ભારતમાં 2022 માં શ્રેષ્ઠ પ્રદર્શન કરતી SIP યોજનાઓ

શ્રેષ્ઠSIP યોજનાઓ? તેમને કેવી રીતે પસંદ કરવા? આ કેટલાક સામાન્ય પ્રશ્નો છે જે રોકાણકારોના મનમાં જ્યારે વિચારે છેરોકાણ માંમ્યુચ્યુઅલ ફંડ SIP અથવા સિસ્ટમેટિક દ્વારારોકાણ યોજના.

SIP રોકાણ મ્યુચ્યુઅલ ફંડમાં રોકાણ કરતી વખતે સૌથી વધુ શિસ્તબદ્ધ રોકાણ વિકલ્પોમાંથી એક છે. વધુમાં, SIP મ્યુચ્યુઅલ ફંડમાં રોકાણની લઘુત્તમ રકમ INR 500 જેટલી ઓછી છે. આનાથી રોકાણ કરવામાં આવે છે.ટોચની SIP ખૂબ અનુકૂળ યોજનાઓ.

સામાન્ય રીતે, ભારતમાં કેટલીક શ્રેષ્ઠ SIP યોજનાઓ જ્યારે લાંબા ગાળા માટે રોકાણ કરવામાં આવે ત્યારે સારું વળતર આપે છે. SIP અથવા સિસ્ટમેટિક ઇન્વેસ્ટમેન્ટ પ્લાનમાં રોકાણ કરીને વ્યક્તિ કેટલી કમાણી કરી શકે છે તે જાણવા માટે, તપાસોસિપ કેલ્ક્યુલેટર (SIP રીટર્ન કેલ્ક્યુલેટર તરીકે પણ ઓળખાય છે) નીચેનો વિભાગ.

સિસ્ટમેટિક ઇન્વેસ્ટમેન્ટ પ્લાનમાં શા માટે રોકાણ કરવું?

વ્યવસ્થિત રોકાણ યોજના બહુવિધ લાભો સાથે આવે છે. તેની લઘુત્તમ રોકાણ રકમINR 500 મ્યુચ્યુઅલ ફંડમાં રોકાણની યાત્રા શરૂ કરવા માટે માત્ર મોટાભાગની વસ્તીનું જ નહીં, પરંતુ ઘણા યુવાનોનું પણ ધ્યાન ખેંચ્યું છે. એનરોકાણકાર કોણ ઈચ્છે છેSIP માં રોકાણ કરો તેમના મુખ્ય આયોજન કરી શકે છેનાણાકીય લક્ષ્યો જેમ કે- બાળકનું શિક્ષણ, લગ્ન ખર્ચ, મકાન/ગાડી વગેરેની ખરીદી, શિસ્તબદ્ધ રીતે. વ્યક્તિ ફક્ત તેમના લક્ષ્યો (ટૂંકા ગાળાના, મધ્ય-ગાળાના અને લાંબા ગાળાના) અનુસાર રોકાણ કરવાનું શરૂ કરી શકે છે અને ચોક્કસ સમયગાળામાં સંપત્તિમાં વધારો કરી શકે છે.

SIPs મુખ્ય લાભો આપે છે જેમ કે રૂપિયાની સરેરાશ કિંમત અનેસંયોજન શક્તિ. રૂપિયાની સરેરાશ કિંમત વ્યક્તિને સંપત્તિની ખરીદીની કિંમતની સરેરાશ કાઢવામાં મદદ કરે છે. SIP માં, એકમોની ખરીદી લાંબા ગાળા માટે કરવામાં આવે છે અને તે માસિક અંતરાલો (સામાન્ય રીતે) પર સમાન રીતે ફેલાયેલી હોય છે. રોકાણ સમયાંતરે ફેલાયેલ હોવાને કારણે, રોકાણ સ્ટોકમાં કરવામાં આવે છેબજાર જુદા જુદા ભાવ બિંદુઓ પર રોકાણકારને સરેરાશ ખર્ચનો લાભ આપે છે, તેથી રૂપિયો ખર્ચ સરેરાશ શબ્દ.

ચક્રવૃદ્ધિ વ્યાજના કિસ્સામાં, સાદા વ્યાજથી વિપરીત જ્યાં તમે માત્ર મુદ્દલ પર વ્યાજ મેળવો છો, અહીં વ્યાજની રકમ મુદ્દલમાં ઉમેરવામાં આવે છે, અને વ્યાજની ગણતરી નવા મુદ્દલ (જૂની મુદ્દલ વત્તા નફો) પર કરવામાં આવે છે. આ પ્રક્રિયા દર વખતે ચાલુ રહે છે. SIPમાં મ્યુચ્યુઅલ ફંડ હપ્તામાં હોવાથી, તે ચક્રવૃદ્ધિમાં હોય છે, જે શરૂઆતમાં રોકાણ કરેલી રકમમાં વધુ ઉમેરે છે.

સિસ્ટમેટિક ઇન્વેસ્ટમેન્ટ પ્લાનમાં કેવી રીતે રોકાણ કરવું?

Fincash.com પર આજીવન માટે મફત રોકાણ ખાતું ખોલો

તમારી નોંધણી અને KYC પ્રક્રિયા પૂર્ણ કરો

દસ્તાવેજો અપલોડ કરો (PAN, આધાર, વગેરે).અને, તમે રોકાણ કરવા માટે તૈયાર છો!

તો, તમે શેની રાહ જોઈ રહ્યા છો? તમારી SIP અથવા સિસ્ટમેટિક ઇન્વેસ્ટમેન્ટ પ્લાન સાથે પ્રારંભ કરો અને હવે વધુ સારી રીતે બચત કરો!

Talk to our investment specialist

નાણાકીય વર્ષ 22 - 23 માં રોકાણ કરવા માટે શ્રેષ્ઠ SIP યોજનાઓ

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Small Cap Fund Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹35.8635

↓ -0.43 ₹5,817 500 5.9 14.5 28.8 33.7 28.5 11.3 DSP World Gold Fund Growth ₹62.7255

↓ -1.20 ₹1,756 500 36 84.7 155.1 55.6 28.2 167.1 ICICI Prudential Infrastructure Fund Growth ₹195.93

↓ -2.37 ₹8,134 100 -1.9 1.5 15 25.2 27.3 6.7 Invesco India PSU Equity Fund Growth ₹67.17

↓ -0.74 ₹1,449 500 1.2 7.9 26.1 31.5 26.4 10.3 DSP India T.I.G.E.R Fund Growth ₹322.272

↓ -3.84 ₹5,323 500 1 4.2 17.6 25.6 24.3 -2.5 Nippon India Power and Infra Fund Growth ₹348.815

↓ -3.72 ₹7,117 100 -1.7 2.9 15.9 26.4 24.1 -0.5 HDFC Infrastructure Fund Growth ₹47.366

↓ -0.64 ₹2,452 300 -2.4 0.3 14 27.1 24.1 2.2 Nippon India Small Cap Fund Growth ₹162.704

↓ -1.81 ₹68,287 100 -4.2 -1.9 8.7 21.1 23.8 -4.7 Franklin Build India Fund Growth ₹147.013

↓ -1.68 ₹3,036 500 1.1 5 19.5 27.6 23.8 3.7 LIC MF Infrastructure Fund Growth ₹50.2038

↓ -0.39 ₹1,003 1,000 0.1 3.5 18.4 28.9 23.5 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary SBI PSU Fund DSP World Gold Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Nippon India Power and Infra Fund HDFC Infrastructure Fund Nippon India Small Cap Fund Franklin Build India Fund LIC MF Infrastructure Fund Point 1 Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,756 Cr). Top quartile AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Upper mid AUM (₹5,323 Cr). Upper mid AUM (₹7,117 Cr). Lower mid AUM (₹2,452 Cr). Highest AUM (₹68,287 Cr). Lower mid AUM (₹3,036 Cr). Bottom quartile AUM (₹1,003 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (17+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (upper mid). Top rated. Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Point 5 5Y return: 28.49% (top quartile). 5Y return: 28.22% (top quartile). 5Y return: 27.25% (upper mid). 5Y return: 26.40% (upper mid). 5Y return: 24.34% (upper mid). 5Y return: 24.11% (lower mid). 5Y return: 24.10% (lower mid). 5Y return: 23.80% (bottom quartile). 5Y return: 23.79% (bottom quartile). 5Y return: 23.54% (bottom quartile). Point 6 3Y return: 33.68% (top quartile). 3Y return: 55.56% (top quartile). 3Y return: 25.17% (bottom quartile). 3Y return: 31.48% (upper mid). 3Y return: 25.64% (bottom quartile). 3Y return: 26.36% (lower mid). 3Y return: 27.08% (lower mid). 3Y return: 21.07% (bottom quartile). 3Y return: 27.55% (upper mid). 3Y return: 28.88% (upper mid). Point 7 1Y return: 28.78% (top quartile). 1Y return: 155.09% (top quartile). 1Y return: 15.05% (bottom quartile). 1Y return: 26.09% (upper mid). 1Y return: 17.61% (lower mid). 1Y return: 15.93% (lower mid). 1Y return: 14.04% (bottom quartile). 1Y return: 8.74% (bottom quartile). 1Y return: 19.49% (upper mid). 1Y return: 18.41% (upper mid). Point 8 Alpha: -0.22 (lower mid). Alpha: 1.32 (top quartile). Alpha: 0.00 (top quartile). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -15.06 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -1.23 (lower mid). Alpha: 0.00 (upper mid). Alpha: -18.43 (bottom quartile). Point 9 Sharpe: 0.33 (top quartile). Sharpe: 3.42 (top quartile). Sharpe: 0.12 (upper mid). Sharpe: 0.27 (upper mid). Sharpe: -0.31 (bottom quartile). Sharpe: -0.20 (lower mid). Sharpe: -0.12 (lower mid). Sharpe: -0.42 (bottom quartile). Sharpe: -0.05 (upper mid). Sharpe: -0.21 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.67 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.37 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.34 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.02 (lower mid). Information ratio: 0.00 (lower mid). Information ratio: 0.28 (top quartile). SBI PSU Fund

DSP World Gold Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Nippon India Power and Infra Fund

HDFC Infrastructure Fund

Nippon India Small Cap Fund

Franklin Build India Fund

LIC MF Infrastructure Fund

સંપત્તિ >= 200 કરોડ & પર છટણી કરેલ5 વર્ષનું વળતર.1. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (13 Feb 26) ₹35.8635 ↓ -0.43 (-1.19 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 5.7% 3 Month 5.9% 6 Month 14.5% 1 Year 28.8% 3 Year 33.7% 5 Year 28.5% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.59 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.24% Utility 29.32% Energy 13.87% Industrials 12% Basic Materials 6.69% Asset Allocation

Asset Class Value Cash 2.8% Equity 97.11% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN17% ₹975 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL9% ₹518 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325559% ₹509 Cr 15,443,244

↑ 900,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹502 Cr 29,150,000

↑ 3,400,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328988% ₹467 Cr 17,635,554

↑ 1,100,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹372 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321346% ₹325 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹232 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328143% ₹203 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹163 Cr 3,850,000 2. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (12 Feb 26) ₹62.7255 ↓ -1.20 (-1.88 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 7.6% 3 Month 36% 6 Month 84.7% 1 Year 155.1% 3 Year 55.6% 5 Year 28.2% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.85 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 94.95% Asset Allocation

Asset Class Value Cash 2.43% Equity 94.95% Debt 0.01% Other 2.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,294 Cr 1,219,254

↓ -59,731 VanEck Gold Miners ETF

- | GDX25% ₹442 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹28 Cr Net Receivables/Payables

Net Current Assets | -0% -₹8 Cr 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (13 Feb 26) ₹195.93 ↓ -2.37 (-1.20 %) Net Assets (Cr) ₹8,134 on 31 Dec 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.12 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 1.6% 3 Month -1.9% 6 Month 1.5% 1 Year 15% 3 Year 25.2% 5 Year 27.3% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.59 Yr. Sharmila D’mello 30 Jun 22 3.51 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 46.72% Financial Services 13.08% Basic Materials 11.19% Utility 10.14% Energy 8.12% Real Estate 4.42% Consumer Cyclical 1.99% Communication Services 0.86% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹717 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO7% ₹565 Cr 1,116,358

↑ 891,940 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹342 Cr 10,376,448

↓ -600,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹250 Cr 1,700,000

↓ -154,934 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹246 Cr 612,120

↓ -57,631 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹240 Cr 1,529,725 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹230 Cr 1,911,120

↑ 107,554 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | 5322153% ₹214 Cr 1,683,557 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹209 Cr 2,424,016 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹209 Cr 13,053,905 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (13 Feb 26) ₹67.17 ↓ -0.74 (-1.09 %) Net Assets (Cr) ₹1,449 on 31 Dec 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.27 Information Ratio -0.37 Alpha Ratio -1.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 1% 3 Month 1.2% 6 Month 7.9% 1 Year 26.1% 3 Year 31.5% 5 Year 26.4% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.5 Yr. Sagar Gandhi 1 Jul 25 0.5 Yr. Data below for Invesco India PSU Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.01% Financial Services 29.88% Utility 19.12% Energy 13.49% Basic Materials 3.52% Consumer Cyclical 1.22% Asset Allocation

Asset Class Value Cash 1.76% Equity 98.24% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹136 Cr 1,387,617

↓ -38,697 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL8% ₹120 Cr 2,997,692 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005477% ₹104 Cr 2,717,009

↓ -184,556 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328147% ₹97 Cr 1,157,444

↑ 76,826 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN6% ₹86 Cr 9,129,820

↑ 339,034 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹86 Cr 196,158 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | 5321345% ₹66 Cr 2,244,222

↑ 127,830 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹65 Cr 445,685

↑ 21,640 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP4% ₹64 Cr 646,300 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325554% ₹59 Cr 1,801,543

↓ -223,420 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (13 Feb 26) ₹322.272 ↓ -3.84 (-1.18 %) Net Assets (Cr) ₹5,323 on 31 Dec 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio -0.31 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 4.4% 3 Month 1% 6 Month 4.2% 1 Year 17.6% 3 Year 25.6% 5 Year 24.3% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.54 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 30.1% Basic Materials 14.02% Financial Services 11.6% Utility 10.47% Consumer Cyclical 8.71% Energy 7.67% Health Care 5.45% Communication Services 3.33% Technology 1.7% Real Estate 1.7% Consumer Defensive 1.36% Asset Allocation

Asset Class Value Cash 3.89% Equity 96.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹284 Cr 694,468

↓ -3,201 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325554% ₹235 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP3% ₹173 Cr 245,928 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹171 Cr 812,745

↑ 56,591 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹152 Cr 136,165 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | 5328983% ₹147 Cr 5,567,574 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹141 Cr 1,154,264

↓ -258,148 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹134 Cr 305,098 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹133 Cr 3,321,453 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Dec 24 | AMBER2% ₹126 Cr 197,265 6. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (13 Feb 26) ₹348.815 ↓ -3.72 (-1.06 %) Net Assets (Cr) ₹7,117 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.2 Information Ratio 0.34 Alpha Ratio -15.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,955 31 Jan 23 ₹16,453 31 Jan 24 ₹27,930 31 Jan 25 ₹30,936 31 Jan 26 ₹31,936 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 4% 3 Month -1.7% 6 Month 2.9% 1 Year 15.9% 3 Year 26.4% 5 Year 24.1% 10 Year 15 Year Since launch 17.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.61 Yr. Rahul Modi 19 Aug 24 1.37 Yr. Lokesh Maru 5 Sep 25 0.32 Yr. Divya Sharma 5 Sep 25 0.32 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 32.98% Utility 23% Consumer Cyclical 10.79% Energy 10.36% Basic Materials 7.3% Technology 4.55% Communication Services 3.55% Financial Services 2.54% Real Estate 2.43% Health Care 2.08% Asset Allocation

Asset Class Value Cash 0.43% Equity 99.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹715 Cr 4,550,000

↑ 125,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹560 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹435 Cr 1,064,337 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹300 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL4% ₹253 Cr 1,200,000

↓ -900,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325383% ₹200 Cr 170,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | 5001033% ₹198 Cr 6,900,000

↓ -1,100,838 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000933% ₹196 Cr 3,020,014 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | 5004932% ₹173 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹165 Cr 17,497,157

↑ 350,000 7. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (13 Feb 26) ₹47.366 ↓ -0.64 (-1.34 %) Net Assets (Cr) ₹2,452 on 31 Dec 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio -0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,059 31 Jan 23 ₹16,950 31 Jan 24 ₹28,499 31 Jan 25 ₹31,485 31 Jan 26 ₹33,227 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 1.7% 3 Month -2.4% 6 Month 0.3% 1 Year 14% 3 Year 27.1% 5 Year 24.1% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.53 Yr. Ashish Shah 1 Nov 25 0.17 Yr. Data below for HDFC Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 39.43% Financial Services 20.52% Basic Materials 10.17% Energy 7.36% Utility 6.95% Communication Services 4.29% Real Estate 2.59% Health Care 1.72% Technology 1.41% Consumer Cyclical 0.69% Asset Allocation

Asset Class Value Cash 4.88% Equity 95.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹162 Cr 397,500

↑ 17,500 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321746% ₹148 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹139 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹91 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹82 Cr 1,400,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹79 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹76 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹74 Cr 350,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹73 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹69 Cr 704,361 8. Nippon India Small Cap Fund

Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (13 Feb 26) ₹162.704 ↓ -1.81 (-1.10 %) Net Assets (Cr) ₹68,287 on 31 Dec 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.44 Sharpe Ratio -0.42 Information Ratio -0.02 Alpha Ratio -1.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹17,257 31 Jan 23 ₹18,306 31 Jan 24 ₹28,687 31 Jan 25 ₹31,667 31 Jan 26 ₹31,833 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0.7% 3 Month -4.2% 6 Month -1.9% 1 Year 8.7% 3 Year 21.1% 5 Year 23.8% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -4.7% 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 9 Yr. Kinjal Desai 25 May 18 7.61 Yr. Lokesh Maru 5 Sep 25 0.32 Yr. Divya Sharma 5 Sep 25 0.32 Yr. Data below for Nippon India Small Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 19.8% Financial Services 16.77% Consumer Cyclical 14.25% Consumer Defensive 11.36% Basic Materials 10.68% Health Care 9.29% Technology 6.96% Utility 3% Energy 1.86% Communication Services 1.26% Real Estate 0.92% Asset Allocation

Asset Class Value Cash 3.83% Equity 96.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX3% ₹2,061 Cr 1,851,010 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,318 Cr 13,300,000 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹1,016 Cr 10,347,848 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹1,006 Cr 38,140,874 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 22 | 5001031% ₹848 Cr 29,507,422 Emami Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | 5311621% ₹835 Cr 15,798,302

↑ 2,923,504 eClerx Services Ltd (Technology)

Equity, Since 31 Jul 20 | ECLERX1% ₹804 Cr 1,712,794 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 24 | RELIANCE1% ₹780 Cr 4,964,128 Zydus Wellness Ltd (Consumer Defensive)

Equity, Since 31 Aug 16 | ZYDUSWELL1% ₹775 Cr 17,048,030

↑ 200,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | 5322151% ₹759 Cr 5,977,976 9. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (13 Feb 26) ₹147.013 ↓ -1.68 (-1.13 %) Net Assets (Cr) ₹3,036 on 31 Dec 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio -0.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 5.2% 3 Month 1.1% 6 Month 5% 1 Year 19.5% 3 Year 27.6% 5 Year 23.8% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.21 Yr. Kiran Sebastian 7 Feb 22 3.9 Yr. Sandeep Manam 18 Oct 21 4.21 Yr. Data below for Franklin Build India Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 35% Financial Services 15.02% Utility 14.66% Energy 13.57% Communication Services 8.21% Basic Materials 5.21% Real Estate 2.63% Consumer Cyclical 1.58% Technology 1.15% Asset Allocation

Asset Class Value Cash 2.97% Equity 97.03% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹272 Cr 665,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹188 Cr 1,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹165 Cr 325,341

↑ 10,341 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003125% ₹164 Cr 6,825,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹149 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹149 Cr 1,500,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹143 Cr 4,350,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322154% ₹127 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN3% ₹98 Cr 1,000,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 Jan 25 | 5321553% ₹96 Cr 5,600,000 10. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (13 Feb 26) ₹50.2038 ↓ -0.39 (-0.77 %) Net Assets (Cr) ₹1,003 on 31 Dec 25 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio -0.21 Information Ratio 0.28 Alpha Ratio -18.43 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 4.5% 3 Month 0.1% 6 Month 3.5% 1 Year 18.4% 3 Year 28.9% 5 Year 23.5% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.29 Yr. Mahesh Bendre 1 Jul 24 1.5 Yr. Data below for LIC MF Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 47.89% Consumer Cyclical 13.2% Basic Materials 9.06% Financial Services 6.21% Utility 5.93% Technology 3.68% Real Estate 3.55% Communication Services 3.18% Health Care 3.07% Asset Allocation

Asset Class Value Cash 4.22% Equity 95.78% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹50 Cr 686,379

↓ -7,478 Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹45 Cr 1,088,395

↓ -159,564 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT4% ₹44 Cr 108,403

↓ -1,181 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | 5329553% ₹32 Cr 901,191

↓ -9,818 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹31 Cr 43,674

↓ -475 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹29 Cr 93,271

↓ -1,016 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹26 Cr 659,065

↓ -7,180 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118

↑ 2,984 Cummins India Ltd (Industrials)

Equity, Since 31 May 21 | 5004803% ₹25 Cr 56,889

↓ -619 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL2% ₹25 Cr 92,624

↓ -1,009

શ્રેષ્ઠ SIP રોકાણ કેવી રીતે પસંદ કરવું?

ત્યાં વિવિધ મ્યુચ્યુઅલ ફંડ્સ છે જે તમને SIP દ્વારા રોકાણ કરવાની મંજૂરી આપે છે. પરંતુ મુખ્ય સમસ્યા એ પસંદ કરવાનું છેશ્રેષ્ઠ મ્યુચ્યુઅલ ફંડ SIP માટે. જો કે શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડ વ્યક્તિએ વ્યક્તિએ અલગ અલગ હોઈ શકે છે, નીચે કેટલાક મુદ્દાઓની સૂચિ છે જે રોકાણકારો શ્રેષ્ઠ SIP મ્યુચ્યુઅલ ફંડ પસંદ કરતા પહેલા ધ્યાનમાં લઈ શકે છે.

SIP રોકાણના ઉદ્દેશ્યને સમજો

જ્યારે રોકાણની વાત આવે છે, ત્યારે આપણામાંના દરેકનો એક અલગ હેતુ હોય છે. તેથી SIP દ્વારા મ્યુચ્યુઅલ ફંડમાં રોકાણ કરતા પહેલા, તમારા રોકાણના લક્ષ્યોની સ્પષ્ટ ચિત્ર મેળવવાની સલાહ આપવામાં આવે છે.જોખમ પ્રોફાઇલ. સામાન્ય રીતે,ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ જ્યારે લાંબા ગાળાના ઉદ્દેશ્યો માટે ફાયદાકારક માનવામાં આવે છેમની માર્કેટ અનેડેટ ફંડ ટૂંકા ગાળાના ઉદ્દેશ્યો માટે યોગ્ય છે.

ફંડ હાઉસ જાણો

SIP રિટર્નનો મોટો ભાગ તમારા વતી તમારા નાણાંનું સંચાલન ફંડ હાઉસ પર આધારિત છે. જો ફંડ હાઉસ તેના ઉદ્દેશ્યમાં નિષ્ફળ જાય, તો તમે જ તમારા પૈસા ગુમાવશો. તમારી પાસે શ્રેષ્ઠ SIP પ્લાન છે તેની ખાતરી કરવા માટે એક પ્રતિષ્ઠિત ફંડ હાઉસ પસંદ કરો.

SIP મ્યુચ્યુઅલ ફંડના ફંડની કામગીરી પર નજર રાખો

મૂળભૂત કારણો પૈકી એક જેના કારણે લોકોમ્યુચ્યુઅલ ફંડમાં રોકાણ કરો SIP દ્વારા પૈસા કમાવવાનું છે. તેથી, શ્રેષ્ઠ ફંડ પસંદ કરવા અને પછી શ્રેષ્ઠ SIP યોજનાઓમાં રોકાણ કરવા માટે સમયાંતરે ભંડોળના પ્રદર્શનનું વિશ્લેષણ કરવું મહત્વપૂર્ણ છે. સામાન્ય રીતે, ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ માટે લાંબા ગાળાની કામગીરી જોવામાં આવે છે, જ્યારે ડેટ માટે મ્યુચ્યુઅલ ફંડ્સ ટૂંકાથી મધ્યમ ગાળાના વળતરને ધ્યાનમાં લેવામાં આવે છે.

SIP ના લોડ અને રિકરિંગ ખર્ચનું વિશ્લેષણ કરો

છેલ્લું પરંતુ ઓછામાં ઓછું નહીં, એક્ઝિટ લોડ અને ખર્ચનો ગુણોત્તર જો નિર્દિષ્ટ સમયગાળા (સામાન્ય રીતે લૉક-ઇન પિરિયડ કહેવાય છે) પહેલાં રિડીમ કરવામાં આવે તો.

તેથી, આ પરિમાણોને ધ્યાનમાં રાખીને શ્રેષ્ઠ SIP યોજનાઓ પસંદ કરવાની સલાહ આપવામાં આવે છે. તમે રોકાણ કરતા પહેલા વિચારો!

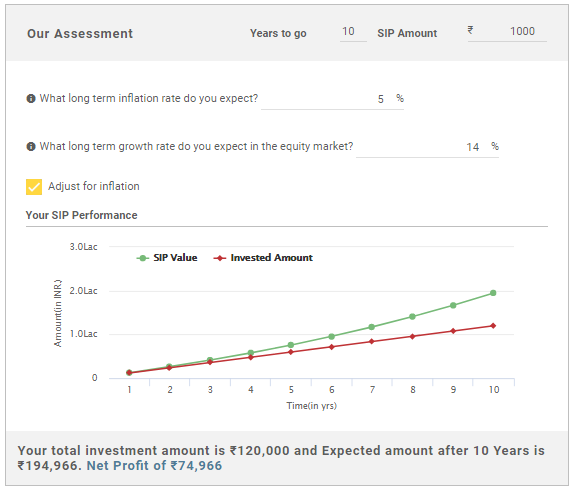

SIP કેલ્ક્યુલેટર (SIP રીટર્ન કેલ્ક્યુલેટર)

માટેનાણાકીય આયોજન, SIP કેલ્ક્યુલેટર અથવા SIP રીટર્ન કેલ્ક્યુલેટર શ્રેષ્ઠ સાધનો પૈકી એક છે.

કમ્પાઉન્ડિંગની શક્તિ દ્વારા તમારી SIP કેવી રીતે વધે છે તેનું નિરીક્ષણ કરવા માટે નીચેના ઉદાહરણનો વિચાર કરો.

| માસિક રોકાણ | રોકાણનો સમયગાળો | રોકાણ કરેલ કુલ રકમ | અંતિમ મૂલ્ય @ 14% p.a. |

|---|---|---|---|

| 1,000 | 5 વર્ષ | 60,000 છે | 87,200 છે |

| 1,000 | 10 વર્ષ | 1,20,000 | 2,62,091 છે |

| 1,000 | 15 વર્ષ | 1,80,000 | 6,12,853 છે |

ઉપરોક્ત કોષ્ટક ઉલ્લેખ કરે છે કે જો તમે SIP મ્યુચ્યુઅલ ફંડમાં દર મહિને INR 1,000 નું રોકાણ કરો છો, તો 5 વર્ષમાં તમારું કુલ રોકાણ INR 60,000 હશે અને તમારું SIP 14% p.a ના ધારિત વળતરની ટકાવારી પર વળતર આપશે. હશેINR 87,2001, અનુક્રમે. તેવી જ રીતે, 10 વર્ષમાં કુલ રોકાણ થશેINR 1,20,000 અને 14% p.a.ની ધારેલી ટકાવારી પર SIP વળતર. હશેINR 2,62,091.

એ જ રીતે, 15 વર્ષમાં રોકાણ થશેINR 1,80,000 અને 14% p.a ના વળતરની ટકાવારી પર અંતિમ મૂલ્ય હશેINR 6,12,853, અનુક્રમે.

તેથી, એક મહિનામાં ફક્ત INR 1,000 નું રોકાણ કરીને, આગામી વર્ષોમાં તમારા પૈસા કેવી રીતે વધશે તે જુઓ. રોકાણ કરવા માટે શ્રેષ્ઠ SIP મ્યુચ્યુઅલ ફંડ પસંદ કરતી વખતે ઉપરોક્ત ગણતરીઓ ધ્યાનમાં લો.

FAQs

1. SIP શું છે?

અ: SIP અથવા સિસ્ટેમેટિક ઇન્વેસ્ટમેન્ટ પ્લાન એ મ્યુચ્યુઅલ ફંડ સ્કીમ હેઠળ ઓફર કરવામાં આવતો રોકાણ માર્ગ છે, જ્યાં નિયમિત અંતરાલ પર સ્કીમ હેઠળ ચોક્કસ રકમનું રોકાણ કરવામાં આવે છે. આ હપ્તો રૂ.500 જેટલો નાનો હોઈ શકે છે.

2. SIP ના ફાયદા શું છે?

અ: SIPનો પ્રાથમિક ફાયદો એ છે કે તે રોકાણને વધુ શિસ્તબદ્ધ બનાવે છે. તે રોકાણકારને બનાવવા માટે પરવાનગી આપે છેનાણાકીય યોજના ઉપયોગી છે અને રોકાણકારને રોકાણકારમાં રોકાણ કરવાની ટેવ વિકસાવવામાં મદદ કરે છે.

3. SIP માં કોણ રોકાણ કરી શકે છે?

અ: કોઈપણ વ્યક્તિ SIPમાં રોકાણ કરી શકે છે. પરંતુ, તમારે તમારું જોખમ વિશ્લેષણ કરવું જોઈએ, એટલે કે તમે કેટલું જોખમ લેવા માંગો છો. ઉપરાંત, શરૂ કરવા માટે, તમારે PAN વિગતો, સરનામાનો પુરાવો અને જરૂરી છેબેંક વિગતો

4. ઑફલાઇન મોડમાં SIP માં રોકાણ કરવા માટેના પગલાં શું છે?

અ: ઑફલાઇન મોડમાં રોકાણ કરવા માટે, તમારે અરજી ફોર્મ ભરવું પડશે, માસિક અથવા ત્રિમાસિક SIP રકમ માટે ચેક સબમિટ કરવો પડશે, તેની એક નકલ પ્રદાન કરવી પડશે.પાન કાર્ડ, સરનામાનો પુરાવો અને તમારી બેંક વિગતોના પુરાવા તરીકે રદ થયેલ ચેક.

5. મારે શા માટે ICICI પ્રુડેન્શિયલ ટેક્નોલોજી ફંડમાં રોકાણ કરવું જોઈએ?

અ: ICICI પ્રુડેન્શિયલ ટેક્નોલોજી ફંડે 3જી માર્ચ 2000ના રોજ લોન્ચ થયા બાદ 11.9% નું વળતર દર્શાવ્યું છે. અન્ય ફંડોથી વિપરીત, વર્ષ 2020 માં, તેણે 70.6% નું વળતર સ્થાપિત કર્યું છે. આથી, ICICI પ્રુડેન્શિયલ ટેક્નોલોજી ફંડમાં રોકાણ કરવું યોગ્ય સાબિત થયું છે અને પાંચ વર્ષ માટે SIPમાં રોકાણ કર્યું છે.

6. મારે SBI બ્લુચિપ ફંડ રેગ્યુલર ગ્રોથમાં શા માટે રોકાણ કરવું જોઈએ?

અ: SBI બ્લુચીપ ફંડ રેગ્યુલર ગ્રોથનો પાંચ વર્ષનો વિકાસ દર દર્શાવે છે5.29%, જે પ્રમાણમાં વધારે છે.

7. SIP માં રોકાણ કરતી વખતે તમારે શું ધ્યાનમાં લેવું જોઈએ?

અ: જ્યારે તમે SIP માં રોકાણ કરો છો, ત્યારે તમારે નેટ એસેટ વેલ્યુ અથવાનથી. આ તે રોકાણ છે જે તમે સ્કીમ માટે કરો છો. તમારે તેના રેટિંગ અને તેના ઐતિહાસિક પ્રદર્શનને પણ તપાસવું આવશ્યક છે. તમારું રોકાણ સુરક્ષિત છે તેની ખાતરી કરવા માટે SIP જે વળતર આપશે તે સમજવું જરૂરી છે.

8. શું SIP માટે KYC મહત્વપૂર્ણ છે?

અ: હા, SIP માટે પણ KYC જરૂરી છે. એસઆઈપી મ્યુચ્યુઅલ ફંડની યોજના હેઠળ આવતી હોવાથી, તમારે એસઆઈપીમાં રોકાણ કરવા માટે કેવાયસી દસ્તાવેજો પ્રદાન કરવા પડશે.

9. શું SIP માં લઘુત્તમ રોકાણની આવશ્યકતા છે?

અ: હા, અમુક SIP ને ન્યૂનતમ રોકાણની જરૂર હોય છે. ઉદાહરણ તરીકે, આદિત્ય બિરલા સન લાઈફ ડિજિટલ ઈન્ડિયા ફંડમાં લઘુત્તમ એસઆઈપી રોકાણની જરૂરિયાત રૂ. 1000 છે. SBI બ્લુચીપ ફંડ રેગ્યુલર ગ્રોથ માટે ન્યૂનતમ રૂ. 5000ની જરૂરિયાત છે. આમ, તમે જે SIPમાં રોકાણ કરી રહ્યા છો તેના આધારે તમારે તમારા રોકાણની રકમ વધારવી પડશે.

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.

You Might Also Like

What Is The Best Date For Sips And Does It Really Affect Returns?

Best Liquid Mutual Funds In 2026 - A Complete Investor Guide

Best Smartphones Under ₹30,000 In India (2025) – Expert Buying Guide

E Filing Of Income Tax – A Complete Guide To File Income Tax Return

Best Android Phones Under ₹25,000 In India — Top Picks & Buying Guide

helpful to invest in SIP