এসআইপি 2022-এর জন্য 11টি সেরা মিউচুয়াল ফান্ড

চুমুক যৌথ পুঁজি (বা শীর্ষ 11 SIP মিউচুয়াল ফান্ড) হল এমন ফান্ড যা স্টক মার্কেটের অনিবার্য উত্থান-পতনের সময় নার্ভাস বিক্রি এড়াতে পর্যায়ক্রমিক বিনিয়োগের সহজ সূত্র মেনে চলে।

সাধারণত, SIP বা পদ্ধতিগতবিনিয়োগ পরিকল্পনা মিউচুয়াল ফান্ডে অর্থ বিনিয়োগ করার একটি মোড।বিনিয়োগ সেরা 11 SIP মিউচুয়াল ফান্ড আপনার বিনিয়োগের জন্য একটি নিয়মতান্ত্রিক এবং সুশৃঙ্খল পদ্ধতি নিয়ে আসে। এটি প্রতিদিন আপনার বিনিয়োগ পরিচালনা করার প্রচেষ্টাকে হ্রাস করেভিত্তি. অধিকন্তু, এটি লিভারেজ অফার করেযৌগিক শক্তি সময়ের সাথে সাথে কাঙ্ক্ষিত রিটার্নের দিকে পরিচালিত করে।

তারা আলাদামিউচুয়াল ফান্ডের প্রকারভেদ এসআইপি-এর জন্য যার মধ্যে রয়েছে ইক্যুইটি, ঋণ, সুষম, অতি-স্বল্পমেয়াদী তহবিল, ইত্যাদি। যাইহোক, ইক্যুইটি মিউচুয়াল ফান্ডগুলি SIP এর মাধ্যমে বিনিয়োগ করলে সর্বাধিক রিটার্ন অফার করে। আর্থিক উপদেষ্টারা পরামর্শ দেন যে, বিনিয়োগকারীদের অবশ্যই বিনিয়োগ করতে হবেসেরা মিউচুয়াল ফান্ড এসআইপি ভিত্তিতে তাদের বিনিয়োগের উদ্দেশ্য এবং সময়কালএসআইপি বিনিয়োগ.

কেন শীর্ষ 11 SIP তহবিলে বিনিয়োগ করবেন?

SIP মিউচুয়াল ফান্ডে বিনিয়োগের প্রতি একটি সুশৃঙ্খল দৃষ্টিভঙ্গি দেয়

পদ্ধতিগত বিনিয়োগ ভবিষ্যতের স্বপ্ন এবং প্রধান লক্ষ্যগুলির অর্থায়নে সাহায্য করে যেমন- অবসর গ্রহণ, সন্তানের কর্মজীবন, একটি বাড়ি, গাড়ি বা অন্য কোনো সম্পদ ক্রয়

এসআইপিগুলি সর্বাধিক চক্রবৃদ্ধি করতে সহায়তা করে এবং তরুণ বিনিয়োগকারীদের জন্য আদর্শ

পদ্ধতিগত বিনিয়োগ পরিকল্পনা ইক্যুইটি ওঠানামার ঝুঁকি কমিয়ে দেয়

কিভাবে SIP এ বিনিয়োগ করবেন?

অর্থ বিনিয়োগ করা একটি শিল্প, সঠিকভাবে করা হলে এটি বিস্ময়কর কাজ করতে পারে। এখন আপনি জানেন যেশীর্ষ SIP পরিকল্পনা আপনি জানতে হবে এটা বিনিয়োগ কিভাবে. আমরা নীচে এসআইপিতে বিনিয়োগের পদক্ষেপগুলি উল্লেখ করেছি।

1. আপনার আর্থিক লক্ষ্য বিশ্লেষণ

আপনার উপযুক্ত একটি SIP বিনিয়োগ চয়ন করুনআর্থিক লক্ষ্য. উদাহরণস্বরূপ, যদি আপনার লক্ষ্য স্বল্পমেয়াদী হয় (যদি আগামী 2 বছরে একটি গাড়ি কিনতে চান), তাহলে আপনাকে ডেট মিউচুয়াল ফান্ডে বিনিয়োগ করা উচিত। এবং, যদি আপনার লক্ষ্য দীর্ঘমেয়াদী হয় (যেমনঅবসর পরিকল্পনা) তারপর ইক্যুইটি মিউচুয়াল ফান্ডে বিনিয়োগ করতে পছন্দ করে।

2. বিনিয়োগের একটি টাইমলাইন বেছে নিন

এটি নিশ্চিত করবে যে আপনি সঠিক সময়ের জন্য সঠিক পরিমাণ অর্থ বিনিয়োগ করবেন।

3. আপনি মাসিক যে পরিমাণ বিনিয়োগ করতে চান তা নির্ধারণ করুন

যেহেতু এসআইপি একটি মাসিক বিনিয়োগ, তাই আপনার এমন একটি পরিমাণ বেছে নেওয়া উচিত যেটি ছাড়াই আপনি মাসিক বিনিয়োগ করতে পারবেনব্যর্থ. আপনি ব্যবহার করে আপনার লক্ষ্য অনুযায়ী উপযুক্ত পরিমাণও গণনা করতে পারেনচুমুক ক্যালকুলেটর অথবা এসআইপি রিটার্ন ক্যালকুলেটর।

4. সেরা SIP পরিকল্পনা নির্বাচন করুন

পরামর্শ করে একটি বিজ্ঞ বিনিয়োগ পছন্দ করুন aআর্থিক উপদেষ্টা বা নির্বাচন করেসেরা SIP পরিকল্পনা বিভিন্ন অনলাইন বিনিয়োগ প্ল্যাটফর্ম দ্বারা অফার করা হয়।

Talk to our investment specialist

ভারতের শীর্ষ 11টি SIP মিউচুয়াল ফান্ড FY 22 - 23৷

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on T o g e n e r a t e income/capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. Research Highlights for Canara Robeco Infrastructure Below is the key information for Canara Robeco Infrastructure Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns Research Highlights for BOI AXA Manufacturing and Infrastructure Fund Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹35.3653

↑ 0.08 ₹5,817 500 6.1 13.9 21.8 32.7 28.4 11.3 ICICI Prudential Infrastructure Fund Growth ₹195.39

↓ -0.45 ₹8,134 100 -1.7 2 9.7 25.3 27.7 6.7 Invesco India PSU Equity Fund Growth ₹66.66

↓ -0.26 ₹1,449 500 1.5 8 19.7 31.1 26.8 10.3 DSP World Gold Fund Growth ₹57.6652

↓ -3.01 ₹1,756 500 40 75.8 134.7 49.4 26.1 167.1 DSP India T.I.G.E.R Fund Growth ₹315.953

↑ 0.08 ₹5,323 500 0 2.4 9.6 25.1 24.6 -2.5 HDFC Infrastructure Fund Growth ₹47.438

↑ 0.09 ₹2,452 300 -1.9 0.7 8.8 26.9 24.5 2.2 LIC MF Infrastructure Fund Growth ₹49.5423

↑ 0.11 ₹1,003 1,000 -1.2 2 10.1 28.6 24.3 -3.7 Nippon India Power and Infra Fund Growth ₹343.931

↓ -0.27 ₹7,117 100 -2.1 1.3 9.2 26 24.3 -0.5 Franklin Build India Fund Growth ₹146.195

↑ 0.27 ₹3,036 500 1.4 4.4 13 27.4 24.2 3.7 Canara Robeco Infrastructure Growth ₹160.98

↑ 0.79 ₹894 1,000 -0.7 0.6 12.9 25.5 23.6 0.1 BOI AXA Manufacturing and Infrastructure Fund Growth ₹59.21

↑ 0.13 ₹674 1,000 1.4 7.2 12.1 25.4 23.6 7.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Feb 26 Research Highlights & Commentary of 11 Funds showcased

Commentary SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP World Gold Fund DSP India T.I.G.E.R Fund HDFC Infrastructure Fund LIC MF Infrastructure Fund Nippon India Power and Infra Fund Franklin Build India Fund Canara Robeco Infrastructure BOI AXA Manufacturing and Infrastructure Fund Point 1 Upper mid AUM (₹5,817 Cr). Highest AUM (₹8,134 Cr). Lower mid AUM (₹1,449 Cr). Lower mid AUM (₹1,756 Cr). Upper mid AUM (₹5,323 Cr). Lower mid AUM (₹2,452 Cr). Bottom quartile AUM (₹1,003 Cr). Top quartile AUM (₹7,117 Cr). Upper mid AUM (₹3,036 Cr). Bottom quartile AUM (₹894 Cr). Bottom quartile AUM (₹674 Cr). Point 2 Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (21+ yrs). Established history (16+ yrs). Established history (20+ yrs). Established history (15+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 3★ (lower mid). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Rating: 3★ (upper mid). Not Rated. Rating: 4★ (upper mid). Top rated. Not Rated. Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 28.40% (top quartile). 5Y return: 27.73% (top quartile). 5Y return: 26.81% (upper mid). 5Y return: 26.14% (upper mid). 5Y return: 24.57% (upper mid). 5Y return: 24.53% (lower mid). 5Y return: 24.32% (lower mid). 5Y return: 24.31% (lower mid). 5Y return: 24.16% (bottom quartile). 5Y return: 23.58% (bottom quartile). 5Y return: 23.56% (bottom quartile). Point 6 3Y return: 32.69% (top quartile). 3Y return: 25.28% (bottom quartile). 3Y return: 31.06% (upper mid). 3Y return: 49.36% (top quartile). 3Y return: 25.14% (bottom quartile). 3Y return: 26.87% (lower mid). 3Y return: 28.60% (upper mid). 3Y return: 26.00% (lower mid). 3Y return: 27.39% (upper mid). 3Y return: 25.51% (lower mid). 3Y return: 25.38% (bottom quartile). Point 7 1Y return: 21.79% (top quartile). 1Y return: 9.66% (lower mid). 1Y return: 19.66% (upper mid). 1Y return: 134.74% (top quartile). 1Y return: 9.63% (bottom quartile). 1Y return: 8.77% (bottom quartile). 1Y return: 10.12% (lower mid). 1Y return: 9.21% (bottom quartile). 1Y return: 12.97% (upper mid). 1Y return: 12.91% (upper mid). 1Y return: 12.08% (lower mid). Point 8 Alpha: -0.22 (lower mid). Alpha: 0.00 (lower mid). Alpha: -1.90 (bottom quartile). Alpha: 1.32 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (top quartile). Alpha: -18.43 (bottom quartile). Alpha: -15.06 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Point 9 Sharpe: 0.33 (top quartile). Sharpe: 0.12 (upper mid). Sharpe: 0.27 (upper mid). Sharpe: 3.42 (top quartile). Sharpe: -0.31 (bottom quartile). Sharpe: -0.12 (lower mid). Sharpe: -0.21 (bottom quartile). Sharpe: -0.20 (bottom quartile). Sharpe: -0.05 (lower mid). Sharpe: -0.18 (lower mid). Sharpe: 0.18 (upper mid). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.37 (bottom quartile). Information ratio: -0.67 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.28 (top quartile). Information ratio: 0.34 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (lower mid). SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP World Gold Fund

DSP India T.I.G.E.R Fund

HDFC Infrastructure Fund

LIC MF Infrastructure Fund

Nippon India Power and Infra Fund

Franklin Build India Fund

Canara Robeco Infrastructure

BOI AXA Manufacturing and Infrastructure Fund

200 কোটি মিউচুয়াল ফান্ডের ইক্যুইটি বিভাগে 5 বছরের ক্যালেন্ডার বছরের রিটার্নের ভিত্তিতে অর্ডার করা হয়েছে।1. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (06 Feb 26) ₹35.3653 ↑ 0.08 (0.22 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month 2.2% 3 Month 6.1% 6 Month 13.9% 1 Year 21.8% 3 Year 32.7% 5 Year 28.4% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.59 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.24% Utility 29.32% Energy 13.87% Industrials 12% Basic Materials 6.69% Asset Allocation

Asset Class Value Cash 2.8% Equity 97.11% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN17% ₹975 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL9% ₹518 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325559% ₹509 Cr 15,443,244

↑ 900,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹502 Cr 29,150,000

↑ 3,400,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328988% ₹467 Cr 17,635,554

↑ 1,100,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹372 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321346% ₹325 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹232 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328143% ₹203 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹163 Cr 3,850,000 2. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (06 Feb 26) ₹195.39 ↓ -0.45 (-0.23 %) Net Assets (Cr) ₹8,134 on 31 Dec 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.12 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -2.1% 3 Month -1.7% 6 Month 2% 1 Year 9.7% 3 Year 25.3% 5 Year 27.7% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.59 Yr. Sharmila D’mello 30 Jun 22 3.51 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 46.72% Financial Services 13.08% Basic Materials 11.19% Utility 10.14% Energy 8.12% Real Estate 4.42% Consumer Cyclical 1.99% Communication Services 0.86% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹717 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO7% ₹565 Cr 1,116,358

↑ 891,940 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹342 Cr 10,376,448

↓ -600,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹250 Cr 1,700,000

↓ -154,934 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹246 Cr 612,120

↓ -57,631 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹240 Cr 1,529,725 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹230 Cr 1,911,120

↑ 107,554 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | 5322153% ₹214 Cr 1,683,557 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹209 Cr 2,424,016 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹209 Cr 13,053,905 3. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (06 Feb 26) ₹66.66 ↓ -0.26 (-0.39 %) Net Assets (Cr) ₹1,449 on 31 Dec 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.27 Information Ratio -0.37 Alpha Ratio -1.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -1.1% 3 Month 1.5% 6 Month 8% 1 Year 19.7% 3 Year 31.1% 5 Year 26.8% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.5 Yr. Sagar Gandhi 1 Jul 25 0.5 Yr. Data below for Invesco India PSU Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.01% Financial Services 29.88% Utility 19.12% Energy 13.49% Basic Materials 3.52% Consumer Cyclical 1.22% Asset Allocation

Asset Class Value Cash 1.76% Equity 98.24% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹136 Cr 1,387,617

↓ -38,697 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL8% ₹120 Cr 2,997,692 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005477% ₹104 Cr 2,717,009

↓ -184,556 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328147% ₹97 Cr 1,157,444

↑ 76,826 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN6% ₹86 Cr 9,129,820

↑ 339,034 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹86 Cr 196,158 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | 5321345% ₹66 Cr 2,244,222

↑ 127,830 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹65 Cr 445,685

↑ 21,640 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP4% ₹64 Cr 646,300 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325554% ₹59 Cr 1,801,543

↓ -223,420 4. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (05 Feb 26) ₹57.6652 ↓ -3.01 (-4.96 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month 5.4% 3 Month 40% 6 Month 75.8% 1 Year 134.7% 3 Year 49.4% 5 Year 26.1% 10 Year 15 Year Since launch 10% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.85 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 94.95% Asset Allocation

Asset Class Value Cash 2.43% Equity 94.95% Debt 0.01% Other 2.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,294 Cr 1,219,254

↓ -59,731 VanEck Gold Miners ETF

- | GDX25% ₹442 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹28 Cr Net Receivables/Payables

Net Current Assets | -0% -₹8 Cr 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (06 Feb 26) ₹315.953 ↑ 0.08 (0.03 %) Net Assets (Cr) ₹5,323 on 31 Dec 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio -0.31 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -0.9% 3 Month 0% 6 Month 2.4% 1 Year 9.6% 3 Year 25.1% 5 Year 24.6% 10 Year 15 Year Since launch 17.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.54 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 30.1% Basic Materials 14.02% Financial Services 11.6% Utility 10.47% Consumer Cyclical 8.71% Energy 7.67% Health Care 5.45% Communication Services 3.33% Technology 1.7% Real Estate 1.7% Consumer Defensive 1.36% Asset Allocation

Asset Class Value Cash 3.89% Equity 96.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹284 Cr 694,468

↓ -3,201 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325554% ₹235 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP3% ₹173 Cr 245,928 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹171 Cr 812,745

↑ 56,591 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹152 Cr 136,165 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | 5328983% ₹147 Cr 5,567,574 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹141 Cr 1,154,264

↓ -258,148 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹134 Cr 305,098 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹133 Cr 3,321,453 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Dec 24 | AMBER2% ₹126 Cr 197,265 6. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (06 Feb 26) ₹47.438 ↑ 0.09 (0.19 %) Net Assets (Cr) ₹2,452 on 31 Dec 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio -0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,059 31 Jan 23 ₹16,950 31 Jan 24 ₹28,499 31 Jan 25 ₹31,485 31 Jan 26 ₹33,227 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -1.2% 3 Month -1.9% 6 Month 0.7% 1 Year 8.8% 3 Year 26.9% 5 Year 24.5% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.53 Yr. Ashish Shah 1 Nov 25 0.17 Yr. Data below for HDFC Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 39.43% Financial Services 20.52% Basic Materials 10.17% Energy 7.36% Utility 6.95% Communication Services 4.29% Real Estate 2.59% Health Care 1.72% Technology 1.41% Consumer Cyclical 0.69% Asset Allocation

Asset Class Value Cash 4.88% Equity 95.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹162 Cr 397,500

↑ 17,500 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321746% ₹148 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹139 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹91 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹82 Cr 1,400,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹79 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹76 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹74 Cr 350,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹73 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹69 Cr 704,361 7. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (06 Feb 26) ₹49.5423 ↑ 0.11 (0.23 %) Net Assets (Cr) ₹1,003 on 31 Dec 25 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio -0.21 Information Ratio 0.28 Alpha Ratio -18.43 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -0.9% 3 Month -1.2% 6 Month 2% 1 Year 10.1% 3 Year 28.6% 5 Year 24.3% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.29 Yr. Mahesh Bendre 1 Jul 24 1.5 Yr. Data below for LIC MF Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 47.89% Consumer Cyclical 13.2% Basic Materials 9.06% Financial Services 6.21% Utility 5.93% Technology 3.68% Real Estate 3.55% Communication Services 3.18% Health Care 3.07% Asset Allocation

Asset Class Value Cash 4.22% Equity 95.78% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹50 Cr 686,379

↓ -7,478 Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹45 Cr 1,088,395

↓ -159,564 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT4% ₹44 Cr 108,403

↓ -1,181 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | 5329553% ₹32 Cr 901,191

↓ -9,818 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹31 Cr 43,674

↓ -475 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹29 Cr 93,271

↓ -1,016 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹26 Cr 659,065

↓ -7,180 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118

↑ 2,984 Cummins India Ltd (Industrials)

Equity, Since 31 May 21 | 5004803% ₹25 Cr 56,889

↓ -619 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL2% ₹25 Cr 92,624

↓ -1,009 8. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (06 Feb 26) ₹343.931 ↓ -0.27 (-0.08 %) Net Assets (Cr) ₹7,117 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.2 Information Ratio 0.34 Alpha Ratio -15.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,955 31 Jan 23 ₹16,453 31 Jan 24 ₹27,930 31 Jan 25 ₹30,936 31 Jan 26 ₹31,936 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -1.7% 3 Month -2.1% 6 Month 1.3% 1 Year 9.2% 3 Year 26% 5 Year 24.3% 10 Year 15 Year Since launch 17.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.61 Yr. Rahul Modi 19 Aug 24 1.37 Yr. Lokesh Maru 5 Sep 25 0.32 Yr. Divya Sharma 5 Sep 25 0.32 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 32.98% Utility 23% Consumer Cyclical 10.79% Energy 10.36% Basic Materials 7.3% Technology 4.55% Communication Services 3.55% Financial Services 2.54% Real Estate 2.43% Health Care 2.08% Asset Allocation

Asset Class Value Cash 0.43% Equity 99.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹715 Cr 4,550,000

↑ 125,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹560 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹435 Cr 1,064,337 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹300 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL4% ₹253 Cr 1,200,000

↓ -900,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325383% ₹200 Cr 170,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | 5001033% ₹198 Cr 6,900,000

↓ -1,100,838 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000933% ₹196 Cr 3,020,014 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | 5004932% ₹173 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹165 Cr 17,497,157

↑ 350,000 9. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (06 Feb 26) ₹146.195 ↑ 0.27 (0.18 %) Net Assets (Cr) ₹3,036 on 31 Dec 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio -0.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month 1.2% 3 Month 1.4% 6 Month 4.4% 1 Year 13% 3 Year 27.4% 5 Year 24.2% 10 Year 15 Year Since launch 17.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.21 Yr. Kiran Sebastian 7 Feb 22 3.9 Yr. Sandeep Manam 18 Oct 21 4.21 Yr. Data below for Franklin Build India Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 35% Financial Services 15.02% Utility 14.66% Energy 13.57% Communication Services 8.21% Basic Materials 5.21% Real Estate 2.63% Consumer Cyclical 1.58% Technology 1.15% Asset Allocation

Asset Class Value Cash 2.97% Equity 97.03% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹272 Cr 665,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹188 Cr 1,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹165 Cr 325,341

↑ 10,341 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003125% ₹164 Cr 6,825,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹149 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹149 Cr 1,500,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹143 Cr 4,350,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322154% ₹127 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN3% ₹98 Cr 1,000,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 Jan 25 | 5321553% ₹96 Cr 5,600,000 10. Canara Robeco Infrastructure

Canara Robeco Infrastructure

Growth Launch Date 2 Dec 05 NAV (06 Feb 26) ₹160.98 ↑ 0.79 (0.49 %) Net Assets (Cr) ₹894 on 31 Dec 25 Category Equity - Sectoral AMC Canara Robeco Asset Management Co. Ltd. Rating Risk High Expense Ratio 2.32 Sharpe Ratio -0.18 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,478 31 Jan 23 ₹16,229 31 Jan 24 ₹24,420 31 Jan 25 ₹29,225 31 Jan 26 ₹31,221 Returns for Canara Robeco Infrastructure

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month 1% 3 Month -0.7% 6 Month 0.6% 1 Year 12.9% 3 Year 25.5% 5 Year 23.6% 10 Year 15 Year Since launch 14.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 0.1% 2023 35.3% 2022 41.2% 2021 9% 2020 56.1% 2019 9% 2018 2.3% 2017 -19.1% 2016 40.2% 2015 2.1% Fund Manager information for Canara Robeco Infrastructure

Name Since Tenure Vishal Mishra 26 Jun 21 4.52 Yr. Shridatta Bhandwaldar 29 Sep 18 7.26 Yr. Data below for Canara Robeco Infrastructure as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 45.69% Utility 12.07% Basic Materials 9.54% Energy 9.39% Financial Services 7.49% Technology 4.06% Communication Services 3.22% Consumer Cyclical 3.04% Real Estate 1.29% Asset Allocation

Asset Class Value Cash 4.21% Equity 95.79% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 11 | LT10% ₹89 Cr 217,901

↓ -5,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE5% ₹46 Cr 291,750

↑ 12,500 State Bank of India (Financial Services)

Equity, Since 31 Jul 24 | SBIN5% ₹43 Cr 442,500 NTPC Ltd (Utilities)

Equity, Since 30 Nov 18 | 5325554% ₹36 Cr 1,106,480

↑ 40,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 19 | BEL4% ₹36 Cr 894,000

↑ 25,000 GE Vernova T&D India Ltd (Industrials)

Equity, Since 31 Jan 24 | 5222754% ₹31 Cr 99,985

↓ -5,200 Tata Power Co Ltd (Utilities)

Equity, Since 30 Sep 24 | 5004003% ₹31 Cr 810,000

↑ 25,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Jan 23 | INDIGO3% ₹29 Cr 58,250 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 24 | BHARTIARTL3% ₹29 Cr 136,600 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Oct 23 | 5000933% ₹29 Cr 440,650

↑ 27,500 11. BOI AXA Manufacturing and Infrastructure Fund

BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (06 Feb 26) ₹59.21 ↑ 0.13 (0.22 %) Net Assets (Cr) ₹674 on 31 Dec 25 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.4 Sharpe Ratio 0.18 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,034 31 Jan 23 ₹15,539 31 Jan 24 ₹23,755 31 Jan 25 ₹27,086 31 Jan 26 ₹29,861 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 6 Feb 26 Duration Returns 1 Month -1.7% 3 Month 1.4% 6 Month 7.2% 1 Year 12.1% 3 Year 25.4% 5 Year 23.6% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.8% 2023 25.7% 2022 44.7% 2021 3.3% 2020 52.5% 2019 28.1% 2018 2.5% 2017 -22.8% 2016 56% 2015 1% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 3.26 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 29.73% Basic Materials 17.25% Consumer Cyclical 15.33% Energy 9.98% Health Care 8.43% Utility 4.93% Real Estate 3.21% Communication Services 2.91% Consumer Defensive 1.84% Asset Allocation

Asset Class Value Cash 6.4% Equity 93.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT9% ₹62 Cr 151,115 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE8% ₹53 Cr 337,740

↑ 10,786 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | 5002956% ₹41 Cr 678,238

↑ 96,357 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹33 Cr 1,006,566 Lloyds Metals & Energy Ltd (Basic Materials)

Equity, Since 30 Nov 24 | 5124554% ₹24 Cr 178,702 Hero MotoCorp Ltd (Consumer Cyclical)

Equity, Since 30 Nov 23 | HEROMOTOCO3% ₹23 Cr 39,215

↓ -13,179 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL3% ₹20 Cr 92,989 Stylam Industries Ltd (Consumer Cyclical)

Equity, Since 30 Apr 25 | 5269513% ₹19 Cr 83,372

↓ -7,190 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS3% ₹18 Cr 116,537

↑ 4,015 Aurobindo Pharma Ltd (Healthcare)

Equity, Since 31 May 25 | AUROPHARMA3% ₹17 Cr 144,862

↑ 16,098

বিনিয়োগকারীদের তাদের পছন্দের SIP প্ল্যানে বিনিয়োগ করার পরামর্শ দেওয়া হয়। উপরে উল্লিখিত শীর্ষ 11 মিউচুয়াল ফান্ড সব ধরনের বিনিয়োগকারীদের জন্য উপযুক্ত। সুতরাং, হয় আপনি একটি উচ্চ ঝুঁকিবিনিয়োগকারী বা তুলনামূলকভাবে কম, এই এসআইপি তহবিলগুলি হলবিনিয়োগের জন্য সেরা মিউচুয়াল ফান্ড. সুতরাং, অপেক্ষা করবেন না, এখনই বিনিয়োগ করুন!

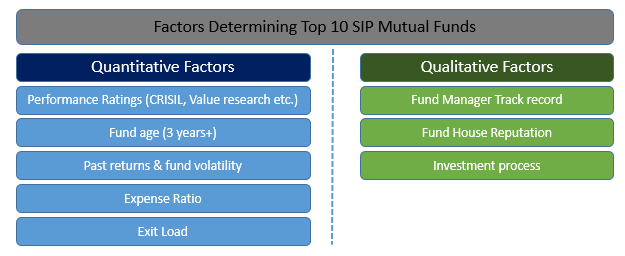

সেরা পদ্ধতিগত বিনিয়োগ পরিকল্পনাগুলিতে বিনিয়োগ করার সময় বিবেচনা করার পরামিতিগুলি

সেরা পারফরম্যান্সকারী এসআইপি তহবিলগুলি মূল্যায়ন করতে, আসুন জেনে নেই যে বিষয়গুলিকে বিনিয়োগ করার আগে অবশ্যই বিবেচনা করতে হবে।

শীর্ষ এসআইপিতে বিনিয়োগের পরিমাণগত কারণ

SIP-এর মাধ্যমে বিনিয়োগ করার আগে যে পরিমাণগত কারণগুলি বিবেচনা করা উচিত তার মধ্যে রয়েছে পারফরম্যান্স রেটিং (CRISIL, ভ্যালু রিসার্চ ইত্যাদি অনুযায়ী), ফান্ডের বয়স, অতীতের রিটার্ন এবং ফান্ডের অস্থিরতা, ব্যয়ের অনুপাত এবং প্রস্থান লোড।

শীর্ষ এসআইপিতে বিনিয়োগ করার জন্য গুণগত কারণ

গুণগত মূল পরিসংখ্যান বিশ্লেষণ করার জন্য ফান্ড ম্যানেজারের ট্র্যাক রেকর্ড, ফান্ড হাউসের খ্যাতি এবং SIP ফান্ডের বিনিয়োগ প্রক্রিয়া অন্তর্ভুক্ত করে।

এসআইপি এমএফ অনলাইনে কীভাবে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

আজই SIP দিয়ে আপনার বিনিয়োগ যাত্রা শুরু করুন!

FAQs

1. মিউচুয়াল ফান্ড কি?

ক: মিউচুয়াল ফান্ডগুলি হল সিস্টেমেটিক ইনভেস্টমেন্ট প্ল্যান বা এসআইপিগুলির একটি অংশ যা সাধারণত পরে চমৎকার রিটার্ন দেয়। যখন তুমিমিউচুয়াল ফান্ডে বিনিয়োগ করুন, আপনি আপনার বিনিয়োগ পোর্টফোলিও বৈচিত্র্যময়. একটি মিউচুয়াল ফান্ড একটি বিনিয়োগের হাতিয়ার হিসাবে বিবেচিত হতে পারে যা একটি দ্বারা তৈরি করা হয়েছেসম্পদ ব্যবস্থাপনা কোম্পানি একাধিক বিনিয়োগকারী এবং কোম্পানির বিনিয়োগের মধ্যে পুলিং করে।

2. বিভিন্ন ধরনের মিউচুয়াল ফান্ড কি কি?

ক: মিউচুয়াল ফান্ডগুলিকে বিস্তৃতভাবে নিম্নলিখিত ধরণের মধ্যে শ্রেণীবদ্ধ করা যেতে পারে:

- ইক্যুইটি বা বৃদ্ধি তহবিল

- স্থায়ী আয় তহবিল বাঋণ তহবিল

- কর সঞ্চয় তহবিল

- তরল তহবিল

- ব্যালেন্সড ফান্ড

- গিল্ট ফান্ড

- এক্সচেঞ্জ-ট্রেডেড ফান্ড বাইটিএফ

3. গ্রোথ ইক্যুইটি ফান্ড কি?

ক: বৃদ্ধিইক্যুইটি ফান্ড সবচেয়ে সাধারণ মিউচুয়াল ফান্ড। যাইহোক, এই পোর্টফোলিওতে অস্থির বিনিয়োগ থাকবে। তা সত্ত্বেও, বিনিয়োগকারীরা প্রায়শই গ্রোথ ইক্যুইটি তহবিলগুলিকে পছন্দ করে কারণ এগুলির আয় বেশি এবং অল্প সময়ের জন্য বিনিয়োগ করা যেতে পারে।

4. কেন আপনার একটি ঋণ তহবিলে বিনিয়োগ করা উচিত?

ক: এই বিনিয়োগগুলি সেই ব্যক্তিদের জন্য আদর্শ যারা বিনিয়োগের উপর নির্দিষ্ট রিটার্ন খুঁজছেন। নির্দিষ্ট আয় ডিবেঞ্চার, ঋণ সিকিউরিটিজ, বাণিজ্যিক কাগজপত্র, এবং সরকারী সিকিউরিটিজ থেকে উপার্জন করা যেতে পারে। মিউচুয়াল ফান্ড বিভিন্ন ধরনের বিনিয়োগের একটি পোর্টফোলিও তৈরি করবে এবং ঝুঁকি নষ্ট করবে।

5. কেন আপনি SIP-এ বিনিয়োগ করবেন?

ক: এসআইপি বিনিয়োগকারীকে নিশ্চিত আয় প্রদান করতে পারে। আপনি যদি প্যাসিভ ইনকাম করতে আগ্রহী হন এবং নিশ্চিত করতে চান যে আপনার বিনিয়োগ নিয়মিত আয় তৈরি করে, তাহলে আপনি SIP-এ বিনিয়োগ করার কথা বিবেচনা করতে পারেন। .

6. কর সাশ্রয়ী মিউচুয়াল ফান্ডে কেন বিনিয়োগ করবেন?

ক: আপনি আপনার বৃদ্ধি খুঁজছেন হয়মূলধন এবং একই সময়ে কর ছাড় উপভোগ করতে চান, তাহলে আপনি ট্যাক্স সাশ্রয়ী মিউচুয়াল ফান্ডে বিনিয়োগ করতে পারেন। অধীনধারা 80C এরআয়কর 1861 সালের আইন, আপনি যদি ইক্যুইটি-লিঙ্কড ট্যাক্স সেভিং মিউচুয়াল ফান্ডে বিনিয়োগ করেন, তাহলে আপনি আপনার বিনিয়োগে কর ছাড় উপভোগ করতে পারেন।

7. মিউচুয়াল ফান্ডে বিনিয়োগ করার জন্য আমার কি একজন ব্রোকার দরকার?

ক: বিনিয়োগে সাহায্য করার জন্য আপনাকে একটি ব্রোকার বা আর্থিক প্রতিষ্ঠানের সহায়তার প্রয়োজন হবে। উপযুক্ত এসআইপিগুলি সনাক্ত করতে এবং বিনিয়োগগুলি সঠিকভাবে করা হয়েছে তা নিশ্চিত করতে আপনার সহায়তার প্রয়োজন হবে।

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।

Research Highlights for SBI PSU Fund