ہندوستان میں بہترین کارکردگی کا مظاہرہ کرنے والے SIP پلان 2022

بہترینگھونٹ منصوبے؟ ان کا انتخاب کیسے کریں؟ یہ کچھ عام سوالات ہیں جو سوچتے وقت سرمایہ کاروں کے ذہن میں آتے ہیں۔سرمایہ کاری میںباہمی چندہ ایس آئی پی یا سیسٹیمیٹک کے ذریعےسرمایہ کاری کا منصوبہ.

SIP سرمایہ کاری Mutual Funds میں سرمایہ کاری کرتے وقت سب سے زیادہ نظم و ضبط والے سرمایہ کاری کے اختیارات میں سے ایک ہے۔ مزید یہ کہ، SIP میوچل فنڈ میں سرمایہ کاری کی کم از کم رقم INR 500 سے کم ہے۔ اس سے سرمایہ کاری ہوتی ہے۔ٹاپ ایس آئی پی بہت آسان منصوبے.

عام طور پر، ہندوستان میں کچھ بہترین SIP منصوبے طویل مدت کے لیے سرمایہ کاری کرنے پر اچھا منافع پیش کرتے ہیں۔ یہ جاننے کے لیے کہ کوئی SIP یا سسٹمیٹک انویسٹمنٹ پلان میں سرمایہ کاری کرکے کتنا کما سکتا ہے، چیک کریں۔گھونٹ کیلکولیٹر (جسے ایس آئی پی ریٹرن کیلکولیٹر بھی کہا جاتا ہے) سیکشن نیچے۔

سیسٹیمیٹک انویسٹمنٹ پلان میں سرمایہ کاری کیوں کی جائے؟

ایک منظم سرمایہ کاری کا منصوبہ متعدد فوائد کے ساتھ آتا ہے۔ اس کی کم از کم سرمایہ کاری کی رقمINR 500 میوچل فنڈز میں سرمایہ کاری کا سفر شروع کرنے کے لیے نہ صرف زیادہ تر آبادی بلکہ بہت سے نوجوانوں کی توجہ حاصل کی ہے۔ ایکسرمایہ کار کون چاہتا ہےSIP میں سرمایہ کاری کریں۔ ان کی اہم منصوبہ بندی کر سکتے ہیںمالی اہداف جیسے کہ بچوں کی تعلیم، شادی کے اخراجات، مکان/گاڑی کی خریداری وغیرہ، نظم و ضبط کے ساتھ۔ کوئی بھی اپنے اہداف (مختصر مدت، وسط مدتی اور طویل مدتی) کے مطابق سرمایہ کاری شروع کر سکتا ہے اور ایک خاص مدت کے دوران دولت میں اضافہ حاصل کر سکتا ہے۔

SIPs بڑے فوائد پیش کرتے ہیں جیسے روپے کی اوسط قیمت اورکمپاؤنڈنگ کی طاقت. روپے کی لاگت کا اوسط ایک فرد کو اثاثہ کی خریداری کی قیمت کا اوسط نکالنے میں مدد کرتا ہے۔ ایس آئی پی میں، یونٹس کی خریداری ایک طویل مدت میں کی جاتی ہے اور یہ ماہانہ وقفوں (عام طور پر) پر یکساں طور پر پھیلی ہوئی ہیں۔ سرمایہ کاری وقت کے ساتھ پھیل جانے کی وجہ سے، سرمایہ کاری اسٹاک میں کی جاتی ہے۔مارکیٹ مختلف قیمت پوائنٹس پر سرمایہ کار کو اوسط لاگت کا فائدہ دیتا ہے، لہذا اصطلاح روپیہ لاگت کا اوسط۔

مرکب سود کی صورت میں، سادہ سود کے برعکس جہاں آپ صرف پرنسپل پر سود حاصل کرتے ہیں، یہاں سود کی رقم پرنسپل میں شامل کی جاتی ہے، اور سود کا حساب نئے پرنسپل (پرانے پرنسپل کے علاوہ منافع) پر کیا جاتا ہے۔ یہ عمل ہر بار جاری رہتا ہے۔ چونکہ ایس آئی پی میں میوچل فنڈز قسطوں میں ہوتے ہیں، اس لیے وہ مرکب ہوتے ہیں، جو ابتدائی طور پر لگائی گئی رقم میں مزید اضافہ کرتے ہیں۔

سیسٹیمیٹک انویسٹمنٹ پلان میں کیسے سرمایہ کاری کریں؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

تو، آپ کس چیز کا انتظار کر رہے ہیں؟ اپنے SIP یا منظم سرمایہ کاری کے منصوبے کے ساتھ شروع کریں اور اب بہتر بچت کریں!

Talk to our investment specialist

مالی سال 22 - 23 میں سرمایہ کاری کے لیے بہترین SIP پلان

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on T o g e n e r a t e income/capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. Research Highlights for Canara Robeco Infrastructure Below is the key information for Canara Robeco Infrastructure Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.2744

↓ -1.64 ₹1,975 500 25.4 60.1 153.2 57.7 30.3 167.1 SBI PSU Fund Growth ₹35.004

↓ -1.01 ₹5,980 500 7 13.5 25.3 31 26 11.3 ICICI Prudential Infrastructure Fund Growth ₹184.68

↓ -3.90 ₹8,077 100 -4.6 -3.9 8.3 21.6 24 6.7 Invesco India PSU Equity Fund Growth ₹65.43

↓ -1.94 ₹1,492 500 2.3 7.5 22.8 28.9 24 10.3 DSP India T.I.G.E.R Fund Growth ₹314.397

↓ -6.56 ₹5,184 500 1.7 0.5 16 24.2 23 -2.5 Canara Robeco Infrastructure Growth ₹159.07

↓ -3.48 ₹879 1,000 2.2 -0.1 15.5 24.4 22.2 0.1 Nippon India Power and Infra Fund Growth ₹338.857

↓ -6.60 ₹6,773 100 0 -0.9 12.9 23.8 22.1 -0.5 Franklin Build India Fund Growth ₹140.414

↓ -3.35 ₹3,003 500 -0.2 0.5 14.7 24.9 22 3.7 LIC MF Infrastructure Fund Growth ₹48.0418

↓ -1.12 ₹946 1,000 -0.3 -1.6 14.2 26.6 22 -3.7 HDFC Infrastructure Fund Growth ₹44.556

↓ -1.02 ₹2,366 300 -4.8 -5.1 8.3 23.5 21.7 2.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 10 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Canara Robeco Infrastructure Nippon India Power and Infra Fund Franklin Build India Fund LIC MF Infrastructure Fund HDFC Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Upper mid AUM (₹5,184 Cr). Bottom quartile AUM (₹879 Cr). Top quartile AUM (₹6,773 Cr). Upper mid AUM (₹3,003 Cr). Bottom quartile AUM (₹946 Cr). Lower mid AUM (₹2,366 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (21+ yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Not Rated. Rating: 4★ (upper mid). Top rated. Not Rated. Rating: 3★ (lower mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 30.28% (top quartile). 5Y return: 26.03% (top quartile). 5Y return: 24.03% (upper mid). 5Y return: 23.97% (upper mid). 5Y return: 23.01% (upper mid). 5Y return: 22.24% (lower mid). 5Y return: 22.06% (lower mid). 5Y return: 22.00% (bottom quartile). 5Y return: 21.97% (bottom quartile). 5Y return: 21.69% (bottom quartile). Point 6 3Y return: 57.69% (top quartile). 3Y return: 30.96% (top quartile). 3Y return: 21.62% (bottom quartile). 3Y return: 28.91% (upper mid). 3Y return: 24.24% (lower mid). 3Y return: 24.35% (lower mid). 3Y return: 23.82% (bottom quartile). 3Y return: 24.93% (upper mid). 3Y return: 26.59% (upper mid). 3Y return: 23.46% (bottom quartile). Point 7 1Y return: 153.16% (top quartile). 1Y return: 25.31% (top quartile). 1Y return: 8.28% (bottom quartile). 1Y return: 22.83% (upper mid). 1Y return: 16.03% (upper mid). 1Y return: 15.49% (upper mid). 1Y return: 12.87% (bottom quartile). 1Y return: 14.70% (lower mid). 1Y return: 14.21% (lower mid). 1Y return: 8.34% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (top quartile). Alpha: 0.00 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: -6.78 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: -6.08 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (top quartile). Sharpe: 0.15 (upper mid). Sharpe: 0.53 (upper mid). Sharpe: 0.08 (lower mid). Sharpe: 0.13 (lower mid). Sharpe: -0.03 (bottom quartile). Sharpe: 0.21 (upper mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.06 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.26 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.29 (top quartile). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Canara Robeco Infrastructure

Nippon India Power and Infra Fund

Franklin Build India Fund

LIC MF Infrastructure Fund

HDFC Infrastructure Fund

اثاثے >= 200 کروڑ اور ترتیب دیا گیا5 سال کی واپسی۔.1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (06 Mar 26) ₹62.2744 ↓ -1.64 (-2.56 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month 5.9% 3 Month 25.4% 6 Month 60.1% 1 Year 153.2% 3 Year 57.7% 5 Year 30.3% 10 Year 15 Year Since launch 10.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (09 Mar 26) ₹35.004 ↓ -1.01 (-2.80 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,846 28 Feb 23 ₹13,615 29 Feb 24 ₹26,250 28 Feb 25 ₹24,523 28 Feb 26 ₹34,330 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -2.8% 3 Month 7% 6 Month 13.5% 1 Year 25.3% 3 Year 31% 5 Year 26% 10 Year 15 Year Since launch 8.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (09 Mar 26) ₹184.68 ↓ -3.90 (-2.07 %) Net Assets (Cr) ₹8,077 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.15 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹13,019 28 Feb 23 ₹16,071 29 Feb 24 ₹26,195 28 Feb 25 ₹26,606 28 Feb 26 ₹31,983 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -6.6% 3 Month -4.6% 6 Month -3.9% 1 Year 8.3% 3 Year 21.6% 5 Year 24% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (09 Mar 26) ₹65.43 ↓ -1.94 (-2.88 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,709 28 Feb 23 ₹13,515 29 Feb 24 ₹25,468 28 Feb 25 ₹22,731 28 Feb 26 ₹31,469 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -3.8% 3 Month 2.3% 6 Month 7.5% 1 Year 22.8% 3 Year 28.9% 5 Year 24% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (09 Mar 26) ₹314.397 ↓ -6.56 (-2.04 %) Net Assets (Cr) ₹5,184 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,599 28 Feb 23 ₹14,649 29 Feb 24 ₹23,990 28 Feb 25 ₹23,841 28 Feb 26 ₹30,113 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -2.2% 3 Month 1.7% 6 Month 0.5% 1 Year 16% 3 Year 24.2% 5 Year 23% 10 Year 15 Year Since launch 17.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. Canara Robeco Infrastructure

Canara Robeco Infrastructure

Growth Launch Date 2 Dec 05 NAV (09 Mar 26) ₹159.07 ↓ -3.48 (-2.14 %) Net Assets (Cr) ₹879 on 31 Jan 26 Category Equity - Sectoral AMC Canara Robeco Asset Management Co. Ltd. Rating Risk High Expense Ratio 2.32 Sharpe Ratio 0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,941 28 Feb 23 ₹14,255 29 Feb 24 ₹21,721 28 Feb 25 ₹22,794 28 Feb 26 ₹29,026 Returns for Canara Robeco Infrastructure

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -2.8% 3 Month 2.2% 6 Month -0.1% 1 Year 15.5% 3 Year 24.4% 5 Year 22.2% 10 Year 15 Year Since launch 14.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 0.1% 2023 35.3% 2022 41.2% 2021 9% 2020 56.1% 2019 9% 2018 2.3% 2017 -19.1% 2016 40.2% 2015 2.1% Fund Manager information for Canara Robeco Infrastructure

Name Since Tenure Vishal Mishra 26 Jun 21 4.61 Yr. Shridatta Bhandwaldar 29 Sep 18 7.35 Yr. Data below for Canara Robeco Infrastructure as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 45.41% Utility 12.54% Basic Materials 10.29% Energy 9.34% Financial Services 8.27% Technology 3.24% Communication Services 3.06% Consumer Cyclical 2.93% Real Estate 1.11% Asset Allocation

Asset Class Value Cash 3.81% Equity 96.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 11 | LT10% ₹85 Cr 214,901

↓ -3,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 24 | SBIN5% ₹48 Cr 442,500 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE5% ₹41 Cr 291,750 NTPC Ltd (Utilities)

Equity, Since 30 Nov 18 | NTPC4% ₹39 Cr 1,106,480 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 19 | BEL4% ₹39 Cr 869,000

↓ -25,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Sep 24 | TATAPOWER3% ₹30 Cr 810,000 GE Vernova T&D India Ltd (Industrials)

Equity, Since 31 Jan 24 | GVT&D3% ₹29 Cr 89,735

↓ -10,250 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 24 | BHARTIARTL3% ₹27 Cr 136,600 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Jan 23 | INDIGO3% ₹27 Cr 58,250 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Oct 23 | CGPOWER3% ₹26 Cr 440,650 7. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (09 Mar 26) ₹338.857 ↓ -6.60 (-1.91 %) Net Assets (Cr) ₹6,773 on 31 Jan 26 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.03 Information Ratio 0.26 Alpha Ratio -6.78 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,969 28 Feb 23 ₹14,131 29 Feb 24 ₹25,118 28 Feb 25 ₹23,502 28 Feb 26 ₹29,232 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -3.1% 3 Month 0% 6 Month -0.9% 1 Year 12.9% 3 Year 23.8% 5 Year 22.1% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Rahul Modi 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Power and Infra Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.76% Utility 24.23% Consumer Cyclical 11.14% Energy 10.76% Basic Materials 7.94% Technology 4.08% Communication Services 3.05% Financial Services 2.82% Health Care 2.16% Real Estate 1.9% Asset Allocation

Asset Class Value Cash 0.17% Equity 99.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹650 Cr 4,660,000

↑ 110,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | NTPC9% ₹605 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹389 Cr 989,337

↓ -75,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | TATAPOWER4% ₹289 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL3% ₹207 Cr 1,050,000

↓ -150,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO3% ₹203 Cr 160,000

↓ -10,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | CGPOWER3% ₹176 Cr 3,020,014 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | BHEL3% ₹171 Cr 6,500,000

↓ -400,000 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | BHARATFORG3% ₹170 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹158 Cr 18,358,070

↑ 860,913 8. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (09 Mar 26) ₹140.414 ↓ -3.35 (-2.33 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,098 28 Feb 23 ₹13,800 29 Feb 24 ₹23,698 28 Feb 25 ₹23,292 28 Feb 26 ₹29,368 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -4.8% 3 Month -0.2% 6 Month 0.5% 1 Year 14.7% 3 Year 24.9% 5 Year 22% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000 9. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (09 Mar 26) ₹48.0418 ↓ -1.12 (-2.28 %) Net Assets (Cr) ₹946 on 31 Jan 26 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio 0.03 Information Ratio 0.29 Alpha Ratio -6.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,622 28 Feb 23 ₹13,475 29 Feb 24 ₹21,758 28 Feb 25 ₹22,556 28 Feb 26 ₹29,283 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -4.2% 3 Month -0.3% 6 Month -1.6% 1 Year 14.2% 3 Year 26.6% 5 Year 22% 10 Year 15 Year Since launch 9.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065 10. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (09 Mar 26) ₹44.556 ↓ -1.02 (-2.25 %) Net Assets (Cr) ₹2,366 on 31 Jan 26 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio 0.06 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,903 28 Feb 23 ₹13,888 29 Feb 24 ₹25,247 28 Feb 25 ₹24,286 28 Feb 26 ₹29,124 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Mar 26 Duration Returns 1 Month -7.4% 3 Month -4.8% 6 Month -5.1% 1 Year 8.3% 3 Year 23.5% 5 Year 21.7% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.62 Yr. Ashish Shah 1 Nov 25 0.25 Yr. Data below for HDFC Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 40.3% Financial Services 21.02% Basic Materials 10.31% Energy 7.4% Utility 7.38% Communication Services 4.32% Real Estate 2.99% Health Care 1.84% Technology 1.33% Consumer Cyclical 0.67% Asset Allocation

Asset Class Value Cash 2.44% Equity 97.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹159 Cr 403,500

↑ 6,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹149 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹130 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹87 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹80 Cr 1,400,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | NTPC3% ₹78 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹76 Cr 704,361 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹70 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹69 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹69 Cr 350,000

بہترین SIP سرمایہ کاری کا انتخاب کیسے کریں؟

مختلف میوچل فنڈز ہیں جو آپ کو SIP کے ذریعے سرمایہ کاری کرنے کی اجازت دیتے ہیں۔ لیکن بنیادی مسئلہ انتخاب کا ہے۔بہترین باہمی فنڈز ایس آئی پی کے لیے۔ اگرچہ بہترین میوچل فنڈز ہر شخص میں مختلف ہو سکتے ہیں، ذیل میں کچھ نکات کی فہرست دی گئی ہے جن پر سرمایہ کار بہترین SIP میوچل فنڈ کا انتخاب کرنے سے پہلے غور کر سکتے ہیں۔

SIP سرمایہ کاری کے مقصد کو سمجھیں۔

جب سرمایہ کاری کی بات آتی ہے تو ہم میں سے ہر ایک کا مقصد مختلف ہوتا ہے۔ لہذا SIP کے ذریعے میوچل فنڈز میں سرمایہ کاری کرنے سے پہلے، یہ مشورہ دیا جاتا ہے کہ آپ اپنے سرمایہ کاری کے اہداف کی واضح تصویر حاصل کریں اوررسک پروفائل. عام طور پر،ایکویٹی میوچل فنڈز طویل مدتی مقاصد کے لیے فائدہ مند سمجھا جاتا ہے جبکہکرنسی مارکیٹ اورقرض فنڈ مختصر مدت کے مقاصد کے لیے موزوں ہیں۔

فنڈ ہاؤس کو جانیں۔

SIP ریٹرن کا ایک بڑا حصہ فنڈ ہاؤس پر منحصر ہے جو آپ کی طرف سے آپ کے پیسے کا انتظام کرتا ہے۔ اگر فنڈ ہاؤس اپنے مقصد میں ناکام ہو جاتا ہے، تو آپ اپنی رقم کھونے والے ہوں گے۔ یہ یقینی بنانے کے لیے کہ آپ کے پاس بہترین SIP پلان ہے ایک معروف فنڈ ہاؤس کا انتخاب کریں۔

ایس آئی پی میوچل فنڈ کے فنڈ کی کارکردگی کی نگرانی کریں۔

بنیادی وجوہات میں سے ایک جس کی وجہ سے لوگمیوچل فنڈز میں سرمایہ کاری کریں۔ ایس آئی پی کے ذریعے پیسہ کمانا ہے۔ لہذا، بہترین فنڈ کا انتخاب کرنے اور پھر بہترین SIP منصوبوں میں سرمایہ کاری کرنے کے لیے وقت کے دوران فنڈز کی کارکردگی کا تجزیہ کرنا ضروری ہے۔ عام طور پر، ایکویٹی Mutual Funds کے لیے طویل مدتی کارکردگی کو دیکھا جاتا ہے، جبکہ قرض کے لیے Mutual Funds مختصر سے درمیانی مدت کے منافع پر غور کیا جاتا ہے۔

SIP کے بوجھ اور بار بار چلنے والے اخراجات کا تجزیہ کریں۔

آخری لیکن کم از کم نہیں، ایگزٹ لوڈ اور اخراجات کا تناسب اگر ایک مخصوص مدت (عام طور پر لاک ان پیریڈ کہلاتا ہے) سے پہلے سرمایہ کاری کو چھڑا لیا جائے۔

لہذا، یہ مشورہ دیا جاتا ہے کہ ان پیرامیٹرز کو ذہن میں رکھتے ہوئے بہترین SIP پلانز کا انتخاب کریں۔ سرمایہ کاری کرنے سے پہلے سوچیں!

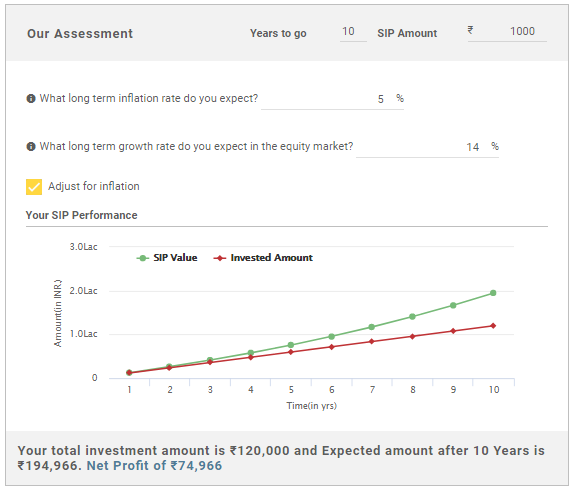

SIP کیلکولیٹر (SIP ریٹرن کیلکولیٹر)

کے لیےمعاشی منصوبہ بندی، ایس آئی پی کیلکولیٹر یا ایس آئی پی ریٹرن کیلکولیٹر بہترین ٹولز میں سے ایک ہے۔

یہ مانیٹر کرنے کے لیے کہ آپ کا SIP کمپاؤنڈنگ کی طاقت سے کیسے بڑھتا ہے، ذیل کی مثال پر غور کریں۔

| ماہانہ سرمایہ کاری | سرمایہ کاری کی مدت | سرمایہ کاری کی کل رقم | حتمی قیمت @ 14% p.a. |

|---|---|---|---|

| 1،000 | 5 سال | 60,000 | 87,200 |

| 1,000 | 10 سال | 1,20,000 | 2,62,091 |

| 1,000 | 15 سال | 1,80,000 | 6,12,853 |

مندرجہ بالا جدول میں بتایا گیا ہے کہ اگر آپ SIP Mutual Fund میں ماہانہ INR 1,000 کی سرمایہ کاری کرتے ہیں، تو 5 سالوں میں آپ کی کل سرمایہ کاری INR 60,000 ہوگی اور آپ کا SIP 14% p.a کے مفروضہ واپسی فیصد پر واپس آئے گا۔ ہو گا87,2001 روپےبالترتیب اسی طرح 10 سالوں میں کل سرمایہ کاری ہوگی۔INR 1,20,000 اور SIP 14% p.a کی فرضی فیصد پر واپسی ہو گاINR 2,62,091.

اسی طرح 15 سال میں سرمایہ کاری ہوگی۔INR 1,80,000 اور 14% p.a کی واپسی کے فیصد پر حتمی قیمت ہوگی۔6,12,853 روپےبالترتیب

لہذا، صرف ایک مہینے میں INR 1,000 کی سرمایہ کاری کرکے، دیکھیں کہ آنے والے سالوں میں آپ کی رقم کیسے بڑھے گی۔ سرمایہ کاری کے لیے بہترین SIP میوچل فنڈ کا انتخاب کرتے وقت مذکورہ بالا حسابات پر غور کریں۔

اکثر پوچھے گئے سوالات

1. SIP کیا ہے؟

A: ایس آئی پی یا سیسٹیمیٹک انویسٹمنٹ پلان ایک سرمایہ کاری کا راستہ ہے جو میوچل فنڈ اسکیم کے تحت پیش کیا جاتا ہے، جہاں اسکیم کے تحت باقاعدہ وقفوں پر ایک مخصوص رقم کی سرمایہ کاری کی جاتی ہے۔ یہ قسط 500 روپے تک ہو سکتی ہے۔

2. SIP کے کیا فوائد ہیں؟

A: SIP کا بنیادی فائدہ یہ ہے کہ یہ سرمایہ کاری کو زیادہ نظم و ضبط بناتا ہے۔ یہ سرمایہ کار کو بنانے کی اجازت دیتا ہے۔مالیاتی منصوبہ مفید ہے اور سرمایہ کار میں سرمایہ کاری کی عادت پیدا کرنے میں مدد کرتا ہے۔

3. SIP میں کون سرمایہ کاری کر سکتا ہے؟

A: کوئی بھی ایس آئی پی میں سرمایہ کاری کر سکتا ہے۔ لیکن، آپ کو اپنے خطرے کا تجزیہ کرنا چاہیے، مطلب یہ ہے کہ آپ کتنا خطرہ مول لینا چاہتے ہیں۔ اس کے علاوہ، شروع کرنے کے لیے، آپ کو PAN کی تفصیلات، ایڈریس پروف، اور کی ضرورت ہے۔بینک تفصیلات

4. آف لائن موڈ میں SIP میں سرمایہ کاری کرنے کے کیا اقدامات ہیں؟

A: آف لائن موڈ میں سرمایہ کاری کرنے کے لیے، آپ کو درخواست فارم کو پُر کرنا ہوگا، ماہانہ یا سہ ماہی SIP رقم کے لیے ایک چیک جمع کرانا ہوگا، اس کی ایک کاپی فراہم کرنا ہوگی۔پین کارڈآپ کے بینک کی تفصیلات کے ثبوت کے طور پر ایڈریس کا ثبوت، اور ایک منسوخ شدہ چیک۔

5. مجھے ICICI پرڈینشل ٹیکنالوجی فنڈ میں کیوں سرمایہ کاری کرنی چاہیے؟

A: ICICI پرڈینشل ٹیکنالوجی فنڈ نے 3 مارچ 2000 کو اپنے آغاز کے بعد سے 11.9% کی واپسی ظاہر کی ہے۔ دوسرے فنڈز کے برعکس، سال 2020 میں، اس نے 70.6% کی واپسی قائم کی ہے۔ لہذا، آئی سی آئی سی آئی پرڈینشل ٹیکنالوجی فنڈ میں سرمایہ کاری فائدہ مند ثابت ہوئی ہے اور اس نے پانچ سالوں کے لیے ایس آئی پی میں سرمایہ کاری کی ہے۔

6. مجھے ایس بی آئی بلیوچپ فنڈ ریگولر گروتھ میں کیوں سرمایہ کاری کرنی چاہئے؟

A: ایس بی آئی بلیوچپ فنڈ ریگولر گروتھ نے پانچ سالہ ترقی کی شرح ظاہر کی ہے۔5.29%، جو نسبتاً زیادہ ہے۔

7. SIP میں سرمایہ کاری کرتے وقت آپ کو کن چیزوں پر غور کرنا چاہیے؟

A: جب آپ SIP میں سرمایہ کاری کرتے ہیں، تو آپ کو خالص اثاثہ کی قیمت یانہیں ہیں. یہ وہ سرمایہ کاری ہے جو آپ اسکیم کے لیے کرتے ہیں۔ آپ کو اس کی ریٹنگز اور اس کی تاریخی کارکردگی کو بھی چیک کرنا چاہیے۔ اس بات کو یقینی بنانے کے لیے کہ آپ کی سرمایہ کاری محفوظ ہے SIP سے حاصل ہونے والے منافع کو سمجھنا ضروری ہے۔

8. کیا SIP کے لیے KYC اہم ہے؟

A: ہاں، SIP کے لیے بھی KYC ضروری ہے۔ چونکہ SIP میوچل فنڈ کی اسکیم کے تحت آتا ہے، آپ کو SIP میں سرمایہ کاری کرنے کے لیے KYC دستاویزات فراہم کرنے ہوں گے۔

9. کیا SIPs میں کم از کم سرمایہ کاری کی ضرورت ہوتی ہے؟

A: ہاں، کچھ SIPs میں کم از کم سرمایہ کاری کی ضرورت ہوتی ہے۔ مثال کے طور پر، آدتیہ برلا سن لائف ڈیجیٹل انڈیا فنڈ میں کم از کم SIP سرمایہ کاری کی ضرورت ہے 1000 روپے۔ ایس بی آئی بلیوچپ فنڈ ریگولر گروتھ کی کم از کم ضرورت 5000 روپے ہے۔ اس طرح، آپ جس SIP میں سرمایہ کاری کر رہے ہیں اس پر منحصر ہے، آپ کو اپنی سرمایہ کاری کی رقم میں اضافہ کرنا پڑے گا۔

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

You Might Also Like

What Is The Best Date For Sips And Does It Really Affect Returns?

Best Liquid Mutual Funds In 2026 - A Complete Investor Guide

Best Smartphones Under ₹30,000 In India (2025) – Expert Buying Guide

E Filing Of Income Tax – A Complete Guide To File Income Tax Return

Best Android Phones Under ₹25,000 In India — Top Picks & Buying Guide

helpful to invest in SIP