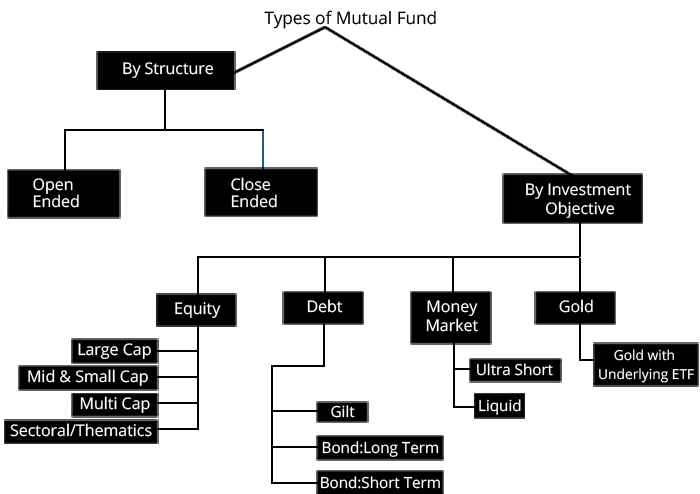

भारतातील म्युच्युअल फंडाचे प्रकार

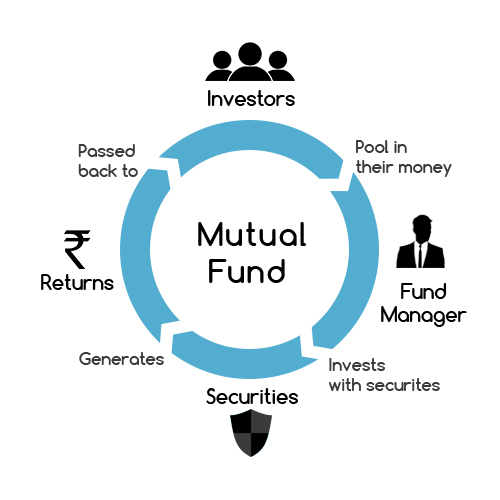

म्युच्युअल फंड उद्योग भारतात 1963 पासून आहे. आज भारतात 10,000 पेक्षा जास्त योजना अस्तित्वात आहेत आणि उद्योगाची वाढ मोठ्या प्रमाणात झाली आहे. भारतीय म्युच्युअल फंड उद्योगाची AUM पासून वाढ झाली आहे30 एप्रिल 2011 पर्यंत ₹7.85 ट्रिलियन ते 30 एप्रिल 2021 पर्यंत ₹32.38 ट्रिलियन याचा अर्थ 10 वर्षांच्या कालावधीत 4 पट वाढ झाली आहे. जोडण्यासाठी, 30 एप्रिल 2021 रोजी MF भाषेनुसार एकूण फोलिओची संख्या होती9.86 कोटी (98.6 दशलक्ष).

अशा डोळ्यांना भुरळ घालणारी वाढ पाहता, अनेक लोक गुंतवणूक करण्यास आकर्षित होतात, जे भविष्य सुरक्षित करण्यासाठी एक उत्तम पाऊल आहे. आपण प्रारंभ करण्यापूर्वी, आपले संशोधन चांगले सुनिश्चित करा. MF चे प्रकार जसे की मूलभूत माहिती जाणून घेणे महत्वाचे आहेम्युच्युअल फंड, जोखीम आणि परतावा, वैविध्य इ. म्युच्युअल फंड इक्विटीसाठी स्टॉक मार्केटमध्ये गुंतवणूक करून पैसे उपयोजित करतात, ते डेट इन्स्ट्रुमेंट्सच्या संपर्कात देखील घेतात. त्याचप्रमाणे, ते देखीलसोन्यात गुंतवणूक करा, संकरित, FOFs, इ.

मूलभूत वर्गीकरण परिपक्वता कालावधीनुसार आहे, जेथे म्युच्युअल फंडाच्या दोन व्यापक श्रेणी आहेत - ओपन एंडेड आणि क्लोज एंडेड.

ओपन-एंडेड म्युच्युअल फंड

भारतातील बहुतांश म्युच्युअल फंड हे ओपन एंडेड स्वरूपाचे आहेत. हे फंड गुंतवणुकदारांसाठी कोणत्याही वेळी सबस्क्रिप्शनसाठी (किंवा सोप्या भाषेत खरेदीसाठी) खुले असतात. ज्या गुंतवणूकदारांना फंडात प्रवेश घ्यायचा आहे त्यांना ते नवीन युनिट्स जारी करतात. प्रारंभिक ऑफर कालावधीनंतर (NFO), या निधीची युनिट्स खरेदी केली जाऊ शकतात. दुर्मिळ परिस्थितीत, मालमत्ता व्यवस्थापन कंपनी (AMCजर एएमसीला असे वाटत असेल की नवीन पैसे उपयोजित करण्यासाठी पुरेशा आणि चांगल्या संधी नाहीत तर ते गुंतवणूकदारांद्वारे पुढील खरेदी थांबवू शकतात. तथापि, विमोचनासाठी, AMC ला युनिट्स परत विकत घ्याव्या लागतात.

Talk to our investment specialist

क्लोज-एंडेड म्युच्युअल फंड

हे असे फंड आहेत जे प्रारंभिक ऑफर कालावधी (NFO) नंतर गुंतवणूकदारांद्वारे पुढील सदस्यता (किंवा खरेदी) साठी बंद केले जातात. ओपन-एंडेड फंडांच्या विपरीत, गुंतवणूकदार एनएफओ कालावधीनंतर या प्रकारच्या म्युच्युअल फंडांची नवीन युनिट्स खरेदी करू शकत नाहीत. त्यामुळे क्लोज-एंडेड फंडात गुंतवणूक करणे केवळ NFO कालावधीतच शक्य आहे. तसेच, एक गोष्ट लक्षात घेण्यासारखी आहे की गुंतवणुकदार क्लोज-एंडेड फंडातील रिडेम्पशनद्वारे बाहेर पडू शकत नाहीत. विमोचन कालावधी परिपक्व झाल्यावर होते.

याव्यतिरिक्त, बाहेर पडण्याची संधी प्रदान करण्यासाठी,म्युच्युअल फंड घरे स्टॉक एक्सचेंजवर क्लोज-एंडेड फंडांची यादी करा. त्यामुळे, गुंतवणूकदारांना मुदतपूर्ती कालावधीपूर्वी ते बाहेर पडण्यासाठी एक्सचेंजवर क्लोज-एंडेड फंडांचा व्यापार करणे आवश्यक आहे.

म्युच्युअल फंडाचे विविध प्रकार

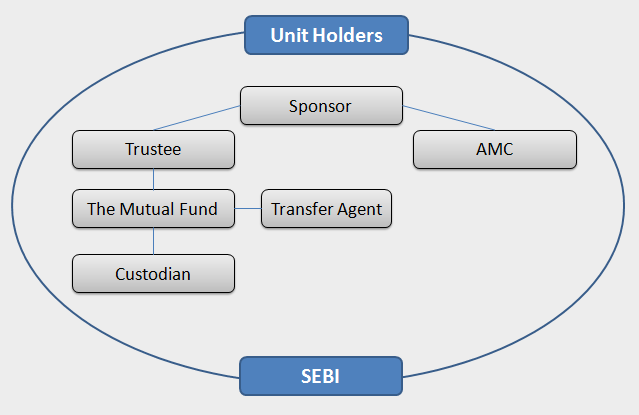

सिक्युरिटीज अँड एक्सचेंज बोर्ड ऑफ इंडियाचे मार्गदर्शनसेबी) नियमानुसार, म्युच्युअल फंडामध्ये पाच मुख्य व्यापक श्रेणी आणि 36 उप-श्रेण्या आहेत.

1. इक्विटी म्युच्युअल फंड

इक्विटी फंड इक्विटी स्टॉक मार्केटमध्ये गुंतवणूक करून गुंतवणूकदारांसाठी पैसे कमवा. दीर्घकालीन परतावा शोधणाऱ्या गुंतवणूकदारांसाठी हा पर्याय योग्य आहे. इक्विटी म्युच्युअल फंडाचे काही प्रकार आहेत-

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹60.3973

↓ -2.23 ₹1,756 32.8 78.1 143 56.3 28.1 167.1 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 7.8 17.7 33.3 34.3 27.5 11.3 ICICI Prudential Infrastructure Fund Growth ₹198.6

↑ 0.98 ₹8,134 0.1 2.5 18.5 25.4 26.5 6.7 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 3.1 11.2 33.1 32.2 25.9 10.3 DSP India T.I.G.E.R Fund Growth ₹326.36

↑ 1.58 ₹5,323 2.1 4.6 23 25.9 24.4 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Highest AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹5,323 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 28.10% (top quartile). 5Y return: 27.55% (upper mid). 5Y return: 26.52% (lower mid). 5Y return: 25.92% (bottom quartile). 5Y return: 24.39% (bottom quartile). Point 6 3Y return: 56.28% (top quartile). 3Y return: 34.34% (upper mid). 3Y return: 25.38% (bottom quartile). 3Y return: 32.18% (lower mid). 3Y return: 25.91% (bottom quartile). Point 7 1Y return: 143.03% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 18.45% (bottom quartile). 1Y return: 33.14% (lower mid). 1Y return: 22.96% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.42 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.12 (bottom quartile). Sharpe: 0.27 (lower mid). Sharpe: -0.31 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.37 (lower mid). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

लार्ज-कॅप फंड अशा कंपन्यांमध्ये गुंतवणूक करतात ज्यांचे बाजार भांडवल (म्हणून नाव लार्ज-), सहसा, या खूप मोठ्या कंपन्या आहेत आणि प्रस्थापित खेळाडू आहेत, उदा. युनिलिव्हर, रिलायन्स, आयटीसी इ. मिड-कॅप आणि स्मॉल-कॅप फंड गुंतवणूक करतात. लहान कंपन्यांमध्ये, या कंपन्या लहान असल्याने असाधारण वाढ दर्शवू शकतात आणि चांगले परतावा देऊ शकतात. तथापि, ते लहान असल्याने ते नुकसान देऊ शकतात आणि अधिक धोकादायक असतात.

थीमॅटिक फंड हे इन्फ्रास्ट्रक्चर, पॉवर, मीडिया आणि मनोरंजन इत्यादीसारख्या विशिष्ट क्षेत्रात गुंतवणूक करतात. सर्व म्युच्युअल फंड थीमॅटिक फंड प्रदान करत नाहीत, उदा.रिलायन्स म्युच्युअल फंड पॉवर सेक्टर फंड, मीडिया आणि एंटरटेनमेंट फंड इत्यादीद्वारे थीमॅटिक फंडांना एक्सपोजर प्रदान करते.ICICI प्रुडेन्शियल म्युच्युअल फंड आयसीआयसीआय प्रुडेन्शियल बँकिंग आणि फायनान्शियल सर्व्हिसेस फंड, आयसीआयसीआय प्रुडेन्शियल टेक्नॉलॉजी फंड द्वारे तंत्रज्ञानाद्वारे बँकिंग आणि वित्तीय सेवा क्षेत्राला एक्सपोजर प्रदान करते.

2. डेट म्युच्युअल फंड

कर्ज निधी निश्चित उत्पन्न साधनांमध्ये गुंतवणूक करा, ज्याला म्हणून देखील ओळखले जातेबंध आणि गिल्ट्स. बाँड फंडांचे त्यांच्या मुदतपूर्तीच्या कालावधीनुसार वर्गीकरण केले जाते (म्हणून नाव, दीर्घकालीन किंवा अल्प मुदत). कार्यकाळानुसार, जोखीम देखील बदलते. डेट म्युच्युअल फंडाच्या विस्तृत श्रेणी, जसे की:

- रात्रभर निधी

- लिक्विड फंड

- अतिअल्पकालीन निधी

- मनी मार्केट फंड

- डायनॅमिक बाँड्स

- कॉर्पोरेट बाँड्स

- गिल्ट फंड

- क्रेडिट जोखीम निधी

- फ्लोटर फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Credit Risk Fund Growth ₹50.3253

↓ -0.01 ₹206 -0.5 0.9 18.8 14.1 10.8 21 Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 8.7 Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3116

↓ -0.01 ₹1,092 4.9 7.4 13.2 12 9.9 13.4 Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 5.6 Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 5.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund Point 1 Bottom quartile AUM (₹206 Cr). Bottom quartile AUM (₹297 Cr). Highest AUM (₹1,092 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Point 2 Established history (22+ yrs). Established history (18+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Not Rated. Rating: 2★ (upper mid). Rating: 2★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 18.80% (top quartile). 1Y return: 13.69% (upper mid). 1Y return: 13.24% (lower mid). 1Y return: 12.83% (bottom quartile). 1Y return: 11.79% (bottom quartile). Point 6 1M return: -0.92% (bottom quartile). 1M return: 0.59% (upper mid). 1M return: 0.90% (top quartile). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (lower mid). Point 7 Sharpe: 1.53 (lower mid). Sharpe: 2.57 (top quartile). Sharpe: 2.08 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.10% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Point 10 Modified duration: 2.38 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (lower mid). Modified duration: 0.47 yrs (upper mid). DSP Credit Risk Fund

Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

3. हायब्रिड म्युच्युअल फंड

हायब्रीड फंड हा एक प्रकारचा म्युच्युअल फंड आहे जो इक्विटी आणि डेट या दोन्हीमध्ये गुंतवणूक करतो. ते असू शकतातसंतुलित निधी किंवामासिक उत्पन्न योजना (एमआयपी). गुंतवणुकीचा भाग इक्विटीमध्ये जास्त असतो. हायब्रीड फंडाचे काही प्रकार आहेत:

- लवाद निधी

- गतिमानमालमत्ता वाटप

- पुराणमतवादी संकरित निधी

- संतुलित संकरित निधी

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.9639

↑ 0.19 ₹6,720 2.1 7.8 15.6 20.5 14.6 11.1 SBI Multi Asset Allocation Fund Growth ₹66.9273

↑ 0.12 ₹13,033 5.3 13 23.2 20.1 14.8 18.6 ICICI Prudential Multi-Asset Fund Growth ₹823.201

↑ 0.61 ₹78,179 2 9.4 17.2 19.7 19.8 18.6 ICICI Prudential Equity and Debt Fund Growth ₹411.62

↑ 0.78 ₹49,641 0.5 4.4 15.7 19.3 19 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.52

↑ 0.22 ₹1,349 0.8 2.1 16.6 19 18.5 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,720 Cr). Lower mid AUM (₹13,033 Cr). Highest AUM (₹78,179 Cr). Upper mid AUM (₹49,641 Cr). Bottom quartile AUM (₹1,349 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.58% (bottom quartile). 5Y return: 14.77% (bottom quartile). 5Y return: 19.81% (top quartile). 5Y return: 18.97% (upper mid). 5Y return: 18.45% (lower mid). Point 6 3Y return: 20.51% (top quartile). 3Y return: 20.06% (upper mid). 3Y return: 19.66% (lower mid). 3Y return: 19.30% (bottom quartile). 3Y return: 19.05% (bottom quartile). Point 7 1Y return: 15.59% (bottom quartile). 1Y return: 23.16% (top quartile). 1Y return: 17.22% (upper mid). 1Y return: 15.67% (bottom quartile). 1Y return: 16.62% (lower mid). Point 8 1M return: 0.52% (bottom quartile). 1M return: 1.02% (lower mid). 1M return: 0.67% (bottom quartile). 1M return: 1.08% (upper mid). 1M return: 1.96% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 4.49 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.55 (bottom quartile). Sharpe: 1.60 (upper mid). Sharpe: 1.86 (top quartile). Sharpe: 0.83 (lower mid). Sharpe: -0.29 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

4. समाधानाभिमुख योजना

दीर्घकालीन संपत्ती निर्माण करू इच्छिणाऱ्या गुंतवणूकदारांसाठी सोल्युशन ओरिएंटेड योजना उपयुक्त आहेत ज्यात प्रामुख्याने समावेश होतोनिवृत्ती नियोजन आणि मुलाचे भविष्यातील शिक्षणम्युच्युअल फंडात गुंतवणूक. पूर्वी, या योजना इक्विटी किंवा संतुलित योजनांचा एक भाग होत्या, परंतु SEBI च्या नवीन परिसंचरणानुसार, या निधीचे स्वतंत्रपणे सोल्यूशन ओरिएंटेड योजनांमध्ये वर्गीकरण केले गेले आहे. तसेच या योजनांना तीन वर्षांसाठी लॉक-इन असायचे, परंतु आता या फंडांना पाच वर्षांचे लॉक-इन अनिवार्य आहे.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Retirement Savings Fund - Equity Plan Growth ₹51.402

↑ 0.11 ₹7,086 -1 1.9 12.2 17.4 17.8 5.2 ICICI Prudential Child Care Plan (Gift) Growth ₹328.56

↑ 0.48 ₹1,418 -1.3 -1.1 14.2 18.6 14.2 8.3 HDFC Retirement Savings Fund - Hybrid - Equity Plan Growth ₹39.176

↑ 0.08 ₹1,744 -0.8 1.9 10.2 13.8 12.6 5.4 Tata Retirement Savings Fund - Progressive Growth ₹63.917

↑ 0.36 ₹2,108 -3.1 -1.8 10.8 15.6 11.2 -1.2 SBI Magnum Children's Benefit Plan Growth ₹111.209

↓ -0.06 ₹132 0.2 1.7 7.3 12.5 11.2 3.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Retirement Savings Fund - Equity Plan ICICI Prudential Child Care Plan (Gift) HDFC Retirement Savings Fund - Hybrid - Equity Plan Tata Retirement Savings Fund - Progressive SBI Magnum Children's Benefit Plan Point 1 Highest AUM (₹7,086 Cr). Bottom quartile AUM (₹1,418 Cr). Lower mid AUM (₹1,744 Cr). Upper mid AUM (₹2,108 Cr). Bottom quartile AUM (₹132 Cr). Point 2 Established history (9+ yrs). Oldest track record among peers (24 yrs). Established history (9+ yrs). Established history (14+ yrs). Established history (24+ yrs). Point 3 Not Rated. Rating: 2★ (lower mid). Not Rated. Top rated. Rating: 5★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.84% (top quartile). 5Y return: 14.16% (upper mid). 5Y return: 12.62% (lower mid). 5Y return: 11.17% (bottom quartile). 5Y return: 11.16% (bottom quartile). Point 6 3Y return: 17.37% (upper mid). 3Y return: 18.62% (top quartile). 3Y return: 13.78% (bottom quartile). 3Y return: 15.58% (lower mid). 3Y return: 12.45% (bottom quartile). Point 7 1Y return: 12.18% (upper mid). 1Y return: 14.18% (top quartile). 1Y return: 10.18% (bottom quartile). 1Y return: 10.79% (lower mid). 1Y return: 7.33% (bottom quartile). Point 8 1M return: 0.73% (upper mid). 1M return: 1.44% (top quartile). 1M return: 0.40% (bottom quartile). 1M return: -1.05% (bottom quartile). 1M return: 0.62% (lower mid). Point 9 Alpha: -2.31 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: -8.71 (bottom quartile). Alpha: 0.00 (lower mid). Point 10 Sharpe: -0.01 (upper mid). Sharpe: 0.21 (top quartile). Sharpe: -0.02 (lower mid). Sharpe: -0.34 (bottom quartile). Sharpe: -0.58 (bottom quartile). HDFC Retirement Savings Fund - Equity Plan

ICICI Prudential Child Care Plan (Gift)

HDFC Retirement Savings Fund - Hybrid - Equity Plan

Tata Retirement Savings Fund - Progressive

SBI Magnum Children's Benefit Plan

5. गोल्ड फंड

गोल्ड म्युच्युअल फंड गुंतवणूक करतातसोने ETFs (एक्सचेंज ट्रेडेड फंड). सोन्यामध्ये एक्सपोजर घेऊ इच्छिणाऱ्या गुंतवणूकदारांसाठी आदर्शपणे योग्य. भौतिक सोन्याच्या विपरीत, ते खरेदी आणि पूर्तता (खरेदी आणि विक्री) करणे सोपे आहे. तसेच, ते गुंतवणूकदारांना खरेदी आणि विक्रीसाठी किंमतीची पारदर्शकता देतात.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹43.8818

↓ -0.02 ₹10,775 23.5 50.1 72.6 37.3 24.9 71.5 IDBI Gold Fund Growth ₹38.9617

↑ 0.15 ₹623 23.5 49.3 71.5 37.1 24.6 79 ICICI Prudential Regular Gold Savings Fund Growth ₹46.4349

↑ 0.04 ₹4,482 23.6 50.1 72.9 37 24.8 72 Aditya Birla Sun Life Gold Fund Growth ₹43.5454

↓ -0.16 ₹1,266 23.6 50 72.9 37 24.7 72 Nippon India Gold Savings Fund Growth ₹57.4018

↑ 0.03 ₹5,301 23.4 50.3 72.5 37 24.8 71.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Gold Fund IDBI Gold Fund ICICI Prudential Regular Gold Savings Fund Aditya Birla Sun Life Gold Fund Nippon India Gold Savings Fund Point 1 Highest AUM (₹10,775 Cr). Bottom quartile AUM (₹623 Cr). Lower mid AUM (₹4,482 Cr). Bottom quartile AUM (₹1,266 Cr). Upper mid AUM (₹5,301 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Point 3 Rating: 2★ (upper mid). Not Rated. Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 24.92% (top quartile). 5Y return: 24.59% (bottom quartile). 5Y return: 24.83% (upper mid). 5Y return: 24.70% (bottom quartile). 5Y return: 24.75% (lower mid). Point 6 3Y return: 37.31% (top quartile). 3Y return: 37.07% (upper mid). 3Y return: 37.03% (lower mid). 3Y return: 37.01% (bottom quartile). 3Y return: 37.00% (bottom quartile). Point 7 1Y return: 72.57% (lower mid). 1Y return: 71.46% (bottom quartile). 1Y return: 72.86% (upper mid). 1Y return: 72.94% (top quartile). 1Y return: 72.47% (bottom quartile). Point 8 1M return: 5.66% (lower mid). 1M return: 5.47% (bottom quartile). 1M return: 5.74% (upper mid). 1M return: 5.58% (bottom quartile). 1M return: 5.76% (top quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 4.38 (lower mid). Sharpe: 4.30 (bottom quartile). Sharpe: 4.33 (bottom quartile). Sharpe: 4.49 (top quartile). Sharpe: 4.46 (upper mid). SBI Gold Fund

IDBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

Aditya Birla Sun Life Gold Fund

Nippon India Gold Savings Fund

इतर म्युच्युअल फंड योजना

इंडेक्स फंड/एक्सचेंज ट्रेडेड फंड (ईटीएफ) आणिनिधीचा निधी (एफओएफ) इतर योजनांतर्गत वर्गीकृत केले आहेत.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Nifty Next 50 Index Fund Growth ₹61.751

↑ 0.43 ₹8,190 0.9 4.2 18.3 22.2 14.7 2.1 IDBI Nifty Junior Index Fund Growth ₹52.0917

↑ 0.36 ₹100 0.9 4.1 18.2 21.9 14.6 2 Kotak Asset Allocator Fund - FOF Growth ₹259.278

↑ 0.17 ₹2,255 2.9 11.6 21.5 19.9 18 15.4 Bandhan Asset Allocation Fund of Funds - Moderate Plan Growth ₹42.4901

↑ 0.12 ₹19 2.5 5 13.1 13.2 9.8 6.3 ICICI Prudential Advisor Series - Debt Management Fund Growth ₹46.4311

↓ -0.02 ₹110 1 2.7 7.1 7.6 6.3 7.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Nifty Next 50 Index Fund IDBI Nifty Junior Index Fund Kotak Asset Allocator Fund - FOF Bandhan Asset Allocation Fund of Funds - Moderate Plan ICICI Prudential Advisor Series - Debt Management Fund Point 1 Highest AUM (₹8,190 Cr). Bottom quartile AUM (₹100 Cr). Upper mid AUM (₹2,255 Cr). Bottom quartile AUM (₹19 Cr). Lower mid AUM (₹110 Cr). Point 2 Established history (15+ yrs). Established history (15+ yrs). Established history (21+ yrs). Established history (16+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 14.66% (upper mid). 5Y return: 14.59% (lower mid). 5Y return: 18.00% (top quartile). 5Y return: 9.81% (bottom quartile). 5Y return: 6.31% (bottom quartile). Point 6 3Y return: 22.21% (top quartile). 3Y return: 21.91% (upper mid). 3Y return: 19.89% (lower mid). 3Y return: 13.16% (bottom quartile). 3Y return: 7.64% (bottom quartile). Point 7 1Y return: 18.34% (upper mid). 1Y return: 18.24% (lower mid). 1Y return: 21.48% (top quartile). 1Y return: 13.08% (bottom quartile). 1Y return: 7.05% (bottom quartile). Point 8 1M return: 2.17% (top quartile). 1M return: 2.15% (upper mid). 1M return: -0.24% (bottom quartile). 1M return: 1.34% (lower mid). 1M return: 0.66% (bottom quartile). Point 9 Alpha: -0.80 (bottom quartile). Alpha: -0.89 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 10 Sharpe: -0.12 (bottom quartile). Sharpe: -0.13 (bottom quartile). Sharpe: 0.89 (top quartile). Sharpe: 0.06 (lower mid). Sharpe: 0.87 (upper mid). ICICI Prudential Nifty Next 50 Index Fund

IDBI Nifty Junior Index Fund

Kotak Asset Allocator Fund - FOF

Bandhan Asset Allocation Fund of Funds - Moderate Plan

ICICI Prudential Advisor Series - Debt Management Fund

म्युच्युअल फंडात ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

What is the future of mutual funds now after Covid 19, approximately how long it will take for the Sensex and Nifty to recover in January-February 2020 ?