म्यूचुअल फंड में एकमुश्त निवेश

क्या आप जानते हैं कि आप एकमुश्त राशि का निवेश कर सकते हैंम्यूचुअल फंड्स? अगर हां, तो अच्छा है। हालांकि, अगर नहीं, तो चिंता न करें। यह लेख आपको उसी के माध्यम से मार्गदर्शन करेगा। म्यूचुअल फंड में एकमुश्त निवेश उस स्थिति को संदर्भित करता है जब कोई व्यक्ति एक बार में म्यूचुअल फंड में पैसा निवेश करता है। यहां, जमा कई बार नहीं होता है। में बहुत अंतर हैसिप और निवेश का एकमुश्त तरीका। तो, आइए म्यूचुअल फंड में एकमुश्त निवेश की अवधारणा को समझते हैं,सर्वश्रेष्ठ म्युचुअल फंड एकमुश्त निवेश के लिए, इस लेख के माध्यम से एकमुश्त निवेश के दौरान विचार की जाने वाली बातें, म्यूचुअल फंड एकमुश्त रिटर्न कैलकुलेटर और अन्य संबंधित पहलू।

म्यूचुअल फंड में एकमुश्त निवेश से आप क्या समझते हैं?

म्यूचुअल फंड में एकमुश्त निवेश एक ऐसा परिदृश्य है जहां व्यक्तिम्युचुअल फंड में निवेश केवल एक बार के लिए। हालांकि, निवेश के एसआईपी मोड के विपरीत, जहां व्यक्ति एकमुश्त मोड में छोटी राशि जमा करते हैं, व्यक्ति काफी राशि जमा करते हैं। दूसरे शब्दों में, यह की एक-शॉट तकनीक हैनिवेश म्यूचुअल फंड में। उन निवेशकों के लिए उपयुक्त निवेश का एकमुश्त तरीका जिनके पास अतिरिक्त धन है जो उनके में आदर्श हैंबैंक खाता और अधिक कमाने के लिए चैनलों की तलाश कर रहे हैंआय म्यूचुअल फंड में निवेश करके।

2022 - 2023 में एकमुश्त निवेश के लिए सर्वश्रेष्ठ म्यूचुअल फंड

इससे पहले कि आप एकमुश्त मोड के माध्यम से म्युचुअल फंड में निवेश करें, व्यक्तियों को विभिन्न मापदंडों जैसे कि एयूएम, निवेश राशि और बहुत कुछ पर विचार करने की आवश्यकता है। तो, इन मापदंडों के आधार पर एकमुश्त निवेश के लिए कुछ बेहतरीन म्युचुअल फंड इस प्रकार हैं।

इक्विटी म्युचुअल फंड में सर्वश्रेष्ठ एकमुश्त निवेश

इक्विटी फ़ंड ऐसी योजनाएं हैं जो विभिन्न कंपनियों के इक्विटी और इक्विटी से संबंधित उपकरणों में अपने कोष का निवेश करती हैं। इन योजनाओं को लंबी अवधि के निवेश के लिए एक अच्छा विकल्प माना जाता है। हालांकि व्यक्ति इक्विटी फंड में एकमुश्त राशि का निवेश कर सकते हैं, फिर भी इक्विटी फंड में निवेश की अनुशंसित तकनीक या तो एसआईपी के माध्यम से है याव्यवस्थित स्थानांतरण योजना (एसटीपी) मोड। एसटीपी मोड में, व्यक्ति पहले काफी पैसा जमा करते हैंडेट फंड जैसे किलिक्विड फंड और फिर इक्विटी फंड में नियमित अंतराल पर पैसा ट्रांसफर किया जाता है। कुछ इक्विटी म्यूचुअल फंड जिन्हें निवेश के लिए माना जा सकता है, वे इस प्रकार हैं।

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹70.6728

↑ 0.61 ₹1,975 1,000 42.7 87.9 203.9 64.5 33.4 167.1 SBI PSU Fund Growth ₹35.6915

↓ -1.03 ₹5,980 5,000 7.9 15.7 32.4 32.1 26 11.3 ICICI Prudential Infrastructure Fund Growth ₹187.26

↓ -4.23 ₹8,077 5,000 -4.5 -2.6 13.6 22.9 24.1 6.7 Invesco India PSU Equity Fund Growth ₹66.02

↓ -1.70 ₹1,492 5,000 2.5 8.5 30 29.7 23.6 10.3 DSP India T.I.G.E.R Fund Growth ₹316.274

↓ -6.60 ₹5,184 1,000 1.1 1.5 21.4 25 22.7 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹5,184 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 33.40% (top quartile). 5Y return: 26.00% (upper mid). 5Y return: 24.14% (lower mid). 5Y return: 23.62% (bottom quartile). 5Y return: 22.74% (bottom quartile). Point 6 3Y return: 64.51% (top quartile). 3Y return: 32.11% (upper mid). 3Y return: 22.89% (bottom quartile). 3Y return: 29.70% (lower mid). 3Y return: 24.98% (bottom quartile). Point 7 1Y return: 203.87% (top quartile). 1Y return: 32.38% (upper mid). 1Y return: 13.63% (bottom quartile). 1Y return: 30.04% (lower mid). 1Y return: 21.39% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (bottom quartile). Sharpe: 0.53 (lower mid). Sharpe: 0.08 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Talk to our investment specialist

डेट म्यूचुअल फंड में सर्वश्रेष्ठ एकमुश्त निवेश

डेट फंड अपने फंड के पैसे को अलग-अलग में निवेश करते हैंनिश्चित आय ट्रेजरी बिल, कॉर्पोरेट जैसे उपकरणबांड, और भी बहुत कुछ। इन योजनाओं को लघु और मध्यम अवधि के लिए एक अच्छा विकल्प माना जाता है। कई व्यक्ति डेट म्यूचुअल फंड में एकमुश्त पैसा निवेश करना चुनते हैं। कुछ केसर्वश्रेष्ठ ऋण निधि जिन्हें एकमुश्त निवेश के लिए चुना जा सकता है, वे इस प्रकार हैं।

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.4152

↓ 0.00 ₹217 1,000 -0.5 0.9 13.5 14.1 21 7.67% 2Y 5M 5D 3Y 4M 24D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3382

↓ -0.04 ₹1,138 1,000 4.6 7.4 13.2 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 5,000 2.9 5 7.5 11 0% Aditya Birla Sun Life Medium Term Plan Growth ₹42.3202

↓ -0.06 ₹2,982 1,000 2.7 5 10.3 10 10.9 7.78% 3Y 4M 24D 4Y 6M 7D Invesco India Credit Risk Fund Growth ₹1,998.59

↑ 0.43 ₹158 5,000 0.9 2.6 8.4 9.4 9.2 7.46% 2Y 3M 4D 3Y Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Aditya Birla Sun Life Credit Risk Fund Franklin India Credit Risk Fund Aditya Birla Sun Life Medium Term Plan Invesco India Credit Risk Fund Point 1 Lower mid AUM (₹217 Cr). Upper mid AUM (₹1,138 Cr). Bottom quartile AUM (₹104 Cr). Highest AUM (₹2,982 Cr). Bottom quartile AUM (₹158 Cr). Point 2 Oldest track record among peers (22 yrs). Established history (10+ yrs). Established history (14+ yrs). Established history (16+ yrs). Established history (11+ yrs). Point 3 Top rated. Not Rated. Rating: 1★ (bottom quartile). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 13.45% (top quartile). 1Y return: 13.24% (upper mid). 1Y return: 7.45% (bottom quartile). 1Y return: 10.29% (lower mid). 1Y return: 8.45% (bottom quartile). Point 6 1M return: -0.46% (bottom quartile). 1M return: 0.63% (upper mid). 1M return: 0.91% (top quartile). 1M return: 0.59% (lower mid). 1M return: 0.43% (bottom quartile). Point 7 Sharpe: 1.48 (lower mid). Sharpe: 2.38 (top quartile). Sharpe: 0.29 (bottom quartile). Sharpe: 2.33 (upper mid). Sharpe: 1.11 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.67% (lower mid). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.78% (upper mid). Yield to maturity (debt): 7.46% (bottom quartile). Point 10 Modified duration: 2.43 yrs (bottom quartile). Modified duration: 2.41 yrs (lower mid). Modified duration: 0.00 yrs (top quartile). Modified duration: 3.40 yrs (bottom quartile). Modified duration: 2.26 yrs (upper mid). DSP Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Franklin India Credit Risk Fund

Aditya Birla Sun Life Medium Term Plan

Invesco India Credit Risk Fund

एकमुश्त निवेश के लिए सर्वश्रेष्ठ हाइब्रिड फंड

हाइब्रिड फंड को के रूप में भी जाना जाता हैबैलेंस्ड फंड इक्विटी और फिक्स्ड इनकम इंस्ट्रूमेंट दोनों में अपना पैसा निवेश करें। ये योजनाएँ उन व्यक्तियों के लिए उपयुक्त हैं जो की तलाश कर रहे हैंराजधानी नियमित आय के साथ पीढ़ी। संतुलित योजनाओं के रूप में भी जाना जाता है, व्यक्ति हाइब्रिड योजनाओं में एकमुश्त राशि का निवेश करना चुन सकते हैं। एकमुश्त निवेश के लिए कुछ बेहतरीन हाइब्रिड फंड नीचे सूचीबद्ध हैं।

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Multi-Asset Fund Growth ₹816.483

↓ -4.34 ₹80,768 5,000 0.6 7.1 18.5 19.9 19.1 18.6 UTI Multi Asset Fund Growth ₹77.9609

↓ -1.26 ₹6,848 5,000 -1.2 4.3 16 19.4 14 11.1 SBI Multi Asset Allocation Fund Growth ₹66.1041

↓ -1.11 ₹14,944 5,000 3 10.6 23.6 19.1 14.5 18.6 ICICI Prudential Equity and Debt Fund Growth ₹397.03

↓ -5.38 ₹49,257 5,000 -3.5 0.5 14.2 18.1 17.7 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹37.25

↓ -0.63 ₹1,329 5,000 -1.1 -0.9 14.8 17.9 16.8 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Multi-Asset Fund UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Highest AUM (₹80,768 Cr). Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (23+ yrs). Established history (17+ yrs). Established history (20+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 1★ (bottom quartile). Top rated. Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.08% (top quartile). 5Y return: 14.01% (bottom quartile). 5Y return: 14.53% (bottom quartile). 5Y return: 17.74% (upper mid). 5Y return: 16.75% (lower mid). Point 6 3Y return: 19.87% (top quartile). 3Y return: 19.36% (upper mid). 3Y return: 19.14% (lower mid). 3Y return: 18.07% (bottom quartile). 3Y return: 17.86% (bottom quartile). Point 7 1Y return: 18.49% (upper mid). 1Y return: 16.01% (lower mid). 1Y return: 23.57% (top quartile). 1Y return: 14.23% (bottom quartile). 1Y return: 14.76% (bottom quartile). Point 8 1M return: 1.33% (top quartile). 1M return: -2.59% (bottom quartile). 1M return: -1.56% (upper mid). 1M return: -3.24% (bottom quartile). 1M return: -2.28% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 1.48 (upper mid). Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). ICICI Prudential Multi-Asset Fund

UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

एकमुश्त निवेश के लिए सर्वश्रेष्ठ इंडेक्स फंड

इंडेक्स फंड के पोर्टफोलियो में शेयर और अन्य इंस्ट्रूमेंट उसी अनुपात में होते हैं जैसे वे इंडेक्स में होते हैं। दूसरे शब्दों में, ये स्कीमें किसी इंडेक्स के प्रदर्शन की नकल करती हैं। ये निष्क्रिय रूप से प्रबंधित फंड हैं और इन्हें एकमुश्त निवेश के लिए एक अच्छा विकल्प माना जा सकता है। सर्वश्रेष्ठ में से कुछइंडेक्स फंड्स जिन्हें एकमुश्त निवेश के लिए चुना जा सकता है, वे इस प्रकार हैं।

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Index Fund - Sensex Plan Growth ₹40.283

↓ -0.57 ₹957 -7.3 -2 9 10.5 9.9 9.8 LIC MF Index Fund Sensex Growth ₹147.601

↓ -2.09 ₹91 -7.4 -2.3 8.3 9.9 9.3 9.1 Franklin India Index Fund Nifty Plan Growth ₹197.551

↓ -3.11 ₹766 -6 -1 11.4 12.2 10.7 11.3 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Nippon India Index Fund - Nifty Plan Growth ₹41.5855

↓ -0.65 ₹3,078 -6 -1 11.6 12.3 10.6 11.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex Franklin India Index Fund Nifty Plan IDBI Nifty Index Fund Nippon India Index Fund - Nifty Plan Point 1 Upper mid AUM (₹957 Cr). Bottom quartile AUM (₹91 Cr). Lower mid AUM (₹766 Cr). Bottom quartile AUM (₹208 Cr). Highest AUM (₹3,078 Cr). Point 2 Established history (15+ yrs). Established history (23+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 1★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 9.86% (bottom quartile). 5Y return: 9.34% (bottom quartile). 5Y return: 10.67% (upper mid). 5Y return: 11.74% (top quartile). 5Y return: 10.63% (lower mid). Point 6 3Y return: 10.47% (bottom quartile). 3Y return: 9.86% (bottom quartile). 3Y return: 12.18% (lower mid). 3Y return: 20.28% (top quartile). 3Y return: 12.30% (upper mid). Point 7 1Y return: 9.05% (bottom quartile). 1Y return: 8.32% (bottom quartile). 1Y return: 11.39% (lower mid). 1Y return: 16.16% (top quartile). 1Y return: 11.56% (upper mid). Point 8 1M return: -5.60% (bottom quartile). 1M return: -5.64% (bottom quartile). 1M return: -5.07% (lower mid). 1M return: 3.68% (top quartile). 1M return: -5.00% (upper mid). Point 9 Alpha: -0.51 (upper mid). Alpha: -1.17 (bottom quartile). Alpha: -0.53 (lower mid). Alpha: -1.03 (bottom quartile). Alpha: -0.47 (top quartile). Point 10 Sharpe: 0.13 (bottom quartile). Sharpe: 0.07 (bottom quartile). Sharpe: 0.25 (lower mid). Sharpe: 1.04 (top quartile). Sharpe: 0.25 (upper mid). Nippon India Index Fund - Sensex Plan

LIC MF Index Fund Sensex

Franklin India Index Fund Nifty Plan

IDBI Nifty Index Fund

Nippon India Index Fund - Nifty Plan

पिछले 1 महीने के आधार पर सर्वश्रेष्ठ म्युचुअल फंड

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds - Emerging Markets Opportunities Fund, an equity fund which invests primarily in an aggressively managed portfolio of emerging market companies Research Highlights for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Below is the key information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. Research Highlights for SBI Healthcare Opportunities Fund Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on To seek to generate capital appreciation and provide long term growth opportunities by investing in equity and equity related securities of companies domiciled in India whose predominant economic activity is in the (a) discovery, development, production, or distribution of natural resources, viz., energy, mining etc; (b) alternative energy and energy technology sectors, with emphasis given to renewable energy, automotive and on-site power generation, energy storage and enabling energy technologies. also invest a certain portion of its corpus in the equity and equity related securities of companies domiciled overseas, which are principally engaged in the discovery, development, production or distribution of natural resources and alternative energy and/or the units shares of Merrill Lynch international Investment Funds New Energy Fund, Merrill Lynch International Investment Funds World Energy Fund and similar other overseas mutual fund schemes. Research Highlights for DSP Natural Resources and New Energy Fund Below is the key information for DSP Natural Resources and New Energy Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (02 Mar 26) ₹70.6728 ↑ 0.61 (0.86 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Mar 26 Duration Returns 1 Month 21.4% 3 Month 42.7% 6 Month 87.9% 1 Year 203.9% 3 Year 64.5% 5 Year 33.4% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (02 Mar 26) ₹34.4904 ↑ 0.16 (0.47 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,307 28 Feb 23 ₹12,279 29 Feb 24 ₹10,745 28 Feb 25 ₹11,677 28 Feb 26 ₹25,661 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Mar 26 Duration Returns 1 Month 12.8% 3 Month 39.2% 6 Month 73.9% 1 Year 120.8% 3 Year 26.8% 5 Year 20.3% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 3. Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Growth Launch Date 7 Jul 14 NAV (02 Mar 26) ₹24.9046 ↓ -0.17 (-0.69 %) Net Assets (Cr) ₹191 on 31 Jan 26 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.04 Sharpe Ratio 2.68 Information Ratio -0.84 Alpha Ratio -0.75 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹8,328 28 Feb 23 ₹7,601 29 Feb 24 ₹7,963 28 Feb 25 ₹8,664 28 Feb 26 ₹13,980 Returns for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Mar 26 Duration Returns 1 Month 6.6% 3 Month 19.4% 6 Month 37.4% 1 Year 60.2% 3 Year 21.7% 5 Year 6.3% 10 Year 15 Year Since launch 8.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 41.1% 2023 5.9% 2022 5.5% 2021 -16.8% 2020 -5.9% 2019 21.7% 2018 25.1% 2017 -7.2% 2016 30% 2015 9.8% Fund Manager information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 9 Apr 18 7.82 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Data below for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Technology 27.66% Financial Services 24.86% Consumer Cyclical 12.11% Communication Services 11.31% Industrials 5.06% Energy 4.92% Basic Materials 2% Real Estate 1.66% Utility 1.05% Consumer Defensive 0.96% Health Care 0.94% Asset Allocation

Asset Class Value Cash 6.29% Equity 93.03% Other 0.4% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM Emerging Mkts Opps I (acc) USD

Investment Fund | -97% ₹185 Cr 96,682 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -3% ₹7 Cr Net Receivables/(Payables)

CBLO | -0% -₹1 Cr Accrued Interest

CBLO | -0% ₹0 Cr 4. SBI Healthcare Opportunities Fund

SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (02 Mar 26) ₹429.167 ↓ -2.24 (-0.52 %) Net Assets (Cr) ₹3,823 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.97 Sharpe Ratio -0.47 Information Ratio -0.15 Alpha Ratio -2.03 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,124 28 Feb 23 ₹11,119 29 Feb 24 ₹17,867 28 Feb 25 ₹19,943 28 Feb 26 ₹22,473 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Mar 26 Duration Returns 1 Month 6.4% 3 Month -0.8% 6 Month 0% 1 Year 12.1% 3 Year 26.2% 5 Year 16.9% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.5% 2023 42.2% 2022 38.2% 2021 -6% 2020 20.1% 2019 65.8% 2018 -0.5% 2017 -9.9% 2016 2.1% 2015 -14% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 14.68 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Health Care 90.37% Basic Materials 8.17% Asset Allocation

Asset Class Value Cash 1.38% Equity 98.55% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA10% ₹383 Cr 2,400,000

↓ -300,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB7% ₹266 Cr 440,000 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Jan 26 | APOLLOHOSP5% ₹209 Cr 300,000

↑ 300,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH5% ₹191 Cr 2,000,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | LUPIN5% ₹181 Cr 840,000 Acutaas Chemicals Ltd (Basic Materials)

Equity, Since 30 Jun 24 | 5433495% ₹172 Cr 900,000 Torrent Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 21 | TORNTPHARM4% ₹158 Cr 400,000 Aether Industries Ltd (Basic Materials)

Equity, Since 31 May 22 | 5435344% ₹140 Cr 1,400,000 Biocon Ltd (Healthcare)

Equity, Since 30 Nov 24 | BIOCON4% ₹138 Cr 3,750,000

↑ 550,000 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | ASTERDM3% ₹133 Cr 2,400,000

↑ 400,000 5. DSP Natural Resources and New Energy Fund

DSP Natural Resources and New Energy Fund

Growth Launch Date 25 Apr 08 NAV (02 Mar 26) ₹109.755 ↓ -0.43 (-0.39 %) Net Assets (Cr) ₹1,765 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio 1.32 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,942 28 Feb 23 ₹13,335 29 Feb 24 ₹19,096 28 Feb 25 ₹18,712 28 Feb 26 ₹26,378 Returns for DSP Natural Resources and New Energy Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Mar 26 Duration Returns 1 Month 5.6% 3 Month 14.9% 6 Month 23% 1 Year 40.4% 3 Year 24.7% 5 Year 20.7% 10 Year 15 Year Since launch 14.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.5% 2023 13.9% 2022 31.2% 2021 9.8% 2020 42.8% 2019 11.5% 2018 4.4% 2017 -15.3% 2016 43.1% 2015 43.1% Fund Manager information for DSP Natural Resources and New Energy Fund

Name Since Tenure Rohit Singhania 1 Jul 12 13.6 Yr. Data below for DSP Natural Resources and New Energy Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Energy 42.96% Basic Materials 36.91% Utility 7.36% Industrials 1.62% Technology 1.28% Consumer Cyclical 0.11% Asset Allocation

Asset Class Value Cash 9.76% Equity 90.24% Debt 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Energy I2

Investment Fund | -11% ₹192 Cr 602,478

↑ 214,175 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 May 20 | ONGC9% ₹159 Cr 5,905,732

↑ 107,567 Jindal Steel Ltd (Basic Materials)

Equity, Since 31 Mar 20 | JINDALSTEL9% ₹154 Cr 1,356,666 Tata Steel Ltd (Basic Materials)

Equity, Since 31 Aug 16 | TATASTEEL9% ₹153 Cr 7,896,586 Oil India Ltd (Energy)

Equity, Since 29 Feb 24 | OIL6% ₹100 Cr 1,954,429

↑ 363,081 National Aluminium Co Ltd (Basic Materials)

Equity, Since 28 Feb 22 | NATIONALUM5% ₹94 Cr 2,439,055 BGF Sustainable Energy I2

Investment Fund | -5% ₹80 Cr 330,203 Coal India Ltd (Energy)

Equity, Since 31 Mar 22 | COALINDIA4% ₹68 Cr 1,533,115 Hindalco Industries Ltd (Basic Materials)

Equity, Since 31 Oct 15 | HINDALCO4% ₹67 Cr 691,612

↓ -127,079 Petronet LNG Ltd (Energy)

Equity, Since 31 Jan 18 | PETRONET4% ₹63 Cr 2,180,366

↓ -116,682

एकमुश्त निवेश के दौरान ध्यान रखने योग्य बातें

म्यूचुअल फंड में निवेश करने से पहले व्यक्तियों को बहुत सारे मापदंडों का ध्यान रखने की आवश्यकता होती है। उसमे समाविष्ट हैं:

बाजार का समय

जब एकमुश्त निवेश की बात आती है, तो व्यक्तियों को हमेशा तलाश करनी चाहिएमंडी समय विशेष रूप से इक्विटी-आधारित फंडों के संबंध में। एकमुश्त निवेश करने का एक अच्छा समय तब होता है जब बाजार कम होते हैं और इस बात की गुंजाइश होती है कि वे जल्द ही सराहना करना शुरू कर देंगे। हालांकि, अगर बाजार पहले से ही चरम पर है, तो एकमुश्त निवेश से दूर रहना बेहतर है।

विविधता

विविधीकरण भी एक महत्वपूर्ण पहलू है जिस पर एकमुश्त निवेश करने से पहले विचार किया जाना चाहिए। एकमुश्त निवेश के मामले में व्यक्तियों को अपने निवेश को विविध माध्यमों में फैलाकर विविधतापूर्ण बनाना चाहिए। इससे यह सुनिश्चित करने में मदद मिलेगी कि उनका समग्र पोर्टफोलियो अच्छा प्रदर्शन करता है, भले ही कोई एक योजना प्रदर्शन न करे।

अपने उद्देश्य के अनुसार अपना निवेश करें

कोई भी निवेश जो व्यक्ति करते हैं वह किसी विशेष उद्देश्य को प्राप्त करने के लिए होता है। इसलिए, व्यक्तियों को यह जांचना चाहिए कि योजना का दृष्टिकोण इसके अनुरूप है या नहींइन्वेस्टरका उद्देश्य। यहां, व्यक्तियों को विभिन्न मापदंडों की तलाश करनी चाहिए जैसे किसीएजीआर योजना में निवेश करने से पहले रिटर्न, पूर्ण रिटर्न, कराधान का प्रभाव और बहुत कुछ।

मोचन सही समय पर किया जाना चाहिए

व्यक्तियों को अपना करना चाहिएमोचन एकमुश्त निवेश में सही समय पर। हालांकि यह अभी तक निवेश के उद्देश्य के अनुसार हो सकता है; व्यक्तियों को उस योजना की समय पर समीक्षा करनी चाहिए जिसमें वे निवेश करने की योजना बना रहे हैं। हालाँकि, उन्हें अपने निवेश को लंबी अवधि के लिए रखने की भी आवश्यकता है ताकि वे अधिक से अधिक लाभ उठा सकें।

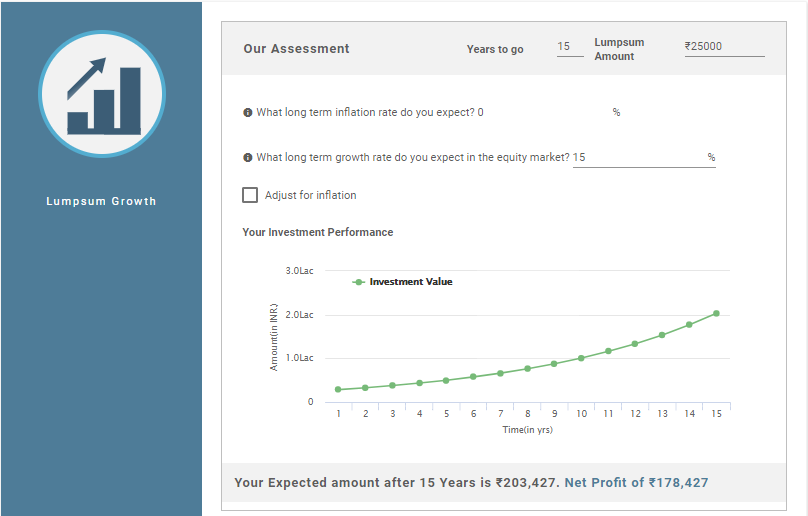

म्यूचुअल फंड एकमुश्त रिटर्न कैलकुलेटर

म्यूचुअल फंड एकमुश्त रिटर्न कैलकुलेटर व्यक्तियों को यह दिखाने में मदद करता है कि किसी व्यक्ति का एकमुश्त निवेश एक निश्चित समय सीमा में कैसे बढ़ता है। कुछ डेटा जिन्हें एकमुश्त कैलकुलेटर में इनपुट करने की आवश्यकता होती है, उनमें निवेश की अवधि, प्रारंभिक निवेश राशि, दीर्घकालिक अपेक्षित विकास दर और बहुत कुछ शामिल हैं। म्यूचुअल फंड एकमुश्त रिटर्न कैलकुलेटर का एक उदाहरण इस प्रकार है।

चित्रण

एकमुश्त निवेश: INR 25,000

निवेश अवधि: पन्द्रह साल

दीर्घकालिक विकास दर (लगभग): 15%

एकमुश्त कैलकुलेटर के अनुसार अपेक्षित रिटर्न: INR 2,03,427

निवेश पर शुद्ध लाभ: INR 1,78,427

इस प्रकार, उपरोक्त गणना से पता चलता है कि आपके निवेश पर निवेश पर शुद्ध लाभ INR 1,78,427 है जबकि आपके निवेश का कुल मूल्य INR 2,03,427 है.

म्यूचुअल फंड में एकमुश्त निवेश के फायदे और नुकसान

एसआईपी के समान, एकमुश्त निवेश के भी फायदे और नुकसान का अपना सेट है। तो आइए जानते हैं इन फायदे और नुकसान के बारे में।

लाभ

एकमुश्त निवेश के लाभ इस प्रकार हैं।

- बड़ी राशि का निवेश करें: व्यक्ति म्यूचुअल फंड में बड़ी मात्रा में निवेश कर सकते हैं और फंड को निष्क्रिय रखने के बजाय उच्च रिटर्न अर्जित कर सकते हैं।

- लंबी अवधि के लिए आदर्श: निवेश का एकमुश्त तरीका लंबी अवधि के निवेश के लिए विशेष रूप से इक्विटी फंड के मामले में अच्छा है। हालांकि, डेट फंड के मामले में, कार्यकाल छोटा या मध्यम अवधि का हो सकता है

- सुविधा: निवेश का एकमुश्त तरीका सुविधाजनक है क्योंकि भुगतान केवल एक बार किया जाता है और नियमित अंतराल पर कटौती नहीं की जाती है।

नुकसान

एकमुश्त निवेश के नुकसान हैं:

- अनियमित निवेश: एकमुश्त निवेश निवेशक की नियमित बचत सुनिश्चित नहीं करता है क्योंकि यह नियमित बचत की आदत नहीं डालता है।

- उच्च जोखिम: एकमुश्त निवेश में, समय को देखना महत्वपूर्ण है। ऐसा इसलिए है क्योंकि एकमुश्त मोड में निवेश केवल एक बार किया जाता है न कि नियमित अंतराल पर। इसलिए, यदि व्यक्ति समय पर विचार नहीं करते हैं, तो उन्हें नुकसान हो सकता है।

निष्कर्ष

इस प्रकार, उपरोक्त बिंदुओं से, यह कहा जा सकता है कि एकमुश्त मोड भी म्यूचुअल फंड में निवेश करने का एक अच्छा तरीका है। हालांकि, योजना में एकमुश्त राशि का निवेश करते समय व्यक्तियों को आश्वस्त होने की आवश्यकता है। यदि नहीं, तो वे निवेश का एसआईपी मोड चुन सकते हैं। इसके अलावा, लोगों को निवेश करने से पहले योजना के तौर-तरीकों को समझना चाहिए। यदि आवश्यक हो, तो वे परामर्श भी कर सकते हैं aवित्तीय सलाहकार. इससे उन्हें यह सुनिश्चित करने में मदद मिलेगी कि उनका पैसा सुरक्षित है और उनके उद्देश्यों को समय पर पूरा किया जाता है.

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।

Research Highlights for DSP World Gold Fund