निवेश करने के लिए शीर्ष 5 सर्वश्रेष्ठ इक्विटी एसआईपी फंड

यदि आप चाहते हैं कि आपके निवेश को सभी का पक्ष लिया जाएमंडी शर्तें, फिर अपना निवेश लेंसिप मार्ग! सिस्टमैटिक इन्वेस्टमेंट प्लान (SIPs) को का सबसे कुशल तरीका माना जाता हैम्यूचुअल फंड में निवेश. और अगर आप इक्विटी में निवेश करने की योजना बना रहे हैं, तो एसआईपी लंबे समय तक रिटर्न बनाने का सबसे अच्छा तरीका है। सर्वश्रेष्ठ इक्विटी एसआईपी फंड आपको लंबी अवधि में वांछित रिटर्न दे सकते हैंवित्तीय लक्ष्यों. तो, आइए देखें कि एसआईपी कैसे काम करता है, इसके लाभएसआईपी निवेश, a . का महत्वपूर्ण उपयोगघूंट कैलकुलेटर इक्विटी निवेश के लिए सबसे अच्छा प्रदर्शन करने वाले एसआईपी फंड के साथ।

Talk to our investment specialist

इक्विटी म्यूचुअल फंड के लिए व्यवस्थित निवेश

आदर्श रूप से, जब निवेशक इक्विटी में निवेश करने की योजना बनाते हैं, तो वे अक्सर रिटर्न की स्थिरता के बारे में संदेह करते हैं। ऐसा इसलिए है क्योंकि वे बाजार से जुड़े हुए हैं और अक्सर अस्थिरता के संपर्क में रहते हैं। इस प्रकार, इस तरह की अस्थिरता को संतुलित करने और दीर्घकालिक स्थिर रिटर्न सुनिश्चित करने के लिए, इक्विटी निवेश में SIP अत्यधिक अनुशंसित हैं। ऐतिहासिक रूप से, खराब बाजार चरण में, यह देखा गया है कि जिन निवेशकों ने एसआईपी मार्ग अपनाया था, उन्होंने एकमुश्त मार्ग लेने वालों की तुलना में अधिक स्थिर रिटर्न अर्जित किया। SIP का निवेश समय के साथ फैलता है, एकमुश्त निवेश के विपरीत जो एक ही बार में होता है। इसलिए, एसआईपी में आपका पैसा हर दिन बढ़ने लगता है (शेयर बाजार में निवेश किया जा रहा है)।

एक व्यवस्थितनिवेश योजना व्यापक रूप से दीर्घकालिक वित्तीय लक्ष्यों को प्राप्त करने के लिए भी माना जाता है जैसेसेवानिवृत्ति योजना, बच्चे की शिक्षा, घर/कार या कोई अन्य संपत्ति की खरीद। इससे पहले कि हम कुछ और देखेंनिवेश के लाभ आइए एक एसआईपी में निवेश करने के लिए कुछ बेहतरीन इक्विटी एसआईपी फंड देखें।

इक्विटी फंड के लिए सर्वश्रेष्ठ एसआईपी योजनाएं 2022

बेस्ट लार्ज कैप इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Indiabulls Blue Chip Fund Growth ₹43.83

↓ -0.53 ₹129 500 -0.6 4.1 17.9 15.6 12.4 7.5 Nippon India Large Cap Fund Growth ₹92.1365

↓ -1.07 ₹50,107 100 -1.2 2.7 16.8 19.9 17.8 9.2 SBI Bluechip Fund Growth ₹94.9063

↓ -0.99 ₹54,821 500 -0.1 4.5 16 15.4 13.1 9.7 ICICI Prudential Bluechip Fund Growth ₹113.53

↑ 0.02 ₹76,646 100 -2.3 3.1 15.4 18.7 16.2 11.3 Aditya Birla Sun Life Frontline Equity Fund Growth ₹532.54

↑ 0.22 ₹30,392 100 -3 1.8 13.7 16.1 13.7 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Blue Chip Fund Nippon India Large Cap Fund SBI Bluechip Fund ICICI Prudential Bluechip Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹129 Cr). Lower mid AUM (₹50,107 Cr). Upper mid AUM (₹54,821 Cr). Highest AUM (₹76,646 Cr). Bottom quartile AUM (₹30,392 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.43% (bottom quartile). 5Y return: 17.82% (top quartile). 5Y return: 13.14% (bottom quartile). 5Y return: 16.17% (upper mid). 5Y return: 13.71% (lower mid). Point 6 3Y return: 15.62% (bottom quartile). 3Y return: 19.90% (top quartile). 3Y return: 15.38% (bottom quartile). 3Y return: 18.72% (upper mid). 3Y return: 16.11% (lower mid). Point 7 1Y return: 17.92% (top quartile). 1Y return: 16.76% (upper mid). 1Y return: 16.03% (lower mid). 1Y return: 15.40% (bottom quartile). 1Y return: 13.73% (bottom quartile). Point 8 Alpha: 0.28 (lower mid). Alpha: 0.30 (upper mid). Alpha: 0.16 (bottom quartile). Alpha: 0.35 (top quartile). Alpha: -0.21 (bottom quartile). Point 9 Sharpe: 0.29 (bottom quartile). Sharpe: 0.30 (top quartile). Sharpe: 0.29 (lower mid). Sharpe: 0.30 (upper mid). Sharpe: 0.26 (bottom quartile). Point 10 Information ratio: -0.32 (bottom quartile). Information ratio: 1.22 (top quartile). Information ratio: -0.33 (bottom quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.31 (lower mid). Indiabulls Blue Chip Fund

Nippon India Large Cap Fund

SBI Bluechip Fund

ICICI Prudential Bluechip Fund

Aditya Birla Sun Life Frontline Equity Fund

बेस्ट लार्ज एंड मिड कैप इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Opportunities Fund Growth ₹355.699

↓ -4.19 ₹29,991 1,000 1.5 7 21.6 20.8 17.6 5.6 Invesco India Growth Opportunities Fund Growth ₹98.19

↓ -1.00 ₹8,959 100 -5 -2.3 19 25.1 17.8 4.7 DSP Equity Opportunities Fund Growth ₹640.457

↑ 1.29 ₹17,434 500 0.1 5.7 16.7 21.7 17.1 7.1 SBI Large and Midcap Fund Growth ₹659.322

↑ 1.53 ₹37,497 500 1.5 6.9 19.9 19.7 18.1 10.1 Aditya Birla Sun Life Equity Advantage Fund Growth ₹914.77

↓ -11.86 ₹5,654 1,000 0.6 4 18.7 16.8 11.5 3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Equity Opportunities Fund Invesco India Growth Opportunities Fund DSP Equity Opportunities Fund SBI Large and Midcap Fund Aditya Birla Sun Life Equity Advantage Fund Point 1 Upper mid AUM (₹29,991 Cr). Bottom quartile AUM (₹8,959 Cr). Lower mid AUM (₹17,434 Cr). Highest AUM (₹37,497 Cr). Bottom quartile AUM (₹5,654 Cr). Point 2 Established history (21+ yrs). Established history (18+ yrs). Established history (25+ yrs). Established history (20+ yrs). Oldest track record among peers (31 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.65% (lower mid). 5Y return: 17.78% (upper mid). 5Y return: 17.05% (bottom quartile). 5Y return: 18.11% (top quartile). 5Y return: 11.51% (bottom quartile). Point 6 3Y return: 20.80% (lower mid). 3Y return: 25.09% (top quartile). 3Y return: 21.66% (upper mid). 3Y return: 19.67% (bottom quartile). 3Y return: 16.81% (bottom quartile). Point 7 1Y return: 21.57% (top quartile). 1Y return: 18.98% (lower mid). 1Y return: 16.74% (bottom quartile). 1Y return: 19.93% (upper mid). 1Y return: 18.70% (bottom quartile). Point 8 Alpha: 2.61 (upper mid). Alpha: -0.94 (bottom quartile). Alpha: 1.22 (lower mid). Alpha: 3.74 (top quartile). Alpha: -1.14 (bottom quartile). Point 9 Sharpe: 0.44 (upper mid). Sharpe: 0.19 (bottom quartile). Sharpe: 0.34 (lower mid). Sharpe: 0.59 (top quartile). Sharpe: 0.18 (bottom quartile). Point 10 Information ratio: 0.08 (lower mid). Information ratio: 0.56 (top quartile). Information ratio: 0.30 (upper mid). Information ratio: -0.27 (bottom quartile). Information ratio: -1.09 (bottom quartile). Kotak Equity Opportunities Fund

Invesco India Growth Opportunities Fund

DSP Equity Opportunities Fund

SBI Large and Midcap Fund

Aditya Birla Sun Life Equity Advantage Fund

बेस्ट मिड कैप इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Emerging Equity Scheme Growth ₹136.874

↓ -1.52 ₹59,041 1,000 0.3 2 22.6 22.5 19.7 1.8 Sundaram Mid Cap Fund Growth ₹1,423.13

↓ -17.00 ₹12,917 100 -1.5 3.4 22.3 25.7 19.9 4.1 Taurus Discovery (Midcap) Fund Growth ₹115.79

↓ -0.86 ₹123 1,000 -6 -3.7 13.1 16.2 14.1 0.8 HDFC Mid-Cap Opportunities Fund Growth ₹202.575

↓ -2.58 ₹92,187 300 0.1 6.8 23.1 27 23.1 6.8 Edelweiss Mid Cap Fund Growth ₹102.905

↓ -1.36 ₹13,802 500 -0.5 4 22 26.9 21.8 3.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Emerging Equity Scheme Sundaram Mid Cap Fund Taurus Discovery (Midcap) Fund HDFC Mid-Cap Opportunities Fund Edelweiss Mid Cap Fund Point 1 Upper mid AUM (₹59,041 Cr). Bottom quartile AUM (₹12,917 Cr). Bottom quartile AUM (₹123 Cr). Highest AUM (₹92,187 Cr). Lower mid AUM (₹13,802 Cr). Point 2 Established history (18+ yrs). Established history (23+ yrs). Oldest track record among peers (31 yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 19.74% (bottom quartile). 5Y return: 19.86% (lower mid). 5Y return: 14.08% (bottom quartile). 5Y return: 23.10% (top quartile). 5Y return: 21.78% (upper mid). Point 6 3Y return: 22.46% (bottom quartile). 3Y return: 25.65% (lower mid). 3Y return: 16.22% (bottom quartile). 3Y return: 27.02% (top quartile). 3Y return: 26.90% (upper mid). Point 7 1Y return: 22.61% (upper mid). 1Y return: 22.32% (lower mid). 1Y return: 13.11% (bottom quartile). 1Y return: 23.09% (top quartile). 1Y return: 21.97% (bottom quartile). Point 8 Alpha: -0.96 (bottom quartile). Alpha: 0.78 (lower mid). Alpha: -5.93 (bottom quartile). Alpha: 3.73 (top quartile). Alpha: 1.70 (upper mid). Point 9 Sharpe: 0.18 (bottom quartile). Sharpe: 0.28 (lower mid). Sharpe: -0.09 (bottom quartile). Sharpe: 0.49 (top quartile). Sharpe: 0.33 (upper mid). Point 10 Information ratio: -0.44 (bottom quartile). Information ratio: 0.23 (lower mid). Information ratio: -1.68 (bottom quartile). Information ratio: 0.47 (upper mid). Information ratio: 0.49 (top quartile). Kotak Emerging Equity Scheme

Sundaram Mid Cap Fund

Taurus Discovery (Midcap) Fund

HDFC Mid-Cap Opportunities Fund

Edelweiss Mid Cap Fund

बेस्ट स्मॉल कैप इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Small Cap Fund Growth ₹84.0292

↓ -1.02 ₹4,778 1,000 -2.4 1.7 18.7 18.9 15.3 -3.7 SBI Small Cap Fund Growth ₹160.639

↓ -1.17 ₹34,449 500 -5.2 -5.2 8.2 13.7 15.6 -4.9 DSP Small Cap Fund Growth ₹194.616

↓ -1.16 ₹16,135 500 -0.8 0 18.2 20.9 20.3 -2.8 HDFC Small Cap Fund Growth ₹133.863

↓ -1.31 ₹36,941 300 -4.4 -3.9 14.5 19.4 20.9 -0.6 Nippon India Small Cap Fund Growth ₹162.162

↓ -1.07 ₹65,812 100 -3.6 -1.8 13 21.4 23.5 -4.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Small Cap Fund SBI Small Cap Fund DSP Small Cap Fund HDFC Small Cap Fund Nippon India Small Cap Fund Point 1 Bottom quartile AUM (₹4,778 Cr). Lower mid AUM (₹34,449 Cr). Bottom quartile AUM (₹16,135 Cr). Upper mid AUM (₹36,941 Cr). Highest AUM (₹65,812 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.27% (bottom quartile). 5Y return: 15.62% (bottom quartile). 5Y return: 20.33% (lower mid). 5Y return: 20.90% (upper mid). 5Y return: 23.46% (top quartile). Point 6 3Y return: 18.86% (bottom quartile). 3Y return: 13.69% (bottom quartile). 3Y return: 20.92% (upper mid). 3Y return: 19.36% (lower mid). 3Y return: 21.38% (top quartile). Point 7 1Y return: 18.68% (top quartile). 1Y return: 8.19% (bottom quartile). 1Y return: 18.18% (upper mid). 1Y return: 14.47% (lower mid). 1Y return: 12.99% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: -0.64 (bottom quartile). Point 9 Sharpe: 0.01 (upper mid). Sharpe: -0.41 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.05 (top quartile). Sharpe: -0.19 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.02 (top quartile). Aditya Birla Sun Life Small Cap Fund

SBI Small Cap Fund

DSP Small Cap Fund

HDFC Small Cap Fund

Nippon India Small Cap Fund

बेस्ट मल्टी कैप इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Standard Multicap Fund Growth ₹87.09

↓ -1.07 ₹56,479 500 0.3 5.5 20.3 18.5 14.6 9.5 Mirae Asset India Equity Fund Growth ₹113.264

↓ -1.30 ₹40,371 1,000 -3 1.8 14.3 13.9 11.9 10.2 Motilal Oswal Multicap 35 Fund Growth ₹56.337

↓ -0.40 ₹13,180 500 -9.3 -7.5 3.9 21.4 12.8 -5.6 BNP Paribas Multi Cap Fund Growth ₹73.5154

↓ -0.01 ₹588 300 -4.6 -2.6 19.3 17.3 13.6 Aditya Birla Sun Life Equity Fund Growth ₹1,849.36

↓ -19.16 ₹24,700 100 -1 5.4 19.1 19.2 15 11.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Standard Multicap Fund Mirae Asset India Equity Fund Motilal Oswal Multicap 35 Fund BNP Paribas Multi Cap Fund Aditya Birla Sun Life Equity Fund Point 1 Highest AUM (₹56,479 Cr). Upper mid AUM (₹40,371 Cr). Bottom quartile AUM (₹13,180 Cr). Bottom quartile AUM (₹588 Cr). Lower mid AUM (₹24,700 Cr). Point 2 Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (27 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.64% (upper mid). 5Y return: 11.92% (bottom quartile). 5Y return: 12.82% (bottom quartile). 5Y return: 13.57% (lower mid). 5Y return: 15.05% (top quartile). Point 6 3Y return: 18.47% (lower mid). 3Y return: 13.94% (bottom quartile). 3Y return: 21.41% (top quartile). 3Y return: 17.28% (bottom quartile). 3Y return: 19.23% (upper mid). Point 7 1Y return: 20.28% (top quartile). 1Y return: 14.28% (bottom quartile). 1Y return: 3.88% (bottom quartile). 1Y return: 19.34% (upper mid). 1Y return: 19.15% (lower mid). Point 8 Alpha: 3.74 (top quartile). Alpha: 0.02 (lower mid). Alpha: -5.98 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 3.72 (upper mid). Point 9 Sharpe: 0.46 (lower mid). Sharpe: 0.27 (bottom quartile). Sharpe: -0.19 (bottom quartile). Sharpe: 2.86 (top quartile). Sharpe: 0.48 (upper mid). Point 10 Information ratio: 0.19 (lower mid). Information ratio: -0.62 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.76 (top quartile). Kotak Standard Multicap Fund

Mirae Asset India Equity Fund

Motilal Oswal Multicap 35 Fund

BNP Paribas Multi Cap Fund

Aditya Birla Sun Life Equity Fund

बेस्ट सेक्टर इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹110.438

↑ 0.34 ₹1,765 500 15.2 25.4 38.8 25.1 21.5 17.5 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.89

↓ -1.06 ₹3,641 1,000 0.6 9.8 25.1 19 13.8 17.5 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 500 2.8 7.5 23.7 28.8 24.3 3.7 ICICI Prudential Banking and Financial Services Fund Growth ₹138.83

↓ -0.25 ₹10,951 100 -1 5.4 19.1 17.5 13.3 15.9 Bandhan Infrastructure Fund Growth ₹47.336

↓ -0.45 ₹1,428 100 -3 -2.7 12.2 24.8 21.5 -6.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund ICICI Prudential Banking and Financial Services Fund Bandhan Infrastructure Fund Point 1 Bottom quartile AUM (₹1,765 Cr). Upper mid AUM (₹3,641 Cr). Lower mid AUM (₹3,003 Cr). Highest AUM (₹10,951 Cr). Bottom quartile AUM (₹1,428 Cr). Point 2 Oldest track record among peers (17 yrs). Established history (12+ yrs). Established history (16+ yrs). Established history (17+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.46% (lower mid). 5Y return: 13.81% (bottom quartile). 5Y return: 24.26% (top quartile). 5Y return: 13.25% (bottom quartile). 5Y return: 21.54% (upper mid). Point 6 3Y return: 25.07% (upper mid). 3Y return: 19.00% (bottom quartile). 3Y return: 28.84% (top quartile). 3Y return: 17.53% (bottom quartile). 3Y return: 24.78% (lower mid). Point 7 1Y return: 38.81% (top quartile). 1Y return: 25.14% (upper mid). 1Y return: 23.66% (lower mid). 1Y return: 19.09% (bottom quartile). 1Y return: 12.19% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.61 (top quartile). Alpha: 0.00 (lower mid). Alpha: -2.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.32 (top quartile). Sharpe: 1.03 (upper mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.78 (lower mid). Sharpe: -0.27 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.25 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.01 (bottom quartile). Information ratio: 0.00 (bottom quartile). DSP Natural Resources and New Energy Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

ICICI Prudential Banking and Financial Services Fund

Bandhan Infrastructure Fund

सर्वश्रेष्ठ ईएलएसएस एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹45.8014

↓ -0.43 ₹4,566 500 -0.4 6.6 18 17.3 14.7 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹154.123

↓ -1.97 ₹7,060 500 -1.6 3.9 14.5 16.5 16 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹60.91

↓ -0.76 ₹14,993 500 -2.1 1.9 17.8 16.4 10 9.3 DSP Tax Saver Fund Growth ₹142.856

↓ -1.53 ₹17,223 500 -0.1 6 16.2 21.1 17.4 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,566 Cr). Lower mid AUM (₹7,060 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.67% (bottom quartile). 5Y return: 16.02% (lower mid). 5Y return: 9.97% (bottom quartile). 5Y return: 17.43% (top quartile). 5Y return: 17.39% (upper mid). Point 6 3Y return: 17.29% (lower mid). 3Y return: 16.45% (bottom quartile). 3Y return: 16.37% (bottom quartile). 3Y return: 21.14% (top quartile). 3Y return: 20.64% (upper mid). Point 7 1Y return: 17.97% (upper mid). 1Y return: 14.48% (bottom quartile). 1Y return: 17.78% (lower mid). 1Y return: 16.20% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.34 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.14 (bottom quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.35 (bottom quartile). Information ratio: -0.30 (lower mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

बेस्ट वैल्यू इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Equity PE Fund Growth ₹352.434

↓ -4.10 ₹8,819 150 -1.9 5.4 16.1 20.5 16.9 3.7 JM Value Fund Growth ₹92.2839

↓ -0.82 ₹885 500 -5.6 -3.2 6.7 19.7 17.2 -4.4 HDFC Capital Builder Value Fund Growth ₹756.828

↓ -9.14 ₹7,487 300 -1.5 4.6 18.8 20.6 17 8.6 Aditya Birla Sun Life Pure Value Fund Growth ₹126.596

↓ -1.41 ₹6,246 1,000 -0.7 6.8 16.7 21.5 16.9 2.6 Templeton India Value Fund Growth ₹729.232

↓ -6.41 ₹2,265 500 -0.3 4.5 13.9 18.6 18.2 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata Equity PE Fund JM Value Fund HDFC Capital Builder Value Fund Aditya Birla Sun Life Pure Value Fund Templeton India Value Fund Point 1 Highest AUM (₹8,819 Cr). Bottom quartile AUM (₹885 Cr). Upper mid AUM (₹7,487 Cr). Lower mid AUM (₹6,246 Cr). Bottom quartile AUM (₹2,265 Cr). Point 2 Established history (21+ yrs). Established history (28+ yrs). Oldest track record among peers (32 yrs). Established history (17+ yrs). Established history (29+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 16.94% (bottom quartile). 5Y return: 17.24% (upper mid). 5Y return: 17.00% (lower mid). 5Y return: 16.89% (bottom quartile). 5Y return: 18.15% (top quartile). Point 6 3Y return: 20.52% (lower mid). 3Y return: 19.66% (bottom quartile). 3Y return: 20.61% (upper mid). 3Y return: 21.47% (top quartile). 3Y return: 18.57% (bottom quartile). Point 7 1Y return: 16.06% (lower mid). 1Y return: 6.72% (bottom quartile). 1Y return: 18.77% (top quartile). 1Y return: 16.69% (upper mid). 1Y return: 13.90% (bottom quartile). Point 8 Alpha: 0.27 (upper mid). Alpha: -9.27 (bottom quartile). Alpha: 2.68 (top quartile). Alpha: -1.64 (bottom quartile). Alpha: -0.11 (lower mid). Point 9 Sharpe: 0.22 (upper mid). Sharpe: -0.40 (bottom quartile). Sharpe: 0.39 (top quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.18 (lower mid). Point 10 Information ratio: 0.89 (upper mid). Information ratio: 0.35 (bottom quartile). Information ratio: 1.10 (top quartile). Information ratio: 0.57 (lower mid). Information ratio: 0.32 (bottom quartile). Tata Equity PE Fund

JM Value Fund

HDFC Capital Builder Value Fund

Aditya Birla Sun Life Pure Value Fund

Templeton India Value Fund

बेस्ट फोकस्ड इक्विटी एसआईपी फंड

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Focused 25 Fund Growth ₹52.66

↓ -0.50 ₹11,382 500 -4.8 -3.4 9.5 12.6 7.3 2.5 Aditya Birla Sun Life Focused Equity Fund Growth ₹145.193

↓ -1.58 ₹8,068 1,000 -1.8 5.5 16.2 18 14.3 10.1 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Motilal Oswal Focused 25 Fund Growth ₹42.9536

↓ -0.21 ₹1,445 500 -2.4 2.9 17.8 11.1 8 -1.7 HDFC Focused 30 Fund Growth ₹237.984

↓ -3.27 ₹26,332 300 0.4 4.7 17.1 22.6 22 10.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Focused 25 Fund Aditya Birla Sun Life Focused Equity Fund Sundaram Select Focus Fund Motilal Oswal Focused 25 Fund HDFC Focused 30 Fund Point 1 Upper mid AUM (₹11,382 Cr). Lower mid AUM (₹8,068 Cr). Bottom quartile AUM (₹1,354 Cr). Bottom quartile AUM (₹1,445 Cr). Highest AUM (₹26,332 Cr). Point 2 Established history (13+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Established history (12+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 7.26% (bottom quartile). 5Y return: 14.34% (lower mid). 5Y return: 17.29% (upper mid). 5Y return: 8.04% (bottom quartile). 5Y return: 22.02% (top quartile). Point 6 3Y return: 12.63% (bottom quartile). 3Y return: 17.96% (upper mid). 3Y return: 17.03% (lower mid). 3Y return: 11.12% (bottom quartile). 3Y return: 22.56% (top quartile). Point 7 1Y return: 9.54% (bottom quartile). 1Y return: 16.16% (bottom quartile). 1Y return: 24.49% (top quartile). 1Y return: 17.83% (upper mid). 1Y return: 17.15% (lower mid). Point 8 Alpha: -3.90 (bottom quartile). Alpha: 3.66 (upper mid). Alpha: -5.62 (bottom quartile). Alpha: -2.93 (lower mid). Alpha: 3.79 (top quartile). Point 9 Sharpe: -0.10 (bottom quartile). Sharpe: 0.49 (lower mid). Sharpe: 1.85 (top quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.60 (upper mid). Point 10 Information ratio: -0.76 (bottom quartile). Information ratio: 0.23 (upper mid). Information ratio: -0.52 (lower mid). Information ratio: -0.68 (bottom quartile). Information ratio: 0.98 (top quartile). Axis Focused 25 Fund

Aditya Birla Sun Life Focused Equity Fund

Sundaram Select Focus Fund

Motilal Oswal Focused 25 Fund

HDFC Focused 30 Fund

इक्विटी फंड पर कराधान

बजट 2018 के भाषण के अनुसार, एक नया दीर्घकालिकराजधानी इक्विटी उन्मुख पर लाभ (LTCG) करम्यूचुअल फंड्स और स्टॉक 1 अप्रैल से लागू होंगे। वित्त विधेयक 2018 को 14 मार्च 2018 को लोकसभा में ध्वनि मत से पारित किया गया था। यहां बताया गया है कि कितना नया हैआयकर परिवर्तन 1 अप्रैल 2018 से इक्विटी निवेश को प्रभावित करेंगे। *

1. लॉन्ग टर्म कैपिटल गेन्स

INR 1 लाख से अधिक का LTCG से उत्पन्न होता हैमोचन 1 अप्रैल 2018 को या उसके बाद म्यूचुअल फंड इकाइयों या इक्विटी पर 10 प्रतिशत (प्लस सेस) या 10.4 प्रतिशत पर कर लगाया जाएगा। दीर्घावधिपूंजीगत लाभ INR 1 लाख तक की छूट दी जाएगी। उदाहरण के लिए, यदि आप एक वित्तीय वर्ष में स्टॉक या म्यूचुअल फंड निवेश से संयुक्त दीर्घकालिक पूंजीगत लाभ में INR 3 लाख कमाते हैं। कर योग्य LTCG INR 2 लाख (INR 3 लाख - 1 लाख) होंगे औरवित्त दायित्व INR 20 होगा,000 (INR 2 लाख का 10 प्रतिशत)।

लंबी अवधि के पूंजीगत लाभ बिक्री या मोचन से उत्पन्न होने वाले लाभ हैंइक्विटी फ़ंड एक वर्ष से अधिक समय तक आयोजित किया गया।

2. शॉर्ट टर्म कैपिटल गेन्स

यदि म्युचुअल फंड इकाइयां होल्डिंग के एक वर्ष से पहले बेची जाती हैं, तो शॉर्ट टर्म कैपिटल गेन्स (STCGs) कर लागू होगा। STCGs कर को 15 प्रतिशत पर अपरिवर्तित रखा गया है।

| इक्विटी योजनाएं | इंतेज़ार की अवधि | कर की दर |

|---|---|---|

| लॉन्ग टर्म कैपिटल गेन्स (LTCG .)) | 1 वर्ष से अधिक | 10% (बिना इंडेक्सेशन के)***** |

| शॉर्ट टर्म कैपिटल गेन्स (STCG) | एक वर्ष से कम या उसके बराबर | 15% |

| वितरित लाभांश पर कर | - | 10%# |

* INR 1 लाख तक का लाभ कर मुक्त है। INR 1 लाख से अधिक के लाभ पर 10% की दर से कर लागू होता है। पहले की दर 0% लागत की गणना 31 जनवरी, 2018 को समापन मूल्य के रूप में की गई थी। # 10% का लाभांश कर + अधिभार 12% + उपकर 4% = 11.648% 4% का स्वास्थ्य और शिक्षा उपकर पेश किया गया। पहले शिक्षा उपकर 3 . था%.

एसआईपी निवेश के लाभ

कुछ महत्वपूर्णव्यवस्थित निवेश योजनाओं के लाभ हैं:

रुपया लागत औसत

एक एसआईपी ऑफ़र का सबसे बड़ा लाभ रुपया लागत औसत है, जो किसी व्यक्ति को संपत्ति खरीद की लागत का औसत निकालने में मदद करता है। म्यूचुअल फंड में एकमुश्त निवेश करते समय एक निश्चित संख्या में इकाइयाँ खरीदी जाती हैंइन्वेस्टर एक बार में, एक एसआईपी के मामले में इकाइयों की खरीद लंबी अवधि में की जाती है और ये मासिक अंतराल (आमतौर पर) में समान रूप से फैली हुई हैं। समय के साथ निवेश के फैलाव के कारण, शेयर बाजार में अलग-अलग मूल्य बिंदुओं पर निवेश किया जाता है, जिससे निवेशक को औसत लागत का लाभ मिलता है, इसलिए रुपये की लागत औसत।

कंपाउंडिंग की शक्ति

SIPs का लाभ प्रदान करते हैंकंपाउंडिंग की शक्ति. साधारण ब्याज तब होता है जब आप केवल मूलधन पर ब्याज प्राप्त करते हैं। चक्रवृद्धि ब्याज के मामले में, ब्याज राशि मूलधन में जोड़ दी जाती है, और ब्याज की गणना नए मूलधन (पुराने मूलधन और लाभ) पर की जाती है। यह प्रक्रिया हर बार जारी रहती है। चूंकि एसआईपी में म्युचुअल फंड किश्तों में होते हैं, वे चक्रवृद्धि होते हैं, जो शुरू में निवेश की गई राशि में अधिक जोड़ता है।

सामर्थ्य

एसआईपी काफी किफायती होते हैं। SIP में मासिक न्यूनतम निवेश राशि INR 500 जितनी कम हो सकती है। कुछ फंड हाउस "MicroSIP" नामक कुछ भी प्रदान करते हैं, जहां टिकट का आकार INR 100 जितना कम होता है। यह युवा लोगों को अपनी लंबी शुरुआत करने के लिए एक अच्छा विकल्प देता है। -जीवन के प्रारंभिक चरण में टर्म निवेश।

एसआईपी कैलकुलेटर

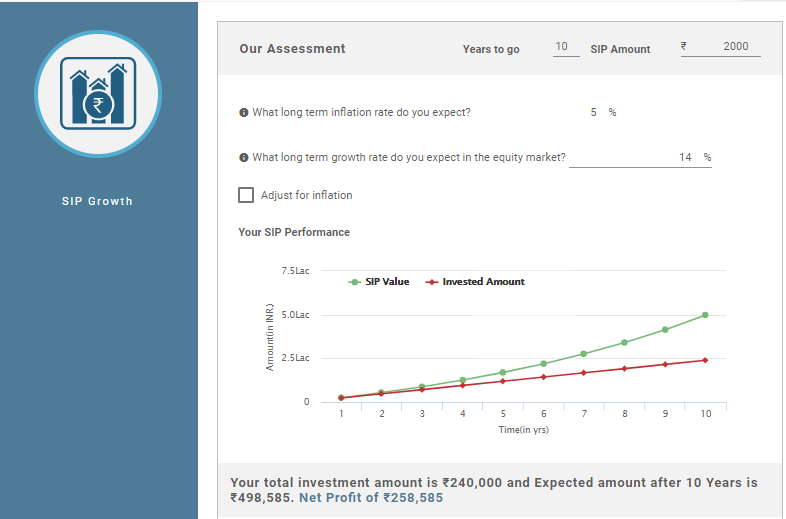

एसआईपी कैलकुलेटर आपके निवेश में सबसे उपयोगी उपकरण हो सकता है। यह आपके एसआईपी निवेश की वृद्धि का अनुमान तब तक लगाता है जब तक आप निवेशित रहना चाहते हैं। तो, पहले भीनिवेश एक फंड में, कोई भी अपने कुल एसआईपी को पूर्व निर्धारित कर सकता हैआय एसआईपी कैलकुलेटर के माध्यम से। कैलकुलेटर आम तौर पर इनपुट लेते हैं जैसे कि एसआईपी निवेश राशि जो निवेश करना चाहता है, निवेश की अवधि, अपेक्षितमुद्रास्फीति दरें (किसी को इसके लिए खाते की आवश्यकता है)। इसका उदाहरण नीचे दिया गया है:

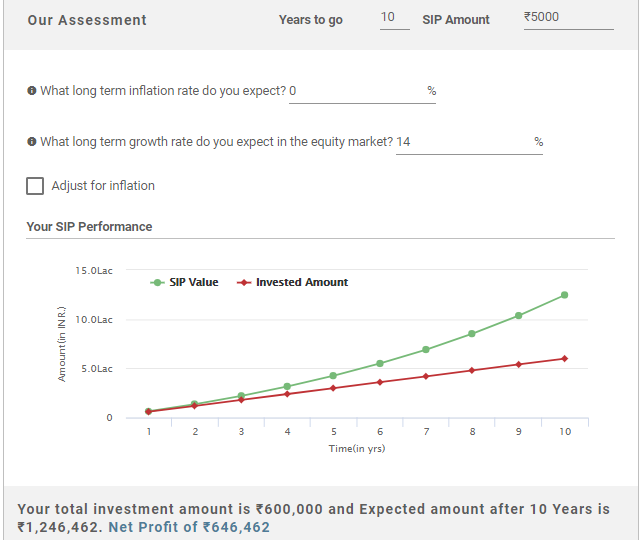

मान लीजिए, अगर आप 10 साल के लिए 5,000 रुपये का निवेश करते हैं, तो देखें कि आपका एसआईपी निवेश कैसे बढ़ता है-

मासिक निवेश: INR 5,000

निवेश अवधि: 10 वर्ष

निवेश की गई कुल राशि: INR 6,00,000

दीर्घकालिक विकास दर (लगभग): 14%

एसआईपी कैलकुलेटर के अनुसार अपेक्षित रिटर्न: INR 12,46,462

शुद्ध लाभ: INR 6,46,462

उपरोक्त गणनाओं से पता चलता है कि यदि आप 10 वर्षों के लिए मासिक रूप से 5,000 रुपये (कुल 6,00,000 रुपये) का निवेश करते हैं तो आप कमाएंगेINR 12,46,462 जिसका अर्थ है कि आप जो शुद्ध लाभ कमाते हैं वह हैINR 6,46,462। बढ़िया है ना!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।