2022 में निवेश करने के लिए शीर्ष 5 म्युचुअल फंड

म्यूचुअल फंड्स देर से ही सही, निवेश का एक लोकप्रिय तरीका बन गया है, और कई निवेशक इसका झुकाव कर रहे हैंनिवेश इस में। म्यूचुअल फंड न केवल अच्छा रिटर्न देते हैं, बल्कि हासिल करने का एक व्यवस्थित अवसर भी देते हैंवित्तीय लक्ष्यों, जो हाल के दिनों में उनकी लोकप्रियता का एक कारण है। हालांकि, वांछित निवेश लक्ष्य प्राप्त करने या अच्छा रिटर्न अर्जित करने के लिए, सही फंड में निवेश करना महत्वपूर्ण है। इसलिए हम यहाँ हैं! निवेशक योजना बना रहे हैंम्युचुअल फंड में निवेश, हम आपको उनमें से कुछ लाते हैंसर्वश्रेष्ठ प्रदर्शन करने वाले म्युचुअल फंड जिन पर आपको निवेश करते समय विचार करने की आवश्यकता है। इन फंडों को एयूएम जैसे महत्वपूर्ण मानकों को पूरा करके शॉर्टलिस्ट किया गया है।नहीं हैं, पिछले प्रदर्शन, सहकर्मी औसत रिटर्न, सूचना अनुपात, आदि।

Talk to our investment specialist

भारत में शीर्ष 5 सर्वश्रेष्ठ प्रदर्शन करने वाले म्युचुअल फंड

बेस्ट इक्विटी म्यूचुअल फंड 2022

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Information Ratio Sharpe Ratio DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 1,000 500 39.2 84.2 156.2 58.2 29.3 167.1 -0.47 3.41 SBI PSU Fund Growth ₹36.6508

↑ 0.35 ₹5,980 5,000 500 7.6 16.8 29.9 34.6 28 11.3 -0.63 0.63 Invesco India PSU Equity Fund Growth ₹68.35

↑ 0.53 ₹1,492 5,000 500 2.2 10 28.4 32 26 10.3 -0.5 0.53 Franklin India Opportunities Fund Growth ₹255.949

↓ -2.85 ₹8,271 5,000 500 -2.4 0.4 15.1 29.3 20.1 3.1 1.66 0.12 LIC MF Infrastructure Fund Growth ₹50.4298

↑ 0.39 ₹946 5,000 1,000 0.8 3.5 21.6 28.7 23.6 -3.7 0.29 0.03 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Note: Ratio's shown as on 31 Jan 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund Franklin India Opportunities Fund LIC MF Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Highest AUM (₹8,271 Cr). Bottom quartile AUM (₹946 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (26 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.99% (upper mid). 5Y return: 26.01% (lower mid). 5Y return: 20.10% (bottom quartile). 5Y return: 23.65% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 34.56% (upper mid). 3Y return: 32.03% (lower mid). 3Y return: 29.25% (bottom quartile). 3Y return: 28.73% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 29.87% (upper mid). 1Y return: 28.36% (lower mid). 1Y return: 15.07% (bottom quartile). 1Y return: 21.61% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: -1.01 (lower mid). Alpha: -6.08 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.53 (lower mid). Sharpe: 0.12 (bottom quartile). Sharpe: 0.03 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 1.66 (top quartile). Information ratio: 0.29 (upper mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

Franklin India Opportunities Fund

LIC MF Infrastructure Fund

बेस्ट डेट फंड 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.3151

↓ -0.01 ₹217 -0.5 0.8 17.9 14.1 21 7.67% 2Y 5M 5D 3Y 4M 24D Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3113

↓ 0.00 ₹1,138 4.8 7.4 13.1 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 4.19% 5M 18D 8M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund Point 1 Bottom quartile AUM (₹217 Cr). Bottom quartile AUM (₹297 Cr). Highest AUM (₹1,138 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Point 2 Established history (22+ yrs). Established history (18+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Not Rated. Rating: 2★ (upper mid). Rating: 2★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 17.89% (top quartile). 1Y return: 13.69% (upper mid). 1Y return: 13.15% (lower mid). 1Y return: 12.83% (bottom quartile). 1Y return: 11.79% (bottom quartile). Point 6 1M return: -0.97% (bottom quartile). 1M return: 0.59% (upper mid). 1M return: 1.01% (top quartile). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (lower mid). Point 7 Sharpe: 1.48 (lower mid). Sharpe: 2.57 (top quartile). Sharpe: 2.38 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.67% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Point 10 Modified duration: 2.43 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (lower mid). Modified duration: 0.47 yrs (upper mid). DSP Credit Risk Fund

Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

बेस्ट हाइब्रिड फंड्स 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.6676

↑ 0.33 ₹6,848 1.2 6.8 14.8 20.3 14.6 11.1 SBI Multi Asset Allocation Fund Growth ₹67.0842

↑ 0.16 ₹14,944 5.3 12.8 22.7 20.1 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹820.211

↓ -4.94 ₹80,768 1.7 7.8 16.4 19.5 19.7 18.6 ICICI Prudential Equity and Debt Fund Growth ₹409.05

↑ 1.60 ₹49,257 -0.7 2.9 14.5 19.1 19.1 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.23

↑ 0.10 ₹1,329 -0.3 0.6 12.6 18.6 18.5 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.61% (bottom quartile). 5Y return: 14.82% (bottom quartile). 5Y return: 19.74% (top quartile). 5Y return: 19.12% (upper mid). 5Y return: 18.47% (lower mid). Point 6 3Y return: 20.31% (top quartile). 3Y return: 20.08% (upper mid). 3Y return: 19.52% (lower mid). 3Y return: 19.10% (bottom quartile). 3Y return: 18.59% (bottom quartile). Point 7 1Y return: 14.76% (lower mid). 1Y return: 22.69% (top quartile). 1Y return: 16.44% (upper mid). 1Y return: 14.53% (bottom quartile). 1Y return: 12.64% (bottom quartile). Point 8 1M return: 0.44% (bottom quartile). 1M return: 1.35% (lower mid). 1M return: 0.39% (bottom quartile). 1M return: 2.19% (upper mid). 1M return: 3.86% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

बेस्ट गोल्ड म्यूचुअल फंड 2022

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 39.2 84.2 156.2 58.2 29.3 167.1 SBI Gold Fund Growth ₹44.9826

↑ 1.10 ₹15,024 25.6 55.4 75.6 38 25.5 71.5 ICICI Prudential Regular Gold Savings Fund Growth ₹47.5707

↑ 1.14 ₹6,338 25.6 55.3 75.7 37.8 25.4 72 HDFC Gold Fund Growth ₹45.8562

↑ 0.23 ₹11,458 25.3 55 75.2 37.8 25.6 71.3 Axis Gold Fund Growth ₹44.6398

↑ 0.07 ₹2,835 25.8 55 74.6 37.7 25.7 69.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI Gold Fund ICICI Prudential Regular Gold Savings Fund HDFC Gold Fund Axis Gold Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Highest AUM (₹15,024 Cr). Lower mid AUM (₹6,338 Cr). Upper mid AUM (₹11,458 Cr). Bottom quartile AUM (₹2,835 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 25.54% (bottom quartile). 5Y return: 25.44% (bottom quartile). 5Y return: 25.57% (lower mid). 5Y return: 25.66% (upper mid). Point 6 3Y return: 58.17% (top quartile). 3Y return: 38.00% (upper mid). 3Y return: 37.81% (lower mid). 3Y return: 37.80% (bottom quartile). 3Y return: 37.71% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 75.65% (lower mid). 1Y return: 75.70% (upper mid). 1Y return: 75.15% (bottom quartile). 1Y return: 74.58% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). 1M return: 1.67% (bottom quartile). 1M return: 2.86% (upper mid). 1M return: 1.70% (lower mid). 1M return: 1.31% (bottom quartile). Point 9 Sharpe: 3.41 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Sharpe: 3.25 (bottom quartile). Sharpe: 3.10 (bottom quartile). Sharpe: 3.29 (lower mid). Sharpe: 3.44 (top quartile). DSP World Gold Fund

SBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

HDFC Gold Fund

Axis Gold Fund

म्यूचुअल फंड प्रकार: जोखिम और रिटर्न

निवेश करने से पहले, निम्नलिखित म्युचुअल फंड श्रेणियों के मूल जोखिम और औसत रिटर्न को जानें:

| म्युचुअल फंड श्रेणी | औसत रिटर्न | जोखिम | जोखिम का प्रकार |

|---|---|---|---|

| इक्विटी फ़ंड | 2% -20% | उच्च से मध्यम | अस्थिरता जोखिम, प्रदर्शन जोखिम, एकाग्रता जोखिम |

| कर्ज़/बांड | 8-14% | निम्न से मध्यम | ब्याज दर जोखिम, ऋण जोखिम |

| मुद्रा बाजार फंड | 4% -8% | कम | मुद्रास्फीति जोखिम, अवसर हानि |

| बैलेंस्ड फंड | 5-15% | उदारवादी | इक्विटी, डेट होल्डिंग्स में अधिक एक्सपोजर |

म्यूचुअल फंड कैलकुलेटर: अपने निवेश रिटर्न को पूर्व-निर्धारित करें

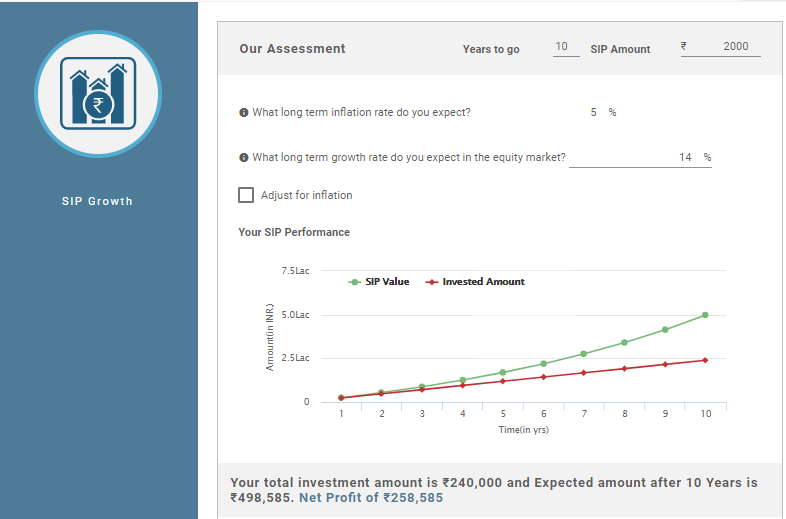

एघूंट कैलकुलेटर एक स्मार्ट टूल है जो निवेशकों के प्रमुख प्रश्नों को हल करता है जैसे 'कितना निवेश करें', 'मैं कितना कमाऊंगा', 'मेरा लाभ कितना होगा', आदि।म्यूचुअल फंड कैलकुलेटर, अधिक विशेष रूप से,सिप कैलकुलेटर आपकी निवेश राशि को उस अवधि के लिए पूर्व-निर्धारित करता है जिसके लिए आप निवेश करना चाहते हैं। यह प्रभावी के लिए सबसे अच्छे उपकरणों में से एक हैवित्तीय योजना. क्या कोई कार, घर, योजना खरीदने की योजना बनाना चाहता हैनिवृत्ति, एक बच्चे की उच्च शिक्षा या कोई अन्य वित्तीय लक्ष्य, उसके लिए SIP कैलकुलेटर का उपयोग किया जा सकता है। यहां बताया गया है कि कैलकुलेटर कैसे काम करता है:

चित्रण:

मासिक निवेश: ₹ 2,000

निवेश अवधि: 10 वर्ष

निवेश की गई कुल राशि: ₹ 2,40,000

दीर्घकालिक मुद्रास्फीति: 5% (लगभग)

दीर्घकालिक विकास दर: 14% (लगभग)

एसआईपी कैलकुलेटर के अनुसार अपेक्षित रिटर्न: ₹ 4,98,585

एसआईपी कैलकुलेटर में आपको केवल निवेश राशि और निवेश की अवधि (मुद्रास्फीति और अपेक्षित जैसे अतिरिक्त इनपुट) जैसे कुछ बुनियादी इनपुट दर्ज करने होंगे।मंडी रिटर्न अधिक यथार्थवादी तस्वीर देगा)। इन प्रविष्टियों का आउटपुट परिपक्वता और अर्जित लाभ पर अंतिम राशि होगी।

लक्ष्य तक पहुँचने के लिए कितनी राशि का निवेश करना चाहिए, यह निर्धारित करने के लिए एक लक्ष्य को ध्यान में रखते हुए एक समान गणना भी की जा सकती है। आपको नीचे दिए गए लक्ष्य की तरह एक विशेष लक्ष्य चुनना होगा और लक्ष्य कैलकुलेटर का उपयोग करके विवरण का अनुमान लगाना होगा।

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।