ભારતમાં ટોચના 15 મ્યુચ્યુઅલ ફંડ ગૃહો

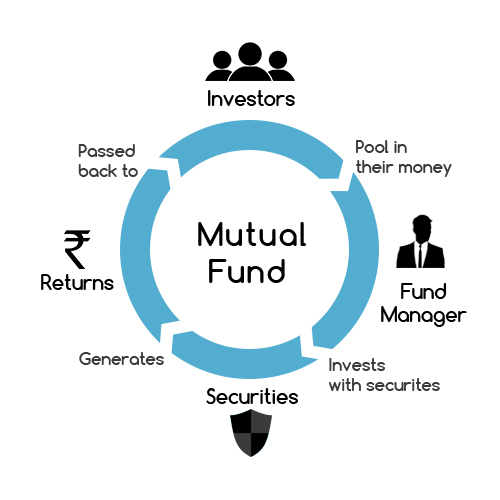

મ્યુચ્યુઅલ ફંડ છેલ્લા કેટલાક વર્ષોથી ભારતમાં ઘણી લોકપ્રિયતા મેળવી રહી છે. તેનું નફાકારક વળતર અને પોષણક્ષમતા ઘણા લોકોને રોકાણ કરવા આકર્ષે છે. પરંતુ, આયોજન કરતી વખતેમ્યુચ્યુઅલ ફંડમાં રોકાણ કરો, મોટાભાગના લોકો વિચારે છે કે સારી મ્યુચ્યુઅલ ફંડ કંપની ગેરંટીવાળું વળતર આપી શકે છે. વાસ્તવમાં આ હકીકત નથી. જ્યારે સારું બ્રાન્ડ નામ, રોકાણ કરવા માટેનું એક માપદંડ હોઈ શકે છે, પરંતુ અન્ય ઘણા વિવિધ પરિબળો છે જે નક્કી કરે છેશ્રેષ્ઠ પ્રદર્શન કરનાર મ્યુચ્યુઅલ ફંડ રોકાણ કરવું.

એયુએમ, ફંડ મેનેજરની કુશળતા, ફંડની ઉંમર, એએમસી સાથેના ભંડોળ, ભૂતકાળની કામગીરી વગેરે જેવા પરિબળો રોકાણ માટે અંતિમ ફંડ પસંદ કરવામાં સમાન ભૂમિકા ભજવે છે. આવા પરિમાણોને ધ્યાનમાં રાખીને, અમે સંબંધિત AMC દ્વારા કેટલીક શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડ યોજનાઓ સાથે ભારતના ટોચના 15 મ્યુચ્યુઅલ ફંડ ગૃહોને શોર્ટલિસ્ટ કર્યા છે.

Talk to our investment specialist

ભારતમાં શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડ કંપનીઓ

ભારતની શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડ કંપનીઓ નીચે મુજબ છે-

- SBI મ્યુચ્યુઅલ ફંડ

- HDFC મ્યુચ્યુઅલ ફંડ

- ICICI પ્રુડેન્શિયલ મ્યુચ્યુઅલ ફંડ

- રિલાયન્સ મ્યુચ્યુઅલ ફંડ

- આદિત્યબિરલા સન લાઇફ મ્યુચ્યુઅલ ફંડ

- ડીએસપી બ્લેકરોક મ્યુચ્યુઅલ ફંડ

- ફ્રેન્કલિન ટેમ્પલટન મ્યુચ્યુઅલ ફંડ

- મ્યુચ્યુઅલ ફંડ બોક્સ

- IDFC મ્યુચ્યુઅલ ફંડ

- ટાટા મ્યુચ્યુઅલ ફંડ

- ઇન્વેસ્કો મ્યુચ્યુઅલ ફંડ

- મુખ્ય મ્યુચ્યુઅલ ફંડ

- સુંદરમ મ્યુચ્યુઅલ ફંડ

- એલ એન્ડ ટી મ્યુચ્યુઅલ ફંડ

- UTI મ્યુચ્યુઅલ ફંડ

નૉૅધ: નીચે દર્શાવેલ તમામ ફંડની નેટ એસેટ્સ છે500 કરોડ અથવા વધારે.

SBI મ્યુચ્યુઅલ ફંડ

SBI મ્યુચ્યુઅલ ફંડ એ ભારતમાં જાણીતી કંપની પૈકીની એક છે. કંપની ભારતીય મ્યુચ્યુઅલ ફંડ ઉદ્યોગમાં ત્રણ દાયકા કરતાં વધુ સમયથી હાજર છે. AMC વ્યક્તિઓની વિવિધ જરૂરિયાતોને પૂરી કરવા માટે વિવિધ કેટેગરીના ફંડમાં સ્કીમ ઓફર કરે છે. રોકાણકારો કે જેઓ SBI મ્યુચ્યુઅલ ફંડ યોજનાઓમાં રોકાણ કરવા ઈચ્છે છે, અહીં કેટલાક ટોચના ફંડ્સ છે જે તમે તમારી રોકાણ જરૂરિયાતો અને ઉદ્દેશ્યો અનુસાર પસંદ કરી શકો છો.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Debt Hybrid Fund Growth ₹74.666

↓ -0.12 ₹9,851 500 0.3 3.1 8.6 10 9.2 6.7 SBI Small Cap Fund Growth ₹162.844

↓ -2.06 ₹36,268 500 -4.9 -3.3 4.8 13.5 16.1 -4.9 SBI Magnum COMMA Fund Growth ₹112.699

↓ -2.04 ₹863 500 4 9.3 24.8 20.2 17.6 12.3 SBI Multi Asset Allocation Fund Growth ₹66.6779

↓ -0.60 ₹13,033 500 4.6 12.9 21.9 19.8 14.8 18.6 SBI Large and Midcap Fund Growth ₹659.979

↓ -2.40 ₹37,443 500 2.5 8.3 17.9 19 17.7 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Debt Hybrid Fund SBI Small Cap Fund SBI Magnum COMMA Fund SBI Multi Asset Allocation Fund SBI Large and Midcap Fund Point 1 Bottom quartile AUM (₹9,851 Cr). Upper mid AUM (₹36,268 Cr). Bottom quartile AUM (₹863 Cr). Lower mid AUM (₹13,033 Cr). Highest AUM (₹37,443 Cr). Point 2 Oldest track record among peers (24 yrs). Established history (16+ yrs). Established history (20+ yrs). Established history (20+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderate. Risk profile: Moderately High. Point 5 5Y return: 9.23% (bottom quartile). 5Y return: 16.09% (lower mid). 5Y return: 17.59% (upper mid). 5Y return: 14.85% (bottom quartile). 5Y return: 17.67% (top quartile). Point 6 3Y return: 10.02% (bottom quartile). 3Y return: 13.54% (bottom quartile). 3Y return: 20.18% (top quartile). 3Y return: 19.82% (upper mid). 3Y return: 19.03% (lower mid). Point 7 1Y return: 8.60% (bottom quartile). 1Y return: 4.78% (bottom quartile). 1Y return: 24.82% (top quartile). 1Y return: 21.93% (upper mid). 1Y return: 17.88% (lower mid). Point 8 1M return: 0.72% (bottom quartile). Alpha: 0.00 (lower mid). Alpha: -4.27 (bottom quartile). 1M return: 1.80% (lower mid). Alpha: 2.06 (top quartile). Point 9 Alpha: 0.00 (upper mid). Sharpe: -0.54 (bottom quartile). Sharpe: 0.43 (upper mid). Alpha: 0.00 (bottom quartile). Sharpe: 0.37 (lower mid). Point 10 Sharpe: 0.16 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Sharpe: 1.60 (top quartile). Information ratio: -0.38 (bottom quartile). SBI Debt Hybrid Fund

SBI Small Cap Fund

SBI Magnum COMMA Fund

SBI Multi Asset Allocation Fund

SBI Large and Midcap Fund

HDFC મ્યુચ્યુઅલ ફંડ

HDFC મ્યુચ્યુઅલ ફંડ એ ભારતની સૌથી જાણીતી AMCs પૈકીની એક છે. તેણે 2000 માં તેની પ્રથમ યોજના શરૂ કરી અને ત્યારથી, ફંડ હાઉસ આશાસ્પદ વૃદ્ધિ દર્શાવે છે. વર્ષોથી, HDFC MF એ ઘણા રોકાણકારોનો વિશ્વાસ જીત્યો છે અને પોતાને ભારતમાં ટોચના પ્રદર્શનકારોમાં સ્થાન આપ્યું છે. એચડીએફસી મ્યુચ્યુઅલ ફંડમાં રોકાણ કરવા આતુર રોકાણકારો, અહીં પસંદ કરવા માટેની કેટલીક શ્રેષ્ઠ યોજનાઓ છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Banking and PSU Debt Fund Growth ₹23.751

↑ 0.03 ₹5,719 300 0.7 2.5 7 7.3 6 7.5 HDFC Corporate Bond Fund Growth ₹33.5142

↑ 0.05 ₹34,805 300 0.5 2.3 6.7 7.6 6.2 7.3 HDFC Small Cap Fund Growth ₹134.886

↓ -2.04 ₹37,753 300 -5.4 -3.3 10.6 19.1 21 -0.6 HDFC Equity Savings Fund Growth ₹67.809

↓ -0.28 ₹5,897 300 0.5 3.4 8.3 10.4 9.6 6.8 HDFC Credit Risk Debt Fund Growth ₹25.0596

↑ 0.01 ₹6,974 300 1.4 3.4 7.9 7.6 6.8 8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Banking and PSU Debt Fund HDFC Corporate Bond Fund HDFC Small Cap Fund HDFC Equity Savings Fund HDFC Credit Risk Debt Fund Point 1 Bottom quartile AUM (₹5,719 Cr). Upper mid AUM (₹34,805 Cr). Highest AUM (₹37,753 Cr). Bottom quartile AUM (₹5,897 Cr). Lower mid AUM (₹6,974 Cr). Point 2 Established history (11+ yrs). Established history (15+ yrs). Established history (17+ yrs). Oldest track record among peers (21 yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 1Y return: 6.97% (bottom quartile). 1Y return: 6.68% (bottom quartile). 5Y return: 20.97% (top quartile). 5Y return: 9.60% (upper mid). 1Y return: 7.86% (lower mid). Point 6 1M return: 0.50% (upper mid). 1M return: 0.41% (lower mid). 3Y return: 19.11% (top quartile). 3Y return: 10.40% (upper mid). 1M return: 0.75% (top quartile). Point 7 Sharpe: 0.74 (upper mid). Sharpe: 0.63 (lower mid). 1Y return: 10.60% (top quartile). 1Y return: 8.29% (upper mid). Sharpe: 1.63 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Alpha: 0.00 (lower mid). 1M return: 0.14% (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.99% (lower mid). Yield to maturity (debt): 7.13% (upper mid). Sharpe: -0.23 (bottom quartile). Alpha: 0.00 (bottom quartile). Yield to maturity (debt): 8.10% (top quartile). Point 10 Modified duration: 3.22 yrs (bottom quartile). Modified duration: 4.53 yrs (bottom quartile). Information ratio: 0.00 (lower mid). Sharpe: 0.17 (bottom quartile). Modified duration: 2.46 yrs (upper mid). HDFC Banking and PSU Debt Fund

HDFC Corporate Bond Fund

HDFC Small Cap Fund

HDFC Equity Savings Fund

HDFC Credit Risk Debt Fund

ICICI પ્રુડેન્શિયલ મ્યુચ્યુઅલ ફંડ

વર્ષ 1993 માં શરૂ કરાયેલ, ICICI મ્યુચ્યુઅલ ફંડ સૌથી મોટામાંનું એક છેએસેટ મેનેજમેન્ટ કંપનીઓ દેશ માં. ફંડ હાઉસ કોર્પોરેટ અને છૂટક રોકાણ બંને માટે સોલ્યુશન્સનો વ્યાપક સ્પેક્ટ્રમ ઓફર કરે છે. ICICI મ્યુચ્યુઅલ ફંડ કંપની સંતોષકારક પ્રોડક્ટ સોલ્યુશન્સ અને નવીન યોજનાઓ આપીને મજબૂત ગ્રાહક આધાર જાળવી રહી છે. AMC દ્વારા ઇક્વિટી, ડેટ, હાઇબ્રિડ જેવી વિવિધ મ્યુચ્યુઅલ ફંડ યોજનાઓ ઓફર કરવામાં આવે છે.ELSS, લિક્વિડ, વગેરે. અહીં ICICI MF ની કેટલીક શ્રેષ્ઠ કામગીરી કરતી યોજનાઓ છે જેને તમે પસંદ કરી શકો છોરોકાણ માં

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Banking and Financial Services Fund Growth ₹137.39

↓ -1.21 ₹11,154 100 -0.8 3.4 16 16 12.6 15.9 ICICI Prudential Nifty Next 50 Index Fund Growth ₹60.4104

↓ -0.95 ₹8,190 100 -1.6 3.2 13 21.6 14.7 2.1 ICICI Prudential MIP 25 Growth ₹77.8447

↓ -0.24 ₹3,359 100 0.2 2.4 8.2 10.2 8.8 7.9 ICICI Prudential Long Term Plan Growth ₹37.9337

↑ 0.01 ₹14,929 100 0.7 2.3 6.4 7.5 6.4 7.2 ICICI Prudential US Bluechip Equity Fund Growth ₹73.34

↓ -0.86 ₹3,521 100 5.7 10.5 17.3 14.9 13.1 15.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Banking and Financial Services Fund ICICI Prudential Nifty Next 50 Index Fund ICICI Prudential MIP 25 ICICI Prudential Long Term Plan ICICI Prudential US Bluechip Equity Fund Point 1 Upper mid AUM (₹11,154 Cr). Lower mid AUM (₹8,190 Cr). Bottom quartile AUM (₹3,359 Cr). Highest AUM (₹14,929 Cr). Bottom quartile AUM (₹3,521 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Oldest track record among peers (21 yrs). Established history (16+ yrs). Established history (13+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Risk profile: High. Point 5 5Y return: 12.63% (lower mid). 5Y return: 14.65% (top quartile). 5Y return: 8.76% (bottom quartile). 1Y return: 6.44% (bottom quartile). 5Y return: 13.09% (upper mid). Point 6 3Y return: 15.98% (upper mid). 3Y return: 21.60% (top quartile). 3Y return: 10.23% (bottom quartile). 1M return: 0.35% (upper mid). 3Y return: 14.94% (lower mid). Point 7 1Y return: 16.05% (upper mid). 1Y return: 12.98% (lower mid). 1Y return: 8.23% (bottom quartile). Sharpe: 0.53 (bottom quartile). 1Y return: 17.25% (top quartile). Point 8 Alpha: -0.56 (lower mid). 1M return: 0.43% (top quartile). 1M return: 0.13% (lower mid). Information ratio: 0.00 (lower mid). Alpha: -2.77 (bottom quartile). Point 9 Sharpe: 0.88 (top quartile). Alpha: -0.80 (bottom quartile). Alpha: 0.00 (top quartile). Yield to maturity (debt): 7.62% (top quartile). Sharpe: 0.81 (upper mid). Point 10 Information ratio: 0.16 (top quartile). Sharpe: -0.12 (bottom quartile). Sharpe: 0.57 (lower mid). Modified duration: 4.91 yrs (bottom quartile). Information ratio: -1.01 (bottom quartile). ICICI Prudential Banking and Financial Services Fund

ICICI Prudential Nifty Next 50 Index Fund

ICICI Prudential MIP 25

ICICI Prudential Long Term Plan

ICICI Prudential US Bluechip Equity Fund

રિલાયન્સ મ્યુચ્યુઅલ ફંડ

વર્ષ 1995 માં તેની શરૂઆત થઈ ત્યારથી, રિલાયન્સ મ્યુચ્યુઅલ ફંડ દેશની સૌથી ઝડપથી વિકસતી મ્યુચ્યુઅલ ફંડ કંપનીમાંની એક છે. ફંડ હાઉસ સતત વળતરનો પ્રભાવશાળી ટ્રેક રેકોર્ડ ધરાવે છે. રિલાયન્સ મ્યુચ્યુઅલ ફંડ વિવિધ પ્રકારની યોજનાઓ ઓફર કરે છે જે રોકાણકારોની વિવિધ જરૂરિયાતોને પૂરી કરી શકે છે. રોકાણકારો તેમના રોકાણના ઉદ્દેશ્યો અનુસાર ફંડ પસંદ કરી શકે છે અને તેમના અનુસાર રોકાણ કરી શકે છેજોખમની ભૂખ.

No Funds available.

આદિત્ય બિરલા સન લાઇફ મ્યુચ્યુઅલ ફંડ

બિરલા સન લાઈફ મ્યુચ્યુઅલ ફંડ એવા સોલ્યુશન્સ ઓફર કરે છે જે રોકાણકારોને તેમની નાણાકીય સફળતા હાંસલ કરવામાં મદદ કરી શકે છે. ફંડ હાઉસ કર બચત, વ્યક્તિગત બચત, સંપત્તિ સર્જન વગેરે જેવા વિવિધ રોકાણના ઉદ્દેશ્યોમાં વિશેષતા ધરાવે છે. તેઓ ઇક્વિટી, ડેટ, હાઇબ્રિડ, ELSS જેવી મ્યુચ્યુઅલ ફંડ યોજનાઓનું બંડલ ઓફર કરે છે.લિક્વિડ ફંડ્સ, વગેરે. AMC હંમેશા તેના સાતત્યપૂર્ણ પ્રદર્શન માટે જાણીતું છે. તેથી, રોકાણકારો શ્રેષ્ઠ વળતર મેળવવા માટે તેમના પોર્ટફોલિયોમાં BSL મ્યુચ્યુઅલ ફંડની યોજનાઓ ઉમેરવાનું પસંદ કરી શકે છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹64.59

↓ -0.67 ₹3,694 1,000 1.7 8.4 22.6 17.4 13 17.5 Aditya Birla Sun Life Small Cap Fund Growth ₹84.7186

↓ -1.32 ₹4,938 1,000 -3.2 1.3 13.7 18.1 15.9 -3.7 Aditya Birla Sun Life Equity Hybrid 95 Fund Growth ₹1,551.47

↓ -14.08 ₹7,533 100 -0.7 3.1 10.9 14.6 11.2 7.2 Aditya Birla Sun Life Regular Savings Fund Growth ₹68.9954

↓ -0.13 ₹1,541 500 0.7 3.1 8.7 9.3 8.5 7.1 Aditya Birla Sun Life Savings Fund Growth ₹569.942

↑ 0.31 ₹23,615 1,000 1.4 3 7.2 7.4 6.3 7.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Banking And Financial Services Fund Aditya Birla Sun Life Small Cap Fund Aditya Birla Sun Life Equity Hybrid 95 Fund Aditya Birla Sun Life Regular Savings Fund Aditya Birla Sun Life Savings Fund Point 1 Bottom quartile AUM (₹3,694 Cr). Lower mid AUM (₹4,938 Cr). Upper mid AUM (₹7,533 Cr). Bottom quartile AUM (₹1,541 Cr). Highest AUM (₹23,615 Cr). Point 2 Established history (12+ yrs). Established history (18+ yrs). Oldest track record among peers (31 yrs). Established history (21+ yrs). Established history (22+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately Low. Point 5 5Y return: 12.95% (upper mid). 5Y return: 15.89% (top quartile). 5Y return: 11.18% (lower mid). 5Y return: 8.48% (bottom quartile). 1Y return: 7.17% (bottom quartile). Point 6 3Y return: 17.43% (upper mid). 3Y return: 18.11% (top quartile). 3Y return: 14.59% (lower mid). 3Y return: 9.35% (bottom quartile). 1M return: 0.57% (lower mid). Point 7 1Y return: 22.63% (top quartile). 1Y return: 13.71% (upper mid). 1Y return: 10.90% (lower mid). 1Y return: 8.73% (bottom quartile). Sharpe: 3.14 (top quartile). Point 8 Alpha: -1.32 (bottom quartile). Alpha: 0.00 (top quartile). 1M return: -0.18% (bottom quartile). 1M return: 0.63% (upper mid). Information ratio: 0.00 (bottom quartile). Point 9 Sharpe: 0.84 (upper mid). Sharpe: -0.32 (bottom quartile). Alpha: -1.63 (bottom quartile). Alpha: -0.05 (lower mid). Yield to maturity (debt): 6.81% (lower mid). Point 10 Information ratio: 0.25 (upper mid). Information ratio: 0.00 (bottom quartile). Sharpe: 0.15 (bottom quartile). Sharpe: 0.29 (lower mid). Modified duration: 0.47 yrs (lower mid). Aditya Birla Sun Life Banking And Financial Services Fund

Aditya Birla Sun Life Small Cap Fund

Aditya Birla Sun Life Equity Hybrid 95 Fund

Aditya Birla Sun Life Regular Savings Fund

Aditya Birla Sun Life Savings Fund

ડીએસપી બ્લેકરોક મ્યુચ્યુઅલ ફંડ

DSPBR એ વિશ્વની સૌથી મોટી લિસ્ટેડ AMC છે. તે રોકાણકારોની વિવિધ રોકાણ જરૂરિયાતોને પૂરી કરવા માટે વિવિધ મ્યુચ્યુઅલ ફંડ યોજનાઓ ઓફર કરે છે. તે રોકાણની શ્રેષ્ઠતામાં બે દાયકાથી વધુનો પ્રદર્શન રેકોર્ડ ધરાવે છે. અહીં કેટલીક શ્રેષ્ઠ પ્રદર્શન કરતી DSPBR મ્યુચ્યુઅલ ફંડ યોજનાઓ છે જે તમે રોકાણ કરતી વખતે ધ્યાનમાં લઈ શકો છો.

No Funds available.

ફ્રેન્કલિન ટેમ્પલટન મ્યુચ્યુઅલ ફંડ

ફ્રેન્કલિન ટેમ્પલટન મ્યુચ્યુઅલ ફંડ ભારતીય મ્યુચ્યુઅલ ફંડ ઉદ્યોગમાં બે દાયકાથી વધુ સમયથી હાજર છે. વર્ષોથી, કંપનીએ રોકાણકારોમાં અપાર વિશ્વાસ મેળવ્યો છે. ફ્રેન્કલિન ટેમ્પલટન લાંબા ગાળાની વૃદ્ધિ, ટૂંકા ગાળાના જેવા વિવિધ પરિબળો પર ધ્યાન કેન્દ્રિત કરે છેબજાર વધઘટ,રોકડ પ્રવાહ, આવક વગેરે. રોકાણકારો તેમની રોકાણની જરૂરિયાતો અનુસાર ઇક્વિટી, ડેટ, હાઇબ્રિડ, ELSS, લિક્વિડ ફંડ્સ વગેરે જેવા વિકલ્પોમાંથી પસંદગી કરી શકે છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Build India Fund Growth ₹147.013

↓ -1.68 ₹3,036 500 1.1 5 19.5 27.6 23.8 3.7 Franklin India Smaller Companies Fund Growth ₹163.096

↓ -2.11 ₹13,238 500 -4.3 -1.9 5.6 19.4 20.1 -8.4 Franklin India Feeder - Franklin U S Opportunities Fund Growth ₹77.8287

↓ -1.81 ₹4,465 500 -3.1 -1.5 1.3 20.5 8 11.4 Franklin India Opportunities Fund Growth ₹259.69

↓ -1.06 ₹8,380 500 -1 4.6 14.5 30 20.1 3.1 Franklin India Bluechip Fund Growth ₹1,054.89

↓ -8.92 ₹7,972 500 -0.5 4.5 12.9 15.1 11.5 8.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin Build India Fund Franklin India Smaller Companies Fund Franklin India Feeder - Franklin U S Opportunities Fund Franklin India Opportunities Fund Franklin India Bluechip Fund Point 1 Bottom quartile AUM (₹3,036 Cr). Highest AUM (₹13,238 Cr). Bottom quartile AUM (₹4,465 Cr). Upper mid AUM (₹8,380 Cr). Lower mid AUM (₹7,972 Cr). Point 2 Established history (16+ yrs). Established history (20+ yrs). Established history (14+ yrs). Established history (26+ yrs). Oldest track record among peers (32 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.79% (top quartile). 5Y return: 20.14% (upper mid). 5Y return: 7.96% (bottom quartile). 5Y return: 20.08% (lower mid). 5Y return: 11.49% (bottom quartile). Point 6 3Y return: 27.55% (upper mid). 3Y return: 19.44% (bottom quartile). 3Y return: 20.53% (lower mid). 3Y return: 30.04% (top quartile). 3Y return: 15.13% (bottom quartile). Point 7 1Y return: 19.49% (top quartile). 1Y return: 5.62% (bottom quartile). 1Y return: 1.32% (bottom quartile). 1Y return: 14.51% (upper mid). 1Y return: 12.95% (lower mid). Point 8 Alpha: 0.00 (top quartile). Alpha: -5.23 (bottom quartile). Alpha: -9.96 (bottom quartile). Alpha: -4.27 (lower mid). Alpha: -1.44 (upper mid). Point 9 Sharpe: -0.05 (lower mid). Sharpe: -0.60 (bottom quartile). Sharpe: 0.36 (top quartile). Sharpe: -0.10 (bottom quartile). Sharpe: 0.24 (upper mid). Point 10 Information ratio: 0.00 (lower mid). Information ratio: -0.26 (bottom quartile). Information ratio: -2.15 (bottom quartile). Information ratio: 1.69 (top quartile). Information ratio: 0.20 (upper mid). Franklin Build India Fund

Franklin India Smaller Companies Fund

Franklin India Feeder - Franklin U S Opportunities Fund

Franklin India Opportunities Fund

Franklin India Bluechip Fund

મ્યુચ્યુઅલ ફંડ બોક્સ

વર્ષ 1998 માં તેની શરૂઆત થઈ ત્યારથી, કોટક મ્યુચ્યુઅલ ફંડ ભારતમાં જાણીતી AMC માંની એક બની ગયું છે. કંપની રોકાણકારોની વિવિધ જરૂરિયાતોને પૂરી કરવા માટે વિવિધ મ્યુચ્યુઅલ ફંડ યોજનાઓ ઓફર કરે છે. મ્યુચ્યુઅલ ફંડની કેટલીક શ્રેણીઓમાં ઇક્વિટી, ડેટ, હાઇબ્રિડ, લિક્વિડ, ELSS વગેરેનો સમાવેશ થાય છે. રોકાણકારો તેમના રોકાણની યોજના બનાવી શકે છે અને કોટક મ્યુચ્યુઅલ ફંડ દ્વારા આ ટોચની કામગીરી કરતી યોજનાઓનો સંદર્ભ લઈ શકે છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Opportunities Fund Growth ₹357.346

↓ -3.37 ₹30,039 1,000 1.8 6.6 18.2 20.1 17.2 5.6 Kotak Standard Multicap Fund Growth ₹87.984

↓ -1.06 ₹56,460 500 1 4.9 17.7 17.7 13.9 9.5 Kotak Asset Allocator Fund - FOF Growth ₹262.631

↓ -1.72 ₹2,255 1,000 4.5 13.4 21.7 20.2 18.4 15.4 Kotak Emerging Equity Scheme Growth ₹136.156

↓ -1.61 ₹60,637 1,000 -1.4 1 16.6 21.7 19.6 1.8 Kotak Infrastructure & Economic Reform Fund Growth ₹65.414

↓ -0.73 ₹2,353 1,000 -1.6 1.9 12.9 20 21.8 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Equity Opportunities Fund Kotak Standard Multicap Fund Kotak Asset Allocator Fund - FOF Kotak Emerging Equity Scheme Kotak Infrastructure & Economic Reform Fund Point 1 Lower mid AUM (₹30,039 Cr). Upper mid AUM (₹56,460 Cr). Bottom quartile AUM (₹2,255 Cr). Highest AUM (₹60,637 Cr). Bottom quartile AUM (₹2,353 Cr). Point 2 Oldest track record among peers (21 yrs). Established history (16+ yrs). Established history (21+ yrs). Established history (18+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 17.21% (bottom quartile). 5Y return: 13.89% (bottom quartile). 5Y return: 18.39% (lower mid). 5Y return: 19.58% (upper mid). 5Y return: 21.84% (top quartile). Point 6 3Y return: 20.09% (lower mid). 3Y return: 17.67% (bottom quartile). 3Y return: 20.23% (upper mid). 3Y return: 21.73% (top quartile). 3Y return: 19.95% (bottom quartile). Point 7 1Y return: 18.22% (upper mid). 1Y return: 17.72% (lower mid). 1Y return: 21.70% (top quartile). 1Y return: 16.59% (bottom quartile). 1Y return: 12.89% (bottom quartile). Point 8 Alpha: -2.40 (lower mid). Alpha: 1.61 (top quartile). 1M return: 2.47% (upper mid). Alpha: -3.77 (bottom quartile). Alpha: -18.36 (bottom quartile). Point 9 Sharpe: 0.04 (lower mid). Sharpe: 0.28 (upper mid). Alpha: 0.00 (upper mid). Sharpe: -0.11 (bottom quartile). Sharpe: -0.27 (bottom quartile). Point 10 Information ratio: -0.05 (lower mid). Information ratio: -0.04 (upper mid). Sharpe: 0.89 (top quartile). Information ratio: -0.44 (bottom quartile). Information ratio: -0.25 (bottom quartile). Kotak Equity Opportunities Fund

Kotak Standard Multicap Fund

Kotak Asset Allocator Fund - FOF

Kotak Emerging Equity Scheme

Kotak Infrastructure & Economic Reform Fund

IDFC મ્યુચ્યુઅલ ફંડ

IDFC મ્યુચ્યુઅલ ફંડ વર્ષ 1997 માં અસ્તિત્વમાં આવ્યું હતું. તેની શરૂઆતથી, પેઢીએ ભારતીય રોકાણકારોમાં લોકપ્રિયતા મેળવી છે. રોકાણકારોની વિવિધ રોકાણ જરૂરિયાતોને પૂરી કરવા માટે, કંપની વિવિધ પ્રકારની મ્યુચ્યુઅલ ફંડ યોજનાઓ ઓફર કરે છે. રોકાણકારો રોકાણ કરી શકે છેઇક્વિટી ફંડ્સ,ડેટ ફંડ,હાઇબ્રિડ ફંડ, લિક્વિડ ફંડ્સ વગેરે, તેમના રોકાણના ઉદ્દેશ્ય અને જોખમની ભૂખ મુજબ. IDFC મ્યુચ્યુઅલ ફંડ દ્વારા ઓફર કરવામાં આવતી કેટલીક શ્રેષ્ઠ યોજનાઓ નીચે મુજબ છે.

No Funds available.

ટાટા મ્યુચ્યુઅલ ફંડ

ટાટા મ્યુચ્યુઅલ ફંડ ભારતમાં બે દાયકા કરતાં વધુ સમયથી કાર્યરત છે. ટાટા મ્યુચ્યુઅલ ફંડ એ ભારતના જાણીતા ફંડ હાઉસ પૈકીનું એક છે. ફંડ હાઉસ તેના સાતત્યપૂર્ણ પ્રદર્શન શ્રેષ્ઠ સેવા સાથે લાખો ગ્રાહકોનો વિશ્વાસ જીતવામાં સફળ રહ્યું છે. ટાટા મ્યુચ્યુઅલ ફંડ ઇક્વિટી, ડેટ, હાઇબ્રિડ, લિક્વિડ અને ELSS જેવી વિવિધ શ્રેણીઓ ઓફર કરે છે, રોકાણકારો તેમની રોકાણની જરૂરિયાતો અને ઉદ્દેશ્યો અનુસાર રોકાણ કરી શકે છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹45.9278

↓ -0.53 ₹4,748 500 0.2 5.9 13.5 16.5 13.7 4.9 Tata Equity PE Fund Growth ₹354.912

↓ -7.82 ₹9,061 150 -1.2 4.6 12.3 20 16.1 3.7 Tata Retirement Savings Fund-Moderate Growth ₹63.0917

↓ -1.21 ₹2,166 150 -3 -0.6 7.6 14.5 10.7 1 Tata Retirement Savings Fund - Progressive Growth ₹63.3012

↓ -1.45 ₹2,108 150 -3.5 -1.5 6.9 15.5 10.9 -1.2 Tata Treasury Advantage Fund Growth ₹4,075.62

↑ 2.42 ₹3,563 500 1.2 2.8 6.9 7.1 5.9 7.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Tata Equity PE Fund Tata Retirement Savings Fund-Moderate Tata Retirement Savings Fund - Progressive Tata Treasury Advantage Fund Point 1 Upper mid AUM (₹4,748 Cr). Highest AUM (₹9,061 Cr). Bottom quartile AUM (₹2,166 Cr). Bottom quartile AUM (₹2,108 Cr). Lower mid AUM (₹3,563 Cr). Point 2 Established history (11+ yrs). Oldest track record among peers (21 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately Low. Point 5 5Y return: 13.69% (upper mid). 5Y return: 16.07% (top quartile). 5Y return: 10.69% (bottom quartile). 5Y return: 10.95% (lower mid). 1Y return: 6.89% (bottom quartile). Point 6 3Y return: 16.52% (upper mid). 3Y return: 19.98% (top quartile). 3Y return: 14.49% (bottom quartile). 3Y return: 15.50% (lower mid). 1M return: 0.54% (upper mid). Point 7 1Y return: 13.55% (top quartile). 1Y return: 12.35% (upper mid). 1Y return: 7.60% (lower mid). 1Y return: 6.92% (bottom quartile). Sharpe: 1.97 (top quartile). Point 8 Alpha: -2.63 (lower mid). Alpha: -3.79 (bottom quartile). 1M return: -1.46% (bottom quartile). 1M return: -1.74% (bottom quartile). Information ratio: 0.00 (lower mid). Point 9 Sharpe: 0.00 (upper mid). Sharpe: -0.07 (lower mid). Alpha: 0.00 (top quartile). Alpha: -8.71 (bottom quartile). Yield to maturity (debt): 6.61% (top quartile). Point 10 Information ratio: -0.26 (bottom quartile). Information ratio: 0.96 (top quartile). Sharpe: -0.28 (bottom quartile). Sharpe: -0.34 (bottom quartile). Modified duration: 0.03 yrs (bottom quartile). Tata India Tax Savings Fund

Tata Equity PE Fund

Tata Retirement Savings Fund-Moderate

Tata Retirement Savings Fund - Progressive

Tata Treasury Advantage Fund

ઇન્વેસ્કો મ્યુચ્યુઅલ ફંડ

ઇન્વેસ્કો મ્યુચ્યુઅલ ફંડની સ્થાપના વર્ષ 2006માં કરવામાં આવી હતી અને ત્યારથી તે રોકાણકારોને નફાકારક વળતર આપી રહ્યું છે. ફંડ હાઉસ દ્વારા ઓફર કરવામાં આવતી વિવિધ યોજનાઓમાં રોકાણ કરીને રોકાણકારો તેમના વિવિધ રોકાણ લક્ષ્યો હાંસલ કરી શકે છે. ઇન્વેસ્કો મ્યુચ્યુઅલ ફંડનો ઉદ્દેશ્યમાં ઉત્તમ વૃદ્ધિ પ્રદાન કરવાનો છેપાટનગર રોકાણકારો દ્વારા રોકાણ.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Invesco India Growth Opportunities Fund Growth ₹100.09

↓ -1.32 ₹9,344 100 -2.2 -0.9 17.9 24.9 17.4 4.7 Invesco India Financial Services Fund Growth ₹146.55

↓ -2.65 ₹1,599 100 2 7.6 23.9 22.4 15.4 15.1 Invesco India Contra Fund Growth ₹133.84

↓ -1.97 ₹20,658 500 -2.9 0 9.6 19.4 15.6 3.1 Invesco India Liquid Fund Growth ₹3,719.7

↑ 0.78 ₹16,203 500 1.5 2.9 6.4 6.9 5.9 6.5 Invesco India PSU Equity Fund Growth ₹67.17

↓ -0.74 ₹1,449 500 1.2 7.9 26.1 31.5 26.4 10.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Invesco India Growth Opportunities Fund Invesco India Financial Services Fund Invesco India Contra Fund Invesco India Liquid Fund Invesco India PSU Equity Fund Point 1 Lower mid AUM (₹9,344 Cr). Bottom quartile AUM (₹1,599 Cr). Highest AUM (₹20,658 Cr). Upper mid AUM (₹16,203 Cr). Bottom quartile AUM (₹1,449 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Established history (18+ yrs). Oldest track record among peers (19 yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Low. Risk profile: High. Point 5 5Y return: 17.43% (upper mid). 5Y return: 15.45% (bottom quartile). 5Y return: 15.59% (lower mid). 1Y return: 6.36% (bottom quartile). 5Y return: 26.40% (top quartile). Point 6 3Y return: 24.85% (upper mid). 3Y return: 22.37% (lower mid). 3Y return: 19.39% (bottom quartile). 1M return: 0.53% (bottom quartile). 3Y return: 31.48% (top quartile). Point 7 1Y return: 17.85% (lower mid). 1Y return: 23.94% (upper mid). 1Y return: 9.56% (bottom quartile). Sharpe: 3.28 (top quartile). 1Y return: 26.09% (top quartile). Point 8 Alpha: -3.20 (lower mid). Alpha: -4.92 (bottom quartile). Alpha: -4.24 (bottom quartile). Information ratio: 0.00 (bottom quartile). Alpha: -1.90 (upper mid). Point 9 Sharpe: 0.01 (bottom quartile). Sharpe: 0.59 (upper mid). Sharpe: -0.12 (bottom quartile). Yield to maturity (debt): 5.92% (top quartile). Sharpe: 0.27 (lower mid). Point 10 Information ratio: 0.75 (lower mid). Information ratio: 0.79 (upper mid). Information ratio: 0.97 (top quartile). Modified duration: 0.12 yrs (bottom quartile). Information ratio: -0.37 (bottom quartile). Invesco India Growth Opportunities Fund

Invesco India Financial Services Fund

Invesco India Contra Fund

Invesco India Liquid Fund

Invesco India PSU Equity Fund

મુખ્ય મ્યુચ્યુઅલ ફંડ

પ્રિન્સિપલ મ્યુચ્યુઅલ ફંડ રિટેલ અને સંસ્થાકીય રોકાણકારો બંને માટે નવીન નાણાકીય ઉકેલોની વિવિધ શ્રેણી ઓફર કરે છે. ફંડ હાઉસ ગ્રાહકની વિવિધ જરૂરિયાતોને સંતોષવા માટે સતત નવીન યોજનાઓ લાવવાનું લક્ષ્ય રાખે છે. પ્રિન્સિપલ મ્યુચ્યુઅલ ફંડ તેના રોકાણના નિર્ણયોને સમર્થન આપવા માટે સખત જોખમ-વ્યવસ્થાપન નીતિ અને યોગ્ય સંશોધન તકનીકોનો ઉપયોગ કરે છે.

No Funds available.

સુંદરમ મ્યુચ્યુઅલ ફંડ

સુંદરમ મ્યુચ્યુઅલ ફંડ એ ભારતની જાણીતી AMCs પૈકીની એક છે. AMC દ્વારા રોકાણકારોના ઇચ્છિત ધ્યેયો હાંસલ કરવામાં મદદ મળે છેઓફર કરે છે તે વિવિધ મ્યુચ્યુઅલ ફંડ યોજનાઓ. રોકાણકારો ઇક્વિટી, ડેટ, હાઇબ્રિડ, ELSS, લિક્વિડ ફંડ્સ વગેરે જેવી યોજનાઓમાંથી ફંડ પસંદ કરી શકે છે. સુંદરમ મ્યુચ્યુઅલ ફંડ દ્વારા ઓફર કરવામાં આવતી કેટલીક શ્રેષ્ઠ કામગીરીવાળી યોજનાઓ નીચે મુજબ છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Rural and Consumption Fund Growth ₹93.0154

↓ -1.79 ₹1,584 100 -6.9 -4 2.1 15.1 13.1 -0.1 Sundaram Mid Cap Fund Growth ₹1,424.07

↓ -21.64 ₹13,293 100 -0.9 3.9 17.8 25.1 20.1 4.1 Sundaram Diversified Equity Fund Growth ₹223.076

↓ -2.80 ₹1,477 250 -1.2 1.3 10.2 13.5 12.5 7.1 Sundaram Corporate Bond Fund Growth ₹41.4507

↑ 0.04 ₹768 250 0.7 2.4 7.1 7.1 6 7.5 Sundaram Large and Mid Cap Fund Growth ₹87.3403

↓ -1.13 ₹6,987 100 -0.8 4 13.9 17.4 14.7 3.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Sundaram Rural and Consumption Fund Sundaram Mid Cap Fund Sundaram Diversified Equity Fund Sundaram Corporate Bond Fund Sundaram Large and Mid Cap Fund Point 1 Lower mid AUM (₹1,584 Cr). Highest AUM (₹13,293 Cr). Bottom quartile AUM (₹1,477 Cr). Bottom quartile AUM (₹768 Cr). Upper mid AUM (₹6,987 Cr). Point 2 Established history (19+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (21+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately Low. Risk profile: Moderately High. Point 5 5Y return: 13.10% (lower mid). 5Y return: 20.08% (top quartile). 5Y return: 12.52% (bottom quartile). 1Y return: 7.06% (bottom quartile). 5Y return: 14.70% (upper mid). Point 6 3Y return: 15.09% (lower mid). 3Y return: 25.06% (top quartile). 3Y return: 13.51% (bottom quartile). 1M return: 0.41% (lower mid). 3Y return: 17.36% (upper mid). Point 7 1Y return: 2.06% (bottom quartile). 1Y return: 17.77% (top quartile). 1Y return: 10.18% (lower mid). Sharpe: 0.83 (top quartile). 1Y return: 13.93% (upper mid). Point 8 Alpha: -8.82 (bottom quartile). Alpha: -1.77 (lower mid). Alpha: -0.41 (upper mid). Information ratio: 0.00 (upper mid). Alpha: -4.36 (bottom quartile). Point 9 Sharpe: -0.38 (bottom quartile). Sharpe: -0.01 (lower mid). Sharpe: 0.14 (upper mid). Yield to maturity (debt): 6.90% (top quartile). Sharpe: -0.07 (bottom quartile). Point 10 Information ratio: -0.52 (lower mid). Information ratio: 0.13 (top quartile). Information ratio: -0.78 (bottom quartile). Modified duration: 3.25 yrs (bottom quartile). Information ratio: -0.78 (bottom quartile). Sundaram Rural and Consumption Fund

Sundaram Mid Cap Fund

Sundaram Diversified Equity Fund

Sundaram Corporate Bond Fund

Sundaram Large and Mid Cap Fund

એલ એન્ડ ટી મ્યુચ્યુઅલ ફંડ

L&T મ્યુચ્યુઅલ ફંડ રોકાણ અને જોખમ વ્યવસ્થાપન માટે શિસ્તબદ્ધ અભિગમને અનુસરે છે. કંપની બહેતર લાંબા ગાળાના જોખમ-વ્યવસ્થિત પ્રદર્શન પર ભાર મૂકે છે. AMC ની શરૂઆત વર્ષ 1997 માં કરવામાં આવી હતી અને ત્યારથી તેણે તેના રોકાણકારોમાં પુષ્કળ વિશ્વાસ મેળવ્યો છે. રોકાણકારો ઇક્વિટી, ડેટ, હાઇબ્રિડ ફંડ્સ વગેરે જેવા વિકલ્પોના યજમાનમાંથી સ્કીમ પસંદ કરી શકે છે. શ્રેષ્ઠ પ્રદર્શન કરતી કેટલીક યોજનાઓ છે:

No Funds available.

UTI મ્યુચ્યુઅલ ફંડ

UTI મ્યુચ્યુઅલ ફંડનો ઉદ્દેશ્ય રોકાણકારોના ઇચ્છિત રોકાણ લક્ષ્યોને પૂર્ણ કરવાનો છે. તે રોકાણકારોને તેમના ભવિષ્ય માટે લાંબા ગાળાની સંપત્તિ બનાવવામાં મદદ કરે છે. ફંડ હાઉસ વિવિધ પ્રકારની મ્યુચ્યુઅલ ફંડ યોજનાઓ ઓફર કરે છે જેમ કે ઇક્વિટી, ડેટ, હાઇબ્રિડ, વગેરે, રોકાણકારો તેમની જરૂરિયાતો અનુસાર યોજનાઓ પસંદ કરી શકે છે અને રોકાણ કરી શકે છે.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Banking & PSU Debt Fund Growth ₹22.7378

↑ 0.02 ₹1,015 500 1.1 2.7 7.5 7.4 7.2 7.8 UTI Treasury Advantage Fund Growth ₹3,688.67

↑ 2.25 ₹2,667 500 1.3 3 7.3 7.4 7.3 7.5 UTI Money Market Fund Growth ₹3,207.28

↑ 1.50 ₹19,301 500 1.4 3 7.3 7.5 6.3 7.5 UTI Short Term Income Fund Growth ₹32.7783

↑ 0.03 ₹3,181 500 0.9 2.5 7 7.3 7 7.3 UTI Ultra Short Term Fund Growth ₹4,389.56

↑ 2.09 ₹3,655 500 1.3 2.8 6.5 6.8 6.2 6.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Banking & PSU Debt Fund UTI Treasury Advantage Fund UTI Money Market Fund UTI Short Term Income Fund UTI Ultra Short Term Fund Point 1 Bottom quartile AUM (₹1,015 Cr). Bottom quartile AUM (₹2,667 Cr). Highest AUM (₹19,301 Cr). Lower mid AUM (₹3,181 Cr). Upper mid AUM (₹3,655 Cr). Point 2 Established history (12+ yrs). Established history (18+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Low. Risk profile: Moderate. Risk profile: Moderately Low. Point 5 1Y return: 7.50% (top quartile). 1Y return: 7.35% (upper mid). 1Y return: 7.26% (lower mid). 1Y return: 6.99% (bottom quartile). 1Y return: 6.47% (bottom quartile). Point 6 1M return: 0.57% (upper mid). 1M return: 0.58% (top quartile). 1M return: 0.56% (lower mid). 1M return: 0.53% (bottom quartile). 1M return: 0.52% (bottom quartile). Point 7 Sharpe: 1.48 (bottom quartile). Sharpe: 2.59 (upper mid). Sharpe: 3.02 (top quartile). Sharpe: 0.96 (bottom quartile). Sharpe: 1.85 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.67% (bottom quartile). Yield to maturity (debt): 7.02% (top quartile). Yield to maturity (debt): 6.33% (bottom quartile). Yield to maturity (debt): 7.02% (upper mid). Yield to maturity (debt): 6.78% (lower mid). Point 10 Modified duration: 1.28 yrs (bottom quartile). Modified duration: 0.92 yrs (lower mid). Modified duration: 0.35 yrs (top quartile). Modified duration: 2.51 yrs (bottom quartile). Modified duration: 0.47 yrs (upper mid). UTI Banking & PSU Debt Fund

UTI Treasury Advantage Fund

UTI Money Market Fund

UTI Short Term Income Fund

UTI Ultra Short Term Fund

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.

You Might Also Like

Best Debt Mutual Funds In India For 2026 | Top Funds By Tenure & Tax Benefits

Pgim India Mutual Fund (formerly DHFL Pramerica Mutual Fund)

Mutual Fund Houses That Allow Usa/canada-based Nris To Invest In India

Top 3 Best Balanced Funds By Nippon/reliance Mutual Fund 2026

Top 4 Best Balanced Funds By ICICI Prudential Mutual Fund 2026