Index Fund - Sensex Plan Growth ₹42.1706

↑ 0.16 ₹957 -3.4 1.1 10 11.6 10.9 9.8 LIC MF Index Fund Sensex Growth ₹154.54

↑ 0.58 ₹91 -3.5 0.8 9.3 11 10.3 9.1 Franklin India Index Fund Nifty Plan Growth ₹206.375

↑ 0.94 ₹766 -2.4 2.1 12.1 13.3 11.8 11.3 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Nippon India Index Fund - Nifty Plan Growth ₹43.4424

↑ 0.20 ₹3,078 -2.4 2.1 12.3 13.4 11.7 11.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex Franklin India Index Fund Nifty Plan IDBI Nifty Index Fund Nippon India Index Fund - Nifty Plan Point 1 Upper mid AUM (₹957 Cr). Bottom quartile AUM (₹91 Cr). Lower mid AUM (₹766 Cr). Bottom quartile AUM (₹208 Cr). Highest AUM (₹3,078 Cr). Point 2 Established history (15+ yrs). Established history (23+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 1★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.86% (bottom quartile). 5Y return: 10.33% (bottom quartile). 5Y return: 11.80% (top quartile). 5Y return: 11.74% (lower mid). 5Y return: 11.74% (upper mid). Point 6 3Y return: 11.61% (bottom quartile). 3Y return: 11.00% (bottom quartile). 3Y return: 13.29% (lower mid). 3Y return: 20.28% (top quartile). 3Y return: 13.41% (upper mid). Point 7 1Y return: 10.01% (bottom quartile). 1Y return: 9.27% (bottom quartile). 1Y return: 12.13% (lower mid). 1Y return: 16.16% (top quartile). 1Y return: 12.31% (upper mid). Point 8 1M return: 0.77% (bottom quartile). 1M return: 0.71% (bottom quartile). 1M return: 1.26% (lower mid). 1M return: 3.68% (top quartile). 1M return: 1.35% (upper mid). Point 9 Alpha: -0.51 (upper mid). Alpha: -1.17 (bottom quartile). Alpha: -0.53 (lower mid). Alpha: -1.03 (bottom quartile). Alpha: -0.47 (top quartile). Point 10 Sharpe: 0.13 (bottom quartile). Sharpe: 0.07 (bottom quartile). Sharpe: 0.25 (lower mid). Sharpe: 1.04 (top quartile). Sharpe: 0.25 (upper mid). Nippon India Index Fund - Sensex Plan

LIC MF Index Fund Sensex

Franklin India Index Fund Nifty Plan

IDBI Nifty Index Fund

Nippon India Index Fund - Nifty Plan

Best Mutual Funds based on Last 1 Month

T o g e n e r a t e income/capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. Below is the key information for Canara Robeco Infrastructure Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate consistent long-term returns by

investing predominantly in

equity/equity-related instruments of

companies engaged either directly or

indirectly in infrastructure- and infrastructure

related activities or expected to benefit from

the growth and development of infrastructure Research Highlights for Sundaram Infrastructure Advantage Fund Below is the key information for Sundaram Infrastructure Advantage Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on 1. Canara Robeco Infrastructure

Canara Robeco Infrastructure

Growth Launch Date 2 Dec 05 NAV (20 Feb 26) ₹164.61 ↑ 1.89 (1.16 %) Net Assets (Cr) ₹879 on 31 Jan 26 Category Equity - Sectoral AMC Canara Robeco Asset Management Co. Ltd. Rating Risk High Expense Ratio 2.32 Sharpe Ratio 0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,478 31 Jan 23 ₹16,229 31 Jan 24 ₹24,420 31 Jan 25 ₹29,225 31 Jan 26 ₹31,221 Returns for Canara Robeco Infrastructure

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 9.3% 3 Month 0.5% 6 Month 2.4% 1 Year 20.5% 3 Year 26% 5 Year 23.5% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 0.1% 2023 35.3% 2022 41.2% 2021 9% 2020 56.1% 2019 9% 2018 2.3% 2017 -19.1% 2016 40.2% 2015 2.1% Fund Manager information for Canara Robeco Infrastructure

Name Since Tenure Vishal Mishra 26 Jun 21 4.61 Yr. Shridatta Bhandwaldar 29 Sep 18 7.35 Yr. Data below for Canara Robeco Infrastructure as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 45.41% Utility 12.54% Basic Materials 10.29% Energy 9.34% Financial Services 8.27% Technology 3.24% Communication Services 3.06% Consumer Cyclical 2.93% Real Estate 1.11% Asset Allocation

Asset Class Value Cash 3.81% Equity 96.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 11 | LT10% ₹85 Cr 214,901

↓ -3,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 24 | SBIN5% ₹48 Cr 442,500 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE5% ₹41 Cr 291,750 NTPC Ltd (Utilities)

Equity, Since 30 Nov 18 | NTPC4% ₹39 Cr 1,106,480 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 19 | BEL4% ₹39 Cr 869,000

↓ -25,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Sep 24 | TATAPOWER3% ₹30 Cr 810,000 GE Vernova T&D India Ltd (Industrials)

Equity, Since 31 Jan 24 | GVT&D3% ₹29 Cr 89,735

↓ -10,250 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 24 | BHARTIARTL3% ₹27 Cr 136,600 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Jan 23 | INDIGO3% ₹27 Cr 58,250 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Oct 23 | CGPOWER3% ₹26 Cr 440,650 2. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (20 Feb 26) ₹50.4298 ↑ 0.39 (0.79 %) Net Assets (Cr) ₹946 on 31 Jan 26 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio 0.03 Information Ratio 0.29 Alpha Ratio -6.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 9.2% 3 Month 0.8% 6 Month 3.5% 1 Year 21.6% 3 Year 28.7% 5 Year 23.6% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065 3. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (20 Feb 26) ₹36.6508 ↑ 0.35 (0.98 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 9.1% 3 Month 7.6% 6 Month 16.8% 1 Year 29.9% 3 Year 34.6% 5 Year 28% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 4. Sundaram Infrastructure Advantage Fund

Sundaram Infrastructure Advantage Fund

Growth Launch Date 29 Sep 05 NAV (20 Feb 26) ₹99.6362 ↑ 0.94 (0.95 %) Net Assets (Cr) ₹917 on 31 Jan 26 Category Equity - Sectoral AMC Sundaram Asset Management Company Ltd Rating Risk High Expense Ratio 2.37 Sharpe Ratio 0.21 Information Ratio -0.15 Alpha Ratio -1.74 Min Investment 100,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,182 31 Jan 23 ₹15,190 31 Jan 24 ₹22,755 31 Jan 25 ₹25,279 31 Jan 26 ₹27,393 Returns for Sundaram Infrastructure Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 9% 3 Month 1% 6 Month 4.4% 1 Year 22.5% 3 Year 23.5% 5 Year 20.5% 10 Year 15 Year Since launch 11.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.1% 2023 23.8% 2022 41.7% 2021 2.1% 2020 49.5% 2019 10.4% 2018 2.2% 2017 -21.9% 2016 55.5% 2015 -0.5% Fund Manager information for Sundaram Infrastructure Advantage Fund

Name Since Tenure Siddarth Mohta 21 Jan 26 0.03 Yr. Data below for Sundaram Infrastructure Advantage Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 38.75% Utility 12.06% Energy 11.66% Communication Services 11.58% Consumer Cyclical 6.98% Basic Materials 6.67% Financial Services 4.49% Real Estate 2.04% Health Care 0.95% Technology 0.46% Asset Allocation

Asset Class Value Cash 4.34% Equity 95.66% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 09 | LT9% ₹83 Cr 210,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL9% ₹82 Cr 415,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 18 | RELIANCE8% ₹71 Cr 510,000 NTPC Ltd (Utilities)

Equity, Since 31 Jan 22 | NTPC5% ₹48 Cr 1,340,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO4% ₹36 Cr 28,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 22 | BEL3% ₹30 Cr 675,000 State Bank of India (Financial Services)

Equity, Since 28 Feb 22 | SBIN2% ₹22 Cr 200,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 19 | BPCL2% ₹21 Cr 575,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Mar 22 | POWERGRID2% ₹21 Cr 800,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | ICICIBANK2% ₹20 Cr 145,000 5. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (20 Feb 26) ₹149.452 ↑ 1.49 (1.00 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 8.9% 3 Month 2.3% 6 Month 5.3% 1 Year 21.1% 3 Year 28.1% 5 Year 23.9% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000

Things to be Considered During Lump Sum Investment

Before investing in Mutual Funds individuals need to take care a lot of parameters. It includes:

Timing the Market

When it comes to lump sum investing, individuals need to always look for market timings especially with respect to equity-based funds. A good timing to invest lump sum is when the markets are low and there’s a scope that they will start appreciating soon. However, in case if the markets are already at peak then, it is better to stay off from lump sum investment.

Diversification

Diversification is also an important aspect that needs to be considered before investing lump sum. Individuals in case of lump sum investment should diversify their investments by spreading into multiple avenues. This will help to ensure that their overall portfolio performs well even if one of the schemes doesn’t perform.

Do Your Investment as per Your Objective

Any investment that individuals do is to attain a particular objective. Therefore, individuals should check whether the scheme’s approach is in-line with the investor’s objective. Here, individuals should look for various parameters such as CAGR returns, Absolute returns, the impact of taxation and much more before investing in the scheme.

Redemption should be done at the Correct Time

Individuals should do their redemption at the correct time in lump sum investment. Though it can be as per the investment objective yet; individuals should do a timely review of the scheme in which they are planning to invest. However, they also need to hold their investments for a longer duration so that they can enjoy maximum benefits.

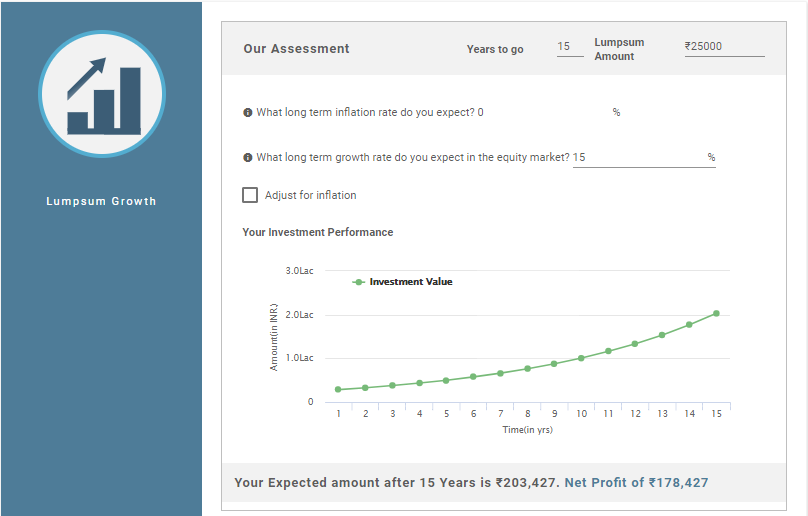

Mutual Fund Lump Sum Return Calculator

Mutual Fund lump sum return calculator helps individuals to show how the lump sum investment of an individual grows over a given timeframe. Some of the data that needs to input in the lump sum calculator includes the tenure of the investment, initial investment amount, long-term expected growth rate and much more. An illustration of the Mutual Fund lump sum return calculator is as follows.

ILLUSTRATION

Lump Sum Investment: INR 25,000

Investment Tenure: 15 Years

Long-term Growth Rate (Approx.): 15%

Expected Returns as per Lump Sum Calculator: INR 2,03,427

Net Profit on the Investment: INR 1,78,427

Thus, the above calculation shows that the net profit on the investment on your investment is INR 1,78,427 while the total value of your investment is INR 2,03,427.

Advantages and Disadvantages of One-Time Investment in Mutual Fund

Similar to SIP, Lump Sum Investment also has its own set of advantages and disadvantages. So, let us look at these advantages and disadvantages.

Advantages

The advantages of Lump Sum investment are as follows.

- Invest Big Amount: Individuals can invest big amounts in Mutual Funds and earn higher returns instead of keeping the funds idle.

- Ideal for Long Term: Lump Sum mode of investment is good for long-term investments specially in case of equity funds. However, in case of debt funds, the tenure can be short or medium-term

- Convenience: Lump sum mode of investment is convenient as the payment is done only once and is not deducted at regular intervals.

Disadvantages

The disadvantages of Lump Sum investment are:

- Irregular Investment: Lump Sum investment does not ensure regular savings of an investor as it does not instil regular savings habit.

- Higher Risk: In Lump Sum investing, it is important to look at the timings. This is because in lump sum mode the investment is done only once and not at regular intervals. Therefore, if individuals do not consider the timing, then they might end up in losses.

Conclusion

Thus, from the above pointers, it can be said that lump sum mode is also a good way to invest in Mutual Funds. However, individuals need to be confident while investing a lump sum amount in the scheme. If not, they can choose SIP mode of investment. In addition, people should understand the scheme’s modalities before investing. If required, they can even consult a financial advisor. This will help them to ensure that their money is safe and their objectives are accomplished on time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for Canara Robeco Infrastructure