SIP 2022 - 2023 کے لیے ہندوستان میں بہترین میوچل فنڈز

ایک منظمسرمایہ کاری کا منصوبہ (گھونٹ) کا سب سے موثر طریقہ سمجھا جاتا ہے۔میوچل فنڈز میں سرمایہ کاری کریں۔خاص طور پر طویل عرصے کے لیےمدتی منصوبہ. یہ سرمایہ کاروں کو طویل مدتی بچت کے منصوبے کو لاگو کرنے کے لیے ہر ماہ ایک مخصوص تاریخ کو یونٹ خریدنے کی اجازت دیتا ہے۔ سرمایہ کاروں کی طرف راحت محسوس کرنے کی ایک وجہسرمایہ کاری SIP میں وہ لچک ہے جو وہ پیش کرتے ہیں۔ سرمایہ کار کر سکتے ہیں۔SIP میں سرمایہ کاری کریں۔ ماہانہ، سہ ماہی یا ہفتہ واربنیاد، ان کی سہولت کے مطابق۔ آئیے اس بارے میں مزید جانیں کہ کوئی ان کو کیسے حاصل کرسکتا ہے۔مالی اہداف منظم سرمایہ کاری کے منصوبوں کے ساتھ، کیسےگھونٹ کیلکولیٹر کے ساتھ ساتھ سرمایہ کاری میں مددگار ہے۔بہترین باہمی فنڈز SIP کے لیے ہندوستان میں۔

SIP- مالی اہداف کے حصول کا بہترین طریقہ

ایس آئی پی کو اس طرح سے ڈیزائن کیا گیا ہے کہ کوئی آسانی سے اپنی سرمایہ کاری کی پہلے سے منصوبہ بندی کر سکتا ہے اور اپنے مالی اہداف کے مطابق سرمایہ کاری کر سکتا ہے۔ لیکن، SIP کے ذریعے اہداف حاصل کرنے کے لیے ایک طویل عرصے تک سرمایہ کاری کرنی پڑتی ہے۔ عام طور پر، SIP بڑے پیمانے پر اہداف کی منصوبہ بندی کے لیے استعمال کیا جاتا ہے جیسے:

Talk to our investment specialist

- کار خریدنا

- گھر خریدنا

- شادی

- بچے کی تعلیم

- بین الاقوامی سفر کے لیے بچت کریں۔

- ریٹائرمنٹ

- طبی ایمرجنسی وغیرہ۔

کوئی بھی کم از کم INR 500 اور INR 1000 کی رقم کے ساتھ SIPs میں سرمایہ کاری شروع کر سکتا ہے۔ ایک بار جب آپ SIP میں سرمایہ کاری کرنا شروع کر دیتے ہیں تو آپ کی رقم ہر روز جانا شروع ہو جاتی ہے کیونکہ یہ اسٹاک کے سامنے آتا ہے۔مارکیٹ. یہی وجہ ہے کہ SIPs کو بطور روٹ زیادہ تر ترجیح دی جاتی ہے۔ایکویٹی فنڈز. مزید برآں، تاریخی طور پر، ایکویٹی اسٹاک میں سرمایہ کاری نے دیگر تمام اثاثوں کے طبقوں کے درمیان متاثر کن منافع دیا ہے، اگر سرمایہ کاری نظم و ضبط کے ساتھ اور طویل مدتی افق کے ساتھ کی گئی ہو۔

ایکویٹی میں ایس آئی پی مارکیٹ کے وقت کے خطرے سے بچنے اور سرمایہ کاری کی اوسط لاگت کے ذریعہ دولت کی تخلیق میں سہولت فراہم کرتا ہے۔ آئیے کچھ اور دیکھتے ہیں۔ایس آئی پی کے فوائد جو طویل مدتی اہداف کے حصول میں مدد کرتا ہے:

کمپاؤنڈنگ کی طاقت- سادہ سود وہ ہے جب آپ صرف اصل پر سود حاصل کرتے ہیں۔ مرکب سود کی صورت میں، سود کی رقم پرنسپل میں شامل کی جاتی ہے، اور سود کا حساب نئے پرنسپل (پرانے پرنسپل کے علاوہ منافع) پر کیا جاتا ہے۔ یہ عمل ہر بار جاری رہتا ہے۔ چونکہ ایس آئی پی میںباہمی چندہ قسطوں میں ہیں، وہ مرکب ہیں، جو ابتدائی طور پر سرمایہ کاری کی رقم میں مزید اضافہ کرتا ہے۔

خطرے میں کمی- یہ دیکھتے ہوئے کہ ایک SIP طویل عرصے تک پھیلا ہوا ہے، کوئی اسٹاک مارکیٹ کے تمام ادوار، اتار چڑھاؤ اور اس سے بھی اہم طور پر مندی کو پکڑتا ہے۔ مندی میں، جب زیادہ تر سرمایہ کاروں کو خوف لاحق ہو جاتا ہے، SIP کی قسطیں اس بات کو یقینی بناتی ہیں کہ سرمایہ کار "کم" خریدیں۔

SIPs کی سہولت- سہولت SIP کے سب سے بڑے فوائد میں سے ایک ہے۔ صارف کو ایک بار سائن اپ کرنا ہوگا اور دستاویزات سے گزرنا ہوگا۔ ایک بار مکمل ہو جانے کے بعد، اس کے بعد کی سرمایہ کاری کے لیے ڈیبٹ خود بخود ہو جاتے ہیں۔سرمایہ کار صرف سرمایہ کاری کی نگرانی کرنا ہے.

SIP 2022 - 2023 کے لیے ہندوستان میں بہترین میوچل فنڈز

ایس آئی پی کے لیے بہترین لارج کیپ فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹93.8953

↑ 0.49 ₹50,876 100 0.4 3.1 16.6 19.3 17.4 9.2 ICICI Prudential Bluechip Fund Growth ₹114.46

↑ 0.46 ₹78,502 100 -0.5 3.3 14.6 18.2 15.5 11.3 DSP TOP 100 Equity Growth ₹483.231

↑ 2.93 ₹7,285 500 -0.2 2.8 11.6 18 13.5 8.4 Bandhan Large Cap Fund Growth ₹79.957

↑ 0.37 ₹2,051 100 0.2 3.8 16.8 17.8 13.1 8.2 Invesco India Largecap Fund Growth ₹70.44

↑ 0.21 ₹1,718 100 -1.3 2.4 15.4 17.7 14 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹2,051 Cr). Bottom quartile AUM (₹1,718 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.39% (top quartile). 5Y return: 15.55% (upper mid). 5Y return: 13.50% (bottom quartile). 5Y return: 13.15% (bottom quartile). 5Y return: 13.96% (lower mid). Point 6 3Y return: 19.34% (top quartile). 3Y return: 18.21% (upper mid). 3Y return: 18.00% (lower mid). 3Y return: 17.77% (bottom quartile). 3Y return: 17.70% (bottom quartile). Point 7 1Y return: 16.58% (upper mid). 1Y return: 14.55% (bottom quartile). 1Y return: 11.61% (bottom quartile). 1Y return: 16.85% (top quartile). 1Y return: 15.40% (lower mid). Point 8 Alpha: -0.94 (upper mid). Alpha: 1.30 (top quartile). Alpha: -1.17 (lower mid). Alpha: -2.13 (bottom quartile). Alpha: -5.05 (bottom quartile). Point 9 Sharpe: 0.29 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.26 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.04 (bottom quartile). Point 10 Information ratio: 1.37 (top quartile). Information ratio: 1.26 (upper mid). Information ratio: 0.74 (lower mid). Information ratio: 0.72 (bottom quartile). Information ratio: 0.67 (bottom quartile). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

ایس آئی پی کے لیے بہترین ملٹی کیپ فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,096.5

↑ 6.02 ₹96,295 300 1.1 4.8 17.4 22.3 20.2 11.4 Motilal Oswal Multicap 35 Fund Growth ₹58.5129

↓ -0.02 ₹13,862 500 -6.6 -4.5 7.4 22.2 13 -5.6 Nippon India Multi Cap Fund Growth ₹301.432

↑ 1.28 ₹50,352 100 -0.8 0.5 17.9 22.1 21.6 4.1 Mahindra Badhat Yojana Growth ₹36.2846

↑ 0.15 ₹6,133 500 -0.1 3.4 18.7 21.4 18.6 3.4 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.99

↑ 0.23 ₹1,099 1,000 1.9 7.4 21.8 21.3 15.3 3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Equity Fund Motilal Oswal Multicap 35 Fund Nippon India Multi Cap Fund Mahindra Badhat Yojana Aditya Birla Sun Life Manufacturing Equity Fund Point 1 Highest AUM (₹96,295 Cr). Lower mid AUM (₹13,862 Cr). Upper mid AUM (₹50,352 Cr). Bottom quartile AUM (₹6,133 Cr). Bottom quartile AUM (₹1,099 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (11+ yrs). Established history (20+ yrs). Established history (8+ yrs). Established history (11+ yrs). Point 3 Rating: 3★ (upper mid). Top rated. Rating: 2★ (lower mid). Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 20.17% (upper mid). 5Y return: 13.02% (bottom quartile). 5Y return: 21.55% (top quartile). 5Y return: 18.62% (lower mid). 5Y return: 15.29% (bottom quartile). Point 6 3Y return: 22.33% (top quartile). 3Y return: 22.15% (upper mid). 3Y return: 22.09% (lower mid). 3Y return: 21.36% (bottom quartile). 3Y return: 21.31% (bottom quartile). Point 7 1Y return: 17.44% (bottom quartile). 1Y return: 7.39% (bottom quartile). 1Y return: 17.87% (lower mid). 1Y return: 18.72% (upper mid). 1Y return: 21.83% (top quartile). Point 8 Alpha: 3.70 (top quartile). Alpha: -12.91 (bottom quartile). Alpha: -1.30 (lower mid). Alpha: -1.73 (bottom quartile). Alpha: 0.00 (upper mid). Point 9 Sharpe: 0.53 (top quartile). Sharpe: -0.51 (bottom quartile). Sharpe: -0.05 (lower mid). Sharpe: -0.07 (bottom quartile). Sharpe: -0.05 (upper mid). Point 10 Information ratio: 1.24 (top quartile). Information ratio: 0.54 (lower mid). Information ratio: 0.64 (upper mid). Information ratio: 0.17 (bottom quartile). Information ratio: 0.00 (bottom quartile). HDFC Equity Fund

Motilal Oswal Multicap 35 Fund

Nippon India Multi Cap Fund

Mahindra Badhat Yojana

Aditya Birla Sun Life Manufacturing Equity Fund

ایس آئی پی کے لیے بہترین مڈ کیپ فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹321.25

↑ 3.53 ₹7,132 100 2.9 8.1 29.4 25.3 20.6 11.1 TATA Mid Cap Growth Fund Growth ₹450.965

↑ 1.81 ₹5,497 150 0.6 5.4 21.2 22.6 18.4 5.8 BNP Paribas Mid Cap Fund Growth ₹106.439

↑ 0.83 ₹2,313 300 1.2 6.5 19.1 21.7 18.5 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹798.55

↑ 3.10 ₹6,301 1,000 -0.8 1.9 18.8 20.9 18.1 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹7,132 Cr). Lower mid AUM (₹5,497 Cr). Bottom quartile AUM (₹2,313 Cr). Upper mid AUM (₹6,301 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.64% (top quartile). 5Y return: 18.39% (lower mid). 5Y return: 18.48% (upper mid). 5Y return: 18.07% (bottom quartile). Point 6 3Y return: 25.32% (top quartile). 3Y return: 22.61% (upper mid). 3Y return: 21.65% (lower mid). 3Y return: 20.94% (bottom quartile). Point 7 1Y return: 29.36% (top quartile). 1Y return: 21.18% (upper mid). 1Y return: 19.06% (lower mid). 1Y return: 18.80% (bottom quartile). Point 8 Alpha: 4.76 (top quartile). Alpha: -0.26 (upper mid). Alpha: -3.59 (bottom quartile). Alpha: -1.66 (lower mid). Point 9 Sharpe: 0.33 (top quartile). Sharpe: 0.07 (upper mid). Sharpe: -0.14 (bottom quartile). Sharpe: -0.01 (lower mid). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.48 (upper mid). Information ratio: -0.91 (bottom quartile). Information ratio: -0.60 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

SIP کے لیے بہترین سمال کیپ فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹164.458

↑ 0.53 ₹68,287 100 -3.6 -1.7 14.3 21.2 23.6 -4.7 DSP Small Cap Fund Growth ₹196.515

↑ 0.84 ₹16,935 500 -0.8 1 20 20.6 20.5 -2.8 Sundaram Small Cap Fund Growth ₹259.069

↓ -0.24 ₹3,401 100 -2.3 2 20.8 20.5 20.2 0.4 Franklin India Smaller Companies Fund Growth ₹164.073

↑ 0.31 ₹13,238 500 -4.2 -2.6 11.3 19.4 19.8 -8.4 HDFC Small Cap Fund Growth ₹135.293

↑ 0.33 ₹37,753 300 -4.7 -3.8 15.5 18.8 20.8 -0.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund HDFC Small Cap Fund Point 1 Highest AUM (₹68,287 Cr). Lower mid AUM (₹16,935 Cr). Bottom quartile AUM (₹3,401 Cr). Bottom quartile AUM (₹13,238 Cr). Upper mid AUM (₹37,753 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.59% (top quartile). 5Y return: 20.47% (lower mid). 5Y return: 20.17% (bottom quartile). 5Y return: 19.83% (bottom quartile). 5Y return: 20.83% (upper mid). Point 6 3Y return: 21.19% (top quartile). 3Y return: 20.64% (upper mid). 3Y return: 20.53% (lower mid). 3Y return: 19.36% (bottom quartile). 3Y return: 18.83% (bottom quartile). Point 7 1Y return: 14.26% (bottom quartile). 1Y return: 20.03% (upper mid). 1Y return: 20.77% (top quartile). 1Y return: 11.27% (bottom quartile). 1Y return: 15.51% (lower mid). Point 8 Alpha: -1.23 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.98 (top quartile). Alpha: -5.23 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.42 (bottom quartile). Sharpe: -0.25 (lower mid). Sharpe: -0.16 (top quartile). Sharpe: -0.60 (bottom quartile). Sharpe: -0.23 (upper mid). Point 10 Information ratio: -0.02 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: -0.20 (bottom quartile). Information ratio: -0.26 (bottom quartile). Information ratio: 0.00 (upper mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

HDFC Small Cap Fund

بہترین ELSS (ٹیکس سیونگ میوچل فنڈز) SIP کے لیے

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹451.682

↑ 2.46 ₹32,609 500 0.7 4.2 13.5 23.9 19.2 6.6 Motilal Oswal Long Term Equity Fund Growth ₹49.4264

↑ 0.29 ₹4,341 500 -7.5 -2.7 15.6 21.9 16.9 -9.1 HDFC Tax Saver Fund Growth ₹1,456.65

↑ 5.11 ₹17,163 500 -0.2 2.6 14.7 21.3 19.4 10.3 DSP Tax Saver Fund Growth ₹145.728

↑ 0.56 ₹17,609 500 1.5 6 16.4 20.9 17.1 7.5 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund DSP Tax Saver Fund IDBI Equity Advantage Fund Point 1 Highest AUM (₹32,609 Cr). Bottom quartile AUM (₹4,341 Cr). Lower mid AUM (₹17,163 Cr). Upper mid AUM (₹17,609 Cr). Bottom quartile AUM (₹485 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (19+ yrs). Established history (12+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.21% (upper mid). 5Y return: 16.94% (bottom quartile). 5Y return: 19.40% (top quartile). 5Y return: 17.06% (lower mid). 5Y return: 9.97% (bottom quartile). Point 6 3Y return: 23.90% (top quartile). 3Y return: 21.95% (upper mid). 3Y return: 21.34% (lower mid). 3Y return: 20.87% (bottom quartile). 3Y return: 20.84% (bottom quartile). Point 7 1Y return: 13.49% (bottom quartile). 1Y return: 15.59% (lower mid). 1Y return: 14.72% (bottom quartile). 1Y return: 16.45% (upper mid). 1Y return: 16.92% (top quartile). Point 8 Alpha: -0.86 (bottom quartile). Alpha: -16.15 (bottom quartile). Alpha: 2.58 (top quartile). Alpha: -0.15 (lower mid). Alpha: 1.78 (upper mid). Point 9 Sharpe: 0.10 (bottom quartile). Sharpe: -0.43 (bottom quartile). Sharpe: 0.41 (upper mid). Sharpe: 0.16 (lower mid). Sharpe: 1.21 (top quartile). Point 10 Information ratio: 1.95 (top quartile). Information ratio: 0.53 (bottom quartile). Information ratio: 1.27 (upper mid). Information ratio: 0.96 (lower mid). Information ratio: -1.13 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

DSP Tax Saver Fund

IDBI Equity Advantage Fund

SIP کے لیے بہترین سیکٹر فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹106.79

↓ -0.56 ₹1,573 500 9.2 21.7 34.4 22.9 21.4 17.5 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 500 7.8 17.7 33.3 34.3 27.5 11.3 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 500 3.1 11.2 33.1 32.2 25.9 10.3 UTI Transportation & Logistics Fund Growth ₹295.897

↑ 0.66 ₹4,084 500 0.8 6.9 29 25.4 19.1 19.5 SBI Banking & Financial Services Fund Growth ₹46.82

↑ 0.28 ₹10,106 500 3.4 9.3 28.4 22.6 14.1 20.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund SBI PSU Fund Invesco India PSU Equity Fund UTI Transportation & Logistics Fund SBI Banking & Financial Services Fund Point 1 Bottom quartile AUM (₹1,573 Cr). Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹4,084 Cr). Highest AUM (₹10,106 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (10+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.39% (lower mid). 5Y return: 27.55% (top quartile). 5Y return: 25.92% (upper mid). 5Y return: 19.13% (bottom quartile). 5Y return: 14.11% (bottom quartile). Point 6 3Y return: 22.86% (bottom quartile). 3Y return: 34.34% (top quartile). 3Y return: 32.18% (upper mid). 3Y return: 25.42% (lower mid). 3Y return: 22.60% (bottom quartile). Point 7 1Y return: 34.36% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 33.14% (lower mid). 1Y return: 29.01% (bottom quartile). 1Y return: 28.43% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: -0.22 (bottom quartile). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 1.96 (top quartile). Point 9 Sharpe: 0.74 (lower mid). Sharpe: 0.33 (bottom quartile). Sharpe: 0.27 (bottom quartile). Sharpe: 0.90 (upper mid). Sharpe: 1.08 (top quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.47 (bottom quartile). Information ratio: -0.37 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.89 (top quartile). DSP Natural Resources and New Energy Fund

SBI PSU Fund

Invesco India PSU Equity Fund

UTI Transportation & Logistics Fund

SBI Banking & Financial Services Fund

ایس آئی پی کے لیے بہترین فوکسڈ فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹97.41

↑ 0.05 ₹14,569 100 1.3 6 21.8 23.6 19 15.4 HDFC Focused 30 Fund Growth ₹242.704

↑ 0.83 ₹26,537 300 1.4 4.7 17.4 22 21.5 10.9 SBI Focused Equity Fund Growth ₹376.732

↑ 0.23 ₹43,173 500 0.2 8.5 18.1 19.4 14.6 15.7 DSP Focus Fund Growth ₹56.092

↑ 0.16 ₹2,687 500 0.3 5.2 15 19.2 13.5 7.3 Aditya Birla Sun Life Focused Equity Fund Growth ₹149.707

↑ 0.44 ₹8,209 1,000 1.8 7.3 17.2 17.9 13.9 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Aditya Birla Sun Life Focused Equity Fund Point 1 Lower mid AUM (₹14,569 Cr). Upper mid AUM (₹26,537 Cr). Highest AUM (₹43,173 Cr). Bottom quartile AUM (₹2,687 Cr). Bottom quartile AUM (₹8,209 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (15+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.03% (upper mid). 5Y return: 21.52% (top quartile). 5Y return: 14.61% (lower mid). 5Y return: 13.49% (bottom quartile). 5Y return: 13.91% (bottom quartile). Point 6 3Y return: 23.56% (top quartile). 3Y return: 22.03% (upper mid). 3Y return: 19.41% (lower mid). 3Y return: 19.21% (bottom quartile). 3Y return: 17.89% (bottom quartile). Point 7 1Y return: 21.82% (top quartile). 1Y return: 17.37% (lower mid). 1Y return: 18.11% (upper mid). 1Y return: 14.95% (bottom quartile). 1Y return: 17.15% (bottom quartile). Point 8 Alpha: 7.16 (upper mid). Alpha: 3.31 (lower mid). Alpha: 7.50 (top quartile). Alpha: -0.18 (bottom quartile). Alpha: 2.34 (bottom quartile). Point 9 Sharpe: 0.70 (upper mid). Sharpe: 0.52 (lower mid). Sharpe: 0.79 (top quartile). Sharpe: 0.15 (bottom quartile). Sharpe: 0.35 (bottom quartile). Point 10 Information ratio: 1.72 (top quartile). Information ratio: 0.99 (upper mid). Information ratio: 0.32 (bottom quartile). Information ratio: 0.52 (lower mid). Information ratio: 0.15 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Aditya Birla Sun Life Focused Equity Fund

ایس آئی پی کے لیے بہترین ویلیو فنڈز

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹232.309

↑ 0.64 ₹9,153 100 -0.9 4.5 14.9 23 18.9 4.2 Aditya Birla Sun Life Pure Value Fund Growth ₹128.721

↑ 0.56 ₹6,411 1,000 0.5 6.3 16.7 20.8 16.6 2.6 ICICI Prudential Value Discovery Fund Growth ₹492

↑ 1.61 ₹61,272 100 -0.2 4.8 15.3 20.7 20.2 13.8 HDFC Capital Builder Value Fund Growth ₹775.081

↑ 1.83 ₹7,652 300 0.5 5 18.8 20.3 16.6 8.6 Tata Equity PE Fund Growth ₹358.373

↑ 0.46 ₹9,061 150 -1 4.6 15.5 19.9 16.3 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund Aditya Birla Sun Life Pure Value Fund ICICI Prudential Value Discovery Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹9,153 Cr). Bottom quartile AUM (₹6,411 Cr). Highest AUM (₹61,272 Cr). Bottom quartile AUM (₹7,652 Cr). Lower mid AUM (₹9,061 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (21+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.86% (upper mid). 5Y return: 16.56% (bottom quartile). 5Y return: 20.19% (top quartile). 5Y return: 16.63% (lower mid). 5Y return: 16.29% (bottom quartile). Point 6 3Y return: 23.01% (top quartile). 3Y return: 20.82% (upper mid). 3Y return: 20.66% (lower mid). 3Y return: 20.33% (bottom quartile). 3Y return: 19.92% (bottom quartile). Point 7 1Y return: 14.85% (bottom quartile). 1Y return: 16.66% (upper mid). 1Y return: 15.33% (bottom quartile). 1Y return: 18.83% (top quartile). 1Y return: 15.52% (lower mid). Point 8 Alpha: -3.34 (lower mid). Alpha: -4.92 (bottom quartile). Alpha: 5.80 (top quartile). Alpha: 0.83 (upper mid). Alpha: -3.79 (bottom quartile). Point 9 Sharpe: -0.07 (lower mid). Sharpe: -0.08 (bottom quartile). Sharpe: 0.74 (top quartile). Sharpe: 0.23 (upper mid). Sharpe: -0.07 (bottom quartile). Point 10 Information ratio: 1.54 (top quartile). Information ratio: 0.58 (bottom quartile). Information ratio: 0.97 (lower mid). Information ratio: 1.10 (upper mid). Information ratio: 0.96 (bottom quartile). Nippon India Value Fund

Aditya Birla Sun Life Pure Value Fund

ICICI Prudential Value Discovery Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

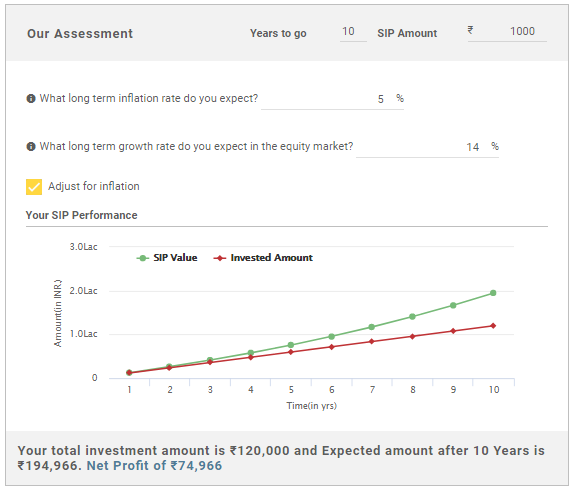

ایس آئی پی کیلکولیٹر

SIP کیلکولیٹر ان موثر ٹولز میں سے ایک ہے جو ایک سرمایہ کار میوچل فنڈز میں سرمایہ کاری کے دوران استعمال کر سکتا ہے۔ چاہے کوئی گاڑی/گھر خریدنے، ریٹائرمنٹ کا منصوبہ، بچے کی اعلیٰ تعلیم یا کوئی اور اثاثہ خریدنے کے لیے سرمایہ کاری کرنا چاہتا ہو، اس کے لیے SIP کیلکولیٹر استعمال کیا جا سکتا ہے۔ یہ سرمایہ کاری کی مقدار اور وقت کی مدت کا حساب لگانے میں مدد کرتا ہے جو مخصوص مالیاتی ہدف تک پہنچنے کے لیے سرمایہ کاری کے لیے درکار ہے۔ لہذا، عام سوالات جیسے "کتنا کرناSIP میں سرمایہ کاری کریں۔ یا اس وقت تک میں کیسے سرمایہ کاری کروں"، اس کیلکولیٹر کا استعمال کرتے ہوئے حل کرتا ہے۔

ایس آئی پی کیلکولیٹر کا استعمال کرتے وقت، کسی کو کچھ متغیرات کو پُر کرنا پڑتا ہے، جن میں شامل ہیں (مثال ذیل میں دی گئی ہے)-

- مطلوبہ سرمایہ کاری کی مدت

- تخمینہ شدہ ماہانہ SIP رقم

- متوقعمہنگائی آنے والے سالوں کے لیے شرح (سالانہ)

- سرمایہ کاری پر طویل مدتی ترقی کی شرح

ایک بار جب آپ اوپر دی گئی تمام معلومات کو فیڈ کر دیں گے، تو کیلکولیٹر آپ کو وہ رقم دے گا جو آپ کو سال کی تعداد کے بعد موصول ہو گی (آپ کی ایس آئی پی کی واپسی)۔ آپ کے خالص منافع کو بھی نمایاں کیا جائے گا تاکہ آپ اس کے مطابق اپنے ہدف کی تکمیل کا اندازہ لگا سکیں۔

بہترین میوچل فنڈز میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔